Willis Lease Finance Corporation Reports Second Quarter Pre-tax Income of $11.0 million

August 04 2022 - 6:30AM

Willis Lease Finance Corporation (NASDAQ: WLFC) today reported

second quarter total revenues of $78.1 million. For the three

months ended June 30, 2022, aggregate lease rent and maintenance

reserve revenues were $60.9 million and spare parts and equipment

sales were $6.8 million. The Company reported increased total

revenues in the second quarter when compared to the prior year

period, primarily due to an increase in lease rent revenue and

short-term maintenance revenue.

“Second quarter pre-tax profit of $11.0 million

speaks to the strength of the underlying business and represents

the beginnings of a recovery post a first quarter, heavily

influenced by the Russian crisis,” said Austin C. Willis, the

Company’s Chief Executive Officer.

“We are pleased with our second quarter results

and our team’s efforts to recover the Company from the impacts of

the pandemic, Russia’s decision to confiscate our engines and

rising interest rates,” said Brian R. Hole, President. “We continue

to believe that our programmatic offerings will be the difference

for customers working to optimize capacity at a time when both new

equipment production and maintenance are facing historic

difficulties and delay.”

Second Quarter 2022 Highlights

(at or for the periods ended June 30, 2022, as compared to June 30,

2021, and December 31, 2021):

- Lease rent revenue increased by $4.3 million, or 13.2%, to

$36.7 million in the second quarter of 2022, compared to $32.4

million in the same quarter of 2021, primarily reflecting an

increase in the number of engines placed on lease as supported by

an increase in utilization compared to the prior year period.

- Maintenance reserve revenue was $24.2 million in the second

quarter of 2022, an increase of 40.3% compared to $17.3 million in

the same quarter of 2021. Long-term maintenance revenue, which is

influenced by end of lease compensation and the realization of

long-term maintenance reserves associated with engines coming off

lease, increased to $15.1 million for the second quarter of 2022,

compared to $14.8 million in the comparable prior period.

Short-term maintenance reserve revenue, which is directly

influenced by on lease engine flight hours and cycles, increased to

$9.2 million for the second quarter of 2022, compared to $2.5

million in the comparable prior period.

- Spare parts and equipment sales increased to $6.8 million in

the second quarter of 2022, compared to $3.6 million in the second

quarter of 2021. The increase in spare parts sales was driven by

improved industry wide demand compared to the prior year

period.

- Gain on sale of leased equipment was $0.5 million in the second

quarter of 2022 reflecting the sale of eight engines. Gain on sale

of financial assets, effectively the sale of leased equipment, was

$3.1 million in the second quarter of 2022 reflecting the sale of

four notes receivable. There were no sales of leased equipment or

notes receivable in the second quarter of 2021.

- The Company generated $11.0 million of pre-tax income in the

second quarter of 2022 compared to $(1.9) million in the comparable

quarter of 2021.

- The book value of lease assets we own directly or through our

joint ventures, inclusive of our notes receivable and investment in

sales-type leases, was $2,352.4 million at June 30, 2022. As of

June 30, 2022, the Company also managed 351 engines, aircraft and

related equipment on behalf of other parties.

- The Company maintained $431.0 million of undrawn revolver

capacity at June 30, 2022.

- During the second quarter of 2022, the Company repurchased a

total of 101,435 shares of common stock for approximately $3.4

million at a weighted average price of $33.55 per share.

- Diluted weighted average income (loss) per common share was

$0.81 for the second quarter of 2022, compared to $(0.12) in the

second quarter of 2021.

- Book value per diluted weighted average common share

outstanding increased to $62.07 at June 30, 2022, compared to

$59.23 at December 31, 2021.

Balance Sheet

As of June 30, 2022, $1,957.6 million of

equipment held in our operating lease portfolio, $83.3 million

notes receivable, and $7.0 million investment in sales-type leases,

represented 293 engines, twelve aircraft, one marine vessel and

other leased parts and equipment. As of December 31, 2021, the

Company had $1,991.4 million equipment held for operating

lease portfolio and $115.5 million notes receivable, which

represented 304 engines, twelve aircraft, one marine vessel and

other leased parts and equipment.

Willis Lease Finance

Corporation

Willis Lease Finance Corporation leases large

and regional spare commercial aircraft engines, auxiliary power

units and aircraft to airlines, aircraft engine manufacturers and

maintenance, repair and overhaul providers in 120 countries. These

leasing activities are integrated with engine and aircraft trading,

engine lease pools and asset management services supported by

cutting edge technology through its subsidiary, Willis Asset

Management Limited, as well as various end-of-life solutions for

engines and aviation materials provided through its subsidiary,

Willis Aeronautical Services, Inc.

