FORM 6-K

U.S. SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13A-16 OR 15D-16 UNDER THE

SECURITIES EXCHANGE ACT OF 1934

Commission File Number 1-15148

BRF–BRASIL FOODS S.A.

(Exact Name as Specified in its Charter)

N/A

(Translation of Registrant’s Name)

760 Av. Escola Politecnica

Jaguare 05350-000 Sao Paulo, Brazil

(Address of principal executive offices) (Zip code)

Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

Form 20-F ___X___ Form 40-F _______

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): [ ]

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): [ ]

Indicate by check mark whether the registrant by furnishing the information contained in this Form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes _______ No ___X____

If “Yes” is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b): Not applicable.

Financial Risk Management Policy

APPROVED ON 06/28/2012

|

Summary

|

1

|

PURPOSE

|

3

|

|

|

|

|

|

2

|

VALIDITY

|

3

|

|

|

|

|

|

3

|

INITIAL PROVISIONS AND GOVERNANCE

|

3

|

|

3.1

|

Financial Risk Management Committee

|

4

|

|

3.2

|

Duties

|

4

|

|

3.2.1

|

Board of Directors

|

4

|

|

3.2.2

|

Board of Directors Finance and Risk Management Committee

|

5

|

|

3.2.3

|

Executive Board

|

5

|

|

3.2.4

|

Financial Risk Management Committee

|

5

|

|

3.2.5

|

Traders

|

6

|

|

3.2.6

|

Risk Management Area

|

6

|

|

3.2.7

|

Outside consultant

|

6

|

|

3.2.8

|

Internal audit

|

7

|

|

3.3

|

Independence

|

7

|

|

|

|

|

|

4

|

ELIGIBLE INSTRUMENTS

|

7

|

|

|

|

|

|

5

|

Market risk

|

7

|

|

5.1

|

Risk factors

|

8

|

|

5.1.1

|

Mapped Risk factors

|

8

|

|

5.2

|

Exposure to the Exchange Rate

|

8

|

|

5.2.1

|

Cash Flow or Type 1 Exposure

|

8

|

|

5.2.1.1

|

Risk control policy

|

8

|

|

5.2.2

|

Balance Sheet or Type 2 Exposure

|

9

|

|

5.2.2.1

|

Risk control policy

|

9

|

|

5.3

|

Exposure to Commodities

|

9

|

|

5.3.1

|

Risk control policy

|

10

|

|

5.4

|

Exposure to Live Cattle [Boi Gordo]

|

10

|

|

5.4.1

|

Risk Control and Policy

|

11

|

|

5.4.1.1

|

Term, Confinement, Calving and Recalving

|

11

|

|

5.5

|

Other risk factors

|

11

|

|

|

|

|

|

6

|

COUNTERPARTY RISK

|

12

|

|

|

|

|

|

7

|

PROCEDURES AND LIMITS OF AUTHORITY

|

12

|

|

7.1

|

Change of strategy

|

12

|

|

7.2

|

Use of Limits of Authority

|

13

|

|

7.3

|

Limits of Authorities

|

14

|

|

|

|

|

|

8

|

GENERAL CONDITIONS

|

14

|

|

8.1

|

Negotiating and Operational Procedures

|

15

|

1

|

9

|

HEDGE ACCOUNTING

|

16

|

|

9.1

|

General accounting rule for financial instruments

|

16

|

|

9.2

|

Hedge accounting rules

|

16

|

|

|

|

|

|

10

|

REVIEW OF THIS POLICY

|

16

|

|

|

|

|

|

ATTACHMENTS

|

17

|

|

I.

|

Glossary

|

17

|

|

II.

|

MARKING TO MARKET – MTM CALCULATION METHOD

|

19

|

|

A.

|

Libor FLOW

|

19

|

|

B.

|

LINEAR RATE INTERPOLATION

|

20

|

|

C.

|

CDI* X US DOLLAR Swap

|

21

|

2

|

1.

PURPOSE

The

purpose of this document is to present BRF-Brasil Foods SA (hereinafter referred

to as BRF or the Company) financial risk management policies, the main focus of

which is the market and counterparty risk. This policy conforms to the best

international practices and also complies with the standards laid down by the

regulatory entities in Brazil and abroad,

It

establishes guidelines and limits to govern the actions of the areas involved in

the implementation of hedging transactions, while observing the criteria

approved by the Board of Directors.

