false0001409269NASDAQ00014092692024-06-052024-06-05

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): June 5, 2024

VENUS CONCEPT INC.

(Exact name of registrant as specified in its charter)

|

Delaware

|

001-38238

|

06-1681204

|

|

(State or other jurisdiction of incorporation)

|

(Commission File Number)

|

(IRS Employer Identification Number)

|

235 Yorkland Blvd, Suite 900

Toronto, Ontario M2J 4Y8

(Address of principal executive offices, including Zip Code)

Registrant’s telephone number, including area code: (877) 848-8430

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the

following provisions:

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

|

Trading

Symbol(s)

|

|

Name of each exchange

on which registered

|

|

Common Stock, $0.0001 par value per share

|

|

VERO

|

|

The Nasdaq Capital Market

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter)

or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or

revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| Item 1.01. |

Entry into a Material Definitive Agreement.

|

Consent Amendment

On June 7, 2024, Venus Concept Inc. (the “Company”), Venus Concept USA, Inc., a wholly-owned subsidiary of the Company (“Venus USA”), Venus Concept Canada Corp., a wholly-owned Canadian subsidiary of the Company (“Venus Canada”), and Venus Concept Ltd., a wholly-owned Israeli subsidiary of the

Company (“Venus Israel” and together with the Company, Venus USA and Venus Canada, the “Loan Parties”), entered into a Consent Agreement with Madryn Health Partners, LP

(“Madryn”) and Madryn Health Partners (Cayman Master), LP (“Madryn Cayman,” and together with Madryn, the “Lenders”) (the “Consent Agreement”). The Consent Agreement amended the MSLP Loan Amendment entered into between the Loan Parties and the Lenders on May 24, 2024 (the “MSLP Loan Amendment”)

to, among other things, grant certain relief from minimum liquidity requirements under the MSLP Loan Amendment.

The foregoing description of the Consent Agreement does not purport to be complete and is qualified in its entirety by reference to the full text of the Consent

Agreement, a copy of which is filed hereto as Exhibit 10.1.

Second Bridge Loan Amendment

On June 7, 2024, the Loan Parties entered into a Second Bridge Loan Amendment Agreement with the Lenders (the “Second Bridge Loan Amendment”). The Second Bridge Loan Amendment amended that certain Loan and Security Agreement, dated April 23, 2024, among Venus USA, as borrower, the Company, Venus Canada and Venus Israel, as

guarantors, and the Lenders, as lenders (as amended from time to time, the “Bridge Loan”), to extend the maturity date of the Bridge Loan from June 7, 2024 to June 21, 2024.

The foregoing description of the Second Bridge Loan Amendment does not purport to be complete and is qualified in its entirety by reference to the full text of the

Second Bridge Loan Amendment, a copy of which is filed hereto as Exhibit 10.2.

| Item 5.07. |

Submission of Matters to a Vote of Security Holders.

|

On June 5, 2024, the Company held its Annual Meeting of Stockholders (the “Annual Meeting”). At the Annual Meeting, the

Company’s stockholders approved the two proposals listed below. The final results for the votes regarding each proposal are set forth in the following tables. Each of these proposals are described in detail in the Company’s definitive proxy statement

for its Annual Meeting.

1. Election of two (2) Class I Directors for a three-year term:

| |

Votes For

|

Votes Withheld

|

Broker Non-Votes

|

|

Rajiv De Silva

|

8,401,971

|

84,005

|

1,298,008

|

|

Keith Sullivan

|

8,326,108

|

159,868

|

1,298,008

|

2. Ratify the selection of MNP LLP as the Company’s independent registered public account firm for the fiscal year ending December 31, 2024:

|

Votes For

|

Votes Against

|

Abstentions

|

|

9,708,204

|

16,515

|

59,265

|

|

Item 9.01.

|

Financial Statements and Exhibits.

|

|

No.

|

Description

|

| |

|

|

|

Consent Agreement, dated June 7, 2024, by and among Venus Concept Inc., Venus Concept Canada Corp., Venus Concept USA Inc., Venus Concept Ltd., Madryn Health Partners, LP and Madryn Health Partners (Cayman

