Alibaba Group Announces Proposed Offering of Senior Unsecured Notes

November 17 2024 - 7:00PM

Business Wire

Alibaba Group Holding Limited (NYSE: BABA and

HKEX: 9988 (HKD Counter) and 89988 (RMB Counter), “Alibaba,”

“Alibaba Group” or the “Company”) today announced that it proposes

to concurrently offer U.S. dollar-denominated senior unsecured

notes (“the USD Notes”) and RMB-denominated senior unsecured notes

(the “RMB Notes,” and together with the USD Notes, the “Notes”),

subject to market and other conditions. The offering of the USD

Notes and the offering of the RMB Notes are not inter-conditional

with each other. The principal amount, interest rates, maturity

dates and other terms of the Notes will be determined at the time

of pricing of the offering.

Alibaba intends to use the net proceeds from the offering of the

Notes for general corporate purposes, including repayment of

offshore debt and share repurchases.

The Notes have not been registered under the U.S. Securities Act

of 1933, as amended (the “U.S. Securities Act”) or any state

securities laws. The USD Notes are being offered and sold in the

United States only to persons reasonably believed to be qualified

institutional buyers pursuant to Rule 144A under the U.S.

Securities Act and to certain non-U.S. persons in offshore

transaction in reliance on Regulation S under the U.S. Securities

Act. Alibaba intends to enter into a registration rights agreement

in connection with the offering of the USD Notes, under which it

will agree to use commercially reasonable efforts to file an

exchange offer registration statement to exchange the USD Notes for

a new issue of substantially identical debt securities registered

under the Securities Act or, under specified circumstances, a shelf

registration statement to cover resale of the USD Notes.

The RMB Notes are being offered and sold only to certain

non-U.S. persons in offshore transaction in reliance on Regulation

S under the U.S. Securities Act.

This press release shall not constitute an offer to sell or a

solicitation of an offer to purchase any securities, in the United

States or elsewhere, and shall not constitute an offer,

solicitation or sale of the securities in any state or jurisdiction

in which such an offer, solicitation or sale would be unlawful. Any

offering of securities will be made by means of one or more

offering documents, which will contain detailed material

information about the Company and its management and financial

statements.

This press release contains information about the pending

offering of the Notes, and there can be no assurance that the

offering will be completed.

Safe Harbor Statement

This press release contains forward-looking statements. These

statements are made under the “safe harbor” provisions of the U.S.

Private Securities Litigation Reform Act of 1995. These

forward-looking statements can be identified by terminology such as

“may,” “will,” “expect,” “anticipate,” “future,” “aim,” “estimate,”

“intend,” “seek,” “plan,” “believe,” “potential,” “continue,”

“ongoing,” “target,” “guidance,” “is/are likely to” and similar

statements. In addition, statements that are not historical facts,

including statements about the intended use of proceeds, the terms

of the Notes, the intention of the Company to enter into a

registration rights agreement in connection with the offering of

the USD Notes and the terms of such agreement, and whether the

Company will complete the offering of the Notes, are or contain

forward-looking statements. Forward-looking statements involve

inherent risks and uncertainties. A number of factors could cause

actual results to differ materially from those contained in any

forward-looking statement, including but not limited to: financial

community and rating agency perceptions of the company and its

business, financial condition and the industries in which it

operates, market conditions, and the satisfaction of customary

closing conditions related to the proposed offering. Further

information regarding these and other risks is included in

Alibaba’s filings with the U.S. Securities and Exchange Commission

and announcements on the website of The Stock Exchange of Hong Kong

Limited. All information provided in this press release is as of

the date of this press release and are based on assumptions that we

believe to be reasonable as of this date, and Alibaba does not

undertake any obligation to update any forward-looking statement,

except as required under applicable law.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241117554853/en/

Investor Relations Contact Lydia Liu Investor Relations

Alibaba Group Holding Limited investor@alibaba-inc.com

Media Contacts Cathy Yan cathy.yan@alibaba-inc.com Ivy Ke

ivy.ke@alibaba-inc.com

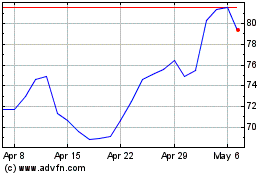

Alibaba (NYSE:BABA)

Historical Stock Chart

From Oct 2024 to Nov 2024

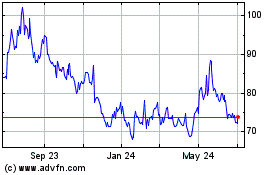

Alibaba (NYSE:BABA)

Historical Stock Chart

From Nov 2023 to Nov 2024