2.

VALIDITY

This

policy will be valid for a maximum period of two years from the date of its last

approval by the Board of Directors.

3.

INITIAL PROVISIONS AND

GOVERNANCE

Briefly, risk management at BRF may be characterized as

follows:

·

Focus:

o

Market risk.

·

Basic principles:

o

Risk

management is a process and not an isolated event, and therefore it should

involve all areas of the Company;

o

The

implementation of this management should be led by the Board of Directors and by

the Executive Board;

o

Risk

management requires the dissemination of a risk awareness and mitigation

culture, with emphasis on the routine participation of employees.

·

Components of the Financial Risk Management

Policy:

o

Definition of the various decision-making levels for the

Company's hedging transactions;

o

Definition of the responsibilities of each hierarchical

level and of the respective authorities;

o

Definition of the acceptable risk limits by BRF in order

to optimize the risk/return ratio, to be approved by the Board of Directors.

o

Implementation of the risk management process: risk

assessment; control, information, communication and monitoring

activities.

3

|

·

Management process:

The

main steps of the risk management process are listed below:

o

Analysis of the operating cash flow projections and

balance sheet positions;

o

Evaluation and measurement of the risk factors;

o

Preliminary analysis of the risk factors and evaluation of

mitigation alternatives;

o

Implementation of mitigation alternatives;

o

Communication of the strategies implemented;

o

Control and monitoring in accordance with the Financial

Risk Management Policy.

·

Organization for financial risk management:

The

risk management process should be conducted by the Financial Risk Management

Committee, whose duty is to assess whether the Financial Risk Management Policy

is being fully complied with and to propose applicable alternatives. In

addition, the Committee has the power to veto proposals for transactions which,

at its discretion, are not appropriate for BRF at the time of their

evaluation.

3.1

Financial Risk Management Committee

The

Financial Risk Management Committee shall meet on a monthly basis or

extraordinarily, when necessary.

The

Financial Risk Management Committee is a formally constituted body reporting to

BRF Executive Board

The

Financial Risk Management Committee may be strengthened by outside consultants

contributing independent opinions about the management of the hedging

transactions and an evaluation free of conflicts of interest in the transactions

and observance of the limits.

3.2

Duties

3.2.1

Board of Directors

The

Board plays a key role (1) in the development of a solid financial risk

management framework, since it is responsible for the approval of the Financial

Risk Management Policy drawn up by the Financial Risk Management Committee risk

and (2) in monitoring compliance with this policy by checking observance of the

overall limits established.

4

|

3.2.2

Board of Directors Finance and Risk Management

Committee

The

Finance and Risk Management Policy Committee will report directly to the Board

of Directors and will play a consultative role in relation to the Financial Risk

Management Policy, as well as other strategic guidelines for financial risk

management and ongoing monitoring of the performance of the Financial Risk

Management Committee.

3.2.3

Executive Board

The

Board of Executive Directors of BRF will act directly in the management of the

financial risk with the following responsibilities:

·

Evaluate the company's positioning for each identified

risk, according to the guidelines and policies issued by the Board of

Directors;

·

Approve the performance indicators to be used in risk

management;

·

Promote the actions for the strengthening and

dissemination of a risk management and internal control culture;

·

Approve proposals for aggregate limits of authority and

evaluate suggestions for improvements in the Financial Risk Management

Policy;

·

Approve proposed amendments suggested in the conceptual

framework of the financial risk management.

3.2.4

Financial Risk Management Committee

The

Financial Risk Management Committee is the body of the Executive Board

responsible for ensuring the implementation of the Financial Risk Management

Policy.

The

responsibilities of the Financial Risk Management Committee may be described as

follows:

·

Propose changes and alterations to the Financial Risk

Management Policy.

·

Supervise the process of financial risk management at

BRF;

·

Assess the Company’s position for each risk identified and

consult the Board if discrepancies arise.

