Annaly Capital Management, Inc. (NYSE:NLY) (the “Company” or

“Annaly”) today announced its financial results for the quarter and

year ended December 31, 2018.

Financial Highlights

- GAAP net income (loss) of ($1.74) per

average common share for the quarter, ($0.06) for the year ended

2018

- Core earnings (excluding PAA) of $0.29

per average common share for the quarter, $1.20 for the year ended

2018

- GAAP return on average equity of 0.38%

and core return on average equity (excluding PAA) of 10.99% for the

year ended 2018

- Book value per common share of

$9.39

- Economic leverage of 7.0x as compared

to 6.7x at September 30, 2018 and 6.6x at December 31,

2017

- Net interest margin (excluding PAA) of

1.49% as compared to 1.50% in the prior quarter

- Declared 21st consecutive quarterly

dividend of $0.30 per common share

Business Highlights

Investment and Capital Growth

- Further advanced Annaly's

diversification strategy by adding $4.2 billion(1) of credit assets

throughout 2018, an increase of 65%(2) year-over-year

- Utilized new origination partnerships

for Residential Credit, which contributed to total portfolio growth

of 17% in 2018

- Expanded Commercial Real Estate

coverage model with enhanced regional origination presence and

capital markets efforts, which drove total portfolio growth of 24%

year-over-year

- Heightened focus on lead arranger roles

in Middle Market Lending with emphasis on larger, more concentrated

positions in high quality credit assets, which contributed to

portfolio growth of 87% in 2018

- Acquired MTGE Investment Corp. in

September 2018 for $906 million, representing Annaly's third

acquisition since the beginning of 2013

- Raised over $2 billion of common and

preferred equity since the beginning of 2018, including gross

proceeds of $840 million through an overnight common equity

offering in January, representing the first equity offering across

the U.S. capital markets in 2019

Financing and Liquidity

- Added $900 million of credit financing

capacity through three new facilities and upsizing of existing

facilities since the beginning of 2018

- Completed four residential whole loan

securitizations since the beginning of 2018 for an aggregate of

$1.5 billion, solidifying market access as a programmatic

issuer

- Ended 2018 with $7.7 billion in

unencumbered assets, reflecting the strength of Annaly’s liquidity

position to continue to support opportunistic portfolio expansion

and manage through periods of volatility

"In 2018, we were successful in accomplishing many of our

strategic goals and delivered strong financial performance despite

a challenging market environment," commented Kevin Keyes, Chairman,

Chief Executive Officer and President. "These achievements are a

direct result of the advancements made in our internal and external

growth strategies. In 2018, we opportunistically grew our capital

allocation to credit through our diversified investment expertise

and proprietary origination partners. Additionally, we enhanced our

external growth strategy through further consolidation of the

industry and our industry leading execution in the capital markets.

Given our numerous and broad strategic priorities for this year and

beyond, we continue to place heightened focus on our liquidity,

disciplined investment approach and diversified financing

alternatives for each of our

businesses."_____________________________________________

(1) Includes unfunded commitments of $161 million(2) Excludes

loans acquired through securitization call rights and assets

onboarded in connection with the MTGE Investment Corp.

acquisition

Financial Performance

The following table summarizes certain key performance

indicators as of and for the quarters ended December 31, 2018,

September 30, 2018 and December 31, 2017:

December 31,2018

September 30,2018

December 31,2017

Book value per common share (1)

$ 9.39 $ 10.03

$ 11.34 Economic leverage at period-end (2)

7.0:1 6.7:1

6.6:1 GAAP net income (loss) per average common share (3)

$

(1.74 ) $ 0.29 0.62 Annualized GAAP return (loss) on

average equity

(62.05 )% 10.73 % 20.58 % Net interest

margin (4)

1.34 % 1.49 % 1.47 % Average yield on

interest earning assets (5)

3.21 % 3.21 % 2.97 %

Average cost of interest bearing liabilities (6)

2.22

% 2.08 % 1.83 % Net interest spread

0.99 %

1.13 % 1.14 %

Core earnings metrics * Core earnings

(excluding PAA) per average common share (3)(7)

$

0.29 $ 0.30 $ 0.31 Core earnings per average common share

(3)(7)

$ 0.26 $ 0.29 $ 0.30 PAA cost (benefit) per

average common share

$ 0.03 $ 0.01 $ 0.01 Annualized

core return on average equity (excluding PAA)

11.48 %

10.85 % 10.67 % Net interest margin (excluding PAA) (4)

1.49

% 1.50 % 1.51 % Average yield on interest earning assets

(excluding PAA) (5)

3.38 % 3.22 % 3.02 % Net interest

spread (excluding PAA)

1.16 %

1.14 % 1.19 % *

Represents non-GAAP financial measures. Please refer to the

‘Non-GAAP Financial Measures’ section for additional information.

(1) Book value per common share at September 30, 2018 includes 10.6

million shares of the Company's common stock that were pending

issuance to shareholders of MTGE Investment Corp. ("MTGE") at

September 30, 2018 in connection with the Company's acquisition of

MTGE. (2) Computed as the sum of recourse debt, to-be-announced

(“TBA”) derivative and CMBX notional outstanding and net forward

purchases (sales) of investments divided by total equity. Recourse

debt consists of repurchase agreements and other secured financing

(excluding certain non-recourse credit facilities). Securitized

debt, certain credit facilities (included within other secured

financing) and mortgages payable are non-recourse to the Company

and are excluded from this measure. (3) Net of dividends on

preferred stock. The quarter ended December 31, 2017 excludes

cumulative and undeclared dividends of $8.3 million on the

Company's Series F Preferred Stock as of September 30, 2017. (4)

Net interest margin represents the sum of the Company's interest

income plus TBA dollar roll income and CMBX coupon income less

interest expense and the net interest component of interest rate

swaps divided by the sum of average interest earning assets plus

average TBA contract and CMBX balances. Net interest margin

(excluding PAA) excludes the premium amortization adjustment

(“PAA”) representing the cumulative impact on prior periods, but

not the current period, of quarter-over-quarter changes in

estimated long-term prepayment speeds related to the Company’s

Agency mortgage-backed securities. (5) Average yield on interest

earning assets represents annualized interest income divided by

average interest earning assets. Average interest earning assets

reflects the average amortized cost of our investments during the

period. Average yield on interest earning assets (excluding PAA) is

calculated using annualized interest income (excluding PAA). (6)

Average cost of interest bearing liabilities represents annualized

economic interest expense divided by average interest bearing

liabilities. Average interest bearing liabilities reflects the

average amortized cost during the period. Economic interest expense

is comprised of GAAP interest expense and the net interest

component of interest rate swaps. Prior to the quarter ended March

31, 2018, this metric included the net interest component of

interest rate swaps used to hedge cost of funds. Beginning with the

quarter ended March 31, 2018, as a result of changes to the

Company’s hedging portfolio, this metric reflects the net interest

component of all interest rate swaps. (7) Beginning with the

quarter ended September 30, 2018, the Company updated its

calculation of core earnings and related metrics to reflect changes

to its portfolio composition and operations, including the

acquisition of MTGE in September 2018. Refer to the section titled

"Non-GAAP Financial Measures" for a complete discussion of core

earnings and core earnings (excluding PAA) per average common

share, and other non-GAAP financial measures. Prior period results

have not been adjusted to conform to the revised calculation as the

impact in each of those periods is not material.

