FORM 6-K

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Report of Foreign Issuer

Pursuant to Rule 13a-16 or 15d-16

of the Securities Exchange Act of 1934

For the month of November 2023

Commission File Number: 001-12568

BBVA Argentina Bank S.A.

(Translation of registrant’s name into English)

111 Córdoba Av, C1054AAA

Buenos Aires, Argentina

(Address of principal executive offices)

Indicate by check mark whether the registrant files

or will file annual reports under cover of Form 20-F or Form 40-F:

Indicate by check mark if the registrant is submitting

the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1):

Indicate by check mark if the registrant is submitting

the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7):

Indicate by check mark whether by furnishing the information

contained in this Form, the Registrant is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the

Securities Exchange Act of 1934:

If “Yes” is marked, indicate below the

file number assigned to the registrant in connection with Rule 12g3-2(b): N/A

Banco BBVA Argentina S.A.

TABLE OF CONTENTS

|

Item |

|

| |

|

| 1. |

Banco BBVA Argentina S.A. reports consolidated third quarter earnings for fiscal year 2023. |

| |

|

| |

|

Banco BBVA Argentina

S.A. announces Third Quarter 2023 results

Buenos

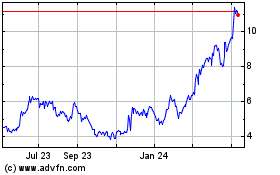

Aires, November 21, 2023 – Banco BBVA Argentina S.A (NYSE; BYMA; MAE: BBAR;

LATIBEX: XBBAR) (“BBVA Argentina” or “BBVA” or “the Bank”) announced today its

consolidated results for the third quarter (3Q23), ended on September 30, 2023.

As of January 1, 2020, the Bank

started to inform its inflation adjusted results pursuant to IAS 29 reporting. To facilitate comparison, figures of comparable quarters

of 2022 and 2023 have been updated according to IAS 29 reporting to reflect the accumulated effect of inflation adjustment for each period

up to September 30, 2023.

3Q23 Highlights

| · | BBVA Argentina’s

inflation adjusted net income in 3Q23 was $9.9 billion, 75.9% lower than the $41.0 billion reported on the second quarter of 2023 (2Q23),

and 57.1% lower than the $23.0 billion reported on the third quarter of 2022 (3Q22). BBVA Argentina’s inflation adjusted net income

for the first nine months of 2023 (9M23) totaled $75.9 billion, 8.5% lower than the $83.0 billion reported in the first nine months of

2022 (9M22). |

| · | In 3Q23, BBVA Argentina posted an inflation

adjusted average return on assets (ROAA) of 0.9% and an inflation adjusted average return on equity (ROAE) of 5.1%. In the first nine

months of 2023, BBVA Argentina posted an inflation adjusted ROAA of 2.6% and an inflation adjusted ROAE of 13.5%. |

| · | Operating income in 3Q23 was $167.3 billion,

1.0% below the $169.0 billion recorded in 2Q23 and 45.0% over the $115.4 billion recorded in 3Q22. In the first nine months of 2023, operating

income was $467.7 billion, 59.7% above the $292.8 billion recorded in the same period of 2022. |

| · | In terms of activity,

total consolidated financing to the private sector in 3Q23 totaled $1.4 trillion, falling 4.8% in real terms compared to 2Q23, and contracting

0.1% compared to 3Q22. In the quarter, the variation was mainly driven by a decline in credit cards by 8.9%, in consumer loans

by 11.7% and in other loans by 7.3%. This was offset by an increase in discounted instruments by 7.1%. BBVA’s consolidated

market share of private sector loans reached 9.35% as of 3Q23. |

| · | Total consolidated deposits

in 3Q23 totaled $2.6 trillion, decreasing 4.3% in real terms during the quarter, and increasing 2.3% YoY. Quarterly decrease was mainly

explained by a fall in savings accounts and in time deposits, by 12.3% and 16.0% respectively. The Bank’s consolidated market share

of private deposits reached 7.13% as of 3Q23. |

| · | As of 3Q23, the non-performing

loan ratio (NPL) reached 1.42%, with a 186.28% coverage ratio. |

| · | The accumulated efficiency ratio in 3Q23

was 63.8%, above 2Q23’s 56.6%, and improving compared to 3Q22’s 69.0%. |

| · | As of 3Q23, BBVA Argentina reached a

regulatory capital ratio of 27.1%, entailing a $476.5 billion or 232.0% excess over minimum regulatory requirement. Tier I ratio was 27.1%. |

| · | Total liquid assets represented

76.6% of the Bank’s total deposits as of 3Q23. |

Message from the CFO

“The Argentine Republic has ended its presidential

election process, which started on August 13, with the PASO elections, continued with the general elections on October 22, and ended with

a second round or ballottage on November 19, where Javier Milei from La Libertad Avanza party was elected president, changing the current

ruling party. The presidential inauguration ceremony will take place on December 10.

The unfavorable macroeconomic conditions have

continued to deteriorate, increasing the risk of economic and financial turbulence in the high uncertainty context of the electoral scenario.

BBVA Research expects GDP to fall by around 3.0% this year, 50 basis points less than previously forecast, mainly due to better unexpected

activity data. For the first months of 2024, strong corrections and increase in inflation is expected. In this context, GDP could contract

4.0% in 2024, 150 bps more than what was previously expected.

In September 2023, private credit in pesos

for the system grew 112% YoY, while BBVA Argentina increased its private loan portfolio in pesos by 134%[1]. Neither

the System, nor Bank’s YoY loan growth exceeded that of inflation (which reached 138.3% YoY as of September 2023). Consolidated

market share increased 88 bps from 8.47% to 9.35% YoY. Regarding consolidated private deposits, the system grew 125% while the Bank grew

141%, beating inflation in the year in the case of the Bank. Consolidated market share of deposits for BBVA Argentina was 7.13%, higher

than the 6.68% recorded the prior year.

Referring to BBVA Argentina performance in

the first nine months of 2023, a better operating income was the product of an improvement in interest income, due to an increase in the

position and yield of Central Bank instruments and inflation linked bonds. At the same time, the effect of interest rates over loans,

mainly leveraged on commercial loans, serves the operating income growth.

As of September 2023, BBVA Argentina reached

an NPL ratio of 1.42%, way below the last available system NPL (August 2023) of 3.1%. Concerning liquidity and solvency indicators, the

Bank ends the quarter with 76.6% and 27.1% respectively, levels which undoubtedly allow to address business growth in the case of an economic

recovery.

As of the date of this report, BBVA Argentina

has distributed the total of the 6 installments scheduled on dividend payments, from $50.4 billion total to be paid, according to the

plan published on June 7, 2023, on the terms agreed with the Central Bank.

On digitalization, our service offering has

evolved in such way that by the end of September 2023, mobile monetary transactions increased 123% compared to the same period a year

back. In the quarter, new client acquisition through digital channels over traditional ones was 76%, while in 3Q22 it was 72%.

On September 13, BBVA Argentina launched Spark,

a business unit focused on offering financial services to start-ups and entrepreneurs with a technological base in the country. This was

previously launched in Mexico and Spain, and it already serves more than 700 clients globally, with a credit portfolio of over 200 million

euros.

BBVA Argentina has a corporate responsibility

with society, inherent to the Bank’s business model, which bolsters inclusion, financial education and supports scientific research

and culture. The Bank works with the highest integrity, long-term vision and best practices, and is present through the BBVA Group in

the main sustainability indexes.

Lastly, the Bank actively monitors its business,

financial conditions and operating results, in the aim of keeping a competitive position to face contextual challenges in a decisive year

for the Argentine Republic.”

Carmen Morillo Arroyo,

CFO at BBVA Argentina

3Q23 Conference Call

Wednesday, November 22 - 12:00 p.m. Buenos Aires

time (10:00 a.m. EST)

To participate please dial-in:

+ 54-11-3984-5677 (Argentina)

+ 1-844-450-3851 (United States)

+ 1-412-317-6373 (International)

Web

Phone: click here

Código

de la conferencia: BBVA

Webcast

& Replay: click here

1 Source: BCRA capital balances as of the last day of each

period. Siscen information as of September 30, 2023.

