UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

————————————

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): February 4, 2016

————————————

BROADRIDGE FINANCIAL SOLUTIONS, INC.

(Exact name of registrant as specified in its charter)

DELAWARE

(State or other jurisdiction of incorporation)

————————————

|

| |

001-33220 | 33-1151291 |

(Commission file number) | (I.R.S. Employer Identification No.) |

5 Dakota Drive

Lake Success, New York 11042

(Address of principal executive offices)

Registrant’s telephone number, including area code: (516) 472-5400

N/A

(Former name or former address, if changed since last report)

————————————

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

[ ] Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

[ ] Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

[ ] Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

[ ] Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 2.02. Results of Operations and Financial Condition.

On February 4, 2016, Broadridge Financial Solutions, Inc. (the “Company”) issued a press release announcing its financial results for the second quarter ended December 31, 2015. On February 4, 2016, the Company also posted an Earnings Webcast & Conference Call Presentation dated February 4, 2016 on the Company's Investor Relations website at www.broadridge-ir.com. In addition, on February 4, 2016, the Company posted key statistics related to its Investor Communication Solutions and Global Technology Operations businesses for the second quarter ended December 31, 2015 on the Company's Investor Relations home page at www.broadridge-ir.com.

Copies of the press release, earnings presentation and key statistics are being furnished as Exhibits 99.1, 99.2, and 99.3 attached hereto, respectively, and are incorporated herein by reference. The information furnished pursuant to Item 2.02 and 9.01, including Exhibits 99.1, 99.2 and 99.3, shall not be deemed "filed" for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities under that Section, and shall not be deemed to be incorporated by reference into any filing of the Company under the Securities Act of 1933, as amended, or the Exchange Act.

Forward-Looking Statements

This current report on Form 8-K and other written or oral statements made from time to time by representatives of Broadridge may contain “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Statements that are not historical in nature, and which may be identified by the use of words such as “expects,” “assumes,” “projects,” “anticipates,” “estimates,” “we believe,” “could be” and other words of similar meaning, are forward-looking statements. In particular, statements about Broadridge’s future financial performance are forward-looking statements. These statements are based on management’s expectations and assumptions and are subject to risks and uncertainties that may cause actual results to differ materially from those expressed. These risks and uncertainties include those risk factors discussed in Part I, “Item 1A. Risk Factors” of our Annual Report on Form 10-K for the fiscal year ended June 30, 2015 (the “2015 Annual Report”), as they may be updated in any future reports filed with the Securities and Exchange Commission. All forward-looking statements speak only as of the date of this 8-K and are expressly qualified in their entirety by reference to the factors discussed in the 2015 Annual Report.

These risks include: the success of Broadridge in retaining and selling additional services to its existing clients and in obtaining new clients; Broadridge’s reliance on a relatively small number of clients, the continued financial health of those clients, and the continued use by such clients of Broadridge’s services with favorable pricing terms; changes in laws and regulations affecting Broadridge’s clients or the investor communication services provided by Broadridge; declines in participation and activity in the securities markets; any material breach of Broadridge security affecting its clients’ customer information; the failure of Broadridge’s outsourced data center services provider to provide the anticipated levels of service; a disaster or other significant slowdown or failure of Broadridge’s systems or error in the performance of Broadridge’s services; overall market and economic conditions and their impact on the securities markets; Broadridge’s failure to keep pace with changes in technology and demands of its clients; Broadridge’s ability to attract and retain key personnel; the impact of new acquisitions and divestitures; and competitive conditions. Broadridge disclaims any obligation to update or revise forward-looking statements that may be made to reflect events or circumstances that arise after the date made or to reflect the occurrence of unanticipated events, other than as required by law.

Item 9.01. Financial Statements and Exhibits.

Exhibits. The following exhibits are furnished herewith:

|

| |

Exhibit No. | Description |

| |

99.1 | Broadridge Financial Solutions, Inc. Press Release dated February 4, 2016 |

99.2 | Broadridge Financial Solutions, Inc. Earnings Webcast & Conference Call Presentation dated February 4, 2016 |

99.3 | Broadridge Financial Solutions, Inc. Key Statistics dated February 4, 2016 |

| |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Dated: February 4, 2016

|

| |

| BROADRIDGE FINANCIAL SOLUTIONS, INC. By: /s/ James M. Young Name: James M. Young Title: Vice President and Chief Financial Officer |

| |

BROADRIDGE REPORTS SECOND QUARTER 2016 RESULTS

Announces Adjusted Diluted EPS Growth of 19% and Recurring Fee Revenue Growth of 8% Reaffirms Full Year Guidance

LAKE SUCCESS, N.Y., February 4, 2016 – Broadridge Financial Solutions, Inc. (NYSE:BR) today reported financial results for the second quarter of its fiscal year 2016. Results for the three months ended December 31, 2015 compared with the same period last year were as follows:

|

|

Second Quarter Fiscal Year 2016 Results: |

- Recurring fee revenues increased 8% to $399 million |

- Total revenues increased 11% to $639 million |

- Adjusted Operating income increased 19% to $80 million |

- Operating income increased 19% to $70 million |

- Adjusted Net earnings increased 16% to $46 million |

- Net earnings increased 16% to $40 million |

- Adjusted Diluted earnings per share increased 19% to $0.38 |

- Diluted earnings per share increased 18% to $0.33 |

- Closed sales decreased 0.2% to $48.5 million |

Commenting on the results, Richard J. Daly, President and Chief Executive Officer, said, "I am pleased with the second quarter results which demonstrate the strength of our well-balanced business. During the second quarter, total revenue grew 11%, driven by continued solid recurring revenue from new sales, the acquisitions we made during fiscal 2015, and healthy event-driven activity. The second quarter results keep us firmly on track to achieve our full year guidance and our three-year objectives.”

