ConAgra Foods Remains Neutral - Analyst Blog

December 31 2012 - 6:00AM

Zacks

We currently maintained our Neutral

recommendation on ConAgra Foods Inc. (CAG), a

world leader in providing branded and value added food services.

Headquartered in Omaha, the company had approximately 26,100

employees as of fiscal 2012 end.

The line of acquisitions for the

company seems to merge well with its operations, achieving laudable

results. In November 2012, the company announced its plans to

acquire Ralcorp Holdings Inc., which is the largest private label

food company in the US. Management expects cost synergies of

roughly $225 million once the acquired company is fully

integrated.

A significant contribution is

expected from CongAgra Foods’ Lamb Weston potato business

considering the trend in the past. Along with this, the company

maintained a strict control on operating costs, striving to keep

high margins.

However, it shouldn’t be overlooked

that the company operates in a highly competitive industry, where

the customers are price-sensitive. This could lead to a reduction

in the prices of products and services despite an increase in the

total costs, thereby squeezing the margins.

ConAgra’s results in the second

quarter of 2013 showed signs of improvement based on the increase

in the potato business, moderate inflation and contribution from

acquired businesses. The company exited the quarter with a strong

balance sheet.

Revenue for the reported quarter

increased 8.9% year over year to $3,735.5 million. However, it was

outshined by an 8.1% increase in the total costs. Earnings per

share were 44 cents for the quarter. Operating margin was recorded

at 8.4% as against 7.7% during the year-earlier quarter.

The current Zacks Consensus

Estimate for the third quarter is 55 cents, an increase of roughly

7.3% year over year. Estimates for 2013 and 2014 are $2.09 and

$2.30, respectively. These represent annual increase of 13.6% in

2013 and 10.1% in 2014.

Currently, we maintain a Neutral

recommendation on ConAgra Foods Inc. The stock also bears a Zacks

#2 (Buy) Rank, while its prime competitors H J HEINZ

CO. (HNZ) and BRF Basil Food (BRFS) carry

a Zacks #3 (Hold) Rank.

BRF-BRASIL FOOD (BRFS): Free Stock Analysis Report

CONAGRA FOODS (CAG): Free Stock Analysis Report

HEINZ (HJ) CO (HNZ): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

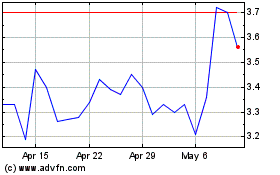

BRF (NYSE:BRFS)

Historical Stock Chart

From Jun 2024 to Jul 2024

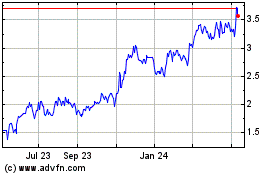

BRF (NYSE:BRFS)

Historical Stock Chart

From Jul 2023 to Jul 2024