Boise Cascade Company ("Boise Cascade," the "Company," "we," or

"our") (NYSE: BCC) today reported net income of $91.0 million, or

$2.33 per share, on sales of $1.7 billion for the third quarter

ended September 30, 2024, compared with net income of $143.1

million, or $3.58 per share, on sales of $1.8 billion for the third

quarter ended September 30, 2023.

"In what has proven to be a moderate demand environment, once

again, we were able to deliver good financial results in the third

quarter. We could not have done this without the tremendous efforts

of our associates and our unique combination of best-in-class

engineered wood products and an unmatched nationwide wholesale

distribution network,” stated Nate Jorgensen, CEO. “In addition, we

continue to progress on our key strategic investment initiatives

and thoughtfully deploy capital to shareholders. Looking forward,

we expect normal seasonality through the winter months, and are

well positioned to serve and support our customer and vendor

partners as changes in demand dictate."

Third Quarter 2024 Highlights

3Q 2024

3Q 2023

% change

(in thousands, except per-share

data and percentages)

Consolidated Results

Sales

$

1,713,724

$

1,834,441

(7

)%

Net income

91,038

143,068

(36

)%

Net income per common share - diluted

2.33

3.58

(35

)%

Adjusted EBITDA 1

154,480

216,465

(29

)%

Segment Results

Wood Products sales

$

453,896

$

515,225

(12

)%

Wood Products income

53,853

99,574

(46

)%

Wood Products EBITDA 1

77,404

122,924

(37

)%

Building Materials Distribution sales

1,567,466

1,670,296

(6

)%

Building Materials Distribution income

74,821

97,076

(23

)%

Building Materials Distribution EBITDA

1

87,749

104,857

(16

)%

1 For reconciliations of non-GAAP

measures, see summary notes at the end of this press release.

In third quarter 2024, total U.S. housing starts and

single-family housing starts decreased 3% and 1%, respectively,

compared to the same period in 2023. On a year-to-date basis

through September 2024, total housing starts decreased 3%, while

single-family housing starts increased 10%, compared to the same

period in 2023. Single-family housing starts are the key demand

driver for our sales.

Wood Products

Wood Products' sales, including sales to Building Materials

Distribution (BMD), decreased $61.3 million, or 12%, to $453.9

million for the three months ended September 30, 2024, from $515.2

million for the three months ended September 30, 2023. The decrease

in sales was driven by lower plywood sales prices, as well as lower

sales prices for LVL and I-joists (collectively referred to as

EWP). In addition, lower sales volumes for I-joists decreased

sales, while sales volumes for LVL and plywood were flat. Other

sales related to lumber and residual byproducts also decreased.

Comparative average net selling prices and sales volume changes

for EWP and plywood are as follows:

3Q 2024 vs. 3Q 2023

3Q 2024 vs. 2Q 2024

Average Net Selling Prices

LVL

(5)%

(2)%

I-joists

(6)%

(2)%

Plywood

(13)%

(8)%

Sales Volumes

LVL

—%

(2)%

I-joists

(8)%

(10)%

Plywood

—%

2%

Wood Products' segment income decreased $45.7 million to $53.9

million for the three months ended September 30, 2024, from $99.6

million for the three months ended September 30, 2023. The decrease

in segment income was due primarily to lower EWP and plywood sales

prices, as well as higher conversion costs. In addition, lower

I-joist sales volumes contributed to the decrease in segment

income.

Building Materials Distribution

BMD's sales decreased $102.8 million, or 6%, to $1,567.5 million

for the three months ended September 30, 2024, from $1,670.3

million for the three months ended September 30, 2023. Compared

with the same quarter in the prior year, the overall decrease in

sales was driven by a sales price decrease of 6%, as sales volumes

were flat. Excluding the impact of the BROSCO acquisition on

October 2, 2023, sales would have decreased by 9%. By product line,

commodity sales decreased 12%, general line product sales increased

4%, and EWP sales (substantially all of which are sourced through

our Wood Products segment) decreased 14%.