Safe Harbor Statement

This press release

contains certain forward-looking statements that reflect the current views and/or expectations of Banco BBVA Argentina and its management

with respect to its performance, business and future events. We use words such as “believe,” “anticipate,” “plan,”

“expect,” “intend,” “target,” “estimate,” “project,” “predict,”

“forecast,” “guideline,” “seek,” “future,” “should” and other similar expressions

to identify forward-looking statements, but they are not the only way we identify such statements. Such statements are subject to a number

of risks, uncertainties and assumptions. We caution you that a number of important factors could cause actual results to differ materially

from the plans, objectives, expectations, estimates and intentions expressed in this release. Actual results, performance or events may

differ materially from those in such statements due to, without limitation, (i) changes in general economic, financial, business, political,

legal, social or other conditions in Argentina or elsewhere in Latin America or changes in either developed or emerging markets, (ii)

changes in regional, national and international business and economic conditions, including inflation, (iii) changes in interest rates

and the cost of deposits, which may, among other things, affect margins, (iv) unanticipated increases in financing or other costs or the

inability to obtain additional debt or equity financing on attractive terms, which may limit our ability to fund existing operations and

to finance new activities, (v) changes in government regulation, including tax and banking regulations, (vi) changes in the policies of

Argentine authorities, (vii) adverse legal or regulatory disputes or proceedings, (viii) competition in banking and financial services,

(ix) changes in the financial condition, creditworthiness or solvency of the customers, debtors or counterparties of Banco BBVA Argentina,

(x) increase in the allowances for loan losses, (xi) technological changes or an inability to implement new technologies, (xii) changes

in consumer spending and saving habits, (xiii) the ability to implement our business strategy and (xiv) fluctuations in the exchange rate

of the Peso. The matters discussed herein may also be affected by risks and uncertainties described from time to time in Banco BBVA Argentina’s

filings with the U.S. Securities and Exchange Commission (SEC) and Comisión Nacional de Valores (CNV). Readers are cautioned not

to place undue reliance on forward-looking statements, which speak only as the date of this document. Banco BBVA Argentina is under no

obligation and expressly disclaims any intention or obligation to update or revise any forward-looking statements, whether as a result

of new information, future events or otherwise.

Information

This earnings release has been prepared in accordance

with the accounting framework established by the Central Bank of Argentina (“BCRA”), based on International Financial Reporting

Standards (“I.F.R.S.”) and the resolutions adopted by the International Accounting Standards Board (“I.A.S.B”)

and by the Federación Argentina de Consejos Profesionales de Ciencias Económicas (“F.A.C.P.E.”), with the following

exceptions:

a) The exclusion of the application of the IFRS

9 impairment model for non-financial public sector debt instruments.

b) In March 2022, the shares corresponding to

the remaining participation in Prisma Medios de Pago S.A. (“Prisma”) were transferred, which were measured at fair value pursuant

to April 29, 2019, and March 22, 2021 Memorandums received from the BCRA, and the income (loss) from their sale was recorded in the quarter

ended March 31, 2022. Had IFRS rules been applied to determine the fair value mentioned, results for the quarter ended on September 30,

2022 would have been modified. Nonetheless, this does not generate differences regarding the value of equity as of December 31, 2022.

The information in this press release contains

unaudited financial information that consolidates, line item by line item, all of the banking activities of BBVA Argentina, including:

BBVA Asset Management Argentina S.A., Consolidar AFJP-undergoing liquidation proceeding, PSA Finance Argentina Compañía

Financiera S.A. (“PSA”) and Volkswagen Financial Services Compañía Financiera S.A (“VWFS”).

BBVA Seguros Argentina S.A. is disclosed on a

consolidated basis recorded as Investments in associates (reported under the proportional consolidation method), and the corresponding

results are reported as “Income from associates”), same as Rombo Compañía Financiera S.A. (“Rombo”),

Play Digital S.A. (“MODO”), Openpay Argentina S.A. and Interbanking S.A.

Financial statements of subsidiaries have been

elaborated as of the same dates and periods as Banco BBVA Argentina S.A.’s. In the case of consolidated companies PSA and VWFS,

financial statements were prepared considering the B.C.R.A. accounting framework for institutions belonging to “Group C”,

considering the model established by the IFRS 9 5.5. “Impairment” section for periods starting as of January 1, 2022, excluding

debt instruments from the non-financial public sector.

The information published by the BBVA Group for

Argentina is prepared according to IFRS, without considering the temporary exceptions established by BCRA.

Quarterly Results

| INCOME STATEMENT |

BBVA ARGENTINA CONSOLIDATED |

| In millions of AR$ - Inflation adjusted |

|

|

|

∆ % |

| |

3Q23 |

2Q23 |

3Q22 |

QoQ |

YoY |

| Net Interest Income |

270,235 |

250,101 |

182,491 |

8.1% |

48.1% |

| Net Fee Income |

17,623 |

32,004 |

21,730 |

(44.9%) |

(18.9%) |

| Net income from measurement of financial instruments at fair value through P&L |

8,171 |

9,996 |

8,940 |

(18.3%) |

(8.6%) |

| Net income from write-down of assets at amortized cost and at fair value through OCI |

4,068 |

3,088 |

243 |

31.7% |

n.m |

| Foreign exchange and gold gains |

2,140 |

4,357 |

5,300 |

(50.9%) |

(59.6%) |

| Other operating income |

9,991 |

9,457 |

10,722 |

5.6% |

(6.8%) |

| Loan loss allowances |

(7,718) |

(14,962) |

(9,774) |

48.4% |

21.0% |

| Net operating income |

304,510 |

294,041 |

219,652 |

3.6% |

38.6% |

| Personnel benefits |

(42,416) |

(39,110) |

(33,026) |

(8.5%) |

(28.4%) |

| Adminsitrative expenses |

(47,345) |

(42,005) |

(34,999) |

(12.7%) |

(35.3%) |

| Depreciation and amortization |

(4,370) |

(4,709) |

(4,909) |

7.2% |

11.0% |

| Other operating expenses |

(43,074) |

(39,225) |

(31,334) |

(9.8%) |

(37.5%) |

| Operarting expenses |

(137,205) |

(125,049) |

(104,268) |

(9.7%) |

(31.6%) |

| Operating income |

167,305 |

168,992 |

115,384 |

(1.0%) |

45.0% |

| Income from associates |

18 |

799 |

(912) |

(97.7%) |

102.0% |

| Income from net monetary position |

(152,072) |

(104,474) |

(84,309) |

(45.6%) |

(80.4%) |

| Net income before income tax |

15,251 |

65,317 |

30,163 |

(76.7%) |

(49.4%) |

| Income tax |

(5,366) |

(24,383) |

(7,137) |

78.0% |

24.8% |

| Net income for the period |

9,885 |

40,934 |

23,026 |

(75.9%) |

(57.1%) |

| Owners of the parent |

9,631 |

40,525 |

23,444 |

(76.2%) |

(58.9%) |

| Non-controlling interests |

254 |

409 |

(418) |

(37.9%) |

160.8% |

| |

|

|

|

|

|

| Other comprehensive Income (OCI) (1) |

(9,742) |

7,046 |

16,514 |

(238.3%) |

(159.0%) |

| Total comprehensive income |

143 |

47,980 |

39,540 |

(99.7%) |

(99.6%) |

BBVA Argentina 3Q23 net income was $9.9 billion,

decreasing 75.9% or $31.0 billion quarter-over-quarter (QoQ) and 57.1% or $13.1 billion year-over-year (YoY). This implied a quarterly

ROAE of 5.1% and a quarterly ROAA of 0.9%.

Quarterly operating results are mainly explained

by (i) better interest income results through public securities and liquidity instruments, and (ii) an improvement in loan loss allowances.

These were negatively offset by (i) lower net fee income and (ii) higher administrative expenses.

It is worth noting a higher income from write-down

of assets at amortized cost and at fair value through Other Comprehensive Income (OCI) of $4.0 billion, mainly due to the sale of corporate

bonds.

In the quarter, there is a positive effect in

the income tax line, considering the final judgments dictated by the Supreme Court of Justice concerning fiscal years 2014 and 2013, rejecting

the extraordinary appeal and the claim presented by the tax authorities, and affirming the prior favorable final judgments. Applying the

accounting information framework established by the BCRA, the Bank has recorded a positive result of $7.4 billion as of September 30,

2023.

Net Income for the period was highly impacted

by income from net monetary position, as inflation increased from 23.8% in 2Q23 to 34.8%[2]

in 3Q23.

Lastly, the OCI line totaled a negative result

of $9.7 billion million, mainly due to results of financial instruments at fair value through OCI, particularly through the revaluation

of inflation-linked (CER) National Treasury bond portfolio.

