UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): November 12, 2015

BROADRIDGE FINANCIAL SOLUTIONS, INC.

(Exact name of registrant as specified in its charter)

DELAWARE

(State or other jurisdiction of incorporation)

|

| |

| |

001-33220 | 33-1151291 |

(Commission file number) | (I.R.S. Employer Identification No.) |

5 Dakota Drive

Lake Success, New York 11042

(Address of principal executive offices)

Registrant’s telephone number, including area code: (516) 472-5400

N/A

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

| |

Item 5.07. | Submission of Matters to a Vote of Security Holders. |

On November 12, 2015, Broadridge Financial Solutions, Inc. (“Broadridge” or the “Company”) held its 2015 Annual Meeting of Stockholders. At the 2015 Annual Meeting, stockholders approved all of management’s proposals, which were:

| |

1. | The election of nine directors for terms of one year and until their successors are elected and qualified; |

| |

2. | The advisory vote on the Company’s executive compensation (the Say on Pay Vote); and |

| |

3. | The ratification of the appointment of Deloitte & Touche LLP as the independent registered public accounting firm to conduct the annual audit of the financial statements of the Company and its subsidiaries for the fiscal year ending June 30, 2016. |

Proposal 1: Election of Directors. The following table reflects the tabulation of the votes with respect to each director who was elected at the 2015 Annual Meeting:

|

| | | | | | | | | | | | |

| | FOR | | AGAINST | | ABSTAIN | | Broker Non Votes |

| | | | | | | | |

Leslie A. Brun | | 93,493,694 |

| | 941,471 |

| | 321,566 |

| | 11,393,573 |

|

Richard J. Daly | | 94,181,737 |

| | 252,444 |

| | 322,550 |

| | 11,393,573 |

|

Robert N. Duelks | | 94,188,412 |

| | 240,014 |

| | 328,305 |

| | 11,393,573 |

|

Richard J. Haviland | | 94,053,156 |

| | 372,174 |

| | 331,401 |

| | 11,393,573 |

|

Brett A. Keller | | 94,206,737 |

| | 224,688 |

| | 325,306 |

| | 11,393,573 |

|

Stuart R. Levine | | 94,177,068 |

| | 258,471 |

| | 321,192 |

| | 11,393,573 |

|

Maura A. Markus | | 94,172,905 |

| | 249,660 |

| | 334,166 |

| | 11,393,573 |

|

Thomas J. Perna | | 94,192,274 |

| | 239,475 |

| | 324,982 |

| | 11,393,573 |

|

Alan J. Weber | | 93,750,244 |

| | 683,211 |

| | 323,276 |

| | 11,393,573 |

|

Proposal 2: Advisory Vote on the Company’s Executive Compensation (the Say on Pay Vote). The approval, on an advisory basis, of the Company’s executive compensation was approved by the stockholders. The stockholders cast 89,797,784 votes in favor of this proposal and 4,598,195 votes against. There were 360,752 abstentions and 11,393,573 broker non-votes.

Proposal 3: Ratification of Appointment of Auditors. The ratification of the appointment of Deloitte & Touche LLP as the Company’s independent registered public accounting firm to conduct the annual audit of the financial statements of the Company and its subsidiaries for the fiscal year ending June 30, 2016, was approved by the stockholders. The stockholders cast 103,921,970 votes in favor of this proposal and 1,846,282 votes against. There were 382,052 abstentions.

| |

Item 7.01. | Regulation FD Disclosure. |

The Company is furnishing the transcript of the Company’s 2015 Annual Meeting of Stockholders held on November 12, 2015.

In certain circumstances, results in this transcript have been presented on an adjusted basis and are not generally accepted accounting principles measures (“Non-GAAP”). These Non-GAAP financial measures should be viewed in addition to, and not as a substitute for, the Company's reported results. The reconciliations of any Non-GAAP measures included in this transcript to their most directly comparable GAAP measures were included in the Company’s press release and Earnings Webcast & Conference Call Presentation dated August 7, 2015 for the fiscal year ended June 30, 2015, and in the Company’s press release and Earnings Webcast & Conference Call Presentation dated November 5, 2015 for the first quarter ended September 30, 2015, which were included as Exhibits 99.1 and 99.2 to the Company’s Forms 8-K dated August 7, 2015 and November 5, 2015, respectively, and are also available under the “Investor Relations” section of the Company’s website at www.broadridge-ir.com.

