0001729149false00017291492023-12-072023-12-07

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of the Securities Exchange Act of 1934

December 7, 2023

Date of Report (Date of earliest event reported)

Viemed Healthcare, Inc.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| | | | |

British Columbia, Canada | | 001-38973 | | N/A |

(State or other jurisdiction

of incorporation) | | (Commission

File Number) | | (I.R.S. Employer

Identification No.) |

| | | | | | | | |

| | |

625 E. Kaliste Saloom Rd. Lafayette, Louisiana | | 70508 |

| (Address of principal executive offices) | | (Zip Code) |

(337) 504-3802

(Registrant’s telephone number, including area code)

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | | | | |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common shares, no par value | VMD | The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 7.01. Regulation FD Disclosure

On December 7, 2023, Viemed Healthcare, Inc. (the "Company") issued a press release announcing that it has applied and received approval from the Toronto Stock Exchange (“TSX”) for the voluntary delisting of its common shares (each a “Common Share”) from the TSX. A copy of the press release is furnished as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated herein by reference.

In accordance with General Instruction B.2 of Form 8-K, the foregoing information, including Exhibit 99.1, shall not be deemed “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall such information and Exhibit 99.1 be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such a filing.

Item 8.01. Other Events

On December 7, 2023, the Company announced that it has applied and received approval from the TSX for the voluntary delisting of its Common Shares from the TSX. The Common Shares will be delisted from TSX effective as of close of markets on December 21, 2023. In accordance with the TSX Company Manual, TSX does not require shareholder approval of the voluntary delisting of the Common Shares from TSX, as an acceptable alternative market will exist for the Common Shares on the date of delisting.

The delisting from TSX will not affect the Company's listing on the NASDAQ Capital Market ("NASDAQ"). The Common Shares will continue to trade on NASDAQ under the symbol “VMD". Following delisting from TSX, Viemed's shareholders can trade their Common Shares through their brokers on NASDAQ.

Certain statements contained in this Current Report on Form 8-K may constitute “forward-looking statements” within the meaning of the U.S. Private Securities Litigation Reform Act of 1995 or “forward-looking information” as such term is defined in applicable Canadian securities legislation (collectively, “forward-looking statements”). By their nature, forward-looking statements are subject to risks, uncertainties, and contingencies, including the anticipated results of delisting and consolidated trading on Nasdaq. The Company does not undertake to update any forward-looking statements, including those contained in this Current Report on Form 8-K. For further information regarding risks and uncertainties associated with the Company, please refer to the “Risk Factors” section of the Company’s SEC filings, including its Annual Report on Form 10-K and Quarterly Reports on Form 10-Q.

| | | | | | | | |

Exhibit

Number | | Description |

| | |

| 104 | | Cover Page Interactive Data File, formatted in Inline XBRL and included as Exhibit 101. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Date: December 7, 2023

| | | | | | | | |

| | |

| VIEMED HEALTHCARE, INC. |

| |

| By: | | /s/ Trae Fitzgerald |

| | Trae Fitzgerald |

| | Chief Financial Officer |

VIEMED TO CENTRALIZE MARKET FOR COMMON SHARES ON NASDAQ

THROUGH VOLUNTARY DELISTING FROM TSX

Lafayette, Louisiana (December 7, 2023) Viemed Healthcare, Inc. (the “Company” or “Viemed”) (NASDAQ:VMD and TSX:VMD.TO), a national leader in respiratory care and technology-enabled home medical equipment services, announced that it has applied and received approval from the Toronto Stock Exchange (“TSX”) for the voluntary delisting of its common shares (each a “Common Share”) from the TSX. The delisting from TSX will not affect the Company's listing on the NASDAQ Capital Market ("NASDAQ").

“The Company is taking strategic action to enhance market efficiency and optimize our administrative processes by consolidating trading volumes on NASDAQ, as the majority of both outstanding shares and trading volume is currently concentrated in the United States. The delisting from TSX will create a singular focal point and central marketplace for the Company’s common shares, contributing to increased long-term liquidity on NASDAQ and increased shareholder value.” said Viemed Chief Operating Officer, Todd Zehnder.

The Common Shares will be delisted from TSX effective as of close of markets on December 21, 2023. In accordance with the TSX Company Manual, TSX does not require shareholder approval of the voluntary delisting of the Common Shares from TSX, as an acceptable alternative market will exist for the Common Shares on the date of delisting. The Common Shares will continue to trade on NASDAQ under the symbol “VMD".

Following delisting from TSX, Viemed's shareholders can trade their Common Shares through their brokers on NASDAQ. As most brokers in Canada, including many discount and online brokers, have the ability to buy and sell securities listed on NASDAQ, Viemed’s NASDAQ listing will continue to provide shareholders with the same accessibility to trade the Common Shares. Shareholders holding their shares in Canadian brokerage accounts should contact their brokers to confirm how to trade Viemed’s shares on NASDAQ.

