BlackRock's Fourth-Quarter Profit Rose 19%, Exceeding Estimates

January 14 2021 - 7:10AM

Dow Jones News

By Dawn Lim

BlackRock Inc.'s quarterly profit rose 19% as investors turned

to the money-management giant's funds through November's election

uncertainty, vaccine breakthroughs and a year-end rally.

The investment company posted fourth-quarter profit of $1.5

billion, or $10.02 a share, up from $1.3 billion, or $8.29 a share,

a year earlier. BlackRock's revenue rose 13% to about $4.5 billion

from roughly $4 billion in the year earlier period.

The firm beat Wall Street analysts' profit and revenue

estimates.

The world's largest money manager scaled a new milestone in

assets under management, breaching the $8 trillion mark to $8.68

trillion in assets.

The company brought in $126.9 billion in new investor money,

down from $128.8 billion in the year-earlier quarter. Many rival

companies are expected to lose money in the uncertain economy,

struggling to stand out in a competitive industry with smaller

scale and less brand recognition.

BlackRock is best known for its iShares funds that trade on

exchanges and mirror markets. That business took in $79 billion in

new flows in the fourth quarter, up from $75.2 billion in the year

earlier period.

CEO Larry Fink has used the firm's scale to undercut the prices

of rival funds in popular index strategies while gaining reach in

more lucrative corners of finance such as private equity.

Across the board, BlackRock had net flows of $390.8 billion in

2020, down from $428.7 billion in 2019.

Write to Dawn Lim at dawn.lim@wsj.com

(END) Dow Jones Newswires

January 14, 2021 06:55 ET (11:55 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

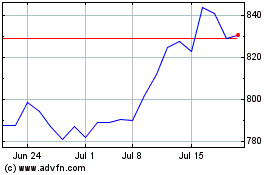

BlackRock (NYSE:BLK)

Historical Stock Chart

From Mar 2024 to Apr 2024

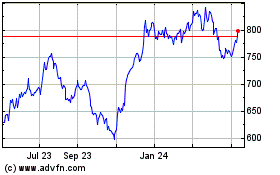

BlackRock (NYSE:BLK)

Historical Stock Chart

From Apr 2023 to Apr 2024