UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 or 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month

of February 2025

Commission File Number: 001-14946

Cemex, S.A.B. de C.V.

(Translation of Registrant’s name into English)

Avenida Ricardo Margáin Zozaya #325, Colonia Valle del Campestre,

San Pedro Garza García, Nuevo León 66265, México

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

Form 20-F ☒ Form 40-F ☐

Indicate by check mark if the registrant is submitting the Form

6-K in paper as permitted by Regulation S-T Rule 101(b)(1):

Indicate by

check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7):

Contents

|

|

|

| 1. |

|

Press release dated February 6, 2025 announcing fourth quarter 2024 results for Cemex, S.A.B. de C.V. (NYSE: CX) (“Cemex”). |

|

|

| 2. |

|

Fourth quarter 2024 results for Cemex. |

|

|

| 3. |

|

Presentation regarding fourth quarter 2024 results for Cemex. |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, Cemex, S.A.B. de C.V. has duly caused this report to be signed on its

behalf by the undersigned, thereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cemex, S.A.B. de C.V. |

|

|

|

|

|

|

|

|

(Registrant) |

|

|

|

|

|

| Date: |

|

February 6, 2025 |

|

|

|

By: |

|

/s/ Rafael Garza Lozano |

|

|

|

|

|

|

|

|

Name: Rafael Garza Lozano |

|

|

|

|

|

|

|

|

Title: Chief Comptroller |

3

EXHIBIT INDEX

|

|

|

EXHIBIT

NO. |

|

DESCRIPTION |

|

|

| 1. |

|

Press release dated February 6, 2025 announcing fourth quarter 2024 results for Cemex, S.A.B. de C.V. (NYSE: CX) (“Cemex”). |

|

|

| 2. |

|

Fourth quarter 2024 results for Cemex. |

|

|

| 3. |

|

Presentation regarding fourth quarter 2024 results for Cemex. |

4

Exhibit 1

Cemex announces record Net Income in FY 2024, substantial

progress on its decarbonization commitments,

and launches savings program “Project Cutting Edge”

| |

• |

|

Net Income of US$939 million, a fivefold increase year over year, reaching a recent record high.

|

| |

• |

|

Consolidated EBITDA grew 3% in 4Q24 with margin expanding by 0.4pp, while full-year EBITDA declined by 1% with

stable margin, on a year-over-year basis. |

| |

• |

|

Free cash flow after maintenance capex, adjusting for non-recurring

taxes, at highest level since 2017. |

| |

• |

|

Closed US$2.2 billion of divestments of non-core assets in emerging

markets. |

| |

• |

|

Introduced “Project Cutting Edge”, a savings program designed to deliver incremental EBITDA growth of

$150 million in 2025 with a run rate of $350 million by 2027, with additional free cash flow benefits. |

Monterrey, Mexico.

February 6, 2025– Cemex reported its fourth quarter and full-year 2024 results today, reaching an annual EBITDA of US$3,079 million and a Net Income of US$939 million, a record in the company’s recent

history. After an exceptional year in 2023, the company continues delivering strong results, reflected in the resiliency of its EBITDA margin and the highest free cash flow after maintenance capex since 2017, adjusting for the Spanish tax fine.

“I am proud of our achievements this year, as it marks a pivotal moment in the corporate transformation we envisioned in 2020,” said Fernando A.

González, CEO of Cemex. “With the recovery of our investment grade ratings, improved free cash flow generation and the execution of US$2.2 billion in asset divestments, we can now pursue more aggressively our capital allocation

priorities of growth through small to medium-sized acquisitions, primarily in the U.S., additional deleveraging, and building further on our shareholder return programs.”

Cemex also launched “Project Cutting Edge”, a three-year, US$350 million saving initiative to streamline operations and improve efficiency,

heavily leveraging digital technology throughout the company. This program is anticipated to deliver US$150 million in incremental EBITDA in 2025 expecting to reach a run rate of US$350 million by 2027. “Project Cutting Edge”

also contemplates expected savings at the free cash flow level.

In Climate Action, the company is advancing its Future in Action roadmap, making

significant progress in profitable decarbonization by reducing Scope 1 and Scope 2 CO2 emissions by 15% and by about 17%, respectively, compared to 2020, a reduction that historically would

have taken Cemex 16 years to achieve. Based on current emissions levels, Cemex is well on its way to reach its 2025 and 2030 CO2 emissions targets.

Cemex’s Consolidated 2024 Full Year and 4th Quarter Financial and Operational Highlights.

| |

• |

|

Net Sales decreased by 1% to US$16,200 million in 2024 and remained flat at US$3,811 million in the

4th quarter. |

| |

• |

|

EBITDA decreased by 1% to US$3,079 million in 2024 and increased by 3% to US$681 million in the 4th

quarter. |

| |

• |

|

EBITDA margin remained flat in 2024 at 19.0% and increased by 0.4 percentage points to 17.9% in the

4th quarter. |

| |

• |

|

Free Cash Flow after Maintenance Capital Expenditures increased to US$1,253 million in 2024, adjusting for

the US$383 million payment related to the tax fine in Spain. |

| |

• |

|

Net Income reached US$939 million, a record level in our recent history. |

1

| |

• |

|

Net Leverage1 stood at 1.81 times, its lowest level since

the outbreak of the 2007 global financial crisis. |

| |

• |

|

Growth investments contributed US$344 million to consolidated EBITDA in 2024. |

| |

• |

|

EBITDA from Cemex’s Urbanization Solutions business increased by 4%, with margin expanding by 1.1 percentage

points in 2024. |

| |

• |

|

Reduction of Scope 1 and Scope 2 CO2 emissions of 15% and

about 17%, respectively, compared to 2020. |

Geographical Markets 2024 Full Year and

4th Quarter Highlights.

| |

• |

|

Sales in Mexico increased by 1% in 2024 to US$4,881 million and decreased by 6% in the 4th quarter to

US$1,050 million. EBITDA increased by 3% in 2024 to US$1,475 million and decreased by 4% in the 4th quarter to US$283 million. |

| |

• |

|

Cemex’s operations in the United States reported Sales of US$5,194 million in 2024, a decrease of 3%,

and US$1,233 million in the 4th quarter, also a 3% decline. EBITDA decreased by 1% in 2024 to US$1,031 million and remained flat at US$238 million in the 4th quarter. |

| |

• |

|

In the Europe, Middle East, and Africa region, Sales decreased by 2% in 2024 to US$4,631 million, and

increased by 8% in the 4th quarter to US$1,155 million. EBITDA was US$637 million in 2024, 3% lower than the previous year, and US$177 million for the 4th quarter, a 43% increase. |

| |

• |

|

Cemex operations in the South, Central America, and the Caribbean region reported Sales of US$1,244 million

in 2024, remaining flat, and US$297 million in the 4th quarter, also remaining stable. EBITDA increased by 2% to US$234 million in 2024 and by 2% to US$57 million in the 4th quarter. |

