false

0000906553

0000906553

2024-02-08

2024-02-08

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

____________________________________________________________________

FORM 8-K

____________________________________________________________________

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (date of earliest event reported): February 8, 2024

____________________________________________________________________

Boyd Gaming Corporation

(Exact Name of Registrant as Specified in its Charter)

____________________________________________________________________

|

Nevada

|

|

001-12882

|

|

88-0242733

|

|

(State or Other Jurisdiction of Incorporation)

|

|

(Commission File Number)

|

|

(I.R.S. Employer Identification Number)

|

6465 South Rainbow Boulevard

Las Vegas, Nevada 89118

(Address of Principal Executive Offices, Including Zip Code)

(702) 792-7200

(Registrant’s Telephone Number, Including Area Code)

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Exchange Act:

|

Title of each class

|

Trading Symbol(s)

|

Name of each exchange on which registered

|

|

Common stock, $0.01 par value

|

BYD

|

New York Stock Exchange

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02. Results of Operations and Financial Condition.

On February 8, 2024, Boyd Gaming Corporation issued a press release announcing its financial results for the fourth quarter and year ended December 31, 2023. A copy of the press release is furnished hereto as Exhibit 99.1 and incorporated herein by reference.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits

|

Exhibit Number

|

|

Description

|

| |

|

|

|

99.1

|

|

|

| |

|

|

| 104 |

|

Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

Date:

|

February 8, 2024

|

Boyd Gaming Corporation

|

| |

|

|

| |

By:

|

/s/ Lori M. Nelson

|

| |

|

Lori M. Nelson

|

| |

|

Senior Vice President Financial Operations and Reporting and Chief Accounting Officer

|

| |

|

|

Exhibit 99.1

BOYD GAMING REPORTS FOURTH-QUARTER, FULL-YEAR 2023 RESULTS

LAS VEGAS - FEBRUARY 8, 2024 - Boyd Gaming Corporation (NYSE: BYD) today reported financial results for the fourth quarter and full year ended December 31, 2023.

Keith Smith, President and Chief Executive Officer of Boyd Gaming, said: “The fourth quarter's strong performance was a fitting conclusion to another record year for our Company. Our fourth-quarter and full-year results were driven by our diversified portfolio, consistent core customer trends and solid returns from our recent property investments. Our management teams continued to demonstrate their ability to efficiently manage the business, achieving property-level operating margins above 40% for both the fourth quarter and full year. And as part of our balanced approach to capital allocation, we returned more than $475 million to our shareholders in 2023 while investing in our properties and maintaining the strongest balance sheet in our Company’s history. Looking ahead, we remain confident in our ability to continue delivering profitable growth and creating long-term shareholder value.”

Fourth-Quarter and Full-Year 2023 Results

Boyd Gaming reported fourth-quarter 2023 revenues of $954.4 million, increasing from $922.9 million in the fourth quarter of 2022. The Company reported net income of $92.6 million, or $0.94 per share, for the fourth quarter of 2023, compared to $172.7 million, or $1.63 per share, for the year-ago period. The Company’s fourth-quarter 2023 results were impacted by $103.3 million in non-cash, pretax goodwill and intangible asset impairment charges.

Total Adjusted EBITDAR(1) was $355.5 million in the fourth quarter of 2023 versus $360.1 million in the fourth quarter of 2022. Adjusted Earnings(1) for the fourth quarter of 2023 were $163.8 million, or $1.66 per share, compared to $181.8 million, or $1.72 per share, for the same period in 2022.

For the full year 2023, Boyd Gaming reported revenues of $3.7 billion, up from $3.6 billion for the full year 2022. The Company reported net income of $620.0 million, or $6.12 per share, compared to net income of $639.4 million, or $5.87 per share, for the full year 2022. The Company’s full-year 2023 and 2022 results were impacted by $107.8 million and $40.8 million, respectively, in non-cash, pretax goodwill and intangible asset impairment charges.

Total Adjusted EBITDAR for the full year 2023 was $1.4 billion, up slightly from the prior year. Full-year 2023 Adjusted Earnings were $639.9 million, or $6.31 per share, compared to Adjusted Earnings of $662.0 million, or $6.07 per share, for the full year 2022.

| |

(1)

|

See footnotes at the end of the release for additional information relative to non-GAAP financial measures.

|

Operations Review

During the fourth quarter, year-over-year revenue and Adjusted EBITDAR performances in the Las Vegas Locals segment were consistent with each of the last two quarters. The Downtown Las Vegas segment delivered fourth-quarter revenue growth while Adjusted EBITDAR equaled last year’s record fourth quarter, with particularly strong results at the recently expanded Fremont. The Midwest & South segment returned to growth during the fourth quarter as both revenue and Adjusted EBITDAR increased over prior year.