Income Statement – 9 month accumulated

| INCOME STATEMENT - 9 MONTH ACCUMULATED |

BBVA ARGENTINA CONSOLIDATED |

| In millions of AR$ - Inflation adjusted |

|

|

|

| |

2023 |

2022 |

∆ % |

| Interest income |

1,503,249 |

868,735 |

73.0% |

| Interest expense |

(763,981) |

(394,649) |

(93.6%) |

| Net interest income |

739,268 |

474,086 |

55.9% |

| Fee income |

121,170 |

125,350 |

(3.3%) |

| Fee expenses |

(52,640) |

(51,045) |

(3.1%) |

| Net fee income |

68,530 |

74,305 |

(7.8%) |

| Net income from financial instruments at fair value through P&L |

29,812 |

26,773 |

11.4% |

| Net loss from write-down of assets at amortized cost and fair value through OCI |

7,220 |

1,774 |

307.0% |

| Foreign exchange and gold gains |

8,257 |

15,660 |

(47.3%) |

| Other operating income |

28,613 |

31,868 |

(10.2%) |

| Loan loss allowances |

(36,327) |

(24,647) |

(47.4%) |

| Net operating income |

845,373 |

599,819 |

40.9% |

| Personnel benefits |

(118,328) |

(100,863) |

(17.3%) |

| Administrative expenses |

(129,368) |

(103,072) |

(25.5%) |

| Depreciation and amortization |

(13,786) |

(15,486) |

11.0% |

| Other operating expenses |

(116,162) |

(87,573) |

(32.6%) |

| Operating expenses |

(377,644) |

(306,994) |

(23.0%) |

| Operating income |

467,729 |

292,825 |

59.7% |

| Income from associates and joint ventures |

717 |

(1,190) |

160.3% |

| Income from net monetary position |

(351,329) |

(217,303) |

(61.7%) |

| Income before income tax |

117,117 |

74,332 |

57.6% |

| Income tax |

(41,233) |

8,624 |

n.m |

| Income for the period |

75,884 |

82,956 |

(8.5%) |

| Owners of the parent |

75,236 |

84,262 |

(10.7%) |

| Non-controlling interests |

648 |

(1,306) |

149.6% |

| |

|

|

|

| Other comprehensive Income (OCI) (1) |

(3,771) |

(7,018) |

46.3% |

| Total comprehensive income |

72,113 |

75,938 |

(5.0%) |

2 Source:

Instituto Nacional de Estadística y Censos (INDEC).

During the first nine months of 2023, BBVA Argentina

net income was $75.9 billion, 8.5% lower than the $83.0 billion reported in the first nine months of 2022. This implied an accumulated

annualized ROAE of 13.5% and a ROAA of 2.6% in 2023, compared to an accumulated annualized ROAE of 17.8% and a ROAA of 3.2% in 2022.

The 59.7% increment in real terms of the Bank’s

operating income is mainly explained by an increase in interest income, mostly due to an increase in the position and yield of Central

Bank instruments and CER bonds.

These effects were negatively offset by (i)

lower net fee income, (ii) lower foreign exchange and gold gains results, (iii) other operating expenses, the latter affected by the increase

in turnover tax derived from a greater income from LELIQ interests, and (iii) higher administrative expenses, mainly due to expenses related

to software and licenses hired through the controlling company abroad.

Another

factor to consider is the income tax line, which had a positive result in the first nine months of 2022 of $8.6 billion, explained

by the implications of fiscal inflation adjustments in the determination of payable taxes and tax deferrals,

recorded during the second quarter of 2022.

Additionally,

net income is affected by income from net monetary position in a context of higher inflation (103.2% 2023 nine month accumulated, versus

66.1% accumulated in the same period of 2022[3]).

| EARNINGS PER SHARE |

BBVA ARGENTINA CONSOLIDATED |

| |

|

|

|

∆ % |

| |

3Q23 |

2Q23 |

3Q22 |

QoQ |

YoY |

| Financial Statement information |

|

|

|

|

|

| Net income for the period attributable to owners of the parent (in AR$ millions, inflation adjusted) |

9,631 |

40,525 |

23,444 |

(76.2%) |

(58.9%) |

| Total shares outstanding (1) |

612,710 |

612,710 |

612,710 |

- |

- |

| Market information |

|

|

|

|

|

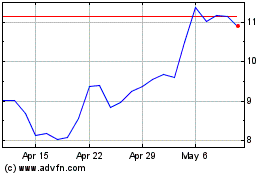

| Closing price of ordinary share at BYMA (in AR$) |

1,024.4 |

1,020.7 |

315.9 |

0.4% |

224.3% |

| Closing price of ADS at NYSE (in USD) |

4.2 |

6.1 |

3.0 |

(32.3%) |

37.9% |

| Book value per share (in AR$) |

1,247.90 |

1,247.67 |

1,174.34 |

0.0% |

6.3% |

| Price-to-book ratio (BYMA price) (%) |

0.82 |

0.82 |

0.27 |

0.4% |

205.2% |

| Earnings per share (in AR$) |

15.72 |

66.14 |

38.26 |

(76.2%) |

(58.9%) |

| Earnings per ADS(2) (in AR$) |

47.16 |

198.42 |

114.79 |

(76.2%) |

(58.9%) |

| |

|

|

|

|

|

| (1) In thousands of shares. |

|

|

|

|

|

| (2) Each ADS accounts for 3 ordinary shares |

|

|

|

|

|

3 Source: Instituto Nacional de Estadística y Censos

(INDEC).

Net Interest Income

| NET INTEREST INCOME |

BBVA ARGENTINA CONSOLIDATED |

| In millions of AR$ - Inflation adjusted |

|

|

|

∆ % |

| |

3Q23 |

2Q23 |

3Q22 |

QoQ |

YoY |

| Net Interest Income |

270,235 |

250,101 |

182,491 |

8.1% |

48.1% |

| Interest Income |

586,891 |

500,488 |

343,875 |

17.3% |

70.7% |

| From government securities |

229,932 |

205,110 |

142,943 |

12.1% |

60.9% |

| From private securities |

683 |

602 |

327 |

13.5% |

108.9% |

| Interest from loans and other financing |

201,347 |

171,592 |

121,168 |

17.3% |

66.2% |

| Financial Sector |

714 |

862 |

1,378 |

(17.2%) |

(48.2%) |

| Overdrafts |

30,875 |

27,275 |

17,609 |

13.2% |

75.3% |

| Discounted Instruments |

61,906 |

43,738 |

20,441 |

41.5% |

202.9% |

| Mortgage loans |

872 |

855 |

2,063 |

2.0% |

(57.7%) |

| Pledge loans |

6,313 |

5,946 |

5,488 |

6.2% |

15.0% |

| Consumer Loans |

21,172 |

21,468 |

16,376 |

(1.4%) |

29.3% |

| Credit Cards |

45,569 |

44,485 |

31,646 |

2.4% |

44.0% |

| Financial leases |

1,660 |

1,419 |

1,055 |

17.0% |

57.3% |

| Loans for the prefinancing and financing of exports |

344 |

261 |

358 |

31.8% |

(3.9%) |

| Other loans |

31,922 |

25,283 |

24,754 |

26.3% |

29.0% |

| Premiums on reverse REPO transactions |

76,607 |

42,666 |

13,898 |

79.6% |

451.2% |

| CER/UVA clause adjustment |

77,965 |

80,126 |

65,267 |

(2.7%) |

19.5% |

| Other interest income |

357 |

392 |

272 |

(8.9%) |

31.3% |

| Interest expenses |

316,656 |

250,387 |

161,384 |

26.5% |

96.2% |

| Deposits |

306,156 |

237,032 |

137,128 |

29.2% |

123.3% |

| Checking accounts |

81,788 |

41,440 |

21,795 |

97.4% |

275.3% |

| Savings accounts |

1,057 |

1,145 |

881 |

(7.7%) |

20.0% |

| Time deposits |

183,237 |

151,749 |

79,877 |

20.8% |

129.4% |

| Investment accounts |

40,074 |

42,698 |

34,575 |

(6.1%) |

15.9% |

| Other liabilities from financial transactions |

187 |

156 |

315 |

19.9% |

(40.6%) |

| Interfinancial loans received |

4,727 |

4,137 |

5,346 |

14.3% |

(11.6%) |

| Premiums on REPO transactions |

15 |

- |

41 |

N/A |

(63.4%) |

| CER/UVA clause adjustment |

5,568 |

9,058 |

18,550 |

(38.5%) |

(70.0%) |

| Other interest expense |

3 |

4 |

4 |

(25.0%) |

(25.0%) |

Net interest income for 3Q23

was $270.2 billion, increasing 8.1% or $20.1 billion QoQ, and 48.1% or $87.7 billion YoY. In 3Q23, interest income, in monetary terms,

increased more than interest expense, mainly due to (i) an increase from premium from reverse REPOs, (ii) a higher position and yield

of public securities, in particular of LELIQ, and (iii) the positive effect of income from loans, especially from discounted instruments

(mainly due to productive investment credit lines for SMEs). This was offset by the negative effect of interest expenses from checking

accounts and time deposits.

In 3Q23, interest income totaled $586.9 billion,

increasing 17.3% compared to 2Q23 and 70.7% compared to 3Q22. Quarterly increase is mainly driven by (i) an increase in income from reverse

REPOs, and (ii) a higher position in public securities, especially LELIQ.

Income from government securities increased

12.1% compared to 2Q23, and 60.9% compared to 3Q22. This is partially due to the higher average position in LELIQ, added to a gradual

increase in the monetary policy rate from 97% at the beginning of the quarter up to 118% at quarter end. 94% of these results are explained

by government securities at fair value through OCI (of which 76% are BCRA securities) and 4% are securities at amortized cost (2027 National

Treasury Bonds at fixed rate, National Treasury Bonds Private 0.70 Badlar Rate maturing on November 2027, and National Treasury Bonds

CER 2025, used for reserve requirement integration).