·

Plan

and check the impact of the implemented decisions on the Company’s

positions;

·

Monitor and follow up the Company’s levels of exposure to

risks and compliance with the Financial Risk Management Policy;

·

Hold

monthly meetings to follow up the performance of the hedging

transactions;

·

Assess stress scenarios applied to Company’s transactions,

cash flow projections and indebtedness;

·

Disseminate a risk management culture across the

Company.

5

|

3.2.5

Traders

In

terms of market risks, the duties of traders when handling the transactions in

compliance with the Company’s Financial Risk Management Policy are:

·

Carry out the transactions (positions) in accordance with

the limits established in this Policy, observing its Limits of Authority (LOA);

·

Perform the hedging transactions in accordance with the

strategy defined by the Committee;

·

Record and disclose the contracted

transactions;

·

Follow up limits and exposures through reports prepared by

the Risk Management area.

3.2.6

Risk Management Area

With

the support of the Financial Risk Management Policy, the main duty of the Risk

Management area will be to track, monitor, assess and report the financial risks

incurred by BRF. This involves mainly:

·

Making a constant critical analysis of the scope of the

Financial Risk Management Policy;

·

Ensuring compliance with exposure, according to the limits

laid;

·

Reporting the Company’s exposures to financial risk

factors, ensuring transparency in their disclosure;

·

Making specific (ad hoc) assessments of the hedging

instruments and suggest alternatives;

·

Modeling and assessing exposures to market risk,

pinpointing and informing the magnitude of their potential impacts;

·

Supplying the Financial Risk Management Committee with

information on the Company's exposures in relation to the mapped risk factors

and suggest mitigation alternatives.

3.2.7

Outside consultant

The

Financial Risk Management Committee may rely on the services of an outside

consultant, provided on a monthly basis, to monitor the implementation of the

Financial Risk Management Policy. One of the important requisites in the

engagement of an outside consultant is to ensure that such person is an

independent professional.

6

|

3.2.8

Internal audit

This

will ensure the governance of the whole financial risk management process in

relation to segregation of duties, internal controls, implementation of this

policy and reflections on accounting. The internal audit team will have its own

schedule and agenda, maintaining its independence, and will have access to

Committee meetings.

3.3

Independence

In

order to segregate duties and ensure the independence of the controls and

information, the Risk Management area will report directly to the Vice President

for Finance, Administration and IR. If needed and at its discretion, it may

assess the CEO directly,

4.

ELIGIBLE

INSTRUMENTS

Derivative instruments eligible for the implementation of

hedging transactions are:

·

Swap

contracts (Currencies, Interest Rates and Commodities);

·

Futures contracts (standardized and OTC, Currencies,

Interest Rates and Commodities) such as NDF (Non-Deliverable Forward - OTC),

Corn, Soybean, Soybean Meal and Oil (BM&FBovespa & CBOT), among others;

and

·

Long

call and put contracts options (Currencies, Interest Rates and

Commodities).

Short positions in options (puts or calls) are permitted,

provided that no net premium is received and that the number of call and put

options are equal.

Any

instrument, transaction, or strategy which, individually or combined, creates

any type of additional leverage or contains contractual devices that gives it an

additional leverage is strictly barred.

Transactions not listed as Eligible Instruments may be

executed solely upon the prior approval by the Board of Directors.

5.

Market risk

Market risk may be defined as the risk posed by price

oscillations of the various risk factors identified in the Company’s

transaction. The principal methodology used to measure the Market Risk is the

C-FaR – Cash Flow at Risk, which seeks to determine the worst result for the

cash flow projected based on the risk factors identified.

7

|

5.1

Risk factors

To

facilitate understanding the market risk involved in BRF activities, the risk

factors mapped in this policy are described below.

5.1.1

Mapped Risk factors

·

Exchange Rate:

This refers to activities tied to the variation of other (non-BRL) currencies.

·

Commodities:

this refers to activities tied to the variation in the price of commodities such

as corn, soybean, soybean meal and oil.

·

Live

Cattle

[Boi Gordo]

:

this refers to activities tied to the variation in the price of Live

cattle.

·

Poultry:

this refers to activities tied to the variation in the price of in natura

birds.

·

Hogs:

this refers to activities tied to the variation in the price of in natura

hogs.