The Company’s Online segment benefited from the introduction of sports-betting in Ohio in January 2023. Revenue and Adjusted EBITDAR growth in Managed & Other was driven by strong results at Sky River Casino.

Dividend and Share Repurchase Update

Boyd Gaming paid a quarterly cash dividend of $0.16 per share on January 15, 2024, as previously announced.

As part of its ongoing share repurchase program, the Company repurchased $100 million in shares of its common stock during the fourth quarter of 2023. As of December 31, 2023, the Company had approximately $326 million remaining under current share repurchase authorizations.

Balance Sheet Statistics

As of December 31, 2023, Boyd Gaming had cash on hand of $304.3 million, and total debt of $2.9 billion.

Conference Call Information

Boyd Gaming will host a conference call to discuss its fourth-quarter and full-year 2023 results today, February 8, at 5:00 p.m. Eastern. The conference call number is (888) 259-6580, passcode 04276776. Please join up to 15 minutes in advance to ensure you are connected prior to the start of the call.

The conference call will also be available live on the Internet at https://investors.boydgaming.com, or https://events.q4inc.com/attendee/946881762.

A replay will be available by dialing (877) 674-7070 today, February 8, after the conclusion of the call, and continuing through Thursday, February 15. The passcode for the replay will be 276776#. The replay will also be available at https://investors.boydgaming.com.

BOYD GAMING CORPORATION

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(Unaudited)

| |

|

Three Months Ended

|

|

|

Year Ended

|

|

| |

|

December 31,

|

|

|

December 31,

|

|

|

(In thousands, except per share data)

|

|

2023

|

|

|

2022

|

|

|

2023

|

|

|

2022

|

|

|

Revenues

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Gaming

|

|

$ |

647,083 |

|

|

$ |

653,876 |

|

|

$ |

2,613,288 |

|

|

$ |

2,674,730 |

|

|

Food & beverage

|

|

|

75,481 |

|

|

|

74,145 |

|

|

|

288,417 |

|

|

|

275,979 |

|

|

Room

|

|

|

50,571 |

|

|

|

50,086 |

|

|

|

199,117 |

|

|

|

189,071 |

|

|

Online

|

|

|

124,058 |

|

|

|

89,695 |

|

|

|

422,211 |

|

|

|

253,898 |

|

|

Management fee

|

|

|

22,292 |

|

|

|

16,746 |

|

|

|

76,921 |

|

|

|

26,905 |

|

|

Other

|

|

|

34,927 |

|

|

|

38,373 |

|

|

|

138,538 |

|

|

|

134,794 |

|

|

Total revenues

|

|

|

954,412 |

|

|

|

922,921 |

|

|

|

3,738,492 |

|

|

|

3,555,377 |

|

|

Operating costs and expenses

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Gaming

|

|

|

248,910 |

|

|

|

249,474 |

|

|

|

1,000,240 |

|

|

|

1,005,830 |

|

|

Food & beverage

|

|

|

63,256 |

|

|

|

61,555 |

|

|

|

240,879 |

|

|

|

231,447 |

|

|

Room

|

|

|

18,610 |

|

|

|

17,325 |

|

|

|

73,490 |

|

|

|

68,383 |

|

|

Online

|

|

|

106,510 |

|

|

|

73,203 |

|

|

|

358,988 |

|

|

|

213,918 |

|

|

Other

|

|

|

12,204 |

|

|

|

11,642 |

|

|

|

46,323 |

|

|

|

45,626 |

|

|

Selling, general and administrative

|

|

|

90,558 |

|

|

|

93,305 |

|

|

|

389,891 |

|

|

|

373,964 |

|

|

Master lease rent expense (a)

