Alight, Inc. (“Alight”) (NYSE: ALIT), a leading cloud-based

human capital technology and services provider, today announced the

commencement of an underwritten secondary public offering of up to

22,500,000 shares of Alight’s Class A common stock by certain funds

affiliated with Blackstone Inc., Jasmine Ventures Pte. Ltd.,

Platinum Falcon B 2018 RSC Ltd. (collectively, the “Selling

Stockholders”) and pursuant to a registration statement filed with

the Securities and Exchange Commission (the “SEC”). In connection

with the offering, the Selling Stockholders intend to grant to the

underwriters a 30-day option to purchase up to 3,375,000 additional

shares of Alight’s Class A common stock. Subject to customary

closing conditions, the offering is expected to settle and close on

or about August 22, 2023. Alight is not selling any shares of Class

A common stock in the offering and will not receive any proceeds

from the offering.

In addition, Alight has entered into a repurchase agreement with

the Selling Stockholders to repurchase an aggregate of $10 million

of shares of Alight’s Class A common stock from such Selling

Stockholders in privately negotiated transactions, concurrently

with the closing of the offering. This offering is not conditioned

upon the completion of the share repurchase, but the share

repurchase is conditioned upon the completion of this offering.

J.P. Morgan, BofA Securities and Morgan Stanley are acting as

joint lead book-running managers of, and as representatives of the

underwriters for, the offering.

The underwriters propose to offer the shares of common stock

from time to time for sale in one or more transactions on the NYSE,

in the over-the-counter market, through negotiated transactions or

otherwise at market prices prevailing at the time of sale, at

prices related to prevailing market prices or at negotiated

prices.

A registration statement relating to these securities has been

filed with the SEC on Form S-3 (File No. 333-258350) that was

declared effective by the SEC on July 6, 2023. A prospectus

supplement relating to the offering will be filed with the SEC. A

preliminary prospectus supplement and accompanying prospectus

relating to and describing the terms of the offering is available

on the SEC’s website located at www.sec.gov. When available, copies

of the preliminary prospectus supplement and accompanying

prospectus relating to the offering may be obtained for free by

visiting EDGAR on the SEC website at www.sec.gov. Alternatively,

Alight, any underwriter, or any dealer participating in the

offering will arrange to send these documents if contacted at: J.P.

Morgan Securities LLC, c/o Broadridge Financial Solutions, Attn:

Prospectus Department, 1155 Long Island Avenue, Edgewood, NY 11717,

or telephone: 1-866-803-9204 or by email at

prospectus-eq_fi@jpmchase.com; or BofA Securities, NC1-022-02-25,

201 North Tryon Street, Charlotte, NC 28255-0001, Attn: Prospectus

Department, Email: dg.prospectus_requests@bofa.com; or Morgan

Stanley & Co. LLC, Attention: Prospectus Department, 180 Varick

Street, 2nd Floor, New York, NY 10014, or by phone:

1-866-718-1649.

This press release shall not constitute an offer to sell or the

solicitation of an offer to buy these securities nor shall there be

any sale of these securities in any state or jurisdiction in which

such offer, solicitation or sale would be unlawful prior to

registration or qualification under the securities laws of any such

state or jurisdiction.

About Alight Solutions

Alight is a leading cloud-based human capital technology and

services provider that powers confident health, wealth, and

wellbeing decisions for 36 million people and dependents. Our

Alight Worklife® platform combines data and analytics with a

simple, seamless user experience. Supported by our global delivery

capabilities, Alight Worklife is transforming the employee

experience for people around the world. With personalized,

data-driven health, wealth, pay and wellbeing insights, Alight

brings people the security of better outcomes and peace of mind

throughout life’s big moments and most important decisions. Learn

how Alight unlocks growth for organizations of all sizes at

alight.com.

Forward-Looking Statements

This press release contains forward-looking statements within

the meaning of Section 27A of the Securities Act of 1933, as

amended, and Section 21E of the Securities Exchange Act of 1934, as

amended. These statements include, but are not limited to,

statements that relate to expectations regarding the performance

and outlook for Alight’s business, financial results, liquidity and

capital resources, the expected benefit of recent acquisitions and

investments in our business, the expected return on investment from

the use of our products, the success of our expanded relationships

with existing clients, the recovery of certain of our businesses,

and other non-historical statements. In some cases, these

forward-looking statements can be identified by the use of words

such as “outlook,” “believes,” “expects,” “potential,” “continues,”

“may,” “will,” “should,” “could,” “seeks,” “projects,” “predicts,”

“intends,” “plans,” “estimates,” “anticipates,” “appears,”

“approximates,” “foresees,” “might,” “possible,” “would” or the

negative version of these words or other comparable words. Such

forward-looking statements are subject to various risks and

uncertainties including, among others, risks related to declines in

economic activity in the industries, markets, and regions our

clients serve, including as a result of increases in inflation

rates or changes in monetary and fiscal policies, risks related to

the performance of our information technology systems and networks,

risks related to our ability to maintain the security and privacy

of confidential and proprietary information, risks related to

changes in regulation, risks related to the ongoing COVID-19

pandemic, risks related to legal proceedings against us, risks

related to the significant control certain existing investors have

over us and risks related to competition in our industry.

Additional factors that could cause Alight’s results to differ

materially from those described in the forward-looking statements

can be found under the section entitled “Risk Factors” of Alight’s

Annual Report on Form 10-K, filed with the SEC on March 1, 2023, as

such factors may be updated from time to time in Alight's filings

with the SEC, which are, or will be, accessible on the SEC’s

website at www.sec.gov. Accordingly, there are or will be important

factors that could cause actual outcomes or results to differ

materially from those indicated in these statements. These factors

should not be construed as exhaustive and should be considered

along with other factors noted in this presentation and in Alight’s

filings with the SEC. Alight does not take any obligation to

publicly update, add or otherwise correct any forward-looking

statement to reflect events or circumstances after the date they

were made, whether as a result of new information, future events,

developments, inaccuracies that become apparent or otherwise,

except as required under applicable securities laws.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230816422912/en/

Investors: Alight Investor Relations

investor.relations@alight.com Media: MacKenzie Lucas

mackenzie.lucas@alight.com

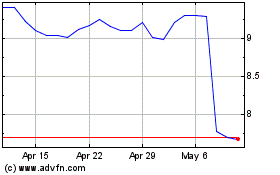

Alight (NYSE:ALIT)

Historical Stock Chart

From Mar 2024 to Apr 2024

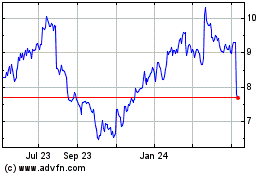

Alight (NYSE:ALIT)

Historical Stock Chart

From Apr 2023 to Apr 2024