·

Dairy:

this refers to activities tied to the variation in the price of milk.

·

Price index:

This refers to activities tied to the variation in the selling price indexes of

the products, contemplating the domestic and the international

markets.

·

Interest Rates:

this refers to activities tied to the variation in pre-fixed or post-fixed

interest rates, in Brazilian reals or other currencies and inflation

rates.

·

Other:

Other factors used in the production process.

5.2

Exposure to the Exchange Rate

This

section addresses specifically the exposure to variations in foreign exchange

rates (USD/GBP/EUR). The main objectives are: identify the origin of the

exposure, define a control policy and establish limits for such

exposure.

The

exposure to foreign exchange rate is derived from the projections of cash flow

in foreign currency (type 1) and/or by the balance sheet accounting balances

(type 2).

5.2.1

Cash Flow or Type 1 Exposure

5.2.1.1

Risk control policy

To

mitigate the risks arising from type 1 exposure, specific control risk policies

will be adopted.

For

a better control, two time horizons will be mapped: up to 12 months and over 12

months.

8

|

·

Up

to 12 months:

o

Monthly calculation of the net exposure of the operating

cash flow in foreign currency;

o

Monthly monitoring of the flow of amortizations of

non-derivative financial instruments referred to as hedge accounting;

o

Hedge transactions will be carried out on the net value of

monthly foreign exchange exposure and will comply with the limits as

established;

o

In

view of the uncertainty in forecasting the amount of cash receipts and payments

in foreign currency, a more conservative stance will be adopted in relation to

the hedge amount to be contracted through financial derivative instruments,

particularly for the longer horizon;

o

Hedging transactions using derivatives instruments may

only be hired for a horizon up to 12 months; except for transactions using

options as described in chapter 4, which will be limited to a 6-month

horizon.

·

Over

12 months:

o

The

position of derivative instruments referred to as hedge accounting and its

schedule of settlements will be monitored and reported monthly to the Board of

Directors. The BOD may establish new criteria and/or limits for such

instruments;

o

Hedge transactions with non-derivative financial

instruments may be carried out solely for the operating cash flow, observing the

specified limit.

Special hedge accounting will be adopted for both time

horizons on exposures arising from highly probable future income up to the

specific limits.

5.2.2

Balance Sheet or Type 2 Exposure

5.2.2.1

Risk control policy

·

Monthly calculation of type 2 exposure.

5.3

Exposure to Commodities

This

section addresses specifically the exposure to variations in the prices of

commodities such as corn, soybean, soybean meal and soybean oil. This exposure

may, in turn, be the result of physical purchase projections.

9

|

5.3.1

Risk control policy

To

mitigate the risks arising from full exposure to variation in prices of

commodities, specific risk control policies will be adopted. For exposure

arising from the operational flow of the purchase of soybean meal/oil and corn,

the following parameters must be observed:

·

Soybean exposure and consumption projections will be

controlled within bran and oil exposure, according to the average yield from

crushing (these will be approved by the Financial Risk Management

Committee).

·

Monthly calculation for the next 12-month horizon of the

physical flow exposure;

·

Hedge operations must be performed for the monthly net

exposure volumes (Inventory and Receivables);

·

Commercial and

Frame

agreements must adhere to the contents of item 4 Eligible Instruments.

·

Maximum and minimum volumes of the projected grain

purchase flow to be hedged should comply with the specified limits;

·

For

projections over 12 months, no hedging transactions will be made for physical

purchase flow.

5.4

Exposure to Live Cattle

[Boi Gordo]

This

section addresses specifically the exposure concerning transactions linked to

the Beef Division, whose main risk factor is the price of Live Cattle

[Boi Gordo]

.

The strategies for origination which may be used include:

·

Forward

[A

termo]

:

Buy

for future delivery of Live Cattle at a fixed price or a price to be set.

·

Confinement:

Hiring of confinement to finish the animal for the market

Lean cattle may be owned by the party or owned by a third party.

·

Calving and recalving:

Acquisition of calves in the pre- or post-weaning

period

·

Spot:

Purchase of Live Cattle in the spot market.