|

|

|

27,235 |

|

|

|

26,828 |

|

|

|

108,398 |

|

|

|

106,616 |

|

|

Maintenance and utilities

|

|

|

35,677 |

|

|

|

35,331 |

|

|

|

151,014 |

|

|

|

143,527 |

|

|

Depreciation and amortization

|

|

|

68,203 |

|

|

|

63,988 |

|

|

|

256,780 |

|

|

|

258,179 |

|

|

Corporate expense

|

|

|

27,731 |

|

|

|

26,756 |

|

|

|

115,963 |

|

|

|

117,007 |

|

|

Project development, preopening and writedowns

|

|

|

2,333 |

|

|

|

(19,464 |

) |

|

|

(8,935 |

) |

|

|

(18,936 |

) |

|

Impairment of assets

|

|

|

103,300 |

|

|

|

35,200 |

|

|

|

107,837 |

|

|

|

40,775 |

|

|

Other operating items, net

|

|

|

(5,166 |

) |

|

|

141 |

|

|

|

(4,207 |

) |

|

|

(12,183 |

) |

|

Total operating costs and expenses

|

|

|

799,361 |

|

|

|

675,284 |

|

|

|

2,836,661 |

|

|

|

2,574,153 |

|

|

Operating income

|

|

|

155,051 |

|

|

|

247,637 |

|

|

|

901,831 |

|

|

|

981,224 |

|

|

Other expense (income)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest income

|

|

|

(1,441 |

) |

|

|

(18,554 |

) |

|

|

(23,886 |

) |

|

|

(21,530 |

) |

|

Interest expense, net of amounts capitalized

|

|

|

42,314 |

|

|

|

41,124 |

|

|

|

171,247 |

|

|

|

151,249 |

|

|

Loss on early extinguishments and modifications of debt

|

|

|

— |

|

|

|

6 |

|

|

|

— |

|

|

|

19,815 |

|

|

Other, net

|

|

|

967 |

|

|

|

(783 |

) |

|

|

1,563 |

|

|

|

2,884 |

|

|

Total other expense, net

|

|

|

41,840 |

|

|

|

21,793 |

|

|

|

148,924 |

|

|

|

152,418 |

|

|

Income before income taxes

|

|

|

113,211 |

|

|

|

225,844 |

|

|

|

752,907 |

|

|

|

828,806 |

|

|

Income tax provision

|

|

|

(20,606 |

) |

|

|

(53,160 |

) |

|

|

(132,884 |

) |

|

|

(189,429 |

) |

|

Net income

|

|

$ |

92,605 |

|

|

$ |

172,684 |

|

|

$ |

620,023 |

|

|

$ |

639,377 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic net income per common share

|

|

$ |

0.94 |

|

|

$ |

1.64 |

|

|

$ |

6.12 |

|

|

$ |

5.87 |

|

|

Weighted average basic shares outstanding

|

|

|

98,935 |

|

|

|

105,569 |

|

|

|

101,325 |

|

|

|

108,885 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Diluted net income per common share

|

|

$ |

0.94 |

|

|

$ |

1.63 |

|

|

$ |

6.12 |

|

|

$ |

5.87 |

|

|

Weighted average diluted shares outstanding

|

|

|

98,979 |

|

|

|

105,649 |

|

|

|

101,373 |

|

|

|

109,004 |

|

__________________________________________

(a) Rent expense incurred by those properties subject to a master lease with a real estate investment trust.

BOYD GAMING CORPORATION

SUPPLEMENTAL INFORMATION

Reconciliation of Adjusted EBITDA to Net Income

(Unaudited)

| |

|

Three Months Ended

|

|

|

Year Ended

|

|

| |

|

December 31,

|

|

|

December 31,

|

|

|

(In thousands)

|

|

2023

|

|

|

2022

|

|

|

2023

|

|

|

2022

|

|

|

Total Revenues by Segment

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Las Vegas Locals

|

|

$ |

235,075 |

|

|

$ |

240,916 |

|

|

$ |

928,118 |

|

|

$ |

930,730 |

|

|

Downtown Las Vegas

|

|

|

63,314 |

|

|

|

62,442 |

|

|

|

222,407 |

|

|

|

215,332 |

|

|

Midwest & South

|

|

|

497,898 |

|

|

|

496,532 |

|

|

|

2,041,945 |

|

|

|

2,076,066 |

|

|

Online

|

|

|

124,058 |

|

|

|

89,695 |

|

|

|

422,211 |

|

|

|

253,898 |

|

|

Managed & Other

|

|

|

34,067 |

|

|

|

33,336 |

|

|

|

123,811 |

|

|

|

79,351 |

|

|

Total revenues

|

|

$ |

954,412 |

|

|

$ |

922,921 |

|

|

$ |

3,738,492 |

|

|

$ |

3,555,377 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Adjusted EBITDAR by Segment

