AS FILED WITH THE SECURITIES AND EXCHANGE COMMISSION ON JUNE

26, 2019

REGISTRATION NO. 333-__________

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-3

REGISTRATION STATEMENT UNDER THE SECURITIES

ACT OF 1933

ZYNEX, INC.

(Exact name of registrant as specified

in its charter)

Nevada

(State or other jurisdiction of

incorporation or organization)

90-0275169

I.R.S. Employer Identification Number

9555 Maroon Cir.

Englewood, CO, 80112

Telephone: (303)

703-4906

(Address, including zip code, and telephone

number, including area code of registrant’s principal executive offices)

Thomas Sandgaard

Chief Executive

Officer

Zynex, Inc.

9555 Maroon Ci.

Englewood, CO 80112

Telephone: (303)

703-4906

(Name, address, including zip code, and

telephone number, including area code, of agent for service)

Copies to:

Gregory Sichenzia,

Esq.

Sichenzia Ross

Ference LLP

1185 Avenue of

the Americas, 37

th

Floor

New York, NY 10036

(212) 930-9700

Approximate date of commencement of proposed

sale to the public:

From time to time after the effective date

of this registration statement.

If the only securities being registered

on this Form are being offered pursuant to dividend or interest reinvestment plans, please check the following box:

¨

If any of the securities being registered

on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, other than

securities offered only in connection with dividend or interest reinvestment plants, check the following box:

x

If this Form is filed to register additional

securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following and list the Securities

Act registration statement number of the earlier effective registration statement for the same offering.

¨

If this Form is a post-effective amendment

filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement

number of the earlier effective registration statement for the same offering.

¨

If this Form is a registration statement

pursuant to General Instruction I.D. or a post-effective amendment thereto that shall become effective upon filing with the Commission

pursuant to Rule 462(e) under the Securities Act, check the following box.

¨

If this Form is a post-effective amendment

to a registration statement filed pursuant to General Instruction I.D. filed to register additional securities or additional classes

of securities pursuant to Rule 413(b) under the Securities Act, check the following box.

¨

Indicate by check mark whether the registrant

is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth

company. See the definitions of “large accelerated filer,” “accelerated filer” , “smaller reporting

company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

¨

Large accelerated filer

|

¨

Accelerated filer

|

|

x

Non-accelerated filer

|

x

Smaller reporting company

|

|

|

¨

Emerging growth company

|

If an emerging growth company, indicate

by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial

accounting standards provided pursuant to Section 7(a)(2)(B) of Securities Act.

¨

CALCULATION OF REGISTRATION FEE

|

|

|

|

|

|

|

|

|

Proposed

|

|

|

|

|

|

|

|

|

|

|

Proposed

|

|

|

maximum

|

|

|

|

|

|

|

|

Amount

|

|

|

maximum

|

|

|

aggregate

|

|

|

Amount of

|

|

|

Title of each class of

|

|

to be

|

|

|

offering price

|

|

|

offering

|

|

|

registration

|

|

|

Securities to be registered

|

|

Registered

|

|

|

per unit (1)

|

|

|

price

|

|

|

fee

|

|

|

Common stock, par value $0.001 per share

|

|

|

16,661,571

|

|

|

$

|

10.58

|

|

|

$

|

176,279,421.18

|

|

|

$

|

21,365.07

|

|

|

(1)

|

Estimated solely for purposes of calculating the registration fee pursuant to Rule 457(c) under the Securities Act of 1933, as amended, using the average of the high and low prices as reported on the NASDAQ Capital Market on June 25, 2019.

|

The registrant hereby amends this Registration

Statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment

which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of

the Securities Act of 1933 or until the Registration Statement shall become effective on such date as the Commission, acting pursuant

to said Section 8(a), may determine.

The information in this prospectus is not complete

and may be changed. The selling stockholders may not sell these securities under this prospectus until the registration statement

of which it is a part and filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell

these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

(Subject to Completion, Dated

June 26, 2019)

PROSPECTUS

ZYNEX, INC.

16,661,571 shares of Common Stock

This prospectus relates

to the public offering of up to 16,661,571 shares of common stock of Zynex, Inc. by the selling stockholders named in this prospectus

or its pledgees, donees, transferees, or other successors in interest.

Our common

stock is currently traded on the NASDAQ Capital Market under the symbol “ZYXI.” On June 25, 2019, the last reported

sales price for our common stock was $10.50 per share.

Investing

in our securities involves certain risks. You should read this prospectus, any prospectus supplement and all other information

included or incorporated by reference into this prospectus carefully before you invest, including the risk factors which begin

on page 4 of this prospectus.

The shares of common

stock may be offered by the selling stockholders in negotiated transactions, at either prevailing market prices or negotiated prices.

Each selling stockholder in its discretion may also offer the shares of common stock from time to time in ordinary brokerage transactions

in the principal market on which our common stock is traded or otherwise. See our discussion in the “Plan of Distribution”

section of this prospectus.

The selling stockholders

and any brokers executing selling orders on behalf of the selling stockholders may be deemed to be "underwriters" within

the meaning of the Securities Act of 1933, as amended, or, the Securities Act, and commissions received by a broker executing

selling orders may be deemed to be underwriting commissions under the Securities Act.

We may amend or

supplement this prospectus from time to time by filing amendments or supplements as required. You should read the entire prospectus

and any amendments or supplements carefully before you make your investment decision.

