As filed with the Securities and Exchange Commission on March 13, 2013

REGISTRATION NO. 333-186004

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM F-10

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

(Amendment

No. 6)

ALAMOS GOLD INC.

(Exact name of Registrant as specified in its charter)

|

|

|

|

|

|

|

British Columbia

|

|

1040

|

|

Not Applicable

|

|

(Province or other Jurisdiction of

Incorporation or Organization)

|

|

(Primary Standard Industrial

Classification Code Number, if applicable)

|

|

(I.R.S. Employer

Identification Number, if applicable)

|

2200 – 130 Adelaide Street West

Toronto, Ontario M5H 3P5

(416) 368-9932

(Address and telephone number of Registrant’s

principal executive offices)

Torys LLP

1114 Avenue of the Americas

23rd Floor

New York, NY 10036

Attention: Mile T. Kurta

(212) 880-6000

(Name, address (including zip code) and telephone number (including area code) of agent for service in the United States)

|

|

|

|

|

|

|

|

|

COPIES TO:

|

|

|

|

Torys LLP

1114 Avenue of the Americas

23rd Floor

New York, NY 10036

Attention: Mile T. Kurta

(212) 880-6000

|

|

|

|

Torys LLP

79 Wellington Street West

Suite 3000

Box 270, TD Centre

Toronto, Ontario, Canada

M5K 1N2

Attention: Kevin M.

Morris

(416) 865-0040

|

Approximate date of commencement of proposed sale to the public: As soon as practicable after this

Registration Statement becomes effective.

Province of Ontario, Canada

(Principal jurisdiction regulating this offering)

It is proposed that this filing shall become effective (check appropriate box below):

|

A.

x

|

upon filing with the Commission, pursuant to Rule 467(a) (if in connection with an offering being made contemporaneously in the United States and Canada).

|

|

B.

¨

|

at some future date (check appropriate box below)

|

|

1.

¨

|

pursuant to Rule 467(b) on ( ) at ( ) (designate a time not sooner than seven calendar days after filing).

|

|

2.

¨

|

pursuant to Rule 467(b) on ( ) at ( ) (designate a time seven calendar days or sooner after filing) because the securities regulatory authority in the review

jurisdiction has issued a receipt or notification of clearance on ( ).

|

|

3.

¨

|

pursuant to Rule 467(b) as soon as practicable after notification of the Commission by the Registrant or the Canadian securities regulatory authority of the review

jurisdiction that a receipt or notification of clearance has been issued with respect hereto.

|

|

4.

¨

|

after the filing of the next amendment to this Form (if preliminary material is being filed).

|

If any of the securities being registered on this form are to be offered on a delayed or continuous basis pursuant to the home jurisdiction’s shelf prospectus offering procedures, check the

following box.

¨

CALCULATION OF

REGISTRATION FEE

|

|

|

|

|

|

|

|

|

|

Title of Each Class of

Securities to be Registered

|

|

Amount

to be

Registered

(1)

|

|

Proposed

Maximum

Aggregate

Offering Price

(2)

|

|

Amount of

Registration Fee

(3)

|

|

Common Shares, without par value

|

|

30,217,850

|

|

US$264,181,771.95

|

|

US$36,034.39

|

|

|

|

|

|

(1)

|

Represents the maximum number of Alamos Gold Inc. (“Alamos”) common shares, without par value, estimated to be issuable upon consummation of the exchange

offer (the “Offer”) for all of the issued and outstanding common shares (the “Common Shares”) of Aurizon Mines Ltd. (assuming full conversion of all outstanding convertible and exercisable securities for Common Shares), other

than any Common Shares owned directly or indirectly by Alamos and its affiliates.

|

|

(2)

|

Estimated solely for the purpose of calculating the registration fee in accordance with General Instruction II.H to Form F-10. The proposed maximum

offering price is equal to the product of (i) US$3.24, which is the average of high and low sale prices of the Common Shares as reported on the NYSE MKT on December 24, 2012

, and (ii) 175,431,302, which is the estimated number of outstanding Common Shares (assuming full conversion of all

outstanding convertible and exercisable securities for Common Shares), other than any Common Shares owned directly or indirectly by Alamos and its affiliates, less cash consideration. For the purposes of calculating the cash consideration payable in

the Offer, an exchange rate of Cdn$0.9868 = US$1.00 (the Bank of Canada noon rate on January 9, 2013) was used.

|

If, as a result of stock

splits, stock dividends or similar transactions, the number of securities purported to be registered on this Registration Statement changes, the provisions of Rule 416 under the Securities Act of 1933, as amended, shall apply to this Registration

Statement.