BMD segment income decreased $22.3 million to $74.8 million for

the three months ended September 30, 2024, from $97.1 million for

the three months ended September 30, 2023. The decrease in segment

income was driven by increased selling and distribution expenses

and depreciation and amortization expense of $10.0 million and $5.1

million, respectively. In addition, gross margin decreased $7.7

million, driven by lower margins on commodity products and EWP,

offset partially by improved margins on general line products.

Balance Sheet and Liquidity

Boise Cascade ended third quarter 2024 with $761.6 million of

cash and cash equivalents and $395.7 million of undrawn committed

bank line availability, for total available liquidity of $1,157.3

million. The Company had $450.0 million of outstanding debt at

September 30, 2024.

Capital Allocation

We expect capital expenditures in 2024, excluding potential

acquisition spending, to total approximately $220 million to $240

million. In addition, we expect capital expenditures in 2025 to

total approximately $200 million to $220 million. These levels of

capital expenditures could increase or decrease as a result of

several factors, including acquisitions, efforts to further

accelerate organic growth, exercise of lease purchase options, our

financial results, future economic conditions, availability of

engineering and construction resources, and timing and availability

of equipment purchases.

For the nine months ended September 30, 2024, the Company paid

$220.5 million in common stock dividends. On October 30, 2024, our

board of directors declared a quarterly dividend of $0.21 per share

on our common stock, payable on December 18, 2024, to stockholders

of record on December 2, 2024.

For the three and nine months ended September 30, 2024, the

Company paid $69.7 million and $158.5 million, respectively, for

the repurchase of 554,500 and 1,232,345 shares of our common stock,

respectively. Furthermore, in October 2024, the Company repurchased

an additional 50,000 shares of our common stock at a cost of $6.9

million. On October 30, 2024, our board of directors authorized the

repurchase of an additional 1.4 million shares of our common stock.

This increase is in addition to the remaining authorized shares

under our prior common stock repurchase program. As of October 31,

2024, approximately 2 million shares were available for repurchase

under our existing share repurchase program.

Outlook

Demand for the products we manufacture, as well as the products

we purchase and distribute, is correlated with new residential

construction, residential repair-and-remodeling activity, and light

commercial construction. Residential construction, particularly new

single-family construction, is the key demand driver for the

products we manufacture and distribute. As reported by the U.S.

Census Bureau, housing starts were 1.42 million in 2023. Current

industry forecasts for U.S. housing starts are approximately 1.35

million in 2024 followed by 2025 starts at or modestly above 1.40

million. For the nine months ended September 2024, single-family

starts are outpacing 2023 levels by 10% whereas multi-family starts

have declined sharply from historic levels due to increased capital

costs for developers, combined with historic levels of multi-family

unit completions in 2024. Home affordability remains a challenge

for many consumers due to home prices and the cost of financing,

with the level of mortgage rates also limiting the supply of

existing housing stock available for sale. Large homebuilders are

addressing affordability challenges by reducing home sizes and plan

complexity, as well as offering mortgage rate buydowns. New

residential construction will continue to be an important source of

supply for the demand created by undersupplied housing, favorable

demographic trends, and low unemployment. We expect 2025 to reflect

modest growth in home improvement spending, as the age of U.S.

housing stock and elevated levels of homeowner equity will continue

to provide a favorable backdrop for repair-and-remodel spending.

Ultimately, macroeconomic factors, the level and expectations for

mortgage rates, home affordability, home equity levels, home size,

and other factors will influence the near-term demand environment

for the products we manufacture and distribute.

As a manufacturer of certain commodity products, we have sales

and profitability exposure to declines in commodity product prices

and rising input costs. Our distribution business purchases and

resells a broad mix of products with periods of increasing prices

providing the opportunity for higher sales and increased margins,

while declining price environments expose us to declines in sales

and profitability. Future product pricing, particularly commodity

products pricing and input costs, may be volatile in response to

economic uncertainties, industry operating rates, supply-related

disruptions, transportation constraints or disruptions, net import

and export activity, inventory levels in various distribution

channels, and seasonal demand patterns.

