U.S. SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Amendment No. 1 to

FORM 20-F

|

¨

REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR (g) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

OR

|

|

x

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

For the fiscal year ended December 31, 2010

|

|

OR

|

|

¨

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

OR

|

|

¨

SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

Commission file number 001-15148

BRF – BRASIL FOODS S.A.

(Exact Name of Registrant as Specified in its Charter)

N/A

(Translation of Registrant’s name into English)

Federative Republic of Brazil

(Jurisdiction of Incorporation or Organization)

1400 R. Hungria, 5

th

Floor – Jd

América-01455000-São Paulo – SP, Brazil

(Address of principal executive offices)

Leopoldo Viriato Saboya, Chief Financial Officer and Investor Relations Officer

Tel. 011-5511-2322-5003, Fax 011-5511-232257400

1400 R. Hungria, 5

th

Floor – Jd

América-01455000-São Paulo – SP, Brazil

(Name, Telephone, E-mail and/or Facsimile number and Address of Company Contact Person)

Securities registered pursuant to Section 12(b) of the Act:

|

Title of Each Class

|

Name of Each Exchange on

which Registered

|

|

Common Shares, no par value per share,

each represented by American Depositary Shares

|

New York Stock Exchange

|

|

|

|

Securities registered pursuant to Section 12(g) of the Act:

None

Securities for which there is a reporting obligation

pursuant to Section 15(d) of the Act:

None

Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the annual report:

|

At December 31, 2010

|

871,692,074 shares of common stock

|

Indicate by check mark if the Registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes

x

No

¨

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934. Yes

¨

No

x

Note- Checking the box above will not relieve any registrant required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 from their obligations under those Sections.

Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes

x

No

¨

Indicate by check mark whether the registrant was submitted electronically and posted on its corporate website, if any, every interactive data filed required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 203.405 of this chapter) during the preceding 12 months (or for such other period that the registrant was required to submit and post such files)

Yes

¨

No

¨

Note: Not required for registrant.

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See definition of “accelerated filer and large accelerated filer” in Rule 12b-2 of the Exchange Act. (Check one):

|

Large accelerated filer

x

|

Accelerated filer

¨

|

Non-accelerated filer

¨

|

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

|

¨

U.S. GAAP

|

x

International Financial Reporting Standards as issued by the International Accounting Standards Board

|

¨

Other

|

If “Other” has been checked in response to the previous question, indicate by check mark which financial statement item the registrant has elected to follow.

Item 17

¨

Item 18

x

.

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes

¨

No

x

Explanatory Note

BRF – Brasil Foods S.A. (the “Company”) is filing this Amendment No. 1 (the “Amendment”) to its Annual Report on Form 20-F (the “Annual Report”) for the year ended December 31, 2010, previously filed with the Securities and Exchange Commission (the “SEC”) on April 29, 2011 (the “Original Filing”), to replace the audit report in the Original Filing with a new audit report that includes a specific reference to International Financial Reporting Standards “as issued by the International Accounting Standards Board.” Because the Company is filing the Amendment to include the new audit report, the Company has

added a cross-reference to the penultimate paragraph of

Note 7 (Business Combination)

,

and has updated Note 38 (Subsequent Events) and Note 39 (Approval of the Annual Financial Statements). The remainder of the consolidated financial statements contained in the Original Filing are unchanged.

Except for Part III, including the consolidated financial statements and auditor’s report, no other information included in the Annual Report as originally filed is being repeated in this Amendment, and this Amendment should be read together with the Annual Report as originally filed, except for Part III, including the consolidated financial statements and auditor’s report. Cross references within this Amendment to items other than those in Part III are references to those items in the Original Filing. This Amendment does not otherwise update the disclosures, including forward-looking information, set forth in the Annual Report for the year ended December 31, 2010, as originally filed, and does not otherwise reflect events occurring after the original filing of the Annual Report on April 29, 2011. Such events include, among others, events described in our reports under the Securities Exchange Act of 1934, as amended, filed with the SEC since April 29, 2011.

Exhibits 12.01, 12.02, 13.01 and 13.02 are being included in this Amendment and have been dated as of the date of this filing but are otherwise unchanged.

INDEX TO FINANCIAL STATEMENTS

PART III

ITEM 17.

FINANCIAL STATEMENTS

The Company has responded to Item 18 in lieu of responding to this Item.

ITEM 18.

FINANCIAL STATEMENTS

See our consolidated financial statements beginning at page F-1.

ITEM 19.

EXHIBITS

The agreements and other documents filed as exhibits to this Annual Report on Form 20-F are not intended to provide factual information or other disclosure other than with respect to the terms of the agreements or other documents themselves, and you should not rely on them for that purpose. In particular, any representations and warranties made by us in these agreements or other documents were made solely within the specific context of the relevant agreement or document and for the benefit of the other parties to the agreements and they may not describe the actual state of affairs as of the date they were made or at any other time.

|

Exhibit Number

|

|

|

1.01

|

Amended and Restated Bylaws of the Registrant (incorporated by reference to Exhibit 99.2 to the Report of Foreign Private Issuer on Form 6-K, filed April 5, 2010, SEC File No. 001-15148).

|

|

2.01

|

Form of Deposit Agreement among Perdigão S.A., The Bank of New York Mellon, as depositary, and the owners and beneficial owners of American Depositary Shares, dated as of July 17, 1997, as amended and restated as of June 26, 2000, as amended and restated as of September 28, 2000, as amended and restated as of July 6, 2009 (incorporated by reference to Exhibit 1 to the Registration Statement on Form F-6, filed June 24, 2009, SEC File No. 333-160191).

|

|

2.02

|

Form of American Depositary Receipt (incorporated by reference to the prospectus filed pursuant to Rule 424(b)(3) under the Securities Act on April 7, 2010, SEC File No. 333-160191).

|

|

4.01

|

Merger Agreement, dated May 19, 2009, among Perdigão S.A., HFF Participações S.A., Sadia S.A. and the shareholders of the Registrant and Sadia S.A. named therein (incorporated by reference to Exhibit 4.01 to the Annual Report of Foreign Private Issuer on Form 20-F, filed June 30, 2009, SEC File No. 001-15148).

|

|

4.02

|

Shareholders’ Voting Agreement of Perdigão S.A., dated March 6, 2006, among certain shareholders of the Registrant and the Registrant (incorporated by reference to Exhibit 99.1 to the Report of Foreign Private Issuer on Form 6-K, filed March 7, 2006, SEC File No. 001-15148).

|

|

4.03

|

Purchase Option Plan or Application for Shares (incorporated by reference to Exhibit 99.5 to the Report of Foreign Private Issuer on Form 6-K/A, filed March 24, 2010, SEC File No. 001-15148).

|

|

4.04

|

Stock Options Program (incorporated by reference to Exhibit 99.4 to the Report of Foreign Private Issuer on Form 6-K/A, filed March 24, 2010, SEC File No. 001-15148).

|

|

8.01

|

Subsidiaries of the Registrant. *

|

|

12.01

|

Certification of the Chief Executive Officer pursuant to Section 302 of the Sarbanes-Oxley Act of 2002.

|

|

12.02

|

Certification of the Chief Financial Officer pursuant to Section 302 of the Sarbanes-Oxley Act of 2002.

|

|

13.01

**

|

Certification of the Chief Executive Officer pursuant to 18 U.S.C. Section 1350, as adopted pursuant to Section 906 of the Sarbanes-Oxley Act of 2002.

|

|

13.02

**

|

Certification of the Chief Financial Officer pursuant to 18 U.S.C. Section 1350, as adopted pursuant to Section 906 of the Sarbanes-Oxley Act of 2002.

|

|

|

|

*

Previously filed.

