false

0001425287

0001425287

2024-12-16

2024-12-16

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF

THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported):

December 16, 2024

WORKHORSE GROUP INC.

(Exact name of registrant as specified in its charter)

| Nevada |

|

001-37673 |

|

26-1394771 |

| (State or Other Jurisdiction of Incorporation) |

|

(Commission

File Number) |

|

(IRS

Employer

Identification Number) |

3600 Park 42 Drive, Suite 160E, Sharonville, Ohio

45241

(Address of principal executive offices) (zip code)

1 (888) 646-5205

(Registrant’s telephone number, including

area code)

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General

Instruction A.2. below):

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the

Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Securities registered pursuant to Section 12(b)

of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| Common Stock, $0.001 par value per share |

|

WKHS |

|

The Nasdaq Capital Market |

Item 1.01.

Entry into a Material Definitive Agreement.

Securities

Purchase Agreement

As

previously disclosed, on March 15, 2024, Workhorse Group Inc. (the “Company”) entered into a securities purchase agreement

(the “Securities Purchase Agreement”) with an institutional investor (the “Investor”) under which the Company

agreed to issue and sell, in one or more registered public offerings by the Company directly to the Investor, (i) senior secured convertible

notes for up to an aggregate principal amount of $139,000,000 (the “Notes”) that will be convertible into shares of the Company’s

common stock, par value of $0.001 per share (the “Common Stock”) and (ii) warrants (the “Warrants”) to purchase

shares of Common Stock in multiple tranches over a period beginning on March 15, 2024. Pursuant to the Securities Purchase Agreement,

on December 16, 2024 (the “Closing Date”), the Company issued and sold to the Investor a Note in the original principal amount

of $3,500,000 (the “Eighth Additional Note”). The Investor has waived its right to receive Warrants in connection with the

issuance of the Eighth Additional Note. Refer to the Company’s Current Report on Form 8-K filed on March 15, 2024 for additional

information related to the Securities Purchase Agreement, the Notes, and the Warrants. The Eighth Additional Note was issued pursuant

to the Company’s Indenture between the Company and U.S. Bank Trust Company, National Association, as trustee (the “Trustee”),

dated December 27, 2023 (the “Base Indenture”), and a Tenth Supplemental Indenture, dated December 16, 2024, entered into

between the Company and the Trustee (together with the Base Indenture, the “Indenture”).

As previously disclosed,

the Company has issued and sold to the Investor (i) Notes in aggregate original principal amount of $35,485,714 (the “Prior Notes”)

and (ii) Warrants to purchase up to 15,640,900 shares of Common Stock (the “Prior Warrants”) pursuant to the Securities Purchase

Agreement (following adjustment in connection with the Company’s 1-for-20 reverse stock split, which became effective on June 17,

2024). As of December 15, 2024, $5,600,000 aggregate principal amount remained outstanding under the Notes, and no shares had been issued

pursuant to the Warrants. Upon our filing of one or more additional prospectus supplements, and our satisfaction of certain other conditions,

the Securities Purchase Agreement contemplates additional closings of up to $100,014,286 in aggregate principal amount of additional Notes

and a corresponding Warrant pursuant to the Securities Purchase Agreement as further described in our Current Report on Form 8-K filed

on March 15, 2024. The description of the Securities Purchase Agreement, form of Note, form of Warrant, Indenture, Security Agreement

and Subsidiary Guarantee contained therein is hereby incorporated by reference herein in its entirety.

No Note may be converted

and no Warrant may be exercised to the extent that such conversion or exercise would cause the then holder of such Note or Warrant to

become the beneficial owner of more than 9.99% of the Company’s then outstanding Common Stock, after giving effect to such conversion

or exercise (the “Beneficial Ownership Cap”).

Notes

Like

the Prior Notes, the Eighth Additional Note was issued with original issue discount of 12.5%, resulting in $3,062,500 of proceeds to the

Company before fees and expenses. The Eighth Additional Note is a senior, secured obligation of the Company, ranking senior to

all other unsecured indebtedness, subject to certain limitations and is unconditionally guaranteed by each of the Company’s subsidiaries,

pursuant to the terms of a certain security agreement and subsidiary guarantee.

Like the Prior Notes,

the Eighth Additional Note bears interest at a rate of 9.0% per annum, payable in arrears on the first trading day of each calendar quarter,

at the Company’s option, either in cash or in-kind by compounding and becoming additional principal. Upon the occurrence and during

the continuance of an event of default, the interest rate will increase to 18.0% per annum. Unless earlier converted or redeemed, the

Eighth Additional Note will mature on the one-year anniversary of the date hereof, subject to extension at the option of the holders in

certain circumstances as provided in the Eighth Additional Note.