About Boise Cascade

Boise Cascade Company is one of the largest producers of

engineered wood products and plywood in North America and a leading

U.S. wholesale distributor of building products. For more

information, please visit the Company's website at www.bc.com.

Webcast and Conference Call

Boise Cascade will host a webcast and conference call to discuss

third quarter earnings on Tuesday, November 5, 2024, at 10 a.m.

Eastern.

To join the webcast, go to the Investors section of our website

at www.bc.com/investors and select the Event Calendar link.

Analysts and investors who wish to ask questions during the Q&A

session can register for the call here.

The archived webcast will be available in the Investors section

of Boise Cascade's website.

Use of Non-GAAP Financial Measures

We refer to the terms EBITDA and Adjusted EBITDA in this

earnings release and the accompanying Quarterly Statistical

Information as supplemental measures of our performance and

liquidity that are not required by or presented in accordance with

generally accepted accounting principles in the United States

(GAAP). We define EBITDA as income before interest (interest

expense and interest income), income taxes, and depreciation and

amortization. Additionally, we disclose Adjusted EBITDA, which

further adjusts EBITDA to exclude the change in fair value of

interest rate swaps.

We believe EBITDA and Adjusted EBITDA are meaningful measures

because they present a transparent view of our recurring operating

performance and allow management to readily view operating trends,

perform analytical comparisons, and identify strategies to improve

operating performance. We also believe EBITDA and Adjusted EBITDA

are useful to investors because they provide a means to evaluate

the operating performance of our segments and our Company on an

ongoing basis using criteria that are used by our management and

because they are frequently used by investors and other interested

parties when comparing companies in our industry that have

different financing and capital structures and/or tax rates. EBITDA

and Adjusted EBITDA, however, are not measures of our liquidity or

financial performance under GAAP and should not be considered as

alternatives to net income, income from operations, or any other

performance measure derived in accordance with GAAP or as

alternatives to cash flow from operating activities as a measure of

our liquidity. The use of EBITDA and Adjusted EBITDA instead of net

income or segment income have limitations as analytical tools,

including: the inability to determine profitability; the exclusion

of interest expense, interest income, and associated significant

cash requirements; and the exclusion of depreciation and

amortization, which represent unavoidable operating costs.

Management compensates for these limitations by relying on our GAAP

results. Our measures of EBITDA and Adjusted EBITDA are not

necessarily comparable to other similarly titled captions of other

companies due to potential inconsistencies in the methods of

calculation.

Forward-Looking Statements

This press release includes statements about our expectations of

future operational and financial performance that are

forward-looking statements within the meaning of Section 27A of the

Securities Act of 1933 and Section 21E of the Securities Exchange

Act of 1934, including, but not limited to, statements regarding

our outlook. Statements preceded or followed by, or that otherwise

include, the words "believes," "expects," "anticipates," "intends,"

"project," "estimates," "plans," "forecast," "is likely to," and

similar expressions or future or conditional verbs such as "will,"

"may," "would," "should," and "could" are generally forward-looking

in nature and not historical facts. Such statements are based upon

the current beliefs and expectations of our management and are

subject to significant risks and uncertainties. The accuracy of

such statements is subject to a number of risks, uncertainties, and

assumptions that could cause our actual results to differ

materially from those projected, including, but not limited to,

prices for building products, changes in the competitive position

of our products, commodity input costs, the effect of general

economic conditions, our ability to efficiently and effectively

integrate the BROSCO acquisition, mortgage rates and availability,

housing demand, housing vacancy rates, governmental regulations,

unforeseen production disruptions, as well as natural disasters.