*

*

This certification will not be deemed “filed” for purposes of Section 18 of the Exchange Act (15 U.S.C. 78r), or otherwise subject to the liability of that section. Such certification will not be deemed to be incorporated by reference into any filing under the Securities Act or the Exchange Act, except to the extent that the Registrant specifically incorporates it by reference.

The total amount of long-term debt of the Company authorized under any instrument does not exceed 10% of the total assets of the Company and its subsidiaries on a consolidated basis. The Company undertakes to furnish to the SEC all other instruments relating to long-term debt of the Company and its subsidiaries upon request by the SEC.

2

SIGNATURES

The registrant hereby certifies that it meets all of the requirements for filing on Form 20-F and that it has duly caused and authorized the undersigned to sign this Annual Report on Form 20-F on its behalf.

|

|

BRF – BRASIL FOODS S.A.

|

|

|

|

|

|

By:

/s/José Antonio do Prado Fay

|

|

|

|

|

|

Name: José Antonio do Prado Fay

|

|

|

Title: Chief Executive Officer

|

|

|

|

|

|

By:

/s/Leopoldo Viriato Saboya

|

|

|

|

|

|

Name: Leopoldo Viriato Saboya

|

|

|

Title: Chief Financial Officer

|

|

|

|

Date:

June

17, 2011

Report of Independent Registered Public Accounting Firm

The Board of Directors and Shareholders

BRF - Brasil Foods S.A.

We have audited the accompanying consolidated balance sheets of BRF - Brasil Foods S.A.

and subsidiaries (the “Company”) as of December 31, 2010, 2009 and January 1, 2009, and the related consolidated statements of income, changes in shareholders’ equity, comprehensive income and cash flows for each of the years in the two-year period ended December 31, 2010. We also have audited the Company’s internal control over financial reporting as of December 31, 2010, based on criteria established in

Internal Control – Integrated Framework

issued by the Committee of Sponsoring Organizations of the Treadway Commission (COSO). The Company’s management is responsible for these consolidated financial statements, for maintaining effective internal control over financial reporting, and for its assessment of the effectiveness of internal control over financial reporting, included in the accompanying Management’s Report on Internal Control Over Financial Reporting. Our responsibility is to express an opinion on these consolidated financial statements and an opinion on the Company’s internal control over financial reporting based on our audits.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audits to obtain reasonable assurance about whether the financial statements are free of material misstatement and whether effective internal control over financial reporting was maintained in all material respects. Our audits of the consolidated financial statements included examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, and evaluating the overall financial statement presentation. Our audit of internal control over financial reporting included obtaining an understanding of internal control over financial reporting, assessing the risk that a material weakness exists, and testing and evaluating the design and operating effectiveness of internal control based on the assessed risk. Our audits also included performing such other procedures as we considered necessary in the circumstances. We believe that our audits provide a reasonable basis for our opinions.

A company’s internal control over financial reporting is a process designed to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements for external purposes in accordance with generally accepted accounting principles. A company’s internal control over financial reporting includes those policies and procedures that (1) pertain to the maintenance of records that, in reasonable detail, accurately and fairly reflect the transactions and dispositions of the assets of the company; (2) provide reasonable assurance that transactions are recorded as necessary to permit preparation of financial statements in accordance with generally accepted accounting principles, and that receipts and expenditures of the company are being made only in accordance with authorizations of management and directors of the company; and (3) provide reasonable assurance regarding prevention or timely detection of unauthorized acquisition, use, or disposition of the company’s assets that could have a material effect on the financial statements.

Because of its inherent limitations, internal control over financial reporting may not prevent or detect misstatements. Also, projections of any evaluation of effectiveness to future periods are subject to the risk that controls may become inadequate because of changes in conditions, or that the degree of compliance with the policies or procedures may deteriorate.

In our opinion, the consolidated financial statements referred to above present fairly, in all material respects, the financial position of the BRF - Brasil Foods S.A. and subsidiaries as of December 31, 2010, 2009 and January 1, 2009, and the results of their operations, cash flows, changes in their shareholders’ equity and comprehensive income for each of the years in the two-year period ended December 31, 2010, in conformity with International Financial Reporting Standards, as issued by the International Accounting Standards Board. Also in our opinion, the Company maintained, in all material respects, effective internal control over financial reporting as of December 31, 2010, based on criteria established in

Internal Control – Integrated Framework

issued by the Committee of Sponsoring Organizations of the Treadway Commission.

As discussed in notes 7 and 38, on July 8, 2009, the Company acquired Sadia S.A. This transaction is under analysis of the Administrative Counsel for Economic Defense (“CADE”) and involved the execution of an Agreement for the Preservation of the Operation Reversibility (“APRO”), until the implementation of the final decision by CADE.

/s/ KPMG Auditores Independentes

São Paulo, Brazil

June 17, 2011

CONSOLIDATED BALANCE SHEETS

December 31, 2010 and 2009 and January 1, 2009

(Amounts expressed in millions of Brazilian reais)