PART I

INFORMATION REQUIRED TO BE DELIVERED TO OFFEREES OR PURCHASERS

|

Item 1.

|

Home Jurisdiction Document

|

This Amendment No. 6 (this “Amendment No. 6”) amends and supplements the Registration Statement on Form F-10 filed on January 14, 2013 (as amended, the “Registration Statement”) by

Alamos Gold Inc., a corporation existing under the laws of British Columbia (“Alamos”).

The Registration Statement

relates to the offer to purchase (the “Offer”) by Alamos for all of the issued and outstanding common shares (the “Common Shares”) of Aurizon Mines Ltd. (assuming full conversion of all outstanding convertible and exercisable

securities for Common Shares), other than any Common Shares owned directly or indirectly by Alamos and its affiliates. The Offer is subject to the terms and conditions set forth in Alamos’ Offer and Circular dated January 14, 2013 (as amended,

the “Offer and Circular”), a copy of which was filed as Exhibit (a)(1)(i) to the Tender Offer Statement on Schedule TO filed on January 14, 2013 by Alamos, as amended by the Notice of Extension and Variation dated February 19, 2013 (the

“First Notice of Extension and Variation”), a copy of which was filed as Exhibit 4.7 to Amendment No. 3 of the Registration Statement, and as further amended by the Notice of Extension and Variation dated March 6, 2013 (the “Second

Notice of Extension and Variation”), a copy of which was filed as Exhibit 4.10 to Amendment No. 5 to the Schedule TO.

The information set forth in the Offer and Circular, the First Notice of Extension and Variation, the Second Notice of Extension and

Variation, the Letter of Transmittal and the Notice of Guaranteed Delivery, including all schedules, exhibits and annexes thereto, is hereby expressly incorporated herein by reference in response to all items of information required to be included

in, or covered by, the Registration Statement, and is supplemented by the information specifically provided herein.

Except as specifically provided herein, this Amendment No. 6 does not modify any of the information previously reported in the

Registration Statement.

General

The first sentence in the first paragraph on the inside cover page of the Offer and Circular is hereby deleted in its entirety.

|

Item 1.

|

Summary Term Sheet.

|

The

first bullet in the section entitled “Summary Term Sheet” in the Offer and Circular under the heading “What are some of the significant conditions of to the Offer?” on page II of the Offer and Circular is hereby deleted in its

entirety.

The second and third sentences in the section entitled “Summary Term Sheet” in the Offer and Circular

under the heading “Why is Alamos making the Offer?” on page II of the Offer and Circular are hereby deleted in their entirety and replaced with the following:

“Assuming all the other conditions to the Offer are satisfied or waived, it is Alamos’ current intention

that, if it takes up and pays for Common Shares deposited under the Offer, it will enter into one or more transactions to enable Alamos to acquire all Common Shares not acquired under the Offer. Alamos currently intends to acquire all of the

outstanding Common Shares not tendered under the Offer by the Expiry Time by way of a Compulsory Acquisition or a Subsequent Acquisition Transaction. There is no assurance that such transaction will be completed, in particular if Alamos acquires

less than such number of Common Shares which, together with the Common Shares directly or indirectly held by Alamos and its affiliates, represents less than

66

2

/

3

% of total issued and outstanding Common Shares on a fully diluted basis pursuant to the Offer.”

The section entitled “Summary Term Sheet” in the Offer and Circular under the heading “If I decide not to tender, how will my Common Shares be affected?” on page VI of the Offer and

Circular is hereby amended to include the following sentences after the last sentence of the first paragraph:

“Alamos’ ability to effect a Compulsory Acquisition or a Subsequent Acquisition Transaction will be dependent upon the number of Common Shares validly tendered under the Offer and, in

particular, whether at least a number of Common Shares are validly tendered under the Offer that, together with the Common Shares directly or indirectly held by Alamos and its affiliates, represents less than 90% or 66

2

/

3

% of the total issued and outstanding Common Shares on a fully diluted basis. In the event that Alamos acquires less than such number of Common Shares which, together with the Common Shares directly or

indirectly held by Alamos and its affiliates, represents less than 66

2

/

3

% of the total used and outstanding Common Shares on a fully diluted basis, Alamos will evaluate the options available to

it at that time and may pursue other means of acquiring, directly or indirectly, all of the Common Shares and other securities exercisable for or convertible or exchangeable into Common Shares in accordance with applicable Law. To the extent that

Alamos is not able to acquire 100% of the Common Shares in a timely manner or at all, Alamos’ management believes that it would be able to successfully manage and operate its business with Aurizon as a majority- or minority-owned subsidiary of

Alamos and, in these circumstances, Alamos would endeavour to maximize the synergies and overall profitability between the two companies.”

