Form 8-K - Current report

August 09 2023 - 12:28PM

Edgar (US Regulatory)

AMERICAN VANGUARD CORP false 0000005981 0000005981 2023-08-03 2023-08-03

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (date of earliest event reported): August 3, 2023

AMERICAN VANGUARD CORPORATION

(Exact name of registrant as specified in its charter)

|

|

|

|

|

| Delaware |

|

001-13795 |

|

95-2588080 |

| (State or other jurisdiction of incorporation) |

|

Commission File Number |

|

(I.R.S. Employer Identification No.) |

4695 MacArthur Court

Newport Beach, California 92660

(Address of principal executive offices)

Registrant’s telephone number: (949) 260-1200

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

| Title of each class |

|

Trading

Symbol |

|

Exchanges on which registered |

| Common Stock, $.10 par value |

|

AVD |

|

New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b02 of the Securities Exchange Act of 1934 (§240.12b02 of this chapter).

Emerging Growth Company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| Item 2.02 |

Results of Operations and Financial Condition |

On August 8, 2023, American Vanguard Corporation (“Registrant”) issued a press release announcing its preliminary, unaudited financial results for the three- and six-month periods ended June 30, 2023. The full text of the press release is linked hereto as Exhibit 99.1 and is incorporated herein by reference.

On August 3, 2023, with respect to that certain Third Amended and Restated Loan Agreement dated as of August 5, 2021 (the “Credit Agreement”), led by BMO Harris, N.A., as successor to Bank of the West, the Lenders (as defined in the Credit Agreement) granted a waiver with respect to an Existing Event of Default (as defined in the Credit Agreement) relating to the Company’s noncompliance with the Minimum Fixed Charge Coverage Ratio (“FCCR”) for the quarter ended June 30, 2023, subject to the terms and conditions of such waiver. The noncompliance arose largely from the expense of the Company’s share repurchase activity over the course of the twelve-month period ended on June 30, 2023.

The information contained in this Item 8.01 shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such a filing.

| Item 9.01 |

Financial Statements and Exhibits. |

(d) Exhibits

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, American Vanguard Corporation has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

AMERICAN VANGUARD CORPORATION |

|

|

|

|

| Date: August 9, 2023 |

|

|

|

By: |

|

/s/ Timothy J. Donnelly |

|

|

|

|

|

|

Timothy J. Donnelly |

|

|

|

|

|

|

Chief Administrative Officer, General Counsel & Secretary |

Exhibit 99.1

FOR IMMEDIATE RELEASE

AMERICAN VANGUARD REPORTS SECOND QUARTER & MIDYEAR 2023 RESULTS

Second Half Rebound Forecast After Lower-Than-Expected First Half Performance

Citing Industry-Wide Drop in Procurement Activity

Announces Share Repurchase Program

Newport Beach, CA – August 8, 2023 – American Vanguard Corporation (NYSE: AVD) today announced financial results for the second quarter and six

months ended June 30, 2023.

|

|

|

|

|

|

|

|

|

|

|

|

|

| 3 Months Ended |

|

June 30, 2023 |

|

|

June 30, 2022 |

|

|

Change |

|

| Net sales |

|

$ |

132,790 |

|

|

$ |

148,203 |

|

|

$ |

(15,413 |

) |

| Net income |

|

$ |

(1,053 |

) |

|

$ |

6,830 |

|

|

$ |

(7,883 |

) |

| EPS |

|

$ |

(0.04 |

) |

|

$ |

0.23 |

|

|

$ |

(0.27 |

) |

| Adjusted EBITDA1 |

|

$ |

10,655 |

|

|

$ |

19,656 |

|

|

$ |

(9,001 |

) |

|

|

|

|

| 6 Months Ended |

|

June 30, 2023 |

|

|

June 30, 2022 |

|

|

Change |

|

| Net sales |

|

$ |

257,674 |

|

|

$ |

297,797 |

|

|

$ |

(40,123 |

) |

| Net income |

|

$ |

865 |

|

|

$ |

16,765 |

|

|

$ |

(15,900 |

) |

| EPS |

|

$ |

0.03 |

|

|

$ |

0.55 |

|

|

$ |

(0.52 |

) |

| Adjusted EBITDA1 |

|

$ |

22,172 |

|

|

$ |

42,523 |

|

|

$ |

(20,351 |

) |

Eric Wintemute, Chairman and CEO of American Vanguard stated: “During the second quarter of 2023, the Global Agriculture