Neither the Securities

and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this

prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

This prospectus is dated ___________, 2019

Table of Contents

You should rely

only on the information contained or incorporated by reference in this prospectus or any prospectus supplement. We have not authorized

anyone to provide you with information different from that contained or incorporated by reference into this prospectus. If any

person does provide you with information that differs from what is contained or incorporated by reference in this prospectus, you

should not rely on it. No dealer, salesperson or other person is authorized to give any information or to represent anything not

contained in this prospectus. You should assume that the information contained in this prospectus or any prospectus supplement

is accurate only as of the date on the front of the document and that any information contained in any document we have incorporated

by reference is accurate only as of the date of the document incorporated by reference, regardless of the time of delivery of this

prospectus or any prospectus supplement or any sale of a security. These documents are not an offer to sell or a solicitation of

an offer to buy these securities in any circumstances under which the offer or solicitation is unlawful.

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING

STATEMENTS

This prospectus and

the documents and information incorporated by reference in this prospectus include forward-looking statements within the meaning

of Section 27A of the Securities Act of 1933, as amended, or the Securities Act, and Section 21E of the Securities Exchange Act

of 1934, as amended, or the Exchange Act. These statements are based on our management’s beliefs and assumptions and on information

currently available to our management. Such forward-looking statements include those that express plans, anticipation, intent,

contingency, goals, targets or future development and/or otherwise are not statements of historical fact.

All statements in

this prospectus and the documents and information incorporated by reference in this prospectus that are not historical facts are

forward-looking statements. We may, in some cases, use terms such as “anticipates,” “believes,” “could,”

“estimates,” “expects,” “intends,” “may,” “plans,” “potential,”

“predicts,” “projects,” “should,” “will,” “would” or similar expressions

or the negative of such items that convey uncertainty of future events or outcomes to identify forward-looking statements.

Forward-looking statements

are made based on management’s beliefs, estimates and opinions on the date the statements are made and we undertake no obligation

to update forward-looking statements if these beliefs, estimates and opinions or other circumstances should change, except as may

be required by applicable law. Although we believe that the expectations reflected in the forward-looking statements are reasonable,

we cannot guarantee future results, levels of activity, performance or achievements.

ABOUT ZYNEX, INC.

Unless

the context otherwise requires, references to “we,” “our,” “us,” “Zynex” or the

“Company” in this prospectus mean Zynex, Inc., a Nevada corporation, on a consolidated basis with its wholly-owned

subsidiaries, as applicable.

Corporate Background

Thomas Sandgaard founded two medical device

companies, Dan Med Inc. (“DMI”) in October 1996 and Stroke Recovery Systems Inc. (“SRSI”) in February 1998,

both Colorado corporations. DMI was merged into SRSI in October 2003 and renamed Zynex Medical Inc. On December 3, 2003, Fox River

Holdings Inc., a publicly traded company incorporated in Nevada, changed its name to Zynex Medical Holdings Inc. and subsequently

completed the acquisition of Zynex Medical Inc. on February 11, 2004. Fox River Holdings Inc. was originally founded on December

26, 1991 under the name Life Medical Technologies and between 1995 and 2003, changed its corporate name and business several times,

as is further detailed in the Company's December 31, 2004 10-KSB filed on April 15, 2005.On June 30, 2008, Zynex Medical Holdings,

Inc. changed its name to Zynex, Inc.

The Company is

the parent company of, and conducts business within six subsidiaries: Zynex Medical, Inc. (“ZMI”), a Colorado corporation,

Zynex Neurodiagnostics, Inc. (“ZND”), a Colorado corporation, Zynex Monitoring Solutions, Inc. (“ZMS”),

a Colorado corporation, Zynex Billing and Consulting, LLC (“ZBC”), a Colorado limited liability company, Zynex Europe

(Zynex Europe ApS) (“ZEU”), a Danish corporation, and Pharmazy, Inc. (“Pharmazy”), which was incorporated

under the laws of Colorado in June 2015 as a wholly-owned subsidiary of ZMI.

Our principal executive

offices are located at 9555 Maroon Circle, Englewood, CO 80112 and our telephone number is (303) 703-4906. Our web site address

is

www.zynex.com

. The information on our website is not a part of, and should not be construed as being incorporated by

reference into, this prospectus.

Overview

We

operate in one primary business segment, Electrotherapy and Pain Management Products. The Company’s primary subsidiary is

ZMI through which the Company conducts most of its operations. One other subsidiary, ZEU, generated minimal revenues during the

years ended December 31, 2018 and 2017 from international sales and marketing. ZMS has developed a blood volume monitoring device

which is in the process of approval by the Food and Drug Administration (“FDA”) in the United States of America and

European Union (“EU”) Certificate European (“CE”) Marking. CE Marking is a certification that a product

meets the standards established by the 28 nations of the EU and qualifies for sale in the EU and 4-nation European Free Trade Association.

As a result, ZMS has achieved no revenues to date. Our inactive subsidiaries include ZND, ZBC, and Pharmazy. The Company’s

compounding pharmacy operated as a division of ZMI dba as Pharmazy through January 2016.