The first sentence in the section entitled “Summary Term Sheet” in the Offer and Circular under the heading “If the Offer is successful will the board of directors and management of Aurizon

change?” on page VII of the Offer and Circular is hereby deleted in its entirety and replaced with the following:

“If the Offer is successful and Alamos owns the requisite number of Common Shares to effect such changes, it is anticipated that the

current management of Alamos will manage Aurizon in place of Aurizon’s current management, and that the board of directors of Aurizon will be replaced by nominees of Alamos.”

The section entitled “Summary” in the Offer and Circular under the heading “Purpose of the Offer and Alamos’ Plans

for Aurizon” on page iv of the Offer and Circular is hereby amended to include the following sentences after the first sentence of the second paragraph:

“Alamos’ ability to effect a Compulsory Acquisition or a Subsequent Acquisition Transaction will be

dependent upon the number of Common Shares validly tendered under the Offer and, in particular, whether at least a number of Common Shares are validly tendered under the Offer that, together with the Common Shares directly or indirectly held by

Alamos and its affiliates, represents less than 90% or 66

2

/

3

% of the total issued and outstanding Common Shares on a fully diluted basis. In the event that Alamos acquires less than

such number of Common Shares which, together with the Common Shares directly or indirectly held by Alamos and its affiliates, represents less than

66

2

/

3

% of the total used and outstanding Common Shares on a fully diluted basis, Alamos will evaluate the options available to it at that time and may pursue other means of acquiring, directly or indirectly,

all of the Common Shares and other securities exercisable for or convertible or exchangeable into Common Shares in accordance with applicable Law. To the extent that Alamos is not able to acquire 100% of the Common Shares in a timely manner or at

all, Alamos’ management believes that it would be able to successfully manage and operate its business with Aurizon as a majority- or minority-owned subsidiary of Alamos and, in these circumstances, Alamos would endeavour to maximize the

synergies and overall profitability between the two companies.”

The section entitled “Summary”

in the Offer and Circular under the heading “Conditions of the Offer” on page v of the Offer and Circular is hereby deleted in its entirety and replaced with the following:

“Alamos reserves the right to withdraw or terminate the Offer and not take up and pay for any Common Shares deposited under the

Offer, or to extend the period of time during which the Offer is open for acceptance and postpone taking up and paying for any Common Shares deposited under the Offer, unless all of the conditions described in Section 4 of the Offer,

“Conditions of the Offer”, are satisfied or waived by Alamos on or prior to the Expiry Time. These conditions include, among others, (i) receipt of all governmental or regulatory approvals required to complete the Offer, including any

necessary or desirable competition or anti-trust approvals and the expiry of any such applicable waiting periods, and (ii) the absence of any Material Adverse Change in relation to Aurizon. For a complete description of the conditions of the Offer,

see Section 4 of the Offer, “Conditions of the Offer”.

The section entitled “The Offer” in the Offer and

Circular under the heading “4. Conditions of the Offer” subsection (a) on page 8 of the Offer and Circular is hereby deleted in its entirety.

The section entitled “Circular” in the Offer and Circular under the heading “5. Purpose of the Offer and Alamos’ Plans for Aurizon” subheading “Purpose of the Offer” on

page 24 of the Offer and Circular is hereby amended to include the following sentences after the first sentence of the second paragraph:

“Alamos’ ability to effect a Compulsory Acquisition or a Subsequent Acquisition Transaction will be dependent upon the number of Common Shares validly tendered under the Offer and, in

particular, whether at least a number of Common Shares are validly tendered under the Offer that, together with the Common Shares directly or indirectly held by Alamos and its affiliates, represents less than 90% or 66

2

/

3

% of the total issued and outstanding Common Shares on a fully diluted basis. In the event that Alamos acquires less than such number of Common Shares which, together with the Common Shares directly or

indirectly held by Alamos and its affiliates, represents less than 66

2

/

3

% of the total used and outstanding Common Shares on a fully diluted basis, Alamos will evaluate the options available to

it at that time and may pursue other means of acquiring, directly or indirectly, all of the Common Shares and other securities exercisable for or convertible or exchangeable into Common Shares in accordance with applicable Law. To the extent that

Alamos is not able to acquire 100% of the Common Shares in a timely manner or at all, Alamos’ management believes that it would be able to successfully manage and operate its business with Aurizon as a majority- or minority-owned subsidiary of

Alamos and, in these circumstances, Alamos would endeavour to maximize the synergies and overall profitability between the two companies.”

The first sentence of the first paragraph in the section “Circular” in the Offer and Circular under the heading “5. Purpose of the Offer and Alamos’ Plans for Aurizon” subheading

“Plans for Aurizon” on page 24 of the Offer and Circular is hereby deleted in its entirety and replaced with the following:

“If the Offer is successful and Alamos owns the requisite number of Common Shares to effect such changes, it is anticipated that the current management of Alamos will manage Aurizon in place of

Aurizon’s current management, and that the board of directors of Aurizon will be replaced by nominees of Alamos.”