Note: All percentage variations related to Sales and EBITDA are on a

like-to-like basis for the ongoing operations and for foreign exchange fluctuations compared to the same period of last year. All references to EBITDA mean Operating

EBITDA.

| (1) |

Calculated in accordance with our main bank debt agreements. |

About Cemex

Cemex is a global construction materials

company that is building a better future through sustainable products and solutions. Cemex is committed to achieving carbon neutrality through relentless innovation and industry-leading research and development. Cemex is at the forefront of the

circular economy in the construction value chain and is pioneering ways to increase the use of waste and residues as alternative raw materials and fuels in its operations with the help of new technologies. Cemex offers cement, ready-mix concrete, aggregates, and urbanization solutions in growing markets around the world, powered by a multinational workforce focused on providing a superior customer experience enabled by digital

technologies. For more information, please visit: www.cemex.com

Contact information

Analyst and Investor Relations - New York

Blake Haider

+1 (212) 317-6011

ir@cemex.com

Analyst and Investor Relations - Monterrey

Patricio Treviño Garza

+52 (81) 8888-4327

ir@cemex.com

Media Relations

Jorge Pérez

+52 (81) 8259-6666

jorgeluis.perez@cemex.com

2

###

Except as the context otherwise may require, references in this press release to “Cemex,”” we,” ”us,” or ”our,”

refer to Cemex, S.A.B. de C.V. and its consolidated subsidiaries. This press release contains forward-looking statements within the meaning of Section 27A of the U.S. Securities Act of 1933, as amended, and Section 21E of the U.S.

Securities Exchange Act of 1934, as amended. Cemex intends these forward-looking statements to be covered by the “safe harbor” provisions for forward-looking statements in the U.S. Private Securities Litigation Reform Act of 1995. These

forward-looking statements reflect Cemex’s current expectations and projections about future events based on Cemex’s knowledge of present facts and circumstances and assumptions about future events, as well as Cemex’s current plans

based on such facts and circumstances, unless otherwise indicated. These statements necessarily involve risks, uncertainties, and assumptions that could cause actual results to differ materially from Cemex’s expectations, including, among

others, risks, uncertainties, assumptions, and other important factors discussed in Cemex’s most recent annual report and detailed from time to time in Cemex’s other filings with the U.S. Securities and Exchange Commission and the Mexican

Stock Exchange (Bolsa Mexicana de Valores), which factors are incorporated herein by reference, which if materialized could ultimately lead to Cemex’s expectations and/or expected results not producing the expected benefits and/or results.

Forward-looking statements should not be considered guarantees of future performance, nor the results or developments are indicative of results or developments in subsequent periods. The forward-looking statements and the information contained in

this press release are made and stated as of the dates specified in this press release and are subject to change without notice, and except to the extent legally required, we expressly disclaim any obligation or undertaking to update or correct this

press release or revise any forward-looking statements contained herein, whether to reflect new information, the occurrence of anticipated or unanticipated future events or circumstances, any change in our expectations regarding those

forward-looking statements, any change in events, conditions, or circumstances on which any statement is based, or otherwise. Any or all of Cemex’s forward-looking statements may turn out to be inaccurate. Accordingly, undue reliance on

forward-looking statements should not be placed, as such forward-looking statements speak only as of the dates on which they are made. The content of this press release is for informational purposes only, and you should not construe any such

information or other material as legal, tax, investment, financial, or other advice. All references to prices in this press release refer to Cemex’s prices for Cemex products and services. Unless otherwise specified, all references to records

are internal records.

This press release and the documents referred to herein include certain

non-International Financial Reporting Standards (“IFRS”) financial measures that differ from financial information presented by Cemex in accordance with IFRS in its financial statements and reports

containing financial information. The aforementioned non-IFRS financial measures include “Operating EBITDA (operating earnings before other expenses, net plus depreciation and amortization)” and

“Operating EBITDA Margin”. The closest IFRS financial measure to Operating EBITDA is “Operating earnings before other expenses, net”, as Operating EBITDA adds depreciation and amortization to the IFRS financial measure. Our

Operating EBITDA Margin is calculated by dividing our Operating EBITDA for the period by our revenues as reported in our financial statements. We believe there is no close IFRS financial measure to compare Operating EBITDA Margin. These non-IFRS financial measures are designed to complement and should not be considered superior to financial measures calculated in accordance with IFRS. Although Operating EBITDA and Operating EBITDA Margin are not

measures of operating performance, an alternative to cash flows or a measure of financial position under IFRS, Operating EBITDA is the financial measure used by Cemex’s management to review operating performance and profitability, for

decision-making purposes and to allocate resources. Moreover, our Operating EBITDA is a measure used by Cemex’s creditors to review our ability to internally fund capital expenditures, service or incur debt and comply with financial covenants

under our financing agreements. Furthermore, Cemex’s management regularly reviews our Operating EBITDA Margin by reportable segment and on a consolidated basis as a measure of performance and profitability. These

non-IFRS financial measures do not have any standardized meaning and are therefore unlikely to be comparable to similarly titled measures presented by other companies.

Non-IFRS financial measures presented in the reports, presentations, and documents to be disclosed during Cemex’s fourth quarter 2024 results conference call and audio webcast presentation are being

provided for informative purposes only and shall not be construed as investment, financial, or other advice.

There is currently no single globally

recognized or accepted, consistent, and comparable set of definitions or standards (legal, regulatory, or otherwise) of, nor widespread cross-market consensus i) as to what constitutes, a “green”, “social”, or

“sustainable” or having equivalent-labelled activity, product, or asset; or ii) as to what precise attributes are required for a particular activity, product, or asset to be defined as “green” “social”, or

“sustainable” or such other equivalent label; or iii) as to climate and sustainable funding and financing activities and their classification and reporting. Therefore, there is little certainty, and no assurance or representation is given

that such activities and/or reporting of those activities will meet any present or future expectations or requirements for describing or classifying funding and financing activities as “green”, “social”, or

“sustainable” or attributing similar labels. We expect policies, regulatory requirements, standards, and definitions to be developed and continuously evolve over time.

