UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE TO

Tender Offer Statement under Section 14(d)(1) or 13(e)(1)

of the Securities Exchange Act of 1934

BLUE APRON HOLDINGS, INC.

(Name of Subject Company (issuer))

BASIL MERGER CORPORATION

(Offeror)

a wholly owned subsidiary of

WONDER GROUP, INC.

(Parent of Offeror)

(Names of Filing Persons (identifying status as offeror, issuer or other person))

Class A Common stock, $0.0001 par value per share

(Title of Class of Securities)

09523Q 309

(CUSIP Number of Class of Securities)

Andrew Gasper

Chief Governance Officer and Secretary

Wonder Group, Inc.

4 World Trade

150 Greenwich Street, 57th Floor

New York, New York 10007

Telephone: (908) 986-2038

(Name, address, and telephone numbers of person authorized to receive notices and communications on behalf of filing persons)

Copy to:

Kris Withrow

David Michaels

Aman Singh

Fenwick & West LLP

801 California Street

Mountain View, California 94041

Telephone: (650) 988-8500

☐

Check the box if the filing relates solely to preliminary communications made before the commencement of a tender offer.

Check the appropriate boxes below to designate any transactions to which the statement relates:

☒

Third-party tender offer subject to Rule 14d-1.

☐

Issuer tender offer subject to Rule 13e-4.

☐

Going-private transaction subject to Rule 13e-3.

☐

Amendment to Schedule 13D under Rule 13d-2.

Check the following box if the filing is a final amendment reporting the results of the tender offer: ☐

If applicable, check the appropriate box(es) below to designate the appropriate rule provision(s) relied upon:

☐

Rule 13e-4(i) (Cross-Border Issuer Tender Offer)

☐

Rule 14d-1(d) (Cross-Border Third-Party Tender Offer)

Items 1 through 9 and Item 11.

This Tender Offer Statement on Schedule TO (together with any amendments and supplements hereto, the “Schedule TO”) relates to the offer by Basil Merger Corporation, a Delaware corporation and a wholly-owned subsidiary of Wonder Group, Inc., a Delaware corporation (“Wonder”), to purchase all of the issued and outstanding shares of Class A common stock, par value $0.0001 per share (the “Shares”), of Blue Apron Holdings, Inc., a Delaware corporation (“Blue Apron”), which constitute all of the issued and outstanding shares of capital stock of Blue Apron, at a purchase price of $13.00 per Share, net to the stockholder in cash, without interest and less any applicable tax withholding, upon the terms and subject to the conditions set forth in the Offer to Purchase, dated October 13, 2023 (as it may be amended or supplemented from time to time, the “Offer to Purchase”), and in the related Letter of Transmittal (as it may be amended or supplemented from time to time, the “Letter of Transmittal”), copies of which are attached hereto as Exhibits (a)(1)(A) and (a)(1)(B), respectively.

All information contained in the Offer to Purchase (including Schedule I thereto) and the related Letter of Transmittal is hereby expressly incorporated herein by reference in response to Items 1 through 9 and Item 11 of this Schedule TO, except as otherwise set forth below.

Item 10. Financial Statements.

Not applicable.

Item 12. Exhibits.

| |

Exhibit No.

|

|

|

Description

|

|

| |

(a)(1)(A)*

|

|

|

|

|

| |

(a)(1)(B)*

|

|

|

|

|

| |

(a)(1)(C)*

|

|

|

|

|

| |

(a)(1)(D)*

|

|

|

|

|

| |

(a)(1)(E)*

|

|

|

|

|

| |

(a)(1)(F)

|

|

|

Joint Press Release issued on September 29, 2023 (incorporated by reference to Exhibit 99.1 to the Schedule TO-C filed by Wonder Group, Inc. with the Securities and Exchange Commission on September 29, 2023).

|

|

| |

(a)(1)(G)

|

|

|

Social Media Content, dated September 29, 2023 (incorporated by reference to Exhibit 99.2 to the Schedule TO-C filed by Wonder Group, Inc. with the Securities and Exchange Commission on September 29, 2023).

|

|

| |

(b)

|

|

|

Not applicable.

|

|

| |

(d)(1)

|

|

|

Agreement and Plan of Merger, dated September 28, 2023, by and among Wonder Group, Inc., Basil Merger Corporation and Blue Apron Holdings, Inc. (incorporated by reference to Exhibit 2.1 to the Current Report on Form 8-K filed by Blue Apron Holdings, Inc. with the Securities and Exchange Commission on September 29, 2023 (File No. 001-38134)).

|

|

| |

(d)(2)

|

|

|

Tender and Support Agreement, dated September 28, 2023, by and among Blue Apron Holdings, Inc., Wonder Group, Inc., Basil Merger Corporation, and FreshRealm, Inc. (incorporated by reference to Exhibit 2.2 to the Current Report on Form 8-K filed by Blue Apron Holdings, Inc. with the Securities and Exchange Commission on September 29, 2023 (File No. 001-38134)).

|

|

| |

(d)(3)*

|

|

|

|

|

| |

Exhibit No.

|

|

|

Description

|

|

| |

(d)(4)*

|

|

|

|

|

| |

(d)(5)*

|

|

|

|

|

| |

(g)

|

|

|

Not applicable.

|

|

| |

(h)

|

|

|

Not applicable.

|

|

| |

107*

|

|

|

|

|

*

Filed herewith.

SIGNATURES

After due inquiry and to the best knowledge and belief of the undersigned, each of the undersigned certifies that the information set forth in this statement is true, complete and correct.

Date: October 13, 2023

BASIL MERGER CORPORATION

/s/ Jay Naik

Name:

Jay Naik

Title:

President

WONDER GROUP, INC.

/s/ Jay Naik

Name:

Jay Naik

Title:

President

Exhibit (a)(1)(A)

Offer to Purchase

All Outstanding Shares of Class A Common Stock

of

BLUE APRON HOLDINGS, INC.

at

$13.00 per share, net in cash, without interest

by

BASIL MERGER CORPORATION

a wholly owned subsidiary of

WONDER GROUP, INC.

| |

|

THE OFFER AND WITHDRAWAL RIGHTS WILL EXPIRE AT ONE MINUTE PAST 11:59 P.M., EASTERN TIME, ON NOVEMBER 9, 2023, UNLESS THE OFFER IS EXTENDED OR EARLIER TERMINATED.

|

|

|

Basil Merger Corporation, a Delaware corporation (“Purchaser”) and a wholly owned subsidiary of Wonder Group, Inc., a Delaware corporation (“Wonder”), is offering to purchase all of the issued and outstanding shares of Class A common stock, par value $0.0001 per share (the “Shares”), of Blue Apron Holdings, Inc., a Delaware corporation (“Blue Apron”), which constitute all of the issued and outstanding shares of capital stock of Blue Apron, at a purchase price of $13.00 per Share (the “Offer Price”), net to the stockholder in cash, without interest and less any applicable tax withholding, upon the terms and subject to the conditions set forth in this Offer to Purchase and in the related Letter of Transmittal (which, together with this Offer to Purchase, as each may be amended or supplemented from time to time, collectively constitute the “Offer”).

The Offer is being made pursuant to an Agreement and Plan of Merger, dated September 28, 2023 (as it may be amended from time to time, the “Merger Agreement”), by and among Blue Apron, Wonder and Purchaser, pursuant to which, after consummation of the Offer and subject to the satisfaction or waiver of certain conditions, Purchaser will merge with and into Blue Apron pursuant to Section 251(h) of the General Corporation Law of the State of Delaware, as amended (the “DGCL”), upon the terms and subject to the conditions set forth in the Merger Agreement, with Blue Apron continuing as the surviving corporation (the “Surviving Corporation”) and becoming a wholly owned subsidiary of Wonder (the “Merger”). At the time at which the Merger shall become effective upon the filing of a certificate of merger with the Secretary of State of the State of Delaware or at such subsequent time or date as Wonder and Blue Apron shall agree and specify in the certificate of merger, subject to the terms of the Merger Agreement (such time, the “Effective Time”), each Share issued and outstanding immediately prior to the Effective Time (other than (i) Shares held in the treasury of Blue Apron or by any wholly owned subsidiary of Blue Apron (each, a “Blue Apron Subsidiary”) immediately prior to the Effective Time, (ii) Shares irrevocably accepted for purchase in the Offer by Purchaser, (iii) Shares held by Wonder, Purchaser or any other wholly owned subsidiary of Wonder immediately prior to the Effective Time, or (iv) Shares issued and outstanding immediately prior to the Effective Time that are held by a holder or beneficially by a “beneficial owner” (as defined in Section 262(a) of the DGCL) who is entitled to demand and properly demands appraisal rights of such Shares pursuant to, and who is complying in all respects with the provisions of Section 262 of the DGCL (until such time as such person effectively withdraws, fails to perfect or otherwise loses such person’s appraisal rights under the DGCL with respect to such shares, at which time such shares shall cease to be dissenting shares (the “Dissenting Shares”)) shall automatically convert into the right to receive an amount in cash equal to the Offer Price, without interest and less any applicable tax withholding, from Purchaser (the “Merger Consideration”).

