Volcon Inc. (NASDAQ: VLCN) (“Volcon'', the “Company” or “we”), the

first all-electric, off-road powersports company, today reported

its operational highlights and financial results for the quarter

ended March 31, 2024

Company Highlights:

|

● |

|

Nasdaq extension for compliance

by June 24, 2024 |

|

● |

|

First Stag delivery to US Dealer

and the Army Corp in May 2024 |

|

● |

|

Continued delivery of the Grunt

EVO |

|

● |

|

105 U.S. dealers and 9

international distributors covering 14 countries |

As previously noted in our 2023 annual operational updates,

Volcon presented its plan of compliance to the Nasdaq Hearing Panel

on March 26, 2024 regarding ongoing compliance with the bid price

and equity compliance. On April 2, 2024, Nasdaq informed the

Company that it has provided an extension until June 24, 2024 for

the Company to execute its plan of compliance.

On May 6, 2024, the Company shipped its first Stag to a U.S.

dealer to fulfill our first consumer pre-order. The Company expects

to ship additional Stags to U.S. dealers to begin fulfilling

previously received pre-orders for the Stag from consumers who have

paid a deposit. Although pre-orders are cancelable until the

customer takes delivery of the Stag, the Company expects that we

will be able to convert some of these pre-orders to sales in 2024.

Also, as previously announced, the Company delivered its first Stag

to the Army Corp of Engineers (Army Corp) on February 27, 2024, at

its Fort Leonard Wood, Missouri facility. The Company expects to

ship the Army Corp three more Stags on May 10, 2024 and anticipates

additional deliveries to complete the Army Corp’s orders by July

2024.

Delivery of the Grunt EVOs continues to grow. Since we began

taking on-line pre-orders for continental U.S. customers, we have

seen an increase in EVO sales. Customer can pay a $100 deposit and

order an EVO which will be delivered to a dealer closest to the

customer. We expect that as we move into the Spring/Summer sales

seasons we will see higher demand due to warmer weather in the

U.S., and the previously discussed ramp up in manufacturing will

allow us to fulfill the expected higher demand. As noted in our

third quarter earnings release, we deferred the launch of the Runt

LT, our smaller off-road motorcycle, to focus on distribution of

the Grunt EVO as well as to start shipping the Stag. After further

evaluation, we have concluded that we will no longer launch the

Runt LT. We are currently evaluating options for new two-wheel

products that we could develop and sell over the next 9 – 12

months. Brat sales continue to do well, and we also expect an

increase in sales as we move into the Spring/Summer sales

season.

To date, the Company’s U.S. dealer count is 105 dealers. We have

signed two new dealers in California where there is a large

population of off-road enthusiasts. Further, California, as well as

other states, are implementing regulations on off-road vehicles to

limit carbon emissions, which will help the adoption of EV in the

off-road industry.

John Kim, CEO, notes “We’ve made major progress in the past

three months. Our Stag UTV production has started, and we are

beginning to make deliveries to our customers. Also, we’re seeing

strong growth in the sales of the Grunt EVO, our offroad

motorcycle. In the coming months, we’ll continue to move forward

with reducing cost of operations and production.”

Financial highlights:

| |

|

3 Months Ended |

|

|

GAAP |

|

March 31, 2024 |

|

|

December 31, 2023 |

|

|

September 30, 2023 |

|

|

Revenue |

|

$ |

1,033,548 |

|

|

$ |

1,083,800 |

|

|

$ |

487,430 |

|

| Cost of goods sold |

|

|

(1,621,580 |

) |

|

|

(6,283,944 |

) |

|

|

(3,542,468 |

) |

| Gross Margin |

|

|

(588,032 |

) |

|

|

(5,200,144 |

) |

|

|

(3,055,038 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Sales & Marketing |

