Current Report Filing (8-k)

May 06 2020 - 4:21PM

Edgar (US Regulatory)

BRINKER INTERNATIONAL, INC false 0000703351 0000703351 2020-05-06 2020-05-06

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON D.C. 20549

FORM 8-K

Current Report

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): May 6, 2020

BRINKER INTERNATIONAL, INC.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

DE

|

|

1-10275

|

|

75-1914582

|

|

(State or Other Jurisdiction

of Incorporation)

|

|

(Commission

File Number)

|

|

(I.R.S. Employer

Identification No.)

|

|

|

|

|

|

3000 Olympus Blvd

Dallas TX

|

|

75019

|

|

(Address of principal executive offices)

|

|

(Zip Code)

|

(972) 980-9917

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

Title of Each Class

|

|

Trading

Symbol(s)

|

|

Name of exchange

on which registered

|

|

Common Stock, $0.10 par value

|

|

EAT

|

|

NYSE

|

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425).

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12).

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)).

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)).

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

SECTION 1 – REGISTRANT’S BUSINESS AND OPERATIONS

Item 1.01. Entry into a Material Definitive Agreement.

On May 6, 2020, Brinker International, Inc. (the “Company”), Brinker Restaurant Corporation, Brinker Florida, Inc., Brinker Texas, Inc. and Brinker International Payroll Company, L.P. entered into a Sixth Amendment to Credit Agreement (the “Sixth Amendment”), which amends the Company’s Credit Agreement dated as of March 12, 2015 (as heretofore amended, the “Existing Credit Agreement”; the Existing Credit Agreement as amended by the Sixth Amendment, the “Amended Credit Agreement”) with a group of banks for which Bank of America, N.A. is acting as administrative agent (the “Administrative Agent”), which governs the Company’s $1.0 billion revolving credit facility (the “Credit Facility”). Capitalized terms not defined in this description shall have the meanings given them in the Existing Credit Agreement.

The Credit Agreement dated as of March 12, 2015 was more specifically described in Item 1.01 of the Company’s Current Report on Form 8-K, filed March 12, 2015, and the Existing Credit Agreement was more specifically described in Note 10 of the Company’s Quarterly Report on Form 10-Q, filed April 29, 2020, both of which descriptions are incorporated by reference.

The Sixth Amendment amended the Existing Credit Agreement to, among other matters:

|

|

•

|

eliminate the $800 million cap on the Company’s Credit Facility borrowing capacity that was imposed by the Fifth Amendment to Credit Agreement (the “Fifth Amendment”) dated as of March 31, 2020 (the “Borrowing Cap”), thereby increasing the Company’s borrowing capacity to $1.0 billion;

|

|

|

•

|

temporarily suspend the requirement to comply with all financial covenants under the Existing Credit Agreement through the fiscal quarter ending December 23, 2020, provided, however that the Company will be required to maintain a maximum leverage ratio and minimum fixed charge coverage ratio as set forth below commencing with, and following, the fiscal quarter ending March 24, 2021;

|

|

|

•

|

impose a minimum liquidity covenant (defined as amounts remaining available to be drawn under the Amended Credit Agreement plus the Company’s consolidated unrestricted cash and cash equivalents) of at least $175 million from the effective date of the Sixth Amendment until the termination of the Restricted Period; and

|

|

|

•

|

from the effective date of the Sixth Amendment until the termination of the Restricted Period, fix the interest rate on the aggregate principal amount of the outstanding borrowings under the Amended Credit Agreement at LIBOR plus 2.35% and the facility commitment fee at 40 basis points.

|

Commencing with the fiscal quarter ending March 24, 2021, the Company will be required to satisfy the following financial covenants:

|

|

•

|

with respect to the leverage ratio:

|

|

|

|

|

|

|

|

Fiscal Quarter Ended

|

|

Maximum Leverage Ratio

|

|

|

March 24, 2021

|

|

|

5.25 to 1.00

|

|

|

June 30, 2021 and thereafter

|

|

|

4.75 to 1.00

|

|

|

|

•

|

and with respect to the fixed charge coverage ratio:

|

|

|

|

|

|

|

|

Fiscal Quarter Ended

|

|

Minimum Fixed Charge

Coverage Ratio

|

|

|

March 24, 2021

|

|

|

1.25 to 1.00

|

|

|

June 30, 2021 and thereafter

|

|

|

1.50 to 1.00

|

|

Until such time as the Company demonstrates compliance with the above referenced financial covenants for the fiscal quarter ending on or after March 24, 2021 (the “Restricted Period”), the Company will continue to be subject to the supplemental reporting obligations and prohibitions on making dividends, stock repurchases and investments, in each case, as established by the Fifth Amendment. During this time, the interest rate on the aggregate principal amount of the outstanding borrowings under the Credit Facility will be fixed at LIBOR plus 2.35% and the facility commitment fee will be fixed at 40 basis points. Following compliance with the above referenced financial covenants the Company will continue to be subject to the $50 million aggregate limitation on dividends, stock repurchases and investments established by the Fifth Amendment.

By its terms, the Sixth Amendment (including the covenant relief and elimination of the Borrowing Cap described above) will not be effective until the Company receives not less than $100.0 million in net cash proceeds from a common stock offering.

Several of the banks party to the Amended Credit Agreement provide various other banking services to the Company.

The foregoing description is only a summary and it is qualified in its entirety by the specific terms of the Sixth Amendment, which is filed as Exhibit 10.1 to this Current Report and is incorporated herein by reference.

SECTION 9 – FINANCIAL STATEMENTS AND EXHIBITS

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits

|

|

|

|

|

|

|

|

|

|

|

|

|

|

10.1

|

|

|

Sixth Amendment to Credit Agreement, dated as of May 6, 2020 between Brinker International, Inc., Brinker Restaurant Corporation, Brinker Texas, Inc., Brinker Florida, Inc., and Brinker International Payroll Company, L.P., each as a guarantor, the Lenders party thereto and Bank of America, N.A., as administrative agent.

|

|

|

|

|

|

|

|

|

104

|

|

|

Cover Page Interactive Data File (embedded within the Inline XBRL document).

|

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the Company has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

BRINKER INTERNATIONAL, INC.,

|

|

|

|

|

|

|

|

|

|

|

|

a Delaware corporation

|

|

|

|

|

|

|

|

|

|

Dated: May 6, 2020

|

|

|

|

By:

|

|

/s/ WYMAN T. ROBERTS

|

|

|

|

|

|

|

|

Wyman T. Roberts,

|

|

|

|

|

|

|

|

President and Chief Executive Officer

and President of Chili’s Grill & Bar

(Principal Executive Officer)

|

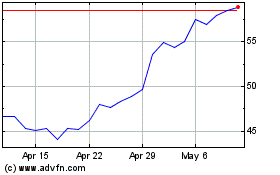

Brinker (NYSE:EAT)

Historical Stock Chart

From Aug 2024 to Sep 2024

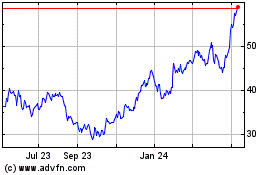

Brinker (NYSE:EAT)

Historical Stock Chart

From Sep 2023 to Sep 2024