Form 6-K - Report of foreign issuer [Rules 13a-16 and 15d-16]

October 17 2024 - 6:04AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 6-K

REPORT OF

FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR

15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

17 October 2024

BHP GROUP

LIMITED

(ABN 49 004 028 077)

(Exact name of Registrant as specified in its charter)

VICTORIA,

AUSTRALIA

(Jurisdiction of incorporation or organisation)

171 COLLINS STREET, MELBOURNE,

VICTORIA 3000 AUSTRALIA

(Address of principal executive offices)

Indicate by check mark whether

the registrant files or will file annual reports under cover of Form 20-F or Form 40-F: ☒ Form

20-F ☐ Form 40-F

Indicate by check mark if the

registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ☐

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ☐

Indicate by check mark whether the registrant by furnishing the information contained

in this Form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934: ☐ Yes ☒ No

If “Yes” is marked, indicate below the file number assigned to the registrant in connection with Rule

12g3-2(b): n/a

|

|

|

|

|

|

|

|

|

17 October 2024 |

Operational review for the quarter ended 30 September 2024

Strong operational performance with increased copper, iron ore and coal production.

“BHP had a strong start to the 2025 financial year, with production up across all major commodities for the quarter. Copper production was up 4% due to higher grade

and recoveries at Escondida, and WAIO production was up 3% as we unlocked capacity by completing the debottlenecking work at the port.

We are also seeing signs of

stabilisation in our steelmaking coal business with production up 20% in the quarter, excluding the recently divested Blackwater and Daunia mines.

We added to our

copper growth prospects in the quarter, announcing a proposed 50/50 joint venture in Argentina with Lundin Mining to advance what we consider to be one of the most significant global copper discoveries in decades.

In Canada, our Jansen Stage 1 potash project is 58% complete after a productive summer period with first production scheduled in around two years.

China has announced a series of monetary easing policies in an effort to support economic growth, and has indicated more significant fiscal stimulus is on the horizon.

Upcoming stimulus is likely to focus on relieving local debt, stabilising the property market and bolstering business confidence.”

|

|

|

|

|

Mike Henry BHP

Chief Executive Officer |

| Summary |

|

|

| |

|

| Operational excellence |

|

Social value |

|

|

| On track to meet FY25 production guidance |

|

Climate Transition Action Plan |

|

|

| Strong operational performance with copper production increasing 4% driven by higher concentrator feed grades and recoveries at Escondida. Production at WAIO increased 2% following commissioning of the Port Debottlenecking Project

(PDP1) and completion of the South Flank ramp up. |

|

We released our second Climate Transition Action Plan (CTAP) which lays out our climate strategy and GHG emissions

goals and targets, and provides an in depth view of our plans and how we’re progressing against them. The CTAP will be put to a shareholder advisory vote at our upcoming AGM on 30 October 2024. We also

announced collaborations with India’s JSW Steel and Carbon Clean and Steel Authority of India to support decarbonisation technology in steelmaking.

|

| |

|

| Portfolio |

|

Outlook |

|

|

| Increased exposure to copper |

|

Copper outlook supports growth pipeline |

|

|

| In July, we agreed to jointly acquire Filo Corp. with Lundin Mining through a Canadian plan of arrangement. In September, the Filo Corp shareholders approved the plan of arrangement. We also

agreed to form a 50/50 joint venture with Lundin Mining to consolidate and advance the Filo del Sol and Josemaria copper projects. We expect the transaction to complete in Q3 FY25, subject to regulatory approvals. |

|

We published our outlook for the copper market, including copper demand, copper supply and long-term copper pricing. We expect copper demand to grow by 70% by 2050, as a result of traditional

economic growth, electrification and the energy transition, and digital infrastructure (including data centres). We will be hosting an investor site visit to our Chilean copper assets in November 2024 to outline our attractive organic copper growth

pipeline in the region. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

| Production |

|

Quarter performance |

|

|

Production guidance |

|

|

|

|

|

|

|

| |

|

Q1 FY25 |

|

|

v Q4 FY24 |

|

|

v Q1 FY24 |

|

|

Current FY25

guidance |

|

|

|

|

| |

|

|

|

|

|

| Copper (kt) |

|

|

476.3 |

|

|

|

(6 |

%) |

|

|

4 |

% |

|

|

1,845 – 2,045 |

|

|

|

|

|

|

|

|

|

|

|

| Escondida (kt) |

|

|

304.2 |

|

|

|

(2 |

%) |

|

|

11 |

% |

|

|

1,180 – 1,300 |

|

|

|

Unchanged |

|

|

|

|

|

|

|

| Pampa Norte (kt)i |

|

|

60.1 |

|

|

|

(9 |

%) |

|

|

(23 |

%)i |

|

|

240 – 270 |

i |

|

|

Unchanged |

|

|

|

|

|

|

|

| Copper South Australia (kt) |

|

|

73.4 |

|

|

|

(18 |

%) |

|

|

2 |

% |

|

|

310 – 340 |

|

|

|

Unchanged |

|

|

|

|

|

|

|

| Antamina (kt) |

|

|

36.3 |

|

|

|

(5 |

%) |

|

|

12 |

% |

|

|

115 – 135 |

|

|

|

Unchanged |

|

|

|

|

|

|

|

| Carajás (kt) |

|

|

2.3 |

|

|

|

10 |

% |

|

|

92 |

% |

|

|

- |

|

|

|

- |

|

| |

|

|

|

|

|

| Iron ore (Mt) |

|

|

64.6 |

|

|

|

(7 |

%) |

|

|

2 |

% |

|

|

255 – 265.5 |

|

|

|

|

|

|

|

|

|

|

|

| WAIO (Mt) |

|

|

63.4 |

|

|

|

(7 |

%) |

|

|

2 |

% |

|

|

250 – 260 |

|

|

|

Unchanged |

|

|

|

|

|

|

|

| WAIO (100% basis) (Mt) |

|

|

71.6 |

|

|

|

(7 |

%) |

|

|

3 |

% |

|

|

282 – 294 |

|

|

|

Unchanged |

|

|

|

|

|

|

|

| Samarco (Mt) |

|

|

1.3 |

|

|

|

23 |

% |

|

|

4 |

% |

|

|

5 – 5.5 |

|

|

|

Unchanged |

|

| |

|

|

|

|

|

| Steelmaking coal – BMA (Mt) |

|

|

4.5 |

|

|

|

(8 |

%) |

|

|

(19 |

%)ii |

|

|

16.5 – 19 |

|

|

|

|

|

|

|

|

|

|

|

| BMA (100% basis) (Mt) |

|

|

9.0 |

|

|

|

(8 |

%) |

|

|

(19 |

%)ii |

|

|

33 – 38 |

|

|

|

Unchanged |

|

| |

|

|

|

|

|

| Energy coal – NSWEC (Mt) |

|

|

3.7 |

|

|

|

(2 |

%) |

|

|

2 |

% |

|

|

13 – 15 |

|

|

|

Unchanged |

|

|

|

|

|

|

|

| Nickel – Western Australia Nickel

(kt) |

|

|

19.6 |

|

|

|

(15 |

%) |

|

|

(3 |

%) |

|

|

- |

|

|

|

- |

|

| i |

Q1 FY24 includes 9.5 kt from Cerro Colorado which entered care and maintenance in December 2023. Excluding these volumes,