3

Exhibit 2

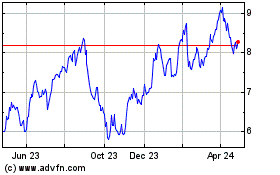

Fourth Quarter Results 2024 1550 On The Green, Houston, United States Photo credit: Skanska Stock Listing Information Investor Relations

NYSE (ADS) In the United States: Ticker: CX + 1 877 7CX NYSE Mexican Stock Exchange (CPO) In Mexico: Ticker: CEMEX.CPO + 52 (81) 8888 4327 Ratio of CEMEXCPO to CX = 10:1 E-Mail: ir@cemex.com

|

|

|

| Operating and financial highlights |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

January - December |

|

|

|

|

|

Fourth Quarter |

|

| |

|

|

|

|

|

|

|

|

|

|

l-t-l |

|

|

|

|

|

|

|

|

|

|

|

l-t-l |

|

| |

|

2024 |

|

|

2023 |

|

|

% var |

|

|

% var |

|

|

2024 |

|

|

2023 |

|

|

% var |

|

|

% var |

|

| Consolidated volumes |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Domestic gray cement |

|

|

44,264 |

|

|

|

45,222 |

|

|

|

(2 |

%) |

|

|

|

|

|

|

10,793 |

|

|

|

11,076 |

|

|

|

(3 |

%) |

|

|

|

|

| Ready-mix |

|

|

44,011 |

|

|

|

46,843 |

|

|

|

(6 |

%) |

|

|

|

|

|

|

11,114 |

|

|

|

10,742 |

|

|

|

3 |

% |

|

|

|

|

| Aggregates |

|

|

135,979 |

|

|

|

138,839 |

|

|

|

(2 |

%) |

|

|

|

|

|

|

33,433 |

|

|

|

33,699 |

|

|

|

(1 |

%) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Sales |

|

|

16,200 |

|

|

|

16,554 |

|

|

|

(2 |

%) |

|

|

(1 |

%) |

|

|

3,811 |

|

|

|

4,027 |

|

|

|

(5 |

%) |

|

|

0 |

% |

| Gross profit |

|

|

5,439 |

|

|

|

5,575 |

|

|

|

(2 |

%) |

|

|

(1 |

%) |

|

|

1,224 |

|

|

|

1,372 |

|

|

|

(11 |

%) |

|

|

(4 |

%) |

| as % of Sales |

|

|

33.6 |

% |

|

|

33.7 |

% |

|

|

(0.1pp |

) |

|

|

|

|

|

|

32.1 |

% |

|

|

34.1 |

% |

|

|

(2.0pp |

) |

|

|

|

|

| Operating earnings before other income and expenses, net |

|

|

1,828 |

|

|

|

1,959 |

|

|

|

(7 |

%) |

|

|

(5 |

%) |

|

|

374 |

|

|

|

405 |

|

|

|

(8 |

%) |

|

|

0 |

% |

| as % of Sales |

|

|

11.3 |

% |

|

|

11.8 |

% |

|

|

(0.5pp |

) |

|

|

|

|

|

|

9.8 |

% |

|

|

10.1 |

% |

|

|

(0.3pp |

) |

|

|

|

|

| SG&A expenses as % of Sales (before depreciation) |

|

|

9.5 |

% |

|

|

9.3 |

% |

|

|

0.2pp |

|

|

|

|

|

|

|

9.6 |

% |

|

|

10.9 |

% |

|

|

(1.3pp |

) |

|

|

|

|

| Controlling interest net income (loss) |

|

|

939 |

|

|

|

182 |

|

|

|

415 |

% |

|

|

|

|

|

|

48 |

|

|

|

(441 |

) |

|

|

N/A |

|

|

|

|

|

| Operating EBITDA |

|

|

3,079 |

|

|

|

3,150 |

|

|

|

(2 |

%) |

|

|

(1 |

%) |

|

|

681 |

|

|

|

705 |

|

|

|

(3 |

%) |

|

|

3 |

% |

| as % of Sales |

|

|

19.0 |

% |

|

|

19.0 |

% |

|

|

0.0pp |

|

|

|

|

|

|

|

17.9 |

% |

|

|

17.5 |

% |

|

|

0.4pp |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Free cash flow after maintenance capital expenditures |

|

|

870 |

|

|

|

1208 |

|

|

|

(28 |

%) |

|

|

|

|

|

|

676 |

|

|

|

511 |

|

|

|

32 |

% |

|

|

|

|

| Free cash flow |

|

|

378 |

|

|

|

788 |

|

|

|

(52 |

%) |

|

|

|

|

|

|

512 |

|

|

|

403 |

|

|

|

27 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total debt |

|

|

6,700 |

|

|

|

7,486 |

|

|

|

(10 |

%) |

|

|

|

|

|

|

6,700 |

|

|

|

7,486 |

|

|

|

(10 |

%) |

|

|

|

|

| Earnings (loss) of continuing operations per ADS |

|

|

0.61 |

|

|

|

0.07 |

|

|

|

788 |

% |

|

|

|

|

|

|

0.16 |

|

|

|

(0.31 |

) |

|

|

N/A |

|

|

|

|

|

| Fully diluted earnings (loss) of continuing operations per ADS |

|

|

0.61 |

|

|

|

0.07 |

|

|

|

788 |

% |

|

|

|

|

|

|

0.16 |

|

|

|

(0.31 |

) |

|

|

N/A |

|

|

|

|

|

| Average ADSs outstanding (1) |

|

|

1,469 |

|

|

|

1,470 |

|

|

|

(0 |

%) |

|

|

|

|

|

|

1,471 |

|

|

|

1,469 |

|

|

|

0 |

% |

|

|

|

|

| Employees |

|

|

44,494 |

|

|

|

44,674 |

|

|

|

(0 |

%) |

|

|

|

|

|

|

44,494 |

|

|

|

44,674 |

|

|

|

(0 |

%) |

|

|

|

|

| (1) |

For purposes of this report, Average ADSs outstanding equals the total number of Series A shares and Series B

shares outstanding as if they were all held in ADS form. |

Cement and aggregates volumes in thousands of metric tons. Ready-mix volumes in thousands of cubic meters.

In millions of U.S. dollars, except volumes,

percentages, employees, and per-ADS amounts. Average ADSs outstanding are presented in millions.

Consolidated net sales in 2024 reached US$16.2 billion, a decrease of

-1% on a like-to-like basis, while remaining flat in fourth quarter on a like-to-like basis. Higher prices were offset by lower volumes in our markets.