|

|

|

|

|

|

|

|

|

|

|

Assets

|

|

Note

|

|

12.31.10

|

|

12.31.09

|

|

01.01.09

|

|

Current assets

|

|

|

|

|

|

|

|

|

|

Cash and cash equivalents

|

|

8

|

|

2,310.6

|

|

1,898.2

|

|

1,233.5

|

|

Marketable securities

|

|

9

|

|

863.8

|

|

2,345.5

|

|

742.5

|

|

Trade accounts receivable, net

|

|

10

|

|

2,565.0

|

|

2,140.7

|

|

1,378.0

|

|

Inventories

|

|

11

|

|

2,135.8

|

|

2,255.5

|

|

1,285.4

|

|

Biological assets

|

|

12

|

|

900.7

|

|

865.5

|

|

427.4

|

|

Recoverable taxes

|

|

14

|

|

695.9

|

|

745.6

|

|

576.3

|

|

Assets held for sale

|

|

13

|

|

62.2

|

|

47.9

|

|

5.8

|

|

Other financial assets

|

|

22

|

|

98.6

|

|

27.6

|

|

79.2

|

|

Other current assets

|

|

|

|

219.4

|

|

351.4

|

|

189.2

|

|

Total current assets

|

|

|

|

9,852.0

|

|

10,677.9

|

|

5,917.3

|

|

Non-current assets

|

|

|

|

|

|

|

|

|

|

Marketable securities

|

|

9

|

|

377.7

|

|

676.7

|

|

0.2

|

|

Trade accounts receivable, net

|

|

10

|

|

7.0

|

|

12.8

|

|

11.6

|

|

Credit notes

|

|

10

|

|

93.1

|

|

92.6

|

|

54.9

|

|

Recoverable taxes

|

|

14

|

|

767.4

|

|

653.1

|

|

147.5

|

|

Deferred income tax

|

|

15

|

|

2,487.6

|

|

2,426.4

|

|

550.8

|

|

Judicial deposits

|

|

16

|

|

234.1

|

|

135.9

|

|

56.1

|

|

Biological assets

|

|

12

|

|

377.7

|

|

391.2

|

|

158.8

|

|

Other current assets

|

|

|

|

223.3

|

|

149.2

|

|

30.5

|

|

Investments

|

|

17

|

|

17.5

|

|

17.2

|

|

1.0

|

|

Property, plant and equipment, net

|

|

18

|

|

9,066.8

|

|

8,874.2

|

|

2,747.8

|

|

Intangible assets

|

|

19

|

|

4,247.3

|

|

4,276.5

|

|

1,557.6

|

|

Total non-current assets

|

|

|

|

17,899.5

|

|

17,705.8

|

|

5,316.8

|

|

|

|

Total assets

|

|

|

|

27,751.5

|

|

28,383.7

|

|

11,234.1

|

See accompanying notes to the consolidated financial statements.

BRF - BRASIL FOODS S.A.

CONSOLIDATED BALANCE SHEETS

December 31, 2010 and 2009 and January 1, 2009

(Amounts expressed in millions of Brazilian reais)

|

|

|

|

|

|

|

|

|

|

|

Liabilities

|

|

Note

|

|

12.31.10

|

|

12.31.09

|

|

01.01.09

|

|

Current liabilities

|

|

|

|

|

|

|

|

|

|

Short-term debt

|

|

21

|

|

2,227.7

|

|

3,200.6

|

|

1,574.7

|

|

Debentures

|

|

21

|

|

-

|

|

2.1

|

|

4.2

|

|

Trade accounts payable

|

|

20

|

|

2,059.2

|

|

1,905.4

|

|

1,083.4

|

|

Payroll and related charges

|

|

|

|

387.3

|

|

341.2

|

|

173.2

|

|

Tax payable

|

|

|

|

210.8

|

|

183.6

|

|

66.6

|

|

Interest on shareholders' equity

|

|

27

|

|

193.1

|

|

92.6

|

|

23.3

|

|

Management and employees profit sharing

|

|

|

|

111.3

|

|

75.4

|

|

17.9

|

|

Other financial liabilities

|

|

22

|

|

82.2

|

|

87.1

|

|

146.7

|

|

Provision for tax, civil and labor

|

|

26

|

|

65.1

|

|

91.3

|

|

38.9

|

|

Other current liabilities

|

|

|

|

349.5

|

|

379.9

|

|

70.1

|

|

Total current liabilities

|

|

|

|

5,686.2

|

|

6,359.2

|

|

3,199.0

|

|

Non-current liabilities

|

|

|

|

|

|

|

|

|

|

Long-term debt

|

|

21

|

|

4,975.2

|

|

5,853.5

|

|

3,719.7

|

|

Social and tax payable

|

|

|

|

64.2

|

|

6.0

|

|

20.1

|

|

Provision for tax, civil and labor

|

|

26

|

|

1,053.7

|

|

940.3

|

|

180.2

|

|

Deferred income tax

|

|

15

|

|

1,635.7

|

|

1,456.4

|

|

73.3

|

|

Employee benefit plan

|

|

25

|

|

274.5

|

|

249.7

|

|

84.2

|

|

Share based payments

|

|

24

|

|

1.3

|

|

-

|

|

-

|

|

Other non-current liabilities

|

|

|

|

424.0

|

|

522.9

|

|

32.3

|

|

Total non-current liabilities

|

|

|

|

8,428.6

|

|

9,028.8

|

|

4,109.8

|

|

|

|

Shareholders' equity

|

|

27

|

|

|

|

|

|

|

|

Capital

|

|

|

|

12,460.5

|

|

12,461.8

|

|

3,445.0

|

|

Capital reserves

|

|

|

|

69.4

|

|

62.8

|

|

-

|

|

Profit reserves

|

|

|

|

1,064.7

|

|

727.6

|

|

731.5

|

|

Accumulated deficit

|

|

|

|

-

|

|

(186.1)

|

|

(213.0)

|

|

Treasury shares

|

|

|

|

(0.7)

|

|

(27.6)

|

|

(0.8)

|

|

Other comprehensive income (loss)

|

|

|

|

35.2

|

|

(47.5)

|

|

(38.1)

|

|

Parent company shareholders' equity

|

|

|

|

13,629.1

|

|

12,991.0

|

|

3,924.6

|

|

Non-controlling interest

|

|

|

|

7.6

|

|

4.7

|

|

0.7

|

|

Shareholders' equity

|

|

|

|

13,636.7

|

|

12,995.7

|

|

3,925.3

|

|

|

|

Total liabilities and shareholders'equity

|

|

|

|

27,751.5

|

|

28,383.7

|

|

11,234.1

|

See accompanying notes to the consolidated financial statements.

BRF - BRASIL FOODS S.A.

CONSOLIDATED STATEMENTS OF INCOME

Years ended December 31, 2010 and 2009

(Amounts expressed in millions of Brazilian reais, except earnings per share data)

|

|

|

|

|

|

|

|

|

|

|

Note

|

|

12.31.10

|

|

12.31.09

|

|

Net sales

|

|

30

|

|

22,681.3

|

|

15,905.8

|

|

Cost of sales

|

|

35

|

|

(16,951.2)

|

|

(12,728.9)

|

|

Gross profit

|

|

|

|

5,730.1

|

|

3,176.9

|

|

Operating income (expenses)

|

|

|

|

|

|

|

|

Sales

|

|

35

|

|

(3,523.1)

|

|

(2,577.1)

|

|

General and administrative

|

|

35

|

|

(332.9)

|

|

(222.2)

|

|

Other operating expenses

|

|

33

|

|

(393.9)

|

|

(302.8)

|

|

Equity interest in income of subsidiaries

|

|

17

|

|

4.3

|

|

2.5

|

|

Operating income

|

|

|

|

1,484.5

|

|

77.3

|

|

Financial expenses

|

|

34

|

|

(1,363.3)

|

|

(1,262.6)

|

|

Financial income

|

|

34

|

|

880.2

|

|

1,525.1

|

|

Income before taxes and participation of non-controlling shareholders

|

|

|

|

1,001.4

|

|

339.8

|

|

Income and social contribution tax expense

|

|

15

|

|

(130.6)

|

|

(80.2)

|

|

Deferred income and social contribution tax expense

|

|

15

|

|

(65.9)

|

|

(141.0)

|

|

Net income

|

|

|

|

804.9

|

|

118.6

|

|

Attributable to:

|

|

|

|

|

|

|

|

BRF shareholders

|

|

|

|

804.1

|

|

123.0

|

|

Non-controlling shareholders

|

|

|

|

0.8

|

|

(4.4)

|

|

Weighted average shares outstanding at the end of the year (thousands) - basic

|

|

|

|

870,887,093

|

|

604,119,958

|

|

Earnings per share - basic

|

|

28

|

|

0.92

|

|

0.20

|

|

Weighted average shares outstanding at the end of the year (thousands) - diluted

|

|

|

|

875,538,749

|

|

606,044,378

|

|

Earnings per share - diluted

|

|

28

|

|

0.92

|

|

0.20

|

See accompanying notes to the consolidated financial statements.

