Current Report Filing (8-k)

December 21 2022 - 6:04AM

Edgar (US Regulatory)

false000170278000017027802022-12-192022-12-19

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

December 20, 2022 (December 19, 2022)

| | | | | | | | | | | |

|

| Altice USA, Inc. |

| (Exact Name of Registrant as Specified in its Charter) |

|

| Delaware |

| (State of Incorporation) |

|

| 001-38126 | | 38-3980194 |

| (Commission File Number) | | (IRS Employer Identification Number) |

|

| 1 Court Square West | | |

| Long Island City, | New York | | 11101 |

| (Address of principal executive offices) | | (Zip Code) |

(516) 803-2300

(Registrant’s telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| | | | | | | | |

| Title of each class | Trading Symbol | Name of each exchange on which registered |

| Class A Common Stock, par value $0.01 per share | ATUS | New York Stock Exchange |

Item 1.01 Entry into a Material Definitive Agreement.

Thirteenth Amendment to Credit Agreement

On December 19, 2022, CSC Holdings, LLC (the “Borrower”), an indirect wholly-owned subsidiary of Altice USA, Inc., entered into a Thirteenth Amendment to Credit Agreement (Refinancing Amendment), by and among the Borrower, the 2022 Refinancing Term Loan Lenders (as defined therein) and JPMorgan Chase Bank, N.A., as administrative agent (the “Thirteenth Amendment”). The Thirteenth Amendment amends and supplements the Borrower’s credit agreement, dated as of October 9, 2015, by and among the Borrower, the lenders party thereto from time to time, the administrative agent, the security agent and the other parties thereto from time to time (as amended, restated, modified or supplemented from time to time and as further amended by the Thirteenth Amendment, the “Credit Agreement”). The Thirteenth Amendment is expected to become effective on or about December 29, 2022, subject to customary closing conditions.

The Thirteenth Amendment provides for, among other things, new refinancing term loan commitments (the “2022 Refinancing Term Loan Commitments”) in an aggregate principal amount of $2,001,942,177.56, issued with an original issue discount of 200 basis points, with an extended maturity until the date that is the earlier of (i) January 15, 2028 and (ii) April 15, 2027 if, as of such date, any September 2019 Term Loans (as defined in the Eleventh Amendment) are still outstanding, unless the September 2019 Term Loan Maturity Date (as defined in the Eleventh Amendment) has been extended to a date falling after January 15, 2028. The loans made pursuant to the 2022 Refinancing Term Loan Commitments (the “2022 Refinancing Term Loans”) may be comprised of Term SOFR borrowings or alternative base rate borrowings, and will bear interest at a rate per annum equal to the Term SOFR rate or the alternate base rate, as applicable, plus the applicable margin, where the applicable margin is (i) with respect to any alternate base rate loan, 3.500% per annum and (ii) with respect to any Term SOFR loan, 4.500% per annum. The proceeds from the 2022 Refinancing Term Loans are expected to be used to refinance (including by way of cashless roll) an equivalent principal amount of the Borrower’s March 2017 Term Loans (as defined in the Fourth Amendment) and October 2018 Incremental Term Loans (as defined in the Sixth Amendment). After the effectiveness of the Thirteenth Amendment, the aggregate principal amount of outstanding March 2017 Term Loans and October 2018 Incremental Term Loans will be $1,535,841,693.39 and $527,013,693.63, respectively.

The foregoing summary of the terms of the Thirteenth Amendment is qualified in its entirety by the Thirteenth Amendment (including in the respective schedules thereto), which is attached as Exhibit 10.1 to this Current Report on Form 8-K and incorporated herein by reference.

Item 2.03 Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant.

The information set forth in Item 1.01 is incorporated herein by reference.

Item 9.01 Financial Statements and Exhibits

(d) Exhibits

| | | | | | | | |

| Exhibit No. | | Description |

| | Thirteenth Amendment to Credit Agreement, dated as of December 19, 2022, by and among the Borrower, each of the other Loan Parties, the Lenders party thereto and JPMorgan Chase Bank, N.A. as the Administrative Agent. |

| 104 | | Cover Page Interactive Data File – the cover page XBRL tags are embedded within the Inline XBRL document |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| ALTICE USA, INC. |

| |

| |

| Dated: December 20, 2022 | By: | /s/ Michael E. Olsen |

| | Michael E. Olsen |

| | Executive Vice President, General Counsel and Secretary |

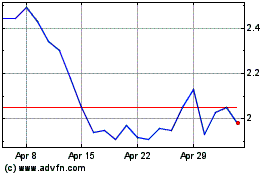

Altice USA (NYSE:ATUS)

Historical Stock Chart

From Aug 2024 to Sep 2024

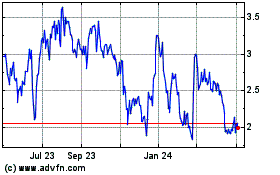

Altice USA (NYSE:ATUS)

Historical Stock Chart

From Sep 2023 to Sep 2024