Zynex Medical, Inc. (ZMI):

ZMI

designs, manufactures and markets medical devices designed to treat chronic and acute pain, as well as activate and exercise muscles

for rehabilitative purposes with electrical stimulation. ZMI devices are intended for pain management to reduce reliance on medications

and are designed to provide rehabilitation and increased mobility through the utilization of non-invasive muscle stimulation, electromyography

technology, interferential current (“IFC”), neuromuscular electrical stimulation (“NMES”) and transcutaneous

electrical nerve stimulation (“TENS”). All our medical devices are intended to be patient friendly and designed for

home use. The ZMI devices are small, portable, battery operated and include an electrical pulse generator which is connected to

the body via electrodes. The products are cost effective when compared to traditional physical therapy, and often result in better

mobility, less pain and increased potential for a patient to return to work earlier than with traditional therapies alone. All

of our medical devices are marketed in the U.S. and follow FDA regulations and approval. Our products require a physician’s

prescription before they can be dispensed in the U.S. We consider the physician’s prescription as an “order”,

and it is on this basis that we provide the product to the patient and either bill the patient directly or the patient’s

private or government insurer for payment. ZMI’s primary product is the NexWave® device. The NexWave is marketed

to physicians and therapists by our field sales representatives. The NexWave requires consumable supplies, such as

electrodes and batteries, which are shipped to patients on a recurring monthly basis, as needed.

ZMI also designs, manufactures and markets

the NeuroMove product. The NeuroMove contains electromyography and electric stimulation technology that is primarily used for stroke,

spinal cord and traumatic brain injury rehabilitation (“SCI”), by reaching parts of the brain to re-connect with muscles,

also known as neuroplasticity. The NeuroMove product is primarily marketed to medical clinics. Zynex did not have material

sales of this product in 2017 or 2018 or for the three months ended March 31, 2019.

Zynex Monitoring Solutions (ZMS):

ZMS was formed in 2011 to develop and market

medical devices for non-invasive cardiac monitoring. The blood volume monitor is a non-invasive medical device for monitoring central

blood volume that would be used in operating and recovery rooms to detect blood loss during surgery and internal bleeding

during recovery. This device has been subjected to multiple clinical studies, which are being utilized for collecting data to further

validate the algorithm used to determine changes in central blood volume, and there are plans to conduct future, additional clinical

studies. We have submitted a 510(k) application to the FDA and are responding to their questions. There is no guarantee when or

if the product will be cleared for marketing by the FDA. Concurrent to our FDA application, we are pursuing EU CE Marking.

The blood volume monitor has been tested

in several International Review Board approved studies and was used in several blood donation settings where hundreds of subjects

have donated half a liter of blood with strong correlation to the index on the device. We have built a number of commercial devices

in pilot-production and continue to refine the algorithms for the Blood Volume Index. In the fourth quarter of 2018 a U.S. utility

patent was obtained for this unique application, and we believe this product could serve a currently unmet need in the market

for safer surgeries and safer monitoring of patients during recovery. ZMS did not produce any revenue for the years ending December,

31, 2018 and 2017 or for the three months ended March 31, 2019.

Zynex International (Zynex Europe) (ZEU):

ZEU was formed in 2012 to further progress

our international expansion. ZEU is currently conducting business and focused on sales and marketing our products within the international

marketplace, upon receipt of necessary regulatory approvals. ZEU did not produce significant revenue for the years ended December

31, 2018 and 2017 or for the three months ended March 31, 2019.

Products

We currently market and sell Zynex-manufactured

products as well as distribute complimentary products and private labeled supplies for Zynex products, as indicated below:

|

Product Name

|

|

Description

|

|

|

|

|

|

Zynex Medical Products

|

|

|

|

|

|

|

|

NexWave

|

|

Dual Channel, multi-modality IFC, TENS, NMES Device

|

|

|

|

|

|

NeuroMove

|

|

Electromyography (EMG) triggered Electrical Stimulation Device

|

|

|

|

|

|

InWave

|

|

Electrical stimulation for treatment of female urinary incontinence

|

|

|

|

|

|

TENSWave

|

|

Dual Channel TENS Device

|

|

|

|

|

|

Private Labeled Supplies

|

|

|

|

|

|

|

|

Electrodes

|

|

Supplies, re-usable for delivery of electrical current to the body

|

|

|

|

|

|

Batteries

|

|

Supplies, for use in electrotherapy products

|

|

|

|

|

|

Distributed Complementary Products

|

|

|

|

|

|

|

|

Comfortrac

|

|

Cervical traction

|

|

|

|

|

|

JetStream

|

|

Hot/Cold therapy

|

|

|

|

|

|

LSO Back Braces

|

|

Lumbar support

|

|

|

|

|

|

Zynex Monitoring Solutions Products

|

|

|

|

|

|

|

|

Non-Invasive Blood Volume Monitor

|

|

Blood Volume Monitor

|

Product Uses

Pain Management and Control

Standard electrotherapy is a clinically

proven and medically accepted alternative to manage acute and chronic pain. Electrical stimulation has been shown to reduce

most types of local pain, such as tennis elbow, neck or lower back pain, arthritis, and others. The devices used to accomplish

this are commonly described as the TENS family of devices. Electrotherapy is not known to have any negative side effects,

a significant advantage over most pain relief medications. The benefits of electrotherapy can include: pain relief, increased blood

flow, reduced edema, prevention of venous thrombosis, increased range-of-motion, prevention of muscle disuse atrophy, and reduced

urinary incontinence.