10

|

5.4.1

Risk Control and Policy

5.4.1.1

Term, Confinement, Calving and

Recalving

For

this strategy, the following definitions apply:

·

Action and control will be based on exposure in

arrobas [15 kg = 33 pounds]

;

·

If

there are restrictions as to the liquidity of open futures contracts, the Cattle

arrobas

bought will have to be spaced out.

·

The

Beef Division and the Financial Management areas will have to make a previous

alignment to mitigate the risk of a mismatch in this strategy;

·

The

Beef Division will be responsible for informing the Financial Management area

the minimum price of the Live Cattle derivative short sale position to ensure

the desired profitability margin. If, during the negotiation of the derivatives,

the market price falls below the minimum price level set, there will be a

mismatch in this strategy. The Beef Division will then make the decision to

change the minimum price or to maintain the mismatch, provided that the limits

laid down in this Policy are observed;

·

Given that there is a seasonality factor in the supply of

cattle between months, which may affect the correlation between maturity dates,

it is recommended that the futures contract traded be aligned with the scheduled

month of slaughtering. In the case of lack of liquidity for a given maturity, a

short sale position should be structured using a derivative with adequate

liquidity and maturity nearest to the scheduled month of

slaughtering;

·

The

Beef Division will be responsible for informing the Financial Management area

about the timing of reversing the respective short sale position of the Cattle

derivative.

5.5

Other risk factors

In

its meetings, the Committee will promote the review and assessment of the

factors outlined but not detailed in this Policy. It may also, should it see

fit, include new factors and, in regular reviews of the Financial Risk

Management Policy, detail and propose limits and controls.

11

|

6.

COUNTERPARTY RISK

Counterparty Risk may be defined as the risk of the

counterparty in an agreement not honoring its contractual

obligations.

6.1

Risk Policy and

Control

·

The

maximum concentration is given only when the sum of the investments and the

derivatives

MtM

is

positive;

·

For

Brazilian institutions in Brazil and their

full

branches abroad, the

rating

will be considered in Brazilian reals.

·

Any other cases will be considered in foreign

currency pursuant to the following rule:

Full

Branches

have the same risk as the parent company and subsidiaries

will have their own local

ratings

unless they have a formal guarantee from the parent company which has been

assessed and approved by BRF’s legal department.

7.

PROCEDURES AND LIMITS OF

AUTHORITY

Procedures and limits of authorities are defined below for

application in case of changes in the market strategies approved by the

Financial Risk Management Committee, as well as for the use of the limits of

authority established by this Financial Risk Management Policy.

7.1

Change of strategy

As

defined in the duties of the Financial Risk Management Committee, this Committee

is responsible for approving, within its limits of authority, hedge alternatives

in accordance with this Policy. Therefore, if there is any change in the

strategy outlined for the current month, the person responsible for the traders

involved will inform such change and the corresponding reason to the Coordinator

of the Financial Risk Management Committee. The Coordinator shall then inform

the Committee members. Lack of response from any signatory member will be

construed as approval for the new strategy.

For

cases requiring higher limits of authority, the item below, 6.2 – Use of Limits

of Authority, will apply:

12

|

7.2

Use of Limits of Authority

The

flow below shows the procedures to be adopted in such cases:

As

noted above, the Risk Management area (after informing, or receiving the reason

from, the Operational area – 01) has a duty to inform the Financial Risk

Management Committee any use which is above (or below) the limit of authority

established for the Operational Area – 02.

The

Committee will request the Operational Area to correct the position or will

agree the strategy/position, provided that it is within its own limit of

authority, otherwise it will inform the Executive Board – 03.

The

Executive Board, in the same manner of the Financial Risk Management Committee,

will request the Operational Area to correct the position or will agree the

strategy/position, provided that it is within its own limit of authority,

otherwise it will inform the Board of Directors – 04.

The

Board of Directors will request the Operational Area to correct the position or

will agree the strategy/position.

Notes:

·

The

traders must implement

immediately

any

decision from the higher levels.

·

All

decisions and communications should keep all persons in the lower levels

informed and necessarily involve the Market Risk Management area;

·

If

the flow described above is not followed, it is the duty of the Risk Management

area to inform the higher level immediately.