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Las Vegas Locals

|

|

$ |

120,431 |

|

|

$ |

125,881 |

|

|

$ |

470,971 |

|

|

$ |

481,643 |

|

|

Downtown Las Vegas

|

|

|

27,631 |

|

|

|

27,833 |

|

|

|

85,507 |

|

|

|

86,049 |

|

|

Midwest & South

|

|

|

190,568 |

|

|

|

188,431 |

|

|

|

781,673 |

|

|

|

830,782 |

|

|

Online

|

|

|

17,309 |

|

|

|

16,862 |

|

|

|

62,337 |

|

|

|

39,778 |

|

|

Managed & Other

|

|

|

24,384 |

|

|

|

23,523 |

|

|

|

84,478 |

|

|

|

40,981 |

|

|

Corporate expense, net of share-based compensation expense (a)

|

|

|

(24,861 |

) |

|

|

(22,428 |

) |

|

|

(90,175 |

) |

|

|

(88,724 |

) |

|

Adjusted EBITDAR

|

|

|

355,462 |

|

|

|

360,102 |

|

|

|

1,394,791 |

|

|

|

1,390,509 |

|

|

Master lease rent expense (b)

|

|

|

(27,235 |

) |

|

|

(26,828 |

) |

|

|

(108,398 |

) |

|

|

(106,616 |

) |

|

Adjusted EBITDA

|

|

|

328,227 |

|

|

|

333,274 |

|

|

|

1,286,393 |

|

|

|

1,283,893 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other operating costs and expenses

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Deferred rent

|

|

|

177 |

|

|

|

193 |

|

|

|

708 |

|

|

|

768 |

|

|

Depreciation and amortization

|

|

|

68,203 |

|

|

|

63,988 |

|

|

|

256,780 |

|

|

|

258,179 |

|

|

Share-based compensation expense

|

|

|

4,329 |

|

|

|

5,579 |

|

|

|

32,379 |

|

|

|

34,066 |

|

|

Project development, preopening and writedowns

|

|

|

2,333 |

|

|

|

(19,464 |

) |

|

|

(8,935 |

) |

|

|

(18,936 |

) |

|

Impairment of assets

|

|

|

103,300 |

|

|

|

35,200 |

|

|

|

107,837 |

|

|

|

40,775 |

|

|

Other operating items, net

|

|

|

(5,166 |

) |

|

|

141 |

|

|

|

(4,207 |

) |

|

|

(12,183 |

) |

|

Total other operating costs and expenses

|

|

|

173,176 |

|

|

|

85,637 |

|

|

|

384,562 |

|

|

|

302,669 |

|

|

Operating income

|

|

|

155,051 |

|

|

|

247,637 |

|

|

|

901,831 |

|

|

|

981,224 |

|

|

Other expense (income)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest income

|

|

|

(1,441 |

) |

|

|

(18,554 |

) |

|

|

(23,886 |

) |

|

|

(21,530 |

) |

|

Interest expense, net of amounts capitalized

|

|

|

42,314 |

|

|

|

41,124 |

|

|

|

171,247 |

|

|

|

151,249 |

|

|

Loss on early extinguishments and modifications of debt

|

|

|

— |

|

|

|

6 |

|

|

|

— |

|

|

|

19,815 |

|

|

Other, net

|

|

|

967 |

|

|

|

(783 |

) |

|

|

1,563 |

|

|

|

2,884 |

|

|

Total other expense, net

|

|

|

41,840 |

|

|

|

21,793 |

|

|

|

148,924 |

|

|

|

152,418 |

|

|

Income before income taxes

|

|

|

113,211 |

|

|

|

225,844 |

|

|

|

752,907 |

|

|

|

828,806 |

|

|

Income tax provision

|

|

|

(20,606 |

) |

|

|

(53,160 |

) |

|

|

(132,884 |

) |

|

|

(189,429 |

) |

|

Net income

|

|

$ |

92,605 |

|

|

$ |

172,684 |

|

|

$ |

620,023 |

|

|

$ |

639,377 |

|

__________________________________________

(a) Reconciliation of corporate expense:

| |

|

Three Months Ended

|

|

|

Year Ended

|

|

| |

|

December 31,

|

|

|

December 31,

|

|

|

(In thousands)

|

|

2023

|

|

|

2022

|

|

|

2023

|

|

|

2022

|

|

|

Corporate expense as reported on Condensed Consolidated

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Statements of Operations

|

|

$ |

27,731 |

|

|

$ |

26,756 |

|

|

$ |

115,963 |

|

|

$ |

117,007 |

|

|

Corporate share-based compensation expense

|

|

|

(2,870 |

) |

|

|

(4,328 |

) |

|

|

(25,788 |

) |

|

|

(28,283 |

) |

|

Corporate expense, net, as reported on the above table

|

|

$ |

24,861 |

|

|

$ |

22,428 |

|

|

$ |

90,175 |

|

|

$ |

88,724 |

|

(b) Rent expense incurred by those properties subject to a master lease with a real estate investment trust.

BOYD GAMING CORPORATION

SUPPLEMENTAL INFORMATION

Reconciliations of Net Income to Adjusted Earnings

and Net Income Per Share to Adjusted Earnings Per Share

(Unaudited)

| |

|

Three Months Ended

|

|

|

Year Ended

|

|

| |

|

December 31,

|

|

|

December 31,

|

|

|

(In thousands, except per share data)

|

|

2023

|

|

|

2022

|

|

|

2023

|

|

|

2022

|

|

|

Net income

|

|

$ |

92,605 |

|

|

$ |

172,684 |

|

|

$ |

620,023 |

|

|

$ |

639,377 |

|

|

Pretax adjustments:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Project development, preopening and writedowns

|

|

|

2,333 |

|

|

|

(19,464 |

) |

|

|

(8,935 |

) |

|

|

(18,936 |

) |

|

Impairment of assets

|

|

|

103,300 |

|

|

|

35,200 |

|

|

|

107,837 |

|

|

|

40,775 |

|

|

Other operating items, net

|

|

|

(5,166 |

) |

|

|

141 |

|

|

|

(4,207 |

) |

|

|

(12,183 |

) |

|

Loss on early extinguishments and modifications of debt

|

|

|

— |

|

|

|

6 |

|

|

|

— |

|

|

|

19,815 |

|

|

Interest income (a)

|

|

|

— |

|

|

|

(14,700 |

) |

|

|

(14,315 |

) |

|

|

(14,700 |

) |

|

Other, net

|

|

|

967 |

|

|

|

(783 |

) |

|

|

1,563 |

|

|

|

2,884 |

|

|

Total adjustments

|

|

|

101,434 |

|

|

|

400 |

|

|

|

81,943 |

|

|

|

17,655 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Income tax effect for above adjustments

|

|

|

(30,214 |

) |

|

|

8,673 |

|

|

|

(26,231 |

) |

|

|

4,961 |

|

|

Impact of tax valuation allowance

|

|

|

— |

|

|

|

— |

|

|

|

(35,856 |

) |

|

|

— |

|

|

Adjusted earnings

|

|

$ |

163,825 |

|

|

$ |

181,757 |

|

|

$ |

639,879 |

|

|

$ |

661,993 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income per share, diluted

|

|

$ |

0.94 |

|

|

$ |

1.63 |

|

|

$ |

6.12 |

|

|

$ |

5.87 |

|

|

Pretax adjustments:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Project development, preopening and writedowns

|

|

|

0.02 |

|

|

|

(0.18 |

) |

|

|

(0.09 |

) |

|

|

(0.17 |

) |

|

Impairment of assets

|

|

|

1.04 |

|

|

|

0.33 |

|

|

|

1.06 |

|

|

|

0.37 |

|

|

Other operating items, net

|

|

|

(0.05 |

) |

|

|

— |

|

|

|

(0.04 |

) |

|

|

(0.11 |

) |

|

Loss on early extinguishments and modifications of debt

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

0.18 |

|

|

Interest income (a)

|

|

|

— |

|

|

|

(0.14 |

) |

|

|

(0.14 |

) |

|

|

(0.14 |

) |

|

Other, net

|

|

|

0.01 |

|

|

|

— |

|

|

|

0.02 |

|

|

|

0.03 |

|

|

Total adjustments

|

|

|

1.02 |

|

|

|

0.01 |

|

|

|

0.81 |

|

|

|

0.16 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Income tax effect for above adjustments