Mr. Daly added, “We also delivered strong sales in the second quarter which included the signing of Barclays for Europe and Asia to the Accenture Post Trade Processing platform. Our sales pipeline remains robust and keeps us well positioned to achieve our closed sales guidance for the full year. Given our solid results, our 98% revenue retention, and our continuing sales momentum, I remain highly confident in Broadridge’s ability to achieve our long term objectives.”

Financial Results for Second Quarter Fiscal Year 2016

Revenues for the second quarter of fiscal year 2016 increased 11% to $639 million, compared to $575 million for the prior year period. The $64 million increase was driven by (i) higher recurring fee revenues of $29 million, or 8%, (ii) higher distribution revenues of $26 million, or 15%, and (iii) higher event-driven fee revenues of $19 million, or 52%. The positive contribution from recurring fee revenues reflected gains from acquisitions (5pts) and Net New Business (4pts), partially offset by negative internal growth (-1pt). The higher distribution revenues of $26 million includes $12 million from acquisitions. The Company defines Net New Business as recurring revenue from closed sales less recurring revenue from client losses.

Operating income for the second quarter ended December 31, 2015 was $70 million, an increase of $11 million, or 19%, compared to $59 million for the prior year period. The increase is due to higher revenues, partially offset by higher operating

expenses including $2 million of increased amortization from acquired intangibles. Operating income margins increased to 11.0% compared to 10.3% for the comparable prior year period. Adjusted operating income margins increased to 12.5% compared to 11.6% for the comparable prior year period.

For the second quarter of fiscal year 2016, Net earnings increased 16% to $40 million, compared to $35 million for the prior year period, primarily due to higher revenues. Adjusted Net earnings increased 16% to $46 million compared to $40 million for the same period last year.

Diluted earnings per share increased to $0.33 per share compared to $0.28 per share for the same period last year. Adjusted Diluted earnings per share were $0.38 compared to $0.32 per share for the same period last year. Acquisition Amortization and Other Costs, net of taxes, decreased Diluted earnings per share by $0.05 and $0.04 for the three months ended December 31, 2015 and 2014, respectively.

In addition, during the second quarter, the Company repurchased 0.1 million shares of Broadridge common stock at an average price of $56.65 per share.

Analysis of Second Quarter Fiscal Year 2016

Investor Communication Solutions

Investor Communication Solutions segment Revenues for the three months ended December 31, 2015 increased $68 million, or 17%, to $472 million compared to $404 million in the second quarter of fiscal year 2015. The increase was attributable to higher recurring fee revenues which contributed $23 million, higher event-driven fee revenues which contributed $19 million and higher distribution revenues which contributed $26 million. Higher recurring fee revenues of 12% were driven by: (i) contributions from our recent acquisitions (8pts); and (ii) Net New Business primarily driven by increases in revenues from closed sales (5pts); which were partially offset by (iii) negative internal growth as a result of lower fund fulfillment revenues (-1pt). Higher event-driven fee revenues were the result of increased mutual fund proxy and corporate actions communications activity.

Global Technology and Operations

Global Technology and Operations segment Revenues for the three months ended December 31, 2015 increased $6 million, or 3%, to $180 million compared to $174 million for the three months ended December 31, 2015. The increase was attributable to: (i) higher Net New Business primarily driven by increases in revenues from closed sales (3pts) and (ii) contributions from a recent acquisition (1pt), partially offset by (iii) negative internal growth (-1pt) due to contract renewals and lower trade activity levels partially offset by increased non-trade activity levels.

Other

Pre-tax loss decreased by $4 million in the second quarter of fiscal year 2016. The decreased loss was mainly due to lower compensation expenses and lower acquisition related expenses, partially offset by an increase in interest expense.

Financial Results for the Six Months ended December 31, 2015

Revenues for the six months ended December 31, 2015 increased 9% to $1,234 million compared to $1,130 million for the comparable period last year. The increase was primarily driven by: (i) higher recurring fee revenues of $63 million, or 9%, (ii) higher distribution revenues of $38 million, or 11%, and (iii) higher event-driven fee revenues of $23 million, or 31%. The higher recurring fee revenues of $63 million reflected contributions from acquisitions (4pts) and gains from Net New Business (4pts). The higher distribution revenues of $38 million include $19 million from acquisitions.

Operating income for the six months ended December 31, 2015 was $129 million, an increase of $13 million, or 11%, compared to $116 million for the three months ended December 31, 2014. The increase is due to higher revenues, partially offset by higher operating expenses including $5 million of increased amortization from acquired intangibles. Operating income margins increased to 10.5% compared to 10.3% for the comparable prior year period. Adjusted operating income margins increased to 12.0% compared to 11.5% for the comparable prior year period.

For the six months ended December 31, 2015, Net earnings increased 10% to $74 million compared to $67 million for the comparable period last year, primarily due to higher revenues. Adjusted Net earnings were $86 million compared to $77 million for the same period last year.

Diluted earnings per share increased to $0.61 per share compared to $0.54 per share for the comparable period last year. Adjusted Diluted earnings per share were $0.71 compared to $0.62 per share for the comparable period last year. Acquisition

Amortization and Other Costs, net of taxes, decreased Diluted earnings per share by $0.10 and $0.08 for the six months ended December 31, 2015 and 2014, respectively.