13

|

7.3

Limits of Authorities

In

addition to the levels of authority in the preceding item, the following

apply:

·

Make

changes the Policy: Board of Directors

·

Approve eligible instruments: Board of

Directors

·

Define the risk management strategy: Financial Risk

Management Committee

·

Approve alternative hedging transactions: Financial Risk

Management Committee

·

Define hedging instruments: Analysts/traders, from the

alternatives approved by the Financial Risk Management Committee;

·

Perform the transactions: Analyst/operators, provided that

observing the limits and guidelines established by the Financial Risk Management

Committee.

8.

GENERAL

CONDITIONS

Some

relevant remarks are set out below:

·

Hedging transactions may be performed solely if they do

not extrapolate, in the whole, i.e., portfolio transactions (transactions

already carried out by the Company’s financial and raw material areas) + new

transactions, the specified limits.

·

The

Financial Risk Management Committee shall pay special attention to the total

hedging transactions in case the variables are close to any of the

limits;

·

As a

result of settlements and maturities of derivatives and non-derivatives

contracts in the current month under analysis (intramonth), the minimum limit of

that month will not be considered due to the natural adjustments made for

adequacy of the limits from one month to the next;

·

The

calculation of exposures must always consider the set of derivatives +

underlying asset (Operating Flow or accounting position, both net

position);

·

The

basic purpose of the Value at Risk - VaR is to control adjustments. Therefore,

solely standard derivatives traded on the Commodities and Futures Exchange (with

daily adjustment) and transactions with derivatives that can be settled in

advance by a tactic decision of the Financial Risk Management Committee will be

considered;

·

It

is important to note that if there are structural factors influencing exposures

(e.g. new borrowings, prepayments, changes in raw material purchases and in

sales, etc.), the limits may be reviewed to reflect the new reality.

14

|

8.1

Negotiating and Operational

Procedures

This

item describes the aspects relating to the negotiating and operational

procedures of the transactions that will be performed.

·

The

operational areas must be technically prepared to price the instruments approved

by this policy. The pricing models should be duly documented and be made

available to the audit area;

·

The

derivatives will be selected within the permitted sets (eligible instruments)

that better fit the market conditions (cost) and mitigate exposure. It is the

duty of the areas to verify that the transactions are made within fair market

parameters (prices). It is recommended that all material (document,

spreadsheets, quotes and other) gathered to select the hedging derivative be

duly documented and made available at any time to the Audit Area;

·

All

transactions carried out should have its quote easily evidenced based on

internal pricing models and using market indicators;

·

All

parameters required for the performance and calculation of the settlement of

transactions must be included in the proposals and/or quotations compiled by the

company;

At

the time of selection of the hedging instruments to be used, the areas involved

in the performance of the transactions must have the following

knowledge:

·

A

methodology for calculation of market value (replacement value);

·

An

understanding the available maturities;

·

An

understanding of the volatility of prices and rates;

·

A

methodology of taxation for the instruments to be used;

·

Financial Spread (margin) charged by financial

institutions for contracting the transaction;

·

Possibility of daily pricing by the selling financial

institution;

·

An

understanding of the documentation and contract applicable to the instrument to

be contracted.

15

|

9.

HEDGE

ACCOUNTING

9.1

General accounting rule for financial

instruments

As

defined in the Accounting Pronouncement Committee - CPC 38 and in the Brazilian

Securities Commission - CVM Resolution No. 604, dated November 17, 2009, a

financial derivative instrument should be classified as a security held for

trading and therefore recorded in the balance sheet as an asset or financial

liability at fair value through income, except if the entity designates it as a

cover instrument in an effective cover relationship.

In this case, the entity must apply optional

cover accounting rules ("

Hedge Accounting

").

9.2

Hedge accounting rules

For

entities that perform cover transactions involving the use of derivative

financial instruments to hedge against a specific risk which has been determined

and documented (and some non-derivative financial instruments used to hedge the

risk of foreign exchange variation), there is the possibility of application of

the methodology called hedge accounting.

This methodology makes the impacts on the

variation of the fair value of derivatives (or other non-derivatives financial

instruments) used as hedging instrument be recognized in the result according to

the recognition of the item that is the subject matter of the hedge.

