0000928022false00009280222023-11-012023-11-01

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): November 1, 2023 Callon Petroleum Company

(Exact name of registrant as specified in its charter) | | | | | | | | | | | | | | |

| DE | | 001-14039 | | 64-0844345 |

| (State or Other Jurisdiction of Incorporation) | | (Commission File Number) | | (I.R.S. Employer Identification Number) |

One Briarlake Plaza

2000 W. Sam Houston Parkway S., Suite 2000

Houston, TX 77042 | | | | | | | | |

| (Address of Principal Executive Offices, and Zip Code) | |

(281) 589-5200 | | | | | | | | |

| (Registrant’s Telephone Number, Including Area Code) | |

| | | | | | | | |

| (Former Name or Former Address, if Changed Since Last Report) | |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

☐ Written communication pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communication pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communication pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Common Stock, $0.01 par value | | CPE | | NYSE |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

☐ Emerging growth company

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02. Results of Operations and Financial Condition

The following information, including the press releases and certain financial and operational supplemental information attached as exhibits, is being furnished pursuant to Item 2.02 “Results of Operations and Financial Condition,” not filed, for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). This information shall not be deemed “filed” for purposes of Section 18 of the Exchange Act or incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such filing.

On November 1, 2023, Callon Petroleum Company issued the press release, attached as Exhibit 99.1, and certain financial and operational supplemental information, attached as Exhibit 99.2, regarding the Company’s third quarter 2023 financial and operating results and outlook.

Item 7.01. Regulation FD

The information set forth under Item 2.02 is incorporated herein by reference.

Item 9.01. Financial Statements and Exhibits

(d) Exhibits

| | | | | | | | |

| | |

| Exhibit Number | | Title of Document |

| | |

| 99.1 | | |

| 99.2 | | |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| | | Callon Petroleum Company |

| | | (Registrant) |

| | | |

| | | |

| November 1, 2023 | | /s/ Kevin Haggard |

| | | Kevin Haggard |

| | | Senior Vice President and Chief Financial Officer |

Exhibit 99.1

Callon Petroleum Company Reports Third Quarter 2023 Results

Reduced long-term debt to $1.9 billion

Reiterated full-year 2023 capital expenditure outlook of $960 – $980 million

Recent efficiency gains are expected to reduce 2024 drilling, completion, and facilities costs by more than 15% per well

HOUSTON, November 1, 2023 /PRNewswire/ - Callon Petroleum Company (NYSE: CPE) (“Callon” or the “Company”) today reported third quarter 2023 financial and operating results. A conference call is planned for 8 a.m. CT, Thursday, November 2; participation details can be found in this release. Slides accompanying today’s release are available at www.callon.com/investors.

Third Quarter Highlights:

•Generated $266.8 million of net cash provided by operating activities

•Adjusted free cash flow of $48.3 million, marking 14 consecutive quarters of adjusted free cash flow generation

•Total production was in line with expectations and averaged 101.7 MBoe/d (79% liquids), while oil production averaged 58.0 MBbls/d

•Capital expenditures of $251 million were at the low end of guidance

•Repurchased $15 million in common stock during the quarter

•Closed Eagle Ford sale and Percussion acquisition, recently commencing production from a five-well project on the Percussion acreage

•Completed land transactions to increase working interest and allow for capital efficient longer laterals

“The third quarter marked an important milestone for Callon as we completed a reorganization of our operations group into a business unit design to improve focus on capital efficiency and capital allocation,” said Joe Gatto, President and Chief Executive Officer. “We have delivered tangible benefits from this move in a short period of time, especially in terms of structural drilling efficiency gains from well design changes. We now expect to complete approximately 50,000 more lateral feet and commence drilling an incremental five wells relative to our mid-year forecast. This additional activity will benefit 2024 production, all while staying within our existing budget. These gains position us well heading into 2024 and set the stage for incremental structural efficiency gains as the year progresses. We expect these improvements will reduce our 2024 average total well costs, including facilities, by over 15%. Our focus into next year remains unchanged -- generate free cash flow, reduce debt, lower costs and return cash to our owners under our share repurchase program.”

Financial Results

Callon reported third quarter 2023 net income of $119.5 million, or $1.75 per share, (all share amounts are stated on a diluted basis), and adjusted EBITDAX of $342.2 million. Adjusted income was $123.9 million, or $1.82 per share. The Company generated $266.8 million of net cash provided by operating activities in the third quarter. Total operational capital expenditures for the quarter were $251 million.

Operational Results

Third quarter total production was in line with guidance and averaged 101.7 MBoe/d (57% oil and 79% liquids). Oil production for the period was lower than expectations and averaged 58.0 MBbls/d. Oil volumes during the period were negatively impacted by weather-related power and midstream disruptions in August and September and a lower-than-expected oil mix from recent completions in the Delaware West area. Approximately half of the third quarter 2023 turned-in-lines (15 of 33) were in the Delaware West.

Average realized commodity prices during the third quarter were $82.18 per Bbl for oil (100% of NYMEX WTI), $22.40 per Bbl for natural gas liquids, and $2.14 per MMBtu for natural gas (80% of NYMEX HH). The total average realized price for the period was $54.50 per Boe on an unhedged basis.

2023 Outlook

Callon today revised its outlook for fourth quarter and full-year 2023 production and reiterated guidance for full-year 2023 capital expenditures.

For the fourth quarter, the Company expects that its total and oil production will average 100 – 103 MBoe/d (~79% liquids) and 56 – 59 MBbls/d (previous guidance was 104 – 108 MBoe/d and 63 – 65 MBbls/d, respectively). Full year 2023 total and oil production is now expected to average 102 – 104 MBoe/d and 59 – 61 MBbls/d (previous guidance was 103 – 106 MBoe/d and 62 – 64 MBbls/d, respectively).

Adjustments to the production outlook reflect the increased natural gas and NGL content from Delaware West and the ongoing optimization of Callon’s artificial lift programs. In the third quarter, the Company accelerated a change in its Delaware Basin artificial lift program, previously planned to start in 2024, that will incorporate an increased proportion of gas lift to reduce production downtime, lower workover expense, and enhance longer-term resource recovery.

Guidance for capital expenditures for full-year 2023 is unchanged at $960 – $980 million, despite an increase in previously forecast drilled lateral feet and completion activity into year-end. The Company is currently running five drilling rigs, four in the Delaware Basin and one in the Midland Basin, as well as one completion crew.

Shareholder Returns

During the third quarter, Callon repurchased 386,719 shares of common stock at a weighted average purchase price of $38.72 per common share for a total cost of approximately $15 million. As of September 30, 2023, the remaining authorized repurchase amount under the Share Repurchase Program was $285 million. Callon intends to use 40% of the fourth quarter adjusted free cash flow to repurchase shares.

Capital Structure

Callon remains focused on using a majority of its adjusted free cash flow to reduce total debt. As of September 30, 2023, Callon has approximately $1.1 billion of liquidity and $1.9 billion of long-term debt, including a drawn balance on the revolving credit facility of $396 million.

Earnings Call Information

The Company plans to host a conference call on Thursday, November 2, 2023, to discuss its third quarter 2023 financial and operating results and outlook.

Please join Callon Petroleum Company via the Internet for a webcast of the conference call:

| | | | | |

Time/Date: | 8 a.m. CT / 9 a.m. ET, Thursday, November 2, 2023 |

| Webcast: | Select “News & Events” under the “Investors” section of the Company’s website: www.callon.com. |

An archive of the conference call webcast will be available at www.callon.com under the “Investors” section of the website.

About Callon Petroleum

Callon Petroleum Company is an independent oil and natural gas company focused on the acquisition, exploration and sustainable development of high-quality assets in the Permian Basin in West Texas.

