As filed with the Securities and Exchange Commission on March 20, 2015

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

Form F-3

REGISTRATION STATEMENT

UNDER

THE

SECURITIES ACT OF 1933

ALAMOS GOLD INC.

(Exact

name of Registrant as specified in its charter)

|

|

|

| British Columbia |

|

Not applicable |

| (State or other jurisdiction of

incorporation or organization) |

|

(I.R.S. Employer

Identification Number) |

2200-130 Adelaide Street West

Toronto, Ontario, Canada M5H 3P5

(416) 368-9932

(Address

and telephone number of Registrant’s principal executive offices)

Torys LLP

1114

Avenue of the Americas

23rd Floor

New York, New York

10036-7703

Attention:

Andrew J. Beck

(212) 880-6000

(Name, address and telephone number of agent for service)

Copies to:

|

|

|

| Jamie Porter

Alamos Gold Inc. 2200-130

Adelaide Street West Toronto, Ontario, Canada

M5H 3P5 (416)

368-9932 |

|

Andrew J. Beck

Torys LLP 1114

Avenue of the Americas 23rd Floor

New York, New York

10036-7703 (212)

880-6000 |

Approximate date of commencement of proposed sale to the public: From time to time after the effective date of this registration statement.

If the only securities being registered on this Form are to be offered pursuant to dividend or interest reinvestment plans, please check the following

box. x

If any of the securities being registered on this Form are to be offered on a delayed

or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. x

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act of 1933, please check the

following box and list the Securities Act of 1933 registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act of 1933, check the following box and list the

Securities Act of 1933 registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a registration statement pursuant to General Instruction I.C. or a post-effective amendment thereto that shall become effective upon filing

with the SEC pursuant to Rule 462(e) under the Securities Act of 1933, check the following box. ¨

If this Form is a post-effective amendment to a registration statement filed pursuant to General Instruction I.C. filed to register additional securities or

additional classes of securities pursuant to Rule 413(b) under the Securities Act of 1933, check the following box. ¨

CALCULATION OF REGISTRATION FEE

|

|

|

|

|

|

|

|

|

| |

| Title of Each Class of

Securities to be Registered |

|

Amount

to be Registered(1) |

|

Proposed Maximum

Aggregate Price

Per Common Share(2) |

|

Proposed

Maximum

Aggregate

Offering Price(2) |

|

Amount of

Registration Fee |

| Common Shares |

|

675,000 |

|

US$5.78 |

|

US$3,901,500 |

|

US$453.35 |

| |

| |

| (1) |

Plus such additional Common Shares as may be issued by reason of stock splits, stock distributions and similar transactions. |

| (2) |

Estimated solely for the purpose of calculating the amount of the registration fee pursuant to Rule 457, based on the average of the high and low prices of Alamos Gold Inc. Common Shares on the New York Stock

Exchange on March 13, 2015. |

675,000 Common Shares

Alamos Gold Inc.

DIVIDEND REINVESTMENT AND SHARE PURCHASE PLAN

This prospectus covers 675,000

Common Shares (the “Common Shares”) of Alamos Gold Inc. (the “Corporation”) issuable under our dividend reinvestment and share purchase plan (the “Plan”) which provides holders of our Common Shares

with a simple and convenient method of investing cash distributions declared on our Common Shares. For a detailed description of our Common Shares, please see the section entitled “Description of Capital Structure” contained in our annual

information form for the year ended December 31, 2013, filed as exhibit 99.1 to our annual report on Form 40-F for the fiscal year ended December 31, 2013, as filed with the Securities and Exchange Commission (the “SEC”)

on April 1, 2014, and which is incorporated by reference herein.

Our Plan was initially adopted by our board of directors on March 18, 2015. On

March 18, 2015, our board of directors also approved the filing of this prospectus to, among other things, register Common Shares issuable pursuant to the Plan. Under the Plan, holders of our Common Shares resident in either Canada or the

United States may opt to purchase additional Common Shares by automatically reinvesting all or any portion of any cash dividends paid on their Common Shares net of any applicable withholding taxes, or through optional cash purchases, without paying

any brokerage commissions or service charges of any kind. The Plan shares will either be Common Shares issued from the treasury of the Corporation or Common Shares acquired on the open market through the New York Stock Exchange

(“NYSE”). The purchase price of Common Shares acquired through the open market will be the average price paid per Common Share on the open market by the agent appointed to administer the plan (the “Plan Agent”).

Common Shares issued from the treasury of the Corporation may be issued at a discount of up to 5% (as determined from time to time by the Corporation in its sole discretion) from the volume weighted average price of the Common Shares on the NYSE for

the five trading days preceding the dividend payment date.

Our Common Shares are listed on the Toronto Stock Exchange (the “TSX”) and on

the NYSE under the symbol “AGI”. On March 13, 2015, the closing price for our Common Shares on the TSX was C$7.55 and on the NYSE was US$5.89. We have been approved for the listing of the Common Shares covered by this prospectus on

the NYSE.

The declaration and payment of dividends on the Common Shares is at the discretion of our board of directors. Dividends on the Common Shares are

paid semi-annually, normally at the end of April and October of each year. Our board of directors supports a consistent dividend policy for the Common Shares and will consider increasing or decreasing dividends from time to time at a rate based on a

portion of the growth in cash flow from operations per Common Share and consideration of the cash required to achieve the Corporation’s development and growth objectives. Special dividends may also be declared from time to time to implement

corporate strategic initiatives.

We cannot estimate the issue price per Common Share, the anticipated proceeds from the issuance of Common Shares under

the Plan or the number of Common Shares to be issued under the Plan, which will in each case depend upon the market price of our Common Shares at the time of issuance, the extent of shareholder participation in the Plan and other factors.

Investing in our Common Shares involves risks. See “Forward-Looking Information” on page

3 of this prospectus. See also “Risk Factors” on page 1 of this prospectus for a discussion of certain factors relevant to an investment in our Common Shares.

Our principal place of business is 130 Adelaide Street West, Suite 2200, Toronto, Ontario, Canada M5H 3P5 and our registered office is located at 1600-925 West

Georgia Street, Vancouver, British Columbia, Canada V6C 2L2, and our telephone number is (416) 368-9932.

NEITHER THE SECURITIES AND EXCHANGE

COMMISSION NOR ANY STATE SECURITIES COMMISSION HAS APPROVED OR DISAPPROVED OF THE SECURITIES OR PASSED UPON THE ADEQUACY OR ACCURACY OF THIS PROSPECTUS. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

The date of this prospectus is March 20, 2015.

TABLE OF CONTENTS

i

RISK FACTORS

Before you decide to participate in the Plan and invest in our Common Shares, you should be aware of the following material risks in making

such an investment. You should consider carefully these risk factors together with all risk factors and information included or incorporated by reference in this prospectus, before you decide to participate in the Plan and purchase Common Shares. In

addition, you should consult your own financial and legal advisors before making an investment.

Risks Related to the

Plan

You will not know the price of the Common Shares you are purchasing under the Plan at the time you authorize the investment or elect to

have your dividends reinvested.

The price of our Common Shares may fluctuate between the time you decide to

purchase Common Shares under the Plan and the time of actual purchase. In addition, during this time period, you may become aware of additional information that might affect your investment decision.

ABOUT THIS PROSPECTUS

This prospectus is part of a registration statement that we filed with the SEC relating to the Common Shares to be offered and sold pursuant

to the Plan.

Before you invest, you should read both this prospectus and any additional information incorporated by reference and

described under the heading “Documents Incorporated by Reference.” The information incorporated by reference in this prospectus is considered to be part of this prospectus, and certain information that we file later with the SEC will

automatically update and supersede this information. This prospectus does not contain all of the information set forth in the registration statement, certain parts of which are omitted in accordance with the rules and regulations of the SEC. You

should refer to the registration statement and the exhibits to the registration statement for further information with respect to us and the securities that may be offered hereunder.