This methodology therefore ensures that the

accounting impacts of the hedging transactions will be the same of the economic

impacts, in line with the accrual basis.

10.

REVIEW OF THIS

POLICY

This

Financial Risk Management Policy will be reviewed and updated on an ongoing

basis every year. The highly likely nature of the exports will be revised

whenever the Company identifies a significant change in its exports and at least

at each annual review of the Policy.

Exceptional revisions will be permitted provided that the

reasons are compatible with the urgency. These reviews also must necessarily be

submitted to BRF Board of Directors, and the Executive Board may also be

consulted.

16

|

ATTACHMENTS

I.

Glossary

Futures markets

Originally developed to meet the needs of marketers and

agricultural producers to eliminate the uncertainty about the price to be

received for certain goods at a future specified date.

Futures contracts

Traded on Commodities and Futures Exchanges, “futures

contracts” are standardized contracts that allow the holder to set a price for a

particular asset at a future date. The settlement of such contract is financial:

the holder will pay (or receive) the difference between the actual price on the

date of expiration of the contract and the contracted price. To minimize the

risk of the other party in the transaction, the Exchanges require the deposit of

a guarantee margin which is adjusted on daily basis.

Derivatives

These may be defined as a private contract, the value of

which almost entirely derived from the value of some underlying asset, reference

rate or pertinent index. The purpose of using these instruments is to manage the

financial risk appropriately.

OTC

(Over-The-Counter) Market

This

is a contract agreed directly between the parties, in which there is flexibility

in relation to maturity, size and settlement. This form of negotiation can

present risk for the other party, for not having, in most cases, the deposit of

guarantees or daily adjustment.

Forward

[A

Termo]

:

Similar to the futures contract, but not standardized,

i.e., traded in the over-the-counter market and, in most cases, presenting a

risk to the other party.

Options:

There are contracts that give the holder the right to buy

(or sell) a particular asset, on (or until) a specified date at a fixed price.

Although they are less liquid than futures contracts, the advantage of these

instruments is that they do not have daily adjustments – the difference is paid

solely only at the closing of the transaction.

17

|

Swap

Swap

is a contract to exchange the profitability of Indexers: the holder receives the

variation of a particular index, and pays the variation of another index. With

this, it expects to obtain a protection against possible differences between the

variations of those indexes.

NDF

– Non-deliverable forward

This

a forward contract for currencies.

Hedge

This

is the use of financial instruments to reduce the exposure to variation in a

particular market.

Hedge Accounting

This

is the description in the Company’s balance sheet of the hedge protecting the

exposure of the corresponding account. It also reduces volatility in the

financial lines of the balance sheet.

VaR

Value at Risk, this is an estimate of the maximum expected

financial loss on a certain asset or set of assets, under normal market

conditions, using statistical models.

Stress Testing

The

stress test aims to quantify the financial loss under abnormal market

conditions, i.e., in a scenario which is different from that observed so

far.

BM

& FBOVESPA

This

is the sole securities, commodities and futures exchange in Brazil.

CBOT

Owned by the CME Group (Chicago Mercantile Exchange),the

CBOT (Chicago Board of Trade) is the largest commodities exchange of the

world.

18

|

II.

MARKING TO MARKET – MTM CALCULATION METHOD

A.

Libor FLOW

·

Initiated flows:

o

Notional = Nominal transaction value – amortized balance

o

Libor = Libor rate established for the period under analysis

o

TaxaPré = Pre-fixed rate defined in the contract

o

OverLibor = Pre-fixed rate defined in the contract

o

Libor Fut = Libor rate projected for the maturity of the flow – Source: Bloomberg terminal

o

Cupom = USD exchange coupon projected for the maturity of the flow – Source: BM&FBOVESPA

o

DC1 = Consecutive days from the initiation to the base date of the flow

o

DC2 = Consecutive days from the base date to the maturity of the flow

o

DC3 = DC2

·

Non-initiated flows:

o

AccrualLibor = Zero

o

AccrualPré = Zero

o

Notional = Nominal value of the transaction

o

Libor = Zero

o

TaxaPré = Pre-fixed rate define in the contract

o

OverLibor = Pre-fixed rate define in the contract

o

Libor Fut = Libor rate projected for the maturity of the flow calculated based on the synthetically created Libor FRAs (Future Libor for the maturity / Future Libor for the date of initiation of the flow) – Source: Terminal Bloomberg

o

Cupom = USD exchange coupon projected for the maturity of the flow – Source: BM&FBOVESPA

o

DC1 = Zero

19

o

DC2

=

Consecutive days from the initiation to the maturity date of the flow

o

DC3

=

Consecutive days from the base date to the maturity of the flow

B.