ABOUT VIEMED HEALTHCARE, INC.

Viemed is a provider of in-home medical equipment and post-acute respiratory healthcare services in the United States. Viemed’s service offerings are focused on effective in-home treatment with clinical practitioners providing therapy and counseling to patients in their homes using cutting-edge technology. Visit our website at www.viemed.com.

For further information, please contact:

Glen Akselrod

Bristol Capital

905-326-1888

glen@bristolir.com

Todd Zehnder

Chief Operating Officer

Viemed Healthcare, Inc.

337-504-3802

investorinfo@viemed.com

Forward-Looking Statements

Certain statements contained in this press release may constitute “forward-looking statements” within the meaning of the U.S. Private Securities Litigation Reform Act of 1995 or “forward-looking information” as such term is defined in applicable Canadian securities legislation (collectively, “forward-looking statements”). Often, but not always, forward-looking statements can be identified by the use of words such as “plans”, “expects”, “is expected”, “budget”, “potential”, “scheduled”, “estimates”, “forecasts”, “intends”, “anticipates”, “believes”, or “projects”, or the negatives thereof or variations of such words and phrases or statements that certain actions, events or results “will”, “should”, “may”, “could”, “would”, “might” or “will be taken”, “occur” or “be achieved” or the negative of these terms or comparable terminology, all statements other than statements of historical fact, including those that express, or involve discussions as to, expectations, beliefs, plans, objectives, assumptions or future events or performance, including the anticipated results of delisting and consolidated trading on Nasdaq. Such statements reflect the Company's current views and intentions with respect to future events, and current information available to the Company, and are subject to certain risks, uncertainties and assumptions. Many factors could cause the actual results, performance or achievements that may be expressed or implied by such forward-looking statements to vary from those described herein should one or more of these risks or uncertainties materialize. These factors include, without limitation: the general business, market and economic conditions in the regions in which the Company operates; the impact of the COVID-19 pandemic and the actions taken by governmental authorities, individuals and companies in response to the pandemic on our business, financial condition and results of operations, including on the Company's patient base, revenues, employees, and equipment and supplies; significant capital requirements and operating risks that the Company may be subject to; the ability of the Company to implement business strategies and pursue business opportunities; volatility in the market price of the Company's common shares; the Company’s novel business model; the state of the capital markets; the availability of funds and resources to pursue operations; reductions in reimbursement rates and audits of reimbursement claims by various governmental and private payor entities; dependence on few payors; possible new drug discoveries; dependence on key suppliers; granting of permits and licenses in a highly regulated business; competition; disruptions in or attacks (including cyber-attacks) on the Company's information technology, internet, network access or other voice or data communications systems or services; the evolution of various types of fraud or other criminal behavior to which the Company is exposed; difficulty integrating newly acquired businesses; the impact of new and changes to, or application of, current laws and regulations; the overall difficult litigation and regulatory environment; increased competition; increased funding costs and market volatility due to market illiquidity and competition for funding; critical accounting estimates and changes to accounting standards, policies, and methods used by the Company; the Company’s status as an emerging growth company and a smaller reporting company; and the occurrence of natural and unnatural catastrophic events or health epidemics or concerns, such as the COVID-19 pandemic, and claims resulting from such events or concerns; as well as those risk factors discussed or referred to in the Company’s disclosure documents, including the Company’s most recent Annual Report on Form 10-K and Quarterly Report on Form 10-Q, filed with the U.S. Securities and Exchange Commission (the “SEC”) available on the SEC’s website at www.sec.gov, and with the securities regulatory authorities in certain provinces of Canada available at www.sedar.com. Should any factor affect the Company in an unexpected manner, or should assumptions underlying the forward-looking statements prove incorrect, the actual results or events may differ materially from the results or events predicted. Any such forward-looking statements are expressly qualified in their entirety by this cautionary statement. Moreover, the Company does not assume responsibility for the accuracy or completeness of such forward-looking statements. The forward-looking statements included in this press release are made as of the date of this press release and the Company undertakes no obligation to publicly update or revise any forward-looking statements, other than as required by applicable law.

v3.23.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

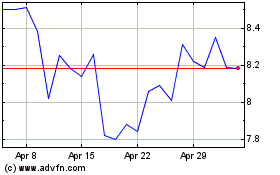

VieMed Healthcare (NASDAQ:VMD)

Historical Stock Chart

From Apr 2024 to May 2024

VieMed Healthcare (NASDAQ:VMD)

Historical Stock Chart

From May 2023 to May 2024