Q1 FY25 production decreased 13%. Production guidance for FY25 is for Spence only. Refer to production and sales report and

copper for further information. |

| ii |

Q1 FY24 production includes 1.8 Mt (3.7 Mt on a 100% basis) from Blackwater and Daunia mines which were divested on

2 April 2024. Excluding these volumes, Q1 FY25 production increased 20%. Refer to production and sales report and

steelmaking coal for further information. |

BHP | Operational review for the year ended 30 September 2024

Segment and asset performance | FY25 YTD v FY24 YTD

|

|

|

|

|

|

Further information in Appendix 1

Detailed production and sales information for all operations in Appendix

2 |

|

|

|

| Copper |

|

|

|

|

| Production

476 kt

4%

4% Q1 FY24 457 kt

FY25e 1,845 – 2,045 kt

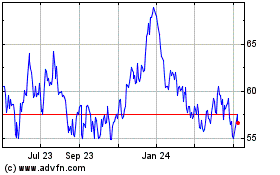

Average realised price

US$4.24/lb

17%

17% Q1 FY24 US$3.63/lb |

|

Total copper production increased 4% to 476 kt. Copper production guidance for FY25 remains unchanged at between 1,845 and 2,045 kt.

Escondida 304

kt

11% (100% basis)

11% (100% basis) Increased production primarily

due to a higher concentrator feed grade of 1.00% (Q1 FY24: 0.85%) and higher recoveries as mining progressed into areas of higher-grade ore as planned. This was partially offset by planned lower cathode production, as the integration of the FullSaL

project continued. The project remains on track for first production later in FY25. A new

collective agreement with Union N°1 of Operators and Maintainers was signed and became effective for 36 months from 2 August 2024. The associated industrial action did not have a material impact on production during the quarter as a result

of mitigating actions taken by management, including mine resequencing and prioritisation of ore movement.

During Q1 FY25, one access ramp into the PL1 high grade mining area was impacted by geotechnical instability. We utilised alternative access ramps and completed

stabilisation works, and as a result no material production impacts are expected. Production

guidance for FY25 remains unchanged at between 1,180 and 1,300 kt, weighted to the second half. Concentrator feed grade for FY25 is expected to remain above 0.90%.

Pampa Norte 60 kt

23%

23% |

|

|

Spence production decreased 13% as expected, as a result of lower cathode production in line with an expected decline in stacked feed grade and planned quarterly maintenance at the concentrator. Concentrator feed grade and

recoveries are in line with prior periods. |

|

|

|

|

Production guidance for Spence remains unchanged at between 240 and 270 kt for FY25. |

|

|

|

|

Cerro Colorado remains in temporary care and maintenance (having contributed 9.5 kt in Q1 FY24). |

|

|

|

|

Copper South Australia 73 kt

2%

2% |

|

|

|

|

Higher production primarily driven by strong underlying operational performance, particularly at Carrapateena following the commissioning of Crusher 2 in Q3 FY24 which has enabled higher productivity from the sub-level cave and resulted in an increase in ore mined and milled. We also completed planned major maintenance at Olympic Dam on the hoist and underground materials handling system, and annual planned maintenance

at the refinery. Production was lower at Prominent Hill due to minor pit geotechnical instability and ventilation constraints which impacted trucking capacity and ore mined, both of which have since been rectified. |

|

|

|

|

Production guidance for FY25 remains unchanged at between 310 and 340 kt, weighted to the second half. |

|

|

|

|

Other copper |

|

|

|

|

At Antamina, copper production increased 12% to 36 kt as a result of higher ore grade and recoveries, partially offset by planned lower concentrator throughput. Zinc production was 46% lower at 19 kt, as a result of planned lower

feed grades. FY25 copper production guidance of between 115 and 135 kt and zinc production guidance of between 90 and 110 kt remain unchanged. |

|

|

|

|

Carajás produced 2.3 kt of copper and 1.7 troy koz of gold. |

2

BHP | Operational review for the year ended 30 September 2024

Iron ore

|

|

|

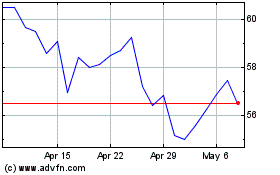

| Production

65 Mt

2%

2%

Q1 FY24 63 Mt

FY25e 255 – 265.5 Mt

Average realised price

US$80.10/wmt

18%

18% Q1 FY24 US$98.04/wmt |

|

Iron ore production increased 2% to 65 Mt. Production guidance for FY25 remains unchanged at between 255 and

265.5 Mt. WAIO 63.4 Mt

2% | 71.6 Mt (100% basis)

2% | 71.6 Mt (100% basis) Production increased

as a result of strong supply chain performance with increased capacity unlocked by PDP1. Higher volumes were delivered from the Central Pilbara hub (South Flank and Mining Area C) following the completion of South Flank ramp up in FY24. We continue

to progress the multi-year Rail Technology Program (RTP1), with tie-in activity increasing in FY25.

Production guidance for FY25 remains unchanged at between 250 and 260 Mt (282 and 294 Mt on a 100% basis).

Samarco 1.3 Mt

4% | 2.6 Mt (100% basis)]

4% | 2.6 Mt (100% basis)] Production increased

due to early resumption of Pelletizing Plant No. 4 enabling improved performance. Production guidance for FY25 remains unchanged at between 5 and 5.5 Mt. The second concentrator at Samarco is expected to come online during Q3 FY25, which will

increase production capacity to ~16 Mtpa of pellets (100% basis) once fully ramped up, which is expected to be by the end of FY26.

BHP Brasil, Samarco and Vale have been engaging in negotiations with the Brazilian State and Federal Governments and other public entities to seek a settlement of

obligations under the Framework Agreement, the Federal Public Prosecution Office Claim, and other claims by government entities relating to the Samarco dam failure. Those negotiations are ongoing.