Fiscal Year 2016 Financial Guidance

The Company continues to anticipate:

| |

• | Recurring fee revenue growth in the range of 10% to 12% and total revenue growth in the range of 8% to 10% |

| |

• | Adjusted Operating income margin of ~18.4% |

| |

• | Effective tax rate of ~34.8% |

| |

• | Adjusted Diluted earnings per share growth in the range of 8% to 12% |

| |

• | Free cash flows in the range of $350 million to $400 million |

| |

• | Closed sales in the range of $120 million to $160 million |

Our guidance does not take into consideration the effect of any future acquisitions, additional debt or share repurchases.

Explanation of the Company’s Use of Non-GAAP Financial Measures

The Company's results in this press release are presented in accordance with generally accepted accounting principles in the United States ("GAAP") except where otherwise noted. In certain circumstances, results have been presented on an adjusted basis and are not generally accepted accounting principles measures (“Non-GAAP”). These Non-GAAP financial measures should be viewed in addition to, and not as a substitute for, the Company's reported results.

With regard to statements in this press release that include certain Non-GAAP financial measures, the adjusted operating income and adjusted earnings measures are adjusted to exclude the impact of certain costs, expenses, gains and losses and other specified items that management believes are not indicative of our ongoing performance. These adjusted measures exclude the impact of Acquisition Amortization and Other Costs which represent the amortization charges associated with intangible asset values as well as other deal costs associated with the Company’s acquisition activities.

The Adjusted Operating income margin and Adjusted Diluted earnings per share fiscal year 2016 guidance provided above is adjusted to exclude the projected impact of Acquisition Amortization and Other Costs.

We provide information on our Free cash flows because we believe this helps investors understand the amount of cash available for dividends, share repurchases, acquisitions and other discretionary investments. Free cash flows is a Non-GAAP measure and is defined by the Company as Net cash flows provided by operating activities less capital expenditures, software purchases and capitalized internal use software.

The Company believes Non-GAAP financial information helps investors understand the effect of these items on our reported results and provides a better representation of our operating performance. These Non-GAAP measures are indicators that management uses to provide additional meaningful comparisons between our current results and prior reported results, and as a basis for planning and forecasting for future periods.

Reconciliations of such Non-GAAP measures to the most directly comparable financial measures presented in accordance with GAAP can be found in the tables that are part of this press release.

Earnings Conference Call

An analyst conference call will be held today, Thursday, February 4, 2016 at 8:30 a.m. ET. A live webcast of the call will be available to the public on a listen-only basis. To listen to the webcast and view the slide presentation, go to www.broadridge-ir.com. The presentation will also be available to download and print approximately one hour before the webcast. Broadridge’s news releases, current financial information, SEC filings and Investor Relations presentations are accessible on the same website.

About Broadridge

Broadridge Financial Solutions, Inc. (NYSE:BR) is the leading provider of investor communications and technology-driven solutions for broker-dealers, banks, mutual funds and corporate issuers globally. Broadridge’s investor communications, securities processing and managed services solutions help clients reduce their capital investments in operations infrastructure, allowing them to increase their focus on core business activities. With over 50 years of experience, Broadridge’s infrastructure underpins proxy voting services for over 90% of public companies and mutual funds in North America, and

processes on average $5 trillion in equity and fixed income trades per day. Broadridge employs approximately 7,400 full-time associates in 14 countries. For more information about Broadridge, please visit www.broadridge.com.

Forward-Looking Statements

This press release and other written or oral statements made from time to time by representatives of Broadridge may contain “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Statements that are not historical in nature, and which may be identified by the use of words such as “expects,” “assumes,” “projects,” “anticipates,” “estimates,” “we believe,” “could be” and other words of similar meaning, are forward-looking statements. In particular, information appearing in the “Fiscal Year 2016 Financial Guidance” section are forward-looking statements. These statements are based on management’s expectations and assumptions and are subject to risks and uncertainties that may cause actual results to differ materially from those expressed. These risks and uncertainties include those risk factors discussed in Part I, “Item 1A. Risk Factors” of our Annual Report on Form 10-K for the fiscal year ended June 30, 2015 (the “2015 Annual Report”), as they may be updated in any future reports filed with the Securities and Exchange Commission. All forward-looking statements speak only as of the date of this press release and are expressly qualified in their entirety by reference to the factors discussed in the 2015 Annual Report.

These risks include: the success of Broadridge in retaining and selling additional services to its existing clients and in obtaining new clients; Broadridge’s reliance on a relatively small number of clients, the continued financial health of those clients, and the continued use by such clients of Broadridge’s services with favorable pricing terms; changes in laws and regulations affecting Broadridge’s clients or the services provided by Broadridge; declines in participation and activity in the securities markets; any material breach of Broadridge security affecting its clients’ customer information; the failure of Broadridge’s outsourced data center services provider to provide the anticipated levels of service; a disaster or other significant slowdown or failure of Broadridge’s systems or error in the performance of Broadridge’s services; overall market and economic conditions and their impact on the securities markets; Broadridge’s failure to keep pace with changes in technology and demands of its clients; Broadridge’s ability to attract and retain key personnel; the impact of new acquisitions and divestitures; and competitive conditions. Broadridge disclaims any obligation to update or revise forward-looking statements that may be made to reflect events or circumstances that arise after the date made or to reflect the occurrence of unanticipated events, other than as required by law.

Contact Information

Investors:

Brian S. Shipman, CFA

Broadridge Financial Solutions, Inc.

