false

--12-31

0000007536

0000007536

2024-12-11

2024-12-11

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE

COMMISSION

WASHINGTON, DC 20549

FORM 8-K

CURRENT REPORT

PURSUANT

TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of

earliest event reported): December 11, 2024

ARROW

ELECTRONICS, INC.

(Exact Name of Registrant

as Specified in Charter)

| New York |

1-4482 |

11-1806155 |

| (State or Other Jurisdiction |

(Commission File |

(IRS Employer |

| of Incorporation) |

Number) |

Identification No.) |

| 9151

East Panorama Circle, Centennial,

CO |

80112 |

| (Address of Principal Executive Offices) |

(Zip Code) |

Registrant's telephone number,

including area code: (303) 824-4000

Not Applicable

(Former Name or Former Address,

if Changed Since Last Report)

Check the appropriate box

below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following

provisions (see General Instruction A.2. below):

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b)

of the Act:

| Title of each class | |

Trading Symbol(s) | |

Name of the exchange

on which

registered |

| Common

Stock, $1 par value | |

ARW | |

New

York Stock Exchange |

Indicate by check mark

whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter)

or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ¨

If an emerging growth company,

indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised

financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

| Item 5.02. |

Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers. |

On December 11, 2024, the Board of Directors (the “Board”)

of Arrow Electronics, Inc. (the “Company”) increased the size of the Board from nine (9) to ten (10) directors

and appointed Lawrence Chen, age 53, to the Board, effective as of that date. Mr. Chen will serve for a term continuing until the

Company’s 2025 annual meeting of shareholders and until his successor has been duly elected and qualified, or until his earlier

resignation or removal. The Board also approved Mr. Chen’s appointment to the Audit Committee of the Board. The Board has affirmatively

determined that Mr. Chen qualifies as an “independent director” under the applicable New York Stock Exchange Rules, meets

the heightened independence criteria required of audit committee members, and qualifies as financially literate.

Mr. Chen has served as President and Chief Executive Officer,

and a member of the Board of Directors, of InterDigital, Inc., a pioneer in wireless, video, and artificial intelligence and leader

in intellectual-property licensing since 2021. Prior to that, Mr. Chen served in roles of increasing responsibility at Qualcomm Incorporated,

culminating in his appointment as Senior Vice President, Global Head of IP, Legal Counsel, from 2019 to 2021.

Mr. Chen will receive cash and equity compensation in accordance

with the Company’s director compensation program, as described under the caption “Director Compensation” in the Company’s

most recent proxy statement for its 2024 annual meeting of shareholders filed with the Securities and Exchange Commission on March 26,

2024, which description is incorporated herein by reference. In addition, Mr. Chen and the Company have entered into the Company’s

standard form indemnification agreement.

The appointment of Mr. Chen to serve as a director was not pursuant

to any arrangement or understanding with respect to any other person. In addition, there are no related party transactions between Mr. Chen

and the Company that would be required to be disclosed pursuant to Item 404(a) of Regulation S-K.

| Item 5.03. |

Amendments to Articles of Incorporation or Bylaws; Change in Fiscal Year. |

On December 12, 2024, with approval of the Board, the Company

filed with the Secretary of State of the State of New York, a restated certificate of incorporation (“Restated Certificate”),

which:

| (i) | eliminates all matters set forth in the Company’s Certificate of Incorporation with respect to shares of the Company’s

$19.375 Convertible Exchangeable Preferred Stock, Participating Preferred Stock, and Series B $19.375 Convertible Exchangeable Preferred

Stock, as no shares of any such series are currently outstanding; |

| (ii) | changes the post office address to which the Secretary of State shall mail a copy of any process against the Company served upon the

Secretary of State; |

| (iii) | designates the Company’s current registered agent, and specifies the address of the registered agent; and |

| (iv) | changes the county of the Company’s office within the State of New York. |

The Restated Certificate became effective as of December 12, 2024,

upon the filing with the Secretary of State of the State of New York pursuant to Section 807 of the New York Business Corporation

Law.