BHP Group Limited and BHP Group (UK) Limited are defendants to a group action claim in the English

High Court, brought by over 600,000 claimants seeking damages in relation to the Fundão Dam failure in 2015. The liability hearing for the group action will begin on 21 October 2024.

|

|

|

| Coal

Steelmaking coal |

|

|

| Production

4.5 Mt

19%

19% Q1 FY24 5.6 Mt

FY25e 16.5 – 19 Mt

Average realised price

US$214.86/t

9%

9% Q1 FY24 US$237.07/t

|

|

BMA 4.5 Mt

19% | 9 Mt (100% basis)

19% | 9 Mt (100% basis) Production increased 20%

(excluding 1.8 Mt from Blackwater and Daunia in Q1 FY24), due to increased stripping enabled by improved truck productivity as well as Q1 FY24 being impacted by the extended longwall move at Broadmeadow. We maintain our focus on restoring value

chain stability, with an increase in raw coal inventory, which will continue into CY26. During

the quarter we completed planned maintenance at Goonyella Riverside and Hay Point Coal Terminal, and commenced a longwall move at Broadmeadow.

Production guidance for FY25 remains unchanged at between 16.5 and 19 Mt (33 and 38 Mt on a 100% basis). |

3

BHP | Operational review for the year ended 30 September 2024

|

|

|

|

|

| Energy coal |

|

|

| Production

3.7 Mt

2%

2%

Q1 FY24 3.6 Mt

FY25e 13 – 15 Mt

Average realised price

US$124.32/t

1%

1%

Q1 FY24 US$125.66/t |

|

NSWEC 3.7 Mt

2%

2% Production increased 2%, including a higher

proportion of washed coal in line with our strategy of prioritising higher quality coals. This was enabled by a drawdown of inventory to offset the impacts of reduced truck availability and unfavourable weather conditions.

Production guidance for FY25 remains unchanged at between 13 and 15 Mt.

The modification to extend mining consent to 30 June 2030 is currently being assessed by the

NSW Government with an outcome anticipated in Q3 FY25. |

| Group & Unallocated |

|

|

| Nickel |

|

|

|

|

| Production |

|

Western Australia Nickel 19.6 kt

3%

3% |

|

|

| 19.6 kt

3%

3%

Q1 FY24 20.2 kt

Average realised price

US$16,359/t

20%

20%

Q1 FY24 US$20,354/t |

|

Production decreased as we commenced the temporary suspension of operations at Nickel West. Operations will be suspended from October 2024 and

handover activities will be completed by December 2024. We continue to support the workforce through this transition period and have made redeployment offers to a large portion of our frontline employees.

We expect costs to remain elevated during the transition to suspension in the first half and we

plan to invest ~US$300 m per annum beginning in January 2025 to preserve optionality for a potential restart.

No production guidance has been provided for FY25. |

Quarterly performance | Q1 FY25 v Q4 FY24

|

|

|

|

|

|

|

|

Copper |

|

|

|

Iron ore |

|

|

| 476 kt

6%

6%

Q4 FY24 505 kt |

|

Lower production due to planned maintenance, in particular across Copper SA, lower concentrator throughput and production across leaching at Escondida due to mine sequencing, and planned lower grades at Spence. |

|

65 Mt

7%

7%

Q4 FY24 69 Mt |

|

Lower production at WAIO as a result of planned equipment maintenance and increased RTP1 tie-in activity. |

|

Steelmaking coal |

|

Energy coal |

| 4.5 Mt

8%

8%

Q4 FY24 4.9 Mt |

|

Lower production as a result of the ramp down and commencement of the longwall move at Broadmeadow in Q1 FY25, and higher yield and lower strip ratio in

the prior quarter as a result of mine sequencing. |

|

3.7 Mt

2%

2%

Q4 FY24 3.8 Mt |

|

Slightly lower production due to operational challenges from truck availability and wet weather, partially offset by a drawdown of inventory. |

|

Nickel |

|

|

|

|

|

|

| 19.6 kt

15%

15%

Q4 FY24 23.0 kt |

|

Lower production as transition of operations to temporary suspension commenced.

|

|

|

|

|

4

BHP | Operational review for the year ended 30 September 2024

Appendix 1

Average realised pricesi

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Quarter |

|

| |

|

Q1 FY25 |

|

|

v Q4 FY24 |

|

|

v Q1 FY24 |

|

| Copper (US$/lb)ii |

|

|

4.24 |

|

|

|

(7 |

%) |

|

|

17 |

% |

| Iron ore (US$/wmt, FOB) |

|

|

80.10 |

|

|

|

(12 |

%) |

|

|

(18 |

%) |

| Steelmaking coal (US$/t)iii |

|

|

214.86 |

|

|

|

(12 |

%) |

|

|

(9 |

%) |

| Thermal coal (US$/t)iv |

|

|

124.32 |

|

|

|

1 |

% |

|

|

(1 |

%) |

| Nickel metal (US$/t)v |

|

|

16,359 |

|

|

|

(11 |

%) |

|

|

(20 |

%) |

| i |

Based on provisional, unaudited estimates. Prices exclude sales from equity accounted investments, third party product and

internal sales, and represent the weighted average of various sales terms (for example: FOB, CIF and CFR), unless otherwise noted. Includes the impact of provisional pricing and finalisation adjustments. |

| ii |

Sales from Carrapateena and Prominent Hill acquired through the purchase of OZL are included from Q4 FY24.

|

| iii |

From FY25, steelmaking coal refers to Hard Coking Coal which is generally those steelmaking coals with a Coke Strength

after Reaction (CSR) of 35 and above, and includes coals across the spectrum from Premium Coking to Semi Hard Coking coals. Comparative periods include impacts from Weak Coking Coal, which refers generally to those steelmaking coals with a CSR below

35, which were sold by Blackwater and Daunia mines, divested on 2 April 2024. |

| iv |

Export sales only. Includes thermal coal sales from steelmaking coal mines. |

| v |

Relates to refined nickel metal only, excludes intermediate products and nickel sulphate. |

