SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

Pursuant to Rule 13a-16 or 15d-16 under

the Securities Exchange Act of 1934

|

For the month of: December 2014

|

Commission File Number: 1-8481

|

BCE Inc.

(Translation of Registrant’s name into English)

1, Carrefour Alexander-Graham-Bell, Verdun, Québec H3E 3B3, (514) 870-8777

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

| Form 20-F __________ |

Form 40-F _____X_____ |

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): _____

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): _____

Indicate by check mark whether by furnishing the information contained in this Form, the registrant is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

| Yes __________ |

No _____X_____ |

If “Yes” is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b): 82- _____.

Notwithstanding any reference to BCE Inc.’s Web site on the World Wide Web in the document attached hereto, the information contained in BCE Inc.’s site or any other site on the World Wide Web referred to in BCE Inc.’s site is not a part of this Form 6-K and, therefore, is not furnished to the Securities and Exchange Commission.

Page 1

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

BCE Inc.

(signed) Miguel Baz |

Miguel Baz

Assistant Corporate Secretary

December 31, 2014 |

Page 2

EXHIBIT INDEX

99.1 Press Release – December 24, 2014

Page 3

Exhibit 99.1

For Immediate Release

Bell to sell 50% stake in wireless retailer GLENTEL to Rogers

MONTRÉAL, December 24, 2014 -- BCE Inc. (TSX, NYSE: BCE; Bell) today announced that it will divest 50% of its ownership stake in wireless retailer GLENTEL Inc. (TSX: GLN) to Rogers Communications Inc. (TSX: RCI.A, RCI.B; NYSE: RCI) following the closing of Bell’s acquisition of GLENTEL, expected in the first half of 2015.

Under the agreement, Bell and Rogers will each own 50% of GLENTEL shares representing

50% of GLENTEL’s retail operations. In exchange, Rogers has agreed to pay in cash to Bell 50% of the GLENTEL transaction value following the successful closing of Bell’s GLENTEL acquisition. In addition, Rogers will withdraw its application for an injunction to block Bell’s acquisition of GLENTEL.

As announced on November 28, 2014, Bell will acquire all of GLENTEL's approximately 22.4 million fully diluted common shares for a total consideration for GLENTEL's equity of approximately $594 million. This represents a premium of 108% based on GLENTEL's closing share price on the TSX on November 27, 2014 and a 121% premium to the volume weighted trading average share price on the TSX for the 10 trading days prior to November 28. Including net debt and minority interest of approximately $78 million, the total enterprise value of GLENTEL is approximately $670 million.

“Providing continued access to GLENTEL’s first-class wireless retail operations for both competitors, this agreement greatly reduces Bell’s cost to acquire GLENTEL and helps ensure the transaction closes as scheduled to the benefit of GLENTEL shareholders,” said George Cope, President and CEO of BCE Inc. and Bell Canada. “GLENTEL’s distribution scope and renowned service and sales capabilities remain key to Bell’s strategy to accelerate wireless in

Canada while delivering an improved customer experience.”

Headquartered in Burnaby, BC and operating as a standalone entity with independent management, GLENTEL will continue with its strategy of offering competing dual-carrier wireless brands to Canadian consumers and business customers. Bell’s agreement with Rogers does not impact the GLENTEL acquisition timeline or plan of arrangement, and closing of Bell’s GLENTEL acquisition is not dependent on the closing of Bell’s transaction with Rogers.

The Board of Directors of GLENTEL, acting on the unanimous recommendation of the Special Committee (which consisted solely of independent directors of GLENTEL), has unanimously approved the GLENTEL/Bell arrangement transaction and recommends that GLENTEL shareholders vote in favour of it. The Skidmore family, which owns approximately 37% of the common equity of GLENTEL, supports the transaction.

A special meeting of GLENTEL shareholders is scheduled for January 12, 2015 and the transaction is expected to be completed by the end of the first quarter of 2015.