industry experienced a sharp, unexpected drop in procurement activity for crop inputs, as distribution, faced with higher interest rates, destocked inventory in order to limit carrying costs. We believe that this procurement pattern does not

represent a loss of demand but, rather, a shift in timing of demand – to be closer to the planting season. We saw similar behavior in our non-crop business, as retailers broke with traditional stocking

patterns in favor of just-in-time buying. Further, our businesses in Central America and Brazil faced a flood of low-priced,

generic product from China-based suppliers. These factors taken together adversely affected our second quarter financial performance.”

Mr. Wintemute continued: “With stable commodity prices, a strong farm economy and channel inventory of many of our crop products at low levels, we

expect that demand should improve significantly over the balance of 2023, as growers prepare for the 2024 planting season. While we are uncertain whether destocking activity has completely run its course, we can say that the distribution channel

will need to replenish its stocks, and we are poised to meet the demand. Accordingly, we are revising our 2023 performance targets as indicated below.

| 1 |

Adjusted earnings before interest, taxes, depreciation, amortization,

non-cash stock compensation, and proxy contest activities. Adjusted EBITDA is not a financial measure calculated and presented in accordance with U.S. generally accepted accounting principles (GAAP) and should

not be considered as an alternative to net income (loss), operating income (loss) or any other financial measures so calculated and presented, nor as an alternative to cash flow from operating activities as a measure of liquidity. We provide these

measures because we believe that they provide helpful comparisons to other companies in our industry and peer group. The items excluded from Adjusted EBITDA are detailed in the reconciliation attached to this news release. Other companies (including

the Company’s competitors) may define Adjusted EBITDA differently. |

2023 Performance Targets

|

|

|

|

|

|

|

|

|

|

|

|

|

| Metric |

|

2023 Range |

|

|

2022 Actual |

|

|

Change |

|

| Net sales |

|

$ |

615MM - $625MM |

|

|

$ |

610MM |

|

|

|

flat to up |

|

| Gross margin % |

|

|

32 |

% |

|

|

32 |

% |

|

|

flat |

|

| Opex as % of sales |

|

|

25 |

% |

|

|

25 |

% |

|

|

flat |

|

| Adjusted EBITDA |

|

$ |

70MM - $75MM |

|

|

$ |

73.0MM |

|

|

|

Similar |

|

| Net income |

|

$ |

20MM - $24MM |

|

|

$ |

27.5MM |

|

|

|

down |

|

Mr. Wintemute concluded: “As a demonstration of our confidence in the company’s prospects, our board of

directors has authorized us to enter into a 10b5-1 plan under which we may purchase up to $7.5 million of our common stock on the open market. We continue to see enduring value in our equity and believe

that this repurchase program is a prudent allocation of capital. We encourage you to join us for our upcoming earnings call, during which we will give you a more detailed presentation of our first-half performance and full-year targets.”

Conference Call

Eric Wintemute, Chairman & CEO

and David T. Johnson, VP & CFO, will conduct a conference call focusing on the financial results and strategic themes at 5 pm ET on August 8, 2023. Interested parties may participate in the call by dialing 713-481-1320. Please call in 10 minutes before the call is scheduled to begin and ask for the American Vanguard call. The conference call will also be webcast live via the News and Media section of the

Company’s web site at www.american-vanguard.com. To listen to the live webcast, go to the web site at least 15 minutes early to register, download and install any necessary audio software. If you are unable to listen live, the conference call

will be archived on the Company’s web site.