Current year unit cost guidance

|

|

|

|

|

|

|

|

|

| Unit cost |

|

Current

FY25 guidancei |

|

|

|

|

|

|

|

| Escondida (US$/lb) |

|

|

1.30 –1.60 |

|

|

|

Unchanged |

|

|

|

|

| Spence (US$/lb) |

|

|

2.00 – 2.30 |

|

|

|

Unchanged |

|

|

|

|

| Copper South Australia (US$/lb) |

|

|

1.30 –1.80 |

ii |

|

|

Unchanged |

|

|

|

|

| WAIO (US$/t) |

|

|

18.00 –19.50 |

|

|

|

Unchanged |

|

|

|

|

| BMA (US$/t) |

|

|

112 – 124 |

|

|

|

Unchanged |

|

| i |

FY25 unit cost guidance is based on exchange rates of AUD/USD 0.66 and USD/CLP 842. |

| ii |

Calculated using the following assumptions for by-products: gold US$2,000/oz, and

uranium US$80/lb. |

Medium term guidancei

|

|

|

|

|

|

|

|

|

| |

|

Production

guidance |

|

|

Unit cost

guidanceii |

|

|

|

|

| Escondidaiii |

|

|

900 –1,000 ktpa |

|

|

US$ |

1.50 –1.80/lb |

|

|

|

|

| Spence |

|

|

~250 ktpa |

|

|

US$ |

2.05 – 2.35/lb |

|

|

|

|

| WAIO |

|

|

>305 Mtpa |

|

|

|

<US$17.50/t |

|

|

|

|

| BMA |

|

|

43 – 45 Mtpa |

|

|

|

<US$110/t |

|

| i |

Medium term refers to a five year time horizon unless otherwise noted. |

| ii |

Unit cost guidance is based on exchange rates of AUD/USD 0.66 and USD/CLP 842. |

| iii |

Medium term refers to FY27 onwards. Production for FY25 and FY26 are expected to average between 1,200 and 1,300 kt.

|

Major projects

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Commodity |

|

Project and ownership |

|

Project scope / capacity |

|

Capital expenditure US$M |

|

|

First production target date |

|

|

Progress |

|

|

|

|

|

|

|

| Potash |

|

Jansen Stage 1

(Canada)

100% |

|

Design, engineering and construction of an underground potash mine and surface infrastructure, with capacity to produce 4.15 Mtpa. |

|

|

5,723 |

|

|

|

End-CY26 |

|

|

|

Project is 58

complete |

%

|

|

|

|

|

|

|

| Potash |

|

Jansen Stage 2

(Canada)

100% |

|

Development of additional mining districts, completion of the second shaft hoist infrastructure, expansion of processing facilities and addition of rail cars to facilitate production of an

incremental 4.36 Mtpa. |

|

|

4,859 |

|

|

|

FY29 |

|

|

|

Project is 4

complete |

%

|

The operating expenditure related to Potash for FY25 is expected to be ~US$300 m.

Exploration

Minerals exploration and evaluation expenditure was US$104 m for

Q1 FY25 (Q1 FY24: US$105 m) of which US$91 m was expensed (Q1 FY24: US$93 m).

5

BHP | Operational Review for the quarter ended 30 September 2024

Appendix 2

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

Production |

|

|

|

|

|

|

|

|

Sales |

|

| |

|

|

|

|

|

Quarter ended |

|

|

|

|

|

Year to date |

|

|

|

|

|

|

|

|

Quarter ended |

|

|

|

|

|

Year to date |

|

| |

|

|

|

|

|

Sep |

|

|

Dec |

|

|

Mar |

|

|

Jun |

|

|

Sep |

|

|

|

|

|

Sep |

|

|

Sep |

|

|

Var |

|

|

|

|

|

|

|

|

Sep |

|

|

Dec |

|

|

Mar |

|

|

Jun |

|

|

Sep |

|

|

|

|

|

Sep |

|

|

Sep |

|

|

Var |

|

| |

|

|

|

|

|

2023 |

|

|

2023 |

|

|

2024 |

|

|

2024 |

|

|

2024 |

|

|

|

|

|

2024 |

|

|

2023 |

|

|

% |

|

|

|

|

|

|

|

|

2023 |

|

|

2023 |

|

|

2024 |

|

|

2024 |

|

|

2024 |

|

|

|

|

|

2024 |

|

|

2023 |

|

|

% |

|

| Group production and sales

summary |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| By commodity |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Metals production is payable metal unless otherwise noted. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Throughout this report figures in italics indicate

that this figure has been adjusted since it was previously reported. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Copper |