Electrotherapy introduces an electrical

current applied through surface electrodes. The electrical current “distorts” a pain signal on its way to the central

nervous system and the brain, thus reducing the pain. Additionally, by applying higher levels of electricity, muscles contract

and such contraction is believed to assist in the benefits mentioned above.

Numerous clinical studies have been published

over several decades showing the effectiveness of IFC and TENS for pain relief. Zynex’s primary TENS device, the NexWave

has received FDA 510(k) clearance. The NexWave is a digital IFC, TENS and NMES device that delivers pain-alleviating electrotherapy.

Stroke and Spinal Cord Injury Rehabilitation

Our proprietary NeuroMove product is a Class

II medical device that has been cleared by the FDA for stroke and SCI rehabilitation. Stroke and SCI usually affect a survivor’s

mobility, functionality, speech, and memory, and the NeuroMove is designed to help the survivor regain movement and functionality.

The NeuroMove product utilizes the relatively

new science of “neuroplasticity” the process by which healthy parts of the brain learn to compensate and assume functions

previously carried out by the damaged areas. To accomplish this task, the extraordinarily sensitive NeuroMove technology monitors

muscle activity and detects brain signals that indicate, even without any visible movement, the brain’s effort to move a

specific muscle or area of the body. Once the effort is detected, the NeuroMove induces actual movement through electrical stimulation,

thus providing effective feedback to initiate relearning in the healthy part of the brain.

We believe the NeuroMove product is unique

because its built-in microprocessor can recognize low-level attempts by muscles to contract and then “reward” such

detection with electrical stimulation. We do not believe there are similar products in the stroke rehabilitation market. Some generic

devices are being offered in international markets; however, we do not believe these products provide similar results with respect

to stroke rehabilitation. When conscientiously using the NeuroMove product for three to twelve months, studies show that the majority

of NeuroMove patients can re-establish the connection between the brain and impaired muscle and thus regain movement and functionality.

When

movement and functionality are restored, the patient may experience increased mobility, increased productivity, an improved outlook,

and a reduced risk of accidents, and may be able to engage in activities they were precluded from before using the NeuroMove. Sales

of NeuroMove have not generated material revenue for years ended December 31, 2018 and 2017 or for the three months ended March

31, 2019.

About this Offering

This prospectus relates

to the resale of 16,661,571 shares of common stock by the selling stockholders.

RISK FACTORS

Investing in our securities

involves a high degree of risk. Before making an investment decision, you should consider carefully the risks, uncertainties and

other factors described in our most recent Annual Report on Form 10-K, as supplemented and updated by subsequent quarterly reports

on Form 10-Q and current reports on Form 8-K that we have filed or will file with the SEC, which are incorporated by reference

into this prospectus.

Our business, affairs,

prospects, assets, financial condition, results of operations and cash flows could be materially and adversely affected by these

risks. For more information about our SEC filings, please see “Where You Can Find More Information.”

USE OF PROCEEDS

The shares of common

stock to be offered and sold pursuant to this prospectus will be offered and sold by the selling stockholders or their transferees.

We will not receive any proceeds from the sale of the shares of common stock by the selling stockholders.

SELLING STOCKHOLDERS

This prospectus relates

to the offering by the selling stockholders of up to 16,661,571 shares of common stock.

The following table

sets forth, based on information provided to us by the selling stockholders or known to us, the name of the selling stockholders

and the number of shares of our common stock beneficially owned by the stockholder before this offering. The number of shares owned

are those beneficially owned, as determined under the rules of the SEC, and the information is not necessarily indicative of beneficial

ownership for any other purpose. Under these rules, beneficial ownership includes any shares of common stock as to which a person

has sole or shared voting power or investment power and any shares of common stock which the person has the right to acquire within

60 days through the exercise of any option, warrant or right, through conversion of any security or pursuant to the automatic termination

of a power of attorney or revocation of a trust, discretionary account or similar arrangement. The shares are being sold by our

Chief Executive Officer and Founder, individually and through an entity of which he is the sole member. None of the selling stockholders

is a broker-dealer or an affiliate of a broker-dealer.

We have assumed all

shares of common stock reflected on the table will be sold from time to time in the offering covered by this prospectus. Because

the selling stockholder may offer all or any portions of the shares of common stock listed in the table below, no estimate can

be given as to the amount of those shares of common stock covered by this prospectus that will be held by the selling stockholder

upon the termination of the offering.

|

|

|

Beneficially ownership

prior to the Offering (1)

|

|

|

|

|

Beneficially

ownership after the Offering (5)

|

|

Selling

Stockholder

|

|

Shares

|

|

%

|

|

|

Number of Shares

Offered

|

|

|

Shares

|

|

|

%

|

|

|

Thomas Sandgaard

|

|

17,055,392

|

(2)

|

|

52.00

|

%

|

|

|

2,129,571

|

|

|

|

393,821

|

(3)

|

|

|

1.2

|

%

|

|

Sandgaard Holdings, LLC

|

|

14,532,000

|

(4)

|

|

44.84

|

%

|

|

|

14,532,000

|

|

|

|

0

|

|

|

|

0

|

%

|

|

|

(1)

|

Based upon 32,407,064 shares issued and outstanding as of June 25, 2019.

|

|

|

(2)

|

Includes 14,532,000 shares of common stock held by Sandgaard Holdings LLC, over which Mr. Sandgaard

holds voting and dispositive power and options to purchase 393,821 shares of common stock held by the Selling Stockholder which

vests within 60 days.