BRF - BRASIL FOODS S.A.

CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME (LOSS)

Years ended December 31, 2010 and 2009

(Amounts expressed in millions of Brazilian reais)

|

|

|

|

|

|

|

|

|

12.31.10

|

|

12.31.09

|

|

|

|

Net income

|

|

804.9

|

|

118.6

|

|

Gain (loss) in foreign currency translation adjustments

|

|

(5.2)

|

|

19.6

|

|

Unrealized gain (loss) in available for sale marketable securities,

|

|

|

|

|

|

net of income taxes (R$0.3) in 2010 and R$0.4 in 2009.

|

|

0.9

|

|

(1.2)

|

|

Unrealized gains (loss) in cash flow hedge,

|

|

|

|

|

|

net of income taxes (R$53.5) in 2010 and R$2.4 in 2009.

|

|

103.9

|

|

(4.7)

|

|

Actuarial loss,

|

|

|

|

|

|

net of income taxes R$8.7 in 2010 and R$11.9 in 2009.

|

|

(16.8)

|

|

(23.1)

|

|

Net income (loss) recorded directly in the shareholders' equity

|

|

82.8

|

|

(9.4)

|

|

Comprehensive income

|

|

887.7

|

|

109.2

|

|

Attributable to:

|

|

|

|

|

|

BRF shareholders

|

|

886.9

|

|

113.6

|

|

Non-controlling shareholders

|

|

0.8

|

|

(4.4)

|

See accompanying notes to the consolidated financial statements.

BRF - BRASIL FOODS S.A.

CONSOLIDATED STATEMENTS OF CHANGES IN SHAREHOLDERS’ EQUITY

Years ended December 31, 2010 and 2009

(Amounts expressed in millions of Brazilian reais, except interest on own capital per share data)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Attributed to interest of controlling shareholders

|

|

|

|

|

|

|

|

|

|

Capital reserve

|

|

Profit reserves

|

|

Other comprehensive income

|

|

|

|

|

|

|

|

|

|

|

|

Capital

|

|

Capital

reserve

|

|

Treasury

shares

|

|

Legal

reserve

|

|

Reserve

for

expansion

|

|

Reserve

for

capital

increases

|

|

Accumulate

d foreign

currency

translation

adjustments

|

|

Available

for sale

marketable

securities

|

|

Actuarial

gains

(losses)

|

|

Accumulated

deficit

|

|

Non-

controlling

interest

|

|

Total

shareholders'

equity

|

|

BALANCES AT JANUARY 1

st

, 2009

|

|

3,445.0

|

|

-

|

|

(0.8)

|

|

66.2

|

|

505.0

|

|

160.3

|

|

(1.0)

|

|

(37.1)

|

|

-

|

|

(213.0)

|

|

0.7

|

|

3,925.3

|

|

Comprehensive income:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Gain in foreign currency translation adjustments

|

|

-

|

|

-

|

|

-

|

|

-

|

|

-

|

|

-

|

|

19.6

|

|

-

|

|

-

|

|

-

|

|

8.4

|

|

28.0

|

|

Unrealized loss in available for sale marketable securities

|

|

-

|

|

-

|

|

-

|

|

-

|

|

-

|

|

-

|

|

(1.2)

|

|

-

|

|

-

|

|

-

|

|

-

|

|

(1.2)

|

|

Unrealized loss in cash flow hedge

|

|

-

|

|

-

|

|

-

|

|

-

|

|

-

|

|

-

|

|

-

|

|

(4.7)

|

|

-

|

|

-

|

|

-

|

|

(4.7)

|

|

Actuarial gain (loss)

|

|

-

|

|

-

|

|

-

|

|

-

|

|

-

|

|

-

|

|

-

|

|

-

|

|

(23.1)

|

|

-

|

|

-

|

|

(23.1)

|

|

Net income (loss) for the year

|

|

-

|

|

-

|

|

-

|

|

-

|

|

-

|

|

-

|

|

-

|

|

-

|

|

-

|

|

123.0

|

|

(4.4)

|

|

118.6

|

|

TOTAL COMPREHENSIVE INCOME

|

|

-

|

|

-

|

|

-

|

|

-

|

|

-

|

|

-

|

|

17.4

|

|

(41.8)

|

|

(23.1)

|

|

(90.0)

|

|

4.7

|

|

4,042.9

|

|

Capital increase

|

|

9,108.5

|

|

-

|

|

-

|

|

-

|

|

-

|

|

-

|

|

-

|

|

-

|

|

-

|

|

-

|

|

-

|

|

9,108.5

|

|

Appropriation of income (loss):

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest on shareholders' equity - R$ 0.229985 per

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

outstanding share at the end of the year

|

|

-

|

|

-

|

|

-

|

|

-

|

|

-

|

|

-

|

|

-

|

|

-

|

|

-

|

|

(100.0)

|

|

-

|

|

(100.0)

|

|

Legal reserve

|

|

-

|

|

-

|

|

-

|

|

4.8

|

|

-

|

|

-

|

|

-

|

|

-

|

|

-

|

|

(4.8)

|

|

-

|

|

-

|

|

Reserve for expansion

|

|

-

|

|

-

|

|

-

|

|

-

|

|

(8.7)

|

|

-

|

|

-

|

|

-

|

|

-

|

|

8.7

|

|

-

|

|

-

|

|

Valuation of shares

|

|

-

|

|

62.8

|

|

-

|

|

-

|

|

-

|

|

-

|

|

-

|

|

-

|

|

-

|

|

-

|

|

-

|

|

62.8

|

|

Cost of shares issuance

|

|

(91.7)

|

|

-

|

|

-

|

|

-

|

|

-

|

|

-

|

|

-

|

|

-

|

|

-

|

|

-

|

|

-

|

|

(91.7)

|

|

Treasury shares

|

|

-

|

|

-

|

|

(26.8)

|

|

-

|

|

-

|

|

-

|

|

-

|

|

-

|

|

-

|

|

-

|

|

-

|

|

(26.8)

|

|

BALANCES AT DECEMBER 31, 2009

|

|

12,461.8

|

|

62.8

|

|

(27.6)

|

|

71.0

|

|

496.3

|

|

160.3

|

|

17.4

|

|

(41.8)

|

|

(23.1)

|

|

(186.1)

|

|

4.7

|

|

12,995.7

|

|

Comprehensive income:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Gain (loss) in foreign currency translation adjustments

|

|

-

|

|

-

|

|

-

|

|

-

|

|

-

|

|

-

|

|

(5.2)

|

|

-

|

|

-

|

|

-

|

|

2.1

|

|

(3.1)