These and other factors that could cause actual results to differ

materially from such forward-looking statements are discussed in

greater detail in our filings with the Securities and Exchange

Commission. Forward-looking statements speak only as of the date of

this press release. We undertake no obligation to revise them in

light of new information. Finally, we undertake no obligation to

review or confirm analyst expectations or estimates that might be

derived from this release.

Boise Cascade Company

Consolidated Statements of

Operations

(in thousands, except per-share

data) (unaudited)

Three Months Ended

Nine Months Ended

September 30

June 30, 2024

September 30

2024

2023

2024

2023

Sales

$

1,713,724

$

1,834,441

$

1,797,670

$

5,156,814

$

5,193,989

Costs and expenses

Materials, labor, and other operating

expenses (excluding depreciation)

1,375,719

1,442,178

1,440,680

4,123,838

4,099,249

Depreciation and amortization

36,861

31,474

34,367

107,078

93,382

Selling and distribution expenses

157,522

147,714

149,783

451,415

415,707

General and administrative expenses

26,172

27,583

25,943

77,232

84,193

Other (income) expense, net

94

(141

)

(84

)

(68

)

(1,752

)

1,596,368

1,648,808

1,650,689

4,759,495

4,690,779

Income from operations

117,356

185,633

146,981

397,319

503,210

Foreign currency exchange gain (loss)

300

(602

)

(104

)

(103

)

(355

)

Pension expense (excluding service

costs)

(37

)

(40

)

(37

)

(111

)

(122

)

Interest expense

(6,082

)

(6,351

)

(6,105

)

(18,257

)

(19,051

)

Interest income

10,168

13,760

10,543

31,308

34,964

Change in fair value of interest rate

swaps

(866

)

(327

)

(487

)

(1,573

)

(798

)

3,483

6,440

3,810

11,264

14,638

Income before income taxes

120,839

192,073

150,791

408,583

517,848

Income tax provision

(29,801

)

(49,005

)

(38,499

)

(101,129

)

(131,727

)

Net income

$

91,038

$

143,068

$

112,292

$

307,454

$

386,121

Weighted average common shares

outstanding:

Basic

38,848

39,675

39,412

39,286

39,648

Diluted

39,063

39,983

39,608

39,521

39,849

Net income per common share:

Basic

$

2.34

$

3.61

$

2.85

$

7.83

$

9.74

Diluted

$

2.33

$

3.58

$

2.84

$

7.78

$

9.69

Dividends declared per common share

$

5.21

$

0.20

$

0.20

$

5.61

$

3.50

Wood Products Segment

Statements of

Operations

(in thousands, except

percentages) (unaudited)

Three Months Ended

Nine Months Ended

September 30

June 30, 2024

September 30

2024

2023

2024

2023

Segment sales

$

453,896

$

515,225

$

489,823

$

1,412,647

$

1,482,926

Costs and expenses

Materials, labor, and other operating

expenses (excluding depreciation)

361,313

376,754

378,920

1,097,954

1,091,900

Depreciation and amortization

23,551

23,350

22,270

70,205

70,145

Selling and distribution expenses

10,587

10,786

11,114

32,252

33,901

General and administrative expenses

4,640

5,018

4,606

14,266

15,560

Other (income) expense, net

(48

)

(257

)

133

99

(1,584

)

400,043

415,651

417,043

1,214,776

1,209,922

Segment income

$

53,853

$

99,574

$

72,780

$

197,871

$

273,004

(percentage of sales)

Segment sales

100.0

%

100.0

%

100.0

%

100.0

%

100.0

%

Costs and expenses

Materials, labor, and other operating

expenses (excluding depreciation)

79.6

%

73.1

%

77.4

%

77.7

%

73.6

%

Depreciation and amortization

5.2

%

4.5

%

4.5

%

5.0

%

4.7

%

Selling and distribution expenses

2.3

%

2.1

%

2.3

%

2.3

%

2.3

%

General and administrative expenses

1.0

%

1.0

%

0.9

%

1.0

%

1.0

%

Other (income) expense, net

—

%

—

%

—

%

—

%

(0.1

%)