Like the Prior Notes,

all amounts due under the Eighth Additional Note are convertible at any time, in whole or in part, and subject to the Beneficial Ownership

Cap, at the option of the holders into shares of Common Stock at a conversion price equal to the lower of $0.5983 (the “Reference

Price”) or (b) the greater of (x) $0.20 (the “Floor Price”) and (y) 87.5% of the volume weighted average price of the

Common Stock during the ten trading days ending and including the trading day immediately preceding the delivery or deemed delivery of

the applicable conversion notice, as elected by the converting holder. The Reference Price and Floor Price are subject to customary adjustments

upon any stock split, stock dividend, stock combination, recapitalization or similar event. The Reference Price is also subject to full-ratchet

adjustment in connection with a subsequent offering at a per share price less than the Reference Price then in effect. Subject to the

rules and regulations of Nasdaq, we have the right, at any time, with the written consent of the Investor, to lower the reference price

to any amount and for any period of time deemed appropriate by our board of directors. Upon the satisfaction of certain conditions, we

may prepay the Eighth Additional Note upon 15 business days’ written notice by paying an amount equal to the greater of (i) the

face value of the Eighth Additional Note at premium of 25% (or 75% premium, during the occurrence and continuance of an event of default,

or in the event certain redemption conditions are not satisfied) and (ii) the equity value of the shares of Common Stock underlying the

Eighth Additional Note. The equity value of the Common Stock underlying the Eighth Additional Note is calculated using the two greatest

volume weighted average prices of our Common Stock during the period immediately preceding the date of such redemption and ending on the

date we make the required payment.

Like the Prior Notes,

the Eighth Additional Note contains customary affirmative and negative covenants, including certain limitations on debt, liens, restricted

payments, asset transfers, changes in the business and transactions with affiliates. It also requires the Company to maintain minimum

liquidity on the last day of each fiscal quarter in the amount of either (i) $1,500,000 if the sale leaseback transaction of Company’s

manufacturing facility in Union City, Indiana (the “Sale Leaseback”) has not been consummated and (ii) $4,000,000 if the Sale

Leaseback has been consummated, subject to certain conditions. The Eighth Additional Note also contains customary events of default.

The Company and the Investor

previously entered into a limited waiver (the “Waiver”) of certain provisions of the Securities Purchase Agreement. Pursuant

to the Waiver: (i) the Investor has waived its right to receive Warrants in connection with the issuance and sale, if any, of additional

Notes in the aggregate principal amount of up to $16.0 million, of which $9.3 million remains following the issuance of the Eighth Additional

Note, (ii) for the period commencing on the Closing Date and ending on and including October 16, 2025, the Investor waived certain provisions

of the Securities Purchase Agreement to permit the Company to sell up to $5 million in shares of Common Stock pursuant to an at-the-market

offering program without a price floor and without application of certain anti-dilution and participation provisions in the Notes and

the Warrants, and (iii) the Company waived the obligation of an affiliate of the Investor to make certain ongoing lease payments under

the asset purchase agreement pursuant to which the Company divested from its aero business.

Under certain circumstances,

including a change of control, the holder may cause us to redeem all or a portion of the then-outstanding amount of principal and interest

on the Eighth Additional Note in cash at the greater of (i) the face value of the amount of the Eighth Additional Note to be redeemed

at a 25% premium (or at a 75% premium, if certain redemption conditions are not satisfied or during the occurrence and continuance of

an event of default), (ii) the equity value of our Common Stock underlying such amount of the Eighth Additional Note to be redeemed and

(iii) the equity value of the change of control consideration payable to the holder of our Common Stock underlying the Eighth Additional

Note.

In addition, during an

event of default, the holder may require us to redeem in cash all, or any portion, of the Eighth Additional Note at the greater of (i)

the face value of our Common Stock underlying the Eighth Additional Note at a 75% premium and (ii) the equity value of our Common Stock

underlying the Eighth Additional Note. In addition, during a bankruptcy event of default, we shall immediately redeem in cash all amounts

due under the Eighth Additional Note at a 75% premium unless the holder of the Eighth Additional Note waives such right to receive payment.

Further, upon the sale of certain assets, the holder may cause a redemption at a premium, including upon consummation of the Sale Leaseback

if the redemption conditions are not satisfied. The Eighth Additional Note also provides for purchase and participation rights in the

event of a dividend or other purchase right being granted to the holders of Common Stock.

The

issuance of the Eighth Additional Note and the shares of Common Stock issuable upon conversion have been registered pursuant to the Company’s

effective shelf registration statement on Form S-3 (File No. 333-273357) (the “Registration Statement”), and the related base

prospectus included in the Registration Statement, as further supplemented by a prospectus supplement filed on December 16, 2024.

The

description of the terms and conditions of the Securities Purchase Agreement, the Notes, the Warrants and the Base Indenture do not purport

to be complete and is qualified in its entirety by the full text of Securities Purchase Agreement, the Notes, the Warrants and the Base

Indenture, which are filed as exhibits to the Company’s Current Report on Form 8-K filed on March 15, 2024.

Item

2.03 Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant.

The

information set forth under Item 1.01 of this Current Report on Form 8-K is hereby incorporated by reference in its entirety.

Forward-Looking Statements

Certain

statements in this Current Report on Form 8-K are forward-looking statements that involve a number of risks and uncertainties. For such

statements, the Company claims the protection of the Private Securities Litigation Reform Act of 1995. Actual events or results may differ

materially from the Company’s expectations. Additional factors that could cause actual results to differ materially from those stated

or implied by the Company’s forward-looking statements are disclosed in the Company’s reports filed with the Securities and

Exchange Commission.