Under no circumstances will interest be paid on the purchase price for the Shares accepted for payment in the Offer, including by reason of any extension of the Offer or any delay in making payment for the Shares.

The obligation of Purchaser to accept for payment and pay for Shares validly tendered (and not properly withdrawn) pursuant to the Offer is subject to the satisfaction of, among other conditions the Minimum Condition (as defined below in Section 15 — “Conditions of the Offer”). The Offer also is subject to other customary conditions as set forth in this Offer to Purchase. See Section 15 — “Conditions of the Offer.” There is no financing condition to the Offer and the Merger.

The Board of Directors of Blue Apron (the “Blue Apron Board”) unanimously (i) determined and declared that the Offer, the Merger and the other transactions contemplated by the Merger Agreement, on the terms and conditions set forth in the Merger Agreement (collectively, the “Transactions”), are advisable, and in the best interests of, Blue Apron and its stockholders, (ii) resolved that Blue Apron was authorized to enter into and is authorized to perform its obligations under the Merger Agreement, providing for the consummation of the Transactions, (iii) resolved that the Merger Agreement and the Merger will be effected as soon as practicable following the consummation of the Offer and will be governed by and effected under Section 251(h) and the other relevant provisions of the DGCL and (iv) recommended that Blue Apron’s stockholders accept the Offer and tender their Shares pursuant to the Offer.

A summary of the principal terms and conditions of the Offer appears in the “Summary Term Sheet” beginning on page i of this Offer to Purchase. You should read this entire document carefully before deciding whether to tender your Shares in the Offer.

NEITHER THE OFFER NOR THE MERGER HAS BEEN APPROVED OR DISAPPROVED BY THE UNITED STATES SECURITIES AND EXCHANGE COMMISSION (THE “SEC”) OR ANY STATE SECURITIES COMMISSION, NOR HAS THE SEC OR ANY STATE SECURITIES COMMISSION PASSED UPON THE FAIRNESS OR MERITS OF THE OFFER OR THE MERGER OR UPON THE ACCURACY OR ADEQUACY OF THE INFORMATION CONTAINED IN THIS OFFER TO PURCHASE OR THE RELATED LETTER OF TRANSMITTAL. ANY REPRESENTATION TO THE CONTRARY IS UNLAWFUL AND A CRIMINAL OFFENSE.

The Information Agent for the Offer is:

1212 Avenue of the Americas, 17th Floor

New York, NY 10036

Banks and Brokerage Firms Please Call: 1 (212) 297-0720

Shareholders and All Others Call Toll-Free: 1 (844) 343-2625

Via Email: info@okapipartners.com

IMPORTANT

If you wish to tender all or a portion of your Shares to Purchaser in the Offer, you must:

•

If you hold your Shares directly as the holder of record, surrender the certificates evidencing such Shares (the “Share Certificates”) or confirm a book-entry transfer of such Shares into the Depositary’s account at The Depository Trust Company (“DTC”) (such a confirmation, a “Book-Entry Confirmation”) pursuant to the procedures set forth in Section 3 — “Procedures for Accepting the Offer and Tendering Shares” and complete and sign the Letter of Transmittal (or, in the case of a book-entry transfer, deliver an Agent’s Message (as defined below) in lieu of the Letter of Transmittal) that accompanies this Offer to Purchase in accordance with the instructions set forth therein and mail or deliver the Letter of Transmittal with any required signature guarantees and all other required documents to the Depositary (as defined below in the “Summary Term Sheet”). These materials must be delivered to the Depositary prior to the Expiration Time (as defined below).

•

If you hold your Shares through a broker, dealer, commercial bank, trust company or other nominee, request your broker, dealer, commercial bank, trust company or other nominee to tender your Shares through The Depository Trust Company’s (“DTC”) Automated Tender Offer Program (“ATOP”) prior to the Expiration Time.

Questions or requests for assistance may be directed to Okapi Partners LLC, the information agent for the Offer (the “Information Agent”), at the address and telephone number set forth on the back cover of this Offer to Purchase. Additional copies of this Offer to Purchase, the related Letter of Transmittal and other materials related to the Offer may be obtained at no cost to stockholders from the Information Agent. Additionally, copies of this Offer to Purchase, the related Letter of Transmittal and any other materials related to the Offer are available free of charge at www.sec.gov. You may also contact your broker, dealer, commercial bank, trust company or other nominee for assistance.

This Offer to Purchase and the related Letter of Transmittal contain important information, and you should read both carefully and in their entirety before making a decision with respect to the Offer.

TABLE OF CONTENTS

| |

|

|

|

|

|

ii |

|

|

| |

|

|

|

|

|

1 |

|

|

| |

|

|

|

|

|

3 |

|

|

| |

|

|

|

|

|

3 |

|

|

| |

|

|

|

|

|

5 |

|

|

| |

|

|

|

|

|

6 |

|

|

| |

|

|

|

|

|

8 |

|

|

| |

|

|

|

|

|

9 |

|

|

| |

|

|

|

|

|

11 |

|

|

| |

|

|

|

|

|

12 |

|

|

| |

|

|

|

|

|

12 |

|

|

| |

|

|

|

|

|

14 |

|

|

| |

|

|

|

|

|

14 |

|

|

| |

|

|

|

|

|

17 |

|

|

| |

|

|

|

|

|

35 |

|

|

| |

|

|

|

|

|

36 |

|

|

| |

|

|

|

|

|

37 |

|

|

| |

|

|

|

|

|

37 |

|

|

| |

|

|

|

|

|

39 |

|

|

| |

|

|

|

|

|

40 |

|

|

| |

|

|

|

|

|

41 |

|

|

| |

|

|

|

|

|

42 |

|

|

| |

SCHEDULE I

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

SUMMARY TERM SHEET

The information contained in this Summary Term Sheet is a summary only and is not meant to be a substitute for the more detailed description and information contained in the remainder of this Offer to Purchase, the related Letter of Transmittal and other materials related to the Offer. You are urged to read carefully this Offer to Purchase, the related Letter of Transmittal and other materials related to the Offer in their entirety. This Summary Term Sheet includes cross-references to other sections of this Offer to Purchase where you will find more complete descriptions of the topics mentioned below. The information concerning Blue Apron contained in this Summary Term Sheet and elsewhere in this Offer to Purchase has been provided by Blue Apron to Wonder and Purchaser or has been taken from, or is based upon, publicly available documents or records of Blue Apron on file with the SEC or other public sources at the time of the Offer. Wonder and Purchaser have not independently verified the accuracy and completeness of such information.

| |

Securities Sought

|

|

|

Subject to certain conditions, including the satisfaction of the Minimum Condition (as described in Section 15 — “Conditions of the Offer”), all of the issued and outstanding shares of Class A common stock, par value $0.0001 per share, of Blue Apron, which constitute all of the issued and outstanding shares of capital stock of Blue Apron.

|

|

| |

Price Offered Per Share

|

|

|

Upon the terms and subject to the conditions set forth in this Offer to Purchase and in the related Letter of Transmittal: $13.00, net to the stockholder in cash, without interest and less any applicable tax withholding.

|

|

| |

Scheduled Expiration of Offer

|

|

|

One minute past 11:59 P.M., Eastern Time, on November 9, 2023, unless the Offer is otherwise extended or earlier terminated.

|

|

| |

Purchaser

|

|

|

Basil Merger Corporation, a Delaware corporation and a wholly owned subsidiary of Wonder.

|

|

| |

Blue Apron Board Recommendation

|

|

|

The Blue Apron Board unanimously recommended that Blue Apron’s stockholders accept the Offer and tender their Shares pursuant to the Offer.

|

|

Who is offering to buy my securities?