About American Vanguard

American Vanguard Corporation is a diversified specialty and agricultural products company that develops, manufactures, and markets solutions for crop

protection and nutrition, turf and ornamentals management, commercial and consumer pest control. Over the past 20 years, through product and business acquisitions, the Company has expanded its operations into 17 countries and now has over 1,000

product registrations in 56 nations worldwide. Its strategy rests on three growth initiatives – i) Core Business (through innovation of conventional products), ii) Green Solutions (with over 130 biorational products – including

fertilizers, microbials, nutritionals and non-conventional products) and iii) Precision Agriculture innovation (including SIMPAS prescriptive application and Ultimus measure/record/verify technologies).

American Vanguard is included on the Russell 2000® and Russell 3000® Indexes and the Standard & Poor’s Small Cap 600

Index. To learn more about American Vanguard, please reference the Company’s web site at www.american-vanguard.com.

The Company, from time to time,

may discuss forward-looking information. Except for the historical information contained in this release, all forward-looking statements are estimates by the Company’s management and are subject to various risks and uncertainties that may cause

results to differ from management’s current expectations. Such factors include weather conditions, changes in regulatory policy and other risks as detailed from

time-to-time in the Company’s SEC reports and filings. All forward-looking statements, if any, in this release represent the Company’s judgment as of the date

of this release.

|

|

|

| Company Contact: |

|

Investor Representative |

| American Vanguard Corporation |

|

The Equity Group Inc. |

| William A. Kuser, Director of Investor Relations |

|

Lena Cati |

| (949) 260-1200 |

|

(212) 836-9611 |

| williamk@amvac.com |

|

lcati@equityny.com |

AMERICAN VANGUARD CORPORATION AND SUBSIDIARIES

CONDENSED CONSOLIDATED BALANCE SHEETS

(In thousands, except share data)

(Unaudited)

ASSETS

|

|

|

|

|

|

|

|

|

| |

|

June 30,

2023 |

|

|

December 31,

2022 |

|

| Current assets: |

|

|

|

|

|

|

|

|

| Cash and cash equivalents |

|

$ |

14,632 |

|

|

$ |

20,328 |

|

| Receivables: |

|

|

|

|

|

|

|

|

| Trade, net of allowance for doubtful accounts of $6,135 and $5,136, respectively |

|

|

151,479 |

|

|

|

156,492 |

|

| Other |

|

|

11,473 |

|

|

|

9,816 |

|

|

|

|

|

|

|

|

|

|

| Total receivables, net |

|

|

162,952 |

|

|

|

166,308 |

|

| Inventories |

|

|

237,587 |

|

|

|

184,190 |

|

| Prepaid expenses |

|

|

17,546 |

|

|

|

15,850 |

|

| Income taxes receivable |

|

|

5,436 |

|

|

|

1,891 |

|

|

|

|

|

|

|

|

|

|

| Total current assets |

|

|

438,153 |

|

|

|

388,567 |

|

| Property, plant and equipment, net |

|

|

73,452 |

|

|

|

70,912 |

|

| Operating lease

right-of-use assets |

|

|

23,724 |

|

|

|

24,250 |

|

| Intangible assets, net |

|

|

178,624 |

|

|

|

184,664 |

|

| Goodwill |

|

|

48,219 |

|

|

|

47,010 |

|

| Other assets |

|

|

10,193 |

|

|

|

10,769 |

|

| Deferred income tax assets, net |

|

|

293 |

|

|

|

141 |

|

|

|

|

|

|

|

|

|

|

| Total assets |

|

$ |

772,658 |

|

|

$ |

726,313 |

|

|

|

|

|

|

|

|

|

|

| LIABILITIES AND STOCKHOLDERS’

