0001681622false00016816222023-11-172023-11-17

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

___________________________________

FORM 8-K

_____________________________________________________________________________

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): November 17, 2023

___________________________________

VAREX IMAGING CORPORATION

(Exact name of registrant as specified in its charter)

___________________________________ | | | | | | | | | |

| Delaware | | |

| (State or Other Jurisdiction of Incorporation) |

| | | |

| 001-37860 | | | 81-3434516 |

| (Commission File Number) | | (I.R.S. Employer Identification No.) |

| |

| | | |

1678 S. Pioneer Road, Salt Lake City, Utah | | | 84104 |

(Address of principal executive offices) | | | (Zip Code) |

Registrant’s telephone number, including area code: (801) 972-5000

Not Applicable

(Former name or former address, if changed since last report)

___________________________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below): | | | | | |

☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act: | | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Stock | VREX | The Nasdaq Global Select Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 or Rule 12b - 2 of the Securities Exchange Act of 1934. Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 8.01 Other Events

On November 17, 2023, the Compensation and Human Capital Management Committee of the Board of Directors of Varex Imaging Corporation (the “Company”) adopted a form of Performance Unit Agreement to be used to evidence performance unit grants under the Company’s 2020 Omnibus Stock Plan. A copy of the form of agreement is attached hereto as Exhibit 10.1.

The information contained in this Current Report on Form 8-K shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such a filing.

Item 9.01 Financial Statements and Exhibits

(d) Exhibits

Exhibit No. Description

10.1 Form of 2020 Omnibus Stock Plan Performance Unit Agreement

104 Cover Page Interactive Data File (embedded within the Inline XBRL document

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| | VAREX IMAGING CORPORATION

|

| | |

| Dated: November 17, 2023 | By: | /s/ Kimberley E. Honeysett |

| | Kimberley E. Honeysett |

| | Senior Vice President, Chief Legal Officer, and Corporate Secretary |

Exhibit 10.1

VAREX IMAGING CORPORATION

2020 Omnibus Stock Plan

PERFORMANCE UNIT AGREEMENT

Varex Imaging Corporation (the “Company”) hereby awards to the designated employee (“Employee”), Performance Units under the Company’s 2020 Omnibus Stock Plan (the “Plan”). The Performance Units awarded under this Performance Unit Agreement (the "Agreement") consist of the right to receive shares of common stock of the Company (“Shares”). The Grant Date is the date of this Agreement (the “Grant Date”). Subject to the provisions of Appendix A of this Agreement ("Appendix A") (attached) [, which includes the Country-Specific Addendum,] Appendix B of this Agreement ("Appendix B”), of the Employee's Clawback Agreement, and of the Plan, the principal features of this award are as follows:

[Number of Performance Units at Threshold Performance: [____________]]

Number of Performance Units at Target Performance: [____________] (Your Target Grant)

[Maximum Number of Performance Units: [____________] (Potential Maximum)]

Performance Period: [The three-year period commencing on the Grant Date and ending on the third anniversary of the Grant Date] (the “Performance Period”)

Performance Goals: The actual number of Shares to be earned under this award will be determined based on the performance goals set forth in Appendix B (the “Performance Unit Vesting Terms”). Such Performance Unit Vesting Terms and the extent to which they have been achieved will be determined by the Compensation and Management Development Committee (the “Committee”) of the Board of Directors of the Company (the “Board”), in its sole discretion.

As provided in the Plan, this Agreement, Appendix A and Appendix B, this Award may terminate before the end of the Performance Period. For example, if Employee experiences a Termination of Service before the end of the Performance Period, this Award will terminate at the same time as such termination unless an exception applies as set forth in Appendix A and Appendix B. Important additional information on vesting and forfeiture of the Performance Units covered by this Award is contained in Appendix A and Appendix B.

Your acceptance of this award online at the service provider web-site or, when provided, your signature of a copy of this Agreement, indicates your agreement and understanding that this award is subject to all of the terms and conditions contained in Appendix A, Appendix B, your Clawback Agreement, and the Plan.

PLEASE BE SURE TO READ ALL OF APPENDIX A AND APPENDIX B, YOUR CLAWBACK AGREEMENT, AND THE PLAN, WHICH CONTAINS THE SPECIFIC TERMS AND CONDITIONS OF THIS AGREEMENT. YOU CAN REQUEST A COPY OF THE PLAN BY CONTACTING THE CORPORATE HUMAN RESOURCES OFFICE IN SALT LAKE CITY, UTAH. TO THE EXTENT ANY CAPITALIZED TERMS USED IN APPENDIX A AND APPENDIX B ARE NOT DEFINED HEREIN, THEY WILL HAVE THE MEANING ASCRIBED TO THEM IN THE PLAN.

VAREX IMAGING CORPORATION EMPLOYEE

By:

Title: [NAME]

APPENDIX A

TERMS AND CONDITIONS OF PERFORMANCE UNITS

1.Award. The Company hereby awards to the Employee under the Plan as a separate incentive in connection with his or her employment, and not in lieu of any salary or other compensation for his or her services, an award of (Your Target Grant) Performance Units on the date hereof, subject to all of the terms and conditions in this Agreement and the Plan.

2.Vesting. Except as otherwise provided in this Appendix A or in Appendix B, to the extent that the Performance Goals are achieved and Shares are earned, as determined and certified by the Committee in its sole discretion, then the earned Shares shall be paid following the end of the Performance Period and no later than December 15th immediately following the end of the Performance Period (the “Settlement Date”) provided that Employee does not experience a Termination of Service from the Grant Date through the applicable Determination Date (as defined in Appendix B) or, if applicable, the New Vesting Date (as defined in Exhibit B) (the “Employment Requirement”).

3.Committee Discretion. The Committee, in its absolute discretion, may waive the Employment Requirement with respect to all or any portion of the Performance Units at any time.

4.Forfeiture and Other Remedies.

(a) Except as provided in this Appendix A or in Appendix B, and notwithstanding any contrary provision of this Agreement, in the event that Employee ceases to be continuously employed by the Company or by one of its Affiliates through the last day of the Performance Period, the Performance Units shall thereupon be forfeited.

(b) The Performance Units granted hereunder shall be subject to the forfeiture, recapture and other remedial provisions as provided in any recoupment policy or agreement that the Employee is subject to, including as provided in the Employee's Clawback Agreement.

5.Settlement of Performance Units; Dividend Equivalents.

(a) Status as a Creditor. Prior to settlement of any vested Performance Units, the Performance Units will represent an unfunded and unsecured obligation of the Company, payable (if at all) only from the general assets of the Company. The Employee is an unsecured general creditor of the Company, and settlement of vested Performance Units is subject to the claims of the Company’s creditors.

(b) Form and Timing of Settlement. Except as otherwise provided herein, Performance Units will automatically be settled in the form of Shares on the Settlement Date to the extent earned in accordance with the terms hereof. Fractional Shares will not be issued with respect to Performance Units. Where a fractional Share would be owed to the Employee with respect to vested Performance Units, a cash payment equivalent will be paid in place of any such fractional Share using the Fair Market Value on the relevant Settlement Date.

(c) Dividend Equivalents. In the event that the Company declares a cash dividend on its Shares having a record date on or after the