The foregoing summary of the changes effected by the Restated Certificate

does not purport to be complete and is qualified in its entirety by reference to the full text of the Restated Certificate, a copy of

which is attached as Exhibit 3.1 to this Current Report on Form 8-K and incorporated herein by reference.

| Item 7.01. |

Regulation FD Disclosure. |

A copy of the press release announcing the appointment of Mr. Chen

as a member of the Board effective December 11, 2024, is attached hereto as Exhibit 99.1. The information in this Item 7.01

of this Current Report on Form 8-K and Exhibit 99.1 attached hereto is being furnished and shall not be deemed “filed”

for any purpose, including for the purposes of Section 18 of the Exchange Act, as amended (the “Exchange Act”), or otherwise

subject to the liabilities of that section, nor shall it be deemed incorporated by reference into any filing under the Securities Act

of 1933, as amended, or the Exchange Act, whether made before or after the date hereof, except as expressly set forth by specific reference

in such filing.

| Item 9.01 |

Financial Statements and Exhibits. |

(d) Exhibits

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

ARROW ELECTRONICS, INC. |

| |

|

| Date: December 12, 2024 |

By: |

/s/ Carine L. Jean-Claude |

| |

Name: |

Carine L. Jean-Claude |

| |

Title: |

Senior Vice President, Chief Legal Officer and Secretary |

Exhibit 3.1

RESTATED CERTIFICATE OF INCORPORATION

OF

ARROW ELECTRONICS, INC.

Under Section 807 of the Business Corporation Law

| 1. | The name of the Corporation is Arrow Electronics, Inc. |

| 2. | The date of filing of the Certificate of Incorporation of the Corporation in the office of the Department

of State is November 20, 1946. |

| 3. | The Certificate of Incorporation is hereby amended or changed to effect the following amendments or changes

authorized by the Business Corporation Law of the State of New York: (1) (a) the elimination of the Corporation’s $19.375

Convertible Exchangeable Preferred Stock, no shares of which are outstanding and no shares of which series will be issued subject to the

Certificate of Incorporation, (b) the elimination of the Corporation’s Participating Preferred Stock, no shares of which are

outstanding and no shares of which series will be issued subject to the Certificate of Incorporation, and (c) the elimination of

the Corporation’s Series B $19.375 Convertible Exchangeable Preferred Stock, no shares of which are outstanding and no shares

of which series will be issued subject to the Certificate of Incorporation, (2) to change the post office address to which the Secretary

of State shall mail a copy of any process against the Corporation served upon the Secretary of State, (3) to designate Corporation

Service Company as the Corporation's registered agent, and to specify the address of the registered agent, and (4) to change the

county location, within the state of New York, in which the office of the Corporation is located to Suffolk County. |

| 4. | The text of the certificate of incorporation hereby is restated, as amended, in its entirety as follows: |

FIRST: The name of the Corporation is

ARROW ELECTRONICS, INC.

SECOND: The purposes for which this Corporation is formed

are as follows:

To design, patent,

manufacture, fabricate, buy, sell, distribute, import, export and generally deal in electrical devices, wireless telegraph and telephone

instruments, sets, apparatus and parts thereof, radio transmitting and receiving instruments, sets, apparatus and parts thereof, electronic

devices, instruments, sets, apparatus and parts thereof, as well as television instruments, sets, apparatus and parts thereof.

To buy, sell and

trade in all machinery, supplies and merchandise, and to do any and every act or thing that may be appurtenant, incidental to or necessary

in connection with the foregoing purposes.

To take, buy,

exchange, lease or otherwise acquire real estate and any interest or right therein, and to hold, own, operate, control, maintain,

manage and develop the same and to construct, maintain, alter, manage and control directly or through ownership of stock in any

other corporation any and all kinds of buildings, stores, offices, warehouses, mills, shops, factories, machinery and plants, and

any and all other structures and erections which may at any time be necessary, useful or advantageous for the purpose of this

Corporation.

To sell, assign and transfer,

convey, lease or otherwise alienate or dispose of, and to mortgage or otherwise encumber the lands, buildings, real and personal property

of the Corporation wherever situated, and any and all legal and equitable interests therein.

To purchase, sell, lease,

manufacture, deal in and deal with every kind of goods, wares and merchandise, and every kind of personal property, including patents

and patent rights, chattels, easements, privileges and franchises which may lawfully be purchased, sold, produced, or dealt in by corporations

formed under Article Two of the Stock Corporation Law of the State of New York.

To purchase, acquire, hold

and dispose of the stocks, bonds and other evidences of indebtedness of any corporation, domestic or foreign, and to issue in exchange

therefor its stocks, bonds or other obligations, and to exercise in respect thereof all the rights, powers and privileges of individual

owners; including the right to vote thereon; and to aid in any manner permitted by law any corporation of which any bonds or other securities

or evidences of indebtedness or stocks are held by this corporation, and to do any acts or things designed to protect, preserve, improve

or enhance the value of any such bonds or other securities or evidence of indebtedness of stock.