LINEAR RATE

INTERPOLATION

Where:

Taxa1 =

First rate to be interpolated

Taxa2 =

Second rate to be interpolated

Dias1 =

Consecutive days from the base date to the first rate to be

interpolated

Dias2 =

Consecutive days from the base date to the date desired for the

interpolation

Dias3 =

Consecutive days from the base date to the second rate to be

interpolated

Being:

(Taxa1<Taxa2)

(Dias1<Dias2<Dias3)

20

C.

CDI* X US DOLLAR Swap

*CDI = Interbank Deposit

Certificate

a. CDI-Indexed

Products (Passive End)

Mark to

Market: MtM (R$) on date

t

will be

given by

Where:

|

VN

|

=

|

Nominal value of the transaction made on

the base date

b

|

|

|

=

|

Percentage of the CDI of the

transaction

|

|

|

=

|

Percentage of the CDI market on date

t

|

|

|

=

|

CDI rate on date

i

|

b. USD-Indexed Products

(Active End)

Mark to

Market: MtM (R$) on date

t

will be

given by

|

|

=

|

Clean foreign exchange coupon valid

between dates

t

and

i

|

|

DolarPartida

|

=

|

Commercial cash US dollar rate on the

date of the transaction

|

|

|

=

|

Ptax800 rate quote on date

0-1

|

|

|

=

|

Coupon (spread)

contracted

|

21

a. CDI-Indexed

Products (Passive End)

Mark to

Market: MtM (R$) on date

t

will be

given by

Where:

|

VN

|

=

|

Nominal value of the transaction made on

the base date

b

|

|

|

=

|

Percentage of the CDI of the

transaction

|

|

|

=

|

Percentage of the CDI market on date

t

|

|

|

=

|

CDI rate on date

i

|

b. USD-Indexed Products

(Active End)

Mark to

Market: MtM (R$) on date

t

will be

given by

|

|

=

|

Clean foreign exchange coupon valid

between dates

t

and

i

|

|

DolarPartida

|

=

|

Commercial cash US dollar rate on the

date of the transaction

|

|

|

=

|

Ptax800 rate quote on date

0-1

|

|

|

=

|

Coupon (spread)

contracted

|

22

Mark to Market: MtM (R$) on date

t

will be given by

|

|

=

|

transaction sign ("+" for buy, "-" for sell);

|

|

|

=

|

foreign exchange rate on the date at issue, according to the contract specification or as obtained in the same source described in swap contracts

|

|

|

=

|

foreign exchange rate contracted for the final date of the transaction

|

|

r

|

=

|

pre rate expected, obtained from the Pre Curve without Cash

|

|

s

|

=

|

traded currency expected, obtained from the coupon curve without coupon

|

23

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this Report to be signed on its behalf by the undersigned, thereunto duly authorized.

Date: June 29, 2012

|

|

By:

|

/s/ Leopoldo Viriato Saboya

|

|

|

|

|

|

|

|

|

|

|

|

|

Name:

|

Leopoldo Viriato Saboya

|

|

|

|

Title:

|

Financial and Investor Relations Director

|

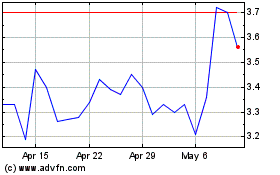

BRF (NYSE:BRFS)

Historical Stock Chart

From Jun 2024 to Jul 2024

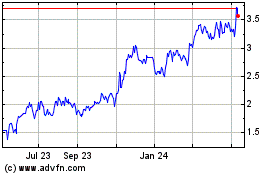

BRF (NYSE:BRFS)

Historical Stock Chart

From Jul 2023 to Jul 2024