Except for historical information, the matters

discussed in this press release contain forward-looking statements

that involve risks and uncertainties. Do not unduly rely on

forward-looking statements, which give only expectations about the

future and are not guarantees. Forward-looking statements speak

only as of the date they are made, and we undertake no obligation

to update them. Our actual results may differ materially from the

results discussed in forward-looking statements. Factors that might

cause such a difference include, but are not limited to: the

effects on the airline industry and the global economy of events

such as war, terrorist activity and the COVID-19 pandemic; changes

in oil prices, rising inflation and other disruptions to world

markets; trends in the airline industry and our ability to

capitalize on those trends, including growth rates of markets and

other economic factors; risks associated with owning and leasing

jet engines and aircraft; our ability to successfully negotiate

equipment purchases, sales and leases, to collect outstanding

amounts due and to control costs and expenses; changes in interest

rates and availability of capital, both to us and our customers;

our ability to continue to meet changing customer demands;

regulatory changes affecting airline operations, aircraft

maintenance, accounting standards and taxes; the market value of

engines and other assets in our portfolio; and risks detailed in

the Company’s Annual Report on Form 10-K and other continuing

reports filed with the Securities and Exchange Commission.

Unaudited Consolidated Statements of

Income(In thousands, except per share data)

| |

Three Months Ended June 30, |

|

|

|

Six Months Ended June 30, |

|

|

| |

2022 |

|

2021 |

|

% Change |

|

2022 |

|

2021 |

|

% Change |

| REVENUE |

|

|

|

|

|

|

|

|

|

|

|

|

Lease rent revenue |

$ |

36,704 |

|

$ |

32,431 |

|

|

13.2% |

|

$ |

74,829 |

|

|

$ |

63,951 |

|

|

17.0% |

| Maintenance reserve revenue |

|

24,245 |

|

|

17,278 |

|

|

40.3% |

|

|

39,079 |

|

|

|

37,090 |

|

|

5.4% |

| Spare parts and equipment

sales |

|

6,792 |

|

|

3,569 |

|

|

90.3% |

|

|

13,422 |

|

|

|

8,135 |

|

|

65.0% |

| Gain on sale of leased

equipment |

|

498 |

|

|

— |

|

|

N/A |

|

|

2,796 |

|

|

|

— |

|

|

N/A |

| Gain on sale of financial

assets |

|

3,116 |

|

|

— |

|

|

N/A |

|

|

3,116 |

|

|

|

— |

|

|

N/A |

| Asset transition fee |

|

— |

|

|

6,256 |

|

|

(100.0)% |

|

|

— |

|

|

|

6,256 |

|

|

(100.0)% |

| Other revenue |

|

6,720 |

|

|

6,938 |

|

|

(3.1)% |

|

|

13,650 |

|

|

|

12,165 |

|

|

12.2% |

| Total revenue |

|

78,075 |

|

|

66,472 |

|

|

17.5% |

|

|

146,892 |

|

|

|

127,597 |

|

|

15.1% |

| |

|

|

|

|

|

|

|

|

|

|

|

| EXPENSES |

|

|

|

|

|

|

|

|

|

|

|

| Depreciation and amortization

expense |

|

21,612 |

|

|

23,340 |

|

|

(7.4)% |

|

|

43,421 |

|

|

|

47,481 |

|

|

(8.6)% |

| Cost of spare parts and equipment

sales |

|

7,014 |

|

|

3,278 |

|

|

114.0% |

|

|

11,876 |

|

|

|

7,087 |

|

|

67.6% |

| Write-down of equipment |

|

78 |

|

|

2,246 |

|

|

(96.5)% |

|

|

21,195 |

|

|

|

4,113 |

|

|

415.3% |

| General and administrative |

|

20,427 |

|

|

19,499 |

|

|

4.8% |

|

|

44,032 |

|

|

|

35,650 |

|

|

23.5% |

| Technical expense |

|

3,436 |

|

|

2,296 |

|

|

49.7% |

|

|

9,082 |

|

|

|

3,606 |

|

|

151.9% |

| Net finance costs: |

|

|

|

|

|

|

|

|

|

|

|

|

Interest expense |

|

16,023 |

|

|

16,987 |

|

|

(5.7)% |

|

|

32,906 |

|

|

|

32,006 |

|

|

2.8% |

| Total net finance costs |

|

16,023 |

|

|

16,987 |

|

|

(5.7)% |

|

|

32,906 |

|

|

|

32,006 |

|

|

2.8% |

| Total expenses |

|

68,590 |

|

|

67,646 |

|

|

1.4% |

|

|

162,512 |

|

|

|

129,943 |

|

|

25.1% |

| |

|

|

|

|

|

|

|

|

|

|

|

| Income (loss) from

operations |

|

9,485 |

|

|

(1,174 |

) |

|

(907.9)% |

|

|

(15,620 |

) |