The first sentence of the first paragraph in the section “Circular” in the Offer and Circular under the heading “15.

Acquisition of Common Shares Not Deposited Under the Offer” subheading “Other Alternatives” on page 38 of the Offer and Circular is hereby deleted in its entirety and replaced with the following:

“If, following completion of the Offer, Alamos does not effect a Compulsory Acquisition or a Subsequent Acquisition Transaction, or

if Alamos proposes a Subsequent Acquisition Transaction but cannot promptly obtain any required approvals or does not own the requisite number of Common Shares to effect a Compulsory Acquisition or a Subsequent Acquisition Transaction, Alamos will

evaluate its other available alternatives.”

The section entitled “Circular” in the Offer and Circular under

the heading “15. Acquisition of Common Shares Not Deposited Under the Offer” subheading “Other Alternatives” on page 39 of the Offer and Circular is hereby amended to include the following paragraphs after the first paragraph:

“If the number of Common Shares Alamos takes up and pays for under the Offer, together with the

Common Shares directly or indirectly held or controlled by Alamos and its affiliates, represents less than

66

2

/

3

% of the total issued and outstanding Common Shares on a fully diluted basis, Aurizon could continue as a separate, public company following the completion of the Offer and, depending on the number of

Common Shares tendered into the Offer, Alamos may or may not be able to exert significant influence over Aurizon. In such a case, any Shareholders that do not tender into the Offer and remain a Shareholder would be free to vote or dispose of their

Common Shares as they see fit in accordance with applicable Law. In these circumstances, certain potential transactions between Alamos and Aurizon would be considered “related party transactions” under applicable Law (specifically, Rule

61-501 and Policy Q-27), which would, unless an exemption is available, require a formal valuation for the transaction and, in addition to any other required securityholder approval, the approval of a majority of the votes cast by

“minority” holders of the affected securities, which would include holders other than Alamos and any other person who is a “related party” of Alamos, including an affiliate or an insider of Alamos and any person acting jointly or

in concert therewith. The ability to effect such transactions would also be subject to future negotiations between the respective Boards of Directors of Alamos and Aurizon, and in such negotiations, any representatives of Alamos appointed to the

Aurizon Board would be precluded from voting on such transactions.

If Alamos were unable to complete a Compulsory

Acquisition or a Subsequent Acquisition Transaction in a timely manner or at all, then it would be unable to fully integrate the operations of Alamos and Aurizon and, consequently, unless Alamos is successful in completing one or more “related

party transactions” with Aurizon, as described above, Alamos would be limited in its ability to avail itself of Aurizon’s cash flows (other than through pro rata distributions to the Shareholders) and in its ability to effect potential

transactions with Aurizon for the purposes of integrating the business and operations of Alamos and Aurizon and, consequently, realizing a significant portion of the synergies otherwise expected to be realized through a combination of Alamos and

Aurizon, as described in Section 4 of the Circular, “Reasons to Accept the Offer”. This could materially affect Alamos’ earnings, cash flows and financial condition.”

The section entitled “Circular” in the Offer and Circular under the heading “24. Risk Factors Related to the Offer”

subheading “The integration of Alamos and Aurizon may not occur as planned.” on page 60 of the Offer and Circular is hereby amended to include the following sentences after the third sentence:

“If Alamos does not acquire such number of Common Shares, which, together with the Common Shares directly or

indirectly held or controlled by Alamos and its affiliates, represents at least 66

2

/

3

% of the Common Shares and cannot or does not complete a Compulsory Acquisition or Subsequent Acquisition Transaction, it

will not be able to control and thereby integrate Aurizon into its business. In such a case, any Shareholders that do not tender into the Offer and remain a Shareholder would be free to vote or dispose of their Common Shares as they see fit in

accordance with applicable Law.”

The section entitled “Circular” in the Offer and Circular under the

heading “24. Risk Factors Related to the Offer” subheading “After consummation of the Offer, Aurizon could be a majority-owned subsidiary of Alamos and Alamos’ interest could differ from that of the remaining minority

Shareholders.” on page 61 of the Offer and Circular is hereby amended as follows:

“After consummation of the Offer

and assuming Alamos acquires more than 50% of the Common Shares, Aurizon could be a majority-owned subsidiary of Alamos and Alamos’ interest could differ from that of the remaining minority Shareholders.”