The information furnished pursuant to Items 7.01 and 9.01, including Exhibit 99.1, shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities under that Section, and shall not be deemed to be incorporated by reference into any filing of the Company under the Securities Act of 1933, as amended, or the Exchange Act.

Forward-Looking Statements

This current report on Form 8-K and other written or oral statements made from time to time by representatives of Broadridge may contain “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Statements that are not historical in nature, and which may be identified by the use of words such as “expects,” “assumes,” “projects,” “anticipates,” “estimates,” “we believe,” “could be” and other words of similar meaning, are forward-looking statements. In particular, statements about Broadridge’s future financial performance are forward-looking statements. These statements are based on management’s expectations and assumptions and are subject to risks and uncertainties that may cause actual results to differ materially from those expressed. These risks and uncertainties include those risk factors discussed in Part I, “Item 1A. Risk Factors” of our Annual Report on Form 10-K for the fiscal year ended June 30, 2015 (the “2015 Annual Report”), as they may be updated in any future reports filed with the Securities and Exchange Commission. All forward-looking statements speak only as of the date of this 8-K and are expressly qualified in their entirety by reference to the factors discussed in the 2015 Annual Report.

These risks include: the success of Broadridge in retaining and selling additional services to its existing clients and in obtaining new clients; Broadridge’s reliance on a relatively small number of clients, the continued financial health of those clients, and the continued use by such clients of Broadridge’s services with favorable pricing terms; changes in laws and regulations affecting Broadridge’s clients or the investor communication services provided by Broadridge; declines in participation and activity in the securities markets; any material breach of Broadridge security affecting its clients’ customer information; the failure of Broadridge’s outsourced data center services provider to provide the anticipated levels of service; a disaster or other significant slowdown or failure of Broadridge’s systems or error in the performance of Broadridge’s services; overall market and economic conditions and their impact on the securities markets; Broadridge’s failure to keep pace with changes in technology and demands of its clients; Broadridge’s ability to attract and retain key personnel; the impact of new acquisitions and

divestitures; and competitive conditions. Broadridge disclaims any obligation to update or revise forward-looking statements that may be made to reflect events or circumstances that arise after the date made or to reflect the occurrence of unanticipated events, other than as required by law.

Item 9.01. Financial Statements and Exhibits.

Exhibits. The following exhibit is furnished herewith:

|

| | |

Exhibit No. | | Description |

99.1 | | Transcript of the 2015 Broadridge Financial Solutions, Inc. Annual Meeting of Stockholders. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Dated: November 13, 2015

|

| |

| BROADRIDGE FINANCIAL SOLUTIONS, INC. By: /s/ Adam D. Amsterdam Name: Adam D. Amsterdam Title: Vice President, General Counsel and Secretary |

EXHIBIT 99.1

Broadridge

November 12, 2015

10:00 AM EST

| |

Les Brun: | Good morning, and welcome to Broadridge's 2015 annual meeting. My name is Les Brun. I have the privilege of chairing this Board. This is Broadridge's 7th completely virtual meeting of shareholders. Validated shareholders can vote and submit questions in real time, and this format has substantially increased shareholder access, participation, and voting. |

I'd like to introduce the slate of directors who are here to be elected today amongst other proposals. Starting to my very far left, Mr. Alan Weber, Ms. Maura Markus, Mr. Stuart Levine, Mr. Rich Haviland. This fellow, who will be speaking to you shortly, who is our CEO, Rich Daly, Thomas Perna, Robert Duelks, and our newest director, Brett Keller. I'd also like to introduce to you representatives of Deloitte & Touche, our independent auditors, Mike Angelaras and Ms. Lynda Hullstrung. As well, Mr. Jon Mark is here from our outside legal counsel of Cahill, Gordon, and Reindel and, at this point, I'd like to turn the meeting over to Adam Amsterdam to conduct the business aspect of the meeting and to close the polls. Adam?

Adam Amsterdam: Thanks, Les. Proof of notice of this meeting will be filed with the minutes. The tabulator has provided me with a report indicating that over 89 percent of our outstanding shares are present by proxy at the meeting. Accordingly, I can certify that a quorum exists.