•

Basil Merger Corporation, a Delaware corporation and a wholly owned subsidiary of Wonder, which was formed solely for the purpose of facilitating the acquisition of Blue Apron by Wonder, is offering to buy all Shares in exchange for the Offer Price.

•

Unless the context indicates otherwise, in this Offer to Purchase, we use the terms “us,” “we” and “our” to refer to Purchaser together with, where appropriate, Wonder. We use the term “Purchaser” to refer to Basil Merger Corporation alone, the term “Wonder” to refer to Wonder Group, Inc. alone and the term “Blue Apron” to refer to Blue Apron Holdings, Inc. alone.

See Section 8 — “Certain Information Concerning Wonder and Purchaser.”

What is the class and amount of securities sought pursuant to the Offer?

•

Purchaser is offering to purchase all of the issued and outstanding Shares on the terms and subject to the conditions set forth in this Offer to Purchase. In this Offer to Purchase, we use the term “Offer” to refer to this offer to purchase the Shares and the term “Shares” to refer to the issued and outstanding shares of Class A common stock, par value $0.0001 per share, of Blue Apron, which constitute all of the issued and outstanding shares of capital stock of Blue Apron, that are the subject of the Offer.

See Section 1 — “Terms of the Offer.”

Why are you making the Offer?

•

We are making the Offer because we want to acquire control of, and ultimately the entire equity interest in, Blue Apron. Following the consummation of the Offer, we intend to complete the Merger

(as defined below) as soon as practicable. Upon completion of the Merger, Blue Apron will become a wholly owned subsidiary of Wonder. In addition, we will cause the Shares to be delisted from The Nasdaq Stock Market (“Nasdaq”) and deregistered under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), after completion of the Merger.

Who can participate in the Offer?

•

The Offer is open to all holders and beneficial owners of the Shares.

How much are you offering to pay and what is the form of payment?

•

Purchaser is offering to pay $13.00 per Share, net to the stockholder in cash, without interest and less any applicable tax withholding.

See the “Introduction” to this Offer to Purchase.

Will I have to pay any fees or commissions?

•

If you are the holder of record of your Shares and you directly tender your Shares to us in the Offer, you will not need to pay brokerage fees, commission or similar expenses. If you own your Shares through a broker, dealer, commercial bank, trust company or other nominee, and your broker, dealer, commercial bank, trust company or other nominee tenders your Shares on your behalf, your broker, dealer, commercial bank, trust company or other nominee may charge you a fee for doing so. You should consult your broker, dealer, commercial bank, trust company or other nominee to determine whether any charges will apply.

See the “Introduction” to this Offer to Purchase and Section 18 — “Fees and Expenses.”

Is there an agreement governing the Offer?

•

Yes. Blue Apron, Wonder and Purchaser have entered into an Agreement and Plan of Merger, dated September 28, 2023 (as it may be amended from time to time, the “Merger Agreement”). The Merger Agreement contains the terms and conditions of the Offer and the Merger.

See Section 11 — “The Merger Agreement; Other Agreements — Merger Agreement” and Section 15 — “Conditions of the Offer.”

What are the material U.S. federal income tax consequences of tendering my Shares in the Offer or having my Shares exchanged for cash pursuant to the Merger?

•

The exchange of Shares for cash pursuant to the Offer or the Merger will be a taxable transaction for U.S. federal income tax purposes. A U.S. Holder (as defined below) who sells Shares pursuant to the Offer or receives cash in exchange for Shares pursuant to the Merger generally will recognize capital gain or loss for U.S. federal income tax purposes in an amount equal to the difference, if any, between (i) the amount of cash received and (ii) the U.S. Holder’s adjusted tax basis in the Shares sold pursuant to the Offer or converted pursuant to the Merger. See Section 5 — “Material U.S. Federal Income Tax Consequences” for a more detailed discussion of the tax treatment of the Offer and the Merger.

•

If you are a Non-U.S. Holder (as defined below), you generally will not be subject to U.S. federal income tax with respect to the sale of Shares pursuant to the Offer or receipt of cash in exchange for Shares pursuant to the Merger unless you have certain connections to the United States. See Section 5 — “Material U.S. Federal Income Tax Consequences” for a more detailed discussion of the tax treatment of the Offer and the Merger.

We urge you to consult with your own tax advisor as to the particular tax consequences to you of the Offer and the Merger in light of your particular circumstances (including the application and effect of any U.S. federal, state, local or non-U.S. income and other tax laws).

Does Purchaser have the financial resources to pay for all of the Shares that it is offering to purchase pursuant to the Offer?

•

Yes. We estimate that we will need approximately $103,000,000 in cash to purchase all of the Shares pursuant to the Offer and to complete the Merger. Wonder will provide Purchaser with sufficient funds

to purchase all Shares validly tendered (and not properly withdrawn) in the Offer. Wonder has and will continue to have cash on hand necessary to satisfy all of Purchaser’s payment obligations under the Merger Agreement and resulting from the Transactions. The Offer is not conditioned upon Wonder’s or Purchaser’s ability to finance or fund the purchase of the Shares pursuant to the Offer.

See Section 9 — “Source and Amount of Funds.”

Is Purchaser’s financial condition relevant to my decision to tender my Shares in the Offer?

•

We do not think Purchaser’s financial condition is relevant to your decision to tender Shares in the Offer because:

•

the Offer is being made for all issued and outstanding Shares solely for cash;

•

through Wonder, Purchaser will have sufficient funds available to purchase all Shares validly tendered (and not properly withdrawn) in the Offer and, if we consummate the Offer and the Merger, all Shares converted into the right to receive an amount in cash equal to the Offer Price in the Merger; and

•

the Offer and the Merger are not subject to any financing condition.

See Section 9 — “Source and Amount of Funds” and Section 11 — “The Merger Agreement; Other Agreements — Merger Agreement.”

Is there a minimum number of Shares that must be tendered in order for you to purchase any securities?

•

Yes. The obligation of Purchaser to accept for payment and pay for Shares validly tendered (and not properly withdrawn) pursuant to the Offer is subject to various conditions set forth in Section 15 — “Conditions of the Offer,” including the Minimum Condition. The “Minimum Condition” means that there have been validly tendered in the Offer and not validly withdrawn immediately prior to the Expiration Time (as defined below) that number of Shares that, when added to the number of Shares, if any, then owned by Wonder, Purchaser or any other wholly owned subsidiary of Wonder, would represent at least one share more than one-half of all Shares then outstanding. See Section 15 — “Conditions of the Offer.”

If you do not consummate the Offer, will you nevertheless consummate the Merger?

•

No. Neither we nor Blue Apron is under any obligation to pursue or consummate the Merger if the Offer is not consummated as set forth in this Offer to Purchase. See Section 11 — “The Merger Agreement; Other Agreements — Merger Agreement.”

How long do I have to decide whether to tender my Shares in the Offer?

•

You will have until the Expiration Time to tender your Shares in the Offer. The term “Expiration Time” means one minute past 11:59 P.M., Eastern Time, on November 9, 2023, unless the expiration of the Offer is extended to a subsequent date in accordance with the terms of the Merger Agreement, in which case the term “Expiration Time” means such subsequent time on such subsequent date. In addition, if, pursuant to the Merger Agreement, we decide to, or are required to, extend the Offer as described below, you will have an additional period of time to tender your Shares.

See Section 1 — “Terms of the Offer” and Section 3 — “Procedures for Accepting the Offer and Tendering Shares.”

Can the Offer be extended and under what circumstances?

•

Yes. The Merger Agreement contains provisions that govern the circumstances under which Purchaser is required or permitted to extend the Offer and under which Wonder is required to cause Purchaser to extend the Offer. Specifically, the Merger Agreement provides:

•

Purchaser may, in its sole discretion, extend the scheduled Expiration Time for one or more periods (not to exceed 10 business days each); provided, however that in no event shall Purchaser

be permitted to extend the Offer beyond one minute after 11:59 p.m. Eastern time, on the day that is the Outside Date (as defined below);

•

Purchaser shall extend the scheduled expiration date:

•

as required by applicable law (including for any period required by any rule, regulation, interpretation or position of the SEC);

•

if, at the then scheduled Expiration Time, any Offer Condition (as defined in Section 15 — “Conditions of the Offer”) has not been satisfied (and Wonder or Purchaser has not waived such condition in accordance with the terms of the Merger Agreement), Purchaser will extend the Offer for one or more periods not to exceed 10 business days if and to the extent requested by Blue Apron; and

•

if as of the then scheduled Expiration Time, the Outside Date would have otherwise occurred but shall have been extended pursuant to the Merger Agreement as a result of any action brought by Blue Apron to specifically enforce the terms or provisions of the Merger Agreement, Purchaser shall extend the Offer until one minute after 11:59 p.m., Eastern time, on the day that is the Outside Date as it may be so extended pursuant to the terms of the Merger Agreement.