EQUITY |

|

| Current liabilities: |

|

|

|

|

|

|

|

|

| Accounts payable |

|

$ |

78,876 |

|

|

$ |

69,000 |

|

| Customer prepayments |

|

|

27,368 |

|

|

|

110,597 |

|

| Accrued program costs |

|

|

80,333 |

|

|

|

60,743 |

|

| Accrued expenses and other payables |

|

|

13,273 |

|

|

|

20,982 |

|

| Current operating lease liabilities |

|

|

5,493 |

|

|

|

5,279 |

|

|

|

|

|

|

|

|

|

|

| Total current liabilities |

|

|

205,343 |

|

|

|

266,601 |

|

| Long-term debt, net |

|

|

160,750 |

|

|

|

51,477 |

|

| Long-term operating lease liabilities |

|

|

18,884 |

|

|

|

19,492 |

|

| Other liabilities, net of current installments |

|

|

4,923 |

|

|

|

4,167 |

|

| Deferred income tax liabilities, net |

|

|

13,683 |

|

|

|

14,597 |

|

|

|

|

|

|

|

|

|

|

| Total liabilities |

|

|

403,583 |

|

|

|

356,334 |

|

|

|

|

|

|

|

|

|

|

| Commitments and contingent liabilities |

|

|

|

|

|

|

|

|

| Stockholders’ equity: |

|

|

|

|

|

|

|

|

| Preferred stock, $.10 par value per share; authorized 400,000 shares; none issued |

|

|

— |

|

|

|

— |

|

| Common stock, $0.10 par value per share; authorized 40,000,000 shares; issued 34,643,674 shares at

June 30, 2023 and 34,446,194 shares at December 31, 2022 |

|

|

3,464 |

|

|

|

3,444 |

|

| Additional paid-in capital |

|

|

106,719 |

|

|

|

105,634 |

|

| Accumulated other comprehensive loss |

|

|

(6,131 |

) |

|

|

(12,182 |

) |

| Retained earnings |

|

|

327,911 |

|

|

|

328,745 |

|

| Less treasury stock at cost, 5,438,093 shares at June 30, 2023 and 5,029,892 shares at

December 31, 2022 |

|

|

(62,888 |

) |

|

|

(55,662 |

) |

|

|

|

|

|

|

|

|

|

| Total stockholders’ equity |

|

|

369,075 |

|

|

|

369,979 |

|

|

|

|

|

|

|

|

|

|

| Total liabilities and stockholders’ equity |

|

$ |

772,658 |

|

|

$ |

726,313 |

|

|

|

|

|

|

|

|

|

|

AMERICAN VANGUARD CORPORATION AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(In thousands, except per share data)

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

For the Three

Months

Ended June 30, |

|

|

For the Six Months

Ended June 30, |

|

| |

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

| Net sales |

|

$ |

132,790 |

|

|

$ |

148,203 |

|

|

$ |

257,674 |

|

|

$ |

297,797 |

|

| Cost of sales |

|

|

(89,881 |

) |

|

|

(98,872 |

) |

|

|

(176,230 |

) |

|

|

(197,070 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Gross profit |

|

|

42,909 |

|

|

|

49,331 |

|

|

|

81,444 |

|

|

|

100,727 |

|

| Operating expenses |

|

|

(39,155 |

) |

|

|

(38,518 |

) |

|

|

(74,423 |

) |

|

|

(75,165 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Operating income |

|

|

3,754 |

|

|

|

10,813 |

|

|

|

7,021 |

|

|

|

25,562 |

|

| Change in fair value of equity investment |

|

|

(55 |

) |

|

|

(486 |

) |

|

|

(77 |

) |

|

|

(403 |

) |

| Interest expense, net |

|

|

(3,211 |

) |

|

|

(772 |

) |

|

|

(4,898 |

) |

|

|

(1,170 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Income before provision for income taxes |