The Company has appointed Tom Tighe as our Inspector of Election. All Broadridge stockholders entitled to vote at this meeting have the ability to do so online as well as the ability to submit questions in real time or over the phone by dialing 1-877-328-2502 and providing the control number that was included with your notice of the meeting.

If you are a stockholder entitled to vote and have not yet voted, or you want to change a previously cast vote, please do so now via the website.

The proposals being considered today are explained in detail in the proxy statement that was distributed to all stockholders entitled to vote. I'll be closing the polls after I review the proposals.

In proposal number 1, the Board is proposing nine nominees for election as directors.

In proposal number 2, the Board is seeking advisory approval of the compensation for the corporate officers named in our proxy statement.

And in proposal number 3, the Board is proposing the ratification of the appointment of Deloitte & Touche to serve as Broadridge's independent auditors for the fiscal year ending June 30, 2016.

Our Board recommends that stockholders vote for each of these proposals. The polls are now closed, and the business of the meeting is concluded. With that, I'll turn the meeting over to our President and CEO, Rich Daly.

| |

Rich Daly: | Good morning, thanks, Adam. I am Rich Daly, President and CEO of Broadridge. It's also my privilege to welcome you to Broadridge's 7th virtual-only annual meeting. |

This virtual annual meeting is powered by Broadridge technology and over the last year we've done about 125 virtual annual meetings of companies of varying sizes including companies as large as Intel and HP who also had a virtual-only annual meeting.

As part of this virtual annual meeting format, I will share with you a few highlights regarding Broadridge's fiscal year 2015 financial performance, strategy, culture, and, finally, our results from the first quarter.

First -- some financial highlights from fiscal year 2015. We had another year of record revenue, earnings, and closed sales results. These results include the records of total revenues that increased 5 percent to $2.7 billion, adjusted net earnings that were 10 percent to $307 million, adjusted diluted EPS that was up 10 percent to $2.47 per share, and closed sales that were up 15 percent to $146 million.

Broadridge delivered top quartile total shareholder return of 23 percent and 36 percent for the one- and three-year periods ended June 30, 2015, respectively.

Our free cash flow grew 9 percent to $365 million. We repurchased about 5.2 million shares for a total of $210 million net of proceeds from option exercises.

We returned a total of $332 million to stockholders in dividends and share repurchases also net of proceeds from option exercises.

In August, we increased our annual dividend 11 percent to $1.20 per share. This is the 8th consecutive year we've raised it every year since being a public company.

Now for a brief strategy update. At Broadridge we have diversified our business through internal product development as well as strategic alliances and acquisitions, and we have positioned our Company with multiple paths to achieve our long-term financial goals.

Financial services firms continue to face pressures of increasing regulation, compliance costs, cyber security challenges, and changing customer communication preferences. This results in an estimated $24 billion market opportunity for Broadridge to address. This $24 billion market opportunity is being significantly enhanced by existing and new opportunities related to the three key industry trends of mutualization, digitization, and data and analytics.

By continuing to buy and acquire products -- that's build and acquire products, excuse me -- that meet our clients' current and future needs, Broadridge has taken control of its growth destiny. This past year our new growth products, whether built or acquired, represented more than 25% of our recurring fee revenues up from 10 percent just five years ago.

In fiscal year 2015, Broadridge acquired four companies as part of their strategy. The first was TwoFour Systems -- now Broadridge FX and Liquidity Solutions. We acquired Direxxis, which expands our growing solutions for financial advisors.

We acquired Wilmington Trust’s retirement trade processing business. This was, in essence, a 401-k rollup in our processing business Matrix, and we acquired part of Thomson Reuters’ Lipper Division now called Broadridge Fund Information Services, which enhances our growing mutual fund data and analytics business in North America and, significantly, globally as well.

At Broadridge, we are on a continuous journey to consistently create long-term shareholder value. The momentum I just discussed positions us well on our journey to create sustainable, top quartile, total shareholder return over any multi-year period.

Our performance is in line with our three-year objectives provided at our last Investor Day in December. These include recurring fee revenue growth of 7 percent to 10 percent, and adjusted net earnings growth of 9 percent to 11 percent.