Vice President, Head of Investor Relations

(516) 472-5129

Broadridge Financial Solutions, Inc.

Condensed Consolidated Statements of Earnings

(In millions, except per share amounts)

(Unaudited)

|

| | | | | | | | | | | | | | | |

| Three Months Ended

December 31, |

| Six Months Ended

December 31, |

| 2015 |

| 2014 |

| 2015 |

| 2014 |

Revenues | $ | 638.9 |

|

| $ | 574.6 |

|

| $ | 1,233.7 |

|

| $ | 1,130.4 |

|

Operating expenses: | | | | | | | |

Cost of revenues | 464.5 |

|

| 414.0 |

|

| 903.1 |

|

| 820.5 |

|

Selling, general and administrative expenses | 104.2 |

|

| 101.5 |

|

| 201.3 |

|

| 193.7 |

|

Total operating expenses | 568.7 |

|

| 515.5 |

|

| 1,104.4 |

|

| 1,014.2 |

|

Operating income | 70.2 |

| | 59.1 |

| | 129.3 |

| | 116.2 |

|

Non-operating expenses, net | 8.9 |

|

| 7.5 |

|

| 16.3 |

|

| 14.6 |

|

Earnings before income taxes | 61.3 |

| | 51.6 |

| | 113.0 |

| | 101.6 |

|

Provision for income taxes | 21.1 |

|

| 16.9 |

|

| 39.2 |

|

| 34.4 |

|

Net earnings | $ | 40.2 |

|

| $ | 34.7 |

|

| $ | 73.8 |

|

| $ | 67.2 |

|

Basic earnings per share | $ | 0.34 |

|

| $ | 0.29 |

|

| $ | 0.62 |

|

| $ | 0.56 |

|

Diluted earnings per share | $ | 0.33 |

|

| $ | 0.28 |

|

| $ | 0.61 |

|

| $ | 0.54 |

|

Weighted-average shares outstanding: |

|

|

|

|

|

|

|

Basic | 118.5 |

|

| 120.2 |

|

| 118.4 |

|

| 120.0 |

|

Diluted | 122.0 |

|

| 124.4 |

|

| 121.9 |

|

| 124.2 |

|

Dividends declared per common share | $ | 0.30 |

|

| $ | 0.27 |

|

| $ | 0.60 |

|

| $ | 0.54 |

|

Amounts may not sum due to rounding.

Broadridge Financial Solutions, Inc.

Condensed Consolidated Balance Sheets

(In millions, except per share amounts)

(Unaudited)

|

| | | | | | | |

| December 31,

2015 |

| June 30,

2015 |

Assets |

|

|

|

Current assets: |

|

|

|

Cash and cash equivalents | $ | 305.1 |

|

| $ | 324.1 |

|

Accounts receivable, net of allowance for doubtful accounts of $4.2 and $3.8, respectively | 409.8 |

|

| 444.5 |

|

Other current assets | 113.3 |

|

| 92.8 |

|

Total current assets | 828.2 |

|

| 861.4 |

|

Property, plant and equipment, net | 106.0 |

|

| 97.3 |

|

Goodwill | 975.4 |

|

| 970.5 |

|

Intangible assets, net | 191.2 |

|

| 195.7 |

|

Other non-current assets | 252.7 |

|

| 243.2 |

|

Total assets | $ | 2,353.6 |

|

| $ | 2,368.1 |

|

Liabilities and Stockholders’ Equity |

|

|

|

Current liabilities: |

|

|

|

Accounts payable | $ | 113.0 |

|

| $ | 115.9 |

|

Accrued expenses and other current liabilities | 248.0 |

|

| 320.4 |

|

Deferred revenues | 67.5 |

|

| 72.6 |

|

Total current liabilities | 428.4 |

|

| 508.9 |

|

Long-term debt | 754.5 |

|

| 689.4 |

|

Deferred taxes | 47.6 |

|

| 61.7 |

|

Deferred revenues | 80.4 |

|

| 75.2 |

|

Other non-current liabilities | 101.1 |

|

| 105.1 |

|

Total liabilities | 1,412.0 |

|

| 1,440.3 |

|

Commitments and contingencies |

|

|

|

Stockholders’ equity: |

|

|

|

Preferred stock: Authorized, 25.0 shares; issued and outstanding, none | — |

|

| — |

|

Common stock, $0.01 par value: Authorized, 650.0 shares; issued, 154.5 and 154.5 shares, respectively; outstanding, 118.5 and 118.2 shares, respectively | 1.6 |

|

| 1.6 |

|

Additional paid-in capital | 884.0 |

|

| 855.5 |

|

Retained earnings | 1,134.8 |

|

| 1,132.0 |

|

Treasury stock, at cost: 35.9 and 36.3 shares, respectively | (1,040.8 | ) |

| (1,040.4 | ) |

Accumulated other comprehensive loss | (38.0 | ) |

| (20.9 | ) |

Total stockholders’ equity | 941.5 |

|

| 927.8 |

|

Total liabilities and stockholders’ equity | $ | 2,353.6 |

|

| $ | 2,368.1 |

|

Amounts may not sum due to rounding.

Broadridge Financial Solutions, Inc.