Interest income from loans and other financing

totaled $201.3 billion, increasing 17.3% QoQ and 66.2% YoY. Quarterly growth is mainly due to an increase in rates, especially through

the discounted instruments line by 41.5%, through an increase in productive investment credit lines for SMEs.

Income from CER/UVA adjustments decreased 2.7%

QoQ and increased 19.5% YoY. Quarterly decline is explained by the delay with which the inflation adjustment effects are recorded, and

impact on the subsequent financial statements. 78% of income from interests from CER/UVA clause adjustments is explained by interests

generated by bonds linked to such indexes.

Interest expenses totaled $316.6 billion, denoting

a 26.5% increase QoQ and a 96.2% increase YoY. Quarterly increase is described by higher checking accounts (in particular interest-bearing

checking accounts) and time deposit expenses.

Interests from time deposits (including investment

accounts) explain 70.5% of interest expenses, versus 77.7% the previous quarter. These increased 20.8% QoQ and 129.4% YoY.

NIM

As of 3Q23, net interest margin

(NIM) was 36.0%, above the 33.3% reported in 2Q23. In 3Q23, NIM in pesos was 37.5% and 1.9% in U.S. dollars.

| ASSETS & LIABILITIES PERFORMANCE - TOTAL |

BBVA ARGENTINA CONSOLIDATED |

| In millions of AR$. Rates and spreads in annualized % |

|

|

|

|

|

|

|

|

| |

3Q23 |

2Q23 |

3Q22 |

| |

Average Balance |

Interest Earned/Paid |

Average Real Rate |

Average Balance |

Interest Earned/Paid |

Average Real Rate |

Average Balance |

Interest Earned/Paid |

Average Real Rate |

| Total interest-earning assets |

2,981,516 |

586,891 |

78.1% |

3,012,790 |

500,488 |

66.6% |

2,768,616 |

343,734 |

49.3% |

| Debt securities |

1,545,312 |

368,175 |

94.5% |

1,596,203 |

309,728 |

77.8% |

1,334,227 |

204,344 |

60.8% |

| Loans to customers/financial institutions |

1,374,136 |

218,711 |

63.1% |

1,368,876 |

190,748 |

55.9% |

1,380,706 |

139,386 |

40.1% |

| Loans to the BCRA |

106 |

3 |

11.2% |

4 |

9 |

935.9% |

5 |

2 |

198.4% |

| Other assets |

61,962 |

2 |

0.0% |

47,707 |

3 |

0.0% |

53,678 |

2 |

0.0% |

| Total non interest-earning assets |

894,149 |

- |

0.0% |

929,810 |

- |

0.0% |

946,308 |

141 |

0.1% |

| Total Assets |

3,875,665 |

586,891 |

60.1% |

3,942,600 |

500,488 |

50.9% |

3,714,923 |

343,875 |

36.7% |

| Total interest-bearing liabilities |

2,025,297 |

316,656 |

62.0% |

2,008,031 |

250,387 |

50.0% |

1,895,858 |

161,384 |

33.8% |

| Savings accounts |

652,403 |

1,057 |

0.6% |

692,542 |

1,145 |

0.7% |

692,146 |

879 |

0.5% |

| Time deposits and investment accounts |

968,014 |

228,878 |

93.8% |

1,034,589 |

203,507 |

78.9% |

961,877 |

133,004 |

54.9% |

| Debt securities issued |

- |

4 |

- |

- |

32 |

- |

455 |

212 |

184.9% |

| Other liabilities |

404,880 |

86,717 |

85.0% |

280,901 |

45,703 |

65.3% |

241,380 |

27,288 |

44.9% |

| Total non-interest-bearing liabilities |

1,850,368 |

- |

0.0% |

1,934,569 |

- |

0.0% |

1,819,065 |

- |

0.0% |

| Total liabilities and equity |

3,875,665 |

316,656 |

32.4% |

3,942,600 |

250,387 |

25.5% |

3,714,923 |

161,384 |

17.2% |

| |

|

|

|

|

|

|

|

|

|

| NIM - Total |

|

|

36.0% |

|

|

33.3% |

|

|

26.1% |

| Spread - Total |

|

|

16.1% |

|

|

16.6% |

|

|

15.5% |

| |

|

|

|

|

|

|

|

|

|

| Nominal rates are calculated over a 365-day year |

|

|

|

|

|

|

|

|

|

| Does not include Net income from measurement of financial instruments at fair value through P&L nor Net income from write-down of assets at amortized cost and at fair value through OCI |

| Interest-bearing checking accounts included in other interest-bearing liabilities. Non interest-bearing accounts are included in non-interest-bearing liabilities. |

|

| ASSETS & LIABILITIES PERFORMANCE - AR$ |

BBVA ARGENTINA CONSOLIDATED |

| In millions of AR$. Rates and spreads in annualized % |

|

|

|

|

|

|

|

|

| |

3Q23 |

2Q23 |

3Q22 |

| |

Average Balance |

Interest Earned/Paid |

Average Real Rate |

Average Balance |

Interest Earned/Paid |

Average Real Rate |

Average Balance |

Interest Earned/Paid |

Average Real Rate |

| Total interest-earning assets |

2,848,446 |

586,100 |

81.6% |

2,864,656 |

499,895 |

70.0% |

2,647,759 |

343,079 |

51.4% |

| Debt securities |

1,504,786 |

368,054 |

97.0% |

1,529,410 |

309,640 |

81.2% |

1,316,444 |

204,294 |

61.6% |

| Loans to customers/financial institutions |

1,281,842 |

218,043 |

67.5% |

1,287,582 |

190,245 |

59.3% |

1,292,041 |

138,783 |

42.6% |

| Loans to the BCRA |

105 |

3 |

11.3% |

3 |

9 |

1403.8% |

2 |

2 |

396.7% |

| Other assets |

61,713 |

- |

0.0% |

47,662 |

- |

0.0% |

39,271 |

- |

0.0% |

| Total non interest-earning assets |

421,888 |

- |

0.0% |

455,969 |

- |

0.0% |

498,573 |

- |

0.0% |

| Total Assets |

3,270,334 |

586,100 |

71.1% |

3,320,625 |

499,895 |

60.4% |

3,146,331 |

343,079 |

43.3% |

| Total interest-bearing liabilities |

1,640,987 |

316,513 |

76.5% |

1,635,742 |

250,309 |

61.4% |

1,529,022 |

161,336 |

41.9% |

| Savings accounts |

326,825 |

1,051 |

1.3% |

372,489 |

1,139 |

1.2% |

376,031 |

874 |

0.9% |

| Time deposits and Investment accounts |

914,525 |

228,855 |

99.3% |

989,513 |

203,486 |

82.5% |

912,822 |

132,981 |

57.8% |

| Debt securities issued |

- |

4 |

- |

- |

32 |

- |

455 |

212 |

184.9% |

| Other liabilities |

399,637 |

86,603 |

86.0% |

273,740 |

45,651 |

66.9% |

239,714 |

27,269 |

45.1% |

| Total non-interest-bearing liabilities |

1,664,932 |

- |

0.0% |

1,742,459 |

- |

0.0% |

1,627,974 |

- |

0.0% |

| Total liabilities and equity |

3,305,919 |

316,513 |

38.0% |

3,378,201 |

250,309 |

29.7% |

3,156,997 |

161,336 |

20.3% |

| |

|

|

|

|

|

|

|

|

|

| NIM - AR$ |

|

|

37.5% |

|

|

34.9% |

|

|

27.2% |

| Spread - AR$ |

|

|

5.1% |

|

|

8.6% |

|

|

9.5% |

| |

|

|

|

|

|

|

|

|

|

| Nominal rates are calculated over a 365-day year |

|

|

|

|

|

|

|

|

|

| Does not include Net income from measurement of financial instruments at fair value through P&L nor Net income from write-down of assets at amortized cost and at fair value through OCI |

| Interest-bearing checking accounts included in other interest-bearing liabilities. Non interest-bearing accounts are included in non-interest-bearing liabilities. |

