0001545654false00015456542023-11-152023-11-15

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): November 15, 2023

ALEXANDER & BALDWIN, INC.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | | | | |

| Hawaii | 001-35492 | 45-4849780 |

(State or other jurisdiction of

incorporation or organization) | (Commission

File Number) | (I.R.S. Employer

Identification No.) |

| | | | | |

| P. O. Box 3440, | Honolulu, | Hawaii | | | 96801 |

| (Address of principal executive offices) | | | (Zip Code) |

(808) 525-6611

(Registrant’s telephone number, including area code)

N/A

(Former name or former address,

if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2.):

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | | | | |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Stock, without par value | ALEX | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 if this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 if this chapter).

| | | | | |

| If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. | ☐ |

Item 2.01. Completion of Acquisition or Disposition of Assets.

In November 2023, Alexander & Baldwin, Inc. (the “Company”), closed on two transactions with a combined sales price of $60.0 million, which consisted of the sale of the Company's interests in Grace Pacific LLC ("Grace Pacific"), a materials and construction company, and AB Maui Quarries, LLC, owner of quarry land on Maui (collectively, the “Grace Disposal Group”), as well as the sale of Grace Pacific's 50% interest in Maui Paving, LLC, a paving company.

On November 15, 2023, the Company sold the Grace Disposal Group to Nan, Inc., an unrelated third party, for total consideration of $57.5 million (the "Transaction"), which consisted of cash proceeds of $42.5 million and a $15.0 million promissory note (the “Seller Note”). The Seller Note has a maturity date of January 5, 2024, and does not accrue interest. In connection with the Transaction, the Company has been released by Grace Pacific's third-party sureties from all indemnity obligations relating to Grace Pacific's construction bonds (bid, performance and payment bonds).

Prior to the Transaction, on November 6, 2023, Grace Pacific completed the sale of its 50% membership interest in Maui Paving, LLC to GBI Holding Co., an unrelated third party, for $2.5 million in cash.

Item 7.01. Regulation FD Disclosure.

The Company issued a press release announcing the completed sale of the Grace Disposal Group. This information is being furnished as Exhibit 99.1 to this report.

Item 9.01. Financial Statements and Exhibits.

(b) Pro forma financial information

The results of operations of the Grace Disposal Group were presented as discontinued operations, and the Grace Disposal Group’s assets and liabilities were presented as held for sale, in the Company’s consolidated financial statements as of and for the three-year period ended December 31, 2022, included in the Company’s Annual Report on Form 10-K for the year ended December 31, 2022, and as of and for the nine months ended September 30, 2023, included in the Company's Quarterly Report on Form 10-Q for the quarter ended September 30, 2023.

Accordingly, there is no pro forma effect to the Company’s income (loss) from continuing operations as reflected in the Company's consolidated statements of operations for the years ended December 31, 2022, 2021, and 2020, or the nine months ended September 30, 2023. The estimated loss from the Grace Disposal Group disposition will be presented in discontinued operations in future reporting periods and therefore is not discussed below as a proforma income statement adjustment. A limited number of pro forma adjustments are required to illustrate the effects of the Transaction on the Company's consolidated balance sheet, as such the following narrative description is furnished in lieu of pro forma statements.

The pro forma effects of the Grace Disposal Group disposition on the Company's consolidated balance sheet at September 30, 2023, assuming the disposition had closed on September 30, 2023, would have been as follows:

•Total assets of $1,785.9 million would be reduced by approximately $89.0 million, reflecting the net effect of the following:

◦the disposition of $144.7 million of assets held for sale related to the Grace Disposal Group;

◦the addition of approximately $40.7 million in net cash proceeds, reflecting closing proceeds, including prorations and other adjustments; and

◦the addition of $15.0 million in other receivables, reflecting the $15.0 million Seller Note.

•Total liabilities of $747.4 million would be reduced by approximately $69.8 million, reflecting the net effect of the following:

◦the disposition of $71.3 million of liabilities associated with assets held for sale, reflecting liabilities of the Grace Disposal Group assumed by the Buyer; and

◦the addition of accrued liabilities of approximately $1.5 million, reflecting the accrual of transaction-related costs.

•Total redeemable noncontrolling interest of $9.7 million would be reduced in its entirety, reflecting the derecognition of the 30% portion of equity in GLP Asphalt not attributable to the Company. The Grace Disposal Group includes Grace Pacific's 70% ownership in GLP Asphalt.

•Total A&B shareholders' equity of $1,028.8 million would be reduced by approximately $9.5 million, reflecting the estimated loss on sale assuming the disposition closed on September 30, 2023, and using the Grace Disposal Group's carrying value as of September 30, 2023, in the loss calculation.

Pro forma adjustments are based upon available information that the Company believes is reasonable and factually supportable. Actual amounts could differ materially from these adjustments.

The pro forma effects of the disposition are illustrative only and are not intended to represent or be indicative of the effects of the disposition of the Grace Disposal Group on the Company’s financial position had the disposition been completed as of September 30, 2023, nor are they indicative of the Company’s future financial condition.

(d) Exhibits

| | | | | |

| 99.1 | | |

| |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Date: November 15, 2023

ALEXANDER & BALDWIN, INC.