Contact

Matthew Hesterberg

Callon Petroleum Company

ir@callon.com

(281) 589-5200

Cautionary Statement Regarding Forward Looking Information

This news release contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. Forward-looking statements include all statements regarding the Company’s expectations and plans with respect to its share repurchase program; wells anticipated to be drilled and placed on production; future levels of development activity and associated production, capital expenditures and cash flow expectations and expected uses thereof; the Company’s production and expenditure guidance; estimated reserve quantities and the present value thereof; future debt levels and leverage; the Company’s initiatives to control costs and improve capital and structural drilling efficiency; and the implementation of the Company’s business plans and strategy, as well as statements including the words “believe,” “expect,” “plans,” “may,” “will,” “should,” “could,” and words of similar meaning. These statements reflect the Company’s current views with respect to future events and financial performance based on management’s experience and perception of historical trends, current conditions, anticipated future developments and other factors believed to be appropriate. No assurances can be given, however, that these events will occur or that these projections will be achieved, and actual results could differ materially from those projected as a result of certain factors. Any forward-looking statement speaks only as of the date on which such statement is made and the Company undertakes no obligation to correct or update any forward-looking statement, whether as a result of new information, future events or otherwise, except as required by applicable law. Some of the factors which could affect our future results and could cause results to differ materially from those expressed in our forward-looking statements include the volatility of oil and natural gas prices; changes in the supply of and demand

for oil and natural gas, including as a result of actions by, or disputes among members of OPEC and other oil and natural gas producing countries with respect to production levels or other matters related to the price of oil; general economic conditions, including the availability of credit, inflation or rising interest rates; our ability to drill and complete wells; operational, regulatory and environment risks; the cost and availability of equipment and labor; our ability to finance our development activities at expected costs or at expected times or at all; rising interest rates and inflation; our inability to realize the benefits of recent transactions; currently unknown risks and liabilities relating to the newly acquired assets and operations; adverse actions by third parties involved with the transactions; risks that are not yet known or material to us; and other risks more fully discussed in our filings with the U.S. Securities and Exchange Commission (the “SEC”), including our most recent Annual Report on Form 10-K and subsequent Quarterly Reports on Form 10-Q, available on our website or the SEC’s website at www.sec.gov. Any forward-looking statement speaks only as of the date on which such statement is made, and the Company undertakes no obligation to correct or update any forward-looking statement, whether as a result of new information, future events or otherwise, except as required by applicable law.

Non-GAAP Financial Measures

This news release refers to non-GAAP financial measures such as “adjusted free cash flow,” “adjusted EBITDAX,” “adjusted income,” and “adjusted income per diluted share.” These measures, detailed below, are provided in addition to, and not as an alternative for, and should be read in conjunction with, the information contained in our financial statements prepared in accordance with GAAP (including the notes), included in our filings with the SEC and posted on our website.

•Adjusted free cash flow is a supplemental non-GAAP measure that is defined by the Company as net cash provided by operating activities before net change in working capital, changes in accrued hedge settlements, merger, integration and transaction expense, and other income and expense, less capital expenditures before increase (decrease) in accrued capital expenditures. We believe adjusted free cash flow provides useful information to investors because it is a comparable metric against other companies in the industry and is a widely accepted financial indicator of an oil and natural gas company’s ability to generate cash for the use of internally funding their capital development program and to service or incur debt. Adjusted free cash flow is not a measure of a company’s financial performance under GAAP and should not be considered as an alternative to net cash provided by operating activities, or as a measure of liquidity.

•Callon calculates adjusted EBITDAX as net income (loss) before interest expense, income tax expense (benefit), depreciation, depletion and amortization, (gains) losses on derivative instruments excluding net settled derivative instruments, (gain) loss on sale of oil and gas properties, impairment of oil and gas properties, non-cash share-based compensation expense, exploration expense, merger, integration and transaction expense, (gain) loss on extinguishment of debt, and certain other expenses. Adjusted EBITDAX is not a measure of financial performance under GAAP. Accordingly, it should not be considered as a substitute for net income (loss), operating income (loss), cash flow provided by operating activities or other income or cash flow data prepared in accordance with GAAP. However, the Company believes that adjusted EBITDAX provides useful information to investors because it provides additional information with respect to our performance or ability to meet our future debt service, capital expenditures and working capital requirements. Because adjusted EBITDAX excludes some, but not all, items that affect net income (loss) and may vary among companies, the adjusted EBITDAX presented above may not be comparable to similarly titled measures of other companies.

•Adjusted income and adjusted income per diluted share are supplemental non-GAAP measures that Callon believes are useful to investors because they provide readers with a meaningful measure of our profitability before recording certain items whose timing or amount cannot be reasonably determined. These measures exclude the net of tax effects of these items and non-cash valuation adjustments, which are detailed in the reconciliation provided. Adjusted income and adjusted income per diluted share are not measures of financial performance under GAAP. Accordingly, neither should be considered as a substitute for net income (loss), operating income (loss), or other income data prepared in accordance with GAAP. However, the Company believes that adjusted income and adjusted income per diluted share provide additional information with respect to our performance. Because adjusted income and adjusted income per diluted share exclude some, but not all, items that affect net income (loss) and may vary among companies, the adjusted income and adjusted income per diluted share presented above may not be comparable to similarly titled measures of other companies.

•Adjusted diluted weighted average common shares outstanding is a non-GAAP financial measure which includes the effect of potentially dilutive instruments that, under certain circumstances described below, are excluded from diluted weighted average common shares outstanding, the most directly comparable GAAP financial measure. When a net loss exists, all potentially dilutive instruments are anti-dilutive to the net loss per common share and therefore excluded from the computation of diluted weighted average common shares outstanding. The effect of potentially dilutive instruments are included in the computation of adjusted diluted weighted average common shares outstanding for purposes of computing adjusted income per diluted share.

Adjusted Income and Adjusted EBITDAX. The following tables reconcile the Company’s adjusted income and adjusted EBITDAX to net income (loss):

| | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | |

| September 30, 2023 | | June 30, 2023 | | September 30, 2022 | | |

| (In thousands except per share data) |

| Net income (loss) | $119,484 | | | ($107,896) | | | $502,039 | | | |

| (Gain) loss on derivative contracts | 55,804 | | | (5,941) | | | (134,850) | | | |

| Gain (loss) on commodity derivative settlements, net | (9,196) | | | 13,663 | | | (105,006) | | | |

| Non-cash expense related to share-based awards | 3,955 | | | 3,688 | | | 1,741 | | | |

| Impairment of oil and gas properties | — | | | 406,898 | | | — | | | |

| Gain on sale of oil and gas properties | (20,570) | | | — | | | — | | | |

| Merger, integration and transaction | 4,925 | | | 1,543 | | | — | | | |

| Other expense | 3,220 | | | 54 | | | 2,861 | | | |

| Gain on extinguishment of debt | (1,238) | | | — | | | — | | | |

Tax effect on adjustments above (a) | (7,749) | | | (88,180) | | | 49,403 | | | |

| Change in valuation allowance | (24,690) | | | (100,749) | | | (102,755) | | | |

| Adjusted income | $123,945 | | | $123,080 | | | $213,433 | | | |

| | | | | | | |

| Net income (loss) per diluted share | $1.75 | | | ($1.74) | | | $8.11 | | | |

| Adjusted income per diluted share | $1.82 | | | $1.99 | | | $3.45 | | | |

| | | | | | | |

| Basic weighted average common shares outstanding | 67,931 | | | 61,856 | | | 61,703 | | | |

| Diluted weighted average common shares outstanding (GAAP) | 68,083 | | | 61,856 | | | 61,870 | | | |

| Effect of potentially dilutive instruments | — | | | 55 | | | — | | | |

| Adjusted diluted weighted average common shares outstanding | 68,083 | | | 61,911 | | | 61,870 | | | |

(a)Calculated using the federal statutory rate of 21%.

| | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | |

| September 30, 2023 | | June 30, 2023 | | September 30, 2022 | | |

| (In thousands) |

| Net income (loss) | $119,484 | | | ($107,896) | | | $502,039 | | | |

| (Gain) loss on derivative contracts | 55,804 | | | (5,941) | | | (134,850) | | | |

| Gain (loss) on commodity derivative settlements, net | (9,196) | | | 13,663 | | | (105,006) | | | |

| Non-cash expense related to share-based awards | 3,955 | | | 3,688 | | | 1,741 | | | |

| Impairment of oil and gas properties | — | | | 406,898 | | | — | | | |

| Gain on sale of oil and gas properties | (20,570) | | | — | | | — | | | |

| Merger, integration and transaction | 4,925 | | | 1,543 | | | — | | | |

| Other expense | 3,220 | | | 54 | | | 2,861 | | | |

| Income tax (benefit) expense | 509 | | | (156,212) | | | 3,383 | | | |

| Interest expense | 43,149 | | | 47,239 | | | 46,929 | | | |

| Depreciation, depletion and amortization | 138,598 | | | 127,348 | | | 129,895 | | | |

| Exploration | 3,588 | | | 1,882 | | | 2,942 | | | |

| Gain on extinguishment of debt | (1,238) | | | — | | | — | | | |

| Adjusted EBITDAX | $342,228 | | | $332,266 | | | $449,934 | | | |

Adjusted Free Cash Flow. The following table reconciles the Company’s adjusted free cash flow to net cash provided by operating activities:

| | | | | | | | | | | | | | | | | |

| Three Months Ended |

| September 30, 2023 | | June 30, 2023 | | September 30, 2022 |

| (In thousands) |

| Net cash provided by operating activities | $266,828 | | $279,522 | | $437,780 |

| Changes in working capital and other | 26,344 | | 11,188 | | (69,388) |

| Changes in accrued hedge settlements | (10,224) | | 638 | | 40,590 |

| Merger, integration and transaction | 4,925 | | 1,543 | | — |

| Cash flow from operations before net change in working capital | 287,873 | | 292,891 | | 408,982 |

| | | | | |

| Capital expenditures | 252,407 | | 293,697 | | 303,268 |

| Increase (decrease) in accrued capital expenditures | (12,872) | | (13,083) | | (42,247) |

| Capital expenditures before accruals | 239,535 | | 280,614 | | 261,021 |

| | | | | |

| Adjusted free cash flow | $48,338 | | $12,277 | | $147,961 |

| | | | | |

| | | | | |

| | | | | |

Callon Petroleum Company

Consolidated Balance Sheets

(In thousands, except par and share amounts)

| | | | | | | | | | | |

| September 30, 2023 | | December 31, 2022* |

| ASSETS | | | |

| Current assets: | | | |

| Cash and cash equivalents | $3,456 | | | $3,395 | |

| Accounts receivable, net | 262,394 | | | 237,128 | |

| Fair value of derivatives | 1,196 | | | 21,332 | |

| | | |

| Other current assets | 29,665 | | | 35,783 | |

| Total current assets | 296,711 | | | 297,638 | |

| Oil and natural gas properties, successful efforts accounting method: | | | |

| | | |

| | | |

| Proved properties, net | 4,815,776 | | | 4,851,529 | |

| Unproved properties | 1,287,019 | | | 1,225,768 | |

| Total oil and natural gas properties, net | 6,102,795 | | | 6,077,297 | |

| | | |

| Other property and equipment, net | 26,398 | | | 26,152 | |

| Deferred income taxes | 199,734 | | | — | |

| Deferred financing costs | 14,235 | | | 18,822 | |

| Fair value of derivatives | 21,742 | | | 454 | |

| Other assets, net | 66,908 | | | 68,106 | |

| Total assets | $6,728,523 | | | $6,488,469 | |

| LIABILITIES AND STOCKHOLDERS’ EQUITY | | | |

| Current liabilities: | | | |

| Accounts payable and accrued liabilities | $585,529 | | | $536,233 | |

| | | |

| | | |

| | | |

| | | |

| Fair value of derivatives | 61,189 | | | 16,197 | |

| | | |

| Other current liabilities | 103,077 | | | 150,384 | |

| Total current liabilities | 749,795 | | | 702,814 | |

| Long-term debt | 1,948,619 | | | 2,241,295 | |

| | | |

| Asset retirement obligations | 41,290 | | | 53,892 | |

| | | |

| | | |

| Fair value of derivatives | 44,807 | | | 13,415 | |

| Other long-term liabilities | 82,954 | | | 51,272 | |

| Total liabilities | 2,867,465 | | | 3,062,688 | |

| Commitments and contingencies | | | |

| Stockholders’ equity: | | | |

| | | |

Common stock, $0.01 par value, 130,000,000 shares authorized; 67,770,721 and 61,621,518 shares outstanding, respectively | 678 | | | 616 | |

| Capital in excess of par value | 4,225,183 | | | 4,022,194 | |

| Accumulated deficit | (364,803) | | | (597,029) | |

| Total stockholders’ equity | 3,861,058 | | | 3,425,781 | |

| Total liabilities and stockholders’ equity | $6,728,523 | | | $6,488,469 | |

*Financial information for the prior period has been recast to reflect retrospective application of the successful efforts method of accounting. For additional information, refer to our Form 10-Q for the period ended September 30, 2023.

Callon Petroleum Company

Consolidated Statements of Operations

(In thousands, except per share amounts)

| | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended September 30, | | Nine Months Ended September 30, |

| | 2023 | | 2022* | | 2023 | | 2022* |

| Operating Revenues: | | | | | | | |

| Oil | $438,665 | | | $575,852 | | | $1,269,996 | | | $1,748,913 | |

| Natural gas | 25,045 | | | 81,018 | | | 63,054 | | | 189,907 | |

| Natural gas liquids | 46,489 | | | 67,548 | | | 130,488 | | | 210,696 | |

| Sales of purchased oil and gas | 109,099 | | | 111,459 | | | 278,089 | | | 377,199 | |

| Total operating revenues | 619,298 | | | 835,877 | | | 1,741,627 | | | 2,526,715 | |

| | | | | | | |

| Operating Expenses: | | | | | | | |

| Lease operating | 73,525 | | | 76,121 | | | 225,415 | | | 216,389 | |

| Production and ad valorem taxes | 30,592 | | | 43,290 | | | 88,019 | | | 125,841 | |

| Gathering, transportation and processing | 27,255 | | | 27,575 | | | 80,570 | | | 71,617 | |

| Exploration | 3,588 | | | 2,942 | | | 7,702 | | | 7,237 | |

| Cost of purchased oil and gas | 111,118 | | | 111,439 | | | 285,947 | | | 378,107 | |

| Depreciation, depletion and amortization | 138,598 | | | 129,895 | | | 391,911 | | | 359,494 | |

| Impairment of oil and gas properties | — | | | — | | | 406,898 | | | — | |

| Gain on sale of oil and gas properties | (20,570) | | | — | | | (20,570) | | | — | |

| General and administrative | 29,339 | | | 24,253 | | | 86,905 | | | 71,485 | |

| Merger, integration and transaction | 4,925 | | | — | | | 6,468 | | | 769 | |

| | | | | | | |

| Total operating expenses | 398,370 | | | 415,515 | | | 1,559,265 | | | 1,230,939 | |

| Income From Operations | 220,928 | | | 420,362 | | | 182,362 | | | 1,295,776 | |

| | | | | | | |

| Other (Income) Expenses: | | | | | | | |

| Interest expense | 43,149 | | | 46,929 | | | 136,694 | | | 141,020 | |

| (Gain) loss on derivative contracts | 55,804 | | | (134,850) | | | 24,218 | | | 305,098 | |

(Gain) loss on extinguishment of debt | (1,238) | | | — | | | (1,238) | | | 42,417 | |

| Other (income) expense | 3,220 | | | 2,861 | | | (3,140) | | | 3,130 | |

| Total other (income) expense | 100,935 | | | (85,060) | | | 156,534 | | | 491,665 | |

| | | | | | | |

Income Before Income Taxes | 119,993 | | | 505,422 | | | 25,828 | | | 804,111 | |

| Income tax benefit (expense) | (509) | | | (3,383) | | | 206,398 | | | (6,536) | |

Net Income | $119,484 | | | $502,039 | | | $232,226 | | | $797,575 | |

| | | | | | | |

Net Income Per Common Share: | | | | | | | |

| Basic | $1.76 | | | $8.14 | | | $3.64 | | | $12.94 | |

| Diluted | $1.75 | | | $8.11 | | | $3.63 | | | $12.88 | |

| | | | | | | |

| Weighted Average Common Shares Outstanding: | | | | | | | |

| Basic | 67,931 | | | 61,703 | | | 63,827 | | | 61,624 | |

| Diluted | 68,083 | | | 61,870 | | | 64,016 | | | 61,927 | |

*Financial information for the prior period has been recast to reflect retrospective application of the successful efforts method of accounting. For additional information, refer to our Form 10-Q for the period ended September 30, 2023.