In each case, Purchaser is not required to extend the Offer beyond the Outside Date and may only do so with Blue Apron’s consent. The “Outside Date” means February 28, 2024. See Section 1 — “Terms of the Offer” and Section 11 — “The Merger Agreement; Other Agreements — Merger Agreement.”

Will there be a subsequent offering period?

•

No, the Merger Agreement does not provide for a “subsequent offering period” in accordance with Rule 14d-11 under the Exchange Act without the prior written consent of Blue Apron.

How will I be notified if the Offer is extended?

•

If we extend the Offer, we intend to inform Computershare Trust Company, N.A., the depositary and paying agent for the Offer (the “Depositary”), of any extension, and will issue a press release announcing the extension no later than 9:00 a.m., Eastern time, on the business day after the previously scheduled Expiration Time.

See Section 1 — “Terms of the Offer.”

What are the most significant conditions to the Offer?

•

The obligation of Purchaser to accept for payment and pay for Shares validly tendered (and not properly withdrawn) pursuant to the Offer is subject to the satisfaction of a number of conditions by the scheduled Expiration Time of the Offer, including, among other conditions:

•

the Minimum Condition (as defined below in Section 15 — “Conditions of the Offer”);

•

the Representations Condition (as defined below in Section 15 — “Conditions of the Offer”); and

•

the Legal Restraint Condition (as defined below in Section 15 — “Conditions of the Offer”).

The above Offer Conditions are further described, and other Offer Conditions are described, below in Section 15 — “Conditions of the Offer.” The Offer and the Merger are not subject to any financing condition.

How do I tender my Shares?

•

If you hold your Shares directly as the holder of record, surrender the Share Certificates or confirm a book-entry transfer of such Shares into the Depositary’s account at DTC pursuant to the procedures set forth in Section 3 — “Procedures for Accepting the Offer and Tendering Shares” and complete and sign the Letter of Transmittal (or, in the case of a book-entry transfer, deliver an Agent’s Message in lieu of the Letter of Transmittal) that accompanies this Offer to Purchase in accordance with the

instructions set forth therein and mail or deliver the Letter of Transmittal with any required signature guarantees and all other required documents to the Depositary. These materials must be delivered to the Depositary prior to the Expiration Time.

•

If you hold your Shares through a broker, dealer, commercial bank, trust company or other nominee, request your broker, dealer, commercial bank, trust company or other nominee to tender your Shares through ATOP prior to the Expiration Time.

•

We are not providing for guaranteed delivery procedures. Therefore, Blue Apron stockholders must allow sufficient time for the necessary tender procedures to be completed during normal business hours of DTC, which end earlier than the Expiration Time. Normal business hours of DTC are between 8:00 a.m. and 5:00 p.m., Eastern Time, Monday through Friday. Blue Apron stockholders must tender their Shares in accordance with the procedures set forth in this Offer to Purchase and the related Letter of Transmittal prior to the Expiration Time. Tenders received by the Depositary after the Expiration Time will be disregarded and of no effect.

See Section 3 — “Procedures for Accepting the Offer and Tendering Shares.”

If I accept the Offer, how will I get paid?

•

If the Offer Conditions are satisfied and we accept your validly tendered Shares for payment, payment will be made by deposit of the aggregate purchase price for the Shares accepted in the Offer with the Depositary, which will act as agent for tendering stockholders for the purpose of receiving payments from Purchaser and transmitting payments, subject to any tax withholding required by applicable law, to tendering stockholders whose Shares have been accepted for payment.

See Section 3 — “Procedures for Accepting the Offer and Tendering Shares.”

Until what time may I withdraw previously tendered Shares?

•

You may withdraw your previously tendered Shares at any time until the Expiration Time. In addition, if we have not accepted your Shares for payment within 60 days of commencement of the Offer, you may withdraw them at any time after December 12, 2023, the 60th day after commencement of the Offer, until we accept your Shares for payment.

See Section 4 — “Withdrawal Rights.”

How do I properly withdraw previously tendered Shares?

•

To properly withdraw previously tendered Shares, you must deliver a written notice of withdrawal with the required information to the Depositary prior to the Expiration Time. If you tendered Shares by giving instructions to a broker, dealer, commercial bank, trust company or other nominee, you must instruct the broker, dealer, commercial bank, trust company or other nominee to arrange for the withdrawal of your Shares in a timely manner prior to the Expiration Time.

See Section 4 — “Withdrawal Rights.”

Has the Offer been approved by the Blue Apron Board?

•

Yes. The Blue Apron Board unanimously (i) determined and declared the Offer, the Merger and the other transactions contemplated by the Merger Agreement, on the terms and conditions set forth in the Merger Agreement (collectively, the “Transactions”), are advisable, and in the best interests of, Blue Apron and its stockholders, (ii) resolved that Blue Apron was authorized to enter into and is authorized to perform its obligations under the Merger Agreement, providing for the consummation of the Transactions, (iii) resolved that the Merger Agreement and the Merger will be effected as soon as practicable following the consummation of the Offer and will be governed by and effected under Section 251(h) and the other relevant provisions of the DGCL and (iv) recommended that Blue Apron’s stockholders accept the Offer and tender their Shares pursuant to the Offer.

Descriptions of the reasons for the Blue Apron Board’s recommendation and approval of the Offer are set forth in Blue Apron’s Solicitation/Recommendation Statement on Schedule 14D-9 (the “Schedule 14D-9”), which is being mailed to Blue Apron stockholders together with the Offer materials (including this Offer to Purchase and the related Letter of Transmittal).

•

Stockholders should carefully read the information set forth in the Schedule 14D-9, including the information set forth in Item 4 thereof under the sub-headings “Recommendation of the Company Board”, “Background of the Offer and the Merger” and “Reasons for the Recommendation.”

If Shares tendered pursuant to the Offer are purchased by Purchaser, will Blue Apron continue as a public company?

•

No. We expect to complete the Merger as soon as practicable following the consummation of the Offer. Once the Merger takes place, Blue Apron will become a wholly owned subsidiary of Wonder. Following the Merger, we will cause the Shares to be delisted from Nasdaq and deregistered under the Exchange Act.

See Section 13 — “Certain Effects of the Offer.”

Will a meeting of Blue Apron stockholders be required to approve the Merger?

•

No. Section 251(h) of the DGCL provides that, unless expressly required by its certificate of incorporation, no vote of stockholders will be necessary to authorize the merger of a constituent corporation which has a class or series of stock listed on a national securities exchange or held of record by more than 2,000 holders immediately prior to the execution of the applicable agreement of merger by such constituent corporation if, subject to certain statutory provisions:

•

the agreement of merger expressly permits or requires that the merger will be effected by Section 251(h) of the DGCL and provides that such merger be effected as soon as practicable following the consummation of the tender offer;

•

an acquiring corporation consummates a tender offer for all of the outstanding stock of such constituent corporation on the terms provided in such agreement of merger that, absent the provisions of Section 251(h) of the DGCL, would be entitled to vote on the adoption or rejection of the agreement of merger; provided, however, that such tender offer may be conditioned on the tender of a minimum number or percentage of shares of the stock of such constituent corporation, or any class or series thereof, and such offer may exclude any excluded stock (as defined in the DGCL);

•

immediately following the consummation of the tender offer, the stock that the acquiring corporation irrevocably accepts for purchase, together with the stock otherwise owned by the acquiring corporation or its affiliates, equals at least the percentage of shares of each class of stock of such constituent corporation that would otherwise be required to adopt the agreement of merger for such constituent corporation;

•

the acquiring corporation merges with or into such constituent corporation pursuant to such agreement of merger; and

•

each outstanding share (other than shares of excluded stock) of each class or series of stock of the constituent corporation that is the subject of and not irrevocably accepted for purchase in the offer is converted in such merger into, or into the right to receive, the same amount and type of consideration in the merger as was payable in the tender offer.