|

|

|

(3)

|

Represents options to purchase 393,821 shares of common stock which vests within 60 days.

|

|

|

(4)

|

Mr. Thomas Sandgaard is the sole member of the selling stockholder, and, in such capacity, holds

voting and dispositive power over the shares of common stock held by the selling stockholder.

|

|

|

(5)

|

Assumes the sale of all shares of common stock offered hereunder.

|

PLAN OF DISTRIBUTION

We are registering

the shares of common stock which have been issued to the selling stockholders, to permit the resale of these shares of common stock

by the holders thereof from time to time after the date of this prospectus. We will not receive any of the proceeds from the sale

by the selling stockholders of the shares of common stock. We will bear all fees and expenses incident to our obligation to register

the shares of common stock.

Each Selling Stockholder

(the “Selling Stockholders”) of the securities and any of their pledgees, assignees and successors-in-interest may,

from time to time, sell any or all of their shares of common stock covered hereby on the principal trading market or any other

stock exchange, market or trading facility on which the securities are traded or in private transactions. These sales may be at

fixed or negotiated prices. A Selling Stockholder may use any one or more of the following methods when selling shares:

|

|

·

|

ordinary brokerage transactions and transactions in which the broker-dealer solicits purchasers;

|

|

|

|

|

|

|

·

|

block trades in which the

broker-dealer will attempt to sell the shares as agent but may position and resell a portion of the block as principal to

facilitate the transaction;

|

|

|

|

|

|

|

·

|

purchases by a broker-dealer as principal and resale by the broker-dealer for its account;

|

|

|

·

|

an exchange distribution in accordance with the rules of the applicable exchange;

|

|

|

·

|

privately negotiated transactions;

|

|

|

|

|

|

|

·

|

settlement of short sales entered

into after the effective date of the registration statement of which this prospectus is a part;

|

|

|

|

|

|

|

·

|

in transactions through

broker-dealers that agree with the Selling Stockholders to sell a specified number of such shares at a stipulated price per

share;

|

|

|

|

|

|

|

·

|

through the writing or settlement

of options or other hedging transactions, whether through an options exchange or otherwise;

|

|

|

|

|

|

|

·

|

a combination of any such methods of sale; or

|

|

|

|

|

|

|

·

|

any other method permitted pursuant to applicable law.

|

The Selling Stockholders

may also sell securities under Rule 144 under the Securities Act of 1933, as amended (the “Securities Act”), if available,

rather than under this prospectus.

Broker-dealers engaged

by the Selling Stockholders may arrange for other brokers-dealers to participate in sales. Broker-dealers may receive commissions

or discounts from the Selling Stockholders (or, if any broker-dealer acts as agent for the purchaser of securities, from the purchaser)

in amounts to be negotiated, but, except as set forth in a supplement to this Prospectus, in the case of an agency transaction

not in excess of a customary brokerage commission in compliance with FINRA Rule 2440; and in the case of a principal transaction

a markup or markdown in compliance with FINRA IM-2440.

In connection with

the sale of the shares or interests therein, the Selling Stockholders may enter into hedging transactions with broker-dealers or

other financial institutions, which may in turn engage in short sales of the securities in the course of hedging the positions

they assume. The Selling Shareholders may also, to the extent permitted under Rule 105 of Regulation M, sell shares of their common

stock short and deliver these securities to close out their short positions, or loan or pledge shares of their common stock to

broker-dealers that in turn may sell these securities. The Selling Stockholders may also enter into option or other transactions

with broker-dealers or other financial institutions or create one or more derivative securities which require the delivery to such

broker-dealer or other financial institution of securities offered by this prospectus, which securities such broker-dealer or other

financial institution may resell pursuant to this prospectus (as supplemented or amended to reflect such transaction).

The Selling Stockholders

and any broker-dealers or agents that are involved in selling the shares may be deemed to be “underwriters” within

the meaning of the Securities Act in connection with such sales. In such event, any commissions received by such broker-dealers

or agents and any profit on the resale of the securities purchased by them may be deemed to be underwriting commissions or discounts

under the Securities Act. In no event shall any broker-dealer receive fees, commissions and markups, other than in connection with

the closing of the shares purchase agreements by and between various Selling Stockholders and the Company, which, in the aggregate,

would exceed eight percent (8%).

The Company is required

to pay certain fees and expenses incurred by the Company incident to the registration of the securities however, a Selling Stockholder

will pay all underwriting discounts and commissions, if any. The Company has agreed to indemnify the Selling Stockholders against

certain losses, claims, damages and liabilities, including liabilities under the Securities Act.

Because Selling Stockholders

may be deemed to be “underwriters” within the meaning of the Securities Act, they will be subject to the prospectus

delivery requirements of the Securities Act including Rule 172 thereunder. In addition, any securities covered by this prospectus

which qualify for sale pursuant to Rule 144 under the Securities Act may be sold under Rule 144 rather than under this prospectus.

The shares

will

be sold only through registered or licensed brokers or dealers if required under applicable state securities laws. In addition,

in certain states, the resale of the shares covered hereby may not be sold unless they have been registered or qualified for sale

in the applicable state or an exemption from the registration or qualification requirement is available and is complied with.

