Apollo (NYSE: APO) and Mubadala Investment Company (“Mubadala”)

today announced an extension of their multi-billion-dollar

partnership focused on global origination opportunities. The

multiple year extension of this partnership, which was first

established in 2022, further strengthens Apollo’s Capital Solutions

business and ability to originate investment opportunities of scale

across asset classes to help meet the growing demand for bespoke

private debt and equity financing solutions globally.

Co-President of Apollo Asset Management Jim

Zelter said, “We are pleased to extend our partnership with

Mubadala, which builds on our strong relationship and several

strategic initiatives that we have collaborated on over the past

several years. Further enhancing our ability to originate

investment opportunities that offer strong risk-adjusted returns is

our top priority amid unprecedented demand for large-scale,

customized capital solutions, and we believe the platform that the

firm has created is particularly well positioned as a financing

provider of choice to leading companies.”

Omar Eraiqaat, Deputy CEO of the Diversified

Investments platform at Mubadala, added, “We share an aligned

investment philosophy with Apollo and are pleased to extend our

longstanding and strategic partnership with them, which provides us

access to Apollo’s differentiated origination ecosystem. We

continue to observe a secular shift in corporate financing toward

private market execution and believe that this platform will

continue to provide a scaled supply of attractive investment

opportunities.”

At the firm’s Investor Day in October, Apollo

announced a new target of reaching $275 billion of annual

origination volumes in the next five years. The firm believes it is

uniquely positioned to address the financing needs of large, high

quality corporate borrowers while serving as a key capital provider

supporting areas including the clean energy transition, power &

utilities and digital infrastructure.

Eric Needleman, Partner and Head of Apollo

Capital Solutions, said, “Mubadala is among the most sophisticated

alternative investors globally, and their continued support of our

origination and Capital Solutions business positions us to

capitalize on a growing global opportunity set as corporate

borrowers increasingly recognize the value of private financing

solutions.”

“Mubadala and Apollo have a long-standing and

mutually beneficial strategic relationship. Within the credit

sector, our partnership commenced more than nine years ago in

direct lending,” said Fabrizio Bocciardi, Head of Credit

Investments at Mubadala. “This partnership has expanded over time

across other private debt asset classes driven by Apollo’s

innovative capital solutions and our partnership-oriented

approach.”

The partnership extension builds on several

recent strategic collaborations between Apollo and Mubadala. The

firms formed a $2.5 billion joint venture to co-invest in global

private credit opportunities, and Mubadala supported Apollo’s

launch of a new middle market lending vehicle, Middle Market Apollo

Institutional Private Lending, earlier this year. Apollo also

invested in Mubadala’s evergreen solutions strategy as part of the

launch of its Mubadala Capital Solutions unit in 2023, and Mubadala

anchored the formation of Apollo Strategic Origination Partners in

2020.

Apollo Forward-Looking Statements

This press release contains forward-looking

statements that are within the meaning of Section 27A of the

Securities Act of 1933, as amended, and Section 21E of the

Securities Exchange Act of 1934, as amended. These forward-looking

statements are based on management’s beliefs, as well as

assumptions made by, and information currently available to,

management. When used in this press release, the words “believe,”

“anticipate,” “estimate,” “expect,” “intend,” “target”, “seek,”

“aim,” “continue,” “will,” “should,” “could,” or “may,” and

variations of such words and similar expressions are intended to

identify forward-looking statements. Although management believes

that the expectations reflected in these forward-looking statements

are reasonable, it can give no assurance that these expectations

will prove to have been correct. These statements are subject to

certain risks, uncertainties and assumptions, including those

described under the section entitled “Risk Factors” in Apollo

Global Management, Inc.’s annual report on Form 10-K filed with the

Securities and Exchange Commission (the “SEC”) on February 27,

2024, and the quarterly report on Form 10-Q filed with the SEC on

August 8, 2024, as such factors may be updated from time to time in

its periodic filings with the SEC, which are accessible on the

SEC’s website at www.sec.gov. These factors should not be construed

as exhaustive and should be read in conjunction with the other

cautionary statements that are included in this press release and

in Apollo’s other filings with the SEC. Apollo undertakes no

obligation to publicly update any forward-looking statements,

whether as a result of new information, future developments or

otherwise, except as required by applicable law. This press release

does not constitute an offer of any Apollo fund.

About Apollo

Apollo is a high-growth, global alternative

asset manager. In our asset management business, we seek to provide

our clients excess return at every point along the risk-reward

spectrum from investment grade credit to private equity. For more

than three decades, our investing expertise across our fully

integrated platform has served the financial return needs of our

clients and provided businesses with innovative capital solutions

for growth. Through Athene, our retirement services business, we

specialize in helping clients achieve financial security by

providing a suite of retirement savings products and acting as a

solutions provider to institutions. Our patient, creative, and

knowledgeable approach to investing aligns our clients, businesses

we invest in, our employees, and the communities we impact, to

expand opportunity and achieve positive outcomes. As of September

30, 2024, Apollo had approximately $733 billion of assets under

management. To learn more, please visit www.apollo.com.

About Mubadala Investment

Company

Mubadala Investment Company is a sovereign

investor managing a global portfolio, aimed at generating

sustainable financial returns for the Government of Abu Dhabi.

Mubadala’s $302 billion (AED 1,111 billion)

portfolio spans six continents with interests in multiple sectors

and asset classes. We leverage our deep sectoral expertise and

long-standing partnerships to drive sustainable growth and profit,

while supporting the continued diversification and global

integration of the economy of the United Arab Emirates.

For more information about Mubadala Investment

Company, please visit: www.mubadala.com

Contacts:

For Apollo:Noah GunnGlobal Head of Investor

RelationsApollo Global Management, Inc.(212)

822-0540IR@apollo.com

Joanna RoseGlobal Head of Corporate CommunicationsApollo Global

Management, Inc.(212) 822-0491Communications@apollo.com

For Mubadala Investment Company:Salam

KitmittoHead of Communications – Diversified InvestmentsMubadala

Investment Company+971 50 276 9286sakitmitto@mubadala.ae

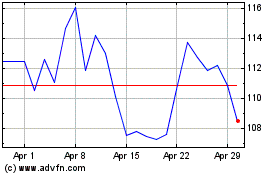

Apollo Global Management (NYSE:APO)

Historical Stock Chart

From Oct 2024 to Nov 2024

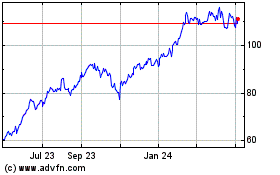

Apollo Global Management (NYSE:APO)

Historical Stock Chart

From Nov 2023 to Nov 2024