•

If the conditions to the Offer and the Merger are satisfied or waived (to the extent waivable), we are required by the Merger Agreement to effect the Merger pursuant to Section 251(h) of the DGCL without a meeting of Blue Apron stockholders and without a vote or any further action by Blue Apron stockholders.

See Section 16 — “Certain Legal Matters; Regulatory Approvals.”

If I do not tender my Shares but the Offer is consummated, what will happen to my Shares?

•

If the Offer is consummated, subject to the satisfaction or waiver of certain conditions set forth in the Merger Agreement (See Section 11 — “The Merger Agreement; Other Agreements — Merger Agreement”), Purchaser will merge with and into Blue Apron pursuant to Section 251(h) of the DGCL. At the Effective Time, each Share issued and outstanding immediately prior to the Effective Time (other than (i) Shares held in the treasury of Blue Apron or by any Blue Apron Subsidiary immediately prior to the Effective Time, (ii) Shares irrevocably accepted for purchase in the Offer by Purchaser, (iii) Shares held by Wonder, Purchaser or any other wholly owned subsidiary of Wonder immediately prior to the Effective Time, or (iv) Dissenting Shares) shall automatically convert into the right to receive the Merger Consideration.

•

If the Merger is completed, Blue Apron stockholders who do not tender their Shares in the Offer (other than stockholders who properly exercise appraisal rights) will receive the same Offer Price per Share that they would have received had they tendered their Shares in the Offer. Therefore, if the Offer is consummated and the Merger is completed, the only differences to you between tendering your Shares and not tendering your Shares in the Offer are that (i) you may be paid earlier if you tender your Shares in the Offer and (ii) appraisal rights will not be available to you if you tender Shares in the Offer, but will be available to you in the Merger if you do not tender Shares in the Offer and you comply in all respects with Section 262 of the DGCL. See Section 17 — “Appraisal Rights.”

•

However, in the unlikely event that the Offer is consummated but the Merger is not completed, the number of Blue Apron stockholders and the number of Shares that are still in the hands of the public may be so small that there will no longer be an active public trading market (or, possibly, there may not be any public trading market) for the Shares. Also, in such event, it is possible that the Shares will be delisted from Nasdaq and Blue Apron will no longer be required to make filings with the SEC under the Exchange Act.

See the “Introduction” to this Offer to Purchase, Section 11 — “The Merger Agreement; Other Agreements — Merger Agreement” and Section 13 — “Certain Effects of the Offer.”

What will happen to my stock options, restricted stock units and performance stock units?

•

The Offer is being made only for Shares, and not for outstanding stock options granted pursuant to any Company Stock Plan (as defined below) (“Options”), restricted stock units granted under any Company Stock Plan which award vests based solely on the continued performance of services (“RSUs”) or restricted stock units granted under any Company Stock Plan which award vests based on the achievement of one or more performance metrics and the continued performance of services (“PSUs”), in each case, granted by Blue Apron with respect to Class A common stock of Blue Apron. Holders of outstanding unexercised Options, or outstanding RSUs or PSUs will receive payment for such Options, RSUs or PSUs following the Effective Time as provided in the Merger Agreement without participating in the Offer. Holders of outstanding vested but unexercised Options who wish to participate in the Offer must exercise such Options in accordance with the terms of the applicable option agreement and tender the Shares, if any, issued upon such exercise. Any exercise of outstanding Options should be completed sufficiently in advance of the Expiration Time to ensure the holder of such outstanding Options will have sufficient time to comply with the procedures for tendering Shares described below in Section 3 — “Procedures for Accepting the Offer and Tendering Shares.” Holders of outstanding unexercised Options that are not settled prior to the Expiration Time as provided above, and holders of unvested, RSUs and PSUs that are not settled prior to the Expiration Time will receive payment with respect to those Options, RSUs and PSUs as described in the following paragraphs.

•

Pursuant to the Merger Agreement, as of immediately prior to the Effective Time, each Option that is then outstanding but not then vested or exercisable, will become vested and exercisable in full. At the Effective Time, each such Option then outstanding (including any Option for which the vesting was accelerated immediately prior to the Effective Time as described in the preceding sentence) and unexercised will be cancelled and the holder thereof will be entitled to receive an amount in cash, without interest and less any applicable tax withholding, equal to the product obtained by multiplying (i) the total number of Shares underlying such Option and (ii) the excess, if any, of the Merger

Consideration over the exercise price per Share of such Option. Any Option that has an exercise price per Share that equals or exceeds the Merger Consideration will be cancelled for no consideration. The Merger Agreement provides that this payment will be made as promptly as practicable after the Effective Time (but in no event later than 10 business days after the Effective Time).

•

Pursuant to the Merger Agreement, as of immediately prior to the Effective Time, each RSU that is then outstanding but not then vested immediately prior to the Effective Time, will become vested in full. At the Effective Time, (i) each such RSU that is then outstanding and vested and (ii) each PSU that is outstanding and vested (including any PSU that becomes vested as a result of any applicable performance-vesting conditions becoming satisfied in connection with the Merger) will automatically be cancelled and the holder thereof will be entitled to receive an amount of cash, without interest and less any applicable tax withholding, equal to the product obtained by multiplying (i) the Merger Consideration by (ii) the number of Shares underlying such vested RSU or vested PSU, as applicable. The Merger Agreement provides that this payment will be made, at or as promptly as practicable after the Effective Time (but in no event later than 10 business days after the Effective Time) or at such later date as required under Section 409A of the Internal Revenue Code of 1986, as amended. Any PSU that is not vested (and does not become vested in connection with the Merger) as of immediately prior to the Effective Time shall be cancelled, without any consideration being payable in respect thereof and have no further effect.

See Section 11 — “The Merger Agreement; Other Agreements — Merger Agreement.”

What will happen to outstanding warrants to purchase Shares?

•

As of immediately prior to the Effective Time, that certain Class A common stock purchase warrant issued by Blue Apron to FreshRealm, Inc. (“FreshRealm”) on June 9, 2023 (such warrant, the “Supplier Warrant”) shall automatically, if then-outstanding and unexercised and not previously exercised, as a result of the acceptance for purchase of all Shares validly tendered (and not validly withdrawn) pursuant to the Offer and without any action on the part of the holder of the Supplier Warrant, be deemed to be exercised in full in a “cashless exercise” prior to the closing of the Merger and in accordance with the terms of such Supplier Warrant (including the terms of the Merger Agreement).

•

As of immediately prior to the date and time at which Purchaser irrevocably accepts for purchase all Shares validly tendered (and not validly withdrawn) pursuant to the Offer (the “Acceptance Time”), each warrant to purchase Shares (not including the Supplier Warrant) (such warrants, the “Common Warrants”) that is then-outstanding and unexercised shall, in accordance with such specified Common Warrant’s terms and with no further action by the holders thereof or Blue Apron, automatically terminate and be cancelled and of no further force or effect and for no consideration.

What will happen to the Company Stock Plans (as defined below)?

•

Blue Apron’s 2012 Equity Incentive Plan and 2017 Stock Incentive Plan (each, a “Company Stock Plan”) will be terminated effective as of the Effective Time.

See Section 11 — “The Merger Agreement; Other Agreements — Merger Agreement.”

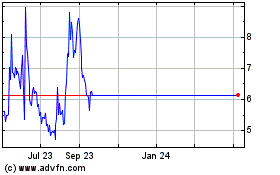

What is the market value of my Shares as of a recent date?

•

On September 28, 2023, the last full day of trading before the public announcement of the execution of the Merger Agreement, the reported closing price of the Shares on Nasdaq was $5.49 per Share. On October 12, 2023, the last full day of trading before commencement of the Offer, the reported closing price of the Shares on Nasdaq was $12.90 per Share. We encourage you to obtain a recent market quotation for the Shares before deciding whether to tender your Shares.

See Section 6 — “Price Range of Shares; Dividends on the Shares.”

Have any stockholders already agreed to tender their Shares in the Offer or to otherwise support the Offer?