|

|

488 |

|

|

|

9,555 |

|

|

|

2,046 |

|

|

|

23,989 |

|

| Income tax expense |

|

|

(1,541 |

) |

|

|

(2,725 |

) |

|

|

(1,181 |

) |

|

|

(7,224 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net income (loss) |

|

$ |

(1,053 |

) |

|

$ |

6,830 |

|

|

$ |

865 |

|

|

$ |

16,765 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net income (loss) per common share—basic |

|

$ |

(.04 |

) |

|

$ |

.23 |

|

|

$ |

.03 |

|

|

$ |

.57 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net income (loss) per common share—assuming dilution |

|

$ |

(.04 |

) |

|

$ |

.23 |

|

|

$ |

.03 |

|

|

$ |

.55 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Weighted average shares outstanding—basic |

|

|

28,428 |

|

|

|

29,602 |

|

|

|

28,397 |

|

|

|

29,639 |

|

| Weighted average shares outstanding—assuming dilution |

|

|

28,428 |

|

|

|

30,225 |

|

|

|

28,985 |

|

|

|

30,289 |

|

AMERICAN VANGUARD CORPORATION AND SUBSIDIARIES

ANALYSIS OF SALES

(In

thousands)

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

For the Three Months

Ended June 30, |

|

|

|

|

|

|

|

| |

|

2023 |

|

|

2022 |

|

|

Change |

|

|

%

Change |

|

| Net sales: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| U.S. crop |

|

$ |

56,212 |

|

|

$ |

63,513 |

|

|

$ |

(7,301 |

) |

|

|

-11 |

% |

| U.S. non-crop |

|

|

16,878 |

|

|

|

20,996 |

|

|

|

(4,118 |

) |

|

|

-20 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| U.S. total |

|

|

73,090 |

|

|

|

84,509 |

|

|

|

(11,419 |

) |

|

|

-14 |

% |

| International |

|

|

59,700 |

|

|

|

63,694 |

|

|

|

(3,994 |

) |

|

|

-6 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net sales: |

|

$ |

132,790 |

|

|

$ |

148,203 |

|

|

$ |

(15,413 |

) |

|

|

-10 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Gross profit: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| U.S. crop |

|

$ |

21,703 |

|

|

$ |

23,913 |

|

|

$ |

(2,210 |

) |

|

|

-9 |

% |

| U.S. non-crop |

|

|

7,109 |

|

|

|

9,244 |

|

|

|

(2,135 |

) |

|

|

-23 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| U.S. total |

|

|

28,812 |

|

|

|

33,157 |

|

|

|

(4,345 |

) |

|

|

-13 |

% |

| International |

|

|

14,097 |

|

|

|

16,174 |

|

|

|

(2,077 |

) |

|

|

-13 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total gross profit: |

|

$ |

42,909 |

|

|

$ |

49,331 |

|

|

$ |

(6,422 |

) |

|

|

-13 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

For the Six Months

Ended June 30, |

|

|

|

|

|

|

|

| |

|

2023 |

|

|

2022 |

|

|

Change |

|

|

%

Change |

|

| Net sales: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| U.S. crop |

|

$ |

118,105 |

|

|

$ |

151,349 |

|

|

$ |

(33,244 |

) |

|

|

-22 |

% |

| U.S. non-crop |

|

|

30,759 |

|

|

|

34,753 |

|

|

|

(3,994 |

) |

|

|

-11 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| U.S. total |

|

|

148,864 |

|

|

|

186,102 |

|

|

|

(37,238 |

) |

|

|

-20 |

% |

| International |

|

|

108,810 |

|

|

|

111,695 |

|

|

|

(2,885 |

) |

|

|

-3 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net sales: |

|

$ |

257,674 |

|

|

$ |

297,797 |

|

|

$ |

(40,123 |

) |

|

|

-13 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Gross profit: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| U.S. crop |