Master), LP

|

| |

|

|

Second Amendment to Bridge Loan Agreement, dated June 7, 2024, by and among Venus Concept USA, Inc., Venus Concept Inc., Venus Concept Canada Corp., Venus Concept Ltd., Madryn Health Partners, LP and Madryn Health

Partners (Cayman Master), LP

|

| |

|

|

104

|

Cover Page Interactive Data File (embedded within the Inline XBRL document)

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

| |

VENUS CONCEPT INC.

|

| |

|

|

|

Date: June 10, 2024

|

By:

|

/s/ Domenic Della Penna

|

| |

|

Domenic Della Penna

|

| |

|

Chief Financial Officer

|

Exhibt 10.1

Execution Copy

CONSENT AGREEMENT

THIS CONSENT AGREEMENT (the “Agreement”) dated as of June 7, 2024 (the “Effective Date”) is entered into among (a) VENUS CONCEPT USA INC., a Delaware corporation (the “Borrower”), (b) VENUS CONCEPT INC., a Delaware corporation (the “Venus Concept”), (c) VENUS CONCEPT

CANADA CORP., a corporation incorporated under the laws of the Province of Ontario (the “Venus Canada”), (d) VENUS CONCEPT LTD., a company formed under the Companies Law of

Israel “Venus Israel” and, together with Venus Concept and Venus Canada, the “Guarantors”; the

Borrower and the Guarantors shall be referred to herein, collectively, as the “Loan Parties”), and (e) each of (i) MADRYN HEALTH PARTNERS, LP, a Delaware limited partnership

(“Madryn Health”) and (ii) MADRYN HEALTH PARTNERS (CAYMAN MASTER), LP, a Cayman Islands limited partnership (“Madryn

Cayman” and, together with Madryn Health, the “Lenders”; together the Lender and the Loan Parties are hereinafter referred to as the “Parties”). Capitalized terms used but not otherwise defined herein shall have the meanings given to them in the Loan Agreement (as defined below).

RECITALS

WHEREAS, CITY NATIONAL BANK OF FLORIDA (“CNB”) and the Borrower were

parties to that certain Loan and Security Agreement (Main Street Priority Loan), dated as of December 8, 2020 (as amended, restated, supplemented, waived or otherwise modified from time to time, the “Loan Agreement”), between CNB, as lender, and Borrower, pursuant to which CNB provided Borrower a term loan in the principal amount of Fifty

Million Dollars ($50,000,000.00) (the “Loan”) issued pursuant to the Main Street Priority Loan Facility, all upon certain terms and conditions set forth in the Loan

Agreement and in the other Loan Documents (as defined in the Loan Agreement);

WHEREAS, to evidence Borrower’s repayment obligations under the Loan Agreement, Borrower executed a Promissory Note in favor of CNB dated December 8,

2020 (as amended, amended and restated, supplemented, waived, exchanged or otherwise modified from time to time, the “Original Note”), in the original principal amount of $50,000,000.00;

WHEREAS, in connection with the Loan, the Venus Concept and Venus Canada previously issued a Guaranty of Payment and Performance, originally dated as

of December 8, 2020, in favor of the Lender (as amended, restated, amended and restated, supplemented or otherwise modified from time to time prior to the date hereof, the “Main Street

Guaranty”);

WHEREAS, pursuant to that certain Main Street Loan – Venus Concept – Sale and Assignment Agreement, dated as of April 23, 2024, between CNB and the

Lenders, CNB assigned, transferred, and conveyed all of its rights, title, and interest in and to the Loan, Original Note, the Loan Agreement, the Main Street Guaranty, all other Loan Documents and any related documents to the Lenders;

WHEREAS, pursuant to that certain Exchange Agreement, dated as of May 24, 2024, between the Borrower, Venus Concept and the Lenders, the Lenders

exchanged the Original Note for (a) two new promissory notes issued by the Borrower to each of Madryn Health and Madryn Cayman (collectively, the “Notes” and each a “Note”) and (b) shares of preferred stock of Venus Concept;