|

|

760,564 |

|

|

|

1,365,186 |

|

|

|

1,870,532 |

|

| Product Development |

|

|

814,945 |

|

|

|

1,932,705 |

|

|

|

2,983,197 |

|

| General &

Administrative |

|

|

2,080,794 |

|

|

|

1,384,872 |

|

|

|

1,544,344 |

|

| Total Operating Expenses |

|

|

3,656,303 |

|

|

|

4,682,763 |

|

|

|

6,398,073 |

|

| Loss from Operations |

|

|

(4,244,335 |

) |

|

|

(9,882,907 |

) |

|

|

(9,453,111 |

) |

| Other Income (Expense) |

|

|

(21,803,709 |

) |

|

|

(6,467,255 |

) |

|

|

(1,874,785 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Net loss |

|

$ |

(26,048,044 |

) |

|

$ |

(3,415,652 |

) |

|

$ |

(11,327,896 |

) |

|

● |

|

Revenue: The Company’s revenue

for the first quarter of 2024 was $1.0 million, consistent with

revenue for the fourth quarter of 2023, and an increase of $0.5

million over the third quarter of 2023. Revenue for the first

quarter of 2024 includes Grunt EVO sales of $0.3 million compared

to approximately $0.4 million and $37,000 of sales of Grunt EVOs in

the fourth and third quarters of 2023, respectively. Brat revenue

in the first quarter of 2024 was $0.5 million compared to Brat

revenue of $0.6 million and $0.5 million in the fourth and third

quarters of 2023, respectively. |

|

● |

|

Operating Expenses: The Company’s

operating expenses for the first quarter of 2024 were $3.7 million

compared to $4.6 million and $6.4 million in the fourth and third

quarters of 2023, respectively. Our sales and marketing costs have

decreased as we have realigned our sales marketing efforts and

reduced headcount. Our product development costs have

declined each quarter due to lower prototype costs due to

completion of Stag development and beginning of production. Our

general and administrative costs the fourth quarter of 2024 were

$0.3 million lower than the first quarter of 2024 due to lower

payroll related costs, including stock-based compensation, due to

the reversal of 2023 executive bonuses that were not awarded by the

board of directors, and they were also $0.1 million lower due to a

refund of product liability premiums on the renewal of our product

liability policies. The Company continues to focus on reducing

operating costs while continuing to make investments in product

development to continue to build our product offerings. |

|

● |

|

Net loss: The Company’s net loss

was $26.0 million for the first quarter of 2024 compared to a net

loss of $3.4 million for the fourth quarter of 2023 and $11.3

million for the second quarter of 2023.Net loss in the first

quarter of 2024 includes the recognition of a loss of $19.8 million

for warrants issued in our November 2023 public offering as these

warrants were deemed to be liabilities and are recorded at fair

value with changes being recorded in income. The first

quarter 2024 net loss also includes a loss of $0.3 million from the

conversion of some of the convertible notes to common stock and a

loss of $1.3 million for the exchange of the remaining convertible

notes for convertible preferred stock. Interest expense for the

first quarter of 2024 decreased by $0.1 million due to the

conversion and exchange of all convertible notes by early March

2024. |

|

|

|

|

|

|

|

Net loss in the fourth quarter of

2023 includes the recognition of $2.1 million in cost of goods sold

to terminate the agreement with Torrot to produce the Volcon Youth

motorcycles as we are discontinuing this product line and a write

down of $1.2 million to reduce the inventory at December 31, 2023

to its estimated net realizable value. In addition, a gain of $8.4

million was recognized for warrants issued in our November 2023

public offering as these warrants were deemed to be liabilities and

are recorded at fair value with changes being recorded in income.

Finally, issuance costs of $1.4 million were recognized for the

warrant liabilities for the allocation of issuance costs from the

public offering to these financial instruments. Interest expense

decreased by $0.7 million due to the extension in September 2023 of

the due date of the outstanding convertible notes to January

2025. |

|

|

|

Net loss in the third quarter of

2023 includes a write-down of $1.6 million related to Volcon Youth

motorcycles to reduce the inventory to its estimated net realizable

value, a $0.7 million loss on the change in derivative liabilities

related to the adjustable conversion features of convertible notes

issued in May 2023 and the exchange of August 2022 convertible

notes for convertible notes and the adjustable exercise price of

warrants issued with the new notes issued in May 2023 and exchange

of the warrants issued with the August 2022 convertible notes as

more fully described in the Company’s interim financial statements

as of and for the three and nine month periods ended September 30,

2023. The conversion feature and warrants are no longer derivative

liabilities as of August 3, 2023, and have been reclassified to

equity as of September 30, 2023. |

| |

|

|

|

● |

|

Adjusted EBITDA: Adjusted EBITDA

for each quarter represents net loss adjusted to add back

stock-based compensation, depreciation and amortization expense,

interest expense, the loss/gain on derivative liabilities and

warrant liabilities, and the add back of issuance costs in the

fourth quarter of 2024. The Company’s adjusted EBITDA

for the first quarter of 2024 was a loss of $4.1 million, compared

to the fourth quarter of 2023 loss of $9.4 million and compared to

the third quarter of 2023 loss of $8.9 million. See “Non-GAAP

Reconciliation” below |

For the latest Company updates, follow Volcon on YouTube,

Facebook, Instagram, and LinkedIn. Investor information about the

Company, including press releases, company SEC filings, and more

can be found at http://ir.volcon.com.

About Volcon

Based in the Austin, Texas area, Volcon was founded as the first

all-electric power sports company producing high-quality and

sustainable electric vehicles for the outdoor community. Volcon

electric vehicles are the future of off-roading, not only because

of their environmental benefits but also because of their

near-silent operation, which allows for a more immersive outdoor

experience.