Unless the context requires otherwise, when used in this prospectus, the terms “we,” “us” and “our” refer to,

collectively, Alamos Gold Inc.

In this prospectus, unless otherwise indicated, all references to “US$” are to U.S. dollars and

all references to “C$” are to Canadian dollars.

WHERE YOU CAN FIND MORE INFORMATION

We are subject to the information requirements of the U.S. Securities Exchange Act of 1934, as amended (the “Exchange Act”),

and, accordingly, file reports with and furnish other information to the SEC. Under the multijurisdictional disclosure system adopted by the United States, these reports and other information (including financial information) may be prepared, in

part, in accordance with the disclosure requirements of Canada, which differ from those in the United States. The reports and other information we file with or furnish to the SEC in accordance with the Exchange Act can be inspected and copied, at

prescribed rates, at the public reference room maintained by the SEC at 100 F Street, N.E., Washington, D.C. 20549. You may call the SEC at 1-800-SEC-0330 for more information on the operation of the public reference room. The SEC maintains a

website at www.sec.gov that contains reports and other information that we file with or furnish electronically to the SEC. You can also find information about the Corporation on our website at www.alamosgold.com. However, any information that is

included on or linked to our website is not a part of this prospectus.

We have filed under the United States Securities Act of 1933, as

amended (the “Securities Act”), a registration statement on Form F-3 relating to our Plan. This prospectus forms a part of the registration statement. This prospectus does not contain all of the information included in the

registration statement, certain portions of which have been omitted as permitted by the rules and regulations of the SEC. For further information about us and our Common Shares you are encouraged to refer to the registration statement and the

exhibits that are incorporated by reference into it as

1

well as the documents incorporated by reference into this prospectus. Statements contained in this prospectus describing provisions of the Plan are not necessarily complete, and in each instance

reference is made to the copy of the Plan which is included as an exhibit to the registration statement, and each such statement in this prospectus is qualified in all respects by such reference.

DOCUMENTS INCORPORATED BY REFERENCE

The SEC allows us to “incorporate by reference” into this prospectus certain documents that we file with or furnish to the SEC. This

means that we can disclose important information to you by referring to those documents. The information incorporated by reference is considered to be an important part of this prospectus, and later information that we file with the SEC will

automatically update and supersede that information. The following documents, which we have filed with or furnished to the SEC, are specifically incorporated by reference in this prospectus:

| |

• |

|

Our annual report on Form 40-F for the fiscal year ended December 31, 2013, which contains our audited financial statements as of and for the years ended December 31, 2013 and 2012. |

| |

• |

|

Our report on Form 6-K, furnished to the SEC on February 19, 2015. |

| |

• |

|

All other reports filed by us under Section 13(a) or 15(d) of the Exchange Act since December 31, 2013. |

In addition, all other annual reports filed by us with the SEC on Form 40-F, and any Form 6-K filed or furnished by us that is

identified in such form as being incorporated by reference into the registration statement of which this prospectus forms a part, in each case subsequent to the date of this prospectus and prior to the termination of this offering, are incorporated

by reference into this prospectus as of the date of the filing of such documents. We will deliver to each person eligible to participate in the Plan, including any beneficial owner, to whom this prospectus has been delivered, copies of the documents

incorporated by reference in this prospectus, but not delivered with this prospectus, upon written or oral request, without charge. Requests should be directed to us at:

Alamos Gold Inc.

Attn: Jamie

Porter

130 Adelaide Street West, Suite 2200

Toronto, Ontario, Canada

M5H 3P5

Email: jporter@alamosgold.com

We are a “foreign private issuer” as defined in the Exchange Act. As a result, our proxy solicitations are not subject to the

disclosure and procedural requirements of Regulation 14A under the Exchange Act and transactions in our Common Shares by our officers and directors are exempt from Section 16 of the Exchange Act.

Any statement contained in a document incorporated by reference in this prospectus shall be deemed to be modified or superseded for the

purposes of this prospectus to the extent that a statement contained herein or therein or in any other later filed document which also is incorporated by reference in this prospectus modifies or supersedes that statement. Any statement so modified

or superseded shall not be deemed, except as so modified or superseded, to constitute a part of this prospectus.

ENFORCEABILITY OF CERTAIN CIVIL LIABILITIES IN THE UNITED STATES

We are a corporation formed by articles of amalgamation dated

February 21, 2003 and organized pursuant to articles of amalgamation under the Business Corporations Act (British Columbia) dated July 15, 2004. Some of the Corporation’s assets are located outside of the United States and some

of our directors and officers, as well as some of the experts named in this prospectus, are residents of Canada. As a result, it may be difficult for U.S. investors to:

| |

• |

|

effect service within the United States upon us or those directors, officers and experts who are not residents of the United States; or |

| |

• |

|

realize in the United States upon judgments of courts of the United States predicated upon the civil liability provisions of the United States federal securities laws. |

2

FORWARD-LOOKING INFORMATION

Certain statements contained and incorporated by reference in this prospectus constitute “forward-looking statements”. When used in

this prospectus or the documents incorporated by reference herein, the words “may”, “will”, “expect”, “plan”, “anticipate”, “estimate”, “project”, “forecast”,

“outlook”, “potential”, “continue”, “should”, “likely”, or the negative of these terms or other similar expressions are intended to identify forward-looking statements. These forward-looking

statements are not historical facts but reflect expectations, estimates and projections. These forward-looking statements are subject to a number of risks and uncertainties that could cause actual results or events to differ materially from current

expectations. These risks include, but are not limited to, our on-going business, including risks related to international operations; our ability to obtain all necessary permits and licenses; the actual results of current exploration activities;

conclusions of economic evaluations and changes in project parameters as plans continue to be refined as well as future prices of gold and silver; our ability to secure the water necessary to conduct our activities as planned; the impact of

environmental regulations on our activities and our ability to comply with applicable laws and regulations; the impact of competition with other mining companies that have greater resources and experience; the impact of currency fluctuations on our

financial position; and our dependence on a small number of key personnel.

These factors and other risk factors, including those under

“Risk Factors” above, represent risks our management believes are material. Other factors not presently known to us or that we presently believe are not material, could also cause actual results to differ materially from those expressed in

the forward-looking statements contained and incorporated by reference herein. Accordingly, undue reliance should not be placed on these forward-looking statements. We do not undertake any obligation to update publicly or to revise any of the

forward-looking statements contained or incorporated by reference in this Form F-3, whether as a result of new information, future events or otherwise, except as required by law, rule or regulation.

ALAMOS GOLD INC.

We were formed by articles of amalgamation dated February 21, 2003 and are organized pursuant to articles of amalgamation under the

Business Corporations Act (British Columbia) dated July 15, 2004. We are an established Canadian-based gold producer that owns and operates the Mulatos Mine in Mexico, and has exploration and development activities in Mexico, Turkey and

the United States. We employ more than 500 people and are committed to the highest standards of sustainable development. We are listed on the TSX and the NYSE under the symbol “AGI”. For more information, please visit our web site at

www.alamosgold.com.

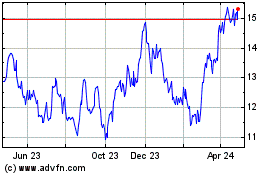

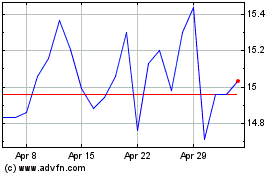

HISTORICAL TRADING INFORMATION FOR THE COMMON SHARES

The following sets out trading information for each of the periods set out below, based on information provided by the TSX and the NYSE.