The foregoing and the following

clauses shall be construed as objects and powers in furtherance and not in limitation of the general powers conferred by the laws of the

State of New York; and it is hereby expressly provided that the foregoing and the following enumeration of specific powers shall not be

held to limit or restrict in any manner the powers of this Corporation, and that this Corporation may do all and everything necessary,

suitable or proper for the accomplishment of any of the purposes or objects hereinabove enumerated either alone or in association with

other corporations, firms or individuals, to the same extent and as fully as individuals might or could do as principals, agents, contractors

or otherwise.

Nothing in this certificate

contained, however, shall authorize the Corporation to carry on any business or exercise any powers in any state or county which a similar

corporation organized under the laws of such state or county could not carry on or exercise; or to engage within or without the State

of New York in the business of a lighting or a transportation corporation, or in the common carrier business, or to issue bills, notes

or other evidences of debt for circulation of money.

THIRD: The total number of shares of all classes

of stock which the Corporation shall have authority to issue is One Hundred Sixty-Two Million (162,000,000) shares, consisting of:

(a) Two Million (2,000,000)

shares of Preferred Stock having a par value of $1 per share (hereinafter referred to as “Preferred Stock”); and

(b) One Hundred Sixty

Million (160,000,000) shares of Common Stock having a par value of $1 per share (hereinafter referred to as “Common Stock”)

A. Preferred

Stock:

Shares of Preferred Stock

may be issued from time to time in one or more series, as may from time to time be determined by the Board of Directors, each of said

series to be distinctly designated. All shares of any one series of Preferred Stock shall be alike in every particular, except that there

may be different dates from which dividends, if any, thereon shall be cumulative, if made cumulative. The voting powers and the preferences

and relative, participating, optional and other special rights or each such series, and the qualifications, limitations or restrictions

thereof, if any, may differ from those of any and all other series at any time outstanding; and, subject to the provisions of subparagraph

1 of Paragraph C of this Article THIRD, the Board of Directors of the Corporation is hereby expressly granted authority to fix by

resolution or resolutions adopted prior to the issuance of any shares of a particular series of Preferred Stock, the voting powers and

the designations, preferences and relative, optional and other special rights and the qualifications, limitations and restrictions of

such series, including, but without limiting the generality of the foregoing, the following:

(a) The

distinctive designation of, and the number of shares of Preferred Stock which shall constitute such series, which number may be increased

(except where otherwise provided by the Board of Directors) or decreased (but not below the number of shares thereof then outstanding)

from time to time by like action of the Board of Directors;

(b) The

rate and times at which, and the terms and conditions on which, dividends, if any, on Preferred Stock of such series shall be paid, the

extent of the preference or relation, if any, of such dividends to the dividends payable on any other class or classes, or series of the

same or other classes of stock and whether such dividends shall be cumulative or non-cumulative;

(c) The

right, if any, of the holders of Preferred Stock of such series to convert the same into, or exchange the same for, shares of any other

class or classes or, of any series of the same or any other class or classes or, of any series of the same or any other class or classes

of stock of the Corporation and the terms and conditions of such conversion or exchange;

(d) Whether

or not Preferred Stock of such series shall be subject to redemption, and the redemption price or prices be subject to redemption, and

the redemption price or prices and the time or times at which, and the terms and conditions on which Preferred Stock of such series may

be redeemed;

(e) The

rights, if any, of the holders of Preferred Stock of such series upon the voluntary or involuntary liquidation, merger, consolidation,

distribution or sale of assets, dissolution or winding-up, of the Corporation;

(f) The

terms of the sinking fund or redemption or purchase account, if any, to be provided for the Preferred Stock of such series; and

(g) The voting powers,

if any, of the holders of such series of Preferred Stock which may, without limiting the generality of the foregoing, include the right,

voting as a series by itself or together with other series of Preferred Stock or all series of Preferred Stock as a class, to elect one

or more directors of the Corporation if there shall have been a default in the payment of dividends on any one or more series of Preferred

Stock or under such other circumstances and on such conditions as the Board of Directors may determine; provided, however, that each holder

of Preferred Stock shall have no more than one vote in respect of each shares of Preferred Stock held by him on any matter voted upon

by the shareholder.