Cost of sales, as a

percentage of Net Sales, increased by 0.1pp to 66.4% in 2024, and was 2.0pp higher in the fourth quarter versus the same period last year, driven by higher fixed costs, along with a decrease in Sales. However, we continued to experience energy

tailwinds, particularly in fuels for cement production.

Operating expenses, as a percentage of Net Sales, increased by 0.4pp to 22.3% in 2024, and

were -1.7pp lower in the fourth quarter compared with the same period last year. Improvement in the fourth quarter is mainly attributed to reduced freight in our Mexican operations.

Operating EBITDA in 2024 reached US$3,079 million, decreasing 1% on a

like-to-like basis. With prices more than offsetting costs in the quarter, slight decline in Operating EBITDA was attributable to volumes dynamics. During the fourth

quarter, Operating EBITDA increased 3% on a like-to-like basis, driven by higher prices, stabilizing volumes in most markets and a favorable fuel cost environment.

Operating EBITDA margin in 2024 remained flat at 19.0% and was +0.4pp higher in the fourth quarter, with all regions experiencing a margin expansion.

Controlling interest net income reached US$939 million in 2024, a record level in our recent history and an increase of 415% on a

year-over-year basis, driven by a lower effective tax rate and gains from asset divestments.

|

|

|

| 2024 Fourth Quarter Results |

|

Page 2 |

|

|

|

| Operating results |

|

|

Mexico

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

January - December |

|

|

Fourth Quarter |

|

| |

|

2024 |

|

|

2023 |

|

|

% var |

|

|

l-t-l

% var |

|

|

2024 |

|

|

2023 |

|

|

% var |

|

|

l-t-l

% var |

|

| Sales |

|

|

4,881 |

|

|

|

5,060 |

|

|

|

(4 |

%) |

|

|

1 |

% |

|

|

1,050 |

|

|

|

1,305 |

|

|

|

(20 |

%) |

|

|

(6 |

%) |

| Operating EBITDA |

|

|

1,475 |

|

|

|

1,488 |

|

|

|

(1 |

%) |

|

|

3 |

% |

|

|

283 |

|

|

|

346 |

|

|

|

(18 |

%) |

|

|

(4 |

%) |

| Operating EBITDA margin |

|

|

30.2 |

% |

|

|

29.4 |

% |

|

|

0.8pp |

|

|

|

|

|

|

|

26.9 |

% |

|

|

26.5 |

% |

|

|

0.4pp |

|

|

|

|

|

In millions of U.S. dollars, except percentages.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Domestic gray cement |

|

|

Ready-mix |

|

|

Aggregates |

|

Year-over-year percentage

variation |

|

January - December |

|

|

Fourth Quarter |

|

|

January - December |

|

|

Fourth Quarter |

|

|

January - December |

|

|

Fourth Quarter |

|

| Volume |

|

|

(1 |

%) |

|

|

(7 |

%) |

|

|

0 |

% |

|

|

1 |

% |

|

|

(0 |

%) |

|

|

(5 |

%) |

| Price (USD) |

|

|

(1 |

%) |

|

|

(12 |

%) |

|

|

2 |

% |

|

|

(10 |

%) |

|

|

(2 |

%) |

|

|

(19 |

%) |

| Price (local currency) |

|

|

3 |

% |

|

|

3 |

% |

|

|

7 |

% |

|

|

5 |

% |

|

|

3 |

% |

|

|

(6 |

%) |

In our Mexican operations, despite a challenging volume backdrop in the second half of 2024, 2024

Operating EBITDA increased 3% on a like-to-like basis with a margin improvement of 0.8pp. The depreciation of the Mexican peso resulted in an Operating EBITDA effect of

$52 million in 2024 results, as our dynamic FX hedging strategy continues to mitigate impact on our leverage.

Volume demand in Mexico

had two speeds in 2024, first growing 6% in the first half and then declining 7% in the second half post-election. In fourth quarter, we continued to see year-over-year volume deceleration aligned with third quarter behavior in cement and an

outperformance in ready-mix. Ready-mix volume growth remains supported by the formal sector in the northeast and central regions in Mexico.

Similar to 2024, we expect 2025 to be a story of two distinct halves, with a tough volume comparison base and FX headwinds in the first half of

the year. Over the medium term, we are optimistic about Mexico’s growth prospects, as the new government’s agenda is supportive of housing and infrastructure spending.

United States

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

January - December |

|

|

Fourth Quarter |

|

| |

|

2024 |

|

|

2023 |

|

|

% var |

|

|

l-t-l

% var |

|

|

2024 |

|

|

2023 |

|

|

% var |

|

|

l-t-l

% var |

|

| Sales |

|

|

5,194 |

|

|

|

5,338 |

|

|

|

(3 |

%) |

|

|

(3 |

%) |

|

|

1,233 |

|

|

|

1,269 |

|

|

|

(3 |

%) |

|

|

(3 |

%) |

| Operating EBITDA |

|

|

1,031 |

|

|

|

1,040 |

|

|

|

(1 |

%) |

|

|

(1 |

%) |

|

|

238 |

|

|

|

239 |

|

|

|

(0 |

%) |

|

|

(0 |

%) |

| Operating EBITDA margin |

|

|

19.8 |

% |

|

|

19.5 |

% |

|

|

0.3pp |

|

|

|

|

|

|

|

19.3 |

% |

|

|

18.8 |

% |

|

|

0.5pp |

|

|

|

|

|

In millions of U.S. dollars, except percentages.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Domestic gray cement |

|

|

Ready-mix |

|

|

Aggregates |

|

Year-over-year percentage

variation |

|

January - December |

|

|

Fourth Quarter |

|

|

January - December |

|

|

Fourth Quarter |

|

|

January - December |

|

|

Fourth Quarter |

|

| Volume |

|

|

(6 |

%) |

|

|

(3 |

%) |

|

|

(10 |

%) |

|

|

(3 |

%) |

|

|

(1 |

%) |

|

|

(7 |

%) |

| Price (USD) |

|

|

2 |

% |

|

|

(0 |

%) |

|

|

5 |

% |

|

|

1 |

% |

|

|

3 |

% |

|

|

5 |

% |

| Price (local currency) |

|

|

2 |

% |

|

|

(0 |

%) |

|

|

5 |

% |

|

|

1 |

% |

|

|

3 |

% |

|

|

5 |

% |

In the United States, Operating EBITDA in 2024 declined 1% year-over-year due to extreme weather events

with four major hurricanes and a deep freeze in Texas. We estimate these events were responsible for an Operating EBITDA impact of ~$38 million in 2024. Adjusting for these weather events, Operating EBITDA would have increased 3% in the full

year.