Other Information

This news release and our public documents to which we refer

contain or incorporate by reference certain forward-looking

statements which are based on various assumptions (some of which

are beyond our control) and may be identified by reference to a

future period or periods or by the use of forward-looking

terminology, such as “may,” “will,” “believe,” “expect,”

“anticipate,” “continue,” or similar terms or variations on those

terms or the negative of those terms. Actual results could differ

materially from those set forth in forward-looking statements due

to a variety of factors, including, but not limited to, changes in

interest rates; changes in the yield curve; changes in prepayment

rates; the availability of mortgage-backed securities and other

securities for purchase; the availability of financing and, if

available, the terms of any financing; changes in the market value

of our assets; changes in business conditions and the general

economy; our ability to grow our commercial real estate business;

our ability to grow our residential credit business; our ability to

grow our middle market lending business; credit risks related to

our investments in credit risk transfer securities, residential

mortgage-backed securities and related residential mortgage credit

assets, commercial real estate assets and corporate debt; risks

related to investments in mortgage servicing rights; our ability to

consummate any contemplated investment opportunities; changes in

government regulations or policy affecting our business; our

ability to maintain our qualification as a REIT for U.S. federal

income tax purposes; and our ability to maintain our exemption from

registration under the Investment Company Act of 1940, as amended.

For a discussion of the risks and uncertainties which could cause

actual results to differ from those contained in the

forward-looking statements, see “Risk Factors” in our most recent

Annual Report on Form 10-K and any subsequent Quarterly Reports on

Form 10-Q. We do not undertake, and specifically disclaim any

obligation, to publicly release the result of any revisions which

may be made to any forward-looking statements to reflect the

occurrence of anticipated or unanticipated events or circumstances

after the date of such statements, except as required by law.

Annaly is a leading diversified capital manager that invests in

and finances residential and commercial assets. Annaly’s principal

business objective is to generate net income for distribution to

its stockholders and to preserve capital through prudent selection

of investments and continuous management of its portfolio. Annaly

has elected to be taxed as a real estate investment trust, or REIT,

for federal income tax purposes. Annaly is externally managed by

Annaly Management Company LLC. Additional information on the

Company can be found at www.annaly.com.

Annaly routinely posts important information for investors on

the Company’s website, www.annaly.com. Annaly intends to use this

webpage as a means of disclosing material, non-public information,

for complying with the Company’s disclosure obligations under

Regulation FD and to post and update investor presentations and

similar materials on a regular basis. Annaly encourages investors,

analysts, the media and others interested in Annaly to monitor the

Company’s website, in addition to following Annaly’s press

releases, SEC filings, public conference calls, presentations,

webcasts and other information it posts from time to time on its

website. To sign-up for email-notifications, please visit the

“Email Alerts” section of our website, www.annaly.com, under the

“Investors” section and enter the required information to enable

notifications. The information contained on, or that may be

accessed through, the Company’s webpage is not incorporated by

reference into, and is not a part of, this document.

The Company prepares a supplemental investor presentation and a

financial summary for the benefit of its shareholders. Both the

Fourth Quarter 2018 Investor Presentation and the Fourth Quarter

2018 Financial Summary can be found at the Company’s website

(www.annaly.com) in the Investors section under Investor

Presentations.

Conference Call

The Company will hold the fourth quarter 2018 earnings

conference call on February 14, 2019 at 9:00 a.m. Eastern

Time. The number to call is 844-512-2926 for domestic calls and

412-317-6300 for international calls. The conference passcode is

4136971. There will also be an audio webcast of the call on

www.annaly.com. The replay of the call will be available for one

week following the conference call. The replay number is

877-344-7529 for domestic calls and 412-317-0088 for international

calls and the conference passcode is 10128325. If you would like to

be added to the e-mail distribution list, please visit

www.annaly.com, click on Investors, then select Email Alerts and

complete the email notification form.

Financial

Statements

ANNALY CAPITAL MANAGEMENT, INC. AND

SUBSIDIARIES

CONSOLIDATED STATEMENTS OF FINANCIAL

CONDITION

(dollars in thousands, except per share

data)

December 31,2018

September 30,2018

June 30,2018

March 31,2018

December 31,2017

(1)

(unaudited) (unaudited) (unaudited)

(unaudited) Assets Cash and cash equivalents

$

1,735,749 $ 1,082,747 $ 1,135,329 $ 984,275 $ 706,589

Securities

92,623,788 91,338,611 88,478,689 90,539,192

92,563,572 Loans, net

4,585,975 4,224,203 3,692,172

3,208,617 2,999,148 Mortgage servicing rights

557,813

588,833 599,014 596,378 580,860 Assets transferred or pledged to

securitization vehicles

3,833,200 4,287,821 3,066,270

3,256,621 3,306,133 Real estate, net

739,473 753,014 477,887

480,063 485,953 Derivative assets

200,503 404,841 212,138

230,302 313,885 Reverse repurchase agreements

650,040

1,234,704 259,762 200,459 — Receivable for unsettled trades

68,779 1,266,840 21,728 45,126 1,232 Interest receivable

357,365 347,278 323,769 326,989 323,526 Goodwill and

intangible assets, net

100,854 103,043 91,009 92,763 95,035

Other assets

333,988 329,868 475,230

421,448 384,117

Total assets $

105,787,527 $ 105,961,803 $ 98,832,997

$ 100,382,233 $ 101,760,050

Liabilities and stockholders’

equity Liabilities Repurchase agreements

$

81,115,874 $ 79,073,026 $ 75,760,655 $ 78,015,431 $

77,696,343 Other secured financing

4,183,311 4,108,547

3,760,487 3,830,075 3,837,528 Debt issued by securitization

vehicles

3,347,062 3,799,542 2,728,692 2,904,873 2,971,771

Mortgages payable

511,056 511,588 309,878 309,794 309,686

Derivative liabilities

889,750 379,794 494,037 580,941

607,854 Payable for unsettled trades

583,036 2,505,428

1,108,834 91,327 656,581 Interest payable

570,928 399,605

478,439 284,696 253,068 Dividends payable

394,129 102,811

349,300 347,897 347,876 Other liabilities

74,580

125,606 68,819 74,264 207,770

Total

liabilities 91,669,726 91,005,947

85,059,141 86,439,298 86,888,477

Stockholders’

equity Preferred stock, par value $0.01 per share (2)