Toronto Stock Exchange

|

|

|

|

|

|

|

|

|

| |

|

Price Per Common

Share |

|

| Year Ended December 31, |

|

High

(C$) |

|

|

Low

(C$) |

|

| 2014 |

|

|

13.92 |

|

|

|

7.39 |

|

| 2013 |

|

|

17.89 |

|

|

|

10.40 |

|

| 2012 |

|

|

21.00 |

|

|

|

13.84 |

|

| 2011 |

|

|

20.15 |

|

|

|

13.26 |

|

| 2010 |

|

|

21.65 |

|

|

|

11.31 |

|

3

|

|

|

|

|

|

|

|

|

| |

|

Price Per Common

Share |

|

| Period |

|

High

(C$) |

|

|

Low

(C$) |

|

| January 1, 2015 – March 19, 2015 |

|

|

10.31 |

|

|

|

6.45 |

|

| October 1, 2014 – December 31, 2014 |

|

|

10.24 |

|

|

|

7.39 |

|

| July 1, 2014 – September 30, 2014 |

|

|

11.26 |

|

|

|

8.65 |

|

| April 1, 2014 – June 30, 2014 |

|

|

11.17 |

|

|

|

8.70 |

|

| January 1, 2014 – March 31, 2014 |

|

|

13.92 |

|

|

|

9.84 |

|

| October 1, 2013 – December 31, 2013 |

|

|

17.06 |

|

|

|

11.92 |

|

| July 1, 2013 – September 30 2013 |

|

|

17.86 |

|

|

|

12.20 |

|

| April 1, 2013 – June 30, 2013 |

|

|

15.43 |

|

|

|

10.40 |

|

| January 1, 2013 – March 31, 2013 |

|

|

17.89 |

|

|

|

13.32 |

|

|

|

|

|

|

|

|

|

|

| |

|

Price Per

Common

Share |

|

| Period |

|

High

(C$) |

|

|

Low

(C$) |

|

| March 1, 2015 – March 19, 2015 |

|

|

7.74 |

|

|

|

6.68 |

|

| February 1, 2015 – February 28, 2015 |

|

|

7.76 |

|

|

|

6.60 |

|

| January 1, 2015 – January 31, 2015 |

|

|

10.31 |

|

|

|

6.45 |

|

| December 1, 2014 – December 31, 2015 |

|

|

8.98 |

|

|

|

7.39 |

|

| November 1, 2014 – November 30, 2014 |

|

|

9.19 |

|

|

|

7.74 |

|

| October 1, 2014 – October 31, 2014 |

|

|

10.24 |

|

|

|

8.01 |

|

| September 1, 2014 – September 30, 2014 |

|

|

10.30 |

|

|

|

8.65 |

|

New York Stock Exchange

|

|

|

|

|

|

|

|

|

| |

|

Price Per Common

Share |

|

| Year Ended December 31, |

|

High

(US$) |

|

|

Low

(US$) |

|

| 2014 |

|

|

12.78 |

|

|

|

6.34 |

|

| 2013* |

|

|

17.38 |

|

|

|

10.10 |

|

|

|

|

|

|

|

|

|

|

| |

|

Price Per Common

Share |

|

| Period |

|

High

(US$) |

|

|

Low

(US$) |

|

| January 1, 2015 – March 19, 2015 |

|

|

8.54 |

|

|

|

5.11 |

|

| October 1, 2014 – December 31, 2014 |

|

|

9.07 |

|

|

|

6.34 |

|

| July 1, 2014 – September 30, 2014 |

|

|

10.55 |

|

|

|

7.79 |

|

| April 1, 2014 – June 30, 2014 |

|

|

10.35 |

|

|

|

8.00 |

|

| January 1, 2014 – March 31, 2014 |

|

|

12.78 |

|

|

|

8.87 |

|

| October 1, 2013 – December 31, 2013 |

|

|

16.35 |

|

|

|

11.14 |

|

| July 1, 2013 – September 30 2013 |

|

|

17.38 |

|

|

|

11.57 |

|

| April 1, 2013 – June 30, 2013 |

|

|

15.03 |

|

|

|

10.10 |

|

| February 13, 2013* – March 31, 2013 |

|

|

15.12 |

|

|

|

13.09 |

|

4

|

|

|

|

|

|

|

|

|

| |

|

Price Per Common

Share |

|

| Period |

|

High

(US$) |

|

|

Low

(US$) |

|

| March 1, 2015 – March 19, 2015 |

|

|

6.15 |

|

|

|

5.25 |

|

| February 1, 2015 – February 28, 2015 |

|

|

6.20 |

|

|

|

5.22 |

|

| January 1, 2015 – January 31, 2015 |

|

|

8.54 |

|

|

|

5.11 |

|

| December 1, 2014 – December 31, 2014 |

|

|

7.85 |

|

|

|

6.34 |

|

| November 1, 2014 – November 30, 2014 |

|

|

8.14 |

|

|

|

6.79 |

|

| October 1, 2014 – October 31, 2014 |

|

|

9.07 |

|

|

|

7.10 |

|

| September 1, 2014 – September 30, 2014 |

|

|

9.51 |

|

|

|

7.79 |

|

| * |

The Common Shares began trading on the NYSE on February 13, 2013. |

USE OF PROCEEDS

We have no basis for estimating precisely either the number of Common Shares that may be sold under the Plan or the prices at which such

Common Shares may be sold. We intend to use the net proceeds from the sale of the Common Shares for general corporate purposes.

DIVIDEND REINVESTMENT AND SHARE PURCHASE PLAN

The following is a summary of the material attributes of the Plan. The summary does

not purport to be complete and is subject to, and qualified in its entirety by, reference to the complete Plan that is filed as an exhibit to the registration statement of which this prospectus forms a part. The Plan will be effective as of

March 23, 2015.

Purpose

The Plan permits eligible holders of Common Shares to automatically reinvest cash dividends paid on Common Shares into additional Common Shares

at the applicable Average Market Price (as defined below) and to make optional cash purchases of additional Common Shares at the applicable Average Market Price.

Definitions

Unless the context otherwise requires, capitalized terms used in the Plan have the following definitions:

“Average Market Price” has the meaning set forth in the Section titled “Price of Common Shares”;

“Beneficial Shareholders” means beneficial holders of Common Shares who hold their shares through an intermediary such as a

financial institution, broker, nominee, or other intermediary;

“Business Day” means any day on which the Plan

Agent’s offices are generally open for the transaction of commercial business, but does not in any event include a Saturday, Sunday, civic or statutory holiday in the Province of Ontario or the State of New York or a day on which the NYSE does

not publicly trade;

“CDS” means Clearing and Depository Services Inc.;

“Code” has the meaning set forth in the Section titled “Certain United States Federal Income Tax Considerations”;

“Common Shares” means common shares of the Corporation;

“Corporation” means Alamos Gold Inc.;

“CRA” has the meaning set forth in the Section titled “Certain Canadian Federal Income Tax Considerations”;

“Dividend Payment Date” means a date on which cash dividends are paid on Common Shares;

5

“Dividend Record Date” means a record date for the payment of dividends on

Common Shares;

“DRS Advice” means Direct Registration System Advice, a record of a security transaction affecting a

shareholder’s account, as part of the Plan Agent’s Direct Registration System service;

“Enrollment Form” means

the Reinvestment Enrollment – Participant Declaration Form, available on Computershare’s self-service web portal at www.investorcentre.com/alamosgold;

“IRS” has the meaning set forth in the Section titled “Certain United States Federal Income Tax Considerations”;

“Market Purchase” means Common Shares purchased on the open market which includes the facilities of the NYSE;

“NYSE” means the New York Stock Exchange;

“Optional Cash Purchase Shares” means Common Shares purchased by the Plan Agent using optional cash payments;

“Optional Cash Purchase Form” means the Optional Cash Purchase – Participant Declaration Form, available at the Plan

Agent’s self-service web portal at www.investorcentre.com/alamosgold;

“Participant” means a registered or

beneficial holder of Common Shares who, on the applicable Dividend Record Date for a cash dividend, is enrolled in the Plan;

“PFIC” has the meaning set forth in the Section titled “Certain United States Federal Income Tax Considerations”;

“Plan” means the Alamos Gold Inc. Dividend Reinvestment and Share Purchase Plan, as amended from time to time;

“Plan Agent” means Computershare Trust Company of Canada, or such other agent that is appointed by the Corporation from time

to time to administer the Plan;

“Plan Shares” means Common Shares purchased under the Plan;

“Proposed Amendments” has the meaning set forth in the Section titled “Certain Canadian Federal Income Tax

Considerations”;

“Registered Participant” means a Participant who holds a certificate or certificates registered in

his or her own name, in each case for Common Shares enrolled in the Plan;

“Regulations” has the meaning set forth in the

Section titled “Certain Canadian Federal Income Tax Considerations”; and

“Tax Act” has the meaning set forth

in the Section titled “Certain Canadian Federal Income Tax Considerations”.