Segment Results

(In millions)

(Unaudited)

|

| | | | | | | | | | | | | | | |

| Revenues |

| Three Months Ended

December 31, | | Six Months Ended

December 31, |

| 2015 | | 2014 | | 2015 | | 2014 |

| | | | | |

Investor Communication Solutions | $ | 471.7 |

| | $ | 403.9 |

| | $ | 901.4 |

| | $ | 798.3 |

|

Global Technology and Operations | 180.3 |

| | 174.3 |

| | 357.0 |

| | 336.9 |

|

Foreign currency exchange | (13.0 | ) | | (3.6 | ) | | (24.7 | ) | | (4.8 | ) |

Total | $ | 638.9 |

| | $ | 574.6 |

| | $ | 1,233.7 |

|

| $ | 1,130.4 |

|

|

| | | | | | | | | | | | | | | |

| Earnings (Loss) before Income

Taxes |

| Three Months Ended

December 31, | | Six Months Ended

December 31, |

| 2015 | | 2014 | | 2015 | | 2014 |

| | | | | |

Investor Communication Solutions | $ | 46.1 |

| | $ | 34.7 |

| | $ | 80.0 |

| | $ | 72.4 |

|

Global Technology and Operations | 29.4 |

| | 32.2 |

| | 59.8 |

| | 58.1 |

|

Other | (15.7 | ) | | (19.3 | ) | | (29.6 | ) | | (37.1 | ) |

Foreign currency exchange | 1.5 |

| | 4.0 |

| | 2.8 |

| | 8.2 |

|

Total | $ | 61.3 |

| | $ | 51.6 |

| | $ | 113.0 |

|

| $ | 101.6 |

|

Amounts may not sum due to rounding.

Broadridge Financial Solutions, Inc. Reconciliation of Non-GAAP to GAAP Measures

(Unaudited)

(In millions, except per share amounts)

|

| | | | | | | | | | | | | | | |

| Three Months Ended

December 31, | | Six Months Ended

December 31, |

| 2015 | | 2014 | | 2015 | | 2014 |

| ($ in millions) |

Adjusted Operating income (Non-GAAP) | $ | 79.7 |

| | $ | 66.9 |

| | $ | 148.2 |

| | $ | 130.4 |

|

Acquisition Amortization and Other Costs | (9.5 | ) | | (7.9 | ) | | (18.9 | ) | | (14.3 | ) |

Operating income (GAAP) | $ | 70.2 |

| | $ | 59.1 |

| | $ | 129.3 |

| | $ | 116.2 |

|

Adjusted Operating income margin (Non-GAAP) | 12.5 | % | | 11.6 | % | | 12.0 | % | | 11.5 | % |

Operating income margin (GAAP) | 11.0 | % | | 10.3 | % | | 10.5 | % | | 10.3 | % |

|

| | | | | | | | | | | | | | | |

| Three Months Ended

December 31, | | Six Months Ended

December 31, |

| 2015 | | 2014 | | 2015 | | 2014 |

| ($ in millions) |

Adjusted Net earnings (Non-GAAP) | $ | 46.5 |

| | $ | 39.9 |

| | $ | 86.1 |

| | $ | 76.6 |

|

Acquisition Amortization and Other Costs, net of taxes | (6.3 | ) | | (5.3 | ) | | (12.3 | ) | | (9.4 | ) |

Net earnings (GAAP) | $ | 40.2 |

| | $ | 34.7 |

| | $ | 73.8 |

| | $ | 67.2 |

|

|

| | | | | | | | | | | | | | | |

| Three Months Ended

December 31, | | Six Months Ended

December 31, |

| 2015 | | 2014 | | 2015 | | 2014 |

Adjusted Diluted earnings per share (Non-GAAP) | $ | 0.38 |

| | $ | 0.32 |

| | $ | 0.71 |

| | $ | 0.62 |

|

Acquisition Amortization and Other Costs, net of taxes | (0.05 | ) | | (0.04 | ) | | (0.10 | ) | | (0.08 | ) |

Diluted earnings per share (GAAP) | $ | 0.33 |

| | $ | 0.28 |

| | $ | 0.61 |

| | $ | 0.54 |

|

|

| | | | | | | |

| Six Months Ended

December 31, |

| 2015 | | 2014 |

| ($ in millions) |

Free cash flows (Non-GAAP) | $ | 5.7 |

| | $ | 55.0 |

|

Capital expenditures, software purchases and capitalized internal use software | 36.9 |

| | 15.8 |

|

Net cash flows provided by operating activities (GAAP) | $ | 42.6 |

| | $ | 70.8 |

|

Amounts may not sum due to rounding.

Broadridge Financial Solutions, Inc.

Reconciliation of Non-GAAP to GAAP Measures

Diluted Earnings Per Share Growth and Operating Income Margin

Fiscal Year 2016 Guidance

(Unaudited)

|

| | |

Earnings Per Share Growth Rate (1) | | FY16 Guidance |

Adjusted Diluted earnings per share (Non-GAAP) | | 8% - 12% growth |

Diluted earnings per share (GAAP) | | 7% - 12% growth |

| | |

Operating Income Margin (2) | | FY16 Guidance |

Adjusted Operating income margin % (Non-GAAP) | | ~18.4% |

Operating income margin % (GAAP) | | ~17.3% |

| | |

(1) Adjusted Diluted EPS growth (Non-GAAP) is adjusted to exclude the projected impact of Acquisition Amortization and Other Costs. Fiscal year 2016 Non-GAAP Adjusted Diluted EPS guidance estimates exclude Acquisition Amortization and Other Costs, net of taxes, of $0.18 per share.

(2) Adjusted Operating income margin % (Non-GAAP) is adjusted to exclude the projected impact of Acquisition Amortization and Other Costs. Fiscal year 2016 Non-GAAP Adjusted Operating income margin guidance estimates exclude Acquisition Amortization and Other Costs of $34 million.