| ASSETS & LIABILITIES PERFORMANCE - FOREIGN CURRENCY |

BBVA ARGENTINA CONSOLIDATED |

| In millions of AR$. Rates and spreads in annualized % |

|

|

|

|

|

|

|

|

| |

3Q23 |

2Q23 |

3Q22 |

| |

Average Balance |

Interest Earned/Paid |

Average Real Rate |

Average Balance |

Interest Earned/Paid |

Average Real Rate |

Average Balance |

Interest Earned/Paid |

Average Real Rate |

| Total interest-earning assets |

133,070 |

791 |

2.4% |

148,134 |

593 |

1.6% |

120,857 |

655 |

2.2% |

| Debt securities |

40,526 |

121 |

1.2% |

66,793 |

88 |

0.5% |

17,783 |

50 |

1.1% |

| Loans to customers/financial institutions |

92,294 |

668 |

2.9% |

81,295 |

503 |

2.5% |

88,665 |

603 |

2.7% |

| Loans to the BCRA |

1 |

- |

0.0% |

1 |

- |

0.0% |

2 |

- |

0.0% |

| Other assets |

249 |

2 |

3.2% |

44 |

3 |

24.3% |

14,407 |

2 |

0.1% |

| Total non interest-earning assets |

472,261 |

- |

0.0% |

473,841 |

- |

0.0% |

447,735 |

141 |

0.1% |

| Total Assets |

605,331 |

791 |

0.5% |

621,975 |

593 |

0.4% |

568,592 |

796 |

0.6% |

| Total interest-bearing liabilities |

384,310 |

143 |

0.1% |

372,289 |

78 |

0.1% |

366,836 |

48 |

0.1% |

| Savings accounts |

325,578 |

6 |

0.0% |

320,053 |

5 |

0.0% |

316,115 |

5 |

0.0% |

| Time deposits and Investment accounts |

53,489 |

23 |

0.2% |

45,076 |

20 |

0.2% |

49,055 |

24 |

0.2% |

| Other liabilities |

5,243 |

114 |

8.6% |

7,160 |

53 |

2.9% |

1,666 |

19 |

4.5% |

| Total non-interest-bearing liabilities |

185,436 |

- |

0.0% |

192,110 |

- |

0.0% |

191,091 |

- |

0.0% |

| Total liabilities and equity |

569,746 |

143 |

0.1% |

564,399 |

78 |

0.1% |

557,926 |

48 |

0.0% |

| |

|

|

|

|

|

|

|

|

|

| NIM - Foreign currency |

|

|

1.9% |

|

|

1.4% |

|

|

2.0% |

| Spread - Foreign currency |

|

|

2.2% |

|

|

1.5% |

|

|

2.1% |

| |

|

|

|

|

|

|

|

|

|

| Nominal rates are calculated over a 365-day year |

|

|

|

|

|

|

|

|

|

| Does not include Net income from measurement of financial instruments at fair value through P&L nor Net income from write-down of assets at amortized cost and at fair value through OCI |

|

|

|

|

| Interest-bearing checking accounts included in other interest-bearing liabilities. Non interest-bearing accounts are included in non-interest-bearing liabilities. |

|

Net Fee Income

| NET FEE INCOME |

BBVA ARGENTINA CONSOLIDATED |

| In millions of AR$ - Inflation adjusted |

|

|

|

∆ % |

| |

3Q23 |

2Q23 |

3Q22 |

QoQ |

YoY |

| Net Fee Income |

17,623 |

32,004 |

21,730 |

(44.9%) |

(18.9%) |

| Fee Income |

39,521 |

44,971 |

39,351 |

(12.1%) |

0.4% |

| Linked to liabilities |

13,807 |

14,551 |

17,039 |

(5.1%) |

(19.0%) |

| From credit cards (1) |

17,011 |

21,540 |

14,986 |

(21.0%) |

13.5% |

| Linked to loans |

4,253 |

4,475 |

3,214 |

(5.0%) |

32.3% |

| From insurance |

1,609 |

1,606 |

1,731 |

0.2% |

(7.0%) |

| From foreign trade and foreign currency transactions |

1,669 |

1,913 |

1,919 |

(12.8%) |

(13.0%) |

| Other fee income |

1,104 |

773 |

462 |

42.8% |

139.0% |

| Linked to loan commitments |

68 |

113 |

- |

(39.8%) |

N/A |

| From guarantees granted |

20 |

14 |

2 |

42.9% |

n.m |

| Linked to securities |

1,084 |

759 |

460 |

42.8% |

135.7% |

| Fee expenses |

21,898 |

12,967 |

17,621 |

68.9% |

24.3% |

| (1) Includes results from Puntos BBVA royalty program pursuant to IFRS 15 regulation. |

|

|

|

|

Net fee income as of 3Q23 totaled

$17.6 billion, decreasing 44.9% or $14.4 billion QoQ and 18.9% or $4.1 billion YoY.

In 3Q23, fee income totaled

$39.5 billion, falling 12.1% QoQ and lightly increasing 0.4% YoY. The quarterly decrease is mainly explained by a 21.0% fall in fees from

credit cards, considering that this line includes Puntos BBVA royalty program, and that there was a greater use of this program. Additionally,

an increase in prices was implemented during September, not getting to offset the negative effect of inflation, and denoting a 5.1% fall

in the fees linked to liabilities line.

Regarding fee expenses, these

totaled $22.0 billion, increasing 68.9% QoQ and 24.3% YoY. Greater expenses are explained by fees paid in foreign exchange transactions

related to royalties affected by the devaluation of the local currency, and client acquisition costs, which translated into a 4% increase

in active clients in 3Q23.

Net Income from Measurement

of Financial Instruments at Fair Value and Foreign Exchange and Gold Gains/Losses

| NET INCOME FROM FINANCIAL INSTRUMENTS AT FAIR VALUE (FV) THROUGH P&L |

BBVA ARGENTINA CONSOLIDATED |

| In millions of AR$ - Inflation adjusted |

|

|

|

∆ % |

| |

3Q23 |

2Q23 |

3Q22 |

QoQ |

YoY |

| Net Income from financial instruments at FV through P&L |

8,171 |

9,996 |

8,940 |

(18.3%) |

(8.6%) |

| Income from government securities |

5,273 |

9,950 |

6,092 |

(47.0%) |

(13.4%) |

| Income from private securities |

377 |

641 |

986 |

(41.2%) |

(61.8%) |

| Interest rate swaps |

(71) |

(80) |

240 |

11.3% |

(129.6%) |

| Income from foreign currency forward transactions |

1,934 |

(400) |

1,644 |

n.m |

17.6% |

| Income from put option long position |

- |

(115) |

(23) |

100.0% |

100.0% |

| Income from corporate bonds |

657 |

- |

1 |

N/A |

n.m |

| Other |

1 |

- |

- |

N/A |

N/A |

In 3Q23, net income from financial

instruments at fair value (FV) through P&L was $8.2 billion, decreasing 18.3% or $1.8 million QoQ and 8.6% or $769 million YoY.

Quarterly results are mainly

explained by a decrease in the income from government securities line item, due to a lower LELIQ position at fair value through

P&L.

| DIFFERENCES IN QUOTED PRICES OF GOLD AND FOREIGN FOREIGN CURRENCY |

BBVA ARGENTINA CONSOLIDATED |

| In millions of AR$ - Inflation adjusted |

|

|

|

∆ % |

| |

3Q23 |

2Q23 |

3Q22 |

QoQ |

YoY |

| Foreign exchange and gold gains/(losses) (1) |

2,140 |

4,357 |

5,300 |

(50.9%) |

(59.6%) |

| From foreign exchange position |

(4,428) |

(2,240) |

(1,753) |

(97.7%) |

(152.6%) |

| Income from purchase-sale of foreign currency |

6,568 |

6,597 |

7,053 |

(0.4%) |

(6.9%) |

| Net income from financial instruments at FV through P&L (2) |

1,934 |

(400) |

1,644 |

n.m |

17.6% |

| Income from foreign currency forward transactions |

1,934 |

(400) |

1,644 |

n.m |

17.6% |

| Total differences in quoted prices of gold & foreign currency (1) + (2) |

4,074 |

3,957 |

6,944 |

3.0% |

(41.3%) |

In 3Q23, the total differences

in quoted prices of gold and foreign currency showed profit for $4.1 billion, increasing 3.0% or $117 million compared to 2Q23.

The quarterly increase in foreign

exchange and gold gains is mainly explained by a higher result from income from foreign currency forward transactions.

In particular, within the line

of foreign exchange and gold gains, the 50.9% loss is explained mostly by the devaluation of the argentine peso by 26.7%[4]

QoQ, which affected liabilities in foreign currency, such as invoices payable in foreign currency abroad.

4 Taking into consideration wholesale U.S. dollar foreign

exchange rates on BCRA’s Communication “A” 3500.

Other Operating Income

| OTHER OPERATING INCOME |

BBVA ARGENTINA CONSOLIDATED |

| In millions of AR$ - Inflation adjusted |

|

|

|

∆ % |

| |

3Q23 |

2Q23 |

3Q22 |

QoQ |

YoY |

| Operating Income |

9,991 |

9,457 |

10,722 |

5.6% |

(6.8%) |

| Rental of safe deposit boxes (1) |

1,382 |

1,409 |

1,341 |

(1.9%) |

3.1% |

| Adjustments and interest on miscellaneous receivables (1) |

4,647 |

3,853 |

3,691 |

20.6% |

25.9% |

| Punitive interest (1) |

444 |

425 |

255 |

4.5% |

74.1% |

| Loans recovered |

1,145 |

762 |

1,384 |

50.3% |

(17.3%) |

| Non-current assets held for sale |

- |

- |

926 |

N/A |

(100.0%) |

| Fee income from credit and debit cards (1) |

772 |

734 |

921 |

5.2% |

(16.2%) |

| Fee expenses recovery |

391 |

369 |

392 |

6.0% |

(0.3%) |

| Rents |

417 |

391 |

284 |

6.6% |

46.8% |

| Sindicated transaction fees |

168 |

128 |

96 |

31.3% |

75.0% |

| Disaffected provisions |

151 |

239 |

380 |

(36.8%) |

(60.3%) |

| Other Operating Income(2) |

474 |

1,147 |

1,052 |

(58.7%) |

(54.9%) |

| (1) Included in the efficiency ratio calculation |

|

|

|

|

|

| (2) Includes some of the concepts used in the efficiency ratio calculation |

|

|

|

|

|

In 3Q23 other operating income

totaled $10.0 billion, growing 5.6% or $534 million QoQ, and falling 6.8% or $731 million YoY. Quarterly increase is partially explained

by a 20.6% growth in the Adjustments and interest on miscellaneous receivables line item (mainly loans related to Prisma sale),

followed by a 50.3% increase in the loans recovered line.