Participation in the Plan

Eligibility

Subject to the

provisions of the Section titled “Participation in the Plan”, registered and beneficial holders of Common Shares residing in Canada or the United States are eligible to participate in the Plan. Dividends to be reinvested by Shareholders

outside of Canada will continue to be subject to withholding under applicable tax laws and the amount reinvested will be reduced by the amount of tax withheld.

6

Enrollment – Registered Shareholders

Eligible shareholders may enroll all or any portion of their Common Shares in the Plan by enrolling online through the Plan Agent’s

self-service web portal at www.investorcentre.com/alamosgold or by downloading the Enrollment Form and duly completing and delivering it to the Plan Agent by 4:00 p.m. (Toronto time) on the fifth (5th) Business Day prior to a Dividend Record

Date for it to be effective on such Dividend Payment Date. Any Enrollment Form received after such time will be processed for the next applicable Dividend Record Date. Registered shareholders may also obtain an Enrollment Form by contacting the Plan

Agent in any of the manners specified in “Notices and Correspondence” below or by following the instructions provided on the Corporation’s website at http://www.alamosgold.com/investors/Dividend-Reinvestment-Plan.

Enrollment – Beneficial Shareholders

Effective March 31, 2014, the Depositary Trust Company (“DTC”) is no longer participating in dividend reinvestment plans

for Canadian issuers. As a result, DTC participants are required to withdraw their securities from DTC and deposit them with CDS or have them registered in the customer name in order to participate in the Plan.

Beneficial Shareholders who hold their Common Shares through an intermediary must have such Common Shares registered in their own name and

enrolled in accordance with the Section titled “Enrollment – Registered Shareholders” or instruct their intermediary to enroll their Common Shares in the Plan on their behalf, if the intermediary allows such enrollment. The date of

enrollment for Beneficial Shareholders who have instructed an intermediary to enroll their Common Shares in the Plan will be determined by the administrative practices of the intermediary.

Ongoing Enrollment

Once a

Participant has enrolled in the Plan, participation continues automatically unless terminated in accordance with the Plan. Eligible Shareholders who participate in the Plan indirectly through CDS or otherwise through their financial institution,

broker, nominee, or other intermediary should consult such intermediary to confirm the intermediary’s policies concerning continued participation following initial enrollment.

Deemed Confirmations

By enrolling

in the Plan, whether directly as a registered shareholder or indirectly as a Beneficial Shareholder through an intermediary, a Participant is deemed to have:

| |

• |

|

represented and warranted to the Corporation and the Plan Agent that they are eligible to participate in the Plan; |

| |

• |

|

appointed the Plan Agent to receive from the Corporation, and directed the Corporation to credit the Plan Agent with, all dividends payable in respect of all Common Shares registered in the name of the shareholder and

enrolled in the Plan or held under the Plan for its account, or, in the case of a Beneficial Shareholder enrolled indirectly through an intermediary, that is enrolled on its behalf in the Plan; |

| |

• |

|

authorized and directed the Plan Agent to reinvest on behalf of the Participant such dividends (less any applicable withholding taxes) in Common Shares, all in accordance with the provisions of the Plan as set forth

herein and otherwise upon and subject to the terms and conditions of the Plan; and |

| |

• |

|

acknowledged and agreed to the limitations on liability as set out in “Liabilities of the Corporation and the Plan Agent”. |

Restrictions

The Corporation may,

in its sole discretion, determine from time to time that any shareholder or group of shareholders may not participate or continue to participate in the Plan. Without limiting the generality of the foregoing, the Corporation may deny the right to

participate in the Plan to any shareholder if the Corporation deems it to be advisable under any laws or regulations. Further, the Corporation may deny the right to participate in the Plan to any shareholder if the Corporation has reasons to believe

that such shareholder has been engaging in market activities, or has been artificially accumulating securities of the Corporation, for the purpose of taking undue advantage of the Plan to the detriment of the Corporation.

7

The Plan Agent

Administration of the Plan

Computershare Trust Company of Canada has been appointed as the initial Plan Agent to administer the Plan on behalf of the Corporation and the

Participants. The Corporation may from time to time appoint a Plan Agent to administer the Plan on behalf of the Corporation and the Participants, pursuant to the agreement between the Corporation and the Plan Agent. Such agreement may be terminated

by the Corporation or the Plan Agent in accordance with its terms.

All funds received by the Plan Agent under the Plan (which consist of

cash dividends and optional cash purchases received from the Participants) will be applied to the purchase of Plan Shares. In no event will interest be paid to Participants on any funds held for reinvestment under the Plan.

Notwithstanding the foregoing, all issues of interpretation arising in connection with the Plan or its application shall be conclusively

determined by the Corporation in accordance with the Section titled “Rules”.

Dealing in Corporation Securities

The Plan Agent or its affiliates may, from time to time, for their own account or on behalf of accounts managed by them, deal in securities of

the Corporation and will not, to the extent permitted by law, be liable to account to the Corporation or to Participants in respect of such dealings.

Adherence to Regulation

The Plan

Agent is required to comply with applicable laws, orders or regulations of any governmental authority which impose on the Plan Agent a duty to take or refrain from taking any action under the Plan and to permit any properly authorized person to have

access to and to examine and make copies of any records relating to the Plan.

Resignation of Plan Agent

The Plan Agent may resign as Plan Agent under the Plan in accordance with the agreement between the Corporation and the Plan Agent, in which

case the Corporation will appoint another agent as the Plan Agent.

Purchase of Common Shares under the Plan

Aggregation of Dividends and Allocation to Participants’ Accounts

On each Dividend Payment Date, the Corporation will pay all cash dividends payable on Common Shares enrolled in the Plan to the Plan Agent.

Those cash dividends will be aggregated and used by the Plan Agent to purchase Common Shares (the “Plan Shares”) on behalf of Registered Participants on each Dividend Payment Date which in the case of a Market Purchase will be

effected in accordance with paragraph (a) under the Section titled “Price of Common Shares”. The dividends on Plan Shares will, in turn, be reinvested in additional Plan Shares.

Following each Dividend Payment Date, each Registered Participant’s account will be credited with that number of Plan Shares, including

fractions computed to six decimal places, which is equal to the aggregate dividend amount to be invested for such Registered Participant’s account divided by the applicable Average Market Price. The crediting of fractional Common Shares in

favor of non-registered shareholders who participate in the Plan through an intermediary will depend on the policies of that intermediary. A Plan Participant that is a non-registered shareholder will receive, from his, her or its intermediary, for

tax reporting purposes, confirmation of the number of Common Shares issued to such Plan Participant under the Plan in accordance with the intermediary’s usual practice.