B. Common

Stock

1. After the requirements

with respect to preferential dividends on the Preferred Stock (fixed in accordance with the provisions of Paragraph A of this Article THIRD),

if any, shall have been met and after the Corporation shall have complied with all the requirements, if any, with respect to the setting

aside of sums as sinking funds or redemption or purchase accounts (fixed in accordance with the provisions of Paragraph A of this Article THIRD),

and subject further to any other conditions which may be fixed in accordance with the provisions of Paragraph A of this Article THIRD,

then and not otherwise the holders of Common Stock shall be entitled to receive such dividends as may be declared from time to time by

the Board of Directors.

2. After distribution, in

full of the preferential amount, if any (foxed in accordance with the provisions of Paragraph A of this Article THIRD), to be distributed

to the holders of Preferred Stock in the event of voluntary or involuntary liquidation, distribution or sale of assets, dissolution or

winding-up, of the Corporation, the holders of the Common Stock shall be entitled to receive all the remaining assets of the Corporation,

tangible and intangible, of whatever kind available for distribution to shareholders ratably in proportion to the number of shares of

Common Stock held by them respectively.

3. Except

as may otherwise be required by law or by the provisions of such resolution or resolutions as may be adopted by the Board of Directors

pursuant to Paragraph A of this Article THIRD, each holder of Common Stock shall have one vote in respect of each share of Common

Stock held by him on all matters voted upon by the shareholders.

1. No

holder of any of the shares of any class or series of stock or of options, warrants or other rights to purchase shares of any class

or series of stock or of other securities of the Corporation shall have any preemptive right to purchase or subscribe for any

unissued stock of any class or series or any additional shares of any class or series to be issued by reason of any increase of the

authorized capital stock of the Corporation of any class or series, or bonds, certificates of indebtedness, debentures or other

securities convertible into or exchangeable for stock of the Corporation of any class or series, or carrying any right to purchase

stock of any class or series, but any such unissued stock, additional authorized issue of shares of any class or series of stock or

securities convertible into or exchangeable for stock, or carrying any right to purchase stock, may be issued and disposed of

pursuant to resolution of the Board of Directors to such persons, firms, corporations or associations, whether such holders or

others, and upon such terms as may be deemed advisable by the Board of Directors in the exercise of its sole discretion.

2. The

relative powers, preferences and rights of each series of Preferred Stock in relation to the powers, preferences and rights of each other

series of Preferred Stock shall, in each case be as fixed from time to time by the Board of Directors in the resolution or resolutions

adopted pursuant to authority granted in Paragraph A of this Article THIRD and the consent, by class or series vote or otherwise,

of the holders of such of the series of Preferred Stock as are from time to time outstanding shall not be required for the issuance by

the Board of Directors of any other series of Preferred Stock whether or not the powers, preferences and rights of such other series shall

be fixed by the Board of Directors as senior to, or on a parity with, the powers, preferences and rights of such outstanding series, or

any of them; provided, however, that the Board of Directors may provide in the resolution or resolutions as to any series of Preferred

Stock adopted pursuant to Paragraph A of this Article THIRD that the consent of the holders of a majority (or such greater proportion

as shall be therein fixed) of the outstanding shares of such series voting thereon shall be required for the issuance of any or all other

series of Preferred Stock.

3. Subject

to the provisions of subparagraph 2 of this Paragraph C, shares of any series of Preferred Stock may be issued from time to time as the

Board of Directors of the Corporation shall determine and on such terms and for such consideration as shall be fixed by the Board of Directors.

4. Shares

of Common Stock may be issued from time to time as the Board of Directors of the Corporation shall determine and on such terms and for

such consideration as shall be fixed by the Board of Directors.

5. The

authorized amount of shares of Common Stock and of Preferred Stock may, without a class or series vote, be increased or decreased from

time to time by the affirmative vote of the holders of a majority of the stock of the Corporation entitled to vote thereon.

FOURTH: The Office of the Corporation within the

State of New York shall be located in the County of Suffolk.

FIFTH: The Secretary of State is designated as

the agent of the Corporation upon whom process against the Corporation may be served. The post office address to which the Secretary of

State shall mail a copy of any process against the Corporation accepted on behalf of the Corporation, is Corporation Service Company,

80 State Street, Albany, NY 12207.

SIXTH: The duration of the Corporation shall be perpetual.

SEVENTH: The number of directors shall be no less

than three and no more than fifteen. Directors need not be shareholders.