Item 9.01. Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

WORKHORSE GROUP INC. |

| |

|

| Date: December 16, 2024 |

By: |

/s/ James D. Harrington |

| |

Name: |

James D. Harrington |

| |

Title: |

General Counsel, Chief Compliance Officer and Secretary |

4

Exhibit

10.1

WORKHORSE

GROUP INC.

TO

TENTH

SUPPLEMENTAL INDENTURE TO

INDENTURE DATED DECEMBER 27, 2023

Dated

as of December 16, 2024

U.S.

BANK TRUST COMPANY, NATIONAL ASSOCIATION,

as Trustee

Series

A-10 Senior Secured Convertible Note Due 2025

WORKHORSE

GROUP INC.

TENTH

SUPPLEMENTAL INDENTURE TO

INDENTURE DATED DECEMBER 27, 2023

Series

A-10 Senior Convertible Note Due 2025

TENTH

SUPPLEMENTAL INDENTURE, dated as of December 16, 2024 (this “Tenth Supplemental Indenture”), between WORKHORSE

GROUP INC., a Nevada corporation (the “Company”), and U.S. BANK TRUST COMPANY, NATIONAL ASSOCIATION, as

Trustee (the “Trustee”).

RECITALS

A.

The Company filed a registration statement on Form S-3 on July 20, 2023 (File Number 333-273357) (the “Registration Statement”)

with the Securities and Exchange Commission (the “SEC”) pursuant to Rule 415 under the Securities Act of 1933, as

amended (the “Securities Act”) and the Registration Statement has been declared effective by the SEC on July 28, 2023.

B.

The Company has heretofore executed and delivered to the Trustee an Indenture, dated as of December 27, 2023, substantially in the form

filed as an exhibit to the Registration Statement (the “Base Indenture”), the Supplemental Indenture, dated as of

December 27, 2023 (the “First Supplemental Indenture”), the Second Supplemental Indenture, dated as of March 15, 2024

(the “Second Supplemental Indenture”), the Third Supplemental Indenture, dated as of May 10, 2024 (the “Third

Supplemental Indenture”), the Fourth Supplemental Indenture, dated as of May 29, 2024 (the “Fourth Supplemental Indenture”),

the Fifth Supplemental Indenture, dated as of July 18, 2024 (the “Fifth Supplemental Indenture”), the Sixth Supplemental

Indenture, dated as of August 23, 2024 (the “Sixth Supplemental Indenture”), the Seventh Supplemental Indenture, dated

as of September 30, 2024 (the “Seventh Supplemental Indenture”), the Eighth Supplemental Indenture, dated as of October

16, 2024 (the “Eighth Supplemental Indenture”), and the Ninth Supplemental Indenture, dated as of November 27, 2024

(the “Ninth Supplemental Indenture”, and collectively with the Base Indenture, the First Supplemental Indenture, the

Second Supplemental Indenture, the Third Supplemental Indenture, the Fourth Supplemental Indenture, the Fifth Supplemental Indenture,

the Sixth Supplemental Indenture, the Seventh Supplemental Indenture, and the Eighth Supplemental Indenture, the “Indenture”),

providing for the issuance from time to time of Securities (as defined in the Indenture) by the Company.

C.

The Indenture has been qualified under the Trust Indenture Act of 1939, as amended (the “Trust Indenture Act”).

D.

Section 2 of the Indenture provides for various matters with respect to any series of Securities issued under the Indenture to be established

in an indenture supplemental to the Indenture.

E.

Section 9.01 of the Indenture provides that, without the consent of the Holders, the Company and the Trustee may enter into an indenture

supplemental to the Indenture to establish the form or terms of Securities of any series as provided by Section 2 of the Indenture.

F.

In accordance with that certain Securities Purchase Agreement, dated March 15, 2024 (the “Securities Purchase Agreement”),

by and among the Company and the investors party thereto (the “Investors”), at the applicable Closing (as defined

in the Securities Purchase Agreement) related to this Tenth Supplemental Indenture, the Company has agreed to sell to the Investors,

and the Investors have agreed to purchase from the Company, up to $3,500,000 in aggregate principal amount of Notes (in one or more tranches,

in accordance with the terms of the Securities Purchase Agreement), subject to the satisfaction of certain terms and conditions set forth

in the Securities Purchase Agreement, in each case, pursuant to (i) the Indenture, (ii) this Tenth Supplemental Indenture, (iii) the

Securities Purchase Agreement, (iv) the Security Agreement (defined below), (v) Subsidiary Guarantee (defined below) and (vi) the Registration

Statement.

G.

In connection with the Securities Purchase Agreement, the Company and each other Grantor (as defined in the Security Agreement) (together

with the Company, each a “Grantor”, and collectively, the “Grantors”) and the Agent (as defined

below), have entered into that certain Security Agreement, dated as of March 15, 2024, (as it may be amended, restated, amended and restated,

supplemented or otherwise modified from time to time, the “Security Agreement”), pursuant to which each Grantor granted

a first priority security interest in such Grantor’s right, title and interest in the Collateral (as defined in the Security Agreement)

to Horsepower Management LLC, as collateral agent for the Investors (in such capacity, the “Agent”), to secure all

obligations owed to the Agent and the Investors under the Transaction Documents (as defined in the Securities Purchase Agreement).

H.