Under applicable rules

and regulations under the Exchange Act, any person engaged in the distribution of the shares may not simultaneously engage in market

making activities with respect to the common stock for the applicable restricted period, as defined in Regulation M, prior to the

commencement of the distribution. In addition, the Selling Stockholders will be subject to applicable provisions of the Exchange

Act and the rules and regulations thereunder, including Regulation M, which may limit the timing of purchases and sales of securities

of the common stock by the Selling Stockholders or any other person. The Company will make copies of this prospectus available

to the Selling Stockholders and have informed them of the need to deliver a copy of this prospectus to each purchaser at or prior

to the time of the sale (including by compliance with Rule 172 under the Securities Act).

LEGAL MATTERS

The validity of the

issuance of securities offered hereby will be passed upon for us by Sichenzia Ross Ference LLP, New York, New York.

EXPERTS

The consolidated balance

sheet of Zynex, Inc. as of December 31, 2018 and the related consolidated statements of operations, stockholders’ equity,

and cash flows for the year then ended, have been audited by Plante & Moran PLLC, independent registered public accounting

firm, as stated in their report which is incorporated herein by reference. The consolidated balance sheet of Zynex, Inc. as of

December 31, 2017 and the related consolidated statements of operations, stockholders’ equity, and cash flows for the year

then ended, have been audited by EKS&H LLLP, independent registered public accounting firm, as stated in their report which

is incorporated herein by reference. Such financial statements have been incorporated herein by reference in reliance on the report

of such firm given upon their authority as experts in accounting and auditing.

WHERE YOU CAN FIND MORE INFORMATION

We file annual, quarterly

and special reports, along with other information with the SEC. Our SEC filings are available to the public over the Internet at

the SEC’s website at http://www.sec.gov. You may also read and copy any document we file at the SEC’s Public Reference

Room at 100 F Street, NE, Washington, D.C. 20549. Please call the SEC at 1-800-SEC-0330 for further information on the Public Reference

Room.

This prospectus is

part of a registration statement on Form S-3 that we filed with the SEC to register the securities offered hereby under the Securities

Act of 1933, as amended. This prospectus does not contain all of the information included in the registration statement, including

certain exhibits and schedules. You may obtain the registration statement and exhibits to the registration statement from the SEC

at the address listed above or from the SEC’s internet site.

INCORPORATION OF CERTAIN DOCUMENTS BY

REFERENCE

This prospectus is

part of a registration statement filed with the SEC. The SEC allows us to “incorporate by reference” into this prospectus

the information that we file with them, which means that we can disclose important information to you by referring you to those

documents. The information incorporated by reference is considered to be part of this prospectus, and information that we file

later with the SEC will automatically update and supersede this information. The following documents are incorporated by reference

and made a part of this prospectus:

|

|

·

|

our Annual Report on Form 10-K for the year ended December 31, 2018 filed with the SEC on

February 26, 2019

;

|

|

|

·

|

our Quarterly Report on Form 10-Q for the quarter ended March 31, 2019 filed with the SEC on

April 30, 2019

;

|

|

|

·

|

the description of our common stock contained in the our Registration Statement on Form 8-A filed

with the SEC on

February 7, 2019

(File No. 001-38804), including any amendment or report filed for the purpose of updating such

description; and

|

|

|

·

|

all reports and other documents subsequently filed by us pursuant to Sections 13(a), 13(c), 14

and 15(d) of the Exchange Act after the date of this prospectus and prior to the termination of this offering.

|

We also incorporate by reference

all documents (other than Current Reports furnished under Item 2.02 or Item 7.01 of Form 8-K and exhibits filed on such form

that are related to such items) that are subsequently filed by us with the U.S. Securities and Exchange Commission pursuant to

Sections 13(a), 13(c), 14, or 15(d) of the Exchange Act prior to the termination of the offering of the securities made by

this prospectus (including documents filed after the date of the initial Registration Statement of which this prospectus is a part

and prior to the effectiveness of the Registration Statement). These documents include periodic reports, such as Annual Reports

on Form 10-K, Quarterly Reports on Form 10-Q, and Current Reports on Form 8-K, as well as proxy statements.

Any statement contained in this prospectus

or in a document incorporated or deemed to be incorporated by reference into this prospectus will be deemed to be modified or superseded

to the extent that a statement contained in this prospectus or any subsequently filed document that is deemed to be incorporated

by reference into this prospectus modifies or supersedes the statement.

The information about

us contained in this prospectus should be read together with the information in the documents incorporated by reference. You may

request a copy of any or all of these filings, at no cost, by writing or telephoning us at 9555 Maroon Cir., Englewood, CO 80112,

phone number 303-703-4906.

16,661,571 shares of

Common Stock

ZYNEX, INC.

Prospectus

____________, 2019

PART II

INFORMATION NOT REQUIRED IN PROSPECTUS

Item 14. Other Expenses of Issuance and Distribution.

The following table sets forth the costs

and expenses payable by the Registrant in connection with this offering, other than underwriting commissions and discounts, all

of which are estimated except for the SEC registration fee.

|

Item

|

|

Amount

|

|

|

SEC registration fee

|

|

$

|

21,365

|

|

|

Legal fees and expenses

|

|

|

|

*

|

|

Accounting fees and expenses

|

|

|

|

*

|

|

Miscellaneous expenses

|

|

|

|

*

|

|

|

|

|

|

*

|

|

Total

|

|

$

|

|

*

|

* Estimated expenses not presently known.