The resilience of the business to lower volumes was impressive, with Operating EBITDA margin expanding, driven by cost optimization

efforts, lower fuel prices and lower imports.

|

|

|

| 2024 Fourth Quarter Results |

|

Page 3 |

|

|

|

| Operating results |

|

|

We anticipate improved conditions in 2025, supported by underlying demand for infrastructure,

as transportation projects under the Infrastructure, Investment and Jobs Act continue to roll out, and the industrial sector, with significant investments in manufacturing projects.

Europe, Middle East, and Africa

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

January - December |

|

|

Fourth Quarter |

|

| |

|

2024 |

|

|

2023 |

|

|

% var |

|

|

l-t-l

% var |

|

|

2024 |

|

|

2023 |

|

|

% var |

|

|

l-t-l

% var |

|

| Sales |

|

|

4,631 |

|

|

|

4,748 |

|

|

|

(2 |

%) |

|

|

(2 |

%) |

|

|

1,155 |

|

|

|

1,097 |

|

|

|

5 |

% |

|

|

8 |

% |

| Operating EBITDA |

|

|

637 |

|

|

|

668 |

|

|

|

(5 |

%) |

|

|

(3 |

%) |

|

|

177 |

|

|

|

130 |

|

|

|

37 |

% |

|

|

43 |

% |

| Operating EBITDA margin |

|

|

13.8 |

% |

|

|

14.1 |

% |

|

|

(0.3pp |

) |

|

|

|

|

|

|

15.4 |

% |

|

|

11.8 |

% |

|

|

3.6pp |

|

|

|

|

|

In millions of U.S. dollars, except percentages.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Domestic gray cement |

|

|

Ready-mix |

|

|

Aggregates |

|

Year-over-year percentage

variation |

|

January - December |

|

|

Fourth Quarter |

|

|

January - December |

|

|

Fourth Quarter |

|

|

January - December |

|

|

Fourth Quarter |

|

| Volume |

|

|

0 |

% |

|

|

4 |

% |

|

|

(6 |

%) |

|

|

10 |

% |

|

|

(4 |

%) |

|

|

8 |

% |

| Price (USD) |

|

|

(0 |

%) |

|

|

(1 |

%) |

|

|

(1 |

%) |

|

|

(3 |

%) |

|

|

1 |

% |

|

|

(1 |

%) |

| Price (local currency) (*) |

|

|

2 |

% |

|

|

6 |

% |

|

|

(1 |

%) |

|

|

(2 |

%) |

|

|

1 |

% |

|

|

(1 |

%) |

In EMEA, the recovery trend continued in the fourth quarter, with our operations in Europe marking the

second consecutive quarter of Operating EBITDA growth, on a year-over-year basis, with improved cement volumes in all of our markets. For the full region, Operating EBITDA in the fourth quarter grew by +43% on a like-to-like basis, with a margin expansion of 3.6pp. This was driven by volumes, operational leverage, as well as one-off adjustment in our UK operations.

Prices for our three core products for the full year more than offset decelerating cost inflation, particularly in energy.

On Climate Action, our operations in Europe continue delivering record levels of decarbonization and are now very close to reaching both the

European Cement Association’s and Cemex’s consolidated 2030 CO2 emissions target. In Middle East & Africa, Operating EBITDA improved due to better pricing dynamics in Egypt and increased construction activity in Israel.

For 2025, we expect continued EMEA volume recovery, driven by Europe’s improved construction activity.

| (*) |

Calculated on a volume-weighted-average basis at constant foreign exchange rates. |

|

|

|

| 2024 Fourth Quarter Results |

|

Page 4 |

|

|

|

| Operating results |

|

|

South, Central America and the Caribbean

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

January - December |

|

|

Fourth Quarter |

|

| |

|

2024 |

|

|

2023 |

|

|

% var |

|

|

l-t-l

% var |

|

|

2024 |

|

|

2023 |

|

|

% var |

|

|

l-t-l

% var |

|

| Sales |

|

|

1,244 |

|

|

|

1,225 |

|

|

|

2 |

% |

|

|

0 |

% |

|

|

297 |

|

|

|

310 |

|

|

|

(4 |

%) |

|

|

0 |

% |

| Operating EBITDA |

|

|

234 |

|

|

|

229 |

|

|

|

2 |

% |

|

|

2 |

% |

|

|

57 |

|

|

|

58 |

|

|

|

(2 |

%) |

|

|

2 |

% |

| Operating EBITDA margin |

|

|

18.8 |

% |

|

|

18.7 |

% |

|

|

0.1pp |

|

|

|

|

|

|

|

19.2 |

% |

|

|

18.9 |

% |

|

|

0.3pp |

|

|

|

|

|

In millions of U.S. dollars, except percentages.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Domestic gray cement |

|

|

Ready-mix |

|

|

Aggregates |

|

Year-over-year percentage

variation |

|

January - December |

|

|

Fourth Quarter |

|

|

January - December |

|

|

Fourth Quarter |

|

|

January - December |

|

|

Fourth Quarter |

|

| Volume |

|

|

(2 |

%) |

|

|

(2 |

%) |

|

|

(5 |

%) |

|

|

(2 |

%) |

|

|

(3 |

%) |

|

|

(2 |

%) |

| Price (USD) |

|

|

5 |

% |

|

|

(1 |

%) |

|

|

14 |

% |

|

|

(0 |

%) |

|

|

5 |

% |

|

|

(7 |

%) |

| Price (local currency) (*) |

|

|

4 |

% |

|

|

3 |

% |

|

|

11 |

% |

|

|

9 |

% |

|

|

3 |

% |

|

|

1 |

% |

In South, Central America and the Caribbean, Operating EBITDA increased by 2%, on a like-to-like basis, both for 2024 and 4Q24, compared to the prior year. Higher Operating EBITDA margins were driven by positive pricing dynamics.

The formal sector continues driving demand with large infrastructure projects such as the Bogotá Metro, in which Cemex was awarded more

than 80% of total volumes, and the fourth bridge over the Canal in Panama.