About Bell

BCE Inc. is Canada's largest communications company, providing a comprehensive and innovative suite of broadband TV, Internet, wireless and other communication services to

1/3

consumers and business customers through the Bell Canada and Bell Aliant brands. Bell Media is Canada's premier multimedia company with leading assets in television, radio, out of home and digital media, including CTV, Canada's #1 television network, and the country's most-watched specialty channels. To learn more, please visit BCE.ca.

Bell Let's Talk is a national charitable program promoting Canadian mental health with national awareness and anti-stigma campaigns, like Clara's Big Ride for Bell Let's Talk and Bell Let's Talk Day, and significant Bell funding of community care and access, research, and workplace initiatives. To learn more, please visit Bell.ca/LetsTalk.

Caution concerning forward-looking statements

Certain statements made in this news release are forward-looking statements, including, but not limited to, statements relating to the proposed acquisition by BCE Inc. (BCE) of all of the issued and outstanding common shares of GLENTEL Inc., and the subsequent divestiture of 50% of its ownership stake in GLENTEL to Rogers, the expected timing of both transactions and sources of funding of the GLENTEL acquisition transaction, certain strategic benefits expected to result from the proposed transactions, and other statements that are not historical facts. Forward-looking statements are typically identified by the words assumption, goal, guidance, objective, outlook, project, strategy, target and other similar expressions or future or conditional verbs such as aim, anticipate, believe, could, expect, intend, may, plan, seek, should, strive and will. All such forward-looking statements are made pursuant to the “safe harbour” provisions of applicable Canadian securities laws and of the United States Private Securities Litigation Reform Act of 1995.

Forward-looking statements, by their very nature, are subject to inherent risks and uncertainties and are based on several assumptions, both general and specific, which give rise to the possibility that actual results or events could differ materially from our expectations expressed in or implied by such forward-looking statements. As a result, we cannot guarantee that any forward-looking statement will materialize and we caution you against relying on any of these forward-looking statements. The forward-looking statements contained in this news release describe our expectations at the date of this news release and, accordingly, are subject to change after such date. Except as may be required by Canadian securities laws, we do not undertake any obligation to update or revise any forward-looking statements contained in this news release, whether as a result of new information, future events or otherwise. Forward looking statements are provided herein for the purpose of giving information about the proposed transactions referred to above and their expected impact. Readers are cautioned that such information may not be appropriate for other purposes. The completion and timing of the proposed transactions are subject to customary closing conditions, termination rights and other risks and uncertainties including, without limitation, court, shareholder and regulatory approvals, including competition and stock exchange approvals. Accordingly, there can be no assurance that the proposed transactions will occur, or that they will occur on the terms and conditions, or at the time, contemplated in this news release. The proposed transactions could be modified, restructured or terminated. There can also be no assurance that the strategic benefits expected to result from the proposed transactions will be realized.

For additional information on assumptions and risks underlying certain forward-looking statements made in this news release relating, in particular, to our network deployment and investment plans, please consult BCE’s 2013 Annual MD&A dated March 6, 2014 (included in the BCE 2013 Annual Report) and BCE’s 2014 First, Second and Third Quarter MD&As dated

May 5, 2014, August 6, 2014 and November 5, 2014 respectively, filed by BCE with the

2/3

Canadian provincial securities regulatory authorities (available at Sedar.com) and with the U.S. Securities and Exchange Commission (available at SEC.gov). These documents are also available at BCE.ca.

Media inquiries:

Jean Charles Robillard

Bell communications

(514) 870-4739

jean_charles.robillard@bell.ca

Investor inquiries:

Thane Fotopoulos

BCE investor relations

(514) 870-4619

thane.fotopoulos@bell.ca

3/3

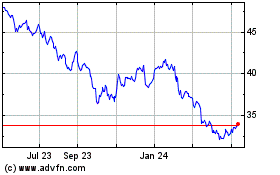

BCE (NYSE:BCE)

Historical Stock Chart

From Jun 2024 to Jul 2024

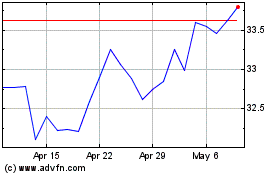

BCE (NYSE:BCE)

Historical Stock Chart

From Jul 2023 to Jul 2024