|

Payable metal in concentrate |

|

kt |

|

|

317.3 |

|

|

|

308.7 |

|

|

|

339.0 |

|

|

|

370.4 |

|

|

|

360.9 |

|

|

|

|

|

|

|

360.9 |

|

|

|

317.3 |

|

|

|

14 |

% |

|

|

|

|

|

|

|

|

|

|

298.0 |

|

|

|

316.5 |

|

|

|

281.5 |

|

|

|

378.7 |

|

|

|

429.1 |

|

|

|

|

|

|

|

429.1 |

|

|

|

298.0 |

|

|

|

44 |

% |

|

|

Escondida |

|

kt |

|

|

221.3 |

|

|

|

207.7 |

|

|

|

239.2 |

|

|

|

258.5 |

|

|

|

264.8 |

|

|

|

|

|

|

|

264.8 |

|

|

|

221.3 |

|

|

|

20 |

% |

|

|

|

|

|

|

|

|

|

|

209.5 |

|

|

|

211.7 |

|

|

|

204.0 |

|

|

|

261.3 |

|

|

|

310.8 |

|

|

|

|

|

|

|

310.8 |

|

|

|

209.5 |

|

|

|

48 |

% |

|

|

Pampa Norte |

|

kt |

|

|

38.8 |

|

|

|

32.6 |

|

|

|

39.5 |

|

|

|

39.4 |

|

|

|

35.7 |

|

|

|

|

|

|

|

35.7 |

|

|

|

38.8 |

|

|

|

(8 |

)% |

|

|

|

|

|

|

|

|

|

|

31.3 |

|

|

|

34.9 |

|

|

|

26.9 |

|

|

|

49.3 |

|

|

|

44.0 |

|

|

|

|

|

|

|

44.0 |

|

|

|

31.3 |

|

|

|

41 |

% |

|

|

Copper South Australia |

|

kt |

|

|

23.5 |

|

|

|

27.4 |

|

|

|

23.3 |

|

|

|

32.1 |

|

|

|

21.8 |

|

|

|

|

|

|

|

21.8 |

|

|

|

23.5 |

|

|

|

(7 |

)% |

|

|

|

|

|

|

|

|

|

|

22.2 |

|

|

|

31.6 |

|

|

|

17.1 |

|

|

|

28.0 |

|

|

|

30.4 |

|

|

|

|

|

|

|

30.4 |

|

|

|

22.2 |

|

|

|

37 |

% |

|

|

Antamina |

|

kt |

|

|

32.5 |

|

|

|

39.2 |

|

|

|

33.9 |

|

|

|

38.3 |

|

|

|

36.3 |

|

|

|

|

|

|

|

36.3 |

|

|

|

32.5 |

|

|

|

12 |

% |

|

|

|

|

|

|

|

|

|

|

32.8 |

|

|

|

38.3 |

|

|

|

31.3 |

|

|

|

37.4 |

|

|

|

39.6 |

|

|

|

|

|

|

|

39.6 |

|

|

|

32.8 |

|

|

|

21 |

% |

|

|

Carajás |

|

kt |

|

|

1.2 |

|

|

|

1.8 |

|

|

|

3.1 |

|

|

|

2.1 |

|

|

|

2.3 |

|

|

|

|

|

|

|

2.3 |

|

|

|

1.2 |

|

|

|

92 |

% |

|

|

|

|

|

|

|

|

|

|

2.2 |

|

|

|

- |

|

|

|

2.2 |

|

|

|

2.7 |

|

|

|

4.3 |

|

|

|

|

|

|

|

4.3 |

|

|

|

2.2 |

|

|

|

95 |

% |

|

|

Cathode |

|

kt |

|

|

139.7 |

|

|

|

128.7 |

|

|

|

126.8 |

|

|

|

134.4 |

|

|

|

115.4 |

|

|

|

|

|

|

|

115.4 |

|

|

|

139.7 |

|

|

|

(17 |

)% |

|

|

|

|

|

|

|

|

|

|

131.9 |

|

|

|

137.6 |

|

|

|

120.1 |

|

|

|

142.3 |

|

|

|

110.7 |

|

|

|

|

|

|

|

110.7 |

|

|

|

131.9 |

|

|

|

(16 |

)% |

|

|

Escondida |

|

kt |

|

|

52.0 |

|

|

|

46.9 |

|

|

|

49.0 |

|

|

|

50.7 |

|

|

|

39.4 |

|

|

|

|

|

|

|

39.4 |

|

|

|

52.0 |

|

|

|

(24 |

)% |

|

|

|

|

|

|

|

|

|

|

49.2 |

|

|

|

52.2 |

|

|

|

44.3 |

|

|

|

54.6 |

|

|

|

37.6 |

|

|

|

|

|

|

|

37.6 |

|

|

|

49.2 |

|

|

|

(24 |

)% |

|

|

Pampa Norte |

|

kt |

|

|

39.5 |

|

|

|

27.2 |

|

|

|

22.1 |

|

|

|

26.5 |

|

|

|

24.4 |

|

|

|

|

|

|

|

24.4 |

|

|

|

39.5 |

|

|

|

(38 |

)% |

|

|

|

|

|

|

|

|

|

|

36.6 |

|

|

|

31.1 |

|

|

|

22.1 |

|

|

|

26.5 |

|

|

|

24.1 |

|

|

|

|

|

|

|

24.1 |

|

|

|

36.6 |

|

|

|

(34 |

)% |

|

|

Copper South Australia |

|

kt |

|

|

48.2 |

|

|

|

54.6 |

|

|

|

55.7 |

|

|

|

57.2 |

|

|

|

51.6 |

|

|

|

|

|

|

|

51.6 |

|

|

|

48.2 |

|

|

|

7 |

% |

|

|

|

|

|

|

|

|

|

|

46.1 |

|

|

|

54.3 |

|

|

|

53.7 |

|

|

|

61.2 |

|

|

|

49.0 |

|

|

|

|

|

|

|

49.0 |

|

|

|

46.1 |

|

|

|

6 |

% |

| |

|

Total |

|

kt |

|

|

457.0 |

|

|

|

437.4 |

|

|

|

465.8 |

|

|

|

504.8 |

|

|

|

476.3 |

|

|

|

|

|

|

|

476.3 |

|

|

|

457.0 |

|

|

|

4 |

% |

|

|

|

|

|

|

|

|

|

|

429.9 |

|

|

|

454.1 |

|

|

|

401.6 |

|

|

|

521.0 |

|

|

|

539.8 |

|

|

|

|

|

|

|

539.8 |

|

|

|

429.9 |

|

|

|

26 |

% |

| Lead |

|

Payable metal in concentrate |

|

t |

|

|

96 |

|

|

|

105 |

|

|

|

- |

|

|

|

131 |

|

|

|

21 |

|

|

|

|

|

|

|

21 |

|

|

|

96 |

|

|

|

(78 |

)% |

|

|

|

|

|

|

|

|

|

|

154 |

|

|

|

91 |

|

|

|

108 |

|

|

|

9 |

|

|

|

125 |

|

|

|

|

|

|

|

125 |

|

|

|

154 |

|

|

|

(19 |

)% |

| |

|

Antamina |

|

t |

|

|

96 |

|

|

|

105 |

|

|

|

- |

|

|

|

131 |

|

|

|

21 |

|

|

|

|

|

|

|

21 |

|

|

|

96 |

|

|

|

(78 |

)% |

|

|

|

|

|

|

|

|

|

|

154 |

|

|

|

91 |

|

|

|

108 |

|

|

|

9 |

|

|

|

125 |

|

|

|

|

|

|

|

125 |

|

|

|

154 |

|

|

|

(19 |

)% |

| Zinc |