Our Urbanization Solutions business is expanding rapidly in

the region, posting record Operating EBITDA growth of 36% in 2024, with a margin expansion of 5.3pp.

| (*) |

Calculated on a volume-weighted-average basis at constant foreign-exchange rates.

|

|

|

|

| 2024 Fourth Quarter Results |

|

Page 5 |

|

|

|

| Operating results |

|

|

Operating EBITDA and free cash flow

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

January - December |

|

|

Fourth Quarter |

|

| |

|

2024 |

|

|

2023 |

|

|

% var |

|

|

2024 |

|

|

2023 |

|

|

% var |

|

| Operating earnings before other income and expenses, net |

|

|

1,828 |

|

|

|

1,959 |

|

|

|

(7 |

%) |

|

|

374 |

|

|

|

405 |

|

|

|

(8 |

%) |

| + Depreciation and operating amortization |

|

|

1,251 |

|

|

|

1,190 |

|

|

|

|

|

|

|

306 |

|

|

|

300 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Operating EBITDA |

|

|

3,079 |

|

|

|

3,150 |

|

|

|

(2 |

%) |

|

|

681 |

|

|

|

705 |

|

|

|

(3 |

%) |

| - Net financial expense |

|

|

593 |

|

|

|

584 |

|

|

|

|

|

|

|

137 |

|

|

|

147 |

|

|

|

|

|

| - Maintenance capital expenditures |

|

|

1,016 |

|

|

|

967 |

|

|

|

|

|

|

|

463 |

|

|

|

389 |

|

|

|

|

|

| - Change in working capital |

|

|

(215 |

) |

|

|

26 |

|

|

|

|

|

|

|

(630 |

) |

|

|

(390 |

) |

|

|

|

|

| - Taxes paid |

|

|

872 |

|

|

|

501 |

|

|

|

|

|

|

|

60 |

|

|

|

44 |

|

|

|

|

|

| - Other cash items (net) |

|

|

64 |

|

|

|

17 |

|

|

|

|

|

|

|

(6 |

) |

|

|

36 |

|

|

|

|

|

| - Free cash flow discontinued operations |

|

|

(121 |

) |

|

|

(154 |

) |

|

|

|

|

|

|

(18 |

) |

|

|

(32 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Free cash flow after maintenance capital expenditures |

|

|

870 |

|

|

|

1,208 |

|

|

|

(28 |

%) |

|

|

676 |

|

|

|

511 |

|

|

|

32 |

% |

| - Strategic capital expenditures |

|

|

492 |

|

|

|

420 |

|

|

|

|

|

|

|

164 |

|

|

|

108 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Free cash flow |

|

|

378 |

|

|

|

788 |

|

|

|

(52 |

%) |

|

|

512 |

|

|

|

403 |

|

|

|

27 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

In millions of U.S. dollars, except percentages.

Free Cash Flow after Maintenance Capex totaled US$870 million in 2024. After adjusting for the extraordinary payment of the Spanish tax

fine, this is the highest Free Cash Flow after Maintenance Capex since 2017.

During the quarter, FCF benefited from a significant

turnaround in working capital, which resulted in a $215 million dollar divestment for the full year. This improvement is the result of targeted management actions to increase the efficiency of our assets across the organization.

During the year, Free Cash Flow after Strategic Capex plus net proceeds from asset divestments were used to reduce Net debt by

US$1,026 million, and for other expenses including payment of coupons on our subordinated notes, capitalized IT expenses, acquisitions such as the JV with Couch Aggregates in the U.S. and Cemex’s dividend payments, among others.

Information on debt

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Fourth Quarter |

|

|

Third

Quarter |

|

|

|

|

Fourth Quarter |

|

| |

|

2024 |

|

|

2023 |

|

|

% var |

|

|

2024 |

|

|

|

|

2024 |

|

|

2023 |

|

| Total debt (1) |

|

|

6,700 |

|

|

|

7,486 |

|

|

|

(10 |

%) |

|

|

7,512 |

|

|

Currency denomination |

|

|

|

|

|

|

|

|

| Short-term |

|

|

7 |

% |

|

|

3 |

% |

|

|

|

|

|

|

5 |

% |

|

U.S. dollar |

|

|

77 |

% |

|

|

74 |

% |

| Long-term |

|

|

93 |

% |

|

|

97 |

% |

|

|

|

|

|

|

95 |

% |

|

Euro |

|

|

15 |

% |

|

|

16 |

% |

| Cash and cash equivalents |

|

|

864 |

|

|

|

624 |

|

|

|

38 |

% |

|

|

422 |

|

|

Mexican peso |

|

|

5 |

% |

|

|

5 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net debt |

|

|

5,836 |

|

|

|

6,862 |

|

|

|

(15 |

%) |

|

|

7,090 |

|

|

Other |

|

|

3 |

% |

|

|

5 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Consolidated net debt (2) |

|

|

5,802 |

|

|

|

6,888 |

|

|

|

|

|

|

|

7,191 |

|

|

Interest rate (3) |

|

|

|

|

|

|

|

|

| Consolidated leverage ratio (2) |

|

|

1.81 |

|

|

|

2.06 |

|

|

|

|

|

|

|

2.22 |

|

|

Fixed |

|

|

74 |

% |

|

|

70 |

% |

| Consolidated coverage ratio (2) |

|

|

7.26 |

|

|

|

7.91 |

|

|

|

|

|

|

|

7.28 |

|

|

Variable |

|

|

26 |

% |

|

|

30 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

In millions of U.S. dollars, except percentages and ratios.

| (1) |

Includes leases, in accordance with International Financial Reporting Standards (IFRS). |

| (2) |

Calculated in accordance with our contractual obligations under our main bank debt agreements

|

| (3) |

Includes the effect of our interest rate derivatives, as applicable. |

The consolidated leverage ratio stood at 1.81 times as of the end of 2024, 0.4x lower than 3Q24, driven primarily by net proceeds from asset

divestments, FX hedging strategy and Free Cash Flow.

|

|

|

| 2024 Fourth Quarter Results |

|

Page 6 |

|

|

|

| Operating results |

|

|

Consolidated Statement of Operations & Statement of Financial Position

Cemex, S.A.B. de C.V. and Subsidiaries

(Thousands of

U.S. dollars, except per ADS amounts)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