•

Yes. On September 28, 2023, in connection with the execution and delivery of the Merger Agreement, FreshRealm, solely in its capacity as a beneficial owner of Shares, entered into a tender and support

agreement (the “Tender and Support Agreement”) with Wonder and Purchaser, pursuant to which FreshRealm agreed, among other things, (i) to fully exercise the Supplier Warrant at least one day before the Offer is commenced, (ii) to tender all of its Shares in the Offer, subject to certain exceptions (including the valid termination of the Merger Agreement), (iii) to vote against other proposals to acquire Blue Apron and (iv) to certain other restrictions on its ability to take actions with respect to Blue Apron and its Shares.

•

The Tender and Support Agreement terminates automatically upon the earliest of (i) the termination or withdrawal of the Offer or the termination of the Merger Agreement in accordance with its terms, (ii) the Effective Time, (iii) any modification, waiver or amendment to the Merger Agreement or the Offer that is effected without FreshRealm’s prior written consent (x) that decreases the amount, or changes the form, of consideration payable pursuant to the terms of the Merger Agreement, imposes any non-immaterial conditions, requirements or restrictions on FreshRealm’s right to receive the consideration payable to FreshRealm or that materially delays the timing of any such payment or (y) is otherwise in a manner adverse (directly or indirectly) to FreshRealm or (iv) the mutual written consent of Wonder and FreshRealm. As of October 12, 2023, FreshRealm beneficially owned approximately 16.5% of the outstanding Shares.

See Section 11 — “The Merger Agreement; Other Agreements — Tender and Support Agreements.”

Will I have appraisal rights in connection with the Offer?

•

No appraisal rights will be available to holders of Shares who tender such Shares in connection with the Offer. However, if Purchaser purchases Shares pursuant to the Offer and the Merger is completed, holders of Shares immediately prior to the Effective Time who (i) did not tender their Shares in the Offer, (ii) follow the procedures set forth in Section 262 of the DGCL and (iii) do not thereafter lose such holders’ appraisal rights (by withdrawal, failure to perfect or otherwise), in each case in accordance with the DGCL, will be entitled to have their Shares appraised by the Delaware Court of Chancery and to receive payment of the “fair value” of such Shares, exclusive of any element of value arising from the accomplishment or expectation of the Merger, together with interest thereon. The “fair value” could be greater than, less than or the same as the Offer Price. More information regarding Section 262 of the DGCL, including how to access it without subscription or cost, is set forth in Blue Apron’s Solicitation/Recommendation Statement on Schedule 14D-9, which is being mailed to Blue Apron stockholders together with the Offer materials (including this Offer to Purchase and the related Letter of Transmittal).

See Section 17 — “Appraisal Rights.”

Whom should I call if I have questions about the Offer?

•

You may call Okapi Partners LLC, the information agent for the Offer (the “Information Agent”), toll free at +1 (844) 343-2625. See the back cover of this Offer to Purchase for additional contact information for the Information Agent.

INTRODUCTION

Basil Merger Corporation, a Delaware corporation (“Purchaser”) and a wholly owned subsidiary of Wonder Group, Inc., a Delaware corporation (“Wonder”), is offering to purchase all of the issued and outstanding shares of Class A common stock, par value $0.0001 per share (the “Shares”), of Blue Apron Holdings, Inc., a Delaware corporation (“Blue Apron”), which constitute all of the issued and outstanding shares of capital stock of Blue Apron, at a purchase price of $13.00 per Share (the “Offer Price”), net to the stockholder in cash, without interest and less any applicable tax withholding, upon the terms and subject to the conditions set forth in this Offer to Purchase and in the related Letter of Transmittal (which, together with this Offer to Purchase, as each may be amended or supplemented from time to time, collectively constitute the “Offer”).

The Offer is being made pursuant to an Agreement and Plan of Merger, dated September 28, 2023 (as it may be amended from time to time, the “Merger Agreement”), by and among Blue Apron, Wonder and Purchaser, pursuant to which, after consummation of the Offer and subject to the satisfaction or waiver of certain conditions, Purchaser will merge with and into Blue Apron pursuant to Section 251(h) of the General Corporation Law of the State of Delaware, as amended (the “DGCL”), upon the terms and subject to the conditions set forth in the Merger Agreement, with Blue Apron continuing as the surviving corporation (the “Surviving Corporation”) and becoming a wholly owned subsidiary of Wonder (the “Merger”). At the time at which the Merger shall become effective upon the filing of a certificate of merger with the Secretary of State of the State of Delaware or at such subsequent time or date as Wonder and Blue Apron shall agree and specify in the certificate of merger, subject to the terms of the Merger Agreement (such time, the “Effective Time”), each Share issued and outstanding immediately prior to the Effective Time (other than (i) Shares held in the treasury of Blue Apron or by any wholly owned subsidiary of Blue Apron (each, a “Blue Apron Subsidiary”) immediately prior to the Effective Time, (ii) Shares irrevocably accepted for purchase in the Offer by Purchaser, (iii) Shares held by Wonder, Purchaser or any other wholly owned subsidiary of Wonder immediately prior to the Effective Time or (iv) Shares issued and outstanding immediately prior to the Effective Time that are held by a holder or beneficially by a “beneficial owner” (as defined in Section 262(a) of the DGCL) who is entitled to demand and properly demands appraisal rights of such Shares pursuant to, and who is complying in all respects with the provisions of Section 262 of the DGCL until such time as such person effectively withdraws, fails to perfect or otherwise loses such person’s appraisal rights under the DGCL with respect to such shares, at which time such shares shall cease to be dissenting shares (the “Dissenting Shares”)) shall automatically convert into the right to receive an amount in cash equal to the Offer Price, without interest and less any applicable tax withholding, from Purchaser (the “Merger Consideration”).

Under no circumstances will interest be paid on the purchase price for the Shares accepted for payment in the Offer, including by reason of any extension of the Offer or any delay in making payment for the Shares.

The Merger Agreement is more fully described in Section 11 — “The Merger Agreement; Other Agreements — Merger Agreement.”

Tendering stockholders who are holders of record of their Shares and who tender directly to the Depositary (as defined above in the “Summary Term Sheet”) will not be obligated to pay brokerage fees or commissions or, except as otherwise provided in Section 6 of the Letter of Transmittal, stock transfer taxes with respect to the purchase of Shares by Purchaser pursuant to the Offer. Stockholders who hold their Shares through a broker, dealer, commercial bank, trust company or other nominee should consult such broker, dealer, commercial bank, trust company or other nominee as to whether it charges any service fees or commissions.

The Board of Directors of Blue Apron (the “Blue Apron Board”) unanimously (i) determined and declared the Offer, the Merger and the other transactions contemplated by the Merger Agreement, on the terms and conditions set forth in the Merger Agreement (collectively, the “Transactions”), are advisable, and in the best interests of, Blue Apron and its stockholders, (ii) resolved that Blue Apron was authorized to enter into and is authorized to perform its obligations under the Merger Agreement, providing for the consummation of the Transactions, (iii) resolved that the Merger Agreement and the Merger will be effected as soon as practicable following the consummation of the Offer and will be governed by and effected

under Section 251(h) and the other relevant provisions of the DGCL and (iv) recommended that Blue Apron’s stockholders accept the Offer and tender their Shares pursuant to the Offer.

Descriptions of the Blue Apron Board’s reasons for authorizing and approving the Merger Agreement and the consummation of the Transactions are set forth in Blue Apron’s Solicitation/Recommendation Statement on Schedule 14D-9 (the “Schedule 14D-9”), which is being mailed to Blue Apron stockholders together with the Offer materials (including this Offer to Purchase and the related Letter of Transmittal). Stockholders should carefully read the information set forth in the Schedule 14D-9, including the information set forth in Item 4 under the sub-headings “Recommendation of the Company Board”, “Background of the Offer and the Merger” and “Reasons for the Recommendation.”

The obligation of Purchaser to accept for payment and pay for Shares validly tendered (and not properly withdrawn) pursuant to the Offer is subject to the satisfaction of, among other conditions the Minimum Condition (as defined below in Section 15 — “Conditions of the Offer”). The Offer also is subject to other customary conditions as set forth in this Offer to Purchase. See Section 15 — “Conditions of the Offer.” There is no financing condition to the Offer and the Merger.