WHEREAS, the Borrower has requested relief from the obligation to comply with the requirements of Section 7(a) of the Loan Agreement (“Liquidity”) in

respect of the Borrower’s minimum liquidity amounts (“Requested Minimum Liquidity Consent”); and

WHEREAS, the Lenders are willing to consent to the Requested Minimum Liquidity Consent, subject to the terms and conditions hereof;

NOW, THEREFORE, in consideration of the premises and the mutual covenants contained herein, and for other good and valuable consideration, the receipt

and sufficiency of which are hereby acknowledged, the parties hereto agree as follows:

1. Requested Minimum Liquidity Consent. The Lenders, as of the date hereof, hereby approve the Requested Minimum Liquidity Consent and agree that until June 21, 2024, the failure of any of the Loan Parties to comply with the

obligations of Sections 7(a) of the Loan Agreement shall not constitute an Event of Default under the Loan Agreement or the Notes. The above consent shall not otherwise modify or affect the Borrower’s and the other Loan Parties’ obligations to

comply fully with the terms of the Loan Agreement, the Notes or any other Loan Document in the future and is limited solely to the matters set forth in this Section 1. Nothing contained in this Agreement shall be deemed to constitute a waiver of

any duty, term, condition or covenant contained in the Loan Agreement, the Notes or any other Loan Document in the future, or any other rights or remedies any Lender may have under the Loan Agreement, the Notes or any other Loan Documents or under

applicable law.

2. Conditions Precedent. This Agreement shall be effective upon the date on which the Lenders shall have received counterparts of this Agreement duly executed by the Borrower, the Guarantors, and the Lenders.

3. Reaffirmation. Each of the Loan Parties acknowledges and reaffirms (a) that it is bound by all of the terms of the Loan Documents to which it is a party and (b) that it is responsible for the observance and full performance

of all Obligations, including without limitation, the repayment of the Loan. Furthermore, the Loan Parties acknowledge and confirm that by entering into this Agreement, the Lenders do not, except as expressly set forth herein, waive or release any

term or condition of the Loan Agreement, the Notes or any of the other Loans Documents or any of their rights or remedies under such Loan Documents or any applicable law or any of the obligations of the Loan Parties thereunder.

4. Representations and Warranties. Each Loan Party represents and warrants to the Lenders as follows:

(a) As of the Effective Date, no Event of Default has occurred and is continuing.

(b) The representations and warranties

of the Borrower and each other Loan Party contained in Section 5 of the Loan Agreement, or which are contained in any document furnished at any time under or in connection therewith, are true and correct in all material respects (and in all

respects if any such representation and warranty is already qualified by materiality or reference to material adverse effect) on and as of the Effective Date, except to the extent that such representations and warranties specifically refer to an

earlier date, in which case they are true and correct in all material respects (and in all respects if any such representation and warranty is already qualified by materiality or reference to material adverse effect) as of such earlier date.

(c) Each Loan Party has the full power

and authority to enter into, execute and deliver this Agreement and perform its obligations hereunder, under the Loan Agreement and under each of the other Loan Documents. The execution, delivery and performance by each Loan Party of this

Agreement, and the performance by each Loan Party of the Loan Agreement and each other Loan Document to which it is a party, in each case, are within such person’s powers and have been authorized by all necessary corporate action of such person.

(d) This Agreement has been duly

executed and delivered by such person and constitutes such person’s legal, valid and binding obligations, enforceable in accordance with its terms, except as such enforceability may be subject to (i) bankruptcy, insolvency, reorganization,

fraudulent conveyance or transfer, moratorium or similar laws affecting creditors’ rights generally and (ii) general principles of equity (regardless of whether such enforceability is considered in a proceeding at law or in equity).

(e) No consent, approval, authorization

or order of, or filing, registration or qualification with, any court or governmental authority or third party is required in connection with the execution, delivery or performance by such person of this Agreement.

(f) The execution and delivery of this

Agreement does not (i) violate, contravene or conflict with any provision of its organization documents or (ii) materially violate, contravene or conflict with any laws applicable to it or its subsidiaries.

(g) The Loan Parties’ obligations are

not reduced or modified by this Agreement and are not subject to any offsets, defenses or counterclaims.

