AAC Holdings, Inc. Completes $125 Million Credit Facility

March 09 2015 - 4:05PM

Business Wire

AAC Holdings, Inc. (NYSE: AAC) announced the closing of a $125

million senior secured credit facility, consisting of a $50 million

revolving credit facility and a $75 million term loan. The facility

matures in March 2020 and amounts outstanding under the credit

facility bear interest at LIBOR plus a margin between 2.25% to

3.25% or a base rate plus a margin between 1.25% and 2.25%, in each

case depending on the Company’s leverage. The facility also has an

accordion feature that allows the total borrowing capacity under

the credit facility to be increased up to $200 million, subject to

certain conditions, including obtaining additional commitments from

lenders.

The facility is led by Bank of America Merrill Lynch and

SunTrust Robinson Humphrey as Joint Bookrunners and Joint Lead

Arrangers and includes BMO Harris Bank, N.A., an affiliate of Bank

of Montreal, Raymond James Bank, Texas Capital Bank, Western

Alliance Bank and Reliant Bank.

Michael Cartwright, Chairman and Chief Executive Officer of AAC

Holdings, noted, “We have an active pipeline of de novo projects

and acquisitions. The new facility and its attractive pricing

enhance the flexibility of our balance sheet to continue executing

these growth strategies. We appreciate the support from this strong

syndicate of healthcare lenders.”

About American Addiction Centers

American Addiction Centers is a leading provider of inpatient

substance abuse treatment services. We treat adults as well as

adolescents who are struggling with drug addiction, alcohol

addiction, and co-occurring mental/behavioral health issues. We

operate eight substance abuse treatment facilities and one mental

health facility specializing in overeating disorders. Located

throughout the United States, these facilities are focused on

delivering effective clinical care and treatment solutions.

Forward Looking Statements

This release contains forward looking statements within the

meaning of the federal securities laws. These forward looking

statements are made only as of the date of this release. In some

cases, you can identify forward-looking statements by terms such as

“anticipates,” “believes,” “could,” “estimates,” “expects,” “may,”

“potential,” “predicts,” “projects,” “should,” “will,” “would,” and

similar expressions intended to identify forward-looking

statements, although not all forward-looking statements contain

these words. Forward-looking statements may include information

concerning AAC Holdings’ possible or assumed future results of

operations, including descriptions of AAC Holdings’ revenues,

profitability, outlook and overall business strategy. These

statements involve known and unknown risks, uncertainties and other

factors that may cause our actual results and performance to be

materially different from the information contained in the forward

looking statements. These risks, uncertainties and other factors

include, without limitation: (i) our inability to operate our

facilities; (ii) our reliance on our sales and marketing program to

continuously attract and enroll clients; (iii) a reduction in

reimbursement rates by certain third-party payors; (iv) our failure

to successfully achieve growth through acquisitions and de novo

expansions; and (v) general economic conditions, as well as other

risks discussed in the “Risk Factors” section of the Company’s

registration statement on Form S-1, as amended, and other filings

with the Securities and Exchange Commission. As a result of these

factors, we cannot assure you that the forward looking statements

in this release will prove to be accurate. Investors should not

place undue reliance upon forward looking statements.

SCR PartnersTripp Sullivan,

615-760-1104IR@contactAAC.com

Ares Acquisition (NYSE:AAC)

Historical Stock Chart

From Jun 2024 to Jul 2024

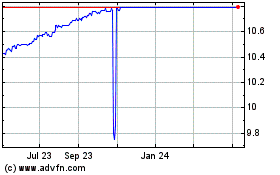

Ares Acquisition (NYSE:AAC)

Historical Stock Chart

From Jul 2023 to Jul 2024