In connection with the Securities Purchase Agreement, that certain Mortgage, Assignment of Leases and Rents, Security Agreement and Fixture

Filing dated as of March 15, 2024 (as it may be amended, restated, amended and restated, supplemented or otherwise modified from time

to time, the “Mortgage”) was made by Workhorse Motor Works Inc. in favor of the Agent, to secure all obligations owed

to the Agent and the Investors under the Transaction Documents (as defined in the Securities Purchase Agreement).

I.

In connection with the Securities Purchase Agreement, certain affiliates and subsidiaries of the Company (each, a “Guarantor”,

and collectively, the “Guarantors”), have entered into that certain Subsidiary Guarantee, dated as of March 15, 2024,

(as it may be amended, restated, amended and restated, supplemented or otherwise modified from time to time, the “Subsidiary

Guarantee”), pursuant to which each Guarantor has guaranteed the obligations owed to the Agent and the Investors under the

Transaction Documents (as defined in the Securities Purchase Agreement).

J.

The Company hereby desires to supplement the Indenture pursuant to this Tenth Supplemental Indenture to set forth the terms and conditions

of the Notes to be issued in accordance herewith.

NOW,

THEREFORE, THIS TENTH SUPPLEMENTAL INDENTURE WITNESSETH, for and in consideration of the premises and the issuance of the series of Securities

provided for herein, it is mutually agreed, for the equal and proportionate benefit of all Holders of the Securities of such series,

as follows:

ARTICLE

I

Relation

to Indenture; Definitions

Section

1.1. RELATION TO INDENTURE. This Tenth Supplemental Indenture constitutes an integral part of the Indenture.

Section

1.2. DEFINITIONS. For all purposes of this Tenth Supplemental Indenture:

(a)

Capitalized terms used herein without definition shall have the meanings specified in the Indenture or in the Notes, as applicable;

(b)

All references herein to Articles and Sections, unless otherwise specified, refer to the corresponding Articles and Sections of this

Tenth Supplemental Indenture; and

(c)

The terms “herein,” “hereof,” “hereunder” and other words of similar import refer to this Tenth Supplemental

Indenture.

ARTICLE

II

The

Series of Securities

Section

2.1. TITLE. There shall be a series of Securities designated the “Series A-10 Senior Secured Convertible Notes Due 2025”

(the “Notes”).

Section

2.2. LIMITATION ON AGGREGATE PRINCIPAL AMOUNT. The aggregate principal amount of the Notes to be sold pursuant to the Securities Purchase

Agreement and to be issued pursuant to this Tenth Supplemental Indenture on the date hereof shall be $3,500,000.

Section

2.3. PRINCIPAL PAYMENT DATE. The principal amount of the Notes outstanding (together with any accrued and unpaid interest and other amounts)

shall be payable in accordance with the terms and conditions set forth in the Notes on each Conversion Date, Alternate Conversion Date,

redemption date and on the Maturity Date, in each case as defined in the Notes.

Section

2.4. INTEREST AND INTEREST RATES. Interest shall accrue and shall be payable at such times and in the manner set forth in the Notes.

Section

2.5. PLACE OF PAYMENT. Except as otherwise provided by the Notes, the place of payment where the Notes may be presented or surrendered

for payment, where the Notes may be surrendered for registration of transfer or exchange (to the extent required or permitted, as applicable,

by the terms of the Notes) and where notices and demand to or upon the Trustee in respect of the Notes and the Indenture may be served

shall be: U.S. Bank Trust Company, National Association, CN-OH-W6CT; 425 Walnut Street, Cincinnati, OH 45202, Attn.: Corporate Trust

- Workhorse Group Inc.; Telephone: (513) 632-2077; Email: Daniel.Boyers@usbank.com.

Section

2.6. REDEMPTION. The Company may redeem the Notes, in whole or in part, at such times and in the manner set forth in the Notes.

Section

2.7. DENOMINATION. The Notes shall be issuable only in registered form without coupons and in minimum denominations of $1,000 and integral

multiples in excess thereof.

Section

2.8. CURRENCY. Principal and interest and any other amounts payable, from time to time, on the Notes shall be payable in such coin or

currency of the United States of America that at the time of payment is legal tender for payment of public and private debts in accordance

with Section 26(b) of the Notes.

Section

2.9. FORM OF SECURITIES. The Notes shall be issued in the form attached hereto as Exhibit A. Exhibit A also

includes the form of Trustee’s certificate of authentication for the Notes. The Company has elected to issue only definitive Securities

and shall not issue any global Securities hereunder.

Section

2.10. CONVERTIBLE SECURITIES. The Notes are convertible into shares of Common Stock (as defined in the Notes) of the Company upon the

terms and conditions set forth in the Notes and all references to “Common Stock” in the Indenture shall be deemed to be references

to Common Stock for all purposes thereunder. In connection with any conversion of any given Note into Common Stock, the Trustee may rely

conclusively, without any independent investigation, on any Conversion Notice (as defined in the Notes) executed by the applicable Holder

of such Note and an Acknowledgement (as defined in the Notes) signed by the Company (in each case, in the forms attached as Exhibits

I and II to the Note), in lieu of the Company’s obligations to deliver an Officer’s Certificate, Board Resolution or an Opinion

of Counsel pursuant to Article Two, Article Three, Section 7.02 or Section 7.07 of the Indenture in connection with any conversion of

any Note. The applicable Conversion Notice and/or Acknowledgement (unless subsequently revoked or withdrawn) shall be deemed to be a

joint instruction by the Company and such Holder to the Trustee to record on the register of the Notes such conversion and decrease in

the principal amount of such Note by such aggregate principal amount of the Note converted, in each case, as set forth in such applicable

Conversion Notice and/or Acknowledgement.