5. Release. As a material part of the consideration for the Lenders entering into this Agreement (this Section 5, the “Release Provision”):

(a) Each Loan Party agrees that the

Lenders, each of their respective affiliates and each of the foregoing persons’ respective officers, managers, members, directors, advisors, sub- advisors, partners, agents and employees, and their respective successors and assigns (hereinafter all

of the above collectively referred to as the “Lender Group”), are irrevocably and unconditionally released, discharged and acquitted from any and all actions, causes of

action, claims, demands, damages and liabilities of whatever kind or nature, in law or in equity, now known or unknown, suspected or unsuspected to the extent that any of the foregoing arises from any action or failure to act under or otherwise

arising in connection with the Loan Agreement, the Notes or the other Loan Documents on or prior to the date hereof.

(b) Each Loan Party hereby

acknowledges, represents and warrants to the Lender Group that:

(i) it has read and understands the

effect of the Release Provision. Each Loan Party has had the assistance of independent counsel of its own choice, or has had the opportunity to retain such independent counsel, in reviewing, discussing, and considering all the terms of the Release

Provision; and if counsel was retained, counsel for such Loan Party has read and considered the Release Provision and advised such Loan Party with respect to the same. Before execution of this Agreement, each Loan Party has had adequate opportunity

to make whatever investigation or inquiry it may deem necessary or desirable in connection with the subject matter of the Release Provision.

(ii) no Loan Party is acting in reliance

on any representation, understanding, or agreement not expressly set forth herein. Each Loan Party acknowledges that the Lender Group has not made any representation with respect to the Release Provision except as expressly set forth herein.

(iii) each Loan Party has executed this

Agreement and the Release Provision thereof as its free and voluntary act, without any duress, coercion, or undue influence exerted by or on behalf of any person.

(iv) each Loan Party is the sole owner of

its respective claims released by the Release Provision, and no Loan Party has heretofore conveyed or assigned any interest in any such claims to any other Person.

(c) The Loan Parties understand that the

Release Provision was a material consideration in the agreement of the Lenders to enter into this Agreement. The Release Provision shall be in addition to any right, privileges and immunities granted to the Lenders under the Loan Documents.

(a) The Loan Agreement and the Notes,

each as may be modified hereby, and the obligations of the Loan Parties thereunder and under the other Loan Documents, are hereby ratified and confirmed and shall remain in full force and effect according to their terms. This Agreement shall

constitute a Loan Document under Loan Agreement.

(b) This Agreement may be executed in

any number of counterparts, each of which when so executed and delivered shall be an original, but all of which shall constitute one and the same instrument. Delivery of an executed counterpart of this Agreement by telecopy shall be effective as an

original and shall constitute a representation that an executed original shall be delivered.

(c) THIS AGREEMENT AND

THE RIGHTS AND OBLIGATIONS OF THE PARTIES HEREUNDER SHALL BE GOVERNED BY AND CONSTRUED AND INTERPRETED IN ACCORDANCE WITH THE LAWS OF THE STATE OF NEW YORK.

[Signature pages follow]

IN WITNESS WHEREOF, the parties hereto have caused this Agreement to be duly

executed as of the date first above written.

| |

VENUS CONCEPT USA INC., as Borrower and a Grantor

|

| |

|

|

| |

By:

|

/s/ Rajiv De Silva

|

| |

|

Name: Rajiv De Silva

|

| |

|

Title: President and Assistant Secretary

|

| |

|

|

| |

VENUS CONCEPT INC., as a Guarantor and a Grantor

|

| |

|

|

| |

By:

|

/s/ Rajiv De Silva

|

| |

|

Name: Rajiv De Silva

|

| |

|

Title: Chief Executive Officer

|

| |

|

|

| |

VENUS CONCEPT CANADA CORP., as a Guarantor and a Grantor

|

| |

|

|

| |

By:

|

/s/ Hemanth Varghese

|

| |

|

Name: Hemanth Varghese

|

| |

|

Title: President and General Manager

|

| |

|

|

| |

VENUS CONCEPT LTD, as a Guarantor and a Grantor

|

| |

|

|

| |

By:

|

/s/ Rajiv De Silva

|

| |

|

Name: Rajiv De Silva

|

| |

|

Title: Chief Executive Officer

|

Signature Page to Consent Agreement

| |

MADRYN HEALTH PARTNERS, LP, as a Lender

|

| |

|

|

| |

By:

|

MADRYN HEALTH ADVISORS, LP, its General Partner

|

| |

|

|

| |

By:

|

MADRYN HEALTH ADVISORS GP, LLC, its General Partner

|

| |

|

|

| |

By:

|

/s/ Avinash Amin

|

| |

|

Name: Avinash Amin

|

| |

|

Title: Member

|

| |

|

|

| |

MADRYN HEALTH PARTNERS (CAYMAN MASTER), LP, as a Lender

|

| |

|

|

| |

By:

|

MADRYN HEALTH ADVISORS, LP, its General Partner

|

| |

|

|

| |

By:

|

MADRYN HEALTH ADVISORS GP, LLC, its General Partner

|

| |

|

|

| |

By:

|

/s/ Avinash Amin

|

| |

|

Name: Avinash Amin

|

| |

|

|

Signature Page to Consent Agreement

Exhibit 10.2

Execution Copy

SECOND AMENDMENT TO BRIDGE LOAN AGREEMENT

THIS SECOND AMENDMENT TO BRIDGE LOAN AGREEMENT (the “Agreement”)

dated

as of June 7, 2024 (the “Effective Date”) is entered into among

(a) VENUS CONCEPT USA INC., a Delaware corporation (the “Borrower”), (b) VENUS CONCEPT INC., a Delaware corporation (the “Venus Concept”), (c) VENUS CONCEPT CANADA CORP., a corporation incorporated under the laws of the Province of Ontario (the “Venus Canada”), (d) VENUS CONCEPT LTD., a company formed under the Companies Law of Israel “Venus Israel” and,

together with Venus Concept and Venus Canada, the “Guarantors”; the Borrower and the Guarantors shall be referred to herein, collectively, as the “Loan Parties”), (e) each lender party hereto (the “Lenders”) and (f) MADRYN HEALTH PARTNERS, LP, a Delaware limited partnership, as Administrative Agent (the “Agent”).

RECITALS

WHEREAS, the Loan Parties, the Lenders and the Agent entered into that certain Loan and Security Agreement, dated as of April 23, 2024 (as

amended, restated, supplemented, waived or otherwise modified from time to time, the “Loan Agreement”), pursuant to which the Lenders agreed to make a

term loan to the Borrower in the original principal amount of $2,237,906.85 and one or more delayed draw term loans of up to an additional principal amount of $2,762,093.15, in each case, subject to the terms and conditions of the Loan Agreement;

WHEREAS, the Borrower has requested that the Loan Agreement be amended to provide for certain modifications thereto;

WHEREAS, the Lenders are willing to amend the Loan Agreement, subject to the terms and conditions of this Agreement;

NOW, THEREFORE, in consideration of the premises and the mutual covenants contained herein, and for other good and valuable consideration,

the receipt and sufficiency of which are hereby acknowledged, the parties hereto agree as follows:

1. Amendment to Loan Agreement. The definition of “Maturity Date” in Section 1.01 of the Loan Agreement is hereby amended by replacing the text “June 7, 2024” with the text “June 21,

2024”.

2. Conditions Precedent. This Agreement shall be effective upon the date on which the Lenders shall have received counterparts of this Agreement duly executed by the Borrower, the

Guarantors, and the Lenders.

3. Reaffirmation. Each of the Loan Parties acknowledges and reaffirms (a) that it is bound by all of the terms of the Loan Documents to which it is a party and (b) that it is

responsible for the observance and full performance of all Obligations, including without limitation, the repayment of the Term Loan. Furthermore, the Loan Parties acknowledge and confirm that by entering into this Agreement, the Lenders do not,

except as expressly set forth herein, waive or release any term or condition of the Loan Agreement or any of the other Loans Documents or any of their rights or remedies under such Loan Documents or any applicable law or any of the obligations of

the Loan Parties thereunder.

4. Representations and Warranties. Each Loan Party represents and warrants to the Lenders as follows:

(a) As of the Effective Date, no Event of Default has occurred and is continuing.