1,778,168 1,778,168 1,723,168 1,723,168 1,720,381 Common

stock, par value $0.01 per share (3)

13,138 13,031 11,643

11,597 11,596 Additional paid-in capital

18,794,331

18,793,706 17,268,596 17,218,191 17,221,265 Accumulated other

comprehensive income (loss)

(1,979,865 ) (3,822,956 )

(3,434,447 ) (3,000,080 ) (1,126,020 Accumulated deficit

(4,493,660 ) (1,811,955 ) (1,800,370 ) (2,015,612 )

(2,961,749

Total stockholders’ equity 14,112,112

14,949,994

13,768,590 13,937,264 14,865,473 Noncontrolling interests

5,689 5,862 5,266 5,671 6,100

Total equity 14,117,801 14,955,856

13,773,856 13,942,935 14,871,573

Total liabilities

and equity $ 105,787,527 $ 105,961,803

$ 98,832,997 $ 100,382,233 $ 101,760,050

(1)

Derived from the audited consolidated financial statements

at December 31, 2017. (2) 7.625% Series C Cumulative

Redeemable Preferred Stock - Includes 7,000,000 shares authorized,

issued and outstanding at December 31, 2018 and September 30, 2018.

Includes 12,000,000 shares authorized and 7,000,000 shares issued

and outstanding at June 30, 2018 and March 31, 2018. Includes

12,000,000 shares authorized, issued and outstanding at December

31, 2017. 7.50% Series D Cumulative Redeemable Preferred

Stock - Includes 18,400,000 shares authorized, issued and

outstanding. 7.625% Series E Cumulative Redeemable Preferred

Stock - Includes 0 shares authorized, issued and outstanding at

December 31, 2018 and September 30, 2018. Includes 11,500,000

shares authorized and 0 shares issued and outstanding at June 30,

2018 and March 31, 2018. Includes 11,500,000 shares authorized,

issued and outstanding at December 31, 2017. 6.95% Series F

Fixed-to-Floating Rate Cumulative Redeemable Preferred Stock -

Includes 28,800,000 shares authorized, issued and outstanding.

6.50% Series G Fixed-to-Floating Rate Cumulative Redeemable

Preferred Stock - Includes 19,550,000 shares authorized and

17,000,000 shares issued and outstanding at December 31, 2018,

September 30, 2018, June 30, 2018 and March 31, 2018. Includes 0

shares authorized, issued and outstanding at December 31, 2017.

8.125% Series H Cumulative Redeemable Preferred Stock -

Includes 2,200,000 shares authorized, issued and outstanding at

December 31, 2018 and September 30, 2018. Includes 0 shares

authorized, issued and outstanding at June 30, 2018, March 31, 2018

and December 31, 2017. (3) Includes 1,924,050,000 shares

authorized and 1,313,763,450 shares issued and outstanding at

December 31, 2018. Includes 1,924,050,000 shares authorized and

1,303,079,555 shares issued and outstanding at September 30, 2018.

Includes 1,909,750,000 shares authorized and 1,164,333,831 shares

issued and outstanding at June 30, 2018. Includes 1,909,750,000

shares authorized and 1,159,657,350 shares issued and outstanding

at March 31, 2018. Includes 1,929,300,000 shares authorized and

1,159,585,078 shares issued and outstanding at December 31, 2017.

ANNALY CAPITAL MANAGEMENT, INC. AND

SUBSIDIARIES CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME

(LOSS) (dollars in thousands, except per share data)

(Unaudited) For the quarters

ended

December 31,2018

September 30,2018

June 30,2018

March 31,2018

December 31,2017

Net interest income Interest income

$ 859,674

$ 816,596 $ 776,806 $ 879,487 $ 745,423 Interest expense

586,774 500,973 442,692 367,421

318,711

Net interest income 272,900

315,623 334,114 512,066 426,712

Realized and unrealized gains (losses) Net interest

component of interest rate swaps

65,889 51,349 31,475

(48,160 ) (82,271 ) Realized gains (losses) on termination or

maturity of interest rate swaps

— 575 — 834 (160,075 )

Unrealized gains (losses) on interest rate swaps

(1,313,882

) 417,203 343,475 977,285 484,447

Subtotal (1,247,993 ) 469,127

374,950 929,959 242,101 Net gains (losses) on

disposal of investments

(747,505 ) (324,294 ) (66,117

) 13,468 7,895 Net gains (losses) on other derivatives

(484,872 ) 94,827 34,189 (47,145 ) 121,334 Net

unrealized gains (losses) on instruments measured at fair value

through earnings

(18,169 ) (39,944 ) (48,376 )

(51,593 ) (12,115 ) Loan loss provision

(3,496 ) —

— — —

Subtotal (1,254,042

) (269,411 ) (80,304 ) (85,270 ) 117,114

Total

realized and unrealized gains (losses) (2,502,035

) 199,716 294,646 844,689 359,215

Other income (loss) 52,377 (10,643 ) 34,170

34,023 25,064

General and administrative expenses

Compensation and management fee

43,750 45,983 45,579 44,529

44,129 Other general and administrative expenses

33,323

80,526 18,202 17,981 15,128

Total general and administrative expenses 77,073

126,509 63,781 62,510 59,257

Income (loss) before income taxes (2,253,831 )

378,187 599,149 1,328,268 751,734

Income taxes 1,041

(7,242 ) 3,262 564 4,963

Net income

(loss) (2,254,872 ) 385,429 595,887 1,327,704

746,771

Net income (loss) attributable to noncontrolling

interests 17 (149 ) (32 ) (96 ) (151 )

Net

income (loss) attributable to Annaly (2,254,889 )