88.1

%

80.7

%

85.1

%

86.0

%

81.6

%

Segment income

11.9

%

19.3

%

14.9

%

14.0

%

18.4

%

Building Materials

Distribution Segment

Statements of

Operations

(in thousands, except

percentages) (unaudited)

Three Months Ended

Nine Months Ended

September 30

June 30, 2024

September 30

2024

2023

2024

2023

Segment sales

$

1,567,466

$

1,670,296

$

1,655,221

$

4,727,708

$

4,686,076

Costs and expenses

Materials, labor, and other operating

expenses (excluding depreciation)

1,322,001

1,417,153

1,409,510

4,009,932

3,983,718

Depreciation and amortization

12,928

7,781

11,741

35,776

22,237

Selling and distribution expenses

146,994

136,982

138,716

419,324

381,878

General and administrative expenses

10,580

11,195

10,070

30,184

33,314

Other (income) expense, net

142

109

(216

)

(192

)

(382

)

1,492,645

1,573,220

1,569,821

4,495,024

4,420,765

Segment income

$

74,821

$

97,076

$

85,400

$

232,684

$

265,311

(percentage of sales)

Segment sales

100.0

%

100.0

%

100.0

%

100.0

%

100.0

%

Costs and expenses

Materials, labor, and other operating

expenses (excluding depreciation)

84.3

%

84.8

%

85.2

%

84.8

%

85.0

%

Depreciation and amortization

0.8

%

0.5

%

0.7

%

0.8

%

0.5

%

Selling and distribution expenses

9.4

%

8.2

%

8.4

%

8.9

%

8.1

%

General and administrative expenses

0.7

%

0.7

%

0.6

%

0.6

%

0.7

%

Other (income) expense, net

—

%

—

%

—

%

—

%

—

%

95.2

%

94.2

%

94.8

%

95.1

%

94.3

%

Segment income

4.8

%

5.8

%

5.2

%

4.9

%

5.7

%

Segment Information

(in thousands) (unaudited)

Three Months Ended

Nine Months Ended

September 30

June 30, 2024

September 30

2024

2023

2024

2023

Segment sales

Wood Products

$

453,896

$

515,225

$

489,823

$

1,412,647

$

1,482,926

Building Materials Distribution

1,567,466

1,670,296

1,655,221

4,727,708

4,686,076

Intersegment eliminations

(307,638

)

(351,080

)

(347,374

)

(983,541

)

(975,013

)

Total net sales

$

1,713,724

$

1,834,441

$

1,797,670

$

5,156,814

$

5,193,989

Segment income

Wood Products

$

53,853

$

99,574

$

72,780

$

197,871

$

273,004

Building Materials Distribution

74,821

97,076

85,400

232,684

265,311

Total segment income

128,674

196,650

158,180

430,555

538,315

Unallocated corporate costs

(11,318

)

(11,017

)

(11,199

)

(33,236

)

(35,105

)

Income from operations

$

117,356

$

185,633

$

146,981

$

397,319

$

503,210

Segment EBITDA

Wood Products

$

77,404

$

122,924

$

95,050

$

268,076

$

343,149

Building Materials Distribution

87,749

104,857

97,141

268,460

287,548

See accompanying summary notes to

consolidated financial statements and segment information.

Boise Cascade Company

Consolidated Balance

Sheets

(in thousands) (unaudited)

September 30, 2024

December 31, 2023

ASSETS

Current

Cash and cash equivalents

$

761,599

$

949,574

Receivables

Trade, less allowances of $4,979 and

$3,278

408,487

352,780

Related parties

289

181

Other

17,411

20,740

Inventories

792,356

712,369

Prepaid expenses and other

32,024

21,170

Total current assets

2,012,166

2,056,814

Property and equipment, net

985,808

932,633

Operating lease right-of-use assets

50,039

62,868

Finance lease right-of-use assets

22,925

24,003

Timber deposits

9,078

7,208

Goodwill

171,945

170,254

Intangible assets, net

177,028

190,743

Deferred income taxes

4,605

4,854

Other assets

8,033

9,269

Total assets

$

3,441,627

$

3,458,646

Boise Cascade Company

Consolidated Balance Sheets

(continued)