/s/ Clayton K.Y. Chun

Clayton K.Y. Chun

Executive Vice President,

Chief Financial Officer and Treasurer

FOR IMMEDIATE RELEASE

Alexander & Baldwin Sells Grace Pacific

Nan, Inc. Acquires one of Hawai'i's Largest Paving Contractors; Expands Footprint in Hawai'i

HONOLULU, November 15, 2023 / PRNewswire – Alexander & Baldwin, Inc. (NYSE: ALEX) ("A&B" or "Company"), a Hawai'i-based company focused on owning, operating, and developing high-quality commercial real estate in Hawai'i, announced today, it has sold Grace Pacific LLC to Nan, Inc., Hawai'i’s largest, locally owned construction company.

A&B acquired Grace Pacific, one of the state's largest asphalt paving contractors, materials, and construction companies, in 2013. Grace Pacific has been an integral force in Hawai'i’s infrastructure growth for over nine decades, providing a reliable local source of construction materials and playing a pivotal role in the development and maintenance of critical infrastructure such as roads, highways, runways, and harbors that connect our island communities.

"The sale of Grace Pacific marks the culmination of A&B's simplification strategy, allowing us to sharpen our focus on our core business as the preeminent commercial real estate company in Hawai'i," said Lance Parker, A&B president & CEO. "This transaction not only marks a significant milestone in the evolution of the Company but also facilitates a path for success and growth of Grace Pacific under the stewardship of Nan, Inc."

Nan, Inc., specializes in large-scale preconstruction, general contracting, and design-build services statewide. Nan, Inc.’s acquisition of Grace Pacific ensures continued local ownership and marks a significant expansion of its presence in the Hawai'i construction industry, further strengthening its growth and fostering economic development in the state.

"We are thrilled to welcome Grace Pacific to the Nan, Inc. family," said Nan Chul Shin, founder and owner of Nan, Inc. "This acquisition allows us to enhance our service offerings and better serve our clients and partners throughout Hawai'i. We are excited about the potential for innovation and growth this partnership will bring."

The addition of Grace Pacific, with its talented team of professionals and state-of-the-art facilities, will significantly contribute to the continued success of Nan, Inc. This acquisition demonstrates Nan, Inc.'s commitment to investing in Hawai'i's infrastructure and supporting local job opportunities.

“Grace Pacific will continue to operate under its well-established brand, and its existing management and staff will remain in place to ensure a seamless transition,” added Shin. “Clients and partners can continue to expect to receive the same high-quality service and dedication they've come to rely on over the years, now backed by Nan, Inc.'s extensive resources and expertise.”

# # #

ABOUT ALEXANDER & BALDWIN

Alexander & Baldwin, Inc. (NYSE: ALEX) (A&B) is the only publicly-traded real estate investment trust to focus exclusively on Hawai'i commercial real estate and is the state's largest owner of grocery-anchored, neighborhood shopping centers. A&B owns, operates, and manages approximately 3.9 million square feet of commercial space in Hawai'i, including 22 retail centers, 13 industrial assets and four office properties, as well as 142 acres of ground leases. A&B is expanding and strengthening its Hawai'i CRE portfolio and achieving its strategic focus on commercial real estate by monetizing its remaining non-core assets. Over its 153-year history, A&B has evolved with the state's economy and played a leadership role in the development of the agricultural, transportation, tourism, construction, residential and commercial real estate industries.

Learn more about A&B at www.alexanderbaldwin.com.

ABOUT NAN, INC

Nan, Inc. is Hawai'i's largest, locally owned construction company with a rich history of providing exceptional services to clients throughout the state. With a commitment to excellence, innovation, and community support, Nan, Inc. has earned a reputation as one of Hawai'i's premier construction firms with a presence throughout the State of Hawai'i, Guam and Kwajalein. In November 2023, Nan, Inc. acquired Grace Pacific, LLC, representing a significant step forward in Nan, Inc.'s growth and ability to serve the local community.

Learn more about Nan, Inc at www.nanhawaii.com

Media Contact:

Andrea Galvin

Manager, Corporate Communications at Alexander & Baldwin

T: 808-525-8404; E: agalvin@abhi.com

v3.23.3

Cover Page

|

Nov. 15, 2023 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Date of Report |

Nov. 15, 2023

|

| Entity Registrant Name |

ALEXANDER & BALDWIN, INC.

|

| Entity Incorporation, State or Country Code |

HI

|

| Entity File Number |

001-35492

|

| Entity Tax Identification Number |

45-4849780

|

| Entity Address, City or Town |

HI

|

| Entity Address, City or Town |

Honolulu,

|

| Entity Address, Postal Zip Code |

96801

|

| Entity Address, Address Line One |

P. O. Box 3440,

|

| City Area Code |

(808)

|

| Local Phone Number |

525-6611

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, without par value

|

| Trading Symbol |

ALEX

|

| Security Exchange Name |

NYSE

|

| Entity Emerging Growth Company |

false

|

| Entity Central Index Key |

0001545654

|

| Amendment Flag |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

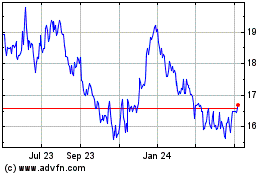

Alexander and Baldwin (NYSE:ALEX)

Historical Stock Chart

From Feb 2025 to Mar 2025

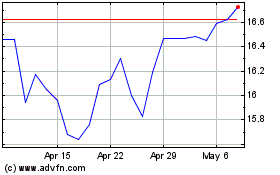

Alexander and Baldwin (NYSE:ALEX)

Historical Stock Chart

From Mar 2024 to Mar 2025