In its press release dated March 5, 2013 and the Second Notice of Extension and Variation, Alamos disclosed that it had received

expressions of support for the Offer from certain large shareholders of Aurizon (the “Supportive Shareholders”) after the public announcement of the merger of Aurizon and Hecla. These Supportive Shareholders represented approximately 17.3%

of the issued and outstanding Common Shares. None of the Supportive Shareholders are subject to any binding agreements obligating them to tender their Common Shares to the Offer and therefore may choose not to tender into the Offer. Although Alamos

has no control as to when a shareholder of Aurizon may decide to tender into the Alamos Offer, Alamos believes that none of the Supportive Shareholders had tendered their Common Shares to the Offer prior to 5:00 p.m. on March 5, 2013, because, in

accordance with their fiduciary duties, the interests of their securityholders and market practice, holders typically delay tendering into an offer until shortly prior to the expiration of an offer. It should be noted that any Aurizon shareholders

that have or may tender into the Offer continue to have the right to withdraw their tendered shares as set forth in the Offer and Circular.

I-1

PART II

INFORMATION NOT REQUIRED TO BE DELIVERED TO

OFFEREES OR PURCHASERS

INDEMNIFICATION OF DIRECTORS OR OFFICERS.

Alamos Gold Inc. is subject to the provisions of the

Business Corporations Act

(British Columbia) (the “Act”).

Under Section 160 of the Act, an individual who:

|

|

•

|

|

is or was a director or officer of the Registrant,

|

|

|

•

|

|

is or was a director or officer of another corporation (i) at a time when the corporation is or was an affiliate of the Registrant, or

(ii) at the request of the Registrant, or

|

|

|

•

|

|

at the request of the Registrant, is or was, or holds or held a position equivalent to that of, a director or officer of a partnership, trust, joint

venture or other unincorporated entity,

|

and includes, the heirs and personal or other legal representatives of that

individual (collectively, an “eligible party”), may be indemnified by the Registrant against a judgment, penalty or fine awarded or imposed in, or an amount paid in settlement of, a proceeding (an “eligible penalty”) in which, by

reason of the eligible party being or having been a director or officer of, or holding or having held a position equivalent to that of a director or officer of, the Registrant or an associated corporation, (a) the eligible party is or may be

joined as a party, or (b) the eligible party is or may be liable for or in respect of a judgment, penalty or fine in, or expenses related to, the proceeding (“eligible proceeding”) to which the eligible party is or may be liable.

Section 160 of the Act also permits the Registrant to pay the expenses actually and reasonably incurred by an eligible party after the final disposition of the eligible proceeding.

Under Section 161 of the Act, the Registrant must, after the final disposition of an eligible proceeding, pay the expenses actually

and reasonably incurred by the eligible party in respect of that proceeding if the eligible party (a) has not been reimbursed for those expenses, and (b) is wholly successful, on the merits or otherwise, in the outcome of the proceeding or

is substantially successful on the merits in the outcome of the proceeding.

Under Section 162 of the Act, the Registrant

may pay, as they are incurred in advance of the final disposition of an eligible proceeding, the expenses actually and reasonably incurred by an eligible party in respect of that proceeding; provided the Registrant must not make such payments unless

it first receives from the eligible party a written undertaking that, if it is ultimately determined that the payment of expenses is prohibited by Section 163 of the Act, the eligible party will repay the amounts advanced.

Under Section 163 of the Act, the Registrant must not indemnify an eligible party against eligible penalties to which the eligible

party is or may be liable or pay the expenses of an eligible party in respect of that proceeding under Sections 160, 161 or 162 of the Act, as the case may be, if any of the following circumstances apply:

|

|

•

|

|

if the indemnity or payment is made under an earlier agreement to indemnify or pay expenses and, at the time that the agreement to indemnify or pay

expenses was made, the Registrant was prohibited from giving the indemnity or paying the expenses by its memorandum or articles;

|

|

|

•

|

|

if the indemnity or payment is made otherwise than under an earlier agreement to indemnify or pay expenses and, at the time that the indemnity or

payment is made, the Registrant is prohibited from giving the indemnity or paying the expenses by its memorandum or articles;

|

|

|

•

|

|

if, in relation to the subject matter of the eligible proceeding, the eligible party did not act honestly and in good faith with a view to the best

interests of the Registrant or the associated corporation, as the case may be; or

|

|

|

•

|

|

in the case of an eligible proceeding other than a civil proceeding, if the eligible party did not have reasonable grounds for believing that the

eligible party’s conduct in respect of which the proceeding was brought was lawful.

|

If an eligible

proceeding is brought against an eligible party by or on behalf of the Registrant or by or on behalf of an associated corporation, the Registrant must not either indemnify the eligible party against eligible penalties to which the eligible party is

or may be liable in respect of the proceeding, or, after the final disposition of an eligible proceeding, pay the expenses of the eligible party under Sections 160, 161 or 162 of the Act in respect of the proceeding.