Section

2.11. REGISTRAR. The Trustee shall only serve initially as the Security Registrar and not as a paying agent and, in such capacity, shall

maintain a register (the “Security Register”) in which the Trustee shall register the Notes and transfers of the Notes.

The entries in the Security Register shall be conclusive and binding for all purposes absent manifest error. The initial Security Register

shall be created by the Trustee in connection with the authentication of the initial Notes in the names and amounts detailed in the related

Company Order. No Note may be transferred or exchanged except in compliance with the authentication procedures of the Trustee in accordance

with this Tenth Supplemental Indenture. The Trustee shall not register a transfer, exchange, redemption, conversion, cancellation or

any other action with respect to a Note unless instructed to do so in an Officer’s Certificate, the Company’s order for the

authentication and delivery of such Note, Conversion Notice and/or Acknowledgement, as applicable. Each Officer’s Certificate,

Company’s order for the authentication and delivery of such Note, Conversion Notice and/or Acknowledgement, as applicable,

given to the Trustee in accordance with this Section 2.11 shall constitute a representation and warranty to the Trustee that the Trustee

shall be fully indemnified in connection with any liability arising out of or related to any action taken by the Trustee in good faith

reliance on such Officer’s Certificate, Company’s order for the authentication and delivery of such Note, Conversion

Notice and/or Acknowledgement, as applicable.

Section

2.12. SINKING FUND OBLIGATIONS. The Company has no obligation to redeem or purchase any Notes pursuant to any sinking fund or analogous

requirement or upon the happening of a specified event or at the option of a Holder thereof.

Section

2.13. NO PAYING AGENT. Notwithstanding anything in Sections 3.02 or 4.03 of the Indenture to the contrary, the Company shall not be required

to appoint and has not appointed any Paying Agent in respect of the Notes pursuant to the Indenture or any Supplemental Indenture and

all amounts payable, from time to time, pursuant to the Notes shall, for so long as so long as no Paying Agent has been appointed, be

paid directly by the Company to the applicable Holder. Unless or until notified otherwise, the Trustee may conclude all payments have

been made when due including principal at maturity. The Company shall provide notification to the Trustee otherwise including any changes

in principal prior to maturity in order for the Trustee to maintain accurate records as Security Register.

Section

2.14. EVENTS OF DEFAULT. The Company has elected that the provisions of Section 4 of the Notes shall govern all Events of Default in

lieu of Section 6 of the Indenture.

Section

2.15.EXCLUDED DEFINITIONS. The Company has elected that none of the following definitions in the Indenture shall be applicable to the

Notes and any analogous definitions set forth in the Notes shall govern in lieu thereof:

| ● | Definition

of “Business Day” in Section 1.01; |

| ● | Definition

of “Event of Default” in Sections 1.01 or 6.01; |

| ● | Definition

of “Person” in Section 1.01; and |

| ● | Definition

of “Subsidiary” in Section 1.01. |

Section

2.16. EXCLUDED PROVISIONS. The Company has elected that none of the following provisions of the Indenture shall be applicable to the

Notes and any analogous provisions (including definitions related thereto) of this Tenth Supplemental Indenture and/or the Notes

shall govern in lieu thereof:

| ● | Section

2.03 (Denominations; Provisions for Payment) |

| ● | Section

2.05 (Registration of Transfer and Exchange) |

| ● | Section

2.06 (Temporary Securities) |

| ● | Section

2.07 (Mutilated, Destroyed, Lost or Stolen Securities) |

| ● | Section

2.10 (Authenticating Agent) |

| ● | Section

2.11 (Global Securities) |

| ● | Section

4.03 (Paying Agents) |

| ● | Article

6 (Remedies of the Trustee and Securityholders on Event of Default) |

| ● | Section

9.01 (Without Consent of Holders) |

| ● | Article

10 (Successor Entity) |

| ● | Article

11 (Satisfaction and Discharge) |

| ● | Article

12 (Immunity of Incorporators, Stockholders, Officers and Directors) |

| ● | Section

13.05 (Governing Law; Jury Trial Waiver) |

Section

2.17. COVENANTS. In addition to any covenants set forth in Article 4 of the Indenture, the Company shall comply with the additional covenants

set forth in Section 15 of the Notes.

Section

2.18. IMMEDIATELY AVAILABLE FUNDS. All cash payments of principal and interest shall be made in U.S. dollars and immediately available

funds.