Volcon's vehicle roadmap includes both motorcycles and UTVs. Its

first product, the innovative Grunt, began shipping to customers in

late 2021 and combines a fat-tired physique with high-torque

electric power and a near-silent drive train. The Volcon Grunt EVO,

an evolution of the original Grunt with a belt drive, an improved

suspension, and seat, began shipping to customers in October 2023.

The Brat is Volcon’s first foray into the wildly popular eBike

market for both on-road and off-road riding and is currently being

delivered to dealers across North America. Volcon debuted the Stag

in July 2022 and entered the rapidly expanding UTV market and

shipped its first production unit in February 2024. The Stag

empowers the driver to explore the outdoors in a new and unique way

that gas-powered UTVs cannot. The Stag offers the same thrilling

performance of a standard UTV without the noise (or pollution),

allowing the driver to explore the outdoors with all their

senses.

For more information on Volcon or to learn more about its

complete motorcycle and side-by-side line-up, visit:

www.volcon.com.

NON-GAAP RECONCILIATION

We believe presenting adjusted EBITDA provides management and

investors consistency and facilitates period to period comparisons

of operations, as it eliminates the effects of certain variations

to overall performance.

The following table reconciles net loss to adjusted EBITDA for

the three months ended March 31, 2024, December 31, 2023, and

September 30, 2023:

| Adjusted

EBITDA |

|

3 Months Ended |

|

| |

|

March 31, 2024 |

|

|

December 31, 2023 |

|

|

September 30, 2023 |

|

|

Net loss |

|

$ |

(26,048,044 |

) |

|

$ |

(3,415,652 |

) |

|

$ |

(11,327,896 |

) |

| Share-based compensation

(benefit) expense |

|

|

(1,922 |

) |

|

|

404,568 |

|

|

|

540,528 |

|

| Depreciation and amortization

expense |

|

|

97,720 |

|

|

|

75,405 |

|

|

|

67,178 |

|

| Interest expense |

|

|

329,968 |

|

|

|

451,266 |

|

|

|

1,135,089 |

|

| Loss from conversion and

exchange of convertible notes |

|

|

1,647,608 |

|

|

|

– |

|

|

|

– |

|

| Issuance costs |

|

|

– |

|

|

|

1,444,547 |

|

|

|

– |

|

| Loss (gain) on change in fair

value of derivative liabilities |

|

|

19,838,987 |

|

|

|

(8,365,424 |

) |

|

|

684,994 |

|

|

Adjusted EBITDA |

|

$ |

(4,135,683 |

) |

|

$ |

(9,405,290 |

) |

|

$ |

(8,900,107 |

) |

Forward-Looking Statements:

Some of the statements in this release are forward-looking

statements, which involve risks and uncertainties. Forward-looking

statements in this press release include, without limitation,

whether the Company will be able to satisfy the Nasdaq continued

listed criteria before June 24, 2024, whether the Company can

increase production of the Stag to meet expected deliveries to

customers, and whether the Company will successfully expand its U.S

dealership network. Although the Company believes that the

expectations reflected in such forward-looking statements are

reasonable as of the date made, expectations may prove to have been

materially different from the results expressed or implied by such

forward-looking statements. The Company has attempted to identify

forward-looking statements by terminology including ''believes,''

''estimates,'' ''anticipates,'' ''expects,'' ''plans,''

''projects,'' ''intends,'' ''potential,'' ''may,'' ''could,''

''might,'' ''will,'' ''should,'' ''approximately'' or other words

that convey uncertainty of future events or outcomes to identify

these forward-looking statements. These statements are only

predictions and involve known and unknown risks, uncertainties, and

other factors. Any forward-looking statements contained in this

release speak only as of its date. The Company undertakes no

obligation to update any forward-looking statements contained in

this release to reflect events or circumstances occurring after its

date or to reflect the occurrence of unanticipated events. More

detailed information about the risks and uncertainties affecting

the Company is contained under the heading “Risk Factors” in the

Company’s Annual Report on Form 10-K and subsequently filed

Quarterly Reports on Form 10-Q and Current Reports on Form 8-K

filed with the SEC, which are available on the SEC’s website,

www.sec.gov.

A photo accompanying this announcement is available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/49f10157-b056-437a-8421-295e3590871e

Volcon Contacts

For Media: media@volcon.com

For Dealers: dealers@volcon.com

For Investors: investors@volcon.com

For Marketing: marketing@volcon.com

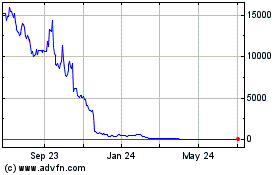

Volcon (NASDAQ:VLCN)

Historical Stock Chart

From Oct 2024 to Nov 2024

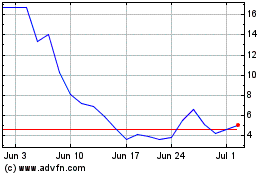

Volcon (NASDAQ:VLCN)

Historical Stock Chart

From Nov 2023 to Nov 2024