(in thousands, except per-share

data) (unaudited)

September 30, 2024

December 31, 2023

LIABILITIES AND STOCKHOLDERS'

EQUITY

Current

Accounts payable

Trade

$

372,199

$

310,175

Related parties

2,216

1,501

Accrued liabilities

Compensation and benefits

122,000

149,561

Interest payable

5,086

9,958

Other

141,741

122,921

Total current liabilities

643,242

594,116

Debt

Long-term debt

445,945

445,280

Other

Compensation and benefits

42,864

40,189

Operating lease liabilities, net of

current portion

43,550

56,425

Finance lease liabilities, net of current

portion

27,492

28,084

Deferred income taxes

96,967

82,014

Other long-term liabilities

18,134

16,874

229,007

223,586

Commitments and contingent

liabilities

Stockholders' equity

Preferred stock, $0.01 par value per

share; 50,000 shares authorized, no shares issued and

outstanding

—

—

Common stock, $0.01 par value per share;

300,000 shares authorized, 45,130 and 44,983 shares issued,

respectively

451

450

Treasury stock, 6,675 and 5,443 shares at

cost, respectively

(305,227

)

(145,335

)

Additional paid-in capital

561,223

560,697

Accumulated other comprehensive loss

(495

)

(517

)

Retained earnings

1,867,481

1,780,369

Total stockholders' equity

2,123,433

2,195,664

Total liabilities and stockholders'

equity

$

3,441,627

$

3,458,646

Boise Cascade Company

Consolidated Statements of

Cash Flows

(in thousands) (unaudited)

Nine Months Ended September

30

2024

2023

Cash provided by (used for)

operations

Net income

$

307,454

$

386,121

Items in net income not using (providing)

cash

Depreciation and amortization, including

deferred financing costs and other

109,531

95,516

Stock-based compensation

11,668

11,518

Pension expense

111

122

Deferred income taxes

15,096

4,351

Change in fair value of interest rate

swaps

1,573

798

Other

322

(1,877

)

Decrease (increase) in working capital,

net of acquisitions

Receivables

(51,192

)

(158,756

)

Inventories

(80,739

)

14,145

Prepaid expenses and other

(6,697

)

(6,604

)

Accounts payable and accrued

liabilities

44,547

152,303

Income taxes payable

(3,970

)

23,664

Other

(3,952

)

(172

)

Net cash provided by operations

343,752

521,129

Cash provided by (used for)

investment

Expenditures for property and

equipment

(135,760

)

(99,251

)

Acquisitions of businesses and

facilities

(5,581

)

—

Proceeds from sales of assets and

other

1,197

2,450

Net cash used for investment

(140,144

)

(96,801

)

Cash provided by (used for)

financing

Treasury stock purchased

(158,509

)

(1,539

)

Dividends paid on common stock

(220,485

)

(140,885

)

Tax withholding payments on stock-based

awards

(11,141

)

(5,926

)

Other

(1,448

)

(1,359

)

Net cash used for financing

(391,583

)

(149,709

)

Net increase (decrease) in cash and

cash equivalents

(187,975

)

274,619

Balance at beginning of the

period

949,574

998,344

Balance at end of the period

$

761,599

$

1,272,963

Summary Notes to Consolidated Financial Statements and

Segment Information

The Consolidated Statements of Operations, Segment Statements of

Operations, Consolidated Balance Sheets, Consolidated Statements of

Cash Flows, and Segment Information presented herein do not include

the notes accompanying the Company's Consolidated Financial

Statements and should be read in conjunction with the Company’s

2023 Form 10-K and the Company's other filings with the Securities

and Exchange Commission. Net income for all periods presented

involved estimates and accruals.