(b) The

representations and warranties of the Borrower and each other Loan Party contained in Section 4 of the Loan Agreement, or which are contained in any document furnished at any time under or in connection therewith, are true and correct in all

material respects (and in all respects if any such representation and warranty is already qualified by materiality or reference to material adverse effect) on and as of the Effective Date, except to the extent that such representations and

warranties specifically refer to an earlier date, in which case they are true and correct in all material respects (and in all respects if any such representation and warranty is already qualified by materiality or reference to material adverse

effect) as of such earlier date.

(c) Each Loan Party

has the full power and authority to enter into, execute and deliver this Agreement and perform its obligations hereunder, under the Loan Agreement and under each of the other Loan Documents. The execution, delivery and performance by each Loan

Party of this Agreement, and the performance by each Loan Party of the Loan Agreement and each other Loan Document to which it is a party, in each case, are within such person’s powers and have been authorized by all necessary corporate action of

such person.

(d) This Agreement

has been duly executed and delivered by such person and constitutes such person’s legal, valid and binding obligations, enforceable in accordance with its terms, except as such enforceability may be subject to (i) bankruptcy, insolvency,

reorganization, fraudulent conveyance or transfer, moratorium or similar laws affecting creditors’ rights generally and (ii) general principles of equity (regardless of whether such enforceability is considered in a proceeding at law or in equity).

(e) No consent,

approval, authorization or order of, or filing, registration or qualification with, any court or governmental authority or third party is required in connection with the execution, delivery or performance by such person of this Agreement.

(f) The execution

and delivery of this Agreement does not (i) violate, contravene or conflict with any provision of its organization documents or (ii) materially violate, contravene or conflict with any laws applicable to it or its subsidiaries.

(g) The Loan

Parties’ obligations are not reduced or modified by this Agreement and are not subject to any offsets, defenses or counterclaims.

5. Release. As a material part of the consideration for the Lenders entering into this Agreement

(this Section 5, the “Release Provision”):

(a) Each Loan Party

agrees that the Lenders, each of their respective affiliates and each of the foregoing persons’ respective officers, managers, members, directors, advisors, sub- advisors, partners, agents and employees, and their respective successors and assigns

(hereinafter all of the above collectively referred to as the “Lender Group”), are irrevocably and unconditionally released, discharged and acquitted

from any and all actions, causes of action, claims, demands, damages and liabilities of whatever kind or nature, in law or in equity, now known or unknown, suspected or unsuspected to the extent that any of the foregoing arises from any action or

failure to act under or otherwise arising in connection with the Loan Agreement or the other Loan Documents on or prior to the date hereof.

(b) Each Loan Party

hereby acknowledges, represents and warrants to the Lender Group that:

(i) it has read

and understands the effect of the Release Provision. Each Loan Party has had the assistance of independent counsel of its own choice, or has had the opportunity to retain such independent counsel, in reviewing, discussing, and considering all the

terms of the Release Provision; and if counsel was retained, counsel for such Loan Party has read and considered the Release Provision and advised such Loan Party with respect to the same. Before execution of this Agreement, each Loan Party has had

adequate opportunity to make whatever investigation or inquiry it may deem necessary or desirable in connection with the subject matter of the Release Provision.

(ii) no Loan Party

is acting in reliance on any representation, understanding, or agreement not expressly set forth herein. Each Loan Party acknowledges that the Lender Group has not made any representation with respect to the Release Provision except as expressly

set forth herein.

(iii) each Loan

Party has executed this Agreement and the Release Provision thereof as its free and voluntary act, without any duress, coercion, or undue influence exerted by or on behalf of any person.

(iv) each Loan Party

is the sole owner of its respective claims released by the Release Provision, and no Loan Party has heretofore conveyed or assigned any interest in any such claims to any other Person.

(c) The Loan Parties

understand that the Release Provision was a material consideration in the agreement of the Lenders to enter into this Agreement. The Release Provision shall be in addition to any right, privileges and immunities granted to the Lenders under the

Loan Documents.