385,578 595,919 1,327,800 746,922

Dividends on preferred

stock (1) 32,494 31,675 31,377

33,766 32,334

Net income (loss) available

(related) to common stockholders $ (2,287,383

) $ 353,903 $ 564,542 $ 1,294,034 $

714,588

Net income (loss) per share available (related)

to common stockholders Basic

$ (1.74 ) $

0.29 $ 0.49 $ 1.12 $ 0.62 Diluted

$ (1.74 ) $

0.29 $ 0.49 $ 1.12 $ 0.62

Weighted average number of common

shares outstanding Basic

1,314,377,748 1,202,353,851

1,160,436,777 1,159,617,848 1,151,653,296 Diluted

1,314,377,748 1,202,353,851 1,160,979,451 1,160,103,185

1,152,138,887

Other comprehensive income (loss) Net

income (loss) $ (2,254,872 ) $ 385,429

$ 595,887 $ 1,327,704 $ 746,771

Unrealized gains (losses) on available-for-sale securities

1,100,052 (719,609 ) (505,130 ) (1,879,479 ) (487,597 )

Reclassification adjustment for net (gains) losses included in net

income (loss)

743,039 331,100 70,763

5,419 1,726 Other comprehensive income (loss)

1,843,091 (388,509 ) (434,367 ) (1,874,060 ) (485,871

) Comprehensive income (loss)

(411,781 ) (3,080 )

161,520 (546,356 ) 260,900 Comprehensive income (loss) attributable

to noncontrolling interests

17 (149 ) (32 ) (96 )

(151 ) Comprehensive income (loss) attributable to Annaly

(411,798 ) (2,931 ) 161,552 (546,260 ) 261,051

Dividends on preferred stock (1)

32,494 31,675

31,377 33,766 32,334

Comprehensive income

(loss) attributable to common stockholders $

(444,292 ) $ (34,606 ) $ 130,175 $ (580,026 )

$ 228,717

(1) The quarter ended December 31, 2017

excludes cumulative and undeclared dividends of $8.3 million on the

Company's Series F Preferred Stock as of September 30, 2017.

ANNALY CAPITAL MANAGEMENT, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME (LOSS)

(dollars in thousands, except per share data)

For the years ended

December 31,2018

December 31,2017

(1)

(unaudited) Net interest income Interest income

$ 3,332,563 $ 2,493,126 Interest expense

1,897,860 1,008,354

Net interest income

1,434,703 1,484,772

Realized and unrealized

gains (losses) Net interest component of interest rate swaps

100,553 (371,108 ) Realized gains (losses) on termination or

maturity of interest rate swaps

1,409 (160,133 ) Unrealized

gains (losses) on interest rate swaps

424,081 512,918

Subtotal 526,043 (18,323 ) Net gains

(losses) on disposal of investments

(1,124,448 )

(3,938 ) Net gains (losses) on other derivatives

(403,001

) 261,438 Net unrealized gains (losses) on instruments

measured at fair value through earnings

(158,082 )

(39,684 ) Loan loss provision

(3,496 ) —

Subtotal (1,689,027 ) 217,816

Total

realized and unrealized gains (losses) (1,162,984

) 199,493

Other income (loss) 109,927

115,857

General and administrative expenses

Compensation and management fee

179,841 164,322 Other

general and administrative expenses

150,032 59,802

Total general and administrative expenses

329,873 224,124

Income (loss) before income

taxes 51,773 1,575,998

Income taxes (2,375

) 6,982

Net income (loss) 54,148

1,569,016

Net income (loss) attributable to noncontrolling

interests (260 ) (588 )

Net income (loss)

attributable to Annaly 54,408 1,569,604

Dividends on

preferred stock 129,312 109,635

Net

income (loss) available (related) to common stockholders

$ (74,904 ) $ 1,459,969

Net income

(loss) per share available (related) to common stockholders

Basic

$ (0.06 ) $ 1.37 Diluted

$

(0.06 ) $ 1.37

Weighted average number of common

shares outstanding Basic

1,209,601,809 1,065,923,652

Diluted

1,209,601,809 1,066,351,616

Other comprehensive

income (loss) Net income (loss) $ 54,148

$ 1,569,016 Unrealized gains (losses) on

available-for-sale securities

(2,004,166 ) (89,997 )

Reclassification adjustment for net (gains) losses included in net

income (loss)

1,150,321 49,870 Other

comprehensive income (loss)

(853,845 ) (40,127 )

Comprehensive income (loss)

(799,697 ) 1,528,889

Comprehensive income (loss) attributable to noncontrolling

interests

(260 ) (588 ) Comprehensive income (loss)

attributable to Annaly

(799,437 ) 1,529,477 Dividends

on preferred stock

129,312 109,635

Comprehensive income (loss) attributable to common

stockholders $ (928,749 ) $ 1,419,842

(1) Derived from the

audited consolidated financial statements for the year ended

December 31, 2017.

Key Financial Data

The following table presents key metrics of the Company’s

portfolio, liabilities and hedging positions, and performance as of

and for the quarters ended December 31, 2018,

September 30, 2018, and December 31, 2017:

December 31, 2018

September 30,2018

December 31,2017

Portfolio related metrics Fixed-rate Residential Securities

as a percentage of total Residential Securities

93 %

92 % 90 % Adjustable-rate and floating-rate Residential Securities

as a percentage of total Residential Securities

7 % 8

% 10 % Weighted average experienced CPR for the period

7.9

% 10.3 % 9.8 % Weighted average projected long-term CPR at

period-end

10.1 % 9.1 % 10.4 %

Liabilities and

hedging metrics Weighted average days to maturity on repurchase

agreements outstanding at period-end

77 55 58 Hedge ratio

(1)

94 % 96 % 70 % Weighted average pay rate on

interest rate swaps at period-end (2)

2.17 % 2.10 %

2.22 % Weighted average receive rate on interest rate swaps at

period-end (2)

2.68 % 2.33 % 1.58 % Weighted average

net rate on interest rate swaps at period-end (2)

(0.51

)% (0.23 )% 0.64 % Leverage at period-end (3)

6.3:1

5.9:1 5.7:1 Economic leverage at period-end (4)

7.0:1 6.7:1

6.6:1 Capital ratio at period-end

12.1 % 12.6 % 12.9

%

Performance related metrics Book value per common share

(5)

$ 9.39 $ 10.03 $ 11.34 GAAP net income (loss) per

average common share (6)

$ (1.74 ) $ 0.29 $

0.62 Annualized GAAP return (loss) on average equity

(62.05

)% 10.73 % 20.58 % Net interest margin

1.34 %

1.49 % 1.47 % Average yield on interest earning assets (7)

3.21 % 3.21 % 2.97 % Average cost of interest bearing

liabilities (8)