Limit of Reinvestments in Certain Events

The Corporation may limit the maximum number of Common Shares that may be issued under the Plan. If issuing Common Shares under the Plan would

result in the Corporation exceeding the limit and the Corporation determines not to issue Common Shares in respect of a particular Dividend Payment Date, Participants will receive from the Plan Agent cash dividends for the dividends that are not

reinvested in Common Shares (without interest or deduction

8

thereon, except for any applicable withholding taxes). The Corporation will be under no obligation to issue Common Shares to any Participants under the Plan where the Corporation exceeds the

maximum number of Common Shares that may be issued under the Plan. The Corporation will be under no obligation to issue Common Shares on a pro rata basis to Participants under the Plan where the Corporation exceeds the maximum number of Common

Shares that may be issued under the Plan. The Corporation is not required to facilitate market purchases of Common Shares for any dividends not reinvested due to a limit on the number of Common Shares issuable under the Plan.

Optional Cash Purchase Shares

Participants may choose to make optional cash purchases of Common Shares under the Plan in amounts equal to or greater than US$500, but not to

exceed an aggregate amount of US$20,000 per fiscal year. There is no obligation on a Participant to make optional cash payments nor to make all such payments in the same amount. No interest will be paid to Participants on any funds held for

investment under the Plan. The aggregate number of Common Shares which may be purchased by all participants in any fiscal year of the Corporation under the optional cash payments may not exceed two percent of the issued and outstanding Common Shares

at the beginning of the fiscal year.

Registered Participants may make optional cash purchases by submitting an Optional Cash Purchase

Form together with sufficient funds via a cheque (in United States or Canadian currency) made payable to the Plan Agent. The Optional Cash Purchase Form and optional cash payment must be received by the Plan Agent no later than 4:00 p.m. (Toronto

time) on the fifth (5th) Business Day prior to a Dividend Payment Date and optional cash payments will be used by the Plan Agent to purchase Common Shares (the “Optional Cash Purchase Shares”) on the Dividend Payment Date which

in the case of a Market Purchase will be effected in accordance with paragraph (a) under the Section titled “Price of Common Shares”. Any Optional Cash Purchase Forms received after such time will be held and processed for the next

applicable Dividend Payment Date.

Payments received in Canadian currency will be converted to U.S. currency at the noon rate of the

principal banker of the Plan Agent on the date of bank deposit by the Plan Agent. Payment in currencies other than Canadian or U.S. dollars are not acceptable.

Anti-money laundering laws require that the Plan Agent collect and record specific information and take other compliance measures on new or

existing Plan participants who elect to make an initial share purchase or additional optional share purchase under the Plan. In order to participate in the optional cash purchase feature of the Plan, all Plan participants must have passed the

requisite requirements under applicable anti-money laundering laws, which are contained in the Enrollment Form and Optional Cash Purchase Form.

Eligible optional cash payments made by Registered Participants will be aggregated and used by the Plan Agent to purchase Optional Cash

Purchase Shares on behalf of those Registered Participants on each Dividend Payment Date which in the case of a Market Purchase will be effected in accordance with paragraph (a) under the Section titled “Price of Common Shares”. The

dividend on such shares will, in turn, be reinvested in additional Plan Shares. Following such purchases, the account of each Registered Participant making an optional cash purchase will be credited with that number of Plan Shares purchased on their

behalf, including fractions computed to six decimal places, which is equal to the aggregate optional cash payment amount to be invested for the Registered Participant’s account divided by the applicable Average Market Price.

Non-registered shareholders should contact their intermediary to determine the procedures for making optional cash purchases of Common Shares

under the Plan.

Source of Plan Shares

The Plan Shares acquired by the Plan Agent under the Plan will be, at the Corporation’s election determined from time to time by

authorization of the Board of Directors of the Corporation, either newly issued Common Shares from the Corporation treasury (a “Treasury Purchase”) or Common Shares purchased on the open market, which includes the facilities of the

NYSE (a “Market Purchase”).

9

Purchases of Common Shares

On each Dividend Payment Date, the Plan Agent will buy Plan Shares either through a Treasury Purchase or a Market Purchase, which Market

Purchase shall be effected in accordance with paragraph (a) under the Section titled “Price of Common Shares”.

Price of Common

Shares

The price allocated to each Plan Share acquired by the Plan Agent under the Plan on each Dividend Payment Date (the

“Average Market Price”) will be determined as follows:

| |

(a) |

For a Market Purchase, the Average Market Price will be the average price paid per Common Share on the open market by the Plan Agent. The Common Shares will be purchased over the five (5) consecutive trading day

period commencing one Business Day following the Dividend Payment Date. |

| |

(b) |

For a Treasury Purchase, the Average Market Price will be equal to the volume weighted average price of the Common Shares on the NYSE for the five (5) trading days preceding the Dividend Payment Date.

|

| |

(c) |

For a Treasury Purchase in connection with the reinvestment of dividends or Optional Cash Purchase Shares, the Average Market Price may also include a discount of up to 5% from the volume weighted average price of the

Common Shares on the NYSE for the five (5) trading days preceding the Dividend Payment Date. The Corporation will from time to time in its sole discretion determine the amount of any applicable discount. |

| |

(d) |

The Corporation will announce by way of press release and/or in dividend announcements whether purchases of Common Shares under the Plan will be made by way of a Treasury Purchase or a Market Purchase and any applicable

discount for Treasury Purchases in connection with the reinvestment of dividends or optional cash purchases. |

Disposition or Withdrawal of Common Shares

Withdrawal of Plan Shares

Registered Participants whose Common Shares are enrolled in the Plan may withdraw some or all of their whole Plan Shares at any time without

terminating their participation in the Plan by completing the withdrawal portion of the voucher located on the reverse of the Registered Participant’s periodic statement of account, and by sending such completed voucher to the Plan Agent.

Participants resident in Canada may also withdraw shares at the Plan Agent’s self-service web portal at www.investorcentre.com/alamosgold. The Plan Agent will confirm such withdrawal in the next statement of account mailed to the Registered

Participant following receipt of such request. The Plan Agent will deliver a share certificate (or DRS Advice if applicable) for the whole Plan Shares withdrawn from the Plan by the Registered Participant, as soon as practicable.

Beneficial Shareholders who have enrolled in the Plan should contact their intermediary to determine the procedures for withdrawing Plan

Shares from the Plan.

Disposition of Plan Shares

Plan Shares may not be pledged, hypothecated, assigned or otherwise disposed of or transferred. Participants who wish to pledge, hypothecate,

assign, dispose of or otherwise transfer their Plan Shares must withdraw such Plan Shares from the Plan prior to such pledge, hypothecation, assignment, disposal or transfer.

Continuation of Participation

If

a Participant withdraws less than such Participant’s entire Plan Shares, cash dividends paid on the remaining Plan Shares held by such Participant will continue to be reinvested into Common Shares under the Plan.

10

Termination of Participant’s Account

Termination by Participant

Registered Participants may terminate their participation in the Plan by completing the termination portion of the voucher located on the

reverse of the Registered Participant’s periodic statement of account and by sending such completed voucher to the Plan Agent. Registered Participants in Canada may also terminate from the Plan at the Plan Agent’s self-service web portal

at www.investorcentre.com/alamosgold. The Plan Agent must receive notice of termination no later than 4:00 p.m. (Toronto time) on the fifth (5th) Business Day prior to the applicable Dividend Record Date for the termination to be effective for

the applicable Dividend Payment Date. Termination requests received after such time will be processed after the Dividend Payment Date.

The Plan Agent will issue a share certificate (or DRS Advice, if applicable) for the number of whole Plan Shares held in such

Participant’s account and a cash payment for any fraction of a Plan Share remaining in the Participant’s account. The amount of payment for any such fraction will be determined by the current market price that is received or would be

received at the time of sale.