January - December |

|

|

Fourth Quarter |

|

| |

|

|

|

|

|

|

|

|

|

|

like-to-like |

|

|

|

|

|

|

|

|

|

|

|

like-to-like |

|

| STATEMENT OF OPERATIONS |

|

2024 |

|

|

2023 |

|

|

% var |

|

|

% var |

|

|

2024 |

|

|

2023 |

|

|

% var |

|

|

% var |

|

| Sales |

|

|

16,200,230 |

|

|

|

16,554,435 |

|

|

|

(2 |

%) |

|

|

(1 |

%) |

|

|

3,811,403 |

|

|

|

4,026,676 |

|

|

|

(5 |

%) |

|

|

0 |

% |

| Cost of sales |

|

|

(10,761,137 |

) |

|

|

(10,979,020 |

) |

|

|

2 |

% |

|

|

|

|

|

|

(2,587,368 |

) |

|

|

(2,654,353 |

) |

|

|

3 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Gross profit |

|

|

5,439,093 |

|

|

|

5,575,415 |

|

|

|

(2 |

%) |

|

|

(1 |

%) |

|

|

1,224,035 |

|

|

|

1,372,322 |

|

|

|

(11 |

%) |

|

|

(4 |

%) |

| Operating expenses |

|

|

(3,611,146 |

) |

|

|

(3,615,928 |

) |

|

|

0 |

% |

|

|

|

|

|

|

(849,776 |

) |

|

|

(967,614 |

) |

|

|

12 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Operating earnings before other income and expenses, net |

|

|

1,827,947 |

|

|

|

1,959,487 |

|

|

|

(7 |

%) |

|

|

(5 |

%) |

|

|

374,259 |

|

|

|

404,708 |

|

|

|

(8 |

%) |

|

|

0 |

% |

| Other expenses, net |

|

|

(7,267 |

) |

|

|

(211,389 |

) |

|

|

97 |

% |

|

|

|

|

|

|

18,026 |

|

|

|

(121,362 |

) |

|

|

N/A |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Operating earnings |

|

|

1,820,680 |

|

|

|

1,748,098 |

|

|

|

4 |

% |

|

|

|

|

|

|

392,285 |

|

|

|

283,346 |

|

|

|

38 |

% |

|

|

|

|

| Financial expense |

|

|

(555,468 |

) |

|

|

(538,277 |

) |

|

|

(3 |

%) |

|

|

|

|

|

|

(125,888 |

) |

|

|

(132,918 |

) |

|

|

5 |

% |

|

|

|

|

| Other financial income (expense), net |

|

|

(377,366 |

) |

|

|

16,002 |

|

|

|

N/A |

|

|

|

|

|

|

|

(104,629 |

) |

|

|

40,120 |

|

|

|

N/A |

|

|

|

|

|

| Financial income |

|

|

37,503 |

|

|

|

37,093 |

|

|

|

1 |

% |

|

|

|

|

|

|

11,042 |

|

|

|

12,336 |

|

|

|

(10 |

%) |

|

|

|

|

| Results from financial instruments, net |

|

|

32,169 |

|

|

|

(58,337 |

) |

|

|

N/A |

|

|

|

|

|

|

|

43,901 |

|

|

|

(5,780 |

) |

|

|

N/A |

|

|

|

|

|

| Foreign exchange results |

|

|

(353,441 |

) |

|

|

129,662 |

|

|

|

N/A |

|

|

|

|

|

|

|

(135,348 |

) |

|

|

59,113 |

|

|

|

N/A |

|

|

|

|

|

| Effects of net present value on assets and liabilities and others, net |

|

|

(93,597 |

) |

|

|

(92,417 |

) |

|

|

(1 |

%) |

|

|

|

|

|

|

(24,224 |

) |

|

|

(25,548 |

) |

|

|

5 |

% |

|

|

|

|

| Equity in gain (loss) of associates |

|

|

92,568 |

|

|

|

97,629 |

|

|

|

(5 |

%) |

|

|

|

|

|

|

24,317 |

|

|

|

31,483 |

|

|

|

(23 |

%) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Income (loss) before income tax |

|

|

980,414 |

|

|

|

1,323,451 |

|

|

|

(26 |

%) |

|

|

|

|

|

|

186,085 |

|

|

|

222,031 |

|

|

|

(16 |

%) |

|

|

|

|

| Income tax |

|

|

(67,039 |

) |

|

|

(1,204,424 |

) |

|

|

94 |

% |

|

|

|

|

|

|

54,788 |

|

|

|

(671,167 |

) |

|

|

N/A |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Profit (loss) of continuing operations |

|

|

913,375 |

|

|

|

119,027 |

|

|

|

667 |

% |

|

|

|

|

|

|

240,873 |

|

|

|

(449,135 |

) |

|

|

N/A |

|

|

|

|

|

| Discontinued operations |

|

|

46,830 |

|

|

|

81,643 |

|

|

|

(43 |

%) |

|

|

|

|

|

|

(187,325 |

) |

|

|

8,385 |

|

|

|

N/A |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Consolidated net income (loss) |

|

|

960,205 |

|

|

|

200,670 |

|

|

|

379 |

% |

|

|

|

|

|

|

53,547 |

|

|

|

(440,750 |

) |

|

|

N/A |

|

|

|

|

|

| Non-controlling interest net income (loss) |

|

|

21,395 |

|

|

|

18,506 |

|

|

|

16 |

% |

|

|

|

|

|

|

5,238 |

|

|

|

250 |

|

|

|

1992 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Controlling interest net income (loss) |

