Additional Proxy Soliciting Materials (definitive) (defa14a)

September 30 2020 - 2:09PM

Edgar (US Regulatory)

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the

Registrant ☒ Filed by a Party other than the

Registrant ☐

Check the appropriate box:

|

|

|

|

|

☐

|

|

Preliminary Proxy Statement

|

|

|

|

|

☐

|

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

|

|

|

|

|

☐

|

|

Definitive Proxy Statement

|

|

|

|

|

☒

|

|

Definitive Additional Materials

|

|

|

|

|

☐

|

|

Soliciting Material Pursuant to § 240.14a-12

|

CBRE

Clarion Global Real Estate Income Fund

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

|

|

|

|

|

|

|

|

|

|

☒

|

|

No fee required.

|

|

|

|

|

☐

|

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

|

|

|

|

|

|

|

|

(1)

|

|

Title of each class of securities to which transaction applies:

|

|

|

|

(2)

|

|

Aggregate number of securities to which transaction applies:

|

|

|

|

(3)

|

|

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing

fee is calculated and state how it was determined):

|

|

|

|

(4)

|

|

Proposed maximum aggregate value of transaction:

|

|

|

|

(5)

|

|

Total fee paid:

|

|

|

|

|

☐

|

|

Fee paid previously with preliminary materials.

|

|

☐

|

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 240.0-11 and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement

number, or the Form or Schedule and the date of its filing.

|

|

|

|

|

|

|

|

(1)

|

|

Amount Previously Paid:

|

|

|

|

(2)

|

|

Form, Schedule or Registration Statement No.:

|

|

|

|

(3)

|

|

Filing Party:

|

|

|

|

(4)

|

|

Date Filed:

|

PRESS RELEASE

FOR IMMEDIATE

RELEASE

|

|

|

|

|

|

|

Analyst and Press Inquiries:

|

|

Investor Relations:

|

|

|

|

David Leggette, Principal

|

|

888.711.4272

|

|

|

|

610.995.2500

|

|

www.cbreclarion.com

|

|

|

CBRE CLARION GLOBAL REAL ESTATE INCOME FUND TO HOLD VIRTUAL-ONLY 2020 ANNUAL MEETING OF SHAREHOLDERS

Philadelphia – September 30, 2020 – The Board of Trustees of the CBRE Clarion Global Real Estate Income Fund (NYSE: IGR) announced today that

its 2020 Annual Meeting of Shareholders (the “Annual Meeting”) will be held in a virtual-only format due to continued public health concerns related to the coronavirus pandemic (COVID-19), and to

support the health and well-being of our shareholders and other meeting participants. Shareholders will not be able to attend the Annual Meeting in person.

The Annual Meeting will still be held on October 9, 2020 at 10:00 a.m. Eastern Time, as previously announced. To register to attend the virtual meeting,

go to https://viewproxy.com/cbre/broadridgevsm/. Please have the control number located on your proxy card or voting information form available.

Shareholders whose shares are registered in the name of a bank, brokerage firm or other nominee that desire to attend and vote their shares at the Annual

Meeting will need to contact their bank, brokerage firm or other nominee to receive instructions on how to obtain a legal proxy and control number that will allow the shareholder to vote at the Annual Meeting.

Whether or not you plan to attend the Annual Meeting, CBRE Clarion Global Real Estate Income Fund urges you to authorize your proxy to vote in advance of the

Annual Meeting by one of the methods described in the proxy materials for the Annual Meeting. The proxy card or voting instruction form included in any hard copies of the proxy materials will not be updated to reflect the change in location and may

continue to be used to vote your shares in connection with the Annual Meeting.

About CBRE Clarion Securities:

CBRE Clarion Securities is a registered investment advisory firm specializing in the management of global real asset securities for institutional investors.

Headquartered near Philadelphia, the firm has employees located in offices in the United States, United Kingdom, Japan, and Australia. For more information about CBRE Clarion Securities, please visit www.cbreclarion.com.

CBRE Clarion Securities is the listed equity management arm of CBRE Global Investors. CBRE Global Investors is a global real assets investment management firm

with $109.6 billion in assets under management* as of June 30, 2020. The firm sponsors investment programs across the risk/return spectrum for investors worldwide.

CBRE Global Investors is an independently operated affiliate of CBRE Group, Inc. (NYSE:CBRE). It harnesses the research, investment sourcing and other

resources of the world’s largest commercial real estate services and investment firm (based on 2019 revenue) for the benefit of its investors. CBRE Group, Inc. has more than 100,000 employees (excluding affiliates) and serves real estate

investors and occupiers through more than 530 offices (excluding affiliates) worldwide. For more information about CBRE Global Investors, please visit www.cbreglobalinvestors.com

|

*

|

Assets under management Assets under management (AUM) refers to the fair market value of real assets-related

investments with respect to which CBRE Global Investors provides, on a global basis, oversight, investment management services and other advice and which generally consist of investments in real assets; equity in funds and joint ventures; securities

portfolios; operating companies and real assets-related loans. This AUM is intended principally to reflect the extent of CBRE Global Investors’ presence in the global real assets market, and its calculation of AUM may differ from the

calculations of other asset managers.

|

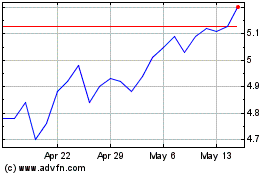

CBRE Global Real Estate ... (NYSE:IGR)

Historical Stock Chart

From Oct 2024 to Nov 2024

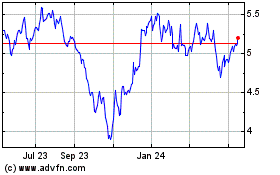

CBRE Global Real Estate ... (NYSE:IGR)

Historical Stock Chart

From Nov 2023 to Nov 2024