Beneficial Shareholders who have enrolled in the Plan should contact their intermediary to determine the

procedures for terminating their participation in the Plan.

Death of a Participant

Participation in the Plan will be terminated upon receipt by the Plan Agent of appropriate evidence of the death of a Registered Participant

from such Participant’s duly appointed legal representative and written instructions to terminate such Participant’s participation in the Plan. Proof of the legal representative’s authority to act must accompany the evidence of death.

The Plan Agent will terminate the account for such deceased Participant and issue a share certificate (or DRS Advice if applicable), and a cash payment for a fractional Plan Share as the case may be, in the name of an estate. The amount of payment

for any such fraction will be determined by the current market price that is received or would be received at the time of sale.

Termination by

Corporation or Plan Agent

The Corporation or the Plan Agent may terminate any Registered Participant’s account upon written

notice to the Participant at any time if the Participant has less than one whole Plan Share. The amount of payment for any such fraction will be calculated determined by the current market price that is received or would be received at the time of

sale.

Administration

Registration of Plan Shares

All

whole and fractional Plan Shares purchased under the Plan will be registered in the name of the Plan Agent or its intermediary and the appropriate number of whole and fractional Plan Shares will be credited to the account of Registered Participants

or, in the case of Beneficial Shareholders, in the name of CDS, or its successor, who will credit the intermediaries, as applicable.

Fees

Except as otherwise specifically provided in the Plan, the Corporation will be responsible for all administrative costs of the

Plan, including any brokerage commissions or the fees or other expenses of the Plan Agent payable in connection with the purchase of Plan Shares under the Plan.

Beneficial Shareholders may be charged additional fees by the intermediary through whom their Plan Shares are held.

11

Statement of Account

The Plan Agent will maintain an account for each Registered Participant in the Plan. An audited statement of account regarding the purchases

under the Plan will be mailed to each Registered Participant on a semi-annual basis and setting out, amongst other things, the number of Plan Shares purchased through the Plan and the applicable Average Market Price per Plan Share. The statement of

account will be mailed as soon as practicable after each Dividend Payment Date. Such statements will constitute a Registered Participant’s continuing record of the date and valuation of the acquisition of Plan Shares and should be retained for

income tax purposes. Registered Participant’s tax information will be mailed annually.

Beneficial Shareholders who have enrolled in

the Plan may receive statements of account from their intermediary in accordance with the intermediary’s administrative practices. Such statements will constitute a Beneficial Shareholder’s continuing record of the date and valuation of

the acquisition of Plan Shares and should be retained for income tax purposes. Beneficial Shareholders should contact their intermediary to determine the procedures for requesting current statements.

Liabilities of the Corporation and Plan Agent

Neither the Corporation nor the Plan Agent will be liable for any act or omission to act, or will have any duties, responsibilities or

liabilities except as expressly set forth in the Plan or as required by law.

Neither the Corporation nor the Plan Agent will be liable in

respect of the prices at which Plan Shares are purchased or sold on behalf of Participants under the Plan or the timing of purchases or sales made under the Plan.

Neither the Corporation nor the Plan Agent can assure a profit or protect against a loss on Plan Shares purchased or sold under the Plan.

The Corporation and the Plan Agent shall have the right to reject any request regarding enrollment, optional cash purchase, withdrawal or

termination from the Plan if such request is not received in proper form. Any such request will be deemed to be invalid until any irregularities have been resolved to the satisfaction of the Corporation and/or the Plan Agent.

Miscellaneous

Voting of

Plan Shares

Registered Participants may vote whole Plan Shares held by the Plan Agent on their behalf, in the same manner as any

other Common Shares of the Corporation either by proxy or in person. The Plan Agent will forward any proxy solicitation materials to Registered Participants as soon as practicable following receipt thereof.

Beneficial Shareholders should contact their intermediary to determine the procedures for voting Plan Shares.

Rights Offerings, Stock Splits and Stock Dividends

If the Corporation makes available to holders of record of its Common Shares rights to subscribe for additional Common Shares or other

securities, Registered Participants will be forwarded rights certificates pertaining to their whole Plan Shares held by the Plan Agent on their behalf, subject to the terms and conditions of the rights offering. No such rights will be made available

in respect of fractions of Plan Shares held by the Plan Agent. Each Registered Participant’s account will be adjusted for any stock splits or stock dividends declared on Plan Shares.

Beneficial Shareholders should contact their intermediary with questions regarding the procedures for rights offerings, stock splits and stock

dividends.

Currency

All

monetary amounts identified in the Plan are in U.S. dollars, unless otherwise expressly stated.

12

Termination, Suspension or Amendment of Plan

Subject to any required regulatory or stock exchange approval, the Corporation may amend or suspend, in whole or in part, or terminate the Plan

at any time upon notice thereof to all Participants, without their consent or approval. If the Plan is terminated by the Corporation, the Plan Agent will remit to each Registered Participant a certificate (or DRS Advice if applicable) for whole Plan

Shares held for such Participant under the Plan, together with the proceeds for any fraction of such shares. The amount of payment for any such fraction will be determined by the current market price that is received or would be received at the time

of sale. In the event of suspension of the Plan, the Plan Agent will make no investments on any Dividend Payment Date following the effective date of such suspension and all dividends will be paid in cash during such suspension.

Beneficial Shareholders should contact their intermediary with questions regarding the procedures of the intermediary in the event of the

suspension or termination of the Plan.

Assignment

A holder of Common Shares may not assign its right to participate in the Plan.

Rules

The Corporation may make

rules and regulations to facilitate the administration of the Plan and reserves the right to regulate and interpret the Plan text as the Corporation deems necessary or desirable. The Corporation may adopt rules and regulations concerning the

establishment of Internet-based or other electronic mechanisms with respect to the enrollment in the Plan, the communication of information concerning the Plan to the Participants and any other aspects of the Plan.

Electronic Communications

References in the Plan to the delivery of instructions, notices or other documents in writing will be deemed to include, subject to the

adoption of rules or regulations by the Corporation, delivery by electronic means, including the Internet.

General

Provisions of the Plan apply to all Participants, but are subject to the administrative practices and requirements of intermediaries through

whom Common Shares are held by Beneficial Shareholders. Beneficial Shareholders should consult with the relevant intermediary to determine the procedures for participation in the Plan. The administrative practices of such intermediaries may vary and

accordingly the various dates by which actions must be taken and the documentary requirements set out in the Plan may not be the same as those required by such intermediaries.

Governing Law

The Plan will be

governed by and construed in accordance with the laws of Ontario and the laws of Canada applicable therein.

Notices and

Correspondence

Communications to the Plan Agent should be addressed as follows: Computershare Trust Company of Canada, 100

University Avenue, 8th Floor, North Tower, Toronto, Ontario, M5J 2Y1, Attention: Dividend Reinvestment Department, Or the National Contact Center at North America: 1-800-564-6253, Outside of North America: 514-982-7555, Or by visiting

www.Investorcentre.com/service; Notices to Alamos Gold Inc., 2200 – 130 Adelaide Street West, Toronto, Ontario, M5H 3P5, Attention: James Porter, Chief Financial Officer, Telephone: 416 368-9932, Facsimile: 416 368-2934.

Registered Participants must notify the Plan Agent promptly in writing of any change of address. Notices or statements from the Plan Agent to

Registered Participants will be mailed at the last address of record for each Participant in the Plan, and any such notice or statement will be deemed received when received by the Participant or within five (5) Business Days after mailing,

whichever occurs earlier.

13

Effective Date

The effective date of the Plan is March 26, 2015.