|

|

938,810 |

|

|

|

182,163 |

|

|

|

415 |

% |

|

|

|

|

|

|

48,309 |

|

|

|

(441,000 |

) |

|

|

N/A |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Operating EBITDA |

|

|

3,078,940 |

|

|

|

3,149,500 |

|

|

|

(2 |

%) |

|

|

(1 |

%) |

|

|

680,734 |

|

|

|

705,122 |

|

|

|

(3 |

%) |

|

|

3 |

% |

| Earnings (loss) of continued operations per ADS |

|

|

0.61 |

|

|

|

0.07 |

|

|

|

788 |

% |

|

|

|

|

|

|

0.16 |

|

|

|

(0.31 |

) |

|

|

N/A |

|

|

|

|

|

| Earnings (loss) of discontinued operations per ADS |

|

|

0.03 |

|

|

|

0.06 |

|

|

|

(43 |

%) |

|

|

|

|

|

|

(0.13 |

) |

|

|

0.01 |

|

|

|

N/A |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

As of December 31 |

|

| STATEMENT OF FINANCIAL POSITION |

|

2024 |

|

|

2023 |

|

|

% var |

|

| Total assets |

|

|

27,298,867 |

|

|

|

28,433,399 |

|

|

|

(4 |

%) |

| Cash and cash equivalents |

|

|

863,926 |

|

|

|

623,933 |

|

|

|

38 |

% |

| Trade receivables less allowance for doubtful accounts |

|

|

1,582,091 |

|

|

|

1,751,468 |

|

|

|

(10 |

%) |

| Other accounts receivable |

|

|

714,532 |

|

|

|

649,674 |

|

|

|

10 |

% |

| Inventories, net |

|

|

1,484,927 |

|

|

|

1,789,303 |

|

|

|

(17 |

%) |

| Assets held for sale |

|

|

265,087 |

|

|

|

48,825 |

|

|

|

443 |

% |

| Other current assets |

|

|

105,331 |

|

|

|

142,197 |

|

|

|

(26 |

%) |

| Current assets |

|

|

5,015,894 |

|

|

|

5,005,400 |

|

|

|

0 |

% |

| Property, machinery and equipment, net |

|

|

11,240,048 |

|

|

|

12,465,655 |

|

|

|

(10 |

%) |

| Other assets |

|

|

11,042,925 |

|

|

|

10,962,343 |

|

|

|

1 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total liabilities |

|

|

14,822,090 |

|

|

|

16,317,466 |

|

|

|

(9 |

%) |

| Current liabilities |

|

|

6,092,987 |

|

|

|

6,785,733 |

|

|

|

(10 |

%) |

| Long-term liabilities |

|

|

5,340,113 |

|

|

|

6,202,961 |

|

|

|

(14 |

%) |

| Other liabilities |

|

|

3,388,990 |

|

|

|

3,328,772 |

|

|

|

2 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total stockholder’s equity |

|

|

12,476,777 |

|

|

|

12,115,933 |

|

|

|

3 |

% |

| Common stock and additional paid-in capital |

|

|

7,699,108 |

|

|

|

7,686,469 |

|

|

|

0 |

% |

| Other equity reserves |

|

|

(2,755,268 |

) |

|

|

(2,334,750 |

) |

|

|

(18 |

%) |

| Subordinated notes |

|

|

1,985,040 |

|

|

|

1,985,040 |

|

|

|

0 |

% |

| Retained earnings |

|

|

5,246,753 |

|

|

|

4,427,943 |

|

|

|

18 |

% |

| Non-controlling interest |

|

|

301,144 |

|

|

|

351,231 |

|

|

|

(14 |

%) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| 2024 Fourth Quarter Results |

|

Page 7 |

|

|

|

| Operating results |

|

|

Operating Summary per Country

In thousands of U.S. dollars

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

January - December |

|

|

|

|

|

Fourth Quarter |

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

like-to-like |

|

|

|

|

|

|

|

|

|

|

|

like-to-like |

|

| Sales |

|

2024 |

|

|

2023 |

|

|

% var |

|

|

% var |

|

|

2024 |

|

|

2023 |

|

|

% var |

|

|

% var |

|

| Mexico |

|

|

4,881,483 |

|

|

|

5,060,105 |

|

|

|

(4 |

%) |

|

|

1 |

% |

|

|

1,050,054 |

|

|

|

1,305,016 |

|

|

|

(20 |

%) |

|

|

(6 |

%) |

| U.S.A. |

|

|

5,193,941 |

|

|

|

5,337,668 |

|

|

|

(3 |

%) |

|

|

(3 |

%) |

|

|

1,233,321 |

|

|

|

1,268,722 |

|

|

|

(3 |

%) |

|

|

(3 |

%) |

| Europe, Middle East and Africa |

|

|

4,630,955 |

|

|

|

4,747,667 |

|

|

|

(2 |

%) |

|

|

(2 |

%) |

|

|

1,154,664 |

|

|

|

1,096,955 |

|

|

|

5 |

% |

|

|

8 |

% |

| Europe |

|

|

3,621,247 |

|

|

|

3,653,975 |

|

|

|

(1 |

%) |

|

|

(2 |

%) |

|

|

872,358 |

|

|

|

848,724 |

|

|

|

3 |

% |

|

|

4 |

% |

| Middle East and Africa |

|

|

1,009,708 |

|

|

|

1,093,692 |

|

|

|

(8 |

%) |

|

|

(2 |

%) |

|

|

282,306 |

|

|

|

248,231 |

|

|

|

14 |

% |

|

|

22 |

% |

| South, Central America and the Caribbean |

|

|

1,244,396 |

|

|

|

1,224,987 |

|

|

|

2 |

% |

|

|

0 |

% |

|

|

297,363 |

|

|

|

309,975 |

|

|

|

(4 |

%) |

|

|

0 |

% |

| Others and intercompany eliminations |

|

|

249,454 |

|

|

|

184,007 |

|

|

|

36 |

% |

|

|

37 |

% |

|

|

76,001 |

|

|

|

46,008 |

|

|

|

65 |

% |

|

|

66 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| TOTAL |

|

|

16,200,230 |

|

|

|

16,554,435 |

|

|

|

(2 |

%) |

|

|

(1 |

%) |

|

|

3,811,403 |

|

|

|

4,026,676 |

|

|

|

(5 |

%) |

|

|

0 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| GROSS PROFIT |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Mexico |

|

|

2,403,402 |

|

|

|

2,414,888 |

|

|

|

(0 |

%) |

|

|

3 |

% |

|

|

487,392 |

|

|

|

617,674 |

|

|

|

(21 |

%) |

|

|

(8 |

%) |

| U.S.A. |

|

|

1,496,024 |

|

|

|

1,556,661 |

|

|

|

(4 |

%) |

|

|

(4 |

%) |

|

|

352,841 |

|

|

|

377,856 |

|

|

|

(7 |

%) |

|

|

(7 |

%) |

| Europe, Middle East and Africa |

|

|

1,160,762 |

|

|

|

1,159,551 |

|

|

|

0 |

% |

|

|

1 |

% |

|

|

314,655 |

|

|

|

255,192 |

|

|

|

23 |

% |

|

|

28 |

% |

| Europe |

|

|

971,066 |

|

|

|

956,424 |

|

|

|

2 |

% |

|

|

1 |

% |

|

|

257,351 |

|

|

|

214,099 |

|

|

|

20 |

% |

|

|

21 |

% |

| Middle East and Africa |

|

|

189,696 |

|

|

|

203,126 |

|

|

|

(7 |

%) |

|

|

4 |

% |

|

|

57,304 |

|

|

|

41,093 |

|

|

|

39 |

% |

|

|

64 |

% |

| South, Central America and the Caribbean |

|

|

383,864 |

|

|

|

370,550 |

|

|

|

4 |

% |

|

|

2 |

% |

|

|

93,257 |

|

|

|

95,550 |

|

|

|

(2 |

%) |

|

|

2 |