Callon Petroleum Company

Consolidated Statements of Cash Flows

(In thousands)

| | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended September 30, | | Nine Months Ended September 30, |

| | 2023 | | 2022* | | 2023 | | 2022* |

| Cash flows from operating activities: | | | | | | | |

Net income | $119,484 | | | $502,039 | | | $232,226 | | | $797,575 | |

Adjustments to reconcile net income to net cash provided by operating activities: | | | | | | | |

| Depreciation, depletion and amortization | 138,598 | | | 129,895 | | | 391,911 | | | 359,494 | |

| Impairment of oil and gas properties | — | | | — | | | 406,898 | | | — | |

| Amortization of non-cash debt related items, net | 2,734 | | | 2,559 | | | 7,979 | | | 9,680 | |

| Deferred income tax (benefit) expense | (1,200) | | | 1,110 | | | (206,041) | | | 1,110 | |

| (Gain) loss on derivative contracts | 55,804 | | | (134,850) | | | 24,218 | | | 305,098 | |

| Cash received (paid) for commodity derivative settlements, net | 1,028 | | | (145,596) | | | 13,274 | | | (433,518) | |

(Gain) loss on extinguishment of debt | (1,238) | | | — | | | (1,238) | | | 42,417 | |

| Gain on sale of oil and gas properties | (20,570) | | | — | | | (20,570) | | | — | |

Non-cash expense related to share-based awards | 3,955 | | | 1,741 | | | 9,524 | | | 4,427 | |

| | | | | | | |

| | | | | | | |

| Other, net | 3,971 | | | 3,504 | | | 4,563 | | | 8,704 | |

| Changes in current assets and liabilities: | | | | | | | |

| Accounts receivable | (28,352) | | | 71,479 | | | 14,219 | | | (52,423) | |

| Other current assets | (6,574) | | | (4,732) | | | (13,178) | | | (12,229) | |

| Accounts payable and accrued liabilities | (812) | | | 10,631 | | | (69,522) | | | (8,649) | |

| | | | | | | |

| | | | | | | |

| Net cash provided by operating activities | 266,828 | | | 437,780 | | | 794,263 | | | 1,021,686 | |

| Cash flows from investing activities: | | | | | | | |

| Capital expenditures | (252,407) | | | (303,268) | | | (751,004) | | | (648,149) | |

| Acquisition of oil and gas properties | (227,984) | | | (1,692) | | | (278,434) | | | (17,006) | |

| | | | | | | |

| Proceeds from sales of assets | 549,333 | | | 4,723 | | | 551,446 | | | 9,313 | |

| | | | | | | |

| Cash paid for settlement of contingent consideration arrangement | — | | | — | | | — | | | (19,171) | |

| Other, net | (1,212) | | | 4,788 | | | (2,850) | | | 13,497 | |

Net cash provided by (used in) investing activities | 67,730 | | | (295,449) | | | (480,842) | | | (661,516) | |

| Cash flows from financing activities: | | | | | | | |

| Borrowings on credit facility | 1,105,000 | | | 811,000 | | | 2,629,500 | | | 2,535,000 | |

| Payments on credit facility | (1,237,000) | | | (954,000) | | | (2,736,500) | | | (2,684,000) | |

| Issuance of 7.5% Senior Notes due 2030 | — | | | — | | | — | | | 600,000 | |

Redemption of 8.25% Senior Notes due 2025 | (187,238) | | | — | | | (187,238) | | | — | |

| Redemption of 6.125% Senior Notes due 2024 | — | | | — | | | — | | | (467,287) | |

| Redemption of 9.0% Second Lien Senior Secured Notes due 2025 | — | | | — | | | — | | | (339,507) | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Payment of deferred financing costs | (510) | | | (1,081) | | | (560) | | | (11,623) | |

| | | | | | | |

| Cash paid to repurchase common stock | (14,980) | | | — | | | (14,980) | | | — | |

| Other, net | (24) | | | — | | | (3,582) | | | 1,715 | |

Net cash used in financing activities | (334,752) | | | (144,081) | | | (313,360) | | | (365,702) | |

| Net change in cash and cash equivalents | (194) | | | (1,750) | | | 61 | | | (5,532) | |

| Balance, beginning of period | 3,650 | | | 6,100 | | | 3,395 | | | 9,882 | |

| Balance, end of period | $3,456 | | | $4,350 | | | $3,456 | | | $4,350 | |

*Financial information for the prior period has been recast to reflect retrospective application of the successful efforts method of accounting. For additional information, refer to our Form 10-Q for the period ended September 30, 2023.

SOURCE Callon Petroleum Company

Exhibit 99.2

Callon Petroleum Company Third Quarter 2023

Supplemental Tables

| | | | | |

| Table of Contents: | Page: |

| Consolidated Balance Sheets | |

| Consolidated Statements of Operations | |

| Consolidated Statements of Cash Flows | |

| Operating Results | |

| Commodity Derivatives | |

| Non-GAAP Measures | |

Callon Petroleum Company

Consolidated Balance Sheets

(In thousands, except par and share amounts)

| | | | | | | | | | | |

| September 30, 2023 | | December 31, 2022* |

| ASSETS | | | |

| Current assets: | | | |

| Cash and cash equivalents | $3,456 | | | $3,395 | |

| Accounts receivable, net | 262,394 | | | 237,128 | |

| Fair value of derivatives | 1,196 | | | 21,332 | |

| | | |

| Other current assets | 29,665 | | | 35,783 | |

| Total current assets | 296,711 | | | 297,638 | |

| Oil and natural gas properties, successful efforts accounting method: | | | |

| | | |

| | | |

| Proved properties, net | 4,815,776 | | | 4,851,529 | |

| Unproved properties | 1,287,019 | | | 1,225,768 | |

| Total oil and natural gas properties, net | 6,102,795 | | | 6,077,297 | |

| | | |

| Other property and equipment, net | 26,398 | | | 26,152 | |

| Deferred income taxes | 199,734 | | | — | |

| Deferred financing costs | 14,235 | | | 18,822 | |

| Fair value of derivatives | 21,742 | | | 454 | |

| Other assets, net | 66,908 | | | 68,106 | |

| Total assets | $6,728,523 | | | $6,488,469 | |

| LIABILITIES AND STOCKHOLDERS’ EQUITY | | | |

| Current liabilities: | | | |

| Accounts payable and accrued liabilities | $585,529 | | | $536,233 | |

| | | |

| | | |

| | | |

| | | |

| Fair value of derivatives | 61,189 | | | 16,197 | |

| | | |

| Other current liabilities | 103,077 | | | 150,384 | |

| Total current liabilities | 749,795 | | | 702,814 | |

| Long-term debt | 1,948,619 | | | 2,241,295 | |

| | | |

| Asset retirement obligations | 41,290 | | | 53,892 | |

| | | |

| | | |

| Fair value of derivatives | 44,807 | | | 13,415 | |

| Other long-term liabilities | 82,954 | | | 51,272 | |

| Total liabilities | 2,867,465 | | | 3,062,688 | |

| Commitments and contingencies | | | |

| Stockholders’ equity: | | | |

| | | |

Common stock, $0.01 par value, 130,000,000 shares authorized; 67,770,721 and 61,621,518 shares outstanding, respectively | 678 | | | 616 | |

| Capital in excess of par value | 4,225,183 | | | 4,022,194 | |

| Accumulated deficit | (364,803) | | | (597,029) | |

| Total stockholders’ equity | 3,861,058 | | | 3,425,781 | |

| Total liabilities and stockholders’ equity | $6,728,523 | | | $6,488,469 | |

*Financial information for the prior period has been recast to reflect retrospective application of the successful efforts method of accounting. For additional information, refer to our Form 10-Q for the period ended September 30, 2023.