II-1

Under Section 164 of the Act, the Supreme Court of British Columbia may, on application

of the Registrant or an eligible party, order the Registrant to indemnify the eligible party or to pay the eligible party’s expenses, despite Sections 160 to 163 of the Act.

The articles of a company may affect its power or obligation to give an indemnity or pay expenses. As indicated above, this is subject to

the overriding power of the Supreme Court of British Columbia under Section 164 of the Act.

Under the articles of Alamos

Gold Inc., subject to the provisions of the Act, the Registrant must indemnify a director, former director or alternate director of the Registrant and the heirs and legal personal representatives of all such persons against all eligible penalties to

which such person is or may be liable, and the Registrant must, after the final disposition of an eligible proceeding, pay the expenses actually and reasonably incurred by such person in respect of that proceeding. Each director and alternate

director is deemed to have contracted with the Registrant on the terms of the indemnity contained in the Registrant’s articles. The failure of a director, alternate director or officer of the Registrant to comply with the Act or the articles of

the Registrant does not invalidate any indemnity to which such person is entitled under the Registrant’s articles.

Under

the articles of Alamos Gold Inc., the Registrant may purchase and maintain insurance for the benefit of any eligible party against any liability incurred by such party as a director, alternate director, officer, employee or agent or person who holds

or held an equivalent position.

Insofar as indemnification for liabilities under the United States Securities Act of 1933 may

be permitted to directors, officers or persons controlling the Registrant pursuant to the foregoing provisions, the Registrant has been advised that in the opinion of the U.S. Securities and Exchange Commission such indemnification is against public

policy as expressed in the Securities Act of 1933 and is therefore unenforceable.

II-2

EXHIBITS

The following exhibits have been filed as part of this Registration Statement:

|

|

|

|

EXHIBIT

NUMBER

|

|

DESCRIPTION

|

|

|

|

|

1.1

|

|

Offer and Circular dated January 14, 2013.*

|

|

|

|

|

1.2

|

|

Letter of Transmittal.*

|

|

|

|

|

1.3

|

|

Notice of Guaranteed Delivery.*

|

|

|

|

|

1.4

|

|

Press Release dated January 14, 2013.*

|

|

|

|

|

1.5

|

|

Newspaper Advertisement dated January 14, 2013.*

|

|

|

|

|

4.1

|

|

Annual Information Form, dated March 29, 2012, for the Year Ended December 31, 2011.*

|

|

|

|

|

4.2

|

|

Annual Audited Consolidated Financial Statements for the Year Ended December 31, 2011, including Consolidated Statements of Financial Position as at December 31, 2011, December

31, 2010 and January 1, 2010 and Consolidated Statements of Comprehensive Income and Changes in Equity and Cash Flows for the Years Ended December 31, 2011 and December 31, 2010 and Related Notes, together with the Auditors’ Report thereon,

contained therein.*

|

|

|

|

|

4.3

|

|

Management’s Discussion and Analysis for the Annual Audited Consolidated Financial Statements for the Year Ended December 31, 2011.*

|

|

|

|

|

4.4

|

|

Unaudited Interim Consolidated Financial Statements for the Three and Nine Months Ended September 30, 2012, together with the Notes thereto.*

|

|

|

|

|

4.5

|

|

Management’s Discussion and Analysis for the Unaudited Interim Consolidated Financial Statements for the Three and Nine Months Ended September 30, 2012.*

|

|

|

|

|

4.6

|

|

Management Information Circular, dated April 26, 2012, in connection with the Annual Meeting of Shareholders Held on May 31, 2012.*

|

|

|

|

|

4.7

|

|

Notice of Extension and Variation dated February 19, 2013.*

|

|

|

|

|

4.8

|

|

Annual Audited Consolidated Financial Statements for the Year Ended December 31, 2012, including Consolidated Statements of Financial Position as at December 31, 2012 and

December 31, 2011 and Consolidated Statements of Comprehensive Income and Changes in Equity and Cash Flows for the Years Ended December 31, 2012 and December 31, 2011 and Related Notes, together with the Auditors’ Report thereon, contained

therein.*

|

|

|

|

|

4.9

|

|

Management’s Discussion and Analysis for the Annual Audited Consolidated Financial Statements for the Year Ended December 31, 2012.*

|

|

|

|

|

4.10

|

|

Notice of Extension and Variation dated March 6, 2013.*

|

|

|

|

|

5.1

|

|

Consent of Ernst & Young LLP.