Operating Expenses

Personnel Benefits and Administrative

Expenses

| PERSONNEL BENEFITS & ADMINISTRATIVE EXPENSES |

BBVA ARGENTINA CONSOLIDATED |

| In millions of AR$ - Inflation adjusted |

|

|

|

∆ % |

| |

3Q23 |

2Q23 |

3Q22 |

QoQ |

YoY |

| Total Personnel Benefits and Adminsitrative Expenses |

89,761 |

81,115 |

68,025 |

10.7% |

32.0% |

| Personnel Benefits (1) |

42,416 |

39,110 |

33,026 |

8.5% |

28.4% |

| Administrative expenses (1) |

47,345 |

42,005 |

34,999 |

12.7% |

35.3% |

| Travel expenses |

338 |

258 |

211 |

31.0% |

60.2% |

| Outsourced administrative expenses |

6,058 |

5,018 |

3,693 |

20.7% |

64.0% |

| Security services |

1,044 |

956 |

888 |

9.2% |

17.6% |

| Fees to Bank Directors and Supervisory Committee |

39 |

50 |

28 |

(22.0%) |

39.3% |

| Other fees |

1,389 |

1,386 |

937 |

0.2% |

48.2% |

| Insurance |

326 |

281 |

327 |

16.0% |

(0.3%) |

| Rent |

6,722 |

6,522 |

5,053 |

3.1% |

33.0% |

| Stationery and supplies |

81 |

54 |

49 |

50.0% |

65.3% |

| Electricity and communications |

1,337 |

1,304 |

1,210 |

2.5% |

10.5% |

| Advertising |

2,136 |

2,288 |

1,656 |

(6.6%) |

29.0% |

| Taxes |

8,840 |

8,039 |

7,352 |

10.0% |

20.2% |

| Maintenance costs |

3,530 |

3,147 |

3,333 |

12.2% |

5.9% |

| Armored transportation services |

3,356 |

3,398 |

3,478 |

(1.2%) |

(3.5%) |

| Software |

8,605 |

6,350 |

3,841 |

35.5% |

124.0% |

| Document distribution |

1,052 |

1,044 |

1,007 |

0.8% |

4.5% |

| Commercial reports |

668 |

400 |

667 |

67.0% |

0.1% |

| Other administrative expenses |

1,824 |

1,510 |

1,269 |

20.8% |

43.7% |

| |

|

|

|

|

|

| Headcount* |

|

|

|

|

|

| BBVA (Bank) |

5,885 |

5,863 |

5,746 |

22 |

139 |

| Subsidiaries (2) |

93 |

94 |

93 |

(1) |

- |

| Total employees* |

6,011 |

5,982 |

5,880 |

29 |

131 |

| In branches** |

2,193 |

1,947 |

1,927 |

246 |

266 |

| At Main office |

3,818 |

4,035 |

3,953 |

(217) |

(135) |

| |

|

|

|

|

|

| Total branches*** |

243 |

243 |

243 |

- |

- |

| Own |

114 |

113 |

113 |

1 |

1 |

| Rented |

129 |

130 |

130 |

(1) |

(1) |

| |

|

|

|

- |

|

| Efficiency Ratio |

|

|

|

|

|

| Efficiency ratio |

82.4% |

52.0% |

64.8% |

3,039 bps |

1,760 bps |

| Accumulated Efficiency Ratio |

63.8% |

56.6% |

69.0% |

719 bps |

(519)bps |

| |

|

|

|

|

|

| (1) Concept included in the efficiency ratio calculation |

|

|

|

|

|

| (2) Includes BBVA Asset Management, PSA & VWFS. Employees included in Main Office. |

|

|

|

|

|

| *Total effective employees, net of temporary contract employees. Expatriates excluded. |

|

|

|

|

|

| **Branch employees + Business Center managers |

|

|

|

|

|

| ***Excludes administrative branches |

|

|

|

|

|

During 3Q23, personnel benefits

and administrative expenses totaled $89.8 billion, increasing 10.7% or $8.6 billion compared to 2Q23, and 32.0% or $21.7 billion compared

to 3Q22.

Personnel benefits increased

8.5% QoQ, and 28.4% YoY. The quarterly increase is mainly explained by the projected inflation adjustment of vacation stock provisions

and variable compensations. This adjustment is applied retroactively. Additionally, the effect of collective agreement on wages with the

unions for 3Q23 by 32% (+97% accumulated year to date) was offset by the release of provisions previously comprised for such purposes.

As of 3Q23, administrative expenses

increased 12.7% QoQ, and 35.3% YoY. The quarterly increase is mainly explained by (i) outsourced administrative expenses, (ii) greater

rent expenses, (iii) taxes, and (iv) an increase in software services. All of these were related to an increase in the amount of services

contracted, and an increase in expenses of services contracted with the Parent company.

The quarterly efficiency ratio

as of 3Q23 was 82.4%, increasing compared to the 52.0% reported in 2Q23, and versus the 64.8% reported in 3Q22. The quarterly increase

is explained by a higher increase in the numerator (expenses) than the denominator (income considering monetary position results), especially

due to a significant increase in results from the net monetary position.

The accumulated efficiency ratio

as of 3Q23 was 63.8%, increasing compared to the 56.6% reported in 2Q23, and improving versus the 69.0% reported in 3Q22.

Other Operating Expenses

| OTHER OPERATING EXPENSES |

BBVA ARGENTINA CONSOLIDATED |

| In millions of AR$ - Inflation adjusted |

|

|

|

∆ % |

| |

3Q23 |

2Q23 |

3Q22 |

QoQ |

YoY |

| Other Operating Expenses |

43,074 |

39,225 |

31,334 |

9.8% |

37.5% |

| Turnover tax |

36,605 |

30,629 |

21,948 |

19.5% |

66.8% |

| Initial loss of loans below market rate |

1,169 |

1,423 |

2,281 |

(17.8%) |

(48.8%) |

| Contribution to the Deposit Guarantee Fund (SEDESA) |

956 |

970 |

1,026 |

(1.4%) |

(6.8%) |

| Interest on liabilities from financial lease |

273 |

237 |

302 |

15.2% |

(9.6%) |

| Other allowances |

387 |

2,910 |

2,432 |

(86.7%) |

(84.1%) |

| Other operating expenses |

3,684 |

3,056 |

3,345 |

20.5% |

10.1% |

In 3Q23, other operating expenses

totaled $43.1 billion, increasing 9.8% or $3.8 billion QoQ, and increasing 37.5% or $11.7 billion YoY.

The key factor explaining the

quarterly growth is in the turnover tax line item, especially due to an increased revenue from interests from loans and revenues

from LELIQ. These expenses are offset by a fall in the other allowances line, linked to the release of provisions related to credit

cards.

Income from Associates

This line reflects the results

from non-consolidated associate companies. During 3Q23, a profit of $18 million has been reported, mainly due to the Bank’s participation

in BBVA Seguros Argentina S.A., Rombo Compañía Financiera S.A., Interbanking S.A. and Play Digital S.A. and Openpay Argentina

S.A.

Income Tax

Accumulated income tax during

the first nine months of 2023 recorded a loss of $41.2 billion. As of 3Q23, income tax expense was $5.4 billion.

In the quarter, there is a positive effect in

the income tax line, considering the final judgments dictated by the Supreme Court of Justice concerning fiscal years 2014 and 2013, rejecting

the extraordinary appeal and the claim presented by the tax authorities, and affirming the prior favorable final judgments. Applying the

accounting information framework established by the BCRA, the Bank has recorded a positive result of $7.4 billion as of September 30,

2023.

The nine month accumulated effective tax rate

in 2023 was 35%[5].

Accumulated income tax during

the first nine months of 2022 recorded a profit of $8.6 billion. Regarding 2Q22, income tax expenses show a positive result, affected

by the implications of inflation adjustments in the determination of payable taxes and tax deferrals.

5 Income tax, according to IAS 34, is recorded on interim

financial periods over the best estimate of the weighted average tax rate expected for the fiscal year.