EIGHTH: The Corporation designates the following

as its registered agent upon whom process against the Corporation may be served in the State of New York:

Corporation Service Company

80 State Street

Albany, NY 12207

NINTH: The following provisions are inserted for

the regulation and conduct of the affairs of the Corporation, and it is expressly provided that they are intended to be in furtherance

and not in limitation or exclusion of the powers conferred by law:

No contract or other transaction

between the Corporation and any other firm or corporation shall be affected or invalidated by reason of the fact that any one or more

of the directors or officers of this Corporation is or are interested in, or is a member, stockholder, director, or officer, or are members,

stockholders, directors, or officers of such other firm or corporation; and any director or officer or officers, individually or jointly,

may be a party or parties to, or may be interested in, any contract or transaction of this Corporation, or in which this Corporation is

interested, and no contract, act or transaction of this Corporation with any person or persons, firm, association or corporation, shall

be affected or invalidated by reason of the fact that any director or directors, officer or officers of this Corporation is a party or

are parties to, or interested in, such contract, act or transaction, or in any way connected with such person or persons, firm, association

or corporation, and each and every person who may become a director or officer of this Corporation is relieved from any liability that

might otherwise exist from thus contracting with this Corporation for the benefit of himself or any firm, association or corporation in

which he may be in anywise interested.

Subject to such restrictions

and regulations contained in By-Laws adopted by the stockholders, the Board of Directors may make, alter, amend and rescind the By-laws,

and may provide therein for the appointment of an executive committee from their own members, to exercise all or any of the powers of

the Board, which may lawfully be delegated when not in session. The By-Laws may be amended or repealed, at any time, by the stockholders.

The Board of Directors shall

have power in its discretion, to provide for and to pay to directors rendering unusual or exceptional services to the Corporation, special

compensation appropriate to the value of such services.

By resolution duly adopted

by the holders of not less than a majority of the shares of stock then issued and outstanding and entitled to vote at any regular or special

meeting of the stockholders of the Corporation duly called and held as provided in the By-Laws of the Corporation, any director or directors

of the Corporation may be removed from office at any time or times, with our without cause. The Board of Directors may at any time remove

any officer of the Corporation with or without cause.

Any person made a party to

any action, suit or proceeding by reason of the fact that he, is testator or intestate, is or was a director, officer or employee of the

Corporation or of any corporation which he served as such at the request of the Corporation shall be indemnified by the Corporation against

the reasonable expenses, including attorney’s fees, actually and necessarily incurred by him in connection with the defense of such

action, suit or proceedings, or in connection with any appeal therein, except in relation to matters as to which it shall be adjudged

in such action, suit or proceeding that such officer, director or employee is liable for negligence or misconduct in the performance of

his duties. The foregoing right or indemnification shall not be deemed exclusive of any other rights to which any officer or director

or employee may be entitled apart from the provisions of this section.

The Corporation may use and

apply its surplus earnings or accumulated profits, not otherwise by law to be reserved, to the purchase or acquisition of property and

to the purchase or acquisition of its own capital stock from time to time and to such extent and in such manner and upon such terms as

its Board of Directors shall determine; and neither the property nor the capital stock so purchased or acquired, nor any of its own capital

stock taken in payment of satisfaction of any debt due to the Corporation, shall be regarded as profits for the purpose of declaration

or payment of dividends, unless otherwise determined by a majority of the Board of Directors.

A director of this Corporation

shall not be personally liable to the Corporation or its shareholders for damages for any breach of fiduciary duty as a director, except

for liability resulting from a judgment or other final adjudication adverse to the director: (i) for acts or omissions in bad faith

or which involve intentional misconduct or a knowing violation of the law, (ii) for any transaction from which the director derived

a financial profit or other advantage to which the director was not legally entitled, or (iii) under Section 719 of the New

York Business Corporation Law.

