Brady Corporation Announces Proposed Offering of Common Stock

June 05 2006 - 5:15PM

PR Newswire (US)

MILWAUKEE, June 5 /PRNewswire-FirstCall/ -- Brady Corporation

(NYSE:BRC) today announced its intention to sell 4,000,000 shares

of Class A Common Stock in an underwritten public offering. This

offering is subject to market and other conditions, and is being

made pursuant to a shelf registration statement that became

effective in November 2005. The underwriters are expected to have

an option to purchase up to an additional 600,000 shares of Class A

Common Stock to cover over-allotments. Underwriters marketing the

offering include sole bookrunning manager Robert W. Baird &

Co., Inc.; co-lead managers Credit Suisse and Wachovia Securities;

and co-manager Harris Nesbitt Corp. Brady intends to use the net

proceeds from the offering to repay amounts under its revolving

credit facility and for general corporate purposes, including

potential future acquisitions. This news release does not

constitute an offer to sell or the solicitation of an offer to buy

any securities. The offering is being made only by means of a

prospectus supplement, a copy of which may be obtained from the

offices of Robert W. Baird & Co., Inc., 777 East Wisconsin

Avenue, 28th Floor, Milwaukee, Wisconsin 53202-5391. An electronic

copy of the prospectus supplement will be available on the

Securities and Exchange Commission's website at http://www.sec.gov/

. Brady Corporation is a leading global manufacturer and marketer

of identification solutions and specialty products that identify

and protect premises, products and people. Its products include

high-performance labels and signs, safety devices, printing systems

and software, and precision die- cut materials. Brady believes that

certain statements in this news release are "forward- looking

statements" within the meaning of the Private Securities Litigation

Reform Act of 1995. All statements related to future, not past,

events included in this news release, including, without

limitation, statements regarding Brady's future financial position,

business strategy, targets, projected sales, costs, earnings,

capital expenditures, debt levels and cash flows, and plans and

objectives of management for future operations are forward-looking

statements. When used in this news release, words such as "may,"

"will," "expect," "intend," "estimate," "anticipate," "believe,"

"should," "project" or "plan" or similar terminology are generally

intended to identify forward-looking statements. These

forward-looking statements by their nature address matters that

are, to different degrees, uncertain and are subject to risks,

assumptions and other factors, some of which are beyond Brady's

control, that could cause actual results to differ materially from

those expressed or implied by such forward-looking statements. For

Brady, uncertainties arise from the potential upsizing or

downsizing and price parameters of the proposed public offering;

unanticipated issues associated with the proposed public offering

or the terms thereof; future financial performance of major markets

Brady serves, which include, without limitation,

telecommunications, manufacturing, electrical, construction,

laboratory, education, governmental, public utility, computer,

transportation; difficulties in making and integrating

acquisitions; risks associated with newly acquired businesses;

Brady's ability to retain significant contracts and customers;

future competition; Brady's ability to develop and successfully

market new products; changes in the supply of, or price for, parts

and components; increased price pressure from suppliers and

customers; interruptions to sources of supply; environmental,

health and safety compliance costs and liabilities; Brady's ability

to realize cost savings from operating initiatives; Brady's ability

to attract and retain key talent; difficulties associated with

exports; risks associated with international operations;

fluctuations in currency rates versus the US dollar; technology

changes; potential write-offs of Brady's substantial intangible

assets; risks associated with obtaining governmental approvals and

maintaining regulatory compliance for new and existing products;

business interruptions due to implementing business systems; and

numerous other matters of national, regional and global scale,

including those of a political, economic, business, competitive and

regulatory nature contained from time to time in Brady's U.S.

Securities and Exchange Commission filings, including, but not

limited to, those factors listed in the "Risk Factors" section

located in Item 1A of Part II of Brady's Quarterly Report on Form

10-Q for the period ended April 30, 2006. These uncertainties may

cause Brady's actual future results to be materially different than

those expressed in its forward-looking statements. Brady does not

undertake to update its forward-looking statements. DATASOURCE:

Brady Corporation CONTACT: Barbara Bolens of Brady Corporation,

+1-414-438-6940 Web site: http://www.bradycorp.com/ Company News

On-Call: http://www.prnewswire.com/comp/952350.html

Copyright

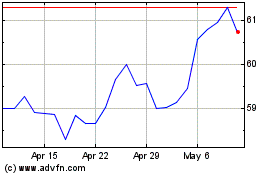

Brady (NYSE:BRC)

Historical Stock Chart

From Jun 2024 to Jul 2024

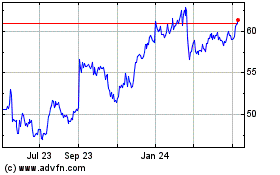

Brady (NYSE:BRC)

Historical Stock Chart

From Jul 2023 to Jul 2024