|

|

(2,346 |

) |

|

565.8% |

| Income (loss) from joint

ventures |

|

1,469 |

|

|

(685 |

) |

|

(314.5)% |

|

|

(1,147 |

) |

|

|

(1,204 |

) |

|

(4.7)% |

| Income (loss) before income

taxes |

|

10,954 |

|

|

(1,859 |

) |

|

(689.2)% |

|

|

(16,767 |

) |

|

|

(3,550 |

) |

|

372.3% |

| Income tax expense (benefit) |

|

5,046 |

|

|

(1,917 |

) |

|

(363.2)% |

|

|

(1,474 |

) |

|

|

(2,276 |

) |

|

(35.2)% |

| Net income (loss) |

|

5,908 |

|

|

58 |

|

|

10,086.2% |

|

|

(15,293 |

) |

|

|

(1,274 |

) |

|

1,100.4% |

| Preferred stock dividends |

|

811 |

|

|

811 |

|

|

—% |

|

|

1,612 |

|

|

|

1,612 |

|

|

—% |

| Accretion of preferred stock

issuance costs |

|

21 |

|

|

21 |

|

|

—% |

|

|

42 |

|

|

|

42 |

|

|

—% |

| Net income (loss) attributable to

common shareholders |

$ |

5,076 |

|

$ |

(774 |

) |

|

(755.8)% |

|

$ |

(16,947 |

) |

|

$ |

(2,928 |

) |

|

478.8% |

| |

|

|

|

|

|

|

|

|

|

|

|

| Basic weighted average income

(loss) per common share |

$ |

0.83 |

|

$ |

(0.12 |

) |

|

|

|

$ |

(2.81 |

) |

|

$ |

(0.48 |

) |

|

|

| Diluted weighted average income

(loss) per common share |

$ |

0.81 |

|

$ |

(0.12 |

) |

|

|

|

$ |

(2.81 |

) |

|

$ |

(0.48 |

) |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

| Basic weighted average common

shares outstanding |

|

6,129 |

|

|

6,218 |

|

|

|

|

|

6,040 |

|

|

|

6,107 |

|

|

|

| Diluted weighted average common

shares outstanding |

|

6,246 |

|

|

6,218 |

|

|

|

|

|

6,040 |

|

|

|

6,107 |

|

|

|

Unaudited Consolidated Balance Sheets(In thousands, except per share data)

| |

June 30, 2022 |

|

December 31, 2021 |

| ASSETS |

|

|

|

|

Cash and cash equivalents |

$ |

12,858 |

|

$ |

14,329 |

| Restricted cash |

|

60,982 |

|

|

81,312 |

| Equipment held for operating

lease, less accumulated depreciation |

|

1,957,638 |

|

|

1,991,368 |

| Maintenance rights |

|

22,511 |

|

|

22,511 |

| Equipment held for sale |

|

4,380 |

|

|

6,952 |

| Receivables, net of

allowances |

|

40,472 |

|

|

39,623 |

| Spare parts inventory |

|

43,396 |

|

|

50,959 |

| Investments |

|

55,341 |

|

|

55,927 |

| Property, equipment &

furnishings, less accumulated depreciation |

|

32,737 |

|

|

31,327 |

| Intangible assets, net |

|

1,158 |

|

|

1,188 |

| Notes receivable |

|

83,295 |

|

|

115,456 |

| Investment in sales-type

leases |

|

7,025 |

|

|

— |

| Other assets |

|

74,590 |

|

|

51,975 |

| Total assets |

$ |

2,396,383 |

|

$ |

2,462,927 |

| |

|

|

|

| LIABILITIES, REDEEMABLE PREFERRED

STOCK AND SHAREHOLDERS’ EQUITY |

|

|

|

| Liabilities: |

|

|

|

| Accounts payable and accrued

expenses |

$ |

26,183 |

|

$ |

26,858 |

| Deferred income taxes |

|

127,400 |

|

|

124,332 |

| Debt obligations |

|

1,731,807 |

|

|

1,790,264 |

| Maintenance reserves |

|

56,811 |

|

|

65,976 |

| Security deposits |

|

18,037 |

|

|

19,349 |

| Unearned revenue |

|

11,404 |

|

|

10,458 |

| Total liabilities |

|

1,971,642 |

|

|

2,037,237 |

| |

|

|

|

| Redeemable preferred stock ($0.01

par value) |

|

49,847 |

|

|

49,805 |

| |

|

|

|

| Shareholders’ equity: |

|

|

|

| Common stock ($0.01 par

value) |

|

63 |

|

|

65 |

| Paid-in capital in excess of

par |

|

14,562 |

|

|

15,401 |

| Retained earnings |

|

338,441 |

|

|

355,388 |

| Accumulated other comprehensive

income, net of tax |

|

21,828 |

|

|

5,031 |

| Total shareholders’ equity |

|

374,894 |

|

|

375,885 |

| Total liabilities, redeemable

preferred stock and shareholders’ equity |

$ |

2,396,383 |

|

$ |

2,462,927 |

|

CONTACT: |

Scott B. Flaherty |

| |

Chief Financial Officer |

| |

(561) 349-9989 |

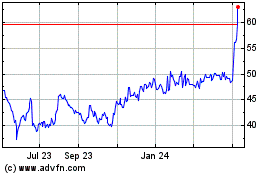

Willis Lease Finance (NASDAQ:WLFC)

Historical Stock Chart

From Mar 2024 to Apr 2024

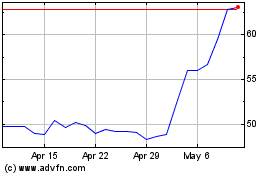

Willis Lease Finance (NASDAQ:WLFC)

Historical Stock Chart

From Apr 2023 to Apr 2024