Item 15. Indemnification of Directors and Officers.

Nevada Revised Statutes

Sections 78.7502 and 78.751 provide us with the power to indemnify any of our directors and officers. The director or officer must

have conducted himself/herself in good faith and reasonably believe that his/her conduct was in, or not opposed to, our best interests.

In a criminal action, the director, officer, employee or agent must not have had reasonable cause to believe his/her conduct was

unlawful.

Under Nevada Revised

Statutes Section 78.751, advances for expenses may be made by agreement if the director or officer affirms in writing that he/she

believes he/she has met the standards and will personally repay the expenses if it is determined such officer or director did not

meet the standards.

Our Articles of

Incorporation and Bylaws provide for indemnification of our directors and certain officers for liabilities and expenses that they

may incur in such capacities. In general, our directors and certain officers are indemnified with respect to actions taken in good

faith and in a manner such person believed to be in our best interests, and with respect to any criminal action or proceedings,

actions that such person has no reasonable cause to believe were unlawful. Furthermore, the personal liability of our directors

is limited as provided in our Articles of Incorporation.

Insofar as indemnification

for liabilities arising under the Securities Act of 1933, as amended, may be permitted to directors, officers and controlling persons

of the registrant pursuant to the foregoing provisions, or otherwise, the registrant has been advised that in the opinion of the

Securities and Exchange Commission such indemnification is against public policy as expressed in the Securities Act of 1933, as

amended, and is, therefore, unenforceable. In the event that a claim for indemnification against such liabilities (other than the

payment by the registrant of expenses incurred or paid by a director, officer or controlling person of the registrant in the successful

defense of any action, suit or proceeding) is asserted by such director, officer or controlling person in connection with the securities

being registered, the registrant will, unless in the opinion of its counsel the matter has been settled by controlling precedent,

submit to a court of appropriate jurisdiction the question whether such indemnification by it is against public policy as expressed

in the Securities Act of 1933, as amended and will be governed by the final adjudication of such issue.

Item 16. Exhibits.

|

*

|

To the extent applicable, to be filed by amendment or as an exhibit to a document filed under the Securities and Exchange Act of 1934, as amended, and incorporated by reference herein.

|

Item 17. Undertakings

(a) The undersigned registrant hereby undertakes:

(1) To file, during

any period in which offers or sales are being made, a post-effective amendment to this registration statement:

(i) To include

any prospectus required by section 10(a)(3) of the Securities Act of 1933;

(ii) To reflect

in the prospectus any facts or events arising after the effective date of the registration statement (or the most recent post-effective

amendment thereof) which, individually or in the aggregate, represent a fundamental change in the information set forth in the

registration statement. Notwithstanding the foregoing, any increase or decrease in volume of securities offered (if the total dollar

value of securities offered would not exceed that which was registered) and any deviation from the low or high end of the estimated

maximum offering range may be reflected in the form of prospectus filed with the Commission pursuant to Rule 424(b) if, in the

aggregate, the changes in volume and price represent no more than 20% change in the maximum aggregate offering price set forth

in the “Calculation of Registration Fee” table in the effective registration statement.

(iii) To

include any material information with respect to the plan of distribution not previously disclosed in the registration statement

or any material change to such information in the registration statement;

provided, however

, That:

Paragraphs (a)(1)(i), (a)(1)(ii)

and (a)(1)(iii) of this section do not apply if the registration statement is on Form S-3 or Form F-3 and the information required

to be included in a post-effective amendment by those paragraphs is contained in reports filed with or furnished to the Commission

by the registrant pursuant to section 13 or section 15(d) of the Securities Exchange Act of 1934 that are incorporated by reference

in the registration statement, or is contained in a form of prospectus filed pursuant to Rule 424(b) that is part of the registration

statement.

(2) That, for the purpose

of determining any liability under the Securities Act of 1933, each such post-effective amendment shall be deemed to be a new registration

statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the

initial bona fide offering thereof.

(3) To remove from

registration by means of a post-effective amendment any of the securities being registered which remain unsold at the termination

of the offering.

(4) That, for the purpose

of determining liability under the Securities Act of 1933 to any purchaser:

(A) Each

prospectus filed by the registrant pursuant to Rule 424(b)(3)shall be deemed to be part of the registration statement as of the

date the filed prospectus was deemed part of and included in the registration statement; and

(B) Each

prospectus required to be filed pursuant to Rule 424(b)(2), (b)(5), or (b)(7) as part of a registration statement in reliance on

Rule 430B relating to an offering made pursuant to Rule 415(a)(1)(i), (vii), or (x) for the purpose of providing the information

required by section 10(a) of the Securities Act of 1933 shall be deemed to be part of and included in the registration statement

as of the earlier of the date such form of prospectus is first used after effectiveness or the date of the first contract of sale

of securities in the offering described in the prospectus. As provided in Rule 430B, for liability purposes of the issuer and any

person that is at that date an underwriter, such date shall be deemed to be a new effective date of the registration statement

relating to the securities in the registration statement to which that prospectus relates, and the offering of such securities

at that time shall be deemed to be the initial bona fide offering thereof. Provided, however, that no statement made in a registration

statement or prospectus that is part of the registration statement or made in a document incorporated or deemed incorporated by

reference into the registration statement or prospectus that is part of the registration statement will, as to a purchaser with

a time of contract of sale prior to such effective date, supersede or modify any statement that was made in the registration statement

or prospectus that was part of the registration statement or made in any such document immediately prior to such effective date;

(b) The registrant hereby undertakes that

for purposes of determining any liability under the Securities Act of 1933, each filing of the registrant’s annual report

pursuant to section 13(a) or section 15(d) of the Securities Exchange Act of 1934 (and, where applicable, each filing of an employee

benefit plan’s annual report pursuant to section 15(d) of the Securities Exchange Act of 1934) that is incorporated by reference

in the registration statement shall be deemed to be a new registration statement relating to the securities offered therein, and

the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof.

