MidCap Financial Investment Corporation (NASDAQ: MFIC) today

announced that it has received stockholder approval of the proposal

related to the previously announced proposed mergers with Apollo

Senior Floating Rate Fund Inc. (NYSE: AFT) and Apollo Tactical

Income Fund Inc. (NYSE: AIF).

AFT announced today the adjournment of its

Special Meeting of Stockholders (the “AFT Special Meeting”),

convened on May 28, 2024, to provide stockholders with additional

time to vote on the proposed merger of AFT with and into MFIC (the

“AFT Merger Proposal”). The AFT Special Meeting will be reconvened

on June 21, 2024 at 10:30 a.m. Eastern Time and will take place via

live audio webcast at www.virtualshareholdermeeting.com/AFT2024SM.

At the time the AFT Special Meeting was adjourned,

stockholders representing approximately 47.08% of AFT’s common

shares outstanding and entitled to vote had submitted proxies or

votes in favor of the AFT Merger Proposal. Under AFT’s

organizational documents, the AFT Merger Proposal requires support

from a majority of common shares outstanding. Therefore, an

additional 2.92% of AFT’s outstanding shares are needed to vote

“FOR” the AFT Merger Proposal in order to achieve the necessary

threshold. The Board of Directors of AFT unanimously

recommends that stockholders vote “FOR” the AFT Merger

Proposal.

AIF announced today the adjournment of its

Special Meeting of Stockholders (the “AIF Special Meeting”),

convened on May 28, 2024, to provide stockholders with additional

time to vote on the proposed merger of AIF with and into MFIC (the

“AIF Merger Proposal”). The AIF Special Meeting will be reconvened

on June 21, 2024 at 11:00 a.m. Eastern Time and will take place via

live audio webcast at www.virtualshareholdermeeting.com/AIF2024SM.

At the time the AIF Special Meeting was adjourned, stockholders

representing approximately 46.02% of AFT’s common shares

outstanding and entitled to vote had submitted proxies or votes in

favor of the AIF Merger Proposal. Under AIF’s organizational

documents, the AIF Merger Proposal requires support from a majority

of common shares outstanding. Therefore, an additional 3.98% of

AIF’s outstanding shares are needed to vote “FOR” the AIF Merger

Proposal in order to achieve the necessary threshold. The

Board of Directors of AIF unanimously recommends that stockholders

vote “FOR” the AIF Merger Proposal.

In addition, AFT and AIF are pleased to announce

that ISS and Glass Lewis have recommended that stockholders vote

“FOR” the AFT Merger Proposal and the AIF Merger Proposal,

respectively.

The record date for determining stockholders

entitled to vote at the AFT Special Meeting and the AIF Special

Meeting will remain the close of business on March 28, 2024.

Stockholders as of the record date can vote, even if they have

subsequently sold their shares. Stockholders who have already voted

do not need to recast their votes. Proxies previously submitted

will be voted at the reconvened meetings unless properly

revoked.

During the adjournment period, AFT and AIF and

their independent proxy solicitor, Broadridge Financial Solutions

(“Broadridge”), will continue to solicit votes from stockholders.

AFT and AIF encourage any stockholder that has not yet voted to

contact their broker, bank or Broadridge at 1-855-200-8397. The

Boards of Directors of AFT and AIF respectively request

stockholders vote their proxies as soon as possible to ensure that

the Special Meetings can occur without further delay. Voting today

will help us reduce the risk of an additional meeting adjournment

and the incurrence of additional solicitation costs.

About MidCap Financial Investment

Corporation

MidCap Financial Investment Corporation (NASDAQ:

MFIC) is a closed-end, externally managed, diversified management

investment company that has elected to be treated as a business

development company (“BDC”) under the Investment Company Act of

1940 (the “1940 Act”). For tax purposes, the Company has elected to

be treated as a regulated investment company (“RIC”) under

Subchapter M of the Internal Revenue Code of 1986, as amended (the

“Code”). The Company is externally managed by Apollo Investment

Management, L.P. (the “MFIC Adviser”), an affiliate of Apollo

Global Management, Inc. and its consolidated subsidiaries

(“Apollo”), a high-growth global alternative asset manager. The

Company’s investment objective is to generate current income and,

to a lesser extent, long-term capital appreciation. The Company

primarily invests in directly originated and privately negotiated

first lien senior secured loans to privately held U.S.

middle-market companies, which the Company generally defines as

companies with less than $75 million in EBITDA, as may be adjusted

for market disruptions, mergers and acquisitions-related charges

and synergies, and other items. To a lesser extent, the Company may

invest in other types of securities including, first lien

unitranche, second lien senior secured, unsecured, subordinated,

and mezzanine loans, and equities in both private and public middle

market companies. For more information, please visit

www.midcapfinancialic.com.

About Apollo Senior Floating Rate Fund

Inc.

Apollo Senior Floating Rate Fund Inc. (NYSE:

AFT) is registered under the 1940 Act as a diversified closed-end

management investment company. AFT’s investment objective is to

seek current income and preservation of capital by investing

primarily in senior, secured loans made to companies whose debt is

rated below investment grade and investments with similar economic

characteristics. Senior loans typically hold a first lien priority

and pay floating rates of interest, generally quoted as a spread

over a reference floating rate benchmark. Under normal market

conditions, AFT invests at least 80% of its managed assets (which

includes leverage) in floating rate senior loans and investments

with similar economic characteristics. Apollo Credit Management,

LLC, an affiliate of Apollo, serves as AFT’s investment adviser.

For tax purposes, AFT has elected to be treated as a RIC under the

Code. For more information, please visit

www.apollofunds.com/apollo-senior-floating-rate-fund.

About Apollo Tactical Income Fund

Inc.

Apollo Tactical Income Fund Inc. (NYSE: AIF) is

registered under the 1940 Act as a diversified closed-end

management investment company. AIF’s primary investment objective

is to seek current income with a secondary objective of

preservation of capital by investing in a portfolio of senior

loans, corporate bonds and other credit instruments of varying

maturities. AIF seeks to generate current income and preservation

of capital primarily by allocating assets among different types of

credit instruments based on absolute and relative value

considerations. Under normal market conditions, AIF invests at

least 80% of its managed assets (which includes leverage) in credit

instruments and investments with similar economic characteristics.

Apollo Credit Management, LLC, an affiliate of Apollo, serves as

AIF’s investment adviser. For tax purposes, AIF has elected to be

treated as a RIC under the Code. For more information, please visit

www.apollofunds.com/apollo-tactical-income-fund.

Forward-Looking Statements

Some of the statements in this press release

constitute forward-looking statements because they relate to future

events, future performance or financial condition. The

forward-looking statements may include statements as to: future

operating results of MFIC, AFT and AIF, and distribution

projections; business prospects of MFIC, AFT and AIF, and the

prospects of their portfolio companies, if applicable; and the

impact of the investments that MFIC, AFT and AIF expect to make. In

addition, words such as “anticipate,” “believe,” “expect,” “seek,”

“plan,” “should,” “estimate,” “project” and “intend” indicate

forward-looking statements, although not all forward-looking

statements include these words. The forward-looking statements

contained in this press release involve risks and uncertainties.

Certain factors could cause actual results and conditions to differ

materially from those projected, including the uncertainties

associated with (i) the ability of the parties to consummate one or

both of the Mergers contemplated by the Agreement and Plan of

Merger among MFIC, AFT and certain other parties thereto and the

Agreement and Plan of Merger among MFIC, AIF and certain other

parties thereto on the expected timeline, or at all; (ii) the

expected synergies and savings associated with the Mergers; (iii)

the ability to realize the anticipated benefits of the Mergers,

including the expected elimination of certain expenses and costs

due to the Mergers; (iv) the percentage of the stockholders of

MFIC, AFT and AIF voting in favor of the applicable Proposals (as

defined below); (v) the possibility that competing offers or

acquisition proposals will be made; (vi) the possibility that any

or all of the various conditions to the consummation of the Mergers

may not be satisfied or waived; (vii) risks related to diverting

management’s attention from ongoing business operations; (viii) the

combined company’s plans, expectations, objectives and intentions,

as a result of the Mergers; (ix) any potential termination of one

or both merger agreements; (x) the future operating results and net

investment income projections of MFIC, AFT and AIF or, following

the closing of one or both of the Mergers, the combined company;

(xi) the ability of MFIC Adviser to implement MFIC Adviser’s future

plans with respect to the combined company; (xii) the ability of

MFIC Adviser and its affiliates to attract and retain highly

talented professionals; (xiii) the business prospects of MFIC, AFT

and AIF or, following the closing of one or both of the Mergers,

the combined company and the prospects of their portfolio

companies; (xiv) the impact of the investments that MFIC, AFT and

AIF or, following the closing of one or both of the Mergers, the

combined company expect to make; (xv) the ability of the portfolio

companies of MFIC, AFT and AIF or, following the closing of one or

both of the Mergers, the combined company to achieve their

objectives; (xvi) the expected financings and investments and

additional leverage that MFIC, AFT and AIF or, following the

closing of one or both of the Mergers, the combined company may

seek to incur in the future; (xvii) the adequacy of the cash

resources and working capital of MFIC, AFT and AIF or, following

the closing of one or both of the Mergers, the combined company;

(xviii) the timing of cash flows, if any, from the operations of

the portfolio companies of MFIC, AFT and AIF or, following the

closing of one or both of the Mergers, the combined company; (xix)

future changes in laws or regulations (including the interpretation

of these laws and regulations by regulatory authorities); and (xx)

the risk that stockholder litigation in connection with one or both

of the Mergers may result in significant costs of defense and

liability. MFIC, AFT and AIF have based the forward-looking

statements included in this press release on information available

to them on the date hereof, and they assume no obligation to update

any such forward-looking statements. Although MFIC, AFT and AIF

undertake no obligation to revise or update any forward-looking

statements, whether as a result of new information, future events

or otherwise, you are advised to consult any additional disclosures

that they may make directly to you or through reports that MFIC,

AFT, and/or AIF in the future may file with the SEC, including the

Joint Proxy Statement and the Registration Statement (in each case,

as defined below), annual reports on Form 10-K, annual reports on

Form N-CSR, quarterly reports on Form 10-Q, semi-annual reports on

Form N-CSRS and current reports on Form 8-K.

No Offer or Solicitation

This press release is not, and under no

circumstances is it to be construed as, a prospectus or an

advertisement and the communication of this press release is not,

and under no circumstances is it to be construed as, an offer to

sell or a solicitation of an offer to purchase any securities in

MFIC, AFT and AIF or in any fund or other investment vehicle

managed by Apollo or any of its affiliates.

Additional Information and Where to Find

It

This press release relates to the proposed

Mergers and certain related matters (the “Proposals”). In

connection with the Proposals, MFIC, AFT, and AIF filed with the

SEC and mailed to their respective stockholders a joint proxy

statement on Schedule 14A (the “Joint Proxy Statement”), and MFIC

filed with the SEC a registration statement that includes the Joint

Proxy Statement and a prospectus of MFIC (the “Registration

Statement”). The Joint Proxy Statement and the Registration

Statement each contains important information about MFIC, AFT and

AIF and the Proposals. This communication does not constitute an

offer to sell or the solicitation of an offer to buy any securities

or a solicitation of any vote or approval. No offer of securities

shall be made except by means of a prospectus meeting the

requirements of Section 10 of the Securities Act.

STOCKHOLDERS OF MFIC, AFT, AND AIF ARE URGED TO READ THE

JOINT PROXY STATEMENT AND REGISTRATION STATEMENT, AND OTHER

DOCUMENTS THAT ARE FILED OR WILL BE FILED WITH THE SEC, AS WELL AS

ANY AMENDMENTS OR SUPPLEMENTS TO THESE DOCUMENTS, CAREFULLY AND IN

THEIR ENTIRETY WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN

IMPORTANT INFORMATION ABOUT MFIC, AFT, AND AIF AND THE

PROPOSALS. Investors and security holders will be able to

obtain the documents filed with the SEC free of charge at the SEC’s

website, http://www.sec.gov or, for documents filed by MFIC, from

MFIC’s website at https://www.midcapfinancialic.com, and, for

documents filed by AFT, from AFT’s website at

https://www.apollofunds.com/apollo-senior-floating-rate-fund, and,

for documents filed by AIF, from AIF’s website at

https://www.apollofunds.com/apollo-tactical-income-fund.

Participants in the

Solicitation

MFIC, its directors, certain of its executive

officers and certain employees and officers of MFIC Adviser and its

affiliates may be deemed to be participants in the solicitation of

proxies in connection with the Proposals. Information about the

directors and executive officers of MFIC is set forth in its proxy

statement for its 2024 Annual Meeting of Stockholders, which was

filed with the SEC on April 29, 2024. AFT, AIF, their directors,

certain of their executive officers and certain employees and

officers of Apollo Credit Management, LLC and its affiliates may be

deemed to be participants in the solicitation of proxies in

connection with the Proposals. Information about the directors and

executive officers of AFT and AIF is set forth in the proxy

statement for their 2024 Annual Meeting of Stockholders, which was

filed with the SEC on May 8, 2024. Information regarding the

persons who may, under the rules of the SEC, be considered

participants in the solicitation of the MFIC, AFT, and AIF

stockholders in connection with the Proposals is contained in the

Joint Proxy Statement. These documents may be obtained free of

charge from the sources indicated above.

Contact

Broadridge Financial Solutions Proxy Solicitor

for MFIC, AFT and AIF 1-855-200-8397

Elizabeth Besen Investor Relations Manager for

MFIC, AFT and AIF 212.822.0625 ebesen@apollo.com

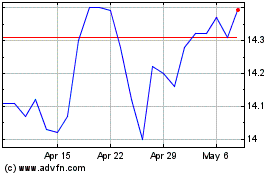

Apollo Tactical Income (NYSE:AIF)

Historical Stock Chart

From Nov 2024 to Dec 2024

Apollo Tactical Income (NYSE:AIF)

Historical Stock Chart

From Dec 2023 to Dec 2024