|

|

Unrealized gain in available for sale marketable securities

|

|

-

|

|

-

|

|

-

|

|

-

|

|

-

|

|

-

|

|

0.9

|

|

-

|

|

-

|

|

-

|

|

-

|

|

0.9

|

|

Unrealized gains in cash flow hedge

|

|

-

|

|

-

|

|

-

|

|

-

|

|

-

|

|

-

|

|

-

|

|

103.9

|

|

-

|

|

-

|

|

-

|

|

103.9

|

|

Actuarial gain

|

|

-

|

|

-

|

|

-

|

|

-

|

|

-

|

|

-

|

|

-

|

|

-

|

|

(16.8)

|

|

(18.5)

|

|

-

|

|

(35.3)

|

|

Net income for the year

|

|

-

|

|

-

|

|

-

|

|

-

|

|

-

|

|

-

|

|

-

|

|

-

|

|

-

|

|

804.1

|

|

0.8

|

|

804.9

|

|

TOTAL COMPREHENSIVE INCOME

|

|

-

|

|

-

|

|

-

|

|

-

|

|

-

|

|

-

|

|

13.1

|

|

62.1

|

|

(39.9)

|

|

599.5

|

|

7.6

|

|

13,867.0

|

|

Appropriation of income (loss):

|

|

-

|

|

-

|

|

-

|

|

-

|

|

-

|

|

-

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest on shareholders' equity - R$ 0.30166 per

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

outstanding share at the end of the year

|

|

-

|

|

-

|

|

-

|

|

-

|

|

-

|

|

-

|

|

-

|

|

-

|

|

-

|

|

(262.5)

|

|

-

|

|

(262.5)

|

|

Legal reserve

|

|

-

|

|

-

|

|

-

|

|

40.2

|

|

-

|

|

-

|

|

-

|

|

-

|

|

-

|

|

(40.2)

|

|

-

|

|

-

|

|

Reserve for expansion

|

|

-

|

|

-

|

|

-

|

|

-

|

|

176.9

|

|

-

|

|

-

|

|

-

|

|

-

|

|

(176.9)

|

|

-

|

|

-

|

|

Reserve for capital increase

|

|

-

|

|

-

|

|

-

|

|

-

|

|

-

|

|

119.9

|

|

-

|

|

-

|

|

-

|

|

(119.9)

|

|

-

|

|

-

|

|

Share-based payments

|

|

-

|

|

6.6

|

|

-

|

|

-

|

|

-

|

|

-

|

|

-

|

|

-

|

|

-

|

|

-

|

|

-

|

|

6.6

|

|

Cost of shares issuance

|

|

(1.3)

|

|

-

|

|

-

|

|

-

|

|

-

|

|

-

|

|

-

|

|

-

|

|

-

|

|

-

|

|

-

|

|

(1.3)

|

|

Treasury shares

|

|

-

|

|

-

|

|

26.9

|

|

-

|

|

-

|

|

-

|

|

-

|

|

-

|

|

-

|

|

-

|

|

-

|

|

26.9

|

|

BALANCES AT DECEMBER 31, 2010

|

|

12,460.5

|

|

69.4

|

|

(0.7)

|

|

111.2

|

|

673.2

|

|

280.2

|

|

13.1

|

|

62.1

|

|

(39.9)

|

|

-

|

|

7.6

|

|

13,636.7

|

See accompanying notes to the consolidated financial statements.

BRF - BRASIL FOODS S.A.

CONSOLIDATED STATEMENTS OF CASH FLOWS

Years ended December 31, 2010 and 2009

(Amounts expressed in millions of Brazilian reais)

|

|

|

|

|

|

|

|

|

12.31.10

|

|

12.31.09

|

|

Operating activities:

|

|

|

|

|

|

Net income for the year

|

|

804.1

|

|

123.0

|

|

Adjustments to reconcile net income to net cash provided by

operating activities:

|

|

|

|

|

|

Non-controlling shareholders

|

|

0.9

|

|

(4.4)

|

|

Depreciation, amortization and depletion

|

|

840.4

|

|

544.6

|

|

Equity interest in income of subsidiaries

|

|

(4.3)

|

|

(2.5)

|

|

Loss in disposal of permanent assets

|

|

87.3

|

|

45.0

|

|

Deferred income tax

|

|

65.9

|

|

141.0

|

|

Provision (reversal) for tax, civil and labor risks

|

|

194.6

|

|

(14.9)

|

|

Other provisions (reversals)

|

|

(89.8)

|

|

20.2

|

|

Exchange rate variations and interest

|

|

236.5

|

|

(533.8)

|

|

Changes in operating assets and liabilities:

|

|

|

|

|

|

Investment in trading securities

|

|

(2,809.7)

|

|

(9,448.8)

|

|

Redemption of trading securities

|

|

4,553.8

|

|

8,480.0

|

|

Investment in available for sale

|

|

(980.7)

|

|

(239.3)

|

|

Redemption of available for sale

|

|

1,170.7

|

|

69.0

|

|

Other financial assets and liabilities

|

|

(75.9)

|

|

(8.0)

|

|

Trade accounts receivable

|

|

(401.5)

|

|

118.9

|

|

Inventories

|

|

167.7

|

|

244.7

|

|

Trade accounts payable

|

|

154.8

|

|

(28.9)

|

|

Payment of provisions for tax, civil and labor risks

|

|

(91.3)

|

|

(30.1)

|

|

Interest paid

|

|

(545.6)

|

|

(438.6)

|

|

Interest in shareholders' equity received

|

|

4.0

|

|

-

|

|

Payroll and related charges

|

|

(50.3)

|

|

(30.9)

|

|

Net cash provided by (used) operating activities

|

|

3,231.6

|

|

(993.8)

|

|

Investing activities:

|

|

|

|

|

|

Investment in marketable securities

|

|

-

|

|

(0.4)

|

|

Redemption in marketable securities

|

|

-

|

|

251.7

|

|

Additional acquisition costs

|

|

-

|

|

99.2

|

|

Other investments, net

|

|

-

|

|

(58.8)

|

|

Additions to property, plant and equipment

|

|

(697.8)

|

|

(693.2)

|

|

Additions to biological assets

|

|

(376.1)

|

|

(225.9)

|

|

Proceeds from disposals of property, plant and equipement

|

|

38.0

|

|

66.4

|

|

Business acquisition, net of cash

|

|

-

|

|

511.3

|

|

Additions to intangible

|

|

(64.7)

|

|

-

|

|

Net cash used in investing activities

|

|

(1,100.6)

|

|

(49.7)

|

|

Financing activities:

|

|

|

|

|

|

Proceeds from debt issuance

|

|

2,928.7

|

|

2,604.6

|

|

Repayment of debt

|

|

(4,357.5)

|

|

(5,923.1)

|

|

Capital increase through issuance of shares

|

|

-

|

|

5,290.0

|

|

Interest on shareholders' equity paid

|

|

(153.2)

|

|

(24.8)

|

|

Cost of shares issuance

|

|

(1.3)

|

|

(91.7)

|

|

Net cash (used in) provided by financing activities

|

|

(1,583.3)

|

|

1,855.0

|

|

Effect of exchange rate variation on cash and cash equivalents

|

|

(135.3)

|

|

(146.8)

|

|

Net increase in cash

|

|

412.4

|

|

664.7

|

|

Cash at the beginning of the year

|

|

1,898.2

|

|

1,233.5

|

|

Cash at the end of the year

|

|

2,310.6

|

|

1,898.2

|

|

Cash flow supplementary information

|

|

412.4

|

|

664.7

|

|

Cash paid during the year for:

|

|

|

|

|

|

Income tax and social contribution

|

|

78.1

|

|

19.8

|

|

Shares exchange due to business combination net of acquired cash and cash equivalent in the amount of R$511.3.

|

|

-

|

|

3,369.8

|

|

|

|

78.1

|

|

3,389.6

|

See accompanying notes to the consolidated financial statements.