|

Payable metal in concentrate |

|

t |

|

|

35,669 |

|

|

|

33,475 |

|

|

|

18,409 |

|

|

|

15,839 |

|

|

|

19,374 |

|

|

|

|

|

|

|

19,374 |

|

|

|

35,669 |

|

|

|

(46 |

)% |

|

|

|

|

|

|

|

|

|

|

33,912 |

|

|

|

37,092 |

|

|

|

17,559 |

|

|

|

14,118 |

|

|

|

19,609 |

|

|

|

|

|

|

|

19,609 |

|

|

|

33,912 |

|

|

|

(42 |

)% |

| |

|

Antamina |

|

t |

|

|

35,669 |

|

|

|

33,475 |

|

|

|

18,409 |

|

|

|

15,839 |

|

|

|

19,374 |

|

|

|

|

|

|

|

19,374 |

|

|

|

35,669 |

|

|

|

(46 |

)% |

|

|

|

|

|

|

|

|

|

|

33,912 |

|

|

|

37,092 |

|

|

|

17,559 |

|

|

|

14,118 |

|

|

|

19,609 |

|

|

|

|

|

|

|

19,609 |

|

|

|

33,912 |

|

|

|

(42 |

)% |

| Gold |

|

Payable metal in concentrate |

|

troy oz |

|

|

89,020 |

|

|

|

94,768 |

|

|

|

79,159 |

|

|

|

100,013 |

|

|

|

85,668 |

|

|

|

|

|

|

|

85,668 |

|

|

|

89,020 |

|

|

|

(4 |

)% |

|

|

|

|

|

|

|

|

|

|

87,687 |

|

|

|

98,969 |

|

|

|

70,398 |

|

|

|

92,323 |

|

|

|

98,936 |

|

|

|

|

|

|

|

98,936 |

|

|

|

87,687 |

|

|

|

13 |

% |

|

|

Escondida |

|

troy oz |

|

|

48,063 |

|

|

|

48,633 |

|

|

|

38,955 |

|

|

|

45,410 |

|

|

|

46,963 |

|

|

|

|

|

|

|

46,963 |

|

|

|

48,063 |

|

|

|

(2 |

)% |

|

|

|

|

|

|

|

|

|

|

48,063 |

|

|

|

48,633 |

|

|

|

38,955 |

|

|

|

45,410 |

|

|

|

46,963 |

|

|

|

|

|

|

|

46,963 |

|

|

|

48,063 |

|

|

|

(2 |

)% |

|

|

Pampa Norte |

|

troy oz |

|

|

3,931 |

|

|

|

2,854 |

|

|

|

1,819 |

|

|

|

4,676 |

|

|

|

4,043 |

|

|

|

|

|

|

|

4,043 |

|

|

|

3,931 |

|

|

|

3 |

% |

|

|

|

|

|

|

|

|

|

|

3,931 |

|

|

|

2,854 |

|

|

|

1,819 |

|

|

|

4,676 |

|

|

|

4,043 |

|

|

|

|

|

|

|

4,043 |

|

|

|

3,931 |

|

|

|

3 |

% |

|

|

Copper South Australia |

|

troy oz |

|

|

36,228 |

|

|

|

42,051 |

|

|

|

36,427 |

|

|

|

48,355 |

|

|

|

32,928 |

|

|

|

|

|

|

|

32,928 |

|

|

|

36,228 |

|

|

|

(9 |

)% |

|

|

|

|

|

|

|

|

|

|

34,176 |

|

|

|

47,482 |

|

|

|

28,136 |

|

|

|

40,507 |

|

|

|

44,761 |

|

|

|

|

|

|

|

44,761 |

|

|

|

34,176 |

|

|

|

31 |

% |

|

|

Carajás |

|

troy oz |

|

|

798 |

|

|

|

1,230 |

|

|

|

1,958 |

|

|

|

1,572 |

|

|

|

1,734 |

|

|

|

|

|

|

|

1,734 |

|

|

|

798 |

|

|

|

117 |

% |

|

|

|

|

|

|

|

|

|

|

1,517 |

|

|

|

- |

|

|

|

1,488 |

|

|

|

1,730 |

|

|

|

3,169 |

|

|

|

|

|

|

|

3,169 |

|

|

|

1,517 |

|

|

|

109 |

% |

|

|

Refined gold |

|

troy oz |

|

|

53,028 |

|

|

|

55,828 |

|

|

|

49,128 |

|

|

|

49,139 |

|

|

|

37,385 |

|

|

|

|

|

|

|

37,385 |

|

|

|

53,028 |

|

|

|

(29 |

)% |

|

|

|

|

|

|

|

|

|

|

54,036 |

|

|

|

55,349 |

|

|

|

41,710 |

|

|

|

52,687 |

|

|

|

40,326 |

|

|

|

|

|

|

|

40,326 |

|

|

|

54,036 |

|

|

|

(25 |

)% |

|

|

Copper South Australia |

|

troy oz |

|

|

53,028 |

|

|

|

55,828 |

|

|

|

49,128 |

|

|

|

49,139 |

|

|

|

37,385 |

|

|

|

|

|

|

|

37,385 |

|

|

|

53,028 |

|

|

|

(29 |

)% |

|

|

|

|

|

|

|

|

|

|

54,036 |

|

|

|

55,349 |

|

|

|

41,710 |

|

|

|

52,687 |

|

|

|

40,326 |

|

|

|

|

|

|

|

40,326 |

|

|

|

54,036 |

|

|

|

(25 |

)% |

| |

|

Total |

|

troy oz |

|

|

142,048 |

|

|

|

150,596 |

|

|

|

128,287 |

|

|

|

149,152 |

|

|

|

123,053 |

|

|

|

|

|

|

|

123,053 |

|

|

|

142,048 |

|

|

|

(13 |

)% |

|

|

|

|

|

|

|

|

|

|

141,723 |

|

|

|

154,318 |

|

|

|

112,108 |

|

|

|

145,010 |

|

|

|

139,262 |

|

|

|

|

|

|

|

139,262 |

|

|

|

141,723 |

|

|

|

(2 |

)% |

| Silver |

|

Payable metal in concentrate |

|

troy koz |

|

|

2,582 |

|

|

|

3,074 |

|

|

|

2,620 |

|

|

|

3,317 |

|

|

|

3,150 |

|

|

|

|

|

|

|

3,150 |

|

|

|

2,582 |

|

|

|

22 |

% |

|

|

|

|

|

|

|

|

|

|

2,527 |

|

|

|

2,938 |

|

|

|

2,431 |

|

|

|

3,137 |

|

|

|

3,126 |

|

|

|

|

|

|

|

3,126 |

|

|

|

2,527 |

|

|

|

24 |

% |

|

|

Escondida |

|

troy koz |

|

|

1,168 |

|

|

|

1,401 |

|

|

|

1,328 |

|

|

|

1,549 |

|

|

|

1,546 |

|

|

|

|

|

|

|

1,546 |

|

|

|

1,168 |

|

|

|

32 |

% |

|

|

|

|

|

|

|

|

|

|

1,168 |

|

|

|

1,401 |

|

|

|

1,328 |

|

|

|

1,549 |

|

|

|

1,546 |

|

|

|

|

|

|

|

1,546 |

|

|

|

1,168 |

