Current Report Filing (8-k)

April 22 2022 - 8:32AM

Edgar (US Regulatory)

0001108134

false

0001108134

2022-04-22

2022-04-22

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE

COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR

15(D) OF

THE SECURITIES EXCHANGE

ACT OF 1934

Date of Report (Date of

earliest event reported): April 22, 2022

BERKSHIRE

HILLS BANCORP, INC.

(Exact Name of Registrant

as Specified in its Charter)

| Delaware |

|

001-15781 |

|

04-3510455 |

(State or Other Jurisdiction)

of Incorporation) |

|

(Commission File No.) |

|

(I.R.S. Employer

Identification No.) |

| 60

State Street, Boston,

Massachusetts |

|

02109 |

| (Address of Principal Executive

Offices) |

|

(Zip Code) |

Registrant’s telephone

number, including area code: (800) 773-5601

Not Applicable

(Former Name or Former Address,

if Changed Since Last Report)

Check the appropriate box

below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following

provisions (see General Instruction A.2. below):

| ¨ |

Written communications

pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b)

of the Act:

| Title of

each class |

|

Trading

symbol(s) |

|

Name of

each exchange on which registered |

Common

stock, par value

$0.01 per share |

|

BHLB |

|

New

York Stock Exchange |

Indicate by check mark

whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule

12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging growth company

¨

If an emerging growth company,

indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised

financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Berkshire Hills Bancorp, Inc. (the “Company”)

is providing additional information on its collaborations with best-in-class financial technology companies that help us cater to our

customers’ needs, enhance customer experience, and grow profitable relationships. Consistent with our BEST transformation plan,

the Company’s subsidiary Berkshire Bank (the “Bank”) has entered two fintech partnerships to date – one with Narmi

Inc., which we discussed at our 1Q22 conference call, and one with Upstart Network Inc., an industry leading unsecured consumer loan digital

origination platform. We announced our Upstart partnership in October 2021.

Upstart was founded in 2012 by former Google executives

and is an artificial intelligence (AI) based lender designed to improve online and digital access to credit while reducing the risk and

cost of lending. Upstart is headquartered in San Mateo California and has transacted over $20 billion of consumer loans originated for

financial companies. In 2021, they transacted $12 billion of consumer loans that were originated by 42 partner banks.

Pursuant to the Company’s BEST plan, we

are exploring additional financial technology partnerships as the banking industry evolves towards increasing adoption of digital channels

for growth, efficiency, and customer experience. S&P Global Market Intelligence estimates that digitally originated loans have had

a compounded annual growth rate of 32% over the last 5 years – meaningfully higher growth than through traditional bank channels.

Upstart sources unsecured consumer loans digitally

and matches loan requests with partner banks. Berkshire Bank loans originated through Upstart pass our credit parameters and are originated

for our customers and prospects in our Northeast operating footprint. The Bank actively offers deposit and other products to deepen relationship

with these borrowers.

Berkshire Bank’s balances of unsecured consumer

loans at the end of first quarter 2022 were approximately 1% of our loan book. Our current minimum FICO score is 640, with a weighted

average FICO score of over 700 for the portfolio. We assess the performance metrics of this portfolio every week and adjust the program

parameters as necessary.

The Company anticipates loan yields of 11 to 12%

and we model approximately 5% of annual net charge-offs. While the program is relatively new, the annualized charge-off rates are well

below the model expectations. We estimate that the Bank will have approximately 3% of its year-end 2022 loan book in loans sourced through

Upstart and other potential financial technology partners.

FORWARD-LOOKING STATEMENTS

This Report contains “forward-looking statements”

within the meaning of Section 27A of the Securities Act of 1933, as amended, and section 21E of the Securities Exchange Act of 1934, as

amended. You can identify these statements from the use of the words “may,” “will,” “should,” “could,”

“would,” “plan,” “potential,” “estimate,” “project,” “believe,”

“intend,” “anticipate,” “expect,” “target” and similar expressions. There are many factors

that could cause actual results to differ significantly from expectations described in the forward-looking statements. For a discussion

of such factors, please see the Company’s most recent reports on Forms 10-K and 10-Q filed with the Securities and Exchange Commission

and available on the SEC’s website at www.sec.gov. You should not place undue reliance on forward-looking statements, which reflect

our expectations only as of the date of this document. Berkshire does not undertake any obligation to update forward-looking statements.

| Item 9.01 | Financial Statements and Exhibits |

| (a) | Financial Statements of Businesses Acquired. Not applicable. |

| (b) | Pro Forma Financial Information. Not applicable. |

| (c) | Shell Company Transactions. Not applicable. |

| Exhibit No. |

Description |

| |

|

| 104.1 |

The cover page for this Current Report on Form 8-K, formatted in Inline

XBRL. |

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, hereunto

duly authorized.

| |

|

BERKSHIRE HILLS BANCORP, INC. |

| |

|

|

| |

|

|

| DATE: April 22, 2022 |

By: |

/s/ Wm. Gordon Prescott |

| |

|

Wm. Gordon Prescott |

| |

|

Executive Vice President and General Counsel |

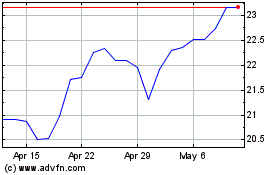

Berkshire Hills Bancorp (NYSE:BHLB)

Historical Stock Chart

From Jun 2024 to Jul 2024

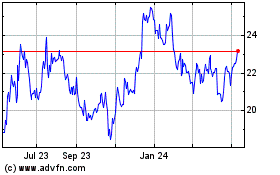

Berkshire Hills Bancorp (NYSE:BHLB)

Historical Stock Chart

From Jul 2023 to Jul 2024