BRF – Brasil Foods S.A.

Notes to Consolidated Financial Statements – (Continued)

Years ended December 31, 2010 and 2009

(Amounts expressed in millions of Brazilian reais, unless otherwise stated)

1.

COMPANY’S OPERATIONS

Founded in 1934, in the State of Santa Catarina, BRF – Brasil Foods S.A. (“BRF”), formerly known as Perdigão S.A., and its subsidiaries (collectively “the Company”) is one of Brazil’s largest companies in the food industry. With a focus on raising, producing and slaughtering of poultry, pork and beef, processing and/or sale of fresh meat, processed products, milk and dairy products, pasta, frozen vegetables and soybean derivatives, among which the following are highlighted:

-

Frozen whole chicken and chicken, turkey, pork and beef cuts;

-

Ham products, sausages, bologna, frankfurters and other smoked products;

-

Hamburgers, breaded meat products, kibes and meatballs;

-

Lasagnas, pizzas, vegetables, cheese breads, pies and frozen pastries;

-

Milk, dairy products and desserts;

-

Juices, soy milk and soy juices;

-

Margarine; and

-

Soy meal and refined soy flour, as well as animal feed.

The Company's activities are segregated into 2 operating segments: domestic and foreign markets.

Currently, the Company operates 44 meat processing plants, 15 milk and dairy products processing plants, 3 margarine processing plants, 4 pasta processing plants, 1 dessert processing plant, and 1 soybean crushing plant, all of them located near to the Company’s raw material suppliers or to the main consumer centers. In the foreign market, the Company has subsidiaries in the United Kingdom, Italy, Austria, Hungary, Japan, The Netherlands, Russia, Singapore and United Arab Emirates, Portugal, France, Germany, Turkey, China, Cayman Islands, Venezuela, Uruguay, Chile and 1 cheese processing plant in Argentina.

The wholly-owned subsidiary Plusfood Groep B.V. operates 2 meat processing plants located in the United Kingdom and The Netherlands.

The table below summarizes the direct and indirect ownership interests of the Company, as well as the activities in which these companies are engaged in:

BRF – Brasil Foods S.A.

Notes to Consolidated Financial Statements – (Continued)

Years ended December 31, 2010 and 2009

(Amounts expressed in millions of Brazilian reais, unless otherwise stated)

1.1.

Interest in subsidiaries:

|

Subsidiary

|

|

Main activity

|

|

Country

|

|

12.31.10

|

|

12.31.09

|

|

01.01.09

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Perdigão Agroindustrial S.A.

|

|

Industrialization and commercialization of products

|

|

Brazil

|

|

-

|

|

-

|

|

100.00%

|

|

PSA Laboratório Veterinário Ltda. (k)

|

|

Veterinary activities

|

|

Brazil

|

|

88.00%

|

|

10.00%

|

|

10.00%

|

|

Sino dos Alpes Alimentos Ltda.

|

|

Industrialization and commercialization of products

|

|

Brazil

|

|

99.99%

|

|

99.99%

|

|

99.99%

|

|

PDF Participações Ltda

|

|

Holding

|

|

Brazil

|

|

1.00%

|

|

1.00%

|

|

1.00%

|

|

Sino dos Alpes Alimentos Ltda

|

|

Industrialization and commercialization of products

|

|

Brazil

|

|

0.01%

|

|

0.01%

|

|

0.01%

|

|

Vip S.A. Emp.Part.Imobiliárias (i)

|

|

Commercialization of owned real estate

|

|

Brazil

|

|

65.00%

|

|

100.00%

|

|

100.00%

|

|

Estab. Levino Zaccardi y Cia. S.A.

|

|

Processing of dairy products

|

|

Argentine

|

|

10.00%

|

|

10.00%

|

|

10.00%

|

|

Avipal Nordeste S.A. (l)

|

|

Raising of poultry for slaughtering

|

|

Brazil

|

|

-

|

|

100.00%

|

|

100.00%

|

|

Avipal S.A. Construtora e Incorporadora (a)

|

|

Construction and comercialization of real estate

|

|

Brazil

|

|

100.00%

|

|

100.00%

|

|

100.00%

|

|

Avipal Centro-oeste S.A. (a)

|

|

Industrialization and comercialization of milk

|

|

Brazil

|

|

100.00%

|

|

100.00%

|

|

100.00%

|

|

Estab. Levino Zaccardi y Cia. S.A.

|

|

Processing of dairy products

|

|

Argentine

|

|

90.00%

|

|

90.00%

|

|

90.00%

|

|

UP Alimentos Ltda

|

|

Industrialization and commercialization of products

|

|

Brazil

|

|

50.00%

|

|

50.00%

|

|

50.00%

|

|

Perdigão Trading S.A. (a)

|

|

Holding

|

|

Brazil

|

|

100.00%

|

|

100.00%

|

|

100.00%

|

|

PSA Laboratório Veterinário Ltda (k)

|

|

Veterinary activities

|

|

Brazil

|

|

12.00%

|

|

90.00%

|

|

90.00%

|

|

PDF Participações Ltda

|

|

Holding

|

|

Brazil

|

|

99.00%

|

|

99.00%

|

|

99.00%

|

|

Perdigão Export Ltd. (a)

|

|

Import and export of products

|

|

Cayman Island

|

|

100.00%

|

|

100.00%

|

|

100.00%

|

|

Crossban Holdings GmbH

|

|

Holding

|

|

Austria

|

|

100.00%

|

|

100.00%

|

|

100.00%

|

|

Perdigão Europe Ltd. (r)

|

|

Import and export of products

|

|

Portugal

|

|

100.00%

|

|

100.00%

|

|

100.00%

|

|

Perdigão International Ltd

|

|

Import and export of products

|

|

Cayman Island

|

|

100.00%

|

|

100.00%

|

|

100.00%

|

|

BFF International Ltd

|

|

Unrestricted activities

|

|

Cayman Island

|

|

100.00%

|

|

100.00%

|

|

100.00%

|

|

Highline International (a)

|

|

Unrestricted activities

|

|

Cayman Island

|

|

100.00%

|

|

100.00%

|

|

100.00%

|

|

Perdigão UK Ltd

|

|

Marketing and logistics services

|

|

United Kingdom

|

|

100.00%

|

|

100.00%

|

|

100.00%

|

|

Plusfood Germany GmbH (c)

|

|

Import and export of products

|

|

Germany

|

|

100.00%

|

|

-

|

|

-

|

|

Perdigão France SARL

|

|

Import and export of products

|

|

France

|

|

100.00%

|

|

100.00%

|

|

100.00%

|

|

Perdigão Holland B.V.