Blue Apron has advised Wonder that at a meeting of the Blue Apron Board held on September 28, 2023, J.P. Morgan Securities LLC (“J.P. Morgan”) rendered its oral opinion to the Blue Apron Board, which was subsequently confirmed by delivery of a written opinion dated September 28, 2023, that, as of such date, and based upon and subject to the various assumptions made, procedures followed, matters considered, and qualifications and limitations upon the review undertaken in preparing its opinion, the Offer Price, to be paid to holders of Shares (other than (i) Shares held in the treasury of Blue Apron or by any Blue Apron Subsidiary immediately prior to the Effective Time, (ii) Shares irrevocably accepted for purchase in the Offer by Purchaser, (iii) Shares owned by Wonder, Purchaser or any other wholly owned subsidiary of Wonder immediately prior to the Effective Time, and (iv) Dissenting Shares (the shares referred to in clauses (i), (ii), (iii) and (iv), the “Excluded Shares”)) pursuant to the Merger Agreement was fair, from a financial point of view, to such holders. The full text of the written opinion delivered by J.P. Morgan to the Blue Apron Board is attached as Annex A to the Schedule 14D-9.

THIS OFFER TO PURCHASE AND THE RELATED LETTER OF TRANSMITTAL CONTAIN IMPORTANT INFORMATION AND SHOULD BE READ CAREFULLY IN THEIR ENTIRETY BEFORE MAKING ANY DECISION WITH RESPECT TO THE OFFER.

THE TENDER OFFER

1.

Terms of the Offer

Purchaser is offering to purchase all of the outstanding Shares, which constitute all of the issued and outstanding shares of capital stock of Blue Apron, at the Offer Price, net to the stockholder in cash, without interest and less any applicable tax withholding. Upon the terms and subject to the conditions of the Offer (including, if the Offer is extended or amended, the terms and conditions of such extension or amendment), we will accept for payment and, promptly after the Expiration Time, pay for all Shares validly tendered prior to the Expiration Time and not properly withdrawn as described in Section 4 — “Withdrawal Rights.”

The Offer is conditioned upon, among other things, the satisfaction of the Minimum Condition and the other conditions described in Section 15 — “Conditions of the Offer.”

The Merger Agreement contains provisions that govern the circumstances under which Purchaser is required or permitted to extend the Offer and under which Wonder is required to cause Purchaser to extend the Offer. Specifically, the Merger Agreement provides:

a.

Purchaser may, in its sole discretion, extend the scheduled Expiration Time for one or more periods (not to exceed 10 business days each); provided, however that in no event shall Purchaser be permitted to extend the Offer beyond one minute after 11:59 p.m. Eastern time, on the day that is the Outside Date;

b.

Purchaser shall extend the scheduled expiration date:

i.

as required by applicable law (including for any period required by any rule, regulation, interpretation or position of the SEC);

ii.

if, at the then scheduled Expiration Time, any Offer Condition (as defined in Section 15 — “Conditions of the Offer”) has not been satisfied (and Wonder or Purchaser has not waived such condition in accordance with the terms of the Merger Agreement), Purchaser will extend the Offer for one or more periods not to exceed 10 business days if and to the extent requested by Blue Apron; and

iii.

if as of the then scheduled Expiration Time, the Outside Date would have otherwise occurred but shall have been extended pursuant to the Merger Agreement as a result of any action brought by Blue Apron to specifically enforce the terms or provisions of the Merger Agreement, Purchaser shall extend the Offer until one minute after 11:59 p.m., Eastern time, on the day that is the Outside Date as it may be so extended pursuant to the terms of the Merger Agreement.

In each case, Purchaser is not required to extend the Offer beyond the Outside Date and may only do so with Blue Apron’s consent. The “Outside Date” means February 28, 2024. See Section 1 — “Terms of the Offer” and Section 11 — “The Merger Agreement; Other Agreements — Merger Agreement.”

If we extend the Offer, are delayed in our acceptance of Shares for payment or are unable to accept Shares for payment pursuant to the Offer for any reason, then, without prejudice to our rights under the Offer and the Merger Agreement, the Depositary may retain tendered Shares on our behalf, and such Shares may not be withdrawn except to the extent that tendering stockholders are entitled to withdrawal rights as described in Section 4 — “Withdrawal Rights,” and as otherwise required by Rule 14e-1(c) under the Exchange Act.

Purchaser expressly reserves the right to waive, in its sole discretion, in whole or in part, any Offer Condition or modify the terms of the Offer in any manner not inconsistent with the Merger Agreement, except that Blue Apron’s prior written approval is required for Purchaser to, and for Wonder to permit Purchaser to:

(i)

change the form of consideration payable in the Offer;

(ii)

decrease the Offer Price;

(iii)

decrease the maximum number of Shares sought to be purchased in the Offer or otherwise change the Offer so that it is for fewer than all of the outstanding Shares;

(iv)

extend or otherwise change the Expiration Time, except to the extent permitted or required by the Merger Agreement;

(v)

terminate the Offer, except pursuant to the Merger Agreement;

(vi)

provide any “subsequent offering period” (or any extension thereof) within the meaning of Rule 14d-11 promulgated under the Exchange Act;

(vii)

amend, change or waive the Minimum Condition (as defined below), the Legal Restraint Condition (as defined below) or the Company Material Adverse Effect Condition;

(viii)

amend, modify or supplement any Offer Condition or the terms of the Offer in any manner adverse to holders of Shares or that would, individually or in the aggregate, reasonably be expected to prevent or delay the consummation of the Offer or prevent, delay or impair the ability of Wonder or Purchaser to consummate the Offer, the Merger or the other Transactions; or

(ix)

impose any condition to the Offer other than the Offer Conditions.

Any extension, delay, termination or amendment of the Offer will be followed as promptly as practicable by a public announcement thereof, and such announcement in the case of an extension will be made no later than 9:00 a.m., Eastern Time, on the business day after the previously scheduled Expiration Time. Without limiting the manner in which we may choose to make any public announcement, we intend to make announcements regarding the Offer by issuing a press release and making any appropriate filing with the SEC.

If we make a material change in the terms of the Offer or the information concerning the Offer or if we waive a material condition of the Offer, we will disseminate additional tender offer materials and extend the Offer, in each case, if and to the extent required by Rules 14d-4(d)(1), 14d-6(c) and 14e-1 under the Exchange Act. The minimum period during which the Offer must remain open following material changes in the terms of the Offer or information concerning the Offer, other than a change in price or a change in percentage of securities sought, will depend upon the facts and circumstances, including the relative materiality of the terms or information changes. We understand that in the SEC’s view, an offer should remain open for a minimum of five business days from the date the material change is first published, sent or given to holders of Shares, and with respect to a change in price or a change in the percentage of Shares sought, a minimum of 10 business days is required to allow for adequate dissemination to holders of Shares and investor response.

If, on or before the Expiration Time, we increase the consideration being paid for Shares accepted for payment in the Offer, such increased consideration will be paid to all holders whose Shares are purchased in the Offer, whether or not such Shares were tendered before the announcement of the increase in the consideration.

The obligation of Purchaser to irrevocably accept for payment, and pay for, all Shares validly tendered (and not properly withdrawn) pursuant to the Offer is subject to the satisfaction of the Offer Conditions. Notwithstanding any other term of the Offer or the Merger Agreement, Purchaser will not be required to, and Wonder will not be required to cause Purchaser to, accept for payment or, subject to any applicable rules and regulations of the SEC, including Rule 14e-1(c) under the Exchange Act, to pay for any tendered Shares if any of the Offer Conditions has not been satisfied at the scheduled Expiration Time. Under certain circumstances described in the Merger Agreement, Wonder or Blue Apron may terminate the Merger Agreement.

Blue Apron has provided us with its stockholder list and security position listings for the purpose of disseminating this Offer to Purchase, the related Letter of Transmittal and other materials related to the Offer to holders of Shares. This Offer to Purchase, the related Letter of Transmittal and other materials related to the Offer, including the Schedule 14D-9, will be mailed to record holders of Shares whose names appear on Blue Apron’s stockholder list and will be furnished for subsequent transmittal to beneficial owners

of Shares to brokers, dealers, commercial banks, trust companies and other nominees whose names, or the names of whose nominees, appear on Blue Apron’s stockholder list or, if applicable, who are listed as participants in a clearing agency’s security position listing.

2.