Callon Petroleum Company

Consolidated Statements of Operations

(In thousands, except per share amounts)

| | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended September 30, | | Nine Months Ended September 30, |

| | 2023 | | 2022* | | 2023 | | 2022* |

| Operating Revenues: | | | | | | | |

| Oil | $438,665 | | | $575,852 | | | $1,269,996 | | | $1,748,913 | |

| Natural gas | 25,045 | | | 81,018 | | | 63,054 | | | 189,907 | |

| Natural gas liquids | 46,489 | | | 67,548 | | | 130,488 | | | 210,696 | |

| Sales of purchased oil and gas | 109,099 | | | 111,459 | | | 278,089 | | | 377,199 | |

| Total operating revenues | 619,298 | | | 835,877 | | | 1,741,627 | | | 2,526,715 | |

| | | | | | | |

| Operating Expenses: | | | | | | | |

| Lease operating | 73,525 | | | 76,121 | | | 225,415 | | | 216,389 | |

| Production and ad valorem taxes | 30,592 | | | 43,290 | | | 88,019 | | | 125,841 | |

| Gathering, transportation and processing | 27,255 | | | 27,575 | | | 80,570 | | | 71,617 | |

| Exploration | 3,588 | | | 2,942 | | | 7,702 | | | 7,237 | |

| Cost of purchased oil and gas | 111,118 | | | 111,439 | | | 285,947 | | | 378,107 | |

| Depreciation, depletion and amortization | 138,598 | | | 129,895 | | | 391,911 | | | 359,494 | |

| Impairment of oil and gas properties | — | | | — | | | 406,898 | | | — | |

| Gain on sale of oil and gas properties | (20,570) | | | — | | | (20,570) | | | — | |

| General and administrative | 29,339 | | | 24,253 | | | 86,905 | | | 71,485 | |

| Merger, integration and transaction | 4,925 | | | — | | | 6,468 | | | 769 | |

| | | | | | | |

| Total operating expenses | 398,370 | | | 415,515 | | | 1,559,265 | | | 1,230,939 | |

| Income From Operations | 220,928 | | | 420,362 | | | 182,362 | | | 1,295,776 | |

| | | | | | | |

| Other (Income) Expenses: | | | | | | | |

| Interest expense | 43,149 | | | 46,929 | | | 136,694 | | | 141,020 | |

| (Gain) loss on derivative contracts | 55,804 | | | (134,850) | | | 24,218 | | | 305,098 | |

(Gain) loss on extinguishment of debt | (1,238) | | | — | | | (1,238) | | | 42,417 | |

| Other (income) expense | 3,220 | | | 2,861 | | | (3,140) | | | 3,130 | |

| Total other (income) expense | 100,935 | | | (85,060) | | | 156,534 | | | 491,665 | |

| | | | | | | |

| Income Before Income Taxes | 119,993 | | | 505,422 | | | 25,828 | | | 804,111 | |

| Income tax benefit (expense) | (509) | | | (3,383) | | | 206,398 | | | (6,536) | |

| Net Income | $119,484 | | | $502,039 | | | $232,226 | | | $797,575 | |

| | | | | | | |

| Net Income Per Common Share: | | | | | | | |

| Basic | $1.76 | | | $8.14 | | | $3.64 | | | $12.94 | |

| Diluted | $1.75 | | | $8.11 | | | $3.63 | | | $12.88 | |

| | | | | | | |

| Weighted Average Common Shares Outstanding: | | | | | | | |

| Basic | 67,931 | | | 61,703 | | | 63,827 | | | 61,624 | |

| Diluted | 68,083 | | | 61,870 | | | 64,016 | | | 61,927 | |

*Financial information for the prior period has been recast to reflect retrospective application of the successful efforts method of accounting. For additional information, refer to our Form 10-Q for the period ended September 30, 2023.

Callon Petroleum Company

Consolidated Statements of Cash Flows

(In thousands)

| | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended September 30, | | Nine Months Ended September 30, |

| | 2023 | | 2022* | | 2023 | | 2022* |

| Cash flows from operating activities: | | | | | | | |

Net income | $119,484 | | | $502,039 | | | $232,226 | | | $797,575 | |

Adjustments to reconcile net income to net cash provided by operating activities: | | | | | | | |

| Depreciation, depletion and amortization | 138,598 | | | 129,895 | | | 391,911 | | | 359,494 | |

| Impairment of oil and gas properties | — | | | — | | | 406,898 | | | — | |

| Amortization of non-cash debt related items, net | 2,734 | | | 2,559 | | | 7,979 | | | 9,680 | |

| Deferred income tax (benefit) expense | (1,200) | | | 1,110 | | | (206,041) | | | 1,110 | |

| (Gain) loss on derivative contracts | 55,804 | | | (134,850) | | | 24,218 | | | 305,098 | |

| Cash received (paid) for commodity derivative settlements, net | 1,028 | | | (145,596) | | | 13,274 | | | (433,518) | |

(Gain) loss on extinguishment of debt | (1,238) | | | — | | | (1,238) | | | 42,417 | |

| Gain on sale of oil and gas properties | (20,570) | | | — | | | (20,570) | | | — | |

Non-cash expense related to share-based awards | 3,955 | | | 1,741 | | | 9,524 | | | 4,427 | |

| | | | | | | |

| | | | | | | |

| Other, net | 3,971 | | | 3,504 | | | 4,563 | | | 8,704 | |

| Changes in current assets and liabilities: | | | | | | | |

| Accounts receivable | (28,352) | | | 71,479 | | | 14,219 | | | (52,423) | |

| Other current assets | (6,574) | | | (4,732) | | | (13,178) | | | (12,229) | |

| Accounts payable and accrued liabilities | (812) | | | 10,631 | | | (69,522) | | | (8,649) | |

| | | | | | | |

| | | | | | | |

| Net cash provided by operating activities | 266,828 | | | 437,780 | | | 794,263 | | | 1,021,686 | |

| Cash flows from investing activities: | | | | | | | |

| Capital expenditures | (252,407) | | | (303,268) | | | (751,004) | | | (648,149) | |

| Acquisition of oil and gas properties | (227,984) | | | (1,692) | | | (278,434) | | | (17,006) | |

| | | | | | | |

| Proceeds from sales of assets | 549,333 | | | 4,723 | | | 551,446 | | | 9,313 | |

| | | | | | | |

| Cash paid for settlement of contingent consideration arrangement | — | | | — | | | — | | | (19,171) | |

| Other, net | (1,212) | | | 4,788 | | | (2,850) | | | 13,497 | |

Net cash provided by (used in) investing activities | 67,730 | | | (295,449) | | | (480,842) | | | (661,516) | |

| Cash flows from financing activities: | | | | | | | |

| Borrowings on credit facility | 1,105,000 | | | 811,000 | | | 2,629,500 | | | 2,535,000 | |

| Payments on credit facility | (1,237,000) | | | (954,000) | | | (2,736,500) | | | (2,684,000) | |

| Issuance of 7.5% Senior Notes due 2030 | — | | | — | | | — | | | 600,000 | |

Redemption of 8.25% Senior Notes due 2025 | (187,238) | | | — | | | (187,238) | | | — | |

| Redemption of 6.125% Senior Notes due 2024 | — | | | — | | | — | | | (467,287) | |

| Redemption of 9.0% Second Lien Senior Secured Notes due 2025 | — | | | — | | | — | | | (339,507) | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Payment of deferred financing costs | (510) | | | (1,081) | | | (560) | | | (11,623) | |

| | | | | | | |

| Cash paid to repurchase common stock | (14,980) | | | — | | | (14,980) | | | — | |

| Other, net | (24) | | | — | | | (3,582) | | | 1,715 | |

Net cash used in financing activities | (334,752) | | | (144,081) | | | (313,360) | | | (365,702) | |

| Net change in cash and cash equivalents | (194) | | | (1,750) | | | 61 | | | (5,532) | |

| Balance, beginning of period | 3,650 | | | 6,100 | | | 3,395 | | | 9,882 | |

| Balance, end of period | $3,456 | | | $4,350 | | | $3,456 | | | $4,350 | |

*Financial information for the prior period has been recast to reflect retrospective application of the successful efforts method of accounting. For additional information, refer to our Form 10-Q for the period ended September 30, 2023.