|

|

|

32 |

% |

|

|

Pampa Norte |

|

troy koz |

|

|

356 |

|

|

|

388 |

|

|

|

327 |

|

|

|

583 |

|

|

|

503 |

|

|

|

|

|

|

|

503 |

|

|

|

356 |

|

|

|

41 |

% |

|

|

|

|

|

|

|

|

|

|

356 |

|

|

|

388 |

|

|

|

327 |

|

|

|

583 |

|

|

|

503 |

|

|

|

|

|

|

|

503 |

|

|

|

356 |

|

|

|

41 |

% |

|

|

Copper South Australia |

|

troy koz |

|

|

260 |

|

|

|

310 |

|

|

|

252 |

|

|

|

312 |

|

|

|

223 |

|

|

|

|

|

|

|

223 |

|

|

|

260 |

|

|

|

(14 |

)% |

|

|

|

|

|

|

|

|

|

|

258 |

|

|

|

364 |

|

|

|

189 |

|

|

|

311 |

|

|

|

295 |

|

|

|

|

|

|

|

295 |

|

|

|

258 |

|

|

|

14 |

% |

|

|

Antamina |

|

troy koz |

|

|

798 |

|

|

|

975 |

|

|

|

713 |

|

|

|

873 |

|

|

|

878 |

|

|

|

|

|

|

|

878 |

|

|

|

798 |

|

|

|

10 |

% |

|

|

|

|

|

|

|

|

|

|

745 |

|

|

|

785 |

|

|

|

587 |

|

|

|

694 |

|

|

|

782 |

|

|

|

|

|

|

|

782 |

|

|

|

745 |

|

|

|

5 |

% |

|

|

Refined silver |

|

troy koz |

|

|

261 |

|

|

|

221 |

|

|

|

248 |

|

|

|

265 |

|

|

|

206 |

|

|

|

|

|

|

|

206 |

|

|

|

261 |

|

|

|

(21 |

)% |

|

|

|

|

|

|

|

|

|

|

219 |

|

|

|

222 |

|

|

|

188 |

|

|

|

329 |

|

|

|

202 |

|

|

|

|

|

|

|

202 |

|

|

|

219 |

|

|

|

(8 |

)% |

|

|

Copper South Australia |

|

troy koz |

|

|

261 |

|

|

|

221 |

|

|

|

248 |

|

|

|

265 |

|

|

|

206 |

|

|

|

|

|

|

|

206 |

|

|

|

261 |

|

|

|

(21 |

)% |

|

|

|

|

|

|

|

|

|

|

219 |

|

|

|

222 |

|

|

|

188 |

|

|

|

329 |

|

|

|

202 |

|

|

|

|

|

|

|

202 |

|

|

|

219 |

|

|

|

(8 |

)% |

| |

|

Total |

|

troy koz |

|

|

2,843 |

|

|

|

3,295 |

|

|

|

2,868 |

|

|

|

3,582 |

|

|

|

3,356 |

|

|

|

|

|

|

|

3,356 |

|

|

|

2,843 |

|

|

|

18 |

% |

|

|

|

|

|

|

|

|

|

|

2,746 |

|

|

|

3,160 |

|

|

|

2,619 |

|

|

|

3,466 |

|

|

|

3,328 |

|

|

|

|

|

|

|

6,454 |

|

|

|

5,273 |

|

|

|

22 |

% |

| Uranium |

|

Payable metal in concentrate |

|

t |

|

|

825 |

|

|

|

986 |

|

|

|

863 |

|

|

|

929 |

|

|

|

672 |

|

|

|

|

|

|

|

672 |

|

|

|

825 |

|

|

|

(19 |

)% |

|

|

|

|

|

|

|

|

|

|

481 |

|

|

|

895 |

|

|

|

394 |

|

|

|

1,554 |

|

|

|

677 |

|

|

|

|

|

|

|

677 |

|

|

|

481 |

|

|

|

41 |

% |

| |

|

Copper South Australia |

|

t |

|

|

825 |

|

|

|

986 |

|

|

|

863 |

|

|

|

929 |

|

|

|

672 |

|

|

|

|

|

|

|

672 |

|

|

|

825 |

|

|

|

(19 |

)% |

|

|

|

|

|

|

|

|

|

|

481 |

|

|

|

895 |

|

|

|

394 |

|

|

|

1,554 |

|

|

|

677 |

|

|

|

|

|

|

|

677 |

|

|

|

481 |

|

|

|

41 |

% |

| Molybdenum |

|

Payable metal in concentrate |

|

t |

|

|

612 |

|

|

|

481 |

|

|

|

824 |

|

|

|

699 |

|

|

|

1,084 |

|

|

|

|

|

|

|

1,084 |

|

|

|

612 |

|

|

|

77 |

% |

|

|

|

|

|

|

|

|

|

|

564 |

|

|

|

468 |

|

|

|

677 |

|

|

|

678 |

|

|

|

862 |

|

|

|

|

|

|

|

862 |

|

|

|

564 |

|

|

|

53 |

% |

|

|

Pampa Norte |

|

t |

|

|

329 |

|

|

|

145 |

|

|

|

203 |

|

|

|

117 |

|

|

|

182 |

|

|

|

|

|

|

|

182 |

|

|

|

329 |

|

|

|

(45 |

)% |

|

|

|

|

|

|

|

|

|

|

303 |

|

|

|

162 |

|

|

|

219 |

|

|

|

134 |

|

|

|

181 |

|

|

|

|

|

|

|

181 |

|

|

|

303 |

|

|

|

(40 |

)% |

| |

|

Antamina |

|

t |

|

|

283 |

|

|

|

336 |

|

|

|

621 |

|

|

|

582 |

|

|

|

902 |

|

|

|

|

|

|

|

902 |

|

|

|

283 |

|

|

|

219 |

% |

|

|

|

|

|

|

|

|

|

|

261 |

|

|

|

306 |

|

|

|

458 |

|

|

|

544 |

|

|

|

681 |

|

|

|

|

|

|

|

681 |

|

|

|

261 |

|

|

|

161 |

% |

| Iron ore |

|

Western Australia Iron Ore (WAIO) |

|

kt |

|

|

62,004 |

|

|

|

64,460 |

|

|

|

60,299 |

|

|

|

68,173 |

|

|

|

63,363 |

|

|

|

|

|

|

|

63,363 |

|

|

|

62,004 |

|

|

|

2 |

% |

|

|

|

|

|

|

|

|

|

|

64,180 |

|

|

|

62,606 |

|

|

|

61,868 |

|

|

|

67,323 |

|

|

|

63,408 |

|

|

|

|

|

|

|

63,408 |

|

|

|

64,180 |

|

|

|

(1 |

)% |

|

|

Samarco |

|

kt |

|

|

1,231 |

|

|

|

1,302 |

|

|

|

1,174 |

|

|

|

1,041 |

|

|

|

1,285 |

|

|

|

|

|

|

|

1,285 |

|

|

|

1,231 |

|

|

|

4 |

% |

|

|

|

|

|

|

|

|

|

|

1,136 |

|

|

|

1,329 |

|

|

|

1,258 |

|

|

|

1,043 |

|

|

|

1,002 |

|

|

|

|

|

|

|