|

|

Administrative services

|

|

The Netherlands

|

|

100.00%

|

|

100.00%

|

|

100.00%

|

|

Plusfood Groep B.V.

|

|

Holding

|

|

The Netherlands

|

|

100.00%

|

|

100.00%

|

|

100.00%

|

|

Plusfood B.V. (n)

|

|

Import and export of products

|

|

The Netherlands

|

|

100.00%

|

|

100.00%

|

|

100.00%

|

|

Plusfood Wrexham (n)

|

|

Import and export of products

|

|

United Kingdom

|

|

100.00%

|

|

-

|

|

-

|

|

Plusfood Constanta SRL (m)

|

|

Meat processsing

|

|

Italy

|

|

-

|

|

100.00%

|

|

100.00%

|

|

Plusfood Finance UK Ltd

|

|

Financial fund-raising

|

|

United Kingdom

|

|

100.00%

|

|

100.00%

|

|

100.00%

|

|

Fribo Foods Ltd (n)

|

|

Import and export of products

|

|

United Kingdom

|

|

-

|

|

100.00%

|

|

100.00%

|

|

Plusfood France SARL (p)

|

|

Import and export of products

|

|

France

|

|

-

|

|

100.00%

|

|

100.00%

|

|

Plusfood Iberia SL

|

|

Distribution of food products

|

|

Spain

|

|

100.00%

|

|

100.00%

|

|

100.00%

|

|

Plusfood Italy SRL

|

|

Import and export of products

|

|

Italia

|

|

67.00%

|

|

67.00%

|

|

67.00%

|

|

BRF Brasil Foods Japan KK (q)

|

|

Import and export of products

|

|

Japão

|

|

100.00%

|

|

100.00%

|

|

100.00%

|

|

Brasil Foods PTE Ltd. (g)

|

|

Marketing and logistics services

|

|

Singapura

|

|

100.00%

|

|

100.00%

|

|

100.00%

|

|

Plusfood Hungary Trade and Service LLC.

(h)

|

|

Import and export of products

|

|

Hungria

|

|

100.00%

|

|

100.00%

|

|

100.00%

|

|

Plusfood UK Ltd

|

|

Marketing and logistics services

|

|

United Kingdom

|

|

100.00%

|

|

100.00%

|

|

100.00%

|

|

Acheron Beteiligung-sverwaltung GmbH (b)

|

|

Holding

|

|

Austria

|

|

100.00%

|

|

100.00%

|

|

100.00%

|

|

Xamol Consul. Serv. Ltda (a)

|

|

Import and export of products

|

|

Portugal

|

|

100.00%

|

|

100.00%

|

|

100.00%

|

|

HFF Participações S.A. (l)

|

|

Holding

|

|

Brazil

|

|

-

|

|

100.00%

|

|

-

|

|

Sadia S.A. (l)

|

|

Industrialization and commercialization of products

|

|

Brazil

|

|

-

|

|

33.15%

|

|

-

|

|

Sadia S.A.

|

|

Industrialization and commercialization of products

|

|

Brazil

|

|

100.00%

|

|

66.85%

|

|

-

|

|

Sadia International Ltd.

|

|

Import and export of products

|

|

Cayman Island

|

|

100.00%

|

|

100.00%

|

|

-

|

|

Sadia Uruguay S.A.

|

|

Import and export of products

|

|

Uruguay

|

|

100.00%

|

|

100.00%

|

|

-

|

|

Sadia Chile S.A.

|

|

Import and export of products

|

|

Chile

|

|

60.00%

|

|

60.00%

|

|

-

|

|

Sadia Alimentos S.A.

|

|

Import and export of products

|

|

Argentine

|

|

95.00%

|

|

95.00%

|

|

-

|

|

Sadia U. K. Ltd.

|

|

Commercialization of real estate and others

|

|

United Kingdom

|

|

100.00%

|

|

100.00%

|

|

-

|

|

Concórdia Foods Ltd.

|

|

Commercialization of real estate and others

|

|

United Kingdom

|

|

100.00%

|

|

100.00%

|

|

-

|

|

Vip S.A. Emp.Part.Imobiliárias (i)

|

|

Commercialization of owned real estate

|

|

Brazil

|

|

35.00%

|

|

100.00%

|

|

-

|

|

Estelar Participações Ltda (a)

|

|

Holding

|

|

Brazil

|

|

99.90%

|

|

-

|

|

-

|

|

Sadia Industrial Ltda.

|

|

Industrialization and commercialization of commodities

|

|

Brazil

|

|

99.90%

|

|

100.00%

|

|

-

|

|

Estelar Participações Ltda (a)

|

|

Holding

|

|

Brazil

|

|

0.10%

|

|

99.99%

|

|

-

|

|

Rezende Marketing e Comunicações Ltda. (e)

|

|

Advertising agency

|

|

Brazil

|

|

-

|

|

0.09%

|

|

-

|

|

Big Foods Ind. de Produtos Alimentícios Ltda. (d)

|

|

Manufacture of bakery products

|

|

Brazil

|

|

-

|

|

100.00%

|

|

-

|

|

Rezende Marketing e Comunicações Ltda. (e)

|

|

Advertising agency

|

|

Brazil

|

|

-

|

|

99.91%

|

|

-

|

|

Sadia Overseas Ltd.

|

|

Financial fund-raising

|

|

Cayman Island

|

|

100.00%

|

|

100.00%

|

|

-

|

|

Sadia GmbH

|

|

Holding

|

|

Austria

|

|

100.00%

|

|

100.00%

|

|

-

|

|

Wellax Food Logistics C.P.A.S.U. Lda.

|

|

Import and export of products

|

|

Portugal

|

|

100.00%

|

|

100.00%

|

|

-

|

|

Sadia Foods GmbH

|

|

Import and export of products

|

|

Germany

|

|

100.00%

|

|

100.00%

|

|

-

|

|

Qualy B. V. (b)

|

|

Import and export of products

|

|

Netherlands

|

|

100.00%

|

|

100.00%

|

|

-

|

|

Sadia Japan KK.

|

|

Import and export of products

|

|

Japan

|

|

100.00%

|

|

100.00%

|

|

-

|

|

Concórdia Ltd. (o)

|

|

Holding

|

|

Russia

|

|

-

|

|

100.00%

|

|

-

|

|

Badi Ltd. (j)

|

|

Import and export of products

|

|

Arab Emirates

|

|

100.00%

|

|

80.00%

|

|

-

|

|

AL-Wafi (f)

|

|

Import and export of products

|

|

Saudi Arabia

|

|

75.00%

|

|

-

|

|

-

|

|

Baumhardt Comércio e Participações Ltda.

|

|

Consulting

|

|

Brazil

|

|

73.94%

|

|

73.94%

|

|

-

|

|

Excelsior Alimentos S.A.

|

|

Slaughterhouse for pork

|

|

Brazil

|

|

25.10%

|

|

25.10%

|

|

-

|

|

Excelsior Alimentos S.A.

|

|

Slaughterhouse for pork

|

|

Brazil

|

|

46.01%

|

|

46.01%

|

|

-

|

|

K&S Alimentos S.A.

|

|

Industrialization and commercialization of products

|

|

Brazil

|

|

49.00%

|

|

49.00%

|

|

-

|

BRF – Brasil Foods S.A.