TENTH: A. 1. In addition to any affirmative vote

required by law or under any other provision of this Certificate of Incorporation, and except as otherwise expressly provided in Paragraph

B:

(i) any

merger or consolidation of the Corporation or any Subsidiary (as hereinafter defined) with or into (A) any 30% Shareholder (as

hereinafter defined) or (B) any other corporation (whether or not itself a 30% Shareholder) which, after such merger or

consolidation, would be an Affiliate (as hereinafter defined) of a 30% Shareholder, or

(ii) any sale, lease, exchange,

mortgage, pledge, transfer or other disposition (in one transaction or a series of related transactions) to or with any 30% Shareholder

of any assets of the Corporation or any Subsidiary having an aggregate fair market value of $5,000,000 or more, or

(iii) the

issuance or transfer by the Corporation or any Subsidiary (in one transaction or a series of related transactions) of any securities

of the Corporation or any Subsidiary to any 30% Shareholder in exchange for cash, securities or other property (or a combination

thereof) having an aggregate fair market value of $5,000,000 or more, provided, however, that this clause (iii) shall not be

applicable to any issuance or transfer to a 30% Shareholder if the acquisition of the 30% Interest (as hereinafter defined) by such

30% Shareholder was approved by the Board of Directors of the Corporation prior to the time that such 30% Shareholder became a 30%

Shareholder and such 30% Shareholder is entitled to acquire such shares pursuant to an agreement approved by a majority of the

continuing directors, or

(iv) any reclassification

of securities (including any reverse stock split), recapitalization, reorganization or any similar transaction designed to reduce materially,

or having the effect of reducing materially, the percentage of the outstanding shares of capital stock of the Corporation entitled to

vote generally in the election of directors, considered for the purpose of this Article TENTH as one class (“Voting Shares”),

which are held by the holders (“Public Holders”) of Voting Shares other than any 30% Shareholder,

shall require the affirmative vote of the holders

of at least 90% of the Voting Shares. Such affirmative vote shall be required notwithstanding the fact that no vote may be required, or

that some lesser percentage may be specified, by law or in any agreement with any national securities exchange or otherwise.

2. The

term “business combination” as used in this Article TENTH shall mean any transaction which is referred to in any one

or more of clauses (i) through (iv) of subparagraph 1 of this Paragraph A.

B. The provisions of Paragraph A of this Article TENTH

shall not be applicable to any particular business combination, and such business combination shall require only such affirmative vote

as is required by law and any other provision of this Certificate of Incorporation, if all of the following conditions shall have been

satisfied:

1. The ratio of:

(a) the aggregate amount

of the cash and the fair market value of other consideration to be received per share by holders of common stock of the Corporation (“Common

Stock”) in such business combination,

(b) the market price of

the Common Stock immediately prior to the announcement of such business combination is at least as great as the ratio of

(i) the highest per share

price (including brokerage commissions, transfer taxes and soliciting dealers’ fees) which such 30% Shareholder has theretofore

paid for any shares of Common Stock already owned by it, to

(ii) the market price

of the Common Stock immediately prior to the initial acquisition by such 30% Shareholder of any Common Stock; and

2. The aggregate amount of

the cash and fair market value of other consideration to be received per share by holders of Common Stock in such business combination

(i) is not less than the

highest per share price (including brokerage commissions, transfer taxes and soliciting dealers’ fees) paid by such 30% Shareholder

in acquiring any of its holdings of Common Stock, and

(ii) is not less than the

earnings per share of Common Stock for the four full consecutive fiscal quarters immediately preceding the record date for solicitation

of votes on such business combination multiplied by the then price/earnings multiple (if any) of such 30% Shareholder as customarily computed

and reported in the financial community; and

3. The

consideration to be received by holders of Common Stock in such business combination shall be in the same form and of the same kind as

the consideration paid by the 30% Shareholder in acquiring the shares of Common Stock already owned by it; and

4. After

such 30% Shareholder has acquired ownership of not less than 30% of the then outstanding Voting Shares (a “30% Interest”)

and prior to the consummation of such business combination:

(i) the 30% Shareholder

shall have taken steps to ensure that the Corporation’s Board of Directors include at all times representation by continuing director(s) (as

hereinafter defined) proportionate to the ratio that the Voting Shares which from time to time are not owned by any 30% Shareholder bear

to all Voting Shares outstanding at such respective times (with a continuing director to occupy any resulting fractional board position);

(ii) there shall have been

no reduction in the rate of dividends payable on the Common Stock except as necessary to ensure that a quarterly dividend payment does

not exceed 15% of the net income of the Corporation for the four full consecutive fiscal quarters immediately preceding the declaration

date of such dividend, or except as may have been approved by a unanimous vote of all directors which the Corporation would have if there

were no vacancies (the “whole Board”);

(iii) such 30% Shareholder

shall not have acquired any newly issued shares of stock, directly or indirectly, from the Corporation (except upon conversion of convertible

securities acquired by it prior to obtaining a 30% Interest or as a result of a pro rata stock dividend or stock split); and