1,002 |

|

|

|

1,136 |

|

|

|

(12 |

)% |

| |

|

Total |

|

kt |

|

|

63,235 |

|

|

|

65,762 |

|

|

|

61,473 |

|

|

|

69,214 |

|

|

|

64,648 |

|

|

|

|

|

|

|

64,648 |

|

|

|

63,235 |

|

|

|

2 |

% |

|

|

|

|

|

|

|

|

|

|

65,316 |

|

|

|

63,935 |

|

|

|

63,126 |

|

|

|

68,366 |

|

|

|

64,410 |

|

|

|

|

|

|

|

64,410 |

|

|

|

65,316 |

|

|

|

(1 |

)% |

|

Steelmaking coal¹ |

|

BHP Mitsubishi Alliance (BMA) |

|

kt |

|

|

5,601 |

|

|

|

5,717 |

|

|

|

6,035 |

|

|

|

4,922 |

|

|

|

4,515 |

|

|

|

|

|

|

|

4,515 |

|

|

|

5,601 |

|

|

|

(19 |

)% |

|

|

|

|

|

|

|

|

|

|

5,325 |

|

|

|

5,706 |

|

|

|

6,359 |

|

|

|

4,904 |

|

|

|

4,273 |

|

|

|

|

|

|

|

4,273 |

|

|

|

5,325 |

|

|

|

(20 |

)% |

| Energy coal |

|

NSW Energy Coal (NSWEC) |

|

kt |

|

|

3,613 |

|

|

|

3,855 |

|

|

|

4,149 |

|

|

|

3,751 |

|

|

|

3,675 |

|

|

|

|

|

|

|

3,675 |

|

|

|

3,613 |

|

|

|

2 |

% |

|

|

|

|

|

|

|

|

|

|

3,307 |

|

|

|

4,250 |

|

|

|

3,932 |

|

|

|

3,678 |

|

|

|

3,951 |

|

|

|

|

|

|

|

3,951 |

|

|

|

3,307 |

|

|

|

19 |

% |

| Nickel |

|

Western Australia Nickel |

|

kt |

|

|

20.2 |

|

|

|

19.6 |

|

|

|

18.8 |

|

|

|

23.0 |

|

|

|

19.6 |

|

|

|

|

|

|

|

19.6 |

|

|

|

20.2 |

|

|

|

(3 |

)% |

|

|

|

|

|

|

|

|

|

|

18.9 |

|

|

|

20.0 |

|

|

|

18.8 |

|

|

|

23.2 |

|

|

|

19.9 |

|

|

|

|

|

|

|

19.9 |

|

|

|

18.9 |

|

|

|

5 |

% |

| Cobalt |

|

Western Australia Nickel |

|

t |

|

|

192 |

|

|

|

182 |

|

|

|

179 |

|

|

|

181 |

|

|

|

294 |

|

|

|

|

|

|

|

294 |

|

|

|

192 |

|

|

|

53 |

% |

|

|

|

|

|

|

|

|

|

|

192 |

|

|

|

110 |

|

|

|

179 |

|

|

|

181 |

|

|

|

294 |

|

|

|

|

|

|

|

294 |

|

|

|

192 |

|

|

|

53 |

% |

1 Includes BMA thermal coal sales.

6

BHP | Operational Review for the quarter ended 30 September 2024

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

Production |

|

|

|

|

|

|

Sales |

|

| |

|

|

|

|

|

Quarter ended |

|

|

|

|

Year to date |

|

|

|

|

|

|

Quarter ended |

|

|

|

|

Year to date |

|

| |

|

|

|

|

|

Sep

2023 |

|

|

Dec

2023 |

|

|

Mar

2024 |

|

|

Jun

2024 |

|

|

Sep

2024 |

|

|

|

|

Sep

2024 |

|

|

Sep

2023 |

|

|

Var

% |

|

|

|

|

|

|

Sep

2023 |

|

|

Dec

2023 |

|

|

Mar

2024 |

|

|

Jun

2024 |

|

|

Sep

2024 |

|

|

|

|

Sep

2024 |

|

|

Sep

2023 |

|

|

Var

% |

|

| Production and sales |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| By asset |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Copper |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Metals production is payable metal unless otherwise noted. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Escondida, Chile¹ |

|

BHP interest 57.5% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Material mined |

|

kt |

|

|

87,462 |

|

|

|

95,168 |

|

|

|

103,872 |

|

|

|

102,752 |

|

|

|

100,416 |

|

|

|

|

|

100,416 |

|

|

|

87,462 |

|

|

|

15 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Concentrator throughput |

|

kt |

|

|

33,332 |

|

|

|

34,752 |

|

|

|

31,653 |

|

|

|

34,377 |

|

|

|

32,488 |

|

|

|

|

|

32,488 |

|

|

|

33,332 |

|

|

|

(3 |

)% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Average copper grade—concentrator |

|

% |

|

|

0.85% |

|

|

|

0.78% |

|

|

|

0.92% |

|

|

|

0.99% |

|

|

|

1.00% |

|

|

|

|

|

1.00% |

|

|

|

0.85% |

|

|

|

18 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Production ex mill |

|

kt |

|

|

225.7 |

|

|

|

217.6 |

|

|

|

238.6 |

|

|

|

279.5 |

|

|

|

269.9 |

|

|

|

|

|

269.9 |

|

|

|

225.7 |

|

|

|

20 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Payable copper |

|

kt |

|

|

221.3 |

|

|

|

207.7 |

|

|

|

239.2 |

|

|

|

258.5 |

|

|

|

264.8 |

|

|

|

|

|

264.8 |

|

|

|

221.3 |

|

|

|

20 |

% |

|

|

|

|

|

|

209.5 |

|

|

|

211.7 |

|

|

|

204.0 |

|

|

|

261.3 |

|

|

|

310.8 |

|

|

|

|

|

310.8 |

|

|

|

209.5 |

|

|

|

48 |

% |

|

|

Copper cathode (EW) |

|

kt |

|

|

52.0 |

|

|

|

46.9 |

|

|

|

49.0 |

|

|

|

50.7 |

|

|

|

39.4 |

|

|

|

|

|

39.4 |

|

|

|

52.0 |

|

|

|

(24 |

)% |

|

|

|

|

|

|

49.2 |

|

|

|

52.2 |

|

|

|

44.3 |

|

|

|

54.6 |

|

|

|

37.6 |

|

|

|

|

|

37.6 |

|

|

|