2.22 % 2.08 % 1.83 % Net interest

spread

0.99 % 1.13 % 1.14 % Dividend declared per

common share

$ 0.30 $ 0.30 $ 0.30 Annualized dividend

yield (9)

12.22 % 11.73 % 10.09 %

Core earnings

metrics * Core earnings (excluding PAA) per average common

share (6)

$ 0.29 $ 0.30 $ 0.31 Core earnings per

average common share (6)

$ 0.26 $ 0.29 $ 0.30 PAA

cost (benefit) per average common share

$ 0.03 $ 0.01

$ 0.01 Annualized core return on average equity (excluding PAA)

11.48 % 10.85 % 10.67 % Net interest margin

(excluding PAA)

1.49 % 1.50 % 1.51 % Average yield on

interest earning assets (excluding PAA) (7)

3.38 %

3.22 % 3.02 % Net interest spread (excluding PAA)

1.16 % 1.14 % 1.19

% * Represents non-GAAP financial measures. Please

refer to the ‘Non-GAAP Financial Measures’ section for additional

information. (1) Measures total notional balances of interest rate

swaps, interest rate swaptions and futures relative to repurchase

agreements, other secured financing and TBA notional outstanding;

excludes MSRs and the effects of term financing, both of which

serve to reduce interest rate risk. Additionally, the hedge ratio

does not take into consideration differences in duration between

assets and liabilities. (2) Excludes forward starting swaps. (3)

Debt consists of repurchase agreements, other secured financing,

securitized debt and mortgages payable. Certain credit facilities

(included within other secured financing), securitized debt and

mortgages payable are non-recourse to the Company. (4) Computed as

the sum of recourse debt, TBA derivative and CMBX notional

outstanding and net forward purchases of investments divided by

total equity. (5) Book value per common share at September 30, 2018

includes 10.6 million shares of the Company's common stock that

were pending issuance to shareholders of MTGE at September 30, 2018

in connection with the Company's acquisition of MTGE. (6) Net of

dividends on preferred stock. The quarter ended December 31, 2017

excludes cumulative and undeclared dividends of $8.3 million on the

Company's Series F Preferred Stock as of September 30, 2017. (7)

Average yield on interest earning assets represents annualized

interest income divided by average interest earning assets. Average

interest earning assets reflects the average amortized cost of our

investments during the period. Average yield on interest earning

assets (excluding PAA) is calculated using annualized interest

income (excluding PAA). (8) Average cost of interest bearing

liabilities represents annualized economic interest expense divided

by average interest bearing liabilities. Average interest bearing

liabilities reflects the average amortized cost during the period.

Economic interest expense is comprised of GAAP interest expense and

the net interest component of interest rate swaps. Prior to the

quarter ended March 31, 2018, this metric included the net interest

component of interest rate swaps used to hedge cost of funds.

Beginning with the quarter ended March 31, 2018, as a result of

changes to the Company’s hedging portfolio, this metric reflects

the net interest component of all interest rate swaps. (9) Based on

the closing price of the Company’s common stock of $9.82, $10.23

and $11.89 at December 31, 2018, September 30, 2018 and December

31, 2017, respectively.

The following table contains additional information on our

residential and commercial investments as of the dates

presented:

For the

quarters ended

December 31, 2018

September 30,2018

December 31,2017

Agency mortgage-backed securities

$ 90,752,995

$ 89,290,128 $ 90,551,763 Credit risk transfer securities

552,097 688,521 651,764 Non-agency mortgage-backed

securities

1,161,938 1,173,467 1,097,294 Commercial

mortgage-backed securities

156,758 186,495

262,751

Total securities $ 92,623,788 $

91,338,611 $ 92,563,572 Residential mortgage loans

$

1,359,806 $ 1,217,139 $ 958,546 Commercial real estate debt

and preferred equity

1,296,803 1,435,865 1,029,327 Loans

held for sale, net

42,184 42,325 — Corporate debt

1,887,182 1,528,874 1,011,275

Total

loans $ 4,585,975 $ 4,224,203 $

2,999,148

Mortgage servicing rights $ 557,813

$ 588,833 $ 580,860 Residential mortgage loans

transferred or pledged to securitization vehicles

$

1,094,831 $ 765,876 $ 479,776 Commercial real estate debt

transferred or pledged to securitization vehicles

2,738,369

3,521,945 2,826,357

Assets transferred or pledged

to securitization vehicles $ 3,833,200 $

4,287,821 $ 3,306,133

Real estate, net $

739,473 $ 753,014 $ 485,953

Total

residential and commercial investments $

102,340,249 $ 101,192,482 $ 99,935,666

Non-GAAP Financial

Measures

Beginning with the quarter ended September 30, 2018, the Company

updated its calculation of core earnings and related metrics to

reflect changes to its portfolio composition and operations,

including the acquisition of MTGE in September 2018. Compared to

prior periods, the revised definition of core earnings includes

coupon income (expense) on CMBX positions (reported in Net gains

(losses) on other derivatives) and excludes depreciation and

amortization expense on real estate and related intangibles

(reported in Other income (loss)), non-core income (loss) allocated

to equity method investments (reported in Other income (loss)) and

the income tax effect of non-core income (loss) (reported in Income

taxes). Prior period results have not been adjusted to conform to

the revised calculation as the impact in each of those periods is

not material.

To supplement its consolidated financial statements, which are

prepared and presented in accordance with U.S. generally accepted

accounting principles (“GAAP”), the Company provides the following

non-GAAP measures:

- core earnings and core earnings

(excluding PAA);

- core earnings attributable to common

stockholders and core earnings attributable to common stockholders

(excluding PAA);

- core earnings and core earnings

(excluding PAA) per average common share;

- annualized core return on average

equity (excluding PAA);

- interest income (excluding PAA);

- economic interest expense;

- economic net interest income (excluding

PAA);

- average yield on interest earning

assets (excluding PAA);

- net interest margin (excluding PAA);

and

- net interest spread (excluding

PAA).

These measures should not be considered a substitute for, or

superior to, financial measures computed in accordance with GAAP.

While intended to offer a fuller understanding of the Company’s

results and operations, non-GAAP financial measures also have

limitations. For example, the Company may calculate its non-GAAP

metrics, such as core earnings, or the PAA, differently than its

peers making comparative analysis difficult. Additionally, in the

case of non-GAAP measures that exclude the PAA, the amount of

amortization expense excluding the PAA is not necessarily

representative of the amount of future periodic amortization nor is

it indicative of the term over which the Company will amortize the

remaining unamortized premium. Changes to actual and estimated

prepayments will impact the timing and amount of premium

amortization and, as such, both GAAP and non-GAAP results.