Notes to Consolidated Financial Statements – (Continued)

Years ended December 31, 2010 and 2009

(Amounts expressed in millions of Brazilian reais, unless otherwise stated)

(a) Dormant subsidiaries.

(b) The wholly-owned subsidiary Acheron Beteiligung-sverwaltung GmbH owns 100 direct subsidiaries in Madeira Island, Portugal, with an investment of R$0.6, and the wholly-owned subsidiary Qualy B.V. owns 48 subsidiaries in the Netherlands, and the amount of this investment, as of December 31, 2010, is represented by a net capital deficiency of R$8.9, the purpose of these two subsidiaries is to operate in the European market to increase the Company’s share of this market, which is regulated by a system of poultry and turkey import quotas.

(c) Establishment of the wholly-owned subsidiary Plusfood Germany GmbH, in Germany, on September 8, 2010.

(d) Merger of 100% of the equity units of the wholly-owned subsidiary Big Foods Ind. de Produtos Alimentícios Ltda. into Sadia in August 31, 2010.

(e) The activities of the wholly-owned subsidiary Rezende Marketing e Comunicações Ltda. were discontinued in August 27, 2010.

(f) Establishment of the wholly-owned subsidiary AL-Wafi in Saudi Arabia in August 2010.

(g) The name of the wholly-owned subsidiary Perdigão Asia PTE Ltd. was changed to Brasil Foods PTE Ltd. in August 2010.

(h) The name of the wholly-owned subsidiary Plusfood Hungary Kft. was changed to Plusfood Hungary Trade and Service LLC.

(i) The name of the wholly-owned subsidiary Avipal S.A. Alimentos was changed to Vip S.A. Empreendimentos e Participações Imobiliárias on January 4, 2010. From August 8, 2010 the wholly-owned subsidiary Sadia holds 35% of the interest in Vip S.A. Empreendimentos e Participações which used to be BRF’s direct wholly-owned subsidiary.

(j) In the second half of 2010, the wholly-owned subsidiary Sadia GmbH acquired 20% of the shares of Badi Ltd, becoming the holder of 100% of the investment for US$0.6.

(k) The change in the ownership interest of Perdigão Trading S.A. and BRF - Brasil Foods S.A. in PSA Laboratório Veterinário Ltda. arises from the corporate restructuring process carried out by management.

(l) Company merged on March 31, 2010, the ownership interests held by this company was transferred to the parent company on this date.

(m) Disposal of ownership interest on March 31, 2010.

(n) The shares of Plusfood Wrexham Ltd. (new name of Fribo Foods Ltd.), which were fully held by the wholly-owned subsidiary Plusfood Finance UK Ltd., were transferred to the wholly-owned subsidiary Plusfood Groep B.V. on June 7, 2010.

(o) Disposal of ownership interest on September 19, 2009.

(p) Activities discontinued on October 22, 2010.

(q) The name of the wholly-owned subsidiary Perdigão Nihon K.K. was changed to Brasil Foods Japan K.K. on November 1, 2010

(r) The name of the wholly-owned subsidiary Perdix was changed to Perdigão Europe on March 18, 2009.

The Company has an advanced distribution system and uses 38 distribution centers, delivering its products to supermarkets, retail stores, wholesalers, food service stores and other institutional customers of the domestic market and

exporting to more than 145 countries.

BRF – Brasil Foods S.A.

Notes to Consolidated Financial Statements – (Continued)

Years ended December 31, 2010 and 2009

(Amounts expressed in millions of Brazilian reais, unless otherwise stated)

BRF has a large number of brands, the principal of which are the following:

Batavo, Claybon, Chester®, Confiança, Delicata, Doriana, Elegê, Fazenda, Nabrasa, Perdigão, Perdix,

in addition to licensed brands such as

Turma da Mônica.

The main brands of the subsidiary Sadia are the following:

Fiesta, Hot Pocket, Miss Daisy, Nuggets, Qualy, Rezende, Sadia, Speciale Sadia, Texas

and

Wilson.

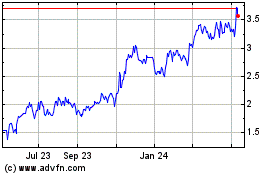

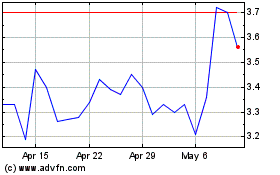

In April 2006, the Company’s shares were listed on the

Novo Mercado

corporate governance (“New Market of the São Paulo Stock Exchange”).

The Extraordinary Shareholders' Meeting held on July 8, 2009 approved that the shares issued by the Company started to be traded on the São Paulo Securities, Futures and Commodities Exchange (“BM&FBOVESPA”) under the new symbol “BRFS3” and on the New York Stock Exchange (“NYSE”) under the new symbol “BRFS,” which replaced the former symbols “PRGA3” and “PDA,” respectively.

1.2.

Corporate restructuring

The Company has been following its sustainable growth plan since mid-2005, which is based on the acquisition of various companies and entry into new businesses.

As a result of these acquisitions, the Company grew and diversified its businesses, increasing its market share in the poultry and pork markets and entering the dairy, margarine and beef markets.

The companies acquired were as follows:

|

Company

|

|

Activity

|

|

Acquisition Year

|

|

Status

|

|

Sadia

|

|

Meat

|

|

2009

|

|

Wholly-owned subsidiary

|

|

HFF Participações

|

|

Holding

|

|

2009

|

|

Merged on 03.31.10

|

|

Eleva Alimentos

|

|

Dairy/meat

|

|

2008

|

|

Merged on 04.30.08

|

|

Cotochés

|

|

Dairy

|

|

2008

|

|

Merged on 12.31.08

|

|

Plusfood

|

|

Meat

|

|

2008

|

|

Wholly-owned subsidiary

|

|

Batávia S.A.

|

|

Dairy

|

|

2006/2007

|

|

Merged on 12.31.08

|

|

Paraíso Agroindustrial

|

|

Meat

|

|

2007

|

|

Merged on 08.01.07

|

|

Ava Comércio e Representação

|

|

Margarines

|

|

2007

|

|

Merged on 08.01.07

|

|

Sino dos Alpes

|

|

Meat

|

|

2007

|

|

Wholly-owned subsidiary

|

|

Mary Loize

|

|

Meat

|

|

2005

|

|

Merged on 12.31.08

|

|

Incubatório Paraíso

|

|

Meat

|

|

2005

|

|

Merged on 07.03.06

|

|

Perdigão Agroindustrial

|

|

Meat

|

|

-

|

|

Merged on 03.09.09