Broadridge's success is built on a strong foundation of values and beliefs. At the core of our foundation is our commitment to the service profit chain. The service profit chain recognizes that in order to have

growing shareholder value, you must start with the associate, and engaged associates who come to work every day committed to exceed or at least meet customer expectations. It's those customers who buy more from us, renew business with us, that leads to stable and growing profits, which ultimately creates that shareholder value.

A proof statement of our commitment to that is our 97 percent client revenue retention rate. Another proof is Broadridge, every year since being a public company, has been named a "best company to work for in New York state," that's eight years consecutive and now in Canada we're seven years consecutive.

We've also been name a "best place to work" for LGBT equality, achieving a perfect 100 rating on the corporate equality index from the Human Rights Campaign. This has now happened for three years in a row. And Broadridge has been named to Fortune magazine's 2015 list of the world's most admired companies.

Finally, before Q&A, a few brief comments on our first quarter in fiscal year 2016. We had solid first quarter results. Total revenues grew 7 percent to $595 million, adjusted diluted EPS grew 10 percent to $0.33 per share. If you'd like to hear more about the first quarter, you can go to our website, click on "Investor Relations" and replay the call or simply look at the materials we presented.

Now that the update is concluded, I'm going to open it for Q&A. You can ask a question during the meeting by clicking "Ask a Question" or by calling 1-877-328-2502. I'm going to repeat that number. It's 1-877-328-2502. If, for some reason, time doesn't allow or follow up to a question is required, we will respond to your questions within 24 hours.

Here is the order that we will answer questions in. First, we will answer any question submitted online before the meeting through our Stockholder Forum. Then we will answer questions submitted live from the Internet during the meeting. And, finally, we'll answer questions from the phone. After Q&A, Adam will report the results of the meeting.

Okay, from our Shareholder Forum -- "I love the innovation and refresh that Broadridge has achieved with the retail voting tools. Are there plans to bring these to other global markets -- these to other global markets and allow shareholders around the world in other companies to have the same experience that Broadridge shareholders enjoy?"

Well, first of all, thanks for the plug in the question. Our proxy vote site has been significantly upgraded, and for retail investors, regardless of where they reside, you have the ability to use the proxy vote tools online for all U.S. companies. And, going forward, for this proxy season, you'll be able to do it in our other large retail market, which is Canada, as well.

As most people know, Broadridge represents, on average, over 50 percent of the outstanding shares in every geography. That activity, though, is driven by institutional investors who, the vast majority, currently participate through our ProxyEdge platform, and ProxyEdge is a very rich voting activity right now for companies regardless of where they are in the world, and through ProxyEdge you can vote through one tool across multiple custodians and receive summary reporting for your filing requirements, whether it be for ARISA or other entities, which would enable you to again vote once across multiple custodians, multiple accounts, receive one report back. So we have robust tools for the global market, but the bulk of our activity in the global market is primarily institutional.

Now, are there other questions from the Forum? Okay, we have no other questions from the Forum, and it appears at this time we have no Internet questions or phone questions. I'll wait just another few seconds.

Okay, well, thank you for your participation today. I'll now turn the meeting over to Adam Amsterdam, our general counsel.

Adam Amsterdam: Thanks, Rich. The Inspector of Election has presented me with a report covering votes received for and against each of our proposals. I am pleased to report that each of the proposals has passed. The complete voting results will be contained in a Form 8-K that will be filed with the SEC within four business days following this meeting. The 8-K will be available on Broadridge's website promptly after it's been filed.

Les, I'll turn the meeting back to you.

| |

Les Brun: | Thank you, Adam. There being no further questions, this business of the meeting is adjourned. Thank you very much for your participation. |

| |

Operator: | Ladies and gentlemen, your conference has now concluded. |

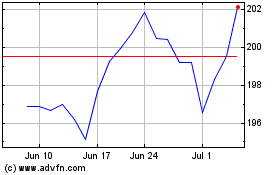

Broadridge Financial Sol... (NYSE:BR)

Historical Stock Chart

From Jun 2024 to Jul 2024

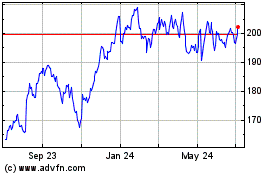

Broadridge Financial Sol... (NYSE:BR)

Historical Stock Chart

From Jul 2023 to Jul 2024