These non-GAAP measures provide additional detail to enhance

investor understanding of the Company’s period-over-period

operating performance and business trends, as well as for assessing

the Company’s performance versus that of industry peers. Additional

information pertaining to the Company’s use of these non-GAAP

financial measures, including discussion of how each such measure

may be useful to investors, and reconciliations to their most

directly comparable GAAP results are provided below.

Core earnings and core earnings (excluding PAA), core

earnings attributable to common stockholders and core earnings

attributable to common stockholders (excluding PAA), core earnings

and core earnings (excluding PAA) per average common share and

annualized core return on average equity (excluding PAA)

The Company's principal business objective is to generate net

income for distribution to its stockholders and to preserve capital

through prudent selection of investments and continuous management

of its portfolio. The Company generates net income by earning a net

interest spread on its investment portfolio, which is a function of

interest income from its investment portfolio less financing,

hedging and operating costs. Core earnings, which is defined as the

sum of (a) economic net interest income, (b) TBA dollar roll income

and CMBX coupon income, (c) realized amortization of MSRs, (d)

other income (loss) (excluding depreciation and amortization

expense on real estate and related intangibles, non-core income

allocated to equity method investments and other non-core

components of other income (loss)), (e) general and administrative

expenses (excluding transaction expenses and non-recurring items)

and (f) income taxes (excluding the income tax effect of non-core

income (loss) items), and core earnings (excluding PAA), which is

defined as core earnings excluding the premium amortization

adjustment representing the cumulative impact on prior periods, but

not the current period, of quarter-over-quarter changes in

estimated long-term prepayment speeds related to the Company’s

Agency mortgage-backed securities, are used by the Company's

management and, the Company believes, used by analysts and

investors to measure its progress in achieving its principal

business objective.

The Company seeks to fulfill this objective through a variety of

factors including portfolio construction, the degree of market risk

exposure and related hedge profile, and the use and forms of

leverage, all while operating within the parameters of the

Company's capital allocation policy and risk governance

framework.

The Company believes these non-GAAP measures provide management

and investors with additional details regarding the Company’s

underlying operating results and investment portfolio trends by (i)

making adjustments to account for the disparate reporting of

changes in fair value where certain instruments are reflected in

GAAP net income (loss) while others are reflected in other

comprehensive income (loss), and (ii) by excluding certain

unrealized, non-cash or episodic components of GAAP net income

(loss) in order to provide additional transparency into the

operating performance of the Company’s portfolio. Annualized core

return on average equity (excluding PAA), which is calculated by

dividing core earnings (excluding PAA) over average stockholders’

equity, provides investors with additional detail on the core

earnings generated by the Company’s invested equity capital.

The following table presents a reconciliation of GAAP financial

results to non-GAAP core earnings for the periods presented:

For the

quarters ended December 31, 2018

September 30,2018

December 31,2017

(dollars in thousands, except per share data) GAAP net

income (loss)

$ (2,254,872 ) $ 385,429 $

746,771 Net income (loss) attributable to noncontrolling interests

17 (149 ) (151 )

Net income (loss) attributable to

Annaly (2,254,889 ) 385,578 746,922

Adjustments to exclude reported realized and unrealized (gains)

losses Realized (gains) losses on termination or maturity of

interest rate swaps

— (575 ) 160,075 Unrealized (gains)

losses on interest rate swaps

1,313,882 (417,203 ) (484,447

) Net (gains) losses on disposal of investments

747,505

324,294 (7,895 ) Net (gains) losses on other derivatives

484,872 (94,827 ) (121,334 ) Net unrealized (gains) losses

on instruments measured at fair value through earnings

18,169 39,944 12,115 Loan loss provision

3,496 — —

Adjustments to exclude components of other (income) loss

Depreciation and amortization expense related to commercial real

estate

11,000 9,278 — Non-core (income) loss allocated to

equity method investments (1)

(10,307 ) (2,358 ) —

Non-core other (income) loss (2)

— 44,525 —

Adjustments

to exclude components of general and administrative expenses and

income taxes

Transaction expenses and non-recurring

items (3)

3,816 60,081 — Income tax effect of non-core income (loss)

items

3,334 886 —

Adjustments to add back components of

realized and unrealized (gains) losses TBA dollar roll income

and CMBX coupon income (4)

69,572 56,570 89,479 MSR

amortization (5)

(18,753 ) (19,913 ) (19,331 )

Core earnings * 371,697 386,280 375,584

Less:

Premium amortization adjustment cost (benefit)

45,472

3,386 11,367

Core earnings (excluding PAA) *

$ 417,169 $ 389,666 $ 386,951

Dividends on preferred stock

32,494

31,675 32,334

Core earnings attributable to

common stockholders * $ 339,203 $ 354,605

$ 343,250

Core earnings attributable to common

stockholders (excluding PAA) * $ 384,675 $

357,991 $ 354,617

GAAP net income (loss) per

average common share $ (1.74 ) $ 0.29 $

0.62

Core earnings per average common share * $

0.26 $ 0.29 $ 0.30

Core earnings (excluding PAA) per

average common share * $ 0.29 $ 0.30 $ 0.31

Annualized GAAP return (loss) on average equity

(62.05 )% 10.73 % 20.58 %

Annualized core return

on average equity (excluding PAA) *

11.48 % 10.85 % 10.67 %

For the years ended December 31, 2018

December 31, 2017 (dollars in thousands,

except per share data) GAAP net income (loss)

$

54,148 $ 1,569,016 Net income (loss) attributable to

noncontrolling interests

(260 ) (588 )

Net income

(loss) attributable to Annaly 54,408 1,569,604

Adjustments to exclude reported realized and unrealized (gains)

losses Realized (gains) losses on termination or maturity of

interest rate swaps

(1,409 ) 160,133 Unrealized

(gains) losses on interest rate swaps

(424,081 )

(512,918 ) Net (gains) losses on disposal of investments

1,124,448 3,938 Net (gains) losses on other derivatives

403,001 (261,438 ) Net unrealized (gains) losses on

instruments measured at fair value through earnings

158,082

39,684 Loan loss provision

3,496 —

Adjustments to exclude

components of other (income) loss Depreciation and amortization

expense related to commercial real estate

20,278 — Non-core

(income) loss allocated to equity method investments (1)

(12,665 ) — Non-core other (income) loss (2)

44,525 —

Adjustments to exclude components of general and

administrative expenses and income taxes Transaction expenses

and non-recurring items (3)

65,416 — Income tax effect of

non-core income (loss) items

4,220 —

Adjustments to add

back components of realized and unrealized (gains) losses TBA

dollar roll income and CMBX coupon income (4)