EBITDA represents income before interest (interest expense and

interest income), income taxes, and depreciation and amortization.

Additionally, we disclose Adjusted EBITDA, which further adjusts

EBITDA to exclude the change in fair value of interest rate swaps.

The following table reconciles net income to EBITDA and Adjusted

EBITDA for the (i) three months ended September 30, 2024 and 2023,

(ii) three months ended June 30, 2024, and (iii) nine months ended

September 30, 2024 and 2023:

Three Months Ended

Nine Months Ended

September 30

June 30, 2024

September 30

2024

2023

2024

2023

(in thousands)

Net income

$

91,038

$

143,068

$

112,292

$

307,454

$

386,121

Interest expense

6,082

6,351

6,105

18,257

19,051

Interest income

(10,168

)

(13,760

)

(10,543

)

(31,308

)

(34,964

)

Income tax provision

29,801

49,005

38,499

101,129

131,727

Depreciation and amortization

36,861

31,474

34,367

107,078

93,382

EBITDA

153,614

216,138

180,720

502,610

595,317

Change in fair value of interest rate

swaps

866

327

487

1,573

798

Adjusted EBITDA

$

154,480

$

216,465

$

181,207

$

504,183

$

596,115

The following table reconciles segment income and unallocated

corporate costs to EBITDA and adjusted EBITDA for the (i) three

months ended September 30, 2024 and 2023, (ii) three months ended

June 30, 2024, and (iii) nine months ended September 30, 2024 and

2023:

Three Months Ended

Nine Months Ended

September 30

June 30, 2024

September 30

2024

2023

2024

2023

(in thousands)

Wood Products

Segment income

$

53,853

$

99,574

$

72,780

$

197,871

$

273,004

Depreciation and amortization

23,551

23,350

22,270

70,205

70,145

EBITDA

$

77,404

$

122,924

$

95,050

$

268,076

$

343,149

Building Materials Distribution

Segment income

$

74,821

$

97,076

$

85,400

$

232,684

$

265,311

Depreciation and amortization

12,928

7,781

11,741

35,776

22,237

EBITDA

$

87,749

$

104,857

$

97,141

$

268,460

$

287,548

Corporate

Unallocated corporate costs

$

(11,318

)

$

(11,017

)

$

(11,199

)

$

(33,236

)

$

(35,105

)

Foreign currency exchange gain (loss)

300

(602

)

(104

)

(103

)

(355

)

Pension expense (excluding service

costs)

(37

)

(40

)

(37

)

(111

)

(122

)

Change in fair value of interest rate

swaps

(866

)

(327

)

(487

)

(1,573

)

(798

)

Depreciation and amortization

382

343

356

1,097

1,000

EBITDA

(11,539

)

(11,643

)

(11,471

)

(33,926

)

(35,380

)

Change in fair value of interest rate

swaps

866

327

487

1,573

798

Corporate adjusted EBITDA

$

(10,673

)

$

(11,316

)

$

(10,984

)

$

(32,353

)

$

(34,582

)

Total Company adjusted EBITDA

$

154,480

$

216,465

$

181,207

$

504,183

$

596,115

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241104417522/en/

Investor Relations Contact - Chris Forrey

investor@bc.com

Media Contact - Amy Evans mediarelations@bc.com

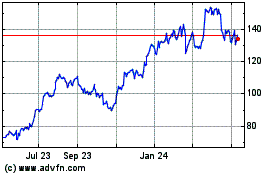

Boise Cascade (NYSE:BCC)

Historical Stock Chart

From Dec 2024 to Jan 2025

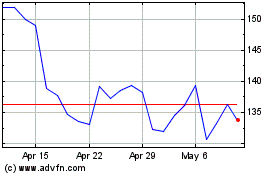

Boise Cascade (NYSE:BCC)

Historical Stock Chart

From Jan 2024 to Jan 2025