(iv) such 30% Shareholder

shall not have acquired any additional shares of the Corporation’s outstanding Common Stock or securities convertible into or exchangeable

for Common Stock except as a part of the transaction which resulted in such 30% Shareholder acquiring its 30% interest; and

5. Prior to

the consummation of such business combination, such 30% Shareholder shall not have (i) received the benefit, directly or

indirectly (except proportionately as a shareholder), of any loans, advances, guarantees, pledges or other financial assistance or

tax credits provided by the Corporation, or (ii) made any major changes in the Corporation’s business or equity capital

structure without the unanimous approval of the whole Board; and

6. A proxy statement responsive

to the requirements of the Securities Exchange Act of 1934 shall have been mailed to all holders of Voting Shares for the purpose of soliciting

shareholder approval of such business combination. Such proxy statement shall contain at the front thereof, in a prominent place, any

recommendations as to the advisability (or inadvisability) of the business combination which the continuing directors, or any of them,

may have furnished in writing and, if deemed advisable by a majority of the continuing directors, an opinion of a reputable investment

banking firm as to the fairness (or lack of fairness) of the terms of such business combination, from the point of view of the Public

Holders (such investment banking firm to be selected by a majority of the continuing directors, to be furnished with all information it

reasonably requests and to be paid a reasonable fee for its services upon receipt by the Corporation of such opinion).

| C. | For the purposes of this Article TENTH: |

| 1. | A “person” shall mean any individual, firm, corporation or other entity. |

2. “30%

Shareholder” shall mean, in respect of any business combination, any person (other than the Corporation) who or which, as of the

record date for the determination of shareholders entitled to notice of and to vote on such business combination,

(a) is the beneficial owner,

directly or indirectly, of not less than 30% of the Voting Shares, or

(b) is an Affiliate of

the Corporation and at any time prior thereto was the beneficial owner, directly or indirectly, of not less than 30% of the then outstanding

Voting Shares, or

(c) is an assignee of or

has otherwise succeeded to any shares of capital stock of the Corporation which were at any time prior thereto beneficially owned by any

30% Shareholder, and such assignment or succession shall have occurred in the course of a transaction or series of transactions not involving

a public offering within the meaning of the Securities Act of 1933, provided, however that this clause (c) shall not be applicable

to any assignment or succession of shares of capital stock that were previously owned by any 30% Shareholder if the acquisition of the

30% Interest by each 30% Shareholder that previously owned any of such shares was approved by the Board of Directors of the Corporation

prior to the time that such 30% Shareholder became a 30% Shareholder and each assignment or succession of such shares from such a 30%

Shareholder is in accordance with an agreement between such 30% Shareholder and the Corporation approved by a majority of the continuing

directors that permits such an assignment or succession.

3. A

person shall be the “beneficial owner” of any Voting Shares:

(a) which such person or

any of its Affiliates or Associates (as hereinafter defined) beneficially owns, directly or indirectly, or

(b) which such person or

any of its Affiliates or Associates has (i) the right to acquire (whether such right is exercisable immediately or only after the

passage of time) pursuant to any agreement, arrangement or understanding or upon the exercise of conversion rights, exchange rights, warrants,

or options, or otherwise, or (ii) the right to vote pursuant to any agreement, arrangement or understanding, or

(c) which are beneficially

owned, directly or indirectly, by any other person with which such first mentioned person or any of its Affiliates or Associates has any

agreement, arrangement, or understanding for the purpose of acquiring, holding, voting or disposing of any shares of capital stock of

the Corporation.

4. The

outstanding Voting Shares shall include shares deemed owned through application of subparagraph 3 above but shall not include any other

Voting Shares which may be issuable pursuant to any agreement, or upon exercise of conversion rights, warrants or options, or otherwise.

5. “Continuing

director” shall mean a person who was a member of the Board of Directors of the Corporation elected by the Public Holders prior

to the date as of which any 30% Shareholder acquired in excess of 10% of the then outstanding Voting Shares, or a person designated (before

his initial election as a director) as a continuing director by a majority of the then continuing directors.

6. “Other

consideration to be received” shall mean Common Stock of the Corporation retained by its Public Holders in the event of a business

combination in which the Corporation is the surviving corporation.

7. “Affiliate”

and “Associate” shall have the respective meanings given those terms in Rule 12b-2 of the General Rules and Regulations

under the Securities Exchange Act of 1934, as in effect on January 1, 1978.