Note: Guidance does not take into consideration the effect of any future acquisitions, additional debt and/or share repurchases.

1© 2014 | Earnings Webcast & Conference Call Second Quarter FY 2016 February 4, 2016 EXHIBIT 99.2

2 Forward-Looking Statements This presentation and other written or oral statements made from time to time by representatives of Broadridge may contain “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Statements that are not historical in nature, and which may be identified by the use of words such as “expects,” “assumes,” “projects,” “anticipates,” “estimates,” “we believe,” could be” and other words of similar meaning, are forward-looking statements. In particular, information referred to as “Fiscal Year 2016 Financial Guidance” or our three-year performance objectives and outlook are forward-looking statements. These statements are based on management’s expectations and assumptions and are subject to risks and uncertainties that may cause actual results to differ materially from those expressed. These risks and uncertainties include those risk factors discussed in Part I, “Item 1A. Risk Factors” of our Annual Report on Form 10-K for the fiscal year ended June 30, 2015 (the “2015 Annual Report”), as they may be updated in any future reports filed with the Securities and Exchange Commission. All forward-looking statements speak only as of the date of this presentation and are expressly qualified in their entirety by reference to the factors discussed in the 2015 Annual Report. These risks include: the success of Broadridge in retaining and selling additional services to its existing clients and in obtaining new clients; Broadridge’s reliance on a relatively small number of clients, the continued financial health of those clients, and the continued use by such clients of Broadridge’s services with favorable pricing terms; changes in laws and regulations affecting Broadridge’s clients or the services provided by Broadridge; declines in participation and activity in the securities markets; any material breach of Broadridge security affecting its clients’ customer information; the failure of Broadridge’s outsourced data center services provider to provide the anticipated levels of service; a disaster or other significant slowdown or failure of Broadridge’s systems or error in the performance of Broadridge’s services; overall market and economic conditions and their impact on the securities markets; Broadridge’s failure to keep pace with changes in technology and demands of its clients; Broadridge’s ability to attract and retain key personnel; the impact of new acquisitions and divestitures; and competitive conditions. Broadridge disclaims any obligation to update or revise forward-looking statements that may be made to reflect events or circumstances that arise after the date made or to reflect the occurrence of unanticipated events, other than as required by law.

3 Explanation and Reconciliation of the Company’s Use of Non-GAAP Financial Measures The Company's results in this presentation are presented in accordance with generally accepted accounting principles in the United States (“GAAP”) except where otherwise noted. In certain circumstances, results have been presented on an adjusted basis and are not generally accepted accounting principles measures (“Non-GAAP”). These Non-GAAP financial measures should be viewed in addition to, and not as a substitute for, the Company's reported results. With regard to statements in this presentation that include certain Non-GAAP financial measures, the adjusted operating income and adjusted earnings measures are adjusted to exclude the impact of certain costs, expenses, gains and losses and other specified items that management believes are not indicative of our ongoing performance. These adjusted measures exclude the impact of Acquisition Amortization and Other Costs which represent the amortization charges associated with intangible asset values as well as other deal costs associated with the Company’s acquisition activities. The Adjusted Operating income, Adjusted Operating income margin and Adjusted Diluted earnings per share fiscal year 2016 guidance provided in this presentation is adjusted to exclude the projected impact of Acquisition Amortization and Other Costs. We also provide information on our Free cash flows because we believe this helps investors understand the amount of cash available for dividends, share repurchases, acquisitions and other discretionary investments. Free cash flows is a Non-GAAP measure and is defined by the Company as Net cash flows provided by operating activities less capital expenditures, software purchases and capitalized internal use software. The Company believes Non-GAAP financial information helps investors understand the effect of these items on our reported results and provides a better representation of our operating performance. These Non-GAAP measures are indicators that management uses to provide additional meaningful comparisons between our current results and prior reported results, and as a basis for planning and forecasting for future periods. Reconciliations of such Non-GAAP measures to the most directly comparable financial measures presented in accordance with GAAP can be found in the attached Appendix. Use of Material Contained Herein The information contained in this presentation is being provided for your convenience and information only. This information is accurate as of the date of its initial presentation. If you plan to use this information for any purpose, verification of its continued accuracy is your responsibility. Broadridge assumes no duty to update or revise the information contained in this presentation. You may reproduce information contained in this presentation provided you do not alter, edit, or delete any of the content and provided you identify the source of the information as Broadridge Financial Solutions, Inc., which owns the copyright. Broadridge and the Broadridge logo are registered trademarks of Broadridge Financial Solutions, Inc.

4 Key Messages • Pleased with Q2 and first half financial results • Strong sales performance in Q2 • Signed Barclays for Europe and Asia to APTP platform • Sales pipeline momentum remains robust • Positions us to achieve full year sales guidance • Maintaining FY16 guidance highlighted by solid recurring fee revenue growth, strong sales performance and 98% revenue retention rate • Delivering strong results in the near term and investing in the business to drive continued growth over the long term

5 Q2FY16 Financial Highlights • Q2 recurring fee revenues were up 8% • Adjusted Diluted earnings per share (EPS) up 19% in Q2 and up 15% year to date • Reaffirming full year 2016 guidance, including: ▪ Recurring fee revenue growth of 10-12% (total revenue growth of 8-10%) ▪ Adjusted Diluted EPS growth in the range of 8% to 12% ▪ Closed sales in the range of $120M-$160M Note: Our guidance does not take into consideration the effect of any future acquisitions, additional debt or share repurchases.