Acceptance for Payment and Payment for Shares

Subject to the terms of the Offer and the Merger Agreement and subject to the satisfaction or waiver of all of the Offer Conditions set forth in Section 15 — “Conditions of the Offer,” we will accept for payment and pay for all Shares validly tendered (and not properly withdrawn) pursuant to the Offer as promptly as practicable after the scheduled Expiration Time and, in any event, not more than two business days after the Expiration Time (the date and time Purchaser irrevocably accepts for purchase all the Shares validly tendered (and not validly withdrawn) pursuant to the Offer, the “Acceptance Time”). Subject to compliance with Rule 14e-1(c) and Rule 14d-11(e) under the Exchange Act, as applicable, and with the Merger Agreement, we expressly reserve the right to delay payment for Shares in order to comply in whole or in part with any applicable law or regulation. See Section 16 — “Certain Legal Matters; Regulatory Approvals.”

In all cases, we will pay for Shares validly tendered and accepted for payment pursuant to the Offer only after timely receipt by the Depositary of (i) to the extent the Shares are not already held with the Depositary, the certificates evidencing such Shares (the “Share Certificates”) or confirmation of a book-entry transfer of such Shares into the Depositary’s account at The Depository Trust Company (“DTC”) (such a confirmation, a “Book-Entry Confirmation”) pursuant to the procedures set forth in Section 3 — “Procedures for Accepting the Offer and Tendering Shares,” (ii) the Letter of Transmittal, properly completed and duly executed, with any required signature guarantees (or, in the case of a book-entry transfer or a tender through DTC’s Automated Tender Offer Program (“ATOP”), an Agent’s Message (as defined below) in lieu of the Letter of Transmittal) and (iii) any other documents required by the Letter of Transmittal or the Depositary, in each case prior to the Expiration Time. Accordingly, tendering stockholders may be paid at different times depending upon when the Share Certificates and Letter of Transmittal, or Book-Entry Confirmations and Agent’s Message, in each case, with respect to Shares that are actually received by the Depositary.

The term “Agent’s Message” means a message transmitted through electronic means by DTC in accordance with the normal procedures of DTC to, and received by, the Depositary and forming part of a Book-Entry Confirmation, that states that DTC has received an express acknowledgment from the participant in DTC tendering the Shares that are the subject of such Book-Entry Confirmation that such participant has received and agrees to be bound by the terms of, the Letter of Transmittal, and that Purchaser may enforce such agreement against such participant. The term “Agent’s Message” also includes any hard copy printout evidencing such message generated by a computer terminal maintained at the Depositary’s office.

For purposes of the Offer, we will be deemed to have accepted for payment, and thereby purchased, Shares validly tendered to Purchaser (and not properly withdrawn) as, if and when we give oral or written notice to the Depositary of our acceptance for payment of such Shares pursuant to the Offer. Upon the terms and subject to the conditions of the Offer, payment for Shares accepted for payment pursuant to the Offer will be made by deposit of the purchase price for such Shares with the Depositary, which will act as agent for tendering stockholders for the purpose of receiving payments from us and transmitting such payments to tendering stockholders whose Shares have been accepted for payment. If we extend the Offer, are delayed in our acceptance of Shares for payment or are unable to accept Shares for payment pursuant to the Offer for any reason, then, without prejudice to our rights under the Offer and the Merger Agreement, the Depositary may retain tendered Shares on our behalf, and such Shares may not be withdrawn except to the extent that tendering stockholders are entitled to withdrawal rights as described in Section 4 — “Withdrawal Rights.” However, our ability to delay the payment for Shares that we have accepted for payment is limited by Rule 14e-1(c) under the Exchange Act, which requires us to pay the consideration offered or return the securities deposited by or on behalf of stockholders promptly after the termination or withdrawal of the Offer. Under no circumstances will interest be paid on the purchase price for the Shares accepted for payment in the Offer, including by reason of any extension of the Offer or any delay in making payment for the Shares.

If any tendered Shares are not accepted for payment pursuant to the terms and conditions of the Offer for any reason, or if Share Certificates are submitted evidencing more Shares than are tendered, Share Certificates representing unpurchased Shares will be promptly returned, without expense to the tendering

stockholder (or, in the case of Shares tendered by book-entry transfer into the Depositary’s account at DTC pursuant to the procedure set forth in Section 3 — “Procedures for Accepting the Offer and Tendering Shares,” such Shares will be credited to an account maintained at DTC) following the Expiration Time.

3.

Procedures for Accepting the Offer and Tendering Shares

Valid Tenders. In order for a stockholder to validly tender Shares pursuant to the Offer, the Letter of Transmittal, properly completed and duly executed, together with any required signature guarantees (or, in the case of a book-entry transfer or a tender through DTC’s ATOP, an Agent’s Message in lieu of the Letter of Transmittal) and any other documents required by the Letter of Transmittal or the Depositary must be received by the Depositary at one of its addresses set forth on the back cover of this Offer to Purchase and, to the extent the Shares are not already held with the Depositary, either (i) in the case of certificated Shares, the Share Certificates evidencing tendered Shares must be received by the Depositary at such address or (ii) in the case of Shares held in book-entry form, such Shares must be tendered pursuant to the procedures for book-entry transfer described below under “Book-Entry Transfer” and a Book-Entry Confirmation must be received by the Depositary, in each case prior to the Expiration Time.

Book-Entry Transfer. The Depositary will establish an account with respect to the Shares at DTC for purposes of the Offer within two business days after the date of this Offer to Purchase. Any financial institution that is a participant in DTC’s system may make a book-entry delivery of Shares by causing DTC to transfer such Shares into the Depositary’s account at DTC in accordance with DTC’s procedures for such transfer. However, although delivery of Shares may be effected through book-entry transfer at DTC, either the Letter of Transmittal, properly completed and duly executed, together with any required signature guarantees, or an Agent’s Message in lieu of the Letter of Transmittal, and any other required documents, must, in any case, be received by the Depositary at one of its addresses set forth on the back cover of this Offer to Purchase prior to the Expiration Time. Delivery of documents to DTC does not constitute delivery to the Depositary.

No Guaranteed Delivery. We are not providing for guaranteed delivery procedures. Therefore, Blue Apron stockholders must allow sufficient time for the necessary tender procedures to be completed during normal business hours of DTC, which end earlier than the Expiration Time. Normal business hours of DTC are between 8:00 a.m. and 5:00 p.m., Eastern Time, Monday through Friday. Blue Apron stockholders must tender their Shares in accordance with the procedures set forth in this Offer to Purchase and the related Letter of Transmittal prior to the Expiration Time. Tenders received by the Depositary after the Expiration Time will be disregarded and of no effect.

Signature Guarantees for Shares. No signature guarantee is required on the Letter of Transmittal (i) if the Letter of Transmittal is signed by the holder(s) of record (which term, for purposes of this Section 3, includes any participant in DTC’s system whose name appears on a security position listing as the owner of the Shares) of the Shares tendered therewith, unless such holder or holders have completed either the box entitled “Special Delivery Instructions” or the box entitled “Special Payment Instructions” on the Letter of Transmittal or (ii) if the Shares are tendered for the account of a financial institution (including most commercial banks, savings and loan associations and brokerage houses) that is a member in good standing of the Security Transfer Agents Medallion Program or any other “eligible guarantor institution,” as such term is defined in Rule 17Ad-15 of the Exchange Act (each, an “Eligible Institution” and collectively, “Eligible Institutions”). In all other cases, all signatures on a Letter of Transmittal must be guaranteed by an Eligible Institution. See Instruction 1 of the Letter of Transmittal. If a Share Certificate is issued in the name of a person or persons other than the signers of the Letter of Transmittal, or if payment is to be made or delivered to, or a Share Certificate not accepted for payment or not tendered is to be issued in, the name(s) of a person or persons other than the holder(s) of record, then the Share Certificate must be endorsed or accompanied by appropriate duly executed stock powers, in either case signed exactly as the name(s) of the holder(s) of record that appear on the Share Certificate, with the signature(s) on such Share Certificate or stock powers guaranteed by an Eligible Institution as provided in the Letter of Transmittal. See Instructions 1 and 5 of the Letter of Transmittal.

Notwithstanding any other provision of this Offer, payment for Shares accepted for payment pursuant to the Offer will in all cases only be made after timely receipt by the Depositary of (i) to the extent the Shares are not already held with the Depositary, certificates evidencing such Shares or a Book-Entry Confirmation