Operating Results

The following table presents summary information for the periods indicated:

| | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended | | |

| | | September 30, 2023 | | June 30, 2023 | | September 30, 2022 | | |

| Total production | | | | | | | | |

| Oil (MBbls) | | | | | | | | |

| Permian | | 5,310 | | 4,671 | | 4,567 | | |

| Eagle Ford | | 28 | | 1,066 | | 1,545 | | |

| Total oil | | 5,338 | | 5,737 | | 6,112 | | |

| | | | | | | | |

| Natural gas (MMcf) | | | | | | | | |

| Permian | | 11,644 | | 10,409 | | 9,041 | | |

| Eagle Ford | | 44 | | 1,292 | | 1,616 | | |

| Total natural gas | | 11,688 | | 11,701 | | 10,657 | | |

| | | | | | | | |

| NGLs (MBbls) | | | | | | | | |

| Permian | | 2,069 | | 1,816 | | 1,702 | | |

| Eagle Ford | | 6 | | 229 | | 283 | | |

| Total NGLs | | 2,075 | | 2,045 | | 1,985 | | |

| | | | | | | | |

| Total production (MBoe) | | | | | | | | |

| Permian | | 9,320 | | 8,222 | | 7,776 | | |

| Eagle Ford | | 41 | | 1,510 | | 2,097 | | |

| Total barrels of oil equivalent | | 9,361 | | 9,732 | | 9,873 | | |

| | | | | | | | |

| Total daily production (Boe/d) | | | | | | | | |

| Permian | | 101,292 | | 90,359 | | 84,517 | | |

| Eagle Ford | | 449 | | 16,589 | | 22,799 | | |

| Total barrels of oil equivalent | | 101,741 | | 106,948 | | 107,316 | | |

| Oil as % of total daily production | | 57 | % | | 59 | % | | 62 | % | | |

| | | | | | | | |

Average realized sales price (excluding impact of settled derivatives) | | | | |

| Oil (per Bbl) | | | | | | | | |

| Permian | | $82.19 | | $73.45 | | $94.19 | | |

| Eagle Ford | | 79.61 | | 73.80 | | 94.31 | | |

| Total oil | | $82.18 | | $73.52 | | $94.22 | | |

| | | | | | | | |

| Natural gas (per Mcf) | | | | | | | | |

| Permian | | $2.13 | | $1.15 | | $7.53 | | |

| Eagle Ford | | 4.82 | | 1.93 | | 8.01 | | |

| Total natural gas | | $2.14 | | $1.23 | | $7.60 | | |

| | | | | | | | |

| NGL (per Bbl) | | | | | | | | |

| Permian | | $22.25 | | $20.14 | | $34.12 | | |

| Eagle Ford | | 74.33 | | 17.72 | | 33.49 | | |

| Total NGL | | $22.40 | | $19.87 | | $34.03 | | |

| | | | | | | | |

| Average realized sales price (per Boe) | | | | | | | | |

| Permian | | $54.43 | | $47.63 | | $71.54 | | |

| Eagle Ford | | 70.41 | | 56.44 | | 80.18 | | |

| Total average realized sales price | | $54.50 | | $49.00 | | $73.37 | | |

| | | | | | | | |

Average realized sales price (including impact of settled derivatives) | | | | |

| Oil (per Bbl) | | $80.66 | | $74.16 | | $81.82 | | |

| Natural gas (per Mcf) | | 2.08 | | 2.08 | | 4.86 | | |

| NGLs (per Bbl) | | 22.23 | | 19.87 | | 34.03 | | |

| Total average realized sales price (per Boe) | | $53.52 | | $50.40 | | $62.74 | | |

| | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended | | |

| | September 30, 2023 | | June 30, 2023 | | September 30, 2022 | | |

Revenues (in thousands)(a) | | | | | | | | |

| Oil | | | | | | | | |

| Permian | | $436,436 | | $343,106 | | $430,145 | | |

| Eagle Ford | | 2,229 | | 78,669 | | 145,707 | | |

| Total oil | | $438,665 | | $421,775 | | $575,852 | | |

| | | | | | | | |

| Natural gas | | | | | | | | |

| Permian | | $24,833 | | $11,934 | | $68,075 | | |

| Eagle Ford | | 212 | | 2,489 | | 12,943 | | |

| Total natural gas | | $25,045 | | $14,423 | | $81,018 | | |

| | | | | | | | |

| NGLs | | | | | | | | |

| Permian | | $46,043 | | $36,570 | | $58,069 | | |

| Eagle Ford | | 446 | | 4,059 | | 9,479 | | |

| Total NGLs | | $46,489 | | $40,629 | | $67,548 | | |

| | | | | | | | |

| Total revenues | | | | | | | | |

| Permian | | $507,312 | | $391,610 | | $556,289 | | |

| Eagle Ford | | 2,887 | | 85,217 | | 168,129 | | |

| Total revenues | | $510,199 | | $476,827 | | $724,418 | | |

| | | | | | | | |

| Additional per Boe data | | | | | | | | |

Sales price (b) | | | | | | | | |

| Permian | | $54.43 | | $47.63 | | $71.54 | | |

| Eagle Ford | | 70.41 | | 56.44 | | 80.18 | | |

| Total sales price | | $54.50 | | $49.00 | | $73.37 | | |

| | | | | | | | |

| Lease operating expense | | | | | | | | |

| Permian | | $7.91 | | $7.42 | | $7.55 | | |

| Eagle Ford | | (3.90) | | 10.44 | | 8.31 | | |

| Total lease operating expense | | $7.85 | | $7.89 | | $7.71 | | |

| | | | | | | | |

| Production and ad valorem taxes | | | | | | | | |

| Permian | | $3.26 | | $2.40 | | $4.27 | | |

| Eagle Ford | | 4.51 | | 3.29 | | 4.79 | | |

| Total production and ad valorem taxes | | $3.27 | | $2.54 | | $4.38 | | |

| | | | | | | | |

| Gathering, transportation and processing | | | | | | | | |

| Permian | | $2.92 | | $2.97 | | $3.06 | | |

| Eagle Ford | | 1.12 | | 1.94 | | 1.80 | | |

| Total gathering, transportation and processing | | $2.91 | | $2.81 | | $2.79 | | |

| | | | | | | | |

| Operating margin | | | | | | | | |

| Permian | | $40.34 | | $34.84 | | $56.66 | | |

| Eagle Ford | | 68.68 | | 40.77 | | 65.28 | | |

| Total operating margin | | $40.47 | | $35.76 | | $58.49 | | |

| | | | | | | | |

| Depletion, depreciation and amortization | | $14.81 | | $13.09 | | $13.16 | | |

| General and administrative | | $3.13 | | $3.06 | | $2.46 | | |

| Adjusted G&A | | | | | | | | |

Cash component (c) | | $2.71 | | $2.68 | | $2.28 | | |

| Non-cash component | | $0.42 | | $0.42 | | $0.39 | | |

(a)Excludes sales of oil and gas purchased from third parties.

