Report of Foreign Issuer (6-k)

September 08 2014 - 6:00AM

Edgar (US Regulatory)

FORM 6-K

U.S. SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 OF THE

SECURITIES EXCHANGE ACT OF 1934

dated September 5, 2014

Commission File Number 1-15148

BRF S.A.

(Exact Name as Specified in its Charter)

N/A

(Translation of Registrant’s Name)

1400 R. Hungria, 5th Floor

Jd América-01455000-São Paulo – SP, Brazil

(Address of principal executive offices) (Zip code)

Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

Form 20-F x Form 40-F o

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T

Rule 101(b)(1):

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T

Rule 101(b)(7):

Indicate by check mark whether by furnishing the information contained in this Form, the registrant is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes o No x

If “Yes” is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b): Not applicable.

* * *

This material includes certain forward-looking statements that are based principally on current expectations and on projections of future events and financial trends that currently affect or might affect the Company’s business, and are not guarantees of future performance. These forward-looking statements are based on management’s expectations, which involve a number of known and unknown risks, uncertainties, assumptions and other important factors, many of which are beyond the Company’s control and any of which could cause actual financial condition and results of operations to differ materially fom those set out in the Company’s forward-looking statements. You are cautioned not to put undue reliance on such forward-looking statements. The Company undertakes no obligation, and expressly disclaims any obligation, to update or revise any forward-looking statements. The risks and uncertainties relating to the forward-looking statements in this Report on Form 6-K, including Exhibit 1 hereto, include those described under the captions “Forward-Looking Statements” and “Item 3. Key Information — D. Risk Factors” in the Company’s annual report on Form 20-F for the year ended December 31, 2012.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this Report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

Date: September 5, 2014 |

|

|

|

|

|

|

BRF S.A. |

|

|

|

|

|

|

|

|

By: |

/s/ Augusto Ribeiro Junior |

|

|

|

Name: |

Augusto Ribeiro Junior |

|

|

|

Title: |

CFO AND IRO

|

BRF S.A.

A PUBLICLY TRADED COMPANY WITH AUTHORIZED CAPITAL

CNPJ 01.838.723/0001-27

NIRE 42.300.034.240

CVM 16269-2

SUMMARY FROM THE MINUTES OF THE 103rd/14 EXTRAORDINARY MEETING OF THE BOARD OF DIRECTORS

DATE, PLACE AND TIME: September 3, 2014 at 5:00 p.m. at Rua Hungria, 1400 – 5th floor in the city and state of São Paulo via conference call. CHAIR: Sergio Rosa, Vice Chairman; Edina Biava, Secretary. ATTENDANCE: The full complement of Board members. 1. Initial considerations: The Board of Directors analyzed the proposal submitted by the Statutory Board of Executive Officers to sign today a binding memorandum of understanding (“Memorandum of Understanding”) with Parmalat S.p.A., a company with registered offices in the city of Parma, Italy and owned by the Groupe Lactalis (“Parmalat”). The Memorandum of Understanding establishes the terms and conditions for the sale of plants in the dairy products segment situated in Bom Conselho (PE), Carambeí (PR), Ravena (MG), Concórdia (SC), Teutônia (RS), Itumbiara (MG), Terenos (MS), Ijuí (RS), Três de Maio I (RS), Três de Maio II (RS) and Santa Rosa (RS) including the corresponding dedicated assets and brands (“Transaction”) under the following conditions: 1.1. The plants incorporating this transaction reported net revenues of R$ 2.6 billion in fiscal year 2013. 1.2. The stipulated value of the Transaction (enterprise value) in the Memorandum of Understanding is R$1.8 billion, subject to certain adjustments and to the verification of conditions precedent and regulatory approvals applicable to transactions of this nature. 1.3. The Company is to grant exclusivity to Parmalat during the period in which the Transaction’s definitive agreements are being negotiated. 2. Resolutions: The Board of Directors decided to agree to the Memorandum of Understanding and authorized the Statutory Board of Executive Officers to adopt all necessary measures with respect to the decision. São Paulo-SP, September 3, 2014. ABILIO DINIZ, Chairman; SÉRGIO RICARDO SILVA ROSA, Vice Chairman; CARLOS FERNANDO COSTA; JOSÉ CARLOS REIS MAGALHÃES NETO; EDUARDO SILVEIRA MUFAREJ; LUIZ FERNANDO FURLAN; LUIS CARLOS FERNANDES AFONSO; WALTER FONTANA FILHO; MANOEL CORDEIRO SILVA FILHO; PAULO ASSUNÇÃO DE SOUSA; VICENTE FALCONI CAMPOS.

EDINA BIAVA

Secretary

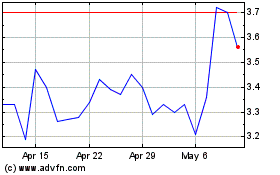

BRF (NYSE:BRFS)

Historical Stock Chart

From Jun 2024 to Jul 2024

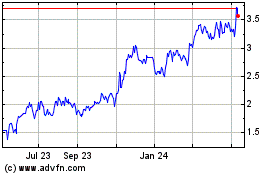

BRF (NYSE:BRFS)

Historical Stock Chart

From Jul 2023 to Jul 2024