Section

2.19. TRUSTEE MATTERS.

(a)

Duties of Trustee. Notwithstanding anything in the Indenture to the contrary:

(i)

the sole duty of the Trustee is to act as the Security Registrar unless otherwise agreed to by Horsepower Opportunities LLC (the “Required

Holder”), the Trustee and the Company in an additional supplemental Indenture (other than this Tenth Supplemental Indenture)

or as separately agreed to in a writing by the Trustee and the Required Holder;

(ii)

the rights, privileges, protections, immunities and benefits given to the Trustee, including, without limitation, its right to be indemnified,

are extended to, and shall be enforceable by, the Trustee in each of its capacities hereunder (including as Security Registrar), and

to each agent, custodian, and any other such Persons employed to act hereunder;

(iii)

the Trustee has no duty to make any calculations called for under the Notes, and shall be protected in conclusively relying without liability

upon an Officer’s Certificate with respect thereto without independent verification;

(iv)

for the protection and enforcement of the provisions of the Indenture, this Tenth Supplemental Indenture and the Notes, the Trustee shall

be entitled to such relief as can be given at either law or equity;

(v)

in the event that the Holders of the Notes have waived any Event of Default with respect to this Tenth Supplemental Indenture or the

Notes, the default covered thereby shall be deemed to be cured for all purposes hereunder and the Company, the Trustee and the Holders

of the Notes shall be restored to their former positions and rights hereunder, respectively, but no such waiver shall extend to any subsequent

or other default to impair any right consequent thereon;

(vi)

the Trustee makes no representation as to the validity or value of any securities or assets issued upon conversion of the Notes, and

the Trustee shall not be responsible for the failure by the Company to comply with any provisions of the Notes;

(vii)

the Trustee will not at any time be under any duty or responsibility to any Holder to determine the Conversion Price (as defined in the

Notes) (or any adjustment thereto) or whether any facts exist that may require any adjustment to the Conversion Price, or with respect

to the nature or extent or calculation of any such adjustment when made, or with respect to the method employed in the Indenture, this

Tenth Supplemental Indenture, in any supplemental indenture or the Notes provided to be employed, in making the same;

(viii)

the Trustee will not be accountable with respect to the validity or value (or the kind or amount) of any shares of Common Stock, or of

any securities, cash or other property that may at any time be issued or delivered upon the conversion of any Note; and the Trustee makes

any representations with respect thereto; and

(ix)

the Trustee will not be responsible for any failure of the Company to issue, transfer or deliver any shares of Common Stock or stock

certificates or other securities, cash or other property upon the surrender of any Note for the purpose of conversion or to comply with

any of the duties, responsibilities or covenants of the Company with respect thereto.

(b)

Additional Indemnification. In addition to any indemnification rights set forth in the Indenture, the Company agrees the Trustee

may retain one separate counsel on behalf of itself and the Holders (and in the case of an actual or perceived conflict of interest,

one additional separate counsel on behalf of the Holders) and, if deemed advisable by such counsel, local counsel, and the Company shall

pay the reasonable fees and expenses of such separate counsel and local counsel.

(c)

Successor Trustee Petition Right. If an instrument of acceptance by a successor Trustee required by Section 7.08 or 7.09 of the

Indenture has not been delivered to the Trustee within 30 days after the giving of a notice of removal, the Trustee being removed, at

the expense of the Company, may petition any court of competent jurisdiction for the appointment of a successor Trustee with respect

to the Securities of such series.

(d)

Trustee as Creditor. If and when the Trustee shall be or become a creditor of the Company (or any other obligor upon the Securities),

the Trustee shall be subject to the provisions of the Trust Indenture Act regarding the collection of claims against the Company (or

any such other obligor).

(e)

Reports by the Company. The parties hereto acknowledge and agree that delivery of such reports, information, and documents to

the Trustee pursuant to the provisions of Section 4.05 of the Indenture is for informational purposes only and the Trustee’s receipt

of such shall not constitute actual or constructive knowledge or notice of any information contained therein or determinable from information

contained therein, including the Company’s compliance with any of its covenants hereunder (as to which the Trustee is entitled

to rely exclusively on Officer’s Certificates). The Trustee shall have no duty to monitor or confirm, on a continuing basis or

otherwise, the Company’s or any other Person’s compliance with any of the covenants under the Indenture and this Tenth Supplemental

Indenture, to determine whether such reports, information or documents are available on the SEC’s website (including the EDGAR

system or any successor system,) the Company’s website or otherwise, to examine such reports, information, documents and other

reports to ensure compliance with the provisions of this Indenture, or to ascertain the correctness or otherwise of the information or

the statements contained therein.

(f)

Statements by Officers as to Default. In addition to the Company’s obligations pursuant to the Indenture, the Company agrees

as follows:

(i)

Annually, within 120 days after the close of each fiscal year beginning with the first fiscal year during which the Notes remain outstanding,

the Company will deliver to the Trustee an Officer’s Certificate (one of which Officers signatory thereto shall be the Chief Executive

Officer, Chief Financial Officer or Chief Corporate and Strategy Officer of the Company) as to the knowledge of such Officers of the

Company’s compliance (without regard to any period of grace or requirement of notice provided herein) with all conditions and covenants

under the Indenture, this First Supplemental Indenture and the Notes and, if any Event of Default has occurred and is continuing, specifying

all such Events of Defaults and the nature and status thereof of which such Officers have knowledge.