|

|

|

|

|

5.2

|

|

Consent of Torys LLP.*

|

|

|

|

|

5.3

|

|

Consent of Joseph M. Keane.*

|

|

|

|

|

5.4

|

|

Consent of Marc Jutras.*

|

|

|

|

|

5.5

|

|

Consent of Marc A. Jutras.*

|

|

|

|

|

5.6

|

|

Consent of Kenneth J. Balleweg.*

|

|

|

|

|

5.7

|

|

Consent of Herbert E. Welhener.*

|

|

|

|

|

5.8

|

|

Consent of Herbert E. Welhener.*

|

|

|

|

|

5.9

|

|

Consent of Mark A. Odell.*

|

|

|

|

|

5.10

|

|

Consent of Russell A. Browne.*

|

|

|

|

|

5.11

|

|

Consent of Russell A. Browne.*

|

|

|

|

|

5.12

|

|

Consent of Susan E. Ames.*

|

|

|

|

|

5.13

|

|

Consent of Dawn H. Garcia.*

|

|

|

|

|

5.14

|

|

Consent of Carl E. Defilippi.*

|

|

|

|

|

5.15

|

|

Consent of Michal Dobr.*

|

|

|

|

|

5.16

|

|

Consent of Dennis Ferrigno.*

|

|

|

|

|

5.17

|

|

Consent of Allen Ray Anderson.*

|

|

|

|

|

5.18

|

|

Consent of Pedro C. Repetto.*

|

|

|

|

|

6.1

|

|

Powers of Attorney (included on the signature pages of the Registration Statement).*

|

II-3

PART III

UNDERTAKING AND CONSENT TO SERVICE OF PROCESS

The Registrant undertakes

to make available, in person or by telephone, representatives to respond to inquiries made by the Securities and Exchange Commission (the “Commission”) staff, and to furnish promptly, when requested to do so by the Commission staff,

information relating to the securities registered pursuant to this Form F-10 or to transactions in said securities.

|

ITEM 2.

|

CONSENT TO SERVICE OF PROCESS.

|

Concurrent with the filing of the initial Registration Statement on Form F-10, the Registrant filed with the Commission a written irrevocable consent and

power of attorney on Form F-X.

Any change to the name or address of the agent for service of the Registrant shall be communicated promptly to

the Commission by amendment of the Form F-X referencing the file number of this Registration Statement.

III-1

SIGNATURES

Pursuant to the requirements of the Securities Act of 1933, the Registrant certifies that it has reasonable grounds to believe that it meets all of the requirements for filing on Form F-10 and has duly

caused this Registration Statement to be signed on its behalf by the undersigned, thereunto duly authorized, in the City of Toronto, Province of Ontario, Country of Canada, on March 13, 2013.

|

|

|

|

|

|

|

ALAMOS GOLD INC.

|

|

|

|

|

By:

|

|

/s/ Matthew Howorth

|

|

|

|

Name:

|

|

Matthew Howorth

|

|

|

|

Title:

|

|

VP, Legal & Corporate Secretary

|

Pursuant to the requirements of the Securities Act of 1933 this Registration Statement has been signed by the

following persons in the following capacities and on March 13, 2013.

|

|

|

|

|

SIGNATURE

|

|

TITLE

|

|

|

|

|

*

|

|

Chief Executive Officer

|

|

John A. McCluskey

|

|

(Principal Executive Officer)

|

|

|

|

|

*

|

|

Chief Financial Officer

|

|

Jamie Porter

|

|

(Principal Financial and Accounting Officer)

|

|

|

|

|

*

|

|

Director

|

|

John A. McCluskey

|

|

|

|

|

|

|

*

|

|

Director

|

|

Paul Murphy

|

|

|

|

|

|

|

*

|

|

Director

|

|

Kenneth Stowe

|

|

|

|

|

|

|

*

|

|

Director

|

|

Anthony Garson

|

|

|

|

|

|

|

|

|

|

|

*By:

|

|

/s/ Matthew Howorth

|

|

|

|

Matthew Howorth

Attorney-in-Fact

|

AUTHORIZED REPRESENTATIVE

Pursuant to the requirements of Section 6(a) of the Securities Act of 1933, as amended, the undersigned has signed this Registration Statement,

solely in the capacity of the duly authorized representative of Alamos Gold Inc. in the United States, on March 13, 2013.