CERTAIN CANADIAN FEDERAL INCOME TAX CONSIDERATIONS

The following is a summary of the principal Canadian federal income tax considerations generally applicable to a Participant who, at all

relevant times, for purposes of the application of the Income Tax Act (Canada) (the “Tax Act”) and the Income Tax Regulations (the “Regulations”), deals at arm’s length with and is not affiliated with the

Corporation, holds Common Shares acquired under the Plan as capital property, and has cash dividends paid on Common Shares reinvested in Common Shares under the Plan or purchases Common Shares through optional cash payments.

This summary is based upon the current provisions of the Tax Act and the Regulations, and all specific proposals to amend the Tax Act and the

Regulations publicly announced by the Minister of Finance (Canada) prior to the date hereof (the “Proposed Amendments”), and the current published administrative policies and assessing practices of the Canada Revenue Agency (the

“CRA”). This summary assumes that all Proposed Amendments will be enacted in the form proposed. However, no assurances can be given that the Proposed Amendments will be enacted as proposed, or at all. This summary is not exhaustive

of all possible Canadian federal income tax considerations, and does not take into account Canadian provincial or territorial income tax laws, or foreign tax considerations.

This summary does not apply to: (i) a Participant who is subject to the “mark-to-market” rules under the Tax Act applicable to

certain “financial institutions”; (ii) a Participant an interest in which is a “tax shelter investment”; (iii) a Participant who makes or has made a functional currency reporting election pursuant to section 261 of the

Tax Act; (iv) a Participant who has entered into or will enter into a “derivative forward agreement” with respect to their Common Shares (all as defined in the Tax Act); or (v) a Participant who purchases Optional Cash Purchase

Shares. Such Participants should consult their own tax advisors.

This summary is of a general nature only and is not, and is not intended

to be, legal or tax advice to any particular Participant under the Plan. This summary is not exhaustive of all Canadian federal income tax considerations. Accordingly, prospective participants should consult their own tax advisers having regard to

their own particular circumstances.

For the purposes of the Tax Act and the Regulations, all U.S. dollar amounts relating to the

acquisition, holding or disposition of Common Shares must generally be expressed in Canadian dollars using the daily noon rate as quoted by the Bank of Canada for the relevant day or such other rate of exchange that is acceptable to the CRA. As a

result, the amount required to be included in the income of a Participant may be affected by virtue of fluctuations in the value of the U.S. dollar relative to the Canadian dollar.

Canadian Residents

This portion of the

summary is generally applicable to a Participant who, at all relevant times, for purposes of the application of the Tax Act, is, or is deemed to be, resident in Canada.

All cash dividends paid on Common Shares that are reinvested on behalf of a Participant will generally be subject to the tax treatment

normally applicable to taxable dividends (including “eligible dividends” as defined in the Tax Act) from “taxable Canadian corporations”, as defined in the Tax Act. For example, in the case of a Participant who is an individual,

such dividends will be subject to the normal gross-up and dividend tax credit rules or, in the case of a Participant who is a private corporation or one of certain other corporations, a refundable tax will apply to the amount of the dividend. Other

taxes could apply depending on the circumstances of the Participant.

A Participant will not realize any taxable income when the

Participant receives certificates, or DRS Advice if applicable, for whole Common Shares credited to the Participant’s account, whether upon the Participant’s request, upon termination of participation or upon termination of the Plan.

14

The cost to a Participant of Common Shares acquired under the Plan will be the price paid for

such shares by the Participant. For the purpose of computing the adjusted cost base of such shares to the Participant, the cost of such shares will be averaged with the adjusted cost base of all Common Shares held by the Participant as capital

property.

A Participant may realize a capital gain or capital loss on the disposition of Common Shares acquired through the Plan,

including in circumstances where a Participant receives a cash payment for any fraction of a Common Share.

Non-Residents of Canada

This portion of the summary is generally applicable to a Participant under the Plan who, at all relevant times, for purposes of the application

of the Tax Act, is not, and is not deemed to be, resident in Canada, and who does not carry on a business in Canada. Special rules, which are not discussed in this summary, may apply to a Participant who is not resident in Canada and who is an

insurer that carries on an insurance business in Canada and elsewhere.

Dividends which a Participant who is not resident in Canada

designates for reinvestment under the Plan will be subject to Canadian withholding tax at the rate of 25%, subject to any reduction in the rate of withholding to which the Participant is entitled under any applicable income tax convention between

Canada and the country in which the Participant is resident. For example, where a Participant is a U.S. resident entitled to benefits under the Canada-U.S. Income Tax Convention (1980), as amended, and is the beneficial owner of the dividends, the

applicable rate of Canadian withholding tax is generally reduced to 15%. The amount of dividends to be invested under the Plan will be reduced by the amount of tax withheld.

Gains on the disposition of Common Shares by a Participant who is not resident in Canada are generally not subject to Canadian income tax

unless such shares are or are deemed to be “taxable Canadian property” (as defined in the Tax Act) and the Participant is not entitled to relief under any applicable income tax convention between Canada and the country in which the

Participant is resident. Provided that the Common Shares are then listed on a “designated stock exchange” (as defined in the Tax Act), the Common Shares generally will not constitute “taxable Canadian property” of a Participant

who is not resident in Canada unless, at any time during the 60-month period immediately preceding the disposition of the common shares of the Bank: (i)(a) the Participant, (b) persons with whom the Participant did not deal at arm’s

length, (c) pursuant to certain Proposed Amendments, partnerships in which the Participant or persons described in (b) holds a membership interest directly or indirectly through one or more partnerships, or (d) one or any combination

of persons or partnerships described in (a) to (c) above, owned 25% or more of the issued shares of any class of the capital stock of the Corporation, and (ii) more than 50% of the fair market value of the Common Shares was derived

directly or indirectly from one or any combination of: (A) real or immovable property situated in Canada; (B) “Canadian resource properties” (as defined in the Tax Act); (C) “timber resource properties” (as defined

in the Tax Act); and (D) options in respect of, or interests in, or for civil law rights in, property described in (A) to (C), whether or not the property exists

CERTAIN UNITED STATES FEDERAL INCOME TAX CONSIDERATIONS

The following discussion summarizes certain United States federal income tax considerations relating to participation in the Plan by U.S.

Participants (as defined below) that hold Common Shares, acquired pursuant to the Plan, as capital assets (generally, property held for investment). For purposes of this discussion, a “U.S. Participant” generally means a beneficial owner

of Common Shares enrolled in the Plan that is, for United States federal income tax purposes, any of the following:

| |

• |

|

a citizen or individual resident of the United States; |

| |

• |

|

a corporation, or other entity treated as a corporation for United States federal income tax purposes, created in, or organized under the laws of, the United States, any state thereof or the District of Columbia;

|

| |

• |

|

an estate whose income is subject to United States federal income tax regardless of its source; or |

| |

• |

|

a trust if either (a) a court within the United States is able to exercise primary supervision over the administration of the trust and one or more United States persons have the authority to control all

substantial decisions of the trust or (b) the trust has a valid election in effect to be treated as a United States person under applicable Treasury regulations. |

15

THIS DISCUSSION IS INCLUDED HEREIN AS GENERAL INFORMATION ONLY. ACCORDINGLY, PROSPECTIVE U.S.

PARTICIPANTS IN THE PLAN ARE URGED TO CONSULT THEIR TAX ADVISORS AS TO THE PARTICULAR UNITED STATES FEDERAL, STATE, LOCAL AND NON-UNITED STATES INCOME AND OTHER TAX CONSIDERATIONS APPLICABLE TO THEM RELATING TO PARTICIPATION IN THE PLAN.