(ii)

The Company shall, so long as any of the Notes remain outstanding, deliver to the Trustee, as soon as practicable and in any event within

30 days after the Company becomes aware of any Event of Default, an Officer’s Certificate specifying such Events of Default, its

status and the actions that the Company is taking or proposes to take in respect thereof.

(g)

Further Instruments and Acts. Upon request of the Trustee, the Company will execute and deliver such further instruments and perform

such further acts as may be reasonably necessary or proper to carry out more effectively the purposes of the Indenture and this Tenth

Supplemental Indenture.

(h)

Expense. Notwithstanding anything in the Indenture to the contrary, any actions taken by the Trustee in any capacity shall be

at the Company’s reasonable expense.

Section

2.20. SATISFACTION; DISCHARGE. The Indenture and this Tenth Supplemental Indenture will be discharged and will cease to be of further

effect with respect to the Notes (except as to any surviving rights expressly provided for herein and in the Transaction Documents (as

defined in the Securities Purchase Agreement)), and the Trustee, at the expense of the Company, shall execute proper instruments acknowledging

satisfaction and discharge of the Indenture and this Tenth Supplemental Indenture with respect to the Notes, when all outstanding amounts

under the Notes shall have been paid in full (and/or converted into shares of Common Stock or other securities in accordance therewith)

and no other obligations remain outstanding pursuant to the terms of the Notes, this Tenth Supplemental Indenture, the Indenture and/or

the other Transaction Documents, as applicable, which have not been paid in full by the Company, and when the Company has delivered to

the Trustee an Officer’s Certificate and an Opinion of Counsel, each stating that all conditions precedent herein provided for

relating to the satisfaction and discharge of the Indenture and this Tenth Supplemental Indenture with respect to the Notes have been

complied with. Notwithstanding the satisfaction and discharge of the Indenture and this Tenth Supplemental Indenture, the obligations

of the Company to the Trustee under Section 7.06 of the Indenture shall survive.

Section

2.21. CONTROL BY SECURITYHOLDERS. The Required Holder shall have the right to direct the time, method and place of conducting any proceeding

for any remedy available to the Trustee, or exercising any trust or power conferred on the Trustee with respect to the Notes; provided,

however, that such direction shall not be in conflict with any rule of law. Subject to the provisions of Section 7.01 of the Indenture

and this Tenth Supplemental Indenture, the Trustee shall have the right to decline to follow any such direction if the Trustee in good

faith shall determine that the proceeding so directed would involve the Trustee in personal liability. The Notes may be amended, modified

or waived, as applicable, in accordance with Section 18 of the Notes. Upon any waiver of any term of the Notes, the default covered thereby

shall be deemed to be cured for all purposes of the Indenture, this Tenth Supplemental Indenture, the Notes and the Company, the Trustee

and the Holders of the Notes shall be restored to their former positions and rights hereunder, respectively; but no such waiver shall

extend to any subsequent or other default or impair any right consequent thereon.

ARTICLE

III

Expenses

Section

3.1. PAYMENT OF EXPENSES. In connection with the offering, sale and issuance of the Notes, the Company, in its capacity as issuer of

the Notes, shall pay all reasonable, documented out-of-pocket costs and expenses relating to the offering, sale and issuance of the Notes

and compensation and expenses of the Trustee under the Indenture in accordance with the provisions of Section 7.06 of the Indenture.

Section

3.2. PAYMENT UPON RESIGNATION OR REMOVAL. Upon termination of this Tenth Supplemental Indenture or the Indenture or the removal or resignation

of the Trustee, unless otherwise stated, the Company shall pay to the Trustee all reasonable, documented out-of-pocket amounts, fees

and expenses (including reasonable attorney’s fees and expenses) accrued to the date of such termination, removal or resignation.

ARTICLE

IV

Miscellaneous

Provisions

Section

4.1. TRUSTEE NOT RESPONSIBLE FOR RECITALS. The recitals herein contained are made by the Company and not by the Trustee, and the Trustee

assumes no responsibility for the correctness thereof. The Trustee makes no representation as to the validity or sufficiency of this

Tenth Supplemental Indenture.

Section

4.2. ADOPTION, RATIFICATION AND CONFIRMATION. The Indenture, as supplemented and amended by this Tenth Supplemental Indenture, is in

all respects hereby adopted, ratified and confirmed.

Section

4.3. CONFLICT WITH INDENTURE; TRUST INDENTURE ACT. Notwithstanding anything to the contrary in the Indenture, if any conflict arises

between the terms and conditions of this Tenth Supplemental Indenture (including, without limitation, the terms and conditions of the

Notes) and the Indenture, the terms and conditions of this Tenth Supplemental Indenture (including the Notes) shall control; provided,

however, that if any provision of this Tenth Supplemental Indenture or the Notes limits, qualifies or conflicts with a provision of the

Trust Indenture Act that is required thereunder to be a part of and govern this Tenth Supplemental Indenture, the latter provisions shall

control. If any provision of this Tenth Supplemental Indenture modifies or excludes any provision of the Trust Indenture Act that may

be so modified or excluded, the latter provisions shall be deemed to apply to the Indenture as so modified or excluded, as the case may

be.

