Wintrust Financial Corporation Announces Initiation of Long-Term Issuer Default Rating

May 02 2013 - 8:00AM

Wintrust Financial Corporation announces that it has received an

"investment grade" rating from Fitch Ratings, Inc. On Monday, April

22, 2013, Fitch Ratings, Inc., announced its initial Long-Term

Issuer Default Rating (IDR) for Wintrust Financial Corporation, as

well as each of the 15 individually chartered community banks under

the holding company. The Long-Term IDR for the holding company

is 'BBB' with the Rating Outlook at Stable.

"Being rated provides a competitive advantage for Wintrust, as

it allows us to further enhance our offerings to commercial banking

customers and prospects who require full service domestic and

international Letter of Credit (LC) banking services and to local

government and non-profit entities," said Edward J. Wehmer,

President & CEO of Wintrust. "Clients or prospects that need

LCs from a rated banking institution, especially international LCs,

can now use our banking subsidiaries for their needs. The

rating will also allow us to service those government or non-profit

entities whose investment policies mandate that each depositary

institution they use maintain an investment grade rating."

Fitch assigns the following ratings with a Stable Outlook to

Wintrust Financial Corporation:

Long-Term IDR at 'BBB'; Short-Term IDR at 'F2'; Viability Rating

at 'bbb'; Subordinated Debt at 'BBB-'; Preferred Stock at 'B+';

Support at '5'; Support Rating at 'NF'.

Additional information and ratings for each bank subsidiary of

Wintrust Financial Corporation is available at

www.fitchratings.com.

About Wintrust Financial Corporation

Wintrust Financial Corporation is a financial holding company

with assets of approximately $17 billion whose common stock is

traded on the NASDAQ Global Select Market (Nasdaq:WTFC). Built

on the "HAVE IT ALL" model, Wintrust offers sophisticated

technology and resources of a large bank while focusing on

providing service-based community banking to each and every

customer. Wintrust operates fifteen community bank

subsidiaries, with more than 100 banking offices located in the

greater Chicago and Milwaukee market areas. Wintrust

also provides wealth management services, commercial insurance

premium financing, mortgage origination, short-term accounts

receivable financing, and certain administrative services, such as

data processing of payrolls, and billing and treasury management

services to its customers.

Forward-Looking Information

This press release contains forward-looking statements within

the meaning of the federal securities laws. Investors are cautioned

that such statements are predictions and that actual events or

results may differ materially. Wintrust's expected financial

results or other plans are subject to a number of risks and

uncertainties. For a discussion of such risks and uncertainties,

which could cause actual results to differ from those contained in

the forward-looking statements, see "Risk Factors" and the

forward-looking statement disclosure contained in Wintrust's Annual

Report on Form 10-K for the most recently ended fiscal year.

Forward-looking statements speak only as of the date made and

Wintrust undertakes no duty to update the information.

CONTACT: FOR MORE INFORMATION CONTACT:

Edward J. Wehmer, President & Chief Executive Officer

David A. Dykstra, Senior Executive Vice President &

Chief Operating Officer

(847) 939-9000

Website address: www.wintrust.com

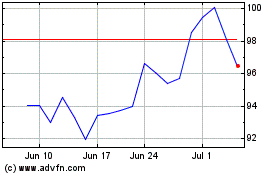

Wintrust Financial (NASDAQ:WTFC)

Historical Stock Chart

From Jun 2024 to Jul 2024

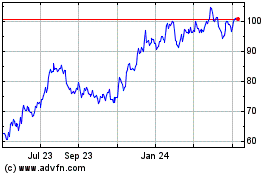

Wintrust Financial (NASDAQ:WTFC)

Historical Stock Chart

From Jul 2023 to Jul 2024