|

$ |

40,585 |

|

|

$ |

56,186 |

|

|

$ |

(15,601 |

) |

|

|

-28 |

% |

| U.S. non-crop |

|

|

14,298 |

|

|

|

16,730 |

|

|

|

(2,432 |

) |

|

|

-15 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| U.S. total |

|

|

54,883 |

|

|

|

72,916 |

|

|

|

(18,033 |

) |

|

|

-25 |

% |

| International |

|

|

26,561 |

|

|

|

27,811 |

|

|

|

(1,250 |

) |

|

|

-4 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total gross profit: |

|

$ |

81,444 |

|

|

$ |

100,727 |

|

|

$ |

(19,283 |

) |

|

|

-19 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

AMERICAN VANGUARD CORPORATION AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(In thousands)

(Unaudited)

|

|

|

|

|

|

|

|

|

| |

|

For the Six Months

Ended June 30, |

|

| |

|

2023 |

|

|

2022 |

|

| Cash flows from operating activities: |

|

|

|

|

|

|

|

|

| Net income |

|

$ |

865 |

|

|

$ |

16,765 |

|

| Adjustments to reconcile net income to net cash used in operating activities: |

|

|

|

|

|

|

|

|

| Depreciation of property, plant and equipment |

|

|

4,322 |

|

|

|

4,077 |

|

| Amortization of intangibles assets |

|

|

6,707 |

|

|

|

6,927 |

|

| Amortization of other long-term assets |

|

|

1,117 |

|

|

|

1,739 |

|

| Provision for bad debts |

|

|

902 |

|

|

|

470 |

|

| Fair value adjustment to contingent consideration |

|

|

— |

|

|

|

635 |

|

| Stock-based compensation |

|

|

2,541 |

|

|

|

2,836 |

|

| Change in deferred income taxes |

|

|

(1,015 |

) |

|

|

109 |

|

| Changes in liabilities for uncertain tax positions or unrecognized tax benefits |