|

|

|

|

|

|

|

TORYS LLP

|

|

|

|

|

By:

|

|

/s/ Mile T. Kurta

|

|

|

|

Name:

|

|

Mile T. Kurta

|

|

|

|

Title:

|

|

Partner

|

EXHIBIT INDEX

|

|

|

|

EXHIBIT

NUMBER

|

|

DESCRIPTION

|

|

|

|

|

1.1

|

|

Offer and Circular dated January 14, 2013.*

|

|

|

|

|

1.2

|

|

Letter of Transmittal.*

|

|

|

|

|

1.3

|

|

Notice of Guaranteed Delivery.*

|

|

|

|

|

1.4

|

|

Press Release dated January 14, 2013.*

|

|

|

|

|

1.5

|

|

Newspaper Advertisement dated January 14, 2013.*

|

|

|

|

|

4.1

|

|

Annual Information Form, dated March 29, 2012, for the Year Ended December 31, 2011.*

|

|

|

|

|

4.2

|

|

Annual Audited Consolidated Financial Statements for the Year Ended December 31, 2011, including Consolidated Statements of Financial Position as at December 31, 2011, December

31, 2010 and January 1, 2010 and Consolidated Statements of Comprehensive Income and Changes in Equity and Cash Flows for the Years Ended December 31, 2011 and December 31, 2010 and Related Notes, together with the Auditors’ Report thereon,

contained therein.*

|

|

|

|

|

4.3

|

|

Management’s Discussion and Analysis for the Annual Audited Consolidated Financial Statements for the Year Ended December 31, 2011.*

|

|

|

|

|

4.4

|

|

Unaudited Interim Consolidated Financial Statements for the Three and Nine Months Ended September 30, 2012, together with the Notes thereto.*

|

|

|

|

|

4.5

|

|

Management’s Discussion and Analysis for the Unaudited Interim Consolidated Financial Statements for the Three and Nine Months Ended September 30, 2012.*

|

|

|

|

|

4.6

|

|

Management Information Circular, dated April 26, 2012, in connection with the Annual Meeting of Shareholders Held on May 31, 2012.*

|

|

|

|

|

4.7

|

|

Notice of Extension and Variation dated February 19, 2013.*

|

|

|

|

|

4.8

|

|

Annual Audited Consolidated Financial Statements for the Year Ended December 31, 2012, including Consolidated Statements of Financial Position as at December 31, 2012 and

December 31, 2011 and Consolidated Statements of Comprehensive Income and Changes in Equity and Cash Flows for the Years Ended December 31, 2012 and December 31, 2011 and Related Notes, together with the Auditors’ Report thereon, contained

therein.*

|

|

|

|

|

4.9

|

|

Management’s Discussion and Analysis for the Annual Audited Consolidated Financial Statements for the Year Ended December 31, 2012.*

|

|

|

|

|

4.10

|

|

Notice of Extension and Variation dated March 6, 2013.*

|

|

|

|

|

5.1

|

|

Consent of Ernst & Young LLP.

|

|

|

|

|

5.2

|

|

Consent of Torys LLP.*

|

|

|

|

|

5.3

|

|

Consent of Joseph M. Keane.*

|

|

|

|

|

5.4

|

|

Consent of Marc Jutras.*

|

|

|

|

|

5.5

|

|

Consent of Marc A. Jutras.*

|

|

|

|

|

5.6

|

|

Consent of Kenneth J. Balleweg.*

|

|

|

|

|

5.7

|

|

Consent of Herbert E. Welhener.*

|

|

|

|

|

5.8

|

|

Consent of Herbert E. Welhener.*

|

|

|

|

|

5.9

|

|

Consent of Mark A. Odell.*

|

|

|

|

|

5.10

|

|

Consent of Russell A. Browne.*

|

|

|

|

|

5.11

|

|

Consent of Russell A. Browne.*

|

|

|

|

|

5.12

|

|

Consent of Susan E. Ames.*

|

|

|

|

|

5.13

|

|

Consent of Dawn H. Garcia.*

|

|

|

|

|

5.14

|

|

Consent of Carl E. Defilippi.*

|

|

|

|

|

5.15

|

|

Consent of Michal Dobr.*

|

|

|

|

|

5.16

|

|

Consent of Dennis Ferrigno.*

|

|

|

|

|

5.17

|

|

Consent of Allen Ray Anderson.*

|

|

|

|

|

5.18

|

|

Consent of Pedro C. Repetto.*

|

|

|

|

|

6.1

|

|

Powers of Attorney (included on the signature pages of the Registration Statement).*

|

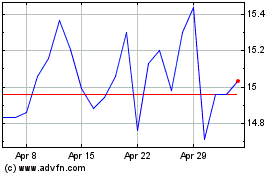

Alamos Gold (NYSE:AGI)

Historical Stock Chart

From Jun 2024 to Jul 2024

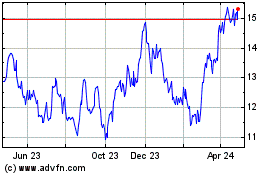

Alamos Gold (NYSE:AGI)

Historical Stock Chart

From Jul 2023 to Jul 2024