8. “Subsidiary”

means any corporation of which a majority of any class of equity security (as defined in Rule 3a11-1 of the General Rules and

Regulations under the Securities Exchange Act of 1934, as in effect on January 1, 1978) is owned, directly or indirectly, by the

Corporation.

D. A

majority of the continuing directors shall have the power and duty to determine for the purposes of this Article TENTH, on the basis

of information known to them, (a) the number of Voting Shares beneficially owned by any person, (b) whether a person is an Affiliate

or Associate of another, (c) whether a person has an agreement, arrangement or understanding with another as to the matters referred

to in subparagraph 3 of Paragraph C, or (d) whether the assets subject to any business combination have an aggregate fair market

value of $5,000,000 or more.

E. Any

amendment, alteration, change or repeal of this Article TENTH of this Certificate of Incorporation shall require the

affirmative vote of the holders of at least 90% of the then outstanding Voting Shares; provided, however, that this Paragraph E

shall not apply to, and such 90% vote shall not be required for, any amendment, alteration, change or repeal unanimously recommended

to the shareholders by the whole Board if all members of the whole Board are continuing directors.

F. Nothing contained in this Article TENTH

shall be construed to relieve any 30% Shareholder from any fiduciary obligation imposed by law.

| 5. | That the above-described amendments to this Certificate of Incorporation were authorized by vote of the

Board of Directors of the Corporation without a vote of the shareholders, as authorized by Sections 807(a), 502(e), and 803(b) of

the Business Corporation Law. |

IN WITNESS WHEREOF this Restated Certificate of Incorporation has been

signed this day of December 12, 2024.

| |

/s/ Carine L.

Jean-Claude |

| |

Name: |

Carine L. Jean-Claude |

| |

Title: |

Senior Vice President, Chief Legal Officer and Secretary |

RESTATED CERTIFICATE

OF INCORPORATION

OF

ARROW ELECTRONICS, INC.

Under Section 807 of the Business Corporation Law

Department of State Identification Number: 60328

Filer's Name and Mailing Address:

ARROW ELECTRONICS, INC.

Name

ARROW ELECTRONICS, INC.

Company, if applicable

9151 EAST PANORAMA CIRCLE

Mailing Address

CENTENNIAL, CO, UNITED STATES, 80112

City, State, and Zip Code

Exhibit 99.1

Arrow Electronics

Names Lawrence (Liren) Chen as a New Director to Its Board

Centennial, Colo. – Dec.12, 2024 – Arrow Electronics, Inc.

(NYSE:ARW) today announced that Lawrence (Liren) Chen has joined the company’s board of directors and has been appointed a member

of the board’s audit committee. The addition of Chen will increase the total number of directors on the board to 10.

Chen is president, chief executive officer and a member of the board

of directors of InterDigital, Inc., a global research and development company focused primarily on wireless, video, artificial intelligence

and related technologies.

Prior to joining InterDigital, Chen served in roles of increasing

responsibility at Qualcomm Inc. for nearly 25 years, culminating in his appointment as senior vice president, global head of IP, legal

counsel. In that role, Mr. Chen oversaw Qualcomm’s global intellectual property portfolio and led technology, business strategy,

product management and global eco-system development for Qualcomm Technology Licensing.

Chen is a member of the U.S. Chamber of Commerce China Advisory Committee

and a member of the Council for Inclusive Innovation of the U.S. Patent and Trademark Office.

About Arrow Electronics

Arrow Electronics, Inc. (NYSE:ARW) sources and engineers technology

solutions for thousands of leading manufacturers and service providers. With global 2023 sales of $33 billion, Arrow’s portfolio

enables technology across major industries and markets. Learn more at arrow.com.

Media Contact

Arrow Electronics, Inc.

John Hourigan

jhourigan@arrow.com

###

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionEnd date of current fiscal year in the format --MM-DD.

| Name: |

dei_CurrentFiscalYearEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:gMonthDayItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

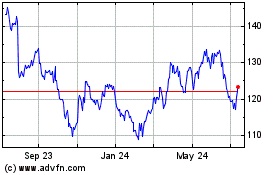

Arrow Electronics (NYSE:ARW)

Historical Stock Chart

From Dec 2024 to Jan 2025

Arrow Electronics (NYSE:ARW)

Historical Stock Chart

From Jan 2024 to Jan 2025