(i) The registrant

hereby undertakes that:

(1) For purposes

of determining any liability under the Securities Act, the information omitted from the form of prospectus filed as part of this

registration statement in reliance upon Rule 430A and contained in a form of prospectus filed by the registrant pursuant to Rule

424(b)(1) or (4) or 497(h) under the Securities Act shall be deemed to be part of this registration statement as of the time it

was declared effective.

(2) For the

purpose of determining any liability under the Securities Act, each post-effective amendment that contains a form of prospectus

shall be deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities

at that time shall be deemed to be the initial bona fide offering thereof.

Insofar as indemnification for liabilities

arising under the Securities Act of 1933 may be permitted to directors, officers and controlling persons of the registrant pursuant

to the foregoing provisions, or otherwise, the registrant has been advised that in the opinion of the Securities and Exchange Commission

such indemnification is against public policy as expressed in the Act and is, therefore, unenforceable. In the event that a claim

for indemnification against such liabilities (other than the payment by the registrant of expenses incurred or paid by a director,

officer or controlling person of the registrant in the successful defense of any action, suit or proceeding) is asserted by such

director, officer or controlling person in connection with the securities being registered, the registrant will, unless in the

opinion of its counsel the matter has been settled by controlling precedent, submit to a court of appropriate jurisdiction the

question whether such indemnification by it is against public policy as expressed in the Act and will be governed by the final

adjudication of such issue.

SIGNATURES

Pursuant to the requirements

of the Securities Act of 1933, the registrant certifies that it has reasonable grounds to believe that it meets all of the requirements

for filing on Form S-3 and has duly caused this registration statement to be signed on its behalf by the undersigned, thereunto

duly authorized, in the City of Englewood, State of Colorado, on June 26, 2019.

|

|

ZYNEX, INC.

|

|

|

|

|

|

|

By:

|

/s/ Thomas Sandgaard

|

|

|

|

Thomas Sandgaard

|

|

|

|

President and Chief Executive Officer (Principal Executive Officer)

|

|

|

By:

|

/s/ Daniel Moorhead

|

|

|

|

Daniel Moorhead

|

|

|

|

Chief Financial Officer (Principal Financial and Accounting Officer)

|

Each person whose

signature appears below constitutes and appoints Thomas Sandgaard and Daniel Moorhead, and each of them severally, as his true

and lawful attorney in fact and agent, with full powers of substitution and resubstitution, for him and in his name, place and

stead, in any and all capacities, to sign any or all amendments (including post effective amendments) to the Registration Statement,

and to sign any registration statement for the same offering covered by this Registration Statement that is to be effective upon

filing pursuant to Rule 462(b) under the Securities Act of 1933, as amended, and all post effective amendments thereto, and to

file the same, with all exhibits thereto, and all documents in connection therewith, with the Securities and Exchange Commission,

granting unto said attorney-in-fact and agent, each acting alone, full power and authority to do and perform each and every act

and thing requisite and necessary to be done in and about the premises, as fully to all intents and purposes as he or she might

or could do in person, hereby ratifying and confirming all that said attorney-in-fact and agent, each acting alone, or his or her

substitute or substitutes, may lawfully do or cause to be done by virtue hereof.

Pursuant to the requirements

of the Securities Act of 1933, this registration statement has been signed by the following persons in the capacities held on the

dates indicated.

|

/s/ Thomas Sandgaard

|

|

Chief Executive Officer, President and Chairman of the Board of Directors

|

|

|

|

Thomas Sandgaard

|

|

(Principal Executive Officer)

|

|

June 26, 2019

|

|

|

|

|

|

|

|

/s/ Daniel Moorhead

|

|

Chief Financial Officer

|

|

|

|

Daniel Moorhead

|

|

(Principal Financial and Accounting Officer)

|

|

June 26, 2019

|

|

|

|

|

|

|

|

/s/ Barry D. Michaels

|

|

|

|

|

|

Barry D. Michaels

|

|

Director

|

|

June 26, 2019

|

|

|

|

|

|

|

|

/s/ Michael Cress

|

|

|

|

|

|

Michael Cress

|

|

Director

|

|

June 26, 2019

|

|

|

|

|

|

|

|

/s/ Joshua R. Disbrow

|

|

|

|

|

|

Joshua R. Disbrow

|

|

Director

|

|

June 26, 2019

|

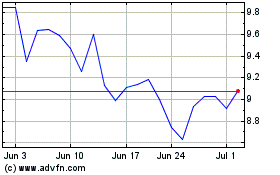

Zynex (NASDAQ:ZYXI)

Historical Stock Chart

From Mar 2024 to Apr 2024

Zynex (NASDAQ:ZYXI)

Historical Stock Chart

From Apr 2023 to Apr 2024