Entergy Corp. Stays Neutral - Analyst Blog

May 10 2013 - 8:30AM

Zacks

We have maintained our Neutral recommendation on Entergy

Corporation (ETR) on May 9, 2013 based on its

year-over-year improvement in first quarter 2013 earnings and

planned investments in infrastructure. Volatile commodity prices

however pose a threat. The company currently has a Zacks Rank #2

(Buy).

Why the Reiteration?

Entergy Corporation posted first quarter 2013 earnings in line with

our expectation, while missing on revenues. However, the company

experienced a significant year-over-year improvement in its results

driven by major generation investments in 2012. Total operating

expenses during the quarter were 2,214.8 million, down from

$2,440.5 million in the prior-year period.

Entergy’s nuclear fleet, along with its complementary and flexible

fossil and hydro fleet, gives the company a distinct generation

cost advantage over its fossil-fuel based competitors.

The company also plans to invest $6.7 billion over the three-year

period from 2013 to 2015. Of this, only $3.3 billion will be for

maintenance while the rest will go towards new capital projects.

This will significantly boost the asset base of the company while

raising the rate base.

Moreover, Entergy’s geographically-diverse mix of regulated and

merchant operations insulates the company from regulatory

bottlenecks and power-price volatility in a particular region.

Recently, Entergy Gulf States Louisiana, L.L.C. entered into a

30-year contract with Sempra Energy (SRE) for the

supply of up to 200 megawatts of additional power to Sempra

Energy’s proposed Cameron LNG liquefaction project in

Hackberry.

The company is also making steady progress to spin off its

electric-transmission business and merge the operation with

ITC Holdings Corporation (ITC). Besides

contributing to earnings, this transaction would allow the company

to focus more on its generation and distribution businesses.

Entergy focuses on maximizing shareholder value through share

repurchases and incremental dividend. In fact, the company is

planning capital deployment through dividends and share repurchases

of as much as $4 billion through 2010 to 2014.

Despite these positives we remain concerned about tepid growth at

the company’s competitive business on account of lukewarm power

demand in the Northeast, the fate of its Indian Point plant with

respect to its re-licensing and volatile commodity prices.

Other Stocks to Consider

ALLETE, Inc. (ALE) also looks good in the space

carrying a Zacks Rank #2 (Buy).

ALLETE INC (ALE): Free Stock Analysis Report

ENTERGY CORP (ETR): Free Stock Analysis Report

ITC HOLDINGS CP (ITC): Free Stock Analysis Report

SEMPRA ENERGY (SRE): Free Stock Analysis Report

To read this article on Zacks.com click here.

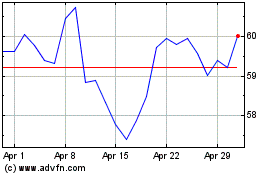

Allete (NYSE:ALE)

Historical Stock Chart

From Jun 2024 to Jul 2024

Allete (NYSE:ALE)

Historical Stock Chart

From Jul 2023 to Jul 2024