6 Q2FY16 Business Update • Closed Sales of $49M in Q2 ▪ Pipeline remains robust with good momentum • Signed Barclays to APTP platform ▪ Third client signed to alliance with Accenture ▪ Societe Generale went live in London during Q2 • Acquisition Update: QED Financial Systems ▪ Closed in November; purchase price of ~$15M ▪ Provides investment accounting solutions to public sector institutional investors ▪ Broadens our buy side offering • SEC mutual fund rule proposal - filed second letter January 13, 2016

7 2Q FY16 2Q YTD FY16 Actual Actual Growth Drivers as a % of Recurring Fee Revenues Closed Sales 6% 6% Client Losses (2)% (2)% Net New Business 4% 4% Internal Growth (1)% 0% Organic Growth 3% 4% Acquisitions 5% 4% Total Recurring Fee Revenue Growth 8% 9% Growth Drivers as a % of Total Revenues Recurring Fee Revenues 5% 6% Event-Driven 3% 2% Distribution 4% 3% FX/Other (2)% (2)% Total Revenue Growth 11% 9% Adjusted Operating income margin (Non-GAAP) 12.5% 12.0% Note: Net New Business is defined as recurring revenue from closed sales less recurring revenue from client losses. Note: Amounts may not sum due to rounding. Key Financial Drivers

8 ($ in millions, except growth and margins) Investor Communication Solutions (ICS) 2Q15 2Q16 Versus Prior Year 2Q15 YTD 2Q16 YTD Versus Prior Year Recurring Fee Revenues $196 $219 12% $391 $435 11% Total Revenues $404 $472 17% $798 $901 13% Earnings before income taxes $35 $46 33% $72 $80 10% Pre-tax Margins 8.6% 9.8% 120 bps 9.1% 8.9% (20) bps Global Technology and Operations (GTO) 2Q15 2Q16 Versus Prior Year 2Q15 YTD 2Q16 YTD Versus Prior Year Total Revenues $174 $180 3% $337 $357 6% Earnings before income taxes $32 $29 (9)% $58 $60 3% Pre-tax Margins 18.5% 16.3% (220) bps 17.2% 16.7% (50) bps Segment Results

9 FY16 Guidance Broadridge Financial Solutions, Inc. Recurring fee revenue growth 10 - 12% Total revenue growth 8 - 10% Adjusted Operating income margins ~18.4% Effective tax rate ~34.8% Adjusted Diluted earnings per share growth 8 - 12% Diluted earnings per share growth 7 - 12% Free cash flows $350M - $400M Closed sales $120M - $160M Segments ICS Total revenue growth 10 - 12% ICS Pre-tax margin ~18.9% GTO Total revenue growth 4 - 6% GTO Pre-tax margins ~17.3% Note: Current guidance remains unchanged from FY2016 guidance issued in August 7, 2015 webcast. Note: Guidance does not take into consideration the effect of any future acquisitions, additional debt and/or share repurchases.

10 Closing Summary • Solid Q2 and YTD financial and closed sales performance reflects continued momentum • Reaffirming FY16 guidance • Expect full-year results to be aligned with three-year objectives ▪ Drive sales performance to deliver strong recurring revenue growth ▪ Build-out acquisitions portfolio via tuck-ins with disciplined execution ▪ Committed to capital stewardship that enhances Total Shareholder Return • Remain confident in ability to generate sustainable top quartile Total Shareholder Return over any multi-year period

11 Q&A and Closing Comments There are no slides during this portion of the presentation

12 Appendix

13 Reconciliation of Non-GAAP to GAAP Measures (Unaudited) Three Months Ended December 31, Six Months Ended December 31, 2015 2014 2015 2014 Adjusted Operating income (Non-GAAP) $ 79.7 $ 66.9 $ 148.2 $ 130.4 Acquisition Amortization and Other Costs (9.5) (7.9) (18.9) (14.3) Operating income (GAAP) $ 70.2 $ 59.1 $ 129.3 $ 116.2 Adjusted Operating income margin (Non-GAAP) 12.5% 11.6% 12.0% 11.5% Operating income margin (GAAP) 11.0% 10.3% 10.5% 10.3% Three Months Ended December 31, Six Months Ended December 31, 2015 2014 2015 2014 Adjusted Net earnings (Non-GAAP) $ 46.5 $ 39.9 $ 86.1 $ 76.6 Acquisition Amortization and Other Costs, net of taxes (6.3) (5.3) (12.3) (9.4) Net earnings (GAAP) $ 40.2 $ 34.7 $ 73.8 $ 67.2 Three Months Ended December 31, Six Months Ended December 31, 2015 2014 2015 2014 Adjusted Diluted earnings per share (Non-GAAP) $ 0.38 $ 0.32 $ 0.71 $ 0.62 Acquisition Amortization and Other Costs, net of taxes (0.05) (0.04) (0.10) (0.08) Diluted earnings per share (GAAP) $ 0.33 $ 0.28 $ 0.61 $ 0.54 Six Months Ended December 31, 2015 2014 Free cash flows (Non-GAAP) $ 5.7 $ 55.0 Capital expenditures, software purchases and capitalized internal use software 36.9 15.8 Net cash flows provided by operating activities (GAAP) $ 42.6 $ 70.8 Note: Amounts may not sum due to rounding.