|

|

|

(0.30 |

) |

|

|

0.08 |

|

|

|

(0.26 |

) |

|

|

0.04 |

|

|

Impact of tax valuation allowance

|

|

|

— |

|

|

|

— |

|

|

|

(0.36 |

) |

|

|

— |

|

|

Adjusted earnings per share, diluted

|

|

$ |

1.66 |

|

|

$ |

1.72 |

|

|

$ |

6.31 |

|

|

$ |

6.07 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted average diluted shares outstanding

|

|

|

98,979 |

|

|

|

105,649 |

|

|

|

101,373 |

|

|

|

109,004 |

|

__________________________________________

(a) Adjustment to the expected losses for interest on note receivable.

Non-GAAP Financial Measures

Our financial presentations include the following non-GAAP financial measures:

| |

●

|

EBITDA: earnings before interest, taxes, depreciation and amortization,

|

| |

●

|

Adjusted EBITDA: EBITDA adjusted for deferred rent, share-based compensation expense, project development, preopening and writedown expenses, impairments of assets, other operating items, net, gain or loss on early extinguishments and modifications of debt and other items, net,

|

| |

●

|

EBITDAR: EBITDA further adjusted for rent expense associated with master leases with a real estate investment trust,

|

| |

●

|

Adjusted EBITDAR: Adjusted EBITDA further adjusted for rent expense associated with master leases with a real estate investment trust,

|

| |

●

|

Adjusted Earnings: net income before project development, preopening and writedown expenses, impairments of assets, other operating items, net, gain or loss on early extinguishments and modifications of debt, adjustments to the expected losses for interest on note receivable, the release of valuation allowances on deferred tax assets and other non-recurring adjustments, net, and,

|

| |

●

|

Adjusted Earnings Per Share (Adjusted EPS): Adjusted Earnings divided by weighted average diluted shares outstanding.

|

Collectively, we refer to these and other non-GAAP financial measures as the “Non-GAAP Measures”.

The Non-GAAP Measures are commonly used measures of performance in our industry that we believe, when considered with measures calculated in accordance with accounting principles generally accepted in the United States (GAAP), provide our investors with a more complete understanding of our operating results and facilitates comparisons between us and our competitors. We provide this information to investors to enable them to perform comparisons of our past, present and future operating results and as a means to evaluate the results of core on-going operations. We have historically reported these measures to our investors and believe that the continued inclusion of the Non-GAAP Measures provides consistency in our financial reporting. We also believe this information is useful to investors in allowing greater transparency related to significant measures used by our management in their financial and operational decision-making, their evaluation of total company and individual property performance, in the evaluation of incentive compensation and in the annual budget process. Management also uses Non-GAAP Measures in the evaluation of potential acquisitions and dispositions. We believe these measures continue to be used by investors in their assessment of our operating performance and the valuation of our company.

The use of Non-GAAP Measures has certain limitations. Our presentation of the Non-GAAP Measures may be different from the presentation used by other companies and therefore comparability may be limited. While excluded from certain of the Non-GAAP Measures, depreciation and amortization expense, interest expense, income taxes and other items have been and will be incurred. Each of these items should also be considered in the overall evaluation of our results. Additionally, the Non-GAAP Measures do not consider capital expenditures and other investing activities and should not be considered as a measure of our liquidity. We compensate for these limitations by providing the relevant disclosure of our depreciation and amortization, interest and income taxes, capital expenditures and other items both in our reconciliations to the historical GAAP financial measures and in our consolidated financial statements, all of which should be considered when evaluating our performance. We do not provide a reconciliation of forward-looking Non-GAAP Measures to the corresponding forward-looking GAAP measure due to our inability to project special charges and certain expenses.

The Non-GAAP Measures are to be used in addition to and in conjunction with results presented in accordance with GAAP. The Non-GAAP Measures should not be considered as an alternative to net income, operating income, or any other operating performance measure prescribed by GAAP, nor should these measures be relied upon to the exclusion of GAAP financial measures. The Non-GAAP Measures reflect additional ways of viewing our operations that we believe, when viewed with our GAAP results and the reconciliations to the corresponding historical GAAP financial measures, provide a more complete understanding of factors and trends affecting our business than could be obtained absent this disclosure. Management strongly encourages investors to review our financial information in its entirety and not to rely on a single financial measure.