Section

4.4. AMENDMENTS; WAIVER. This Tenth Supplemental Indenture may be amended by the written consent of the Company and the Required Holder;

provided however, no amendment shall adversely impact the rights, duties, immunities or liabilities of the Trustee without its prior

written consent. Notwithstanding anything in any other Transaction Document to the contrary, no amendment to any Transaction Document

that adversely impact the rights, duties, immunities or liabilities of the Trustee hereunder, pursuant to the Indenture and/or the Notes,

as applicable, shall be effective without the Trustee’s prior written consent. No provision hereof may be waived other than by

an instrument in writing signed by the party against whom enforcement is sought.

Section

4.5. SUCCESSORS. This Tenth Supplemental Indenture shall be binding upon and inure to the benefit of the parties and their respective

successors and assigns, including any purchasers of the Notes.

Section

4.6. SEVERABILITY; ENTIRE AGREEMENT. If any provision of this Tenth Supplemental Indenture shall be invalid or unenforceable in any jurisdiction,

such invalidity or unenforceability shall not affect the validity or enforceability of the remainder of this Tenth Supplemental Indenture

in that jurisdiction or the validity or enforceability of any provision of this Tenth Supplemental Indenture in any other jurisdiction.

The Indenture, this Tenth Supplemental Indenture, the Transaction Documents and the exhibits hereto and thereto set forth the entire

agreement and understanding of the parties related to this transaction and supersedes all prior agreements and understandings, oral or

written.

Section

4.7. COUNTERPARTS. This Tenth Supplemental Indenture may be executed in any number of counterparts, each of which shall be an original,

but such counterparts shall together constitute but one and the same instrument.

Section

4.8. GOVERNING LAW. This Tenth Supplemental Indenture and the Indenture shall each be construed and enforced in accordance with, and

all questions concerning the construction, validity, interpretation and performance of this Note shall be governed by, the internal laws

of the State of Delaware, without giving effect to any choice of law or conflict of law provision or rule (whether of the State of Delaware

or any other jurisdictions) that would cause the application of the laws of any jurisdictions other than the State of Delaware. Except

as otherwise required by Section 25 of the Notes, the Company hereby irrevocably submits to the exclusive jurisdiction of the Court of

Chancery of the State of Delaware, for the adjudication of any dispute hereunder or in connection herewith or with any transaction contemplated

hereby or discussed herein, and hereby irrevocably waives, and agrees not to assert in any suit, action or proceeding, any claim that

it is not personally subject to the jurisdiction of any such court, that such suit, action or proceeding is brought in an inconvenient

forum or that the venue of such suit, action or proceeding is improper. Nothing contained herein shall be deemed to limit in any way

any right to serve process in any manner permitted by law. Nothing contained herein shall be deemed to limit in any way any right to

serve process in any manner permitted by law. Nothing contained herein (i) shall be deemed or operate to preclude any Holder from bringing

suit or taking other legal action against the Company in any other jurisdiction to collect on the Company’s obligations to such

Holder, to realize on any collateral or any other security for such obligations, or to enforce a judgment or other court ruling in favor

of such Holder or (ii) shall limit, or shall be deemed or construed to limit, any provision of Section 25 of the Notes. THE COMPANY

HEREBY IRREVOCABLY WAIVES ANY RIGHT IT MAY HAVE TO, AND AGREES NOT TO REQUEST, A JURY TRIAL FOR THE ADJUDICATION OF ANY DISPUTE HEREUNDER

OR IN CONNECTION WITH OR ARISING OUT OF THIS TENTH SUPPLEMENTAL INDENTURE OR ANY TRANSACTION

CONTEMPLATED HEREBY.

Section

4.9. U.S.A. PATRIOT ACT. The parties hereto acknowledge that in accordance with Section 326 of the U.S.A. PATRIOT Act, the Trustee

is required to obtain, verify, and record information that identifies each person or legal entity that establishes a relationship or

opens an account with the Trustee. The parties to this Supplemental Indenture agree that they shall provide the Trustee with such information

as it may reasonably request in order for the Trustee to satisfy the requirements of the U.S.A. PATRIOT Act.

[The

remainder of the page is intentionally left blank]

IN

WITNESS WHEREOF, the parties hereto have caused this Tenth Supplemental Indenture to be duly executed on the date or dates indicated

in the acknowledgments and as of the day and year first above written.

| |

WORKHORSE GROUP INC. |

| |

|

|

| |

By: |

|

| |

|

Name: |

|

| |

|

Title: |

|

| |

U.S. BANK TRUST COMPANY, NATIONAL ASSOCIATION, as Trustee |

| |

|

|

| |

By: |

|

| |

|

Name: |

|

| |

|

Title: |

|

EXHIBIT

A

(FORM

OF NOTE)

v3.24.4

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

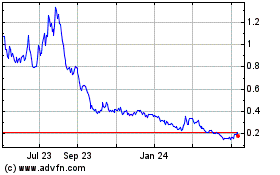

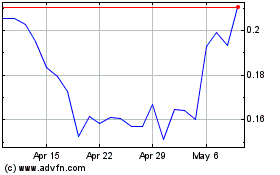

Workhorse (NASDAQ:WKHS)

Historical Stock Chart

From Nov 2024 to Dec 2024

Workhorse (NASDAQ:WKHS)

Historical Stock Chart

From Dec 2023 to Dec 2024