(a) The Loan

Agreement, as modified hereby, and the obligations of the Loan Parties thereunder and under the other Loan Documents, are hereby ratified and confirmed and shall remain in full force and effect according to their terms. This Agreement shall

constitute a Loan Document under Loan Agreement.

(b) This Agreement

may be executed in any number of counterparts, each of which when so executed and delivered shall be an original, but all of which shall constitute one and the same instrument. Delivery of an executed counterpart of this Agreement by telecopy shall

be effective as an original and shall constitute a representation that an executed original shall be delivered.

(c) THIS

AGREEMENT AND THE RIGHTS AND OBLIGATIONS OF THE PARTIES HEREUNDER SHALL BE GOVERNED BY AND CONSTRUED AND INTERPRETED IN ACCORDANCE WITH THE LAWS OF THE STATE OF NEW YORK.

[Signature pages follow]

IN WITNESS WHEREOF, the parties hereto have caused this

Agreement to be duly executed as of the date first above written.

| |

VENUS CONCEPT USA INC., as Borrower

|

| |

|

|

| |

By:

|

/s/ Rajiv De Silva

|

| |

|

Name: Rajiv De Silva

|

| |

|

Title: President and Assistant Secretary

|

| |

|

|

| |

VENUS CONCEPT INC., as a Guarantor

|

| |

|

|

| |

By:

|

/s/ Rajiv De Silva

|

| |

|

Name: Rajiv De Silva

|

| |

|

Title: Chief Executive Officer

|

| |

|

|

| |

VENUS CONCEPT CANADA CORP., as a Guarantor

|

| |

|

|

| |

By:

|

/s/ Hemanth Varghese

|

| |

|

Name: Hemanth Varghese

|

| |

|

Title: President and General Manager

|

| |

|

|

| |

VENUS CONCEPT LTD, as a Guarantor

|

| |

|

| |

By:

|

/s/ Rajiv De Silva

|

| |

|

Name: Rajiv De Silva

|

| |

|

Title: Chief Executive Officer

|

Signature Page to Second Amendment to Bridge Loan Agreement

| |

MADRYN HEALTH PARTNERS, LP, as a Lender

|

| |

|

|

| |

By:

|

MADRYN HEALTH ADVISORS, LP, its General Partner

|

| |

|

|

| |

By:

|

MADRYN HEALTH ADVISORS GP, LLC, its General Partner

|

| |

|

|

| |

By:

|

/s/ Avinash Amin

|

| |

|

Name: Avinash Amin

|

| |

|

Title: Member

|

| |

|

|

| |

MADRYN HEALTH PARTNERS (CAYMAN MASTER), LP, as a Lender

|

| |

|

|

| |

By:

|

MADRYN HEALTH ADVISORS, LP, its General Partner

|

| |

|

|

| |

By:

|

MADRYN HEALTH ADVISORS GP, LLC, its General Partner

|

| |

|

|

| |

By:

|

/s/ Avinash Amin

|

| |

|

Name: Avinash Amin

|

| |

|

Title: Member

|

| |

|

|

| |

MADRYN HEALTH PARTNERS, LP, as Administrative Agent

|

| |

|

|

| |

By:

|

MADRYN HEALTH ADVISORS, LP, its General Partner

|

| |

|

|

| |

By:

|

MADRYN HEALTH ADVISORS GP, LLC, its General Partner

|

| |

|

|

| |

By:

|

/s/ Avinash Amin

|

| |

|

Name: Avinash Amin

|

| |

|

Title: Member

|

Signature Page to Second Amendment to Bridge Loan Agreement

v3.24.1.1.u2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

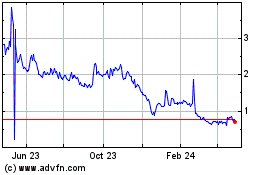

Venus Concept (NASDAQ:VERO)

Historical Stock Chart

From Dec 2024 to Jan 2025

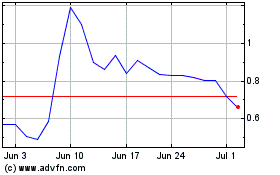

Venus Concept (NASDAQ:VERO)

Historical Stock Chart

From Jan 2024 to Jan 2025