Balance sheet and activity

Loans and Other Financing

| LOANS AND OTHER FINANCING |

BBVA ARGENTINA CONSOLIDATED |

| In millions of AR$ - Inflation adjusted |

|

|

|

∆ % |

| |

3Q23 |

2Q23 |

3Q22 |

QoQ |

YoY |

| To the public sector |

56 |

5 |

13 |

n.m |

330.8% |

| To the financial sector |

5,433 |

9,550 |

11,798 |

(43.1%) |

(53.9%) |

| Non-financial private sector and residents abroad |

1,386,037 |

1,455,698 |

1,387,717 |

(4.8%) |

(0.1%) |

| Non-financial private sector and residents abroad - AR$ |

1,292,530 |

1,364,510 |

1,299,506 |

(5.3%) |

(0.5%) |

| Overdrafts |

113,366 |

112,300 |

114,022 |

0.9% |

(0.6%) |

| Discounted instruments |

304,672 |

283,215 |

177,389 |

7.6% |

71.8% |

| Mortgage loans |

61,951 |

70,697 |

80,203 |

(12.4%) |

(22.8%) |

| Pledge loans |

38,446 |

43,705 |

52,614 |

(12.0%) |

(26.9%) |

| Consumer loans |

126,135 |

142,813 |

146,466 |

(11.7%) |

(13.9%) |

| Credit cards |

480,385 |

530,399 |

523,516 |

(9.4%) |

(8.2%) |

| Receivables from financial leases |

10,960 |

11,988 |

11,989 |

(8.6%) |

(8.6%) |

| Other loans |

156,615 |

169,393 |

193,307 |

(7.5%) |

(19.0%) |

| Non-financial private sector and residents abroad - Foreign Currency |

93,507 |

91,188 |

88,211 |

2.5% |

6.0% |

| Overdrafts |

9 |

10 |

13 |

(10.0%) |

(30.8%) |

| Discounted instruments |

1,986 |

2,985 |

292 |

(33.5%) |

n.m |

| Credit cards |

15,899 |

14,529 |

18,340 |

9.4% |

(13.3%) |

| Receivables from financial leases |

75 |

125 |

216 |

(40.0%) |

(65.3%) |

| Loans for the prefinancing and financing of exports |

64,585 |

62,098 |

51,273 |

4.0% |

26.0% |

| Other loans |

10,953 |

11,441 |

18,077 |

(4.3%) |

(39.4%) |

| |

|

|

|

|

|

| % of total loans to Private sector in AR$ |

93.3% |

93.8% |

93.7% |

(49)bps |

(40)bps |

| % of total loans to Private sector in Foreign Currency |

6.7% |

6.2% |

6.3% |

49 bps |

40 bps |

| |

|

|

|

|

|

| % of mortgage loans with UVA adjustments / Total mortgage loans (1) |

54.2% |

55.3% |

57.8% |

(114)bps |

(368)bps |

| % of pledge loans with UVA adjustments / Total pledge loans (1) |

0.9% |

1.3% |

2.9% |

(38)bps |

(197)bps |

| % of consumer loans with UVA adjustments / Total consumer loans (1) |

0.1% |

0.2% |

1.1% |

(12)bps |

(97)bps |

| % of loans with UVA adjustments / Total loans and other financing(1) |

0.1% |

0.1% |

0.3% |

(3)bps |

(24)bps |

| |

|

|

|

|

|

| Total loans and other financing |

1,391,526 |

1,465,253 |

1,399,528 |

(5.0%) |

(0.6%) |

| Allowances |

(38,885) |

(46,812) |

(36,896) |

16.9% |

(5.4%) |

| Total net loans and other financing |

1,352,641 |

1,418,441 |

1,362,632 |

(4.6%) |

(0.7%) |

| |

|

|

|

|

|

| (1) Excludes effect of accrued interests adjustments. |

|

|

|

|

|

| LOANS AND OTHER FINANCING TO NON-FINANCIAL PRIVATE SECTOR AND RESIDENTS ABROAD IN FOREIGN CURRENCY |

BBVA ARGENTINA CONSOLIDATED |

| In millions of USD |

|

|

|

∆ % |

| |

3Q23 |

2Q23 |

3Q22 |

QoQ |

YoY |

| FX rate* |

350.01 |

256.68 |

147.32 |

36.4% |

137.6% |

| Non-financial private sector and residents abroad - Foreign Currency (USD) |

267 |

263 |

250 |

1.5% |

6.6% |

| *Wholesale U.S. dollar foreign exchange rates on BCRA’s Communication “A” 3500, as of the end of period. |

|

|

|

|

Private sector loans as of 3Q23

totaled $1.4 trillion, decreasing 4.8% or $69.7 billion QoQ, and 0.1% or $1.7 billion YoY.

Loans to the private sector

in pesos fell 5.3% in 3Q23, and 0.6% YoY. During the quarter, the decrease was especially driven by a 9.4% decline in credit cards,

followed by an 11.7% fall in consumer loans, a 7.5% fall in other loans (mainly commercial loans related to productive investment

credit lines for SMEs). The fall was partially offset by a 7.6% increase in discounted instruments, driven by the new productive

investment credit line quotas.

Loans to the private

sector denominated in foreign currency increased 2.6% QoQ and 6.3% YoY. Quarterly increase is mainly explained by a 4.0% growth in financing

and prefinancing of exports, and a 9.4% growth in credit cards. Loans to the private sector in foreign currency measured in

U.S. dollars increased 1.5% QoQ and 6.6% YoY. The depreciation of the argentine peso versus the U.S. dollar was 26.7% QoQ and 57.9% YoY[6].

In 3Q23, total loans and other

financing totaled $1.4 trillion, declining 4.6% QoQ and 0.7% compared to 3Q22.

| LOANS AND OTHER FINANCING |

BBVA ARGENTINA CONSOLIDATED |

| In millions of AR$ - Inflation adjusted |

|

|

|

∆ % |

| |

3Q23 |

2Q23 |

3Q22 |

QoQ |

YoY |

| Non-financial private sector and residents abroad - Retail |

722,816 |

802,143 |

821,139 |

(9.9%) |

(12.0%) |

| Mortgage loans |

61,951 |

70,697 |

80,203 |

(12.4%) |

(22.8%) |

| Pledge loans |

38,446 |

43,705 |

52,614 |

(12.0%) |

(26.9%) |

| Consumer loans |

126,135 |

142,813 |

146,466 |

(11.7%) |

(13.9%) |

| Credit cards |

496,284 |

544,928 |

541,856 |

(8.9%) |

(8.4%) |

| Non-financial private sector and residents abroad - Commercial |

663,221 |

653,555 |

566,578 |

1.5% |

17.1% |

| Overdrafts |

113,375 |

112,310 |

114,035 |

0.9% |

(0.6%) |

| Discounted instruments |

306,658 |

286,200 |

177,681 |

7.1% |

72.6% |

| Receivables from financial leases |

11,035 |

12,113 |

12,205 |

(8.9%) |

(9.6%) |

| Loans for the prefinancing and financing of exports |

64,585 |

62,098 |

51,273 |

4.0% |

26.0% |

| Other loans |

167,568 |

180,834 |

211,384 |

(7.3%) |

(20.7%) |

| |

|

|

|

|

|

| % of total loans to Retail sector |

52.1% |

55.1% |

59.2% |

(295)bps |

(702)bps |

| % of total loans to Commercial sector |

47.9% |

44.9% |

40.8% |

295 bps |

702 bps |

In real terms, retail loans

(mortgage, pledge, consumer and credit cards) fell 9.9% QoQ and 12.0% YoY in real terms. During the quarter all product lines decline,

mainly credit cards by 8.9% and consumer loans by 11.7%.

Commercial loans (overdrafts,

discounted instruments, receivables from financial leases, loans for the prefinancing and financing of exports, and other loans) increased

1.5% QoQ and 17.1% YoY, both in real terms. This is justified by quarterly increases in discounted instruments by 7.1% offset by

a 7.3% fall in other loans.

As observed in previous quarters,

loan portfolios were impacted by the effect of inflation during the third quarter of 2023, which reached 34.8%. In nominal terms, BBVA

Argentina managed to increase the retail, commercial and total loan portfolio by 21.5%, 36.8% and 28.0% respectively

during the quarter, only surpassing quarterly inflation levels in the case of commercial loans.