Forward-looking Statements and Company Information

This press release contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Such statements contain words such as “may,” “will,” “might,” “expect,” “believe,” “anticipate,” “could,” “would,” “estimate,” “continue,” “pursue,” or the negative thereof or comparable terminology, and may include (without limitation) information regarding the Company's expectations, goals or intentions regarding future performance. In addition, forward-looking statements in this press release, as well as in our earnings conference call remarks, include statements regarding continued growth in visitation and spending among the Company’s core customers, the Company’s views that it will be able to drive continued revenue and EBITDAR growth throughout its business, the Company’s operating strategy, the Company’s confidence in its long-term growth trajectory, and the Company’s plans with respect to share repurchases and returning capital to shareholders. Forward-looking statements involve certain risks and uncertainties, and actual results may differ materially from those discussed in any such statement. Risks also include fluctuations in the Company's operating results; the political climate and its effects on consumer spending and its impact on the travel industry; the state of the economy and its effect on consumer spending; the impact and effects of the local economies in the markets where the Company operates; the receipt of legislative, and other state, federal and local approvals for the Company's development projects; developments in legalization of online gaming, the Company's ability to operate online gaming profitably, or otherwise; consumer reaction to fluctuations in the stock market and economic factors; the effects of events adversely impacting the economy or the regions from which the Company draws a significant percentage of its customers; competition; litigation; financial community and rating agency perceptions of the Company; changes in laws and regulations, weather, regulation, economic, credit and capital market conditions; and the effects of war, terrorist or similar activity. Additional factors that could cause actual results to differ are discussed under the heading “Risk Factors” and in other sections of the Company's Annual Report on Form 10-K, its Quarterly Reports on Form 10-Q, and in the Company's other current and periodic reports filed from time to time with the SEC. All forward-looking statements in this press release are made as of the date hereof, based on information available to the Company as of the date hereof, and the Company assumes no obligation to update any forward-looking statement.

About Boyd Gaming

Founded in 1975, Boyd Gaming Corporation (NYSE: BYD) is a leading geographically diversified operator of 28 gaming entertainment properties in 10 states, manager of a tribal casino in northern California, and owner and operator of Boyd Interactive, a B2B and B2C online casino gaming business. The Company is also a strategic partner and 5% equity owner of FanDuel Group, the nation's leading sports-betting operator. With one of the most experienced leadership teams in the casino industry, Boyd Gaming prides itself on offering guests an outstanding entertainment experience and memorable customer service. Through a long-standing company philosophy called Caring the Boyd Way, Boyd Gaming is committed to advancing Corporate Social Responsibility (CSR) initiatives that positively impact the Company's stakeholders and communities. For additional Company information and press releases, visit https://investors.boydgaming.com.

| |

Financial Contact:

|

|

Media Contact:

|

| |

Josh Hirsberg

|

|

David Strow

|

| |

(702) 792-7234

|

|

(702) 792-7386

|

| |

joshhirsberg@boydgaming.com

|

|

davidstrow@boydgaming.com

|

v3.24.0.1

Document And Entity Information

|

Feb. 08, 2024 |

| Document Information [Line Items] |

|

| Entity, Registrant Name |

Boyd Gaming Corporation

|

| Document, Type |

8-K

|

| Document, Period End Date |

Feb. 08, 2024

|

| Entity, Incorporation, State or Country Code |

NV

|

| Entity, File Number |

001-12882

|

| Entity, Tax Identification Number |

88-0242733

|

| Entity, Address, Address Line One |

6465 South Rainbow Boulevard

|

| Entity, Address, City or Town |

Las Vegas

|

| Entity, Address, State or Province |

NV

|

| Entity, Address, Postal Zip Code |

89118

|

| City Area Code |

702

|

| Local Phone Number |

792-7200

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common stock

|

| Trading Symbol |

BYD

|

| Security Exchange Name |

NYSE

|

| Entity, Emerging Growth Company |

false

|

| Amendment Flag |

false

|

| Entity, Central Index Key |

0000906553

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

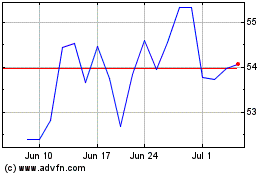

Boyd Gaming (NYSE:BYD)

Historical Stock Chart

From Apr 2024 to May 2024

Boyd Gaming (NYSE:BYD)

Historical Stock Chart

From May 2023 to May 2024