(b)Excludes the impact of settled derivatives.

(c)Excludes the change in fair value and amortization of share-based incentive awards.

Commodity Derivatives

| | | | | | | | | | |

| | Three Months Ended | | |

| | September 30, 2023 | | |

Loss on oil derivatives | | $54,446 | | | |

Gain on natural gas derivatives | | (2,315) | | | |

| Loss on NGL derivatives | | 2,933 | | | |

Loss on commodity derivative contracts | | $55,064 | | | |

| | | | | | | | | | |

| | Three Months Ended | | |

| | September 30, 2023 | | |

| Cash received on oil derivatives | | $1,680 | | | |

Cash paid on natural gas derivatives | | (560) | | | |

| Cash paid on NGL derivatives | | (92) | | | |

| Cash received for commodity derivative settlements, net | | $1,028 | | | |

Non-GAAP Financial Measures

Adjusted Income, Adjusted EBITDAX and Unhedged Adjusted EBITDAX. The following tables present and reconcile the Company’s adjusted income, adjusted EBITDAX and unhedged adjusted EBITDAX to net income (loss):

| | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | |

| September 30, 2023 | | June 30, 2023 | | September 30, 2022 | | |

| (In thousands except per share data) |

| Net income (loss) | $119,484 | | | ($107,896) | | | $502,039 | | | |

| (Gain) loss on derivative contracts | 55,804 | | | (5,941) | | | (134,850) | | | |

| Gain (loss) on commodity derivative settlements, net | (9,196) | | | 13,663 | | | (105,006) | | | |

| Non-cash expense related to share-based awards | 3,955 | | | 3,688 | | | 1,741 | | | |

| Impairment of oil and gas properties | — | | | 406,898 | | | — | | | |

| Gain on sale of oil and gas properties | (20,570) | | | — | | | — | | | |

| Merger, integration and transaction | 4,925 | | | 1,543 | | | — | | | |

| Other expense | 3,220 | | | 54 | | | 2,861 | | | |

| Gain on extinguishment of debt | (1,238) | | | — | | | — | | | |

Tax effect on adjustments above (a) | (7,749) | | | (88,180) | | | 49,403 | | | |

| Change in valuation allowance | (24,690) | | | (100,749) | | | (102,755) | | | |

| Adjusted income | $123,945 | | | $123,080 | | | $213,433 | | | |

| | | | | | | |

| Net income (loss) per diluted share | $1.75 | | | ($1.74) | | | $8.11 | | | |

| Adjusted income per diluted share | $1.82 | | | $1.99 | | | $3.45 | | | |

| | | | | | | |

| Basic weighted average common shares outstanding | 67,931 | | | 61,856 | | | 61,703 | | | |

| Diluted weighted average common shares outstanding (GAAP) | 68,083 | | | 61,856 | | | 61,870 | | | |

| Effect of potentially dilutive instruments | — | | | 55 | | | — | | | |

| Adjusted diluted weighted average common shares outstanding | 68,083 | | | 61,911 | | | 61,870 | | | |

(a)Calculated using the federal statutory rate of 21%.

| | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | |

| September 30, 2023 | | June 30, 2023 | | September 30, 2022 | | |

| (In thousands) |

| Net income (loss) | $119,484 | | | ($107,896) | | | $502,039 | | | |

| (Gain) loss on derivative contracts | 55,804 | | | (5,941) | | | (134,850) | | | |

| Gain (loss) on commodity derivative settlements, net | (9,196) | | | 13,663 | | | (105,006) | | | |

| Non-cash expense related to share-based awards | 3,955 | | | 3,688 | | | 1,741 | | | |

| Impairment of oil and gas properties | — | | | 406,898 | | | — | | | |

| Gain on sale of oil and gas properties | (20,570) | | | — | | | — | | | |

| Merger, integration and transaction | 4,925 | | | 1,543 | | | — | | | |

| Other expense | 3,220 | | | 54 | | | 2,861 | | | |

| Income tax (benefit) expense | 509 | | | (156,212) | | | 3,383 | | | |

| Interest expense | 43,149 | | | 47,239 | | | 46,929 | | | |

| Depreciation, depletion and amortization | 138,598 | | | 127,348 | | | 129,895 | | | |

| Exploration | 3,588 | | | 1,882 | | | 2,942 | | | |

| | | | | | | |

| Gain on extinguishment of debt | (1,238) | | | — | | | — | | | |

| Adjusted EBITDAX | $342,228 | | | $332,266 | | | $449,934 | | | |

| Add: (Gain) loss on commodity derivative settlements, net | 9,196 | | | (13,663) | | | 105,006 | | | |

| Unhedged adjusted EBITDAX | $351,424 | | | $318,603 | | | $554,940 | | | |

Adjusted Free Cash Flow. The following table presents and reconciles the Company’s adjusted free cash flow to net cash provided by operating activities:

| | | | | | | | | | | | | | | | | |

| Three Months Ended |

| September 30, 2023 | | June 30, 2023 | | September 30, 2022 |

| (In thousands) |

| Net cash provided by operating activities | $266,828 | | $279,522 | | $437,780 |

| Changes in working capital and other | 26,344 | | 11,188 | | (69,388) |

| Changes in accrued hedge settlements | (10,224) | | 638 | | 40,590 |

| Merger, integration and transaction | 4,925 | | 1,543 | | — |

| Cash flow from operations before net change in working capital | 287,873 | | 292,891 | | 408,982 |

| | | | | |

| Capital expenditures | 252,407 | | 293,697 | | 303,268 |

| Increase (decrease) in accrued capital expenditures | (12,872) | | (13,083) | | (42,247) |

| Capital expenditures before accruals | 239,535 | | 280,614 | | 261,021 |

| | | | | |

| Adjusted free cash flow | $48,338 | | $12,277 | | $147,961 |

| | | | | |

| | | | | |

| | | | | |

Adjusted G&A. The following table reconciles G&A to Adjusted G&A - cash component (in thousands):

| | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended | | |

| | September 30, 2023 | | June 30, 2023 | | September 30, 2022 | | |

| G&A | | $29,339 | | | $29,768 | | | $24,253 | | | |

| Change in the fair value of liability share-based awards (non-cash) | | (49) | | | 393 | | | 2,151 | | | |

| Adjusted G&A – total | | 29,290 | | | 30,161 | | | 26,404 | | | |

| Equity settled, share-based compensation (non-cash) | | (3,906) | | | (4,081) | | | (3,892) | | | |

| Adjusted G&A – cash component | | $25,384 | | | $26,080 | | | $22,512 | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

Adjusted Total Revenue. The following table presents and reconciles adjusted total revenue to total operating revenues, which excludes revenue from sales of commodities purchased from a third-party:

| | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended |

| | September 30, 2023 | | June 30, 2023 | | September 30, 2022 |

| | (In thousands) |

| Operating revenues | | | | | | |

| Oil | | $438,665 | | | $421,775 | | | $575,852 | |

| Natural gas | | 25,045 | | | 14,423 | | | 81,018 | |

| NGLs | | 46,489 | | | 40,629 | | | 67,548 | |

| Total operating revenues | | $510,199 | | | $476,827 | | | $724,418 | |

| Impact of settled derivatives | | (9,196) | | | 13,663 | | | (105,006) | |

| Adjusted total revenue | | $501,003 | | | $490,490 | | | $619,412 | |

Net Debt. The following table presents and reconciles the Company’s net debt to total debt:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | September 30, 2023 | | June 30, 2023 | | March 31, 2023 | | December 31, 2022 | | September 30, 2022 |

| | (In thousands) |

Long-term debt | | $1,948,619 | | | $2,268,116 | | | $2,204,514 | | | $2,241,295 | | | $2,373,358 | |

| Unamortized premiums, discount, and deferred loan costs, net | | 18,164 | | | 17,905 | | | $18,807 | | | 19,726 | | | 20,663 | |

Adjusted long-term debt | | $1,966,783 | | | $2,286,021 | | | $2,223,321 | | | $2,261,021 | | | $2,394,021 | |

| Less: Cash and cash equivalents | | 3,456 | | | 3,650 | | | $3,370 | | | 3,395 | | | 4,350 | |

| Net debt | | $1,963,327 | | | $2,282,371 | | | $2,219,951 | | | $2,257,626 | | | $2,389,671 | |

Non-GAAP Financial Measures

These supplemental tables present non-GAAP financial measures such as “adjusted free cash flow,” “adjusted EBITDAX,” “unhedged adjusted EBITDAX,” “adjusted income,” “adjusted income per diluted share,” “adjusted total revenue,” “adjusted G&A,” “adjusted G&A - cash component,” and “net debt.” These measures, detailed below, are provided in addition to, and not as an alternative for, and should be read in conjunction with, the information contained in our financial statements prepared in accordance with GAAP (including the notes), included in our filings with the U.S. Securities and Exchange Commission (the “SEC”) and posted on our website.

•Adjusted free cash flow is a supplemental non-GAAP measure that is defined by the Company as net cash provided by operating activities before net change in working capital, changes in accrued hedge settlements, merger, integration and transaction expense, and other income and expense less capital expenditures before increase (decrease) in accrued capital expenditures. We believe adjusted free cash flow provides useful information to investors because it is a comparable metric against other companies in the industry and is a widely accepted financial indicator of an oil and natural gas company’s ability to generate cash for the use of internally funding their capital development program and to service or incur debt. Adjusted free cash flow is not a measure of a company’s financial performance under GAAP and should not be considered as an alternative to net cash provided by operating activities, or as a measure of liquidity.

•Callon calculates adjusted EBITDAX as net income (loss) before interest expense, income tax expense (benefit), depreciation, depletion and amortization, (gains) losses on derivative instruments excluding net settled derivative instruments, (gain) loss on sale of oil and gas properties, impairment of oil and gas properties, non-cash share-based compensation expense, exploration expense, merger, integration and transaction expense, (gain) loss on extinguishment of debt, and certain other expenses. Adjusted EBITDAX is not a measure of financial performance under GAAP. Accordingly, it should not be considered as a substitute for net income (loss), operating income (loss), cash flow provided by operating activities or other income or cash flow data prepared in accordance with GAAP. However, the Company believes that adjusted EBITDAX provides useful information to investors because it provides additional information with respect to our performance or ability to meet our future debt service, capital expenditures and working capital requirements. Because adjusted EBITDAX excludes some, but not all, items that affect net income (loss) and may vary among companies, the adjusted EBITDAX presented above may not be comparable to similarly titled measures of other companies.

•Callon calculates unhedged adjusted EBITDAX as adjusted EBITDAX, as defined above, excluding the impact of net settled derivative instruments. Unhedged adjusted EBITDAX is not a measure of financial performance under GAAP. Accordingly, it should not be considered as a substitute for net income (loss), operating income (loss), cash flow provided by operating activities or other income or cash flow data prepared in accordance with GAAP. However, the Company believes that unhedged adjusted EBITDAX provides useful information to investors because it provides additional information with respect to our performance without the impact of our settled derivative instruments. Because unhedged adjusted EBITDAX excludes some, but not all, items that affect net income (loss) and may vary among companies, the unhedged adjusted EBITDAX presented above may not be comparable to similarly titled measures of other companies.

•Adjusted income and adjusted income per diluted share are supplemental non-GAAP measures that Callon believes are useful to investors because they provide readers with a meaningful measure of our profitability before recording certain items whose timing or amount cannot be reasonably determined. These measures exclude the net of tax effects of these items and non-cash valuation adjustments, which are detailed in the reconciliation provided. Adjusted income and adjusted income per diluted share are not measures of financial performance under GAAP. Accordingly, neither should be considered as a substitute for net income (loss), operating income (loss), or other income data prepared in accordance with GAAP. However, the Company believes that adjusted income and adjusted income per diluted share provide additional information with respect to our performance. Because adjusted income and adjusted income per diluted share exclude some, but not all, items that affect net income (loss) and may vary among companies, the adjusted income and adjusted income per diluted share presented above may not be comparable to similarly titled measures of other companies.

•Callon believes that the non-GAAP measure of adjusted total revenue (which is revenue including the gain or loss from the settlement of derivative contracts) is useful to investors because it provides readers with a revenue value more comparable to other companies who engage in price risk management activities through the use of commodity derivative instruments and reflects the results of derivative settlements with expected cash flow impacts within total revenues.

•Adjusted G&A is a supplemental non-GAAP financial measure that excludes non-cash incentive share-based compensation valuation adjustments and adjusted G&A - cash component further excludes equity settled, share-based compensation expenses. Callon believes that the non-GAAP measure of adjusted G&A and adjusted G&A - cash component are useful to investors because they provide for greater comparability period-over-period. In addition, adjusted G&A - cash component provides a meaningful measure of our recurring G&A expense.

•Net debt is a supplemental non-GAAP measure that is defined by the Company as total debt excluding unamortized premiums, discount, and deferred loan costs, less cash and cash equivalents. Net debt should not be considered an alternative to, or more meaningful than, total debt, the most directly comparable GAAP measure. Management uses net debt to determine the Company’s outstanding debt obligations that would not be readily satisfied by its cash and cash equivalents on hand. We believe this metric is useful to analysts and investors in determining the Company’s leverage position since the Company has the ability to, and may decide to, use a portion of its cash and cash equivalents to reduce debt. This metric is sometimes presented as a ratio with Adjusted EBITDAX in order to provide investors with another means of evaluating the Company’s ability to service its existing debt obligations as well as any future increase in the amount of such obligations. This ratio is referred to by the Company as its leverage ratio.

•Adjusted diluted weighted average common shares outstanding is a non-GAAP financial measure which includes the effect of potentially dilutive instruments that, under certain circumstances described below, are excluded from diluted weighted average common shares outstanding, the most directly comparable GAAP financial measure. When a net loss exists, all potentially dilutive instruments are anti-dilutive to the net loss per common share and therefore excluded from the computation of diluted weighted average common shares outstanding. The effect of potentially dilutive instruments are included in the computation of adjusted diluted weighted average common shares outstanding for purposes of computing adjusted income per diluted share.

v3.23.3

Cover Page

|

Nov. 01, 2023 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Document Period End Date |

Nov. 01, 2023

|

| Entity Registrant Name |

Callon Petroleum Co

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

001-14039

|

| Entity Tax Identification Number |

64-0844345

|

| Entity Address, Address Line One |

One Briarlake Plaza

|

| Entity Address, Address Line Two |

2000 W. Sam Houston Parkway S.

|

| Entity Address, Address Line Three |

Suite 2000

|

| Entity Address, City or Town |

Houston

|

| Entity Address, State or Province |

TX

|

| Entity Address, Postal Zip Code |

77042

|

| City Area Code |

281

|

| Local Phone Number |

589-5200

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, $0.01 par value

|

| Trading Symbol |

CPE

|

| Security Exchange Name |

NYSE

|

| Entity Emerging Growth Company |

false

|

| Entity Central Index Key |

0000928022

|

| Amendment Flag |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 3 such as an Office Park

| Name: |

dei_EntityAddressAddressLine3 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

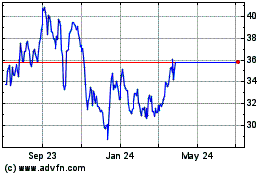

Callon Petroleum (NYSE:CPE)

Historical Stock Chart

From Apr 2024 to May 2024

Callon Petroleum (NYSE:CPE)

Historical Stock Chart

From May 2023 to May 2024