This discussion is based on the Internal Revenue Code of 1986, as amended (the “Code”), its legislative history, United States

Treasury regulations promulgated under the Code, judicial opinions, published positions of the Internal Revenue Service (the “IRS”), and other applicable authorities, all as in effect as of the date hereof, and any of which are subject to

change (possibly with retroactive effect), or differing interpretations, so as to result in United States federal income tax consequences different from those discussed herein. This discussion does not address all aspects of United States federal

income taxation that may be relevant to a particular U.S. Participant in light of that U.S. Participant’s individual circumstances, nor does it address any aspects of United States federal estate and gift, state, local, or non-United States

taxes or the 3.8% tax imposed on certain net investment income. This discussion does not apply, in whole or in part, to particular U.S. Participants in light of their individual circumstances or to participants subject to special treatment under the

United States federal income tax laws, such as:

| |

• |

|

tax-exempt organizations (including private foundations), qualified retirement plans, individual retirement accounts, or other tax-deferred accounts; |

| |

• |

|

banks and other financial institutions; |

| |

• |

|

brokers or dealers in securities or currencies; |

| |

• |

|

regulated investment companies; |

| |

• |

|

real estate investment trusts; |

| |

• |

|

passive foreign investment companies; |

| |

• |

|

entities or arrangements treated as partnerships for United States federal income tax purposes; |

| |

• |

|

U.S. Participants that hold, or will hold, Common Shares as part of a straddle, hedge, appreciated financial position, conversion transaction or other risk reduction strategy; |

| |

• |

|

persons that hold an interest in an entity that holds, or will hold, the Common Shares; |

| |

• |

|

persons liable for alternative minimum tax; |

| |

• |

|

persons that have a “functional currency” other than the United States dollar; |

| |

• |

|

persons that generally mark their securities to market for United States federal income tax purposes; |

| |

• |

|

persons that acquired the Common Shares in connection with the exercise of employee stock options or otherwise as compensation for services; |

| |

• |

|

persons that own, or have owned, directly, indirectly or constructively, 10% or more of the Corporation’s common stock (by vote or value) for United States federal income tax purposes; and |

| |

• |

|

United States expatriates. |

If a partnership (or other entity or arrangement treated as a

partnership for United States federal income tax purposes) participates in the Plan, the tax treatment of a partner will generally depend on the status of the partner and the activities of the partnership. Any such partner or partnership should

consult its tax advisor as to the particular United States federal income tax considerations relating to participation in the Plan.

Tax Considerations

Relating to Dividend Reinvestment

In the case of a Treasury Purchase, a U.S. Participant generally will be treated as receiving a

distribution for United States federal income tax purposes in an amount equal to the fair market value on the applicable Dividend Payment Date of the Common Shares purchased with reinvested dividends plus the amount of any Canadian withholding tax

withheld therefrom. The fair market value of the Common Shares purchased from the Corporation on

16

the applicable Dividend Payment Date may be higher or lower than the price used to determine the number of Common Shares so purchased pursuant to the Plan. In the case of a Market Purchase, a

U.S. Participant generally will be treated as receiving a distribution for United States federal income tax purposes in an amount equal to sum of (i) the cash dividend paid by the Corporation (without reduction for any Canadian tax withheld

from such dividend) and (ii) any brokerage commissions, fees, transaction costs or other related charges paid by the Corporation that are allocable to the Plan Agent’s purchase of Common Shares on behalf of such U.S. Participant. The

amount of any such distribution to a U.S. Participant (reduced by any Canadian tax withheld from such distribution) generally will be such U.S. Participant’s tax basis in the Common Shares purchased. A U.S. Participant’s holding period for

these Common Shares will begin on the day following the date of purchase.

Any distribution to a U.S. Participant described in the

preceding paragraph generally will be subject to United States federal income tax in the same manner as cash distributions described below. See “– Tax Considerations Relating to the Acquisition, Ownership and Disposition of Common Shares

– Distributions on Common Shares; – Backup Withholding Tax and Information Reporting.”

If United States backup withholding

tax applies to any dividends paid that are to be reinvested in Common Shares, the number of Common Shares credited to a U.S. Participant’s account will be reduced as a result of such backup withholding tax. See “– Tax Considerations

Relating to the Acquisition, Ownership and Disposition of Common Shares – Backup Withholding Tax and Information Reporting.”

Tax

Considerations Relating to Optional Cash Purchases

In the case of an optional cash purchase effected as a Treasury Purchase, a U.S.

Participant generally will be treated as having received a distribution for United States federal income tax purposes as a result of such acquisition in an amount equal to the excess, if any, of (i) the fair market value of the Common Shares on

the Dividend Payment Date on which the Plan Agent purchases Common Shares for the benefit of Participants pursuant to the Plan, over (ii) the optional cash payment made. In the case of an optional cash purchase effected as a Market Purchase, a

U.S. Participant generally will be treated for United States federal income tax purposes as receiving a distribution in an amount equal to any brokerage commissions, fees, transaction costs or other related charges paid by the Corporation that are

allocable to the Plan Agent’s purchase of Common Shares on behalf of such U.S. Participant. A U.S. Participant’s tax basis in the Common Shares purchased generally will be equal to the cost paid by the Plan Agent to acquire such Common

Shares, plus the amount (if any) treated as a distribution for United States federal income tax purposes. The U.S. Participant’s holding period for those Common Shares will begin on the day following the date of purchase.

Any distribution to a U.S. Participant described in the preceding paragraph generally will be subject to United States federal income tax in

the same manner as cash distributions described below. See “– Tax Considerations Relating to the Acquisition, Ownership and Disposition of Common Shares – Distributions on Common Shares; – Backup Withholding Tax and Information

Reporting.”

Tax Considerations Relating to the Acquisition, Ownership and Disposition of Common Shares

Distributions on Common Shares

In general, subject to the passive foreign investment company (“PFIC”) rules discussed below, the gross amount of any distribution

made to a U.S. Participant on Common Shares (including amounts withheld to pay Canadian withholding taxes) will constitute a dividend for United States federal income tax purposes to the extent paid out of the Corporation’s current or

accumulated earnings and profits, as determined for United States federal income tax purposes. To the extent the amount of such distribution exceeds the Corporation’s current and accumulated earnings and profits, it will be treated first as a

non-taxable return of capital to the extent of such U.S. Participant’s tax basis in such Common Shares and thereafter will be treated as gain from the sale or exchange of such Common Shares. The Corporation does not intend to calculate its

earnings and profits under United States federal income tax rules. Accordingly, U.S. Participants should expect that a distribution generally will be treated as a dividend for United States federal income tax purposes.

The amount of any dividend paid to a U.S. Participant in Canadian dollars (including amounts withheld to pay Canadian withholding taxes) will

be includible in income in a United States dollar value amount by reference to the exchange rate between the United States dollar and the Canadian dollar in effect on the date of receipt of such dividend

17

by the U.S. Participant (or the Plan Agent on behalf of the U.S. Participant), regardless of whether the Canadian dollars so received are in fact converted into United States dollars. If the

Canadian dollars so received are converted into United States dollars on the date of receipt, such U.S. Participant generally should not be required to recognize foreign currency gain or loss in respect of the dividend income. If the Canadian

dollars so received are not converted into United States dollars on the date of receipt, such U.S. Participant generally will have a tax basis in such Canadian dollars equal to the United States dollar value of such Canadian dollars on the date of

receipt. Such tax basis will be used to measure gain or loss from a subsequent conversion or other disposition of the Canadian dollars. Any gain or loss on a subsequent conversion or other taxable disposition of such Canadian dollars generally will

be treated as ordinary income or loss to such U.S. Participant and generally will be income or loss from sources within the United States for United States foreign tax credit purposes.

Subject to the PFIC rules discussed below, distributions on Common Shares to certain non-corporate U.S. Participants that are treated as

dividends may be taxed at preferential rates. The amount of a distribution treated as a dividend will not be eligible for the “dividends received” deduction ordinarily allowed to corporate shareholders with respect to dividends received

from United States corporations.