|

|

419 |

|

|

|

— |

|

| Change in fair value of equity investments |

|

|

77 |

|

|

|

403 |

|

| Other |

|

|

117 |

|

|

|

412 |

|

| Net foreign currency adjustments |

|

|

(382 |

) |

|

|

(20 |

) |

| Changes in assets and liabilities associated with operations: |

|

|

|

|

|

|

|

|

| Decrease (increase) in net receivables |

|

|

6,092 |

|

|

|

(18,645 |

) |

| Increase in inventories |

|

|

(50,900 |

) |

|

|

(27,774 |

) |

| Increase in prepaid expenses and other assets |

|

|

(1,749 |

) |

|

|

(3,652 |

) |

| Change in income tax receivable/payable, net |

|

|

(3,510 |

) |

|

|

(3,526 |

) |

| Increase (decrease) in net operating lease liability |

|

|

132 |

|

|

|

(21 |

) |

| Increase in accounts payable |

|

|

9,105 |

|

|

|

19,439 |

|

| Decrease in customer prepayments |

|

|

(83,225 |

) |

|

|

(62,789 |

) |

| Increase in accrued program costs |

|

|

19,607 |

|

|

|

35,987 |

|

| Decrease in other payables and accrued expenses |

|

|

(7,824 |

) |

|

|

(602 |

) |

|

|

|

|

|

|

|

|

|

| Net cash used in operating activities |

|

|

(96,602 |

) |

|

|

(27,230 |

) |

|

|

|

|

|

|

|

|

|

| Cash flows from investing activities: |

|

|

|

|

|

|

|

|

| Capital expenditures |

|

|

(6,498 |

) |

|

|

(5,654 |

) |

| Proceeds from disposal of property, plant and equipment |

|

|

44 |

|

|

|

27 |

|

| Intangible assets |

|

|

(718 |

) |

|

|

(1,044 |

) |

|

|

|

|

|

|

|

|

|

| Net cash used in investing activities |

|

|

(7,172 |

) |

|

|

(6,671 |

) |

|

|

|

|

|

|

|

|

|

| Cash flows from financing activities: |

|

|

|

|

|

|

|

|

| Payments under line of credit agreement |

|

|

(54,050 |

) |

|

|

(56,600 |

) |

| Borrowings under line of credit agreement |

|

|

162,500 |

|

|

|

105,000 |

|

| Receipt from the issuance of common stock under ESPP |

|

|

480 |

|

|

|

436 |

|

| Net receipt from the exercise of stock options |

|

|

32 |

|

|

|

765 |

|

| Payment for tax withholding on stock-based compensation awards |

|

|

(1,948 |

) |

|

|

(2,012 |

) |

| Repurchase of common stock |

|

|

(7,226 |

) |

|

|

(6,232 |

) |

| Payment of cash dividends |

|

|

(1,702 |

) |

|

|

(1,330 |

) |

|

|

|

|

|

|

|

|

|

| Net cash provided by financing activities |

|

|

98,086 |

|

|

|

40,027 |

|

|

|

|

|

|

|

|

|

|

| Net (decrease) increase in cash and cash equivalents |

|

|

(5,688 |

) |

|

|

6,126 |

|

| Effect of exchange rate changes on cash and cash equivalents |

|

|

(8 |

) |

|

|

(354 |

) |

| Cash and cash equivalents at beginning of period |

|

|

20,328 |

|

|

|

16,285 |

|

|

|

|

|

|

|

|

|

|

| Cash and cash equivalents at end of period |

|

$ |

14,632 |

|

|

$ |

22,057 |

|

|

|

|

|

|

|

|

|

|

AMERICAN VANGUARD CORPORATION AND SUBSIDIARIES

UNAUDITED RECONCILIATION OF NET INCOME TO ADJUSTED EBITDA

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Three Months Ended

June 30, |

|

|

Six Months Ended

June 30, |

|

| |

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

| Net income, as reported |

|

$ |

(1,053 |

) |

|

$ |

6,830 |

|

|

$ |

865 |

|

|

$ |

16,765 |

|

| Provision for income taxes |

|

|

1,541 |

|

|

|

2,725 |

|

|

|

1,181 |

|

|

|

7,224 |

|

| Interest expense, net |

|

|

3,211 |

|

|

|

772 |

|

|

|

4,898 |

|

|

|

1,170 |

|

| Depreciation and amortization |

|

|

5,889 |

|

|

|

6,271 |

|

|

|

12,146 |

|

|

|

12,743 |

|

| Stock compensation |

|

|

1,067 |

|

|

|

1,273 |

|

|

|

2,541 |

|

|

|

2,836 |

|

| Proxy contest activities |

|

|

— |

|

|

|

1,785 |

|

|

|

541 |

|

|

|

1,785 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Adjusted EBITDA2 |

|

$ |

10,655 |

|

|

$ |

19,656 |

|

|

$ |

22,172 |

|

|

$ |

42,523 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| 2 |

Adjusted earnings before interest, taxes, depreciation, amortization,

non-cash stock compensation, and proxy contest activities. Adjusted EBITDA is not a financial measure calculated and presented in accordance with U.S. generally accepted accounting principles (GAAP) and should

not be considered as an alternative to net income (loss), operating income (loss) or any other financial measures so calculated and presented, nor as an alternative to cash flow from operating activities as a measure of liquidity. We provide these

measures because we believe that they provide helpful comparisons to other companies in our industry and peer group. The items excluded from Adjusted EBITDA are detailed in the reconciliation attached to this news release. Other companies (including

the Company’s competitors) may define Adjusted EBITDA differently. |

v3.23.2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

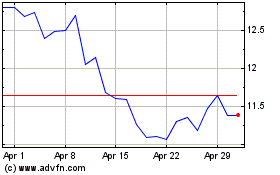

American Vanguard (NYSE:AVD)

Historical Stock Chart

From Mar 2024 to Apr 2024

American Vanguard (NYSE:AVD)

Historical Stock Chart

From Apr 2023 to Apr 2024