6 Taking into consideration wholesale U.S. dollar foreign

exchange rates on BCRA’s Communication “A” 3500.

| LOANS AND OTHER FINANCING - NON RESTATED FIGURES |

BBVA ARGENTINA CONSOLIDATED |

| In millions of AR$ |

|

|

|

∆ % |

| |

3Q23 |

2Q23 |

3Q22 |

QoQ |

YoY |

| Non-financial private sector and residents abroad - Retail |

722,816 |

594,967 |

344,611 |

21.5% |

109.7% |

| Non-financial private sector and residents abroad - Commercial |

663,221 |

484,757 |

237,775 |

36.8% |

178.9% |

| Total loans and other financing (1) |

1,391,526 |

1,086,811 |

587,342 |

28.0% |

136.9% |

| (1) Does not include allowances |

|

|

|

|

|

As of 3Q23, the total loans

and other financing over deposits ratio was 53.6%, lower than the 54.1% recorded in 2Q23 and above the 55.2% in 3Q22.

| MARKET SHARE - PRIVATE SECTOR LOANS |

BBVA ARGENTINA CONSOLIDATED |

| In % |

|

|

|

∆ bps |

| |

3Q23 |

2Q23 |

3Q22 |

QoQ |

YoY |

| Private sector loans - Bank |

8.55% |

8.14% |

7.56% |

41 bps |

99 bps |

| Private sector loans - Consolidated* |

9.35% |

9.01% |

8.47% |

34 bps |

88 bps |

| |

|

|

|

|

|

| Based on daily BCRA information. Capital balance as of the last day of each quarter. |

|

|

|

|

|

| * Consolidates PSA, VWFS & Rombo |

|

|

|

|

|

| LOANS BY ECONOMIC ACTIVITY |

BBVA ARGENTINA CONSOLIDATED |

| % over total gross loans and other financing |

|

|

|

∆ bps |

| |

3Q23 |

2Q23 |

3Q22 |

QoQ |

YoY |

| Government services |

0.00% |

0.00% |

0.00% |

n.m. |

n.m. |

| Non-financial public sector |

0.00% |

0.00% |

0.00% |

n.m. |

n.m. |

| Financial Sector |

0.39% |

0.65% |

0.84% |

(26)bps |

(45)bps |

| Agricultural and Livestock |

4.89% |

5.10% |

5.09% |

(20)bps |

(20)bps |

| Mining products |

4.51% |

3.75% |

3.23% |

77 bps |

128 bps |

| Other manufacturing |

11.36% |

9.18% |

11.64% |

218 bps |

(27)bps |

| Electricity, oil,water and sanitary services |

0.30% |

0.35% |

0.31% |

(5)bps |

(1)bps |

| Wholesale and retail trade |

8.53% |

6.81% |

5.63% |

173 bps |

290 bps |

| Transport |

1.70% |

1.77% |

1.55% |

(7)bps |

15 bps |

| Services |

1.61% |

2.08% |

1.69% |

(47)bps |

(8)bps |

| Others |

15.76% |

17.04% |

13.96% |

(128)bps |

179 bps |

| Construction |

0.66% |

0.62% |

0.75% |

4 bps |

(9)bps |

| Consumer |

50.28% |

52.66% |

55.30% |

(238)bps |

(502)bps |

| Total gross loans and other financing |

100% |

100% |

100% |

|

|

Asset Quality

| ASSET QUALITY |

BBVA ARGENTINA CONSOLIDATED |

| In millions of AR$ - Inflation adjusted |

|

|

|

∆ % |

| |

3Q23 |

2Q23 |

3Q22 |

QoQ |

YoY |

| Commercial non-performing portfolio (1) |

1,899 |

887 |

2,002 |

114.1% |

(5.1%) |

| Total commercial portfolio |

556,588 |

562,518 |

489,556 |

(1.1%) |

13.7% |

| Commercial non-performing portfolio / Total commercial portfolio |

0.34% |

0.16% |

0.41% |

18 pbs |

(7)pbs |

| Retail non-performing portfolio (1) |

18,976 |

20,543 |

13,575 |

(7.6%) |

39.8% |

| Total retail portfolio |

914,086 |

991,602 |

968,799 |

(7.8%) |

(5.6%) |

| Retail non-performing portfolio / Total retail portfolio |

2.08% |

2.07% |

1.40% |

0 pbs |

67 pbs |

| Total non-performing portfolio (1) |

20,875 |

21,430 |

15,577 |

(2.6%) |

34.0% |

| Total portfolio |

1,470,674 |

1,554,120 |

1,458,355 |

(5.4%) |

0.8% |

| Total non-performing portfolio / Total portfolio |

1.42% |

1.38% |

1.07% |

4 pbs |

35 pbs |

| Allowances |

38,885 |

46,812 |

36,896 |

(16.9%) |

5.4% |

| Allowances /Total non-performing portfolio |

186.28% |

218.44% |

236.86% |

(3.217)pbs |

(5.059)pbs |

| Quarterly change in Write-offs |

5,164 |

4,082 |

4,035 |

26.5% |

28.0% |

| Write offs / Total portfolio |

0.35% |

0.26% |

0.28% |

9 pbs |

7 pbs |

| Cost of Risk (CoR) |

2.14% |

4.09% |

2.65% |

(195)bps |

(51)bps |

| |

|

|

|

|

|

| (1) Non-performing loans include: all loans to borrowers classified as "Deficient Servicing (Stage 3)", "High Insolvency Risk (Stage 4)", "Irrecoverable" and/or "Irrecoverable for Technical Decision" (Stage 5) according to BCRA debtor classification system |

As of 3Q23, asset quality ratio or NPL (total

non-performing portfolio / total portfolio) keeps a very good performance at 1.42%. The increase from 2Q23’s 1.38% is explained

by a slight increase in the commercial non-performing portfolio (linked to an increment in the currency foreign exchange rate).

Coverage ratio

(allowances / total non-performing portfolio) decreased from 218.44% in 2Q23 to186.28% in 3Q23 due to the release

of provisions related to credit cards, derived from the stability in the NPL ratios of the retail portfolio.

Cost of risk

(loan loss allowances / average total loans) reached 2.14% in 3Q23 compared to 4.09% in 2Q23. The

decrease is related to the previously mentioned release of provisions.

| ANALYSIS FOR THE ALLOWANCE OF LOAN LOSSES |

BBVA ARGENTINA CONSOLIDATED |

| In millions of AR$ |

|

|

|

|

|

|

| |

Balance at 12/31/2022 |

Stage 1 |

Stage 2 |

Stage 3 |

Monetary result generated by allowances |

Balance at 09/30/2022 |

| Other financial assets |

939 |

103 |

- |

221 |

(553) |

710 |

| Loans and other financing |

42,437 |

3,999 |

2,359 |

18,749 |

(28,659) |

38,885 |

| Other debt securities |

65 |

32 |

- |

- |

(52) |

45 |

| Eventual commitments |

5,473 |

1,090 |

(414) |

92 |

(3,237) |

3,004 |

| Total allowances |

48,915 |

5,223 |

1,945 |

19,061 |

(32,500) |

42,644 |

| |

|

|

|

|

|

|

| Note: to be consistent with Financial Statements, it must be recorded from the beginning of the year instead of the quarter |

|

Allowances for the Bank in 3Q23

reflect expected losses driven by the adoption of the IFRS 9 standards as of January 1, 2020, except for debt instruments issued by the

nonfinancial government sector which were excluded from the scope of such standard.

Public Sector Exposure

| NET PUBLIC DEBT EXPOSURE* |

BBVA ARGENTINA CONSOLIDATED |

| In millions of AR$ - Inflation adjusted |

|

|

|

∆ % |

| |

3Q23 |

2Q23 |

3Q22 |

QoQ |

YoY |

| Treasury and Government securities |

494,352 |

463,129 |

375,247 |

6.7% |

31.7% |

| Treasury and National Government |

494,352 |

463,129 |

375,247 |

6.7% |

31.7% |

| National Treasury Public Debt in AR$ |

414,205 |

463,122 |

360,647 |

(10.6%) |

14.9% |

| National Treasury Public Debt in USD |

24 |

7 |

1,940 |

243.9% |

(98.8%) |

| National Treasury Public Debt in AR$ linked to US dollars |

80,124 |

- |

12,660 |

N/A |

n.m |

| Loans to theNon-financial Public Sector |

56 |

5 |

6 |

n.m |

n.m |

| AR$ Subtotal |

414,261 |

463,127 |

360,653 |

(10.6%) |

14.9% |

| USD Subtotal** |

80,148 |

7 |

14,600 |

n.m |

449.0% |

| Total Public Debt Exposure |

494,408 |

463,134 |

375,253 |

6.8% |

31.8% |

| B.C.R.A. Exposure |

1,092,508 |

1,285,731 |

1,176,960 |

(15.0%) |

(7.2%) |

| Instruments |

787,744 |

1,048,808 |

949,903 |

(24.9%) |

(17.1%) |

| Leliqs |

775,493 |

1,005,898 |

888,087 |

(22.9%) |

(12.7%) |

| Notaliqs |

- |

- |

59,710 |

N/A |

(100.0%) |

| Lediv*** |

12,250 |

42,911 |

2,106 |

(71.5%) |

481.6% |

| Loans to the B.C.R.A. |

- |

- |

7 |

N/A |

(100.0%) |

| Repo / Pases |

304,765 |

236,923 |

227,051 |

28.6% |

34.2% |

| |

|

|

|

|

|

| % Public sector exposure (Excl. B.C.R.A.) / Total assets |

12.7% |

11.0% |

9.8% |

177 pbs |

290 pbs |

| |

|

|

|

|

|

| *Deposits at the Central Bank used to comply with reserve requirements not included. Includes assets used as collateral. |

|

|

|

|

|