276,986

334,824 MSR amortization (5)

(79,764 ) (66,667 )

Core earnings * 1,636,941 1,267,160

Less:

Premium amortization adjustment cost (benefit)

(62,021

) 141,836

Core earnings (excluding PAA) *

$ 1,574,920 $ 1,408,996

Dividends on preferred stock

129,312 109,635

Core earnings attributable to common stockholders * $

1,507,629 $ 1,157,525

Core earnings

attributable to common stockholders (excluding PAA) * $

1,445,608 $ 1,299,361

GAAP net income

(loss) per average common share $ (0.06 )

$ 1.37

Core earnings per average common share * $

1.25 $ 1.09

Core earnings (excluding PAA) per average

common share * $ 1.20 $ 1.22

Annualized GAAP

return (loss) on average equity 0.38 % 11.73 %

Annualized core return on average equity (excluding PAA) *

10.99 % 10.54 %

* Represents a non-GAAP financial measure. (1)

Beginning with the quarter ended September 30, 2018, the Company

excludes non-core (income) loss allocated to equity method

investments, which represents the unrealized (gains) losses

allocated to equity interests in a portfolio of MSR, which is a

component of Other income (loss). The quarter and year ended

December 31, 2018 also include a realized gain on sale within an

unconsolidated joint venture, which is a component of Other income

(loss). (2) The quarter ended September 30, 2018 and the year ended

December 31, 2018 reflect the amount of consideration paid for the

acquisition of MTGE in excess of the fair value of net assets

acquired. This amount is primarily attributable to a decline in

portfolio valuation between the pricing and closing dates of the

transaction and is consistent with changes in market values

observed for similar instruments over the same period. (3)

Represents costs incurred in connection with the MTGE transaction

and costs incurred in connection with securitizations of

residential whole loans. (4) TBA dollar roll income and CMBX coupon

income each represent a component of Net gains (losses) on other

derivatives. CMBX coupon income totaled $1.2 million for each of

the quarters ended December 31, 2018 and September 30, 2018, and

$2.3 million for the year ended December 31, 2018. There were no

adjustments for CMBX coupon income prior to September 30, 2018. (5)

MSR amortization represents the portion of changes in fair value

that is attributable to the realization of estimated cash flows on

the Company’s MSR portfolio and is reported as a component of Net

unrealized gains (losses) on instruments measured at fair value.

From time to time, the Company enters into TBA forward contracts

as an alternate means of investing in and financing Agency

mortgage-backed securities. A TBA contract is an agreement to

purchase or sell, for future delivery, an Agency mortgage-backed

security with a specified issuer, term and coupon. A TBA dollar

roll represents a transaction where TBA contracts with the same

terms but different settlement dates are simultaneously bought and

sold. The TBA contract settling in the later month typically prices

at a discount to the earlier month contract with the difference in

price commonly referred to as the “drop”. The drop is a reflection

of the expected net interest income from an investment in similar

Agency mortgage-backed securities, net of an implied financing

cost, that would be foregone as a result of settling the contract

in the later month rather than in the earlier month. The drop

between the current settlement month price and the forward

settlement month price occurs because in the TBA dollar roll

market, the party providing the financing is the party that would

retain all principal and interest payments accrued during the

financing period. Accordingly, TBA dollar roll income generally

represents the economic equivalent of the net interest income

earned on the underlying Agency mortgage-backed security less an

implied financing cost.

TBA dollar roll transactions are accounted for under GAAP as a

series of derivatives transactions. The fair value of TBA

derivatives is based on methods similar to those used to value

Agency mortgage-backed securities. The Company records TBA

derivatives at fair value on its Consolidated Statements of

Financial Condition and recognizes periodic changes in fair value

as Net gains (losses) on other derivatives in the Consolidated

Statements of Comprehensive Income (Loss), which includes both

unrealized and realized gains and losses on derivatives (excluding

interest rate swaps).

TBA dollar roll income is calculated as the difference in price

between two TBA contracts with the same terms but different

settlement dates multiplied by the notional amount of the TBA

contract. Although accounted for as derivatives, TBA dollar rolls

capture the economic equivalent of net interest income, or carry,

on the underlying Agency mortgage-backed security (interest income

less an implied cost of financing). TBA dollar roll income is

reported as a component of Net gains (losses) on other derivatives

in the Consolidated Statements of Comprehensive Income (Loss).

The CMBX index is a synthetic tradable index referencing a

basket of 25 commercial mortgage-backed securities ("CMBS") of a

particular rating and vintage. The CMBX index allows investors to

take a long exposure (referred to as selling protection) or short

exposure (referred to as buying protection) on the respective

basket of CMBS securities and is structured as a “pay-as-you-go”

contract whereby the protection buyer pays to the protection seller

a standardized running coupon on the contracted notional amount.

The Company reports income (expense) on CMBX positions in Net gains

(losses) on other derivatives in the Consolidated Statements of

Comprehensive Income (Loss). The coupon payments received or paid

on CMBX positions are equivalent to interest income (expense) and

therefore included in core earnings.

Premium Amortization Expense ("PAA")

In accordance with GAAP, the Company amortizes or accretes

premiums or discounts into interest income for its Agency

mortgage-backed securities, excluding interest-only securities,

multifamily and reverse mortgages, taking into account estimates of

future principal prepayments in the calculation of the effective

yield. The Company recalculates the effective yield as differences

between anticipated and actual prepayments occur. Using third-party

model and market information to project future cash flows and

expected remaining lives of securities, the effective interest rate

determined for each security is applied as if it had been in place

from the date of the security’s acquisition. The amortized cost of

the security is then adjusted to the amount that would have existed

had the new effective yield been applied since the acquisition

date. The adjustment to amortized cost is offset with a charge or

credit to interest income. Changes in interest rates and other

market factors will impact prepayment speed projections and the

amount of premium amortization recognized in any given period.

The Company’s GAAP metrics include the unadjusted impact of

amortization and accretion associated with this method. Certain of

the Company’s non-GAAP metrics exclude the effect of the PAA, which

quantifies the component of premium amortization representing the

cumulative impact on prior periods, but not the current period, of

quarter-over-quarter changes in estimated long-term CPR.

