American Financial Group, Inc. Increases Annual Common Stock Dividend by 12.7%; Nineteenth Consecutive Year of Dividend Increases

August 20 2024 - 5:41PM

Business Wire

American Financial Group, Inc. (NYSE: AFG) announced that its

Board of Directors approved an increase in the Company’s regular

annual dividend to $3.20 from $2.84 per share of common stock. The

increased dividend, when declared, will be paid on a quarterly

basis of $0.80 per share of common stock beginning in October 2024.

The new dividend rate is a 12.7% increase over the declared rate.

This is the Company’s nineteenth consecutive year of dividend

increases. The ten-year compound annual growth rate in AFG’s

regular annual dividends paid is 12.4%.

Carl H. Lindner III and S. Craig Lindner, AFG’s Co-Chief

Executive Officers, issued this statement: “Returning excess

capital to shareholders in the form of dividends is an important

and effective component of AFG’s capital management strategy. This

increase in AFG’s annual dividend reflects our confidence in the

Company’s financial condition, liquidity, and prospects for

long-term growth.”

About American Financial

Group, Inc.

American Financial Group is an insurance holding company, based

in Cincinnati, Ohio. Through the operations of Great American

Insurance Group, AFG is engaged primarily in property and casualty

insurance, focusing on specialized commercial products for

businesses. Great American Insurance Group’s roots go back to 1872

with the founding of its flagship company, Great American Insurance

Company.

Forward Looking

Statements

This press release, and any related oral statements, contains

certain statements that may be deemed to be "forward-looking

statements" within the meaning of Section 27A of the Securities Act

of 1933 and Section 21E of the Securities Exchange Act of 1934. All

statements in this press release not dealing with historical

results are forward-looking and are based on estimates,

assumptions, and projections. Examples of such forward-looking

statements include statements relating to: the Company's

expectations concerning market and other conditions and their

effect on future premiums, revenues, earnings, investment

activities and the amount and timing of share repurchases or

special dividends; recoverability of asset values; expected losses

and the adequacy of reserves for asbestos, environmental pollution

and mass tort claims; rate changes; and improved loss

experience.

Actual results and/or financial condition could differ

materially from those contained in or implied by such

forward-looking statements for a variety of reasons including, but

not limited to: the risks and uncertainties AFG describes in the

“Risk Factors” section of its most recent Annual Report on Form

10-K, as updated by its other reports filed with the Securities and

Exchange Commission; changes in financial, political and economic

conditions, including changes in interest and inflation rates,

currency fluctuations and extended economic recessions or

expansions in the U.S. and/or abroad; performance of securities

markets; new legislation or declines in credit quality or credit

ratings that could have a material impact on the valuation of

securities in AFG’s investment portfolio; the availability of

capital; changes in insurance law or regulation, including changes

in statutory accounting rules, including modifications to capital

requirements; changes in the legal environment affecting AFG or its

customers; tax law and accounting changes; levels of natural

catastrophes and severe weather, terrorist activities (including

any nuclear, biological, chemical or radiological events),

incidents of war or losses resulting from pandemics, civil unrest

and other major losses; disruption caused by cyber-attacks or other

technology breaches or failures by AFG or its business partners and

service providers, which could negatively impact AFG’s business

and/or expose AFG to litigation; development of insurance loss

reserves and establishment of other reserves, particularly with

respect to amounts associated with asbestos and environmental

claims; availability of reinsurance and ability of reinsurers to

pay their obligations; competitive pressures; the ability to obtain

adequate rates and policy terms; changes in AFG’s credit ratings or

the financial strength ratings assigned by major ratings agencies

to AFG’s operating subsidiaries; the impact of the conditions in

the international financial markets and the global economy relating

to AFG’s international operations; and effects on AFG’s reputation,

including as a result of environmental, social and governance

matters.

The forward-looking statements herein are made only as of the

date of this press release. The Company assumes no obligation to

publicly update any forward-looking statements.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240820311657/en/

Diane P. Weidner, IRC, CPA (inactive) Vice President – Investor

& Media Relations 513-369-5713

Websites: www.AFGinc.com

www.GreatAmericanInsuranceGroup.com

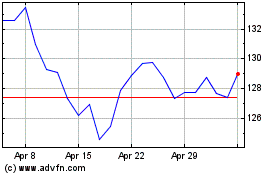

American Financial (NYSE:AFG)

Historical Stock Chart

From Nov 2024 to Dec 2024

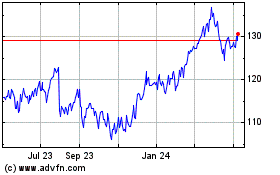

American Financial (NYSE:AFG)

Historical Stock Chart

From Dec 2023 to Dec 2024