- Report of Foreign Issuer (6-K)

March 20 2012 - 11:30AM

Edgar (US Regulatory)

FORM 6-K

U.S. SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13A-16 OR 15D-16 UNDER THE

SECURITIES EXCHANGE ACT OF 1934

Commission File Number 1-15148

BRF–BRASIL FOODS S.A.

(Exact Name as Specified in its Charter)

N/A

(Translation of Registrant’s Name)

760 Av. Escola Politecnica

Jaguare 05350-000 Sao Paulo, Brazil

(Address of principal executive offices) (Zip code)

Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

Form 20-F ___X___ Form 40-F _______

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): [ ]

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): [ ]

Indicate by check mark whether the registrant by furnishing the information contained in this Form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes _______ No ___X____

If “Yes” is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b): Not applicable.

|

|

|

|

BRF – Brasil Foods S.A.

Taxpayer no. CNPJ 01.838.723/0001-27

A Publicly-held Company

|

Marfrig Alimentos S.A.

Taxpayer no. CNPJ 03.853.896/0001-40

A Publicly-held Company

|

NOTICE OF MATERIAL FACT

1. The Management of BRF – Brasil Foods S.A. ("BRF" - Bovespa: BRFS3; NYSE: BRFS) and Marfrig Alimentos S.A. ("Marfrig" - Bovespa: MRFG3; ADR Level 1: MRTTY) hereby announce that, pursuant to the provisions of CVM (Brazilian Securities Commission) Instruction No. 358 of January 3, 2002 and Paragraph 4 of Article 157 of the Brazilian Corporations Act (Law No. 6404 of December 15, 1976, and in addition to the Notice of Material Fact released by BRF and Marfrig on December 8, 2011, that on this date, the Asset Exchange Contract and Other Covenants ("Exchange Contract") was entered into between BRF, Sadia S.A. ("Sadia" and, together with BRF, "BRF Parties") and Sadia Alimentos S.A. ("Sadia Alimentos") on one side and Marfrig, whose main object is to establish the terms and conditions for the transaction described below.

TERMS AND CONDITIONS

2. According to the terms and conditions set forth in the Exchange Agreement, the BRF Parties, on one hand, and Marfrig, on the other, agree to exchange:

(a) of the following assets owned by the BRF Parties referred to in the Performance Commitment Agreement ("TCD") described in the Notice of Material Fact published by BRF on July 13, 2011: (a1) trademarks and intellectual property rights related to such trademarks; (a2) all assets and rights (including real property, facilities and equipment) related to specified plants, (a3) all assets and rights associated with eight (8) distribution centers, (a4) the hog slaughtering plant located in the city of Carambeí, by conclusion of the lease with the option to purchase Marfrig, (a5) the BRF stock described in the Exchange Agreement relating to the assets above (a6) all contracts with integrated producers to ensure Marfrig maintains the same levels of supply for BRF and/or Sadia, (a7) the entire stake held by Sadia, directly and indirectly, equivalent to 64.57% (sixty-four point five seven percent) of capital stock of Excelsior Alimentos S.A.;

(b) the following assets owned by Marfrig: (b1) the entire equity interest held either directly or indirectly by that company, equivalent to 90.05% (ninety point zero five percent) of the capital of Quickfood S.A. ("Quickfood"), a company based in Argentina, (b2 ) the payment of additional amount of R$ 350,000,000.00 (three hundred and fifty million reais), of which R$

100,000,000.00 (one hundred million reais) will be paid between June and October 2012 and the remainder of the amount of R$ 250,000,000.00 (two hundred and fifty million reais) will be paid in 72 (seventy-two) monthly installments, with interest at market rates.

3. Additionally, after the lease period, there shall be the amount of R$ 188,000,000.00 (one hundred eighty-eight million reais) in consideration to exercise the option to buy the pork plant located in the City of Carambeí, leased to Marfrig by BRF, if that option is exercised by Marfrig.

4. Regarding Quickfood, Marfrig is forced to adopt all necessary measures to segregate the food processing activity (the object of the exchange) from the slaughterhouses activity (which will remain with Marfrig).

5. The fulfillment of the transaction is subject to condition precedents set by the parties in the Exchange Agreement which will allow completion of the business up to June 1, 2012.

CONDITION PRECEDENT

6. Transaction implementation is subject to the condition precedent, which is the manifestation of the Administrative Council for Economic Defense ("CADE"), in the sense that once the transaction described above is implemented in the manner set forth in the Exchange Agreement, it represents fulfillment by BRF and Sadia of the obligations assumed by them in the TCD.

ADDITIONAL INFORMATION

7. The management of both BRF and Marfrig will keep the market informed of developments pertaining to the present matter.

Sao Paulo, March 20, 2012

Leopoldo Viriato Saboya

BRF – Brasil Foods S.A.

CFO and Investor Relations Officer

Ricardo Florence

Marfrig Alimentos S.A.

CFO and Investor Relations Officer

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this Report to be signed on its behalf by the undersigned, thereunto duly authorized.

Date: March 20, 2012

|

|

By:

|

/s/ Leopoldo Viriato Saboya

|

|

|

|

|

|

|

|

|

|

|

|

|

Name:

|

Leopoldo Viriato Saboya

|

|

|

|

Title:

|

Financial and Investor Relations Director

|

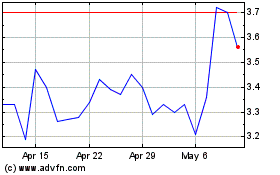

BRF (NYSE:BRFS)

Historical Stock Chart

From Jun 2024 to Jul 2024

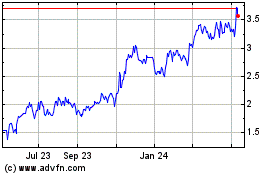

BRF (NYSE:BRFS)

Historical Stock Chart

From Jul 2023 to Jul 2024