The following table illustrates the impact of the PAA on premium

amortization expense for the Company’s Residential Securities

portfolio for the quarters ended December 31, 2018,

September 30, 2018, and December 31, 2017:

For the

quarters ended

December 31, 2018

September 30,2018

December 31,2017

(dollars in thousands) Premium amortization expense

(accretion)

$ 220,131 $ 187,537 $ 203,951 Less: PAA

cost (benefit)

45,472 3,386 11,367

Premium

amortization expense (excluding PAA) $ 174,659

$ 184,151 $ 192,584

For the quarters ended December

31, 2018 September 30,2018 December

31,2017 (per average common share) Premium

amortization expense (accretion)

$ 0.17 $ 0.16 $ 0.18

Less: PAA cost (benefit) (1)

0.03 0.01 0.01

Premium amortization expense (excluding PAA) $

0.14 $ 0.15 $ 0.17

(1) The Company separately

calculates core earnings per average common share and core earnings

(excluding PAA) per average common share, with the difference

between these two per share amounts attributed to the PAA cost

(benefit) per average common share. As such, the reported value of

the PAA cost (benefit) per average common share may not reflect the

result of dividing the PAA cost (benefit) by the weighted average

number of common shares outstanding due to rounding.

Interest income (excluding PAA), economic interest expense

and economic net interest income (excluding PAA)

Interest income (excluding PAA) represents interest income

excluding the effect of the PAA, and serves as the basis for

deriving average yield on interest earning assets (excluding PAA),

net interest spread (excluding PAA) and net interest margin

(excluding PAA), which are discussed below. The Company believes

this measure provides management and investors with additional

detail to enhance their understanding of the Company’s operating

results and trends by excluding the component of premium

amortization expense representing the cumulative impact on prior

periods, but not the current period, of quarter-over-quarter

changes in estimated long-term prepayment speeds related to the

Company’s Agency mortgage-backed securities (other than

interest-only securities), which can obscure underlying trends in

the performance of the portfolio.

Economic interest expense includes GAAP interest expense and the

net interest component of interest rate swaps. Prior to the quarter

ended March 31, 2018, economic interest expense included the net

interest component of interest rate swaps used to hedge cost of

funds. Beginning with the quarter ended March 31, 2018, as a result

of changes to the Company’s hedging portfolio, this metric reflects

the net interest component of all interest rate swaps. The Company

uses interest rate swaps to manage its exposure to changing

interest rates on its repurchase agreements by economically hedging

cash flows associated with these borrowings. Accordingly, adding

the net interest component of interest rate swaps to interest

expense, as computed in accordance with GAAP, reflects the total

contractual interest expense and thus, provides investors with

additional information about the cost of the Company's financing

strategy.

Similarly, economic net interest income (excluding PAA), as

computed below, provides investors with additional information to

enhance their understanding of the net economics of our primary

business operations.

For the

quarters ended December 31, 2018

September 30,2018 December

31,2017 Interest income (excluding PAA)

reconciliation (dollars in thousands) GAAP interest

income

$ 859,674 $ 816,596 $ 745,423 Premium

amortization adjustment

45,472 3,386 11,367

Interest income (excluding PAA) * $ 905,146

$ 819,982 $ 756,790

Economic interest expense

reconciliation GAAP interest expense

$ 586,774 $

500,973 $ 318,711

Add: Net interest component of interest

rate swaps

(65,889 ) (51,349 ) 73,957

Economic

interest expense * $ 520,885 $ 449,624

$ 392,668

Economic net interest income (excluding PAA)

reconciliation Interest income (excluding PAA) *

$

905,146 $ 819,982 $ 756,790

Less: Economic interest

expense *

520,885 449,624 392,668

Economic

net interest income (excluding PAA) * $ 384,261

$ 370,358 $ 364,122

* Represents a non-GAAP financial

measure.

Average yield on interest earning assets (excluding PAA), net

interest spread (excluding PAA) and net interest margin (excluding

PAA)

Net interest spread (excluding PAA), which is the difference

between the average yield on interest earning assets (excluding

PAA) and the average cost of interest bearing liabilities, and net

interest margin (excluding PAA), which is calculated as the sum of

interest income (excluding PAA) plus TBA dollar roll income and

CMBX coupon income less interest expense and the net interest

component of interest rate swaps divided by the sum of average

interest earning assets plus average TBA contract and CMBX

balances, provide management with additional measures of the

Company’s profitability that management relies upon in monitoring

the performance of the business.

Disclosure of these measures, which are presented below,

provides investors with additional detail regarding how management

evaluates the Company’s performance.

For the

quarters ended December 31, 2018

September 30,2018 December

31,2017 Economic metrics (excluding PAA)

(dollars in thousands) Average interest earning assets

$ 107,232,861 $ 101,704,957 $ 100,247,589 Interest

income (excluding PAA) *

$ 905,146 $ 819,982 $

756,790 Average yield on interest earning assets (excluding PAA) *

3.38 % 3.22 % 3.02 % Average interest bearing

liabilities

$ 91,746,160 $ 86,638,082 $ 85,992,215

Economic interest expense *

$ 520,885 $ 449,624 $

392,668 Average cost of interest bearing liabilities

2.22

% 2.08 % 1.83 % Economic net interest income (excluding PAA)

*

$ 384,261 $ 370,358 $ 364,122 Net interest spread

(excluding PAA) *

1.16 % 1.14 % 1.19 % Interest

income (excluding PAA) *

$ 905,146 $ 819,982 $

756,790 TBA dollar roll income and CMBX coupon income

69,572

56,570 89,479 Interest expense

(586,774 ) (500,973 )

(318,711 ) Net interest component of interest rate swaps

65,889 51,349 (82,271 )

Subtotal

$ 453,833 $ 426,928 $ 445,287

Average interest earnings assets

$ 107,232,861 $

101,704,957 $ 100,247,589 Average TBA contract and CMBX balances

14,788,453 12,216,863 17,509,691

Subtotal $ 122,021,314 $ 113,921,820 $

117,757,280

Net interest margin (excluding PAA) *

1.49 % 1.50 %

1.51 %

* Represents a non-GAAP financial

measure.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20190213005726/en/

Annaly Capital Management, Inc.Investor

Relations1-888-8Annalywww.annaly.com

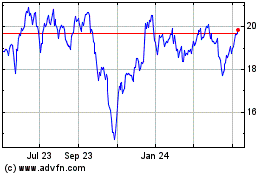

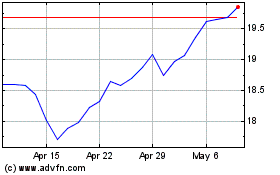

Annaly Capital Management (NYSE:NLY)

Historical Stock Chart

From Mar 2024 to Apr 2024

Annaly Capital Management (NYSE:NLY)

Historical Stock Chart

From Apr 2023 to Apr 2024