14 Reconciliation of Non-GAAP to GAAP Measures- FY16 Guidance Earnings Per Share Growth Rate (1) FY16 Guidance Adjusted Diluted earnings per share (Non-GAAP) 8% - 12% growth Diluted earnings per share (GAAP) 7% - 12% growth Operating Income Margin (2) FY16 Guidance Adjusted Operating income margin % (Non-GAAP) ~18.4% Operating income margin % (GAAP) ~17.3% (Unaudited) (1) Adjusted Diluted EPS growth (Non-GAAP) is adjusted to exclude the projected impact of Acquisition Amortization and Other Costs. Fiscal year 2016 Non- GAAP Adjusted Diluted EPS guidance estimates exclude estimated Acquisition Amortization and Other Costs, net of taxes, of $0.18 per share. (2) Adjusted Operating income margin % (Non-GAAP) is adjusted to exclude the projected impact of Acquisition Amortization and Other Costs. Fiscal year 2016 Non-GAAP Adjusted Operating income margin % guidance estimates exclude estimated Acquisition Amortization and Other Costs of $34 million. Note: Guidance does not take into consideration the effect of any future acquisitions, additional debt, and/or share repurchases.

BROADRIDGE FINANCIAL SOLUTIONS, INC. ‐ KEY STATS Exhibit 99.3 INVESTOR COMMUNICATION SOLUTIONS SEGMENT RC= Recurring Q2 FY16 ED= Event Driven (in millions) Fee Revenues 2Q15 2Q16 YTD FY15 YTD FY16 Type Proxy Equities 27.6$ 32.0$ 54.2$ 61.0$ RC Stock Record Position Growth 7% 4% 7% 2% Pieces 25.1 26.8 44.4 49.1 Mutual Funds 11.0$ 20.6$ 21.0$ 30.6$ ED Pieces 16.8 32.9 31.4 46.8 Contests/Specials 8.4$ 7.2$ 12.2$ 14.1$ ED Pieces 8.8 7.1 12.2 14.8 Total Proxy 47.0$ 59.8$ 87.4$ 105.7$ Total Pieces 50.7 66.8 88.0 110.7 Notice and Access Opt-in % 73% 80% 65% 73% Suppression % 61% 60% 60% 63% Interims Mutual Funds (Annual/Semi- Annual Reports/Annual Prospectuses) 39.6$ 43.0$ 80.4$ 88.3$ RC Position Growth 8% 4% 8% 5% Pieces 192.3 188.2 389.7 394.4 Mutual Funds (Supplemental Prospectuses) & Other 10.8$ 13.1$ 23.1$ 24.7$ ED Pieces 49.3 70.2 110.4 127.8 Total Interims 50.4$ 56.1$ 103.5$ 113.0$ Total Pieces 241.6 258.4 500.1 522.2 Transaction Reporting Transaction Reporting/Customer Communications 39.3$ 41.6$ 78.6$ 81.1$ RC Fulfillment Fulfillment 39.3$ 34.7$ 76.0$ 69.4$ RC Emerging, Emerging/Acquired 50.0$ 67.2$ 102.2$ 134.6$ RC Acquired, Other 7.3$ 16.1$ 16.1$ 25.6$ ED and Other Total Emerging, Acquired and Other 57.3$ 83.3$ 118.3$ 160.2$ Total Fee Revenues 233.3$ 275.5$ 463.8$ 529.4$ Total Distribution Revenues 170.6$ 196.2$ 334.5$ 372.0$ Total Revenues 403.9$ 471.7$ 798.3$ 901.4$ Total RC Fees 195.8$ 218.5$ 391.4$ 434.4$ % RC Growth 13% 12% 11% 11% Total ED Fees 37.5$ 57.0$ 72.4$ 95.0$

BROADRIDGE FINANCIAL SOLUTIONS, INC. ‐ KEY STATS RC= Recurring GLOBAL TECHNOLOGY AND OPERATIONS SEGMENT ED= Event Driven Q2 FY16 (in millions) 2Q15 2Q16 FY15 YTD FY16 YTD Type Equity Transaction-Based Equity Trades 35.4$ 33.2$ 66.9$ 66.0$ RC Internal Trade Volume (Average Trades per Day in '000) 1,014 960 952 959 Internal Trade Growth 9% -5% 5% 1% Trade Volume (Average Trades per Day in '000) 1,030 971 964 965 Non-Transaction Other Equity Services 108.1 115.8 209.1 229.1 RC Total Equity 143.5$ 149.1$ 276.0$ 295.1$ Fixed Income Transaction-Based Fixed Income Trades 14.5$ 14.4$ 28.9$ 29.0$ RC Internal Trade Volume (Average Trades per Day in '000) 316 311 310 314 Internal Trade Growth 2% -2% -1% 1% Trade Volume (Average Trades per Day in '000) 324 319 319 322 Non-Transaction Other Fixed Income Services 16.3$ 16.8$ 32.0$ 33.0$ RC Total Fixed Income 30.8$ 31.2$ 60.9$ 62.0$ Total Revenues 174.3$ 180.3$ 336.9$ 357.0$

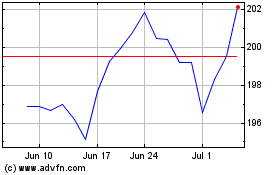

Broadridge Financial Sol... (NYSE:BR)

Historical Stock Chart

From Jun 2024 to Jul 2024

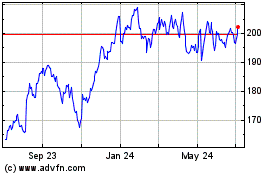

Broadridge Financial Sol... (NYSE:BR)

Historical Stock Chart

From Jul 2023 to Jul 2024