- $454 Million Principal Amount of New Term Loans and Common

Stock Warrants of the Company

- $275 Million Principal Amount of Royalty Notes and Class B

Common Shares of Elk Hills RoyaltyCo

- Consent Solicitation

California Resources Corporation (“CRC” or the “Company”), today

announced the commencement of private offers to exchange (the

“Exchange Offers”), upon the terms and conditions set forth in the

offering memorandum and solicitation statement (the “Offering

Memorandum and Solicitation Statement”), dated February 20, 2020,

and the related letter of transmittal, to all Eligible Holders (as

defined below) of its outstanding 8% Senior Secured Second Lien

Notes due 2022 (the “8% Notes”), 5½% Senior Notes due 2021 (the

“5½% Notes”) and 6% Senior Notes due 2024 (the “6% Notes” and,

together with the 8% Notes and the 5½% Notes, the “Notes”) to

exchange the outstanding Notes, subject to the Acceptance Priority

Level set forth in the table below, for consideration

comprising:

(A).

(i) up to approximately $113 million in

aggregate principal amount of senior secured notes issued by Elk

Hills RoyaltyCo Corporation (“Elk Hills RoyaltyCo,” such secured

notes, the “Royalty Notes”), (ii) up to 29,290,026 shares of class

B common stock issued by Elk Hills RoyaltyCo (the “Class B

Shares”), representing in aggregate an approximately 48.8% equity

interest in Elk Hills RoyaltyCo and (iii) up to approximately $162

million in cash, which cash is required to be used by tendering

holders to subscribe for additional Royalty Notes (the “Option A

Cash Component Consideration” and the maximum amount in the

aggregate in subclauses (i)-(iii) in this clause (A), the “Maximum

Option A Exchange Consideration Amount”); or

(B).

(i) up to approximately $429 million in

aggregate principal amount of the Company’s new term loans due 2028

(the “New Term Loans”), (ii) warrants exercisable for up to

approximately 12.9%, in the aggregate, of the Company’s common

stock as of February 14, 2020 (the “Company Warrants”), issued pro

rata to all Eligible Holders participating and receiving the New

Term Loans on the Settlement Date and (iii) up to $25 million in

cash, which is required to be used by tendering holders to

subscribe for additional New Term Loans (the “Option B Cash

Component Consideration” and, together with the Option A Cash

Component Consideration, the “Cash Component Consideration”) (the

maximum amount in the aggregate in subclauses (i)-(iii) in this

clause (B), the “Maximum Option B Exchange Consideration Amount,”

and together with Maximum Option A Exchange Consideration Amount,

the “Maximum Exchange Consideration Amount”).

Eligible Holders tendering their Notes are allowed to elect

either the Exchange Consideration described in clause (A) or clause

(B) or a combination thereof, as described in detail in the

Offering Memorandum and Consent Solicitation. Elk Hills RoyaltyCo

will be incorporated as a special purpose Delaware corporation to

hold a 20-year term non-participating royalty interest equal to

four and thirty hundredths percent of eight-eighths (4.30% of

8/8ths) in all hydrocarbons that may be produced and saved from the

Company’s underlying fee mineral interests in the Elk Hills unit

(the “Royalty Interest”) as of the date of the conveyance and, upon

consummation of the Offers, 60% of the equity interest in Elk Hills

RoyaltyCo will be owned, in the aggregate, by tendering holders and

Supporting Holders (as defined below).

In connection with the Exchange Offers, the Company is making

subscription offers (the “Subscription Offers” and, together with

the Exchange Offers, the “Offers”) to tendering holders, pursuant

to which holders participating in the Exchange Offers are required

to use the entirety of the Option A Cash Component Consideration to

subscribe for additional Royalty Notes, which subscription is

conditional on the consummation of the Exchange Offer involving

Royalty Notes and Class B Shares, and to use the entirety of the

Option B Cash Component Consideration to subscribe for additional

New Term Loans, which subscription is conditional on the

consummation of the Exchange Offer involving New Term Loans and

Company Warrants. The Offers will be effected in a series of

transactions described in more detail in the Offering Memorandum

and Solicitation Statement and CRC intends to settle the Offers two

(2) business days following the Expiration Time (as defined below)

(the “Settlement Date”) on a net-settlement basis. Participating

holders will not receive cash on the settlement date.

The following table sets forth the Net Consideration, Early

Participation Premium and Net Total Consideration for each series

of Notes:

Net Consideration per $1,000

Principal Amount of Notes(1)

Title

CUSIP Number/ISIN

Principal Amount

Outstanding

Acceptance Priority

Level

Option

Net Consideration

Early Participation

Premium

Net Total

Consideration(2)

8% Senior Secured Second Lien

Notes due 2022

13057QAG2/US13057QAG29

U1303AAD8/USU1303AAD82

$1,808,327,000

1

A

$450 in Royalty Notes and 47.647 Class B

Shares

$50 in Royalty Notes and 5.294 Class B

Shares

$500 in Royalty Notes and 52.941 Class B

Shares

B

$650 in New Term Loans and 9.099 Company

Warrants

$50 in New Term Loans and 0.700 Company

Warrants

$700 in New Term Loans and 9.799 Company

Warrants

5½% Senior Notes due 2021

13057QAD9/US13057QAD97

$99,996,300

2

A

$425 in Royalty Notes and

45.000 Class B Shares

$50 in Royalty Notes and 5.294 Class B

Shares

$475 in Royalty Notes and

50.294 Class B Shares

B

$600 in New Term Loans and 8.399 Company

Warrants

$50 in New Term Loans and 0.700 Company

Warrants

$650 in New Term Loans and 9.099 Company

Warrants

6% Senior Notes due 2024

13057QAF4/US13057QAF46

13057QAE7/US13057QAE70

U1303AAC0/USU1303AAC00

$144,279,000

3

A

$300 in Royalty Notes and

31.764 Class B Shares

$50 in Royalty Notes and 5.294 Class B

Shares

$350 in Royalty Notes and

37.058 Class B Shares

B

$450 in New Term Loans and 6.299 Company

Warrants

$50 in New Term Loans and 0.700 Company

Warrants

$500 in New Term Loans and 6.999 Company

Warrants

(1)

Reflects the net settlement of the

Exchange Offers and the Subscription Offers. Holders will not

receive cash on the Settlement Date in exchange for tendered Notes,

as the Cash Component Consideration will be required to be applied

to the subscriptions of additional Royalty Notes and additional New

Term Loans.

(2)

Includes Early Participation Premium.

The Offers will expire at 11:59 p.m., New York City time, on

March 18, 2020, unless extended by CRC (the “Expiration Time”). For

each $1,000 principal amount of Notes validly tendered and not

validly withdrawn prior to 5:00 p.m., New York City time, on March

4, 2020 (as it may be extended, the “Early Participation Time”),

Eligible Holders will be eligible to receive the “Net Total

Consideration” set forth in the table above, which includes the

“Early Participation Premium” of (A) $50 in principal amount of

Royalty Notes and 5.294 Class B Shares or (B) $50 in principal

amount of New Term Loans and 0.700 Company Warrants. For each

$1,000 principal amount of Notes validly tendered after the Early

Participation Time, Eligible Holders will be eligible to receive

only the “Net Consideration” set forth in the table above.

Tendering holders may elect to decline the acceptance of the

Class B Shares to which it would otherwise be entitled to receive

for Notes tendered. Holders who elect to decline the Class B Shares

will not be entitled to any adjustment to the principal amount of

the Notes tendered and will not receive any other form of

consideration in lieu of the declined Class B Shares. Class B

Shares so declined will be reallocated on a pro rata basis to

Eligible Holders who participate in the Offers and Consent

Solicitation and who have not made such an election.

On February 20, 2020, prior to the launch of the Offers, the

Company and certain significant holders of the Notes (the

“Supporting Holders”) entered into private subscription agreements

(the “Supporting Subscription Agreements”), pursuant to which the

Supporting Holders agreed to sell, in the aggregate, approximately

$452 million of 8% Notes, approximately $26 million of 5½% Notes

and approximately $7 million of 6% Notes for approximately $65

million of Royalty Notes, approximately $246 million of the New

Term Loans, up to 6,709,974 Class B Shares and the Company Warrants

exercisable for approximately 7.0% of the Company’s common stock as

of February 14, 2020, in each case in the aggregate and on a net

basis. The obligations of the Supporting Holders under the

Supporting Subscription Agreements are subject to customary

conditions, including consummation of the Offers.

In conjunction with the Offers, and on the terms and subject to

the conditions set forth in the Offering Memorandum and

Solicitation Statement, the Company will solicit (the “Consent

Solicitation” and, together with the Offers, the “Offers and

Consent Solicitation”) consents (the “Consents”) (i) from tendering

holders of the 8% Notes to the adoption of certain amendments to

the indenture governing the 8% Notes (the “2L Indenture”) and (ii)

from tendering holders of the 6% Notes and the 5½% Notes to the

adoption of certain amendments to the indenture governing the 6%

Notes and the 5½% Notes (the “Unsecured Notes Indenture”), in each

case to modify certain definitions under the 2L Indenture and the

Unsecured Notes Indenture to enable the Company to incur certain

types of indebtedness in the future, including secured

indebtedness. The approval of the amendments to the 2L Indenture is

conditional on, among other things, receipt by the Company of valid

and unrevoked Consents from the Eligible Holders of at least a

majority of the then outstanding aggregate principal amount of the

8% Notes not owned by the Company or its affiliates. The approval

of the amendments to the Unsecured Notes Indenture is conditional

on, among other things, receipt by the Company of valid and

unrevoked Consents from the Eligible Holders of at least a majority

of the then outstanding aggregate principal amount of the 6% Notes

and the 5½% Notes, as a single class, not owned by the Company or

its affiliates. The adoption of the amendments to the 2L Indenture

is not conditional on the adoption of the amendments to the

Unsecured Notes Indenture, and vice versa. No other consideration

will be paid for the Consents. The Supporting Holders have agreed

to deliver the relevant Consents to the proposed amendments to the

2L Indenture and the Unsecured Notes Indenture.

Eligible Holders who validly tender their Notes pursuant to the

Offers will be deemed to have delivered their Consents by such

tender. Eligible Holders may not deliver Consents without also

validly tendering their Notes. Approval by holders of the relevant

series of the Notes to either the amendments to the 2L Indenture or

the Unsecured Notes Indenture is not a condition to the

consummation of the Offers, and the Offers may be consummated even

if such approval is not received. If the amendments to the 2L

Indenture or the Unsecured Notes Indenture are adopted, the

relevant series of Notes will no longer limit the Company’s

activities to the same extent as currently provided in the 2L

Indenture and the Unsecured Notes Indenture.

Eligible Holders will not be entitled to receive any cash

payment with respect to accrued and unpaid interest on Notes

accepted for exchange and any such accrued interest will be

forfeited, as all per $1,000 principal amount exchange ratios with

respect to the Offers have been calculated to take account of

accrued interest through the settlement of the transactions of the

Offers and Consent Solicitation.

Tenders and subscriptions may be validly withdrawn at any time

on or prior to 5:00 p.m., New York City time, on March 4, 2020, but

not thereafter unless required by law.

If the aggregate principal amount of Notes validly tendered (and

not validly withdrawn) would cause the Maximum Exchange

Consideration Amount to be exceeded, then only such aggregate

principal amount of Notes that causes the Maximum Exchange

Consideration Amount to be reached will be accepted for exchange

upon the terms and subject to the conditions set forth in the

Offering Memorandum and Solicitation Statement. The amount of each

series of Notes that is exchanged on the Settlement Date will be

determined in accordance with the respective Acceptance Priority

Levels set forth in the table above (with 1 being the highest

Acceptance Priority Level and 3 being the lowest Acceptance

Priority Level). Pursuant to this structure, if the aggregate

principal amount of Notes validly tendered (and not validly

withdrawn) would cause the Maximum Exchange Consideration Amount to

be exceeded, validly tendered (and not validly withdrawn) Notes

with an Acceptance Priority Level of 1 (i.e., the 8% Notes) will

first be accepted in full, then Notes with an Acceptance Priority

Level of 2 (i.e., the 5½% Notes) will be accepted and then Notes

with an Acceptance Priority Level of 3 (i.e., the 6% Notes) will be

accepted, in each case on a pro rata basis among the Eligible

Holders thereof in proportion to the aggregate principal amount of

such Notes validly tendered (and not validly withdrawn), up to such

aggregate principal amount that causes the Maximum Exchange

Consideration Amount to be reached. Notes validly tendered (and not

validly withdrawn) at or before the Early Participation Time will

be accepted for exchange before any Notes validly tendered after

the Early Participation Time, even if such Notes tendered after the

Early Participation Time have a higher Acceptance Priority Level

than the Notes tendered before the Early Participation Time. If the

aggregate principal amount of Notes validly tendered at or before

the Early Participation Time causes the Maximum Exchange

Consideration Amount to be reached or exceeded, then CRC will not

accept any Notes tendered for exchange after the Early

Participation Time. CRC may elect, in its sole and absolute

discretion, to increase the size of the Maximum Exchange

Consideration Amount.

The consummation of the Offers and Consent Solicitation is

subject to, and conditional upon, the satisfaction or waiver of

certain conditions, including, among other things, that the series

of transactions described in the Offering Memorandum and

Solicitation Statement are completed immediately prior to, or

substantially simultaneously with, the consummation of the Offers

and that the Company is in pro forma compliance with all covenants

in the documents governing its existing indebtedness following the

completion of the transactions contemplated by the Offers and

Consent Solicitation. Approval of the amendments to the 2L

Indenture or the Unsecured Notes Indenture by holders of the

relevant series of Notes is not a condition to the completion of

the Offers. The Offers are not subject to the tendering of any

minimum amount of the Notes. The Company has the right, in its sole

and absolute discretion, subject to applicable law, to terminate,

extend or amend any or all of the Offers at any time prior to the

Expiration Time, or to waive any condition of any Offer as

described in the Offering Memorandum and Solicitation

Statement.

The Company has engaged Perella Weinberg Partners L.P. as its

financial advisor in connection with the Offers and Consent

Solicitation.

Documents relating to the Offers and Consent Solicitation will

only be distributed to “Eligible Holders” of the Notes who complete

and return an eligibility form confirming that they are either a

“qualified institutional buyer” under Rule 144A or not a “U.S.

person” under Regulation S for purposes of applicable securities

laws, and if an Eligible Holder is a “Benefit Plan Investor,” it

will not be eligible to receive Class B Shares. The complete terms

and conditions of the Offers and Consent Solicitation, as well as

the terms of the New Term Loans, the Company Warrants, the Royalty

Notes and the Class B Shares, are described in the Offering

Memorandum and Solicitation Statement and the related letter of

transmittal, copies of which may be obtained by contacting Global

Bondholder Services Corporation, the exchange agent and information

agent in connection with the Offers and Consent Solicitation, at

(866) 470-3800, (212) 430-3774 (banks and brokers), by email at

contact@gbsc-usa.com or by visiting

http://gbsc-usa.com/eligibility/CaliforniaResources to complete the

eligibility process.

The Company Warrants, the Royalty Notes and the Class B

Shares have not been and will not be registered under the U.S.

Securities Act of 1933, as amended (the “Securities Act”), or under

any state securities laws. The Company Warrants, the Royalty Notes

and the Class B Shares may not be offered or sold within the United

States, absent registration or an applicable exemption from

registration requirements.

This press release does not constitute an offer to sell or a

solicitation of any offer to buy any securities, nor shall there be

any sale of any securities in any jurisdiction in which such offer,

solicitation or sale would be unlawful prior to registration or

qualification under the securities laws of any such jurisdiction.

This press release is being issued pursuant to Rule 135c under the

Securities Act.

About California Resources

Corporation

California Resources Corporation is the largest oil and natural

gas exploration and production company in California on a

gross-operated basis. The Company operates its world class resource

base exclusively within the State of California, applying

integrated infrastructure to gather, process and market its

production. Using advanced technology, California Resources

Corporation focuses on safely and responsibly supplying affordable

energy for California by Californians.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20200220006006/en/

Scott Espenshade (Investor Relations) 818-661-6010

Scott.Espenshade@crc.com

Margita Thompson (Media) 818-661-6005

Margita.Thompson@crc.com

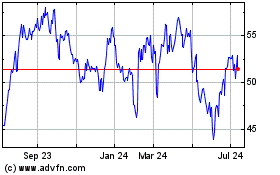

California Resources (NYSE:CRC)

Historical Stock Chart

From Dec 2024 to Jan 2025

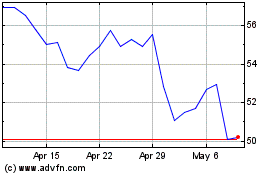

California Resources (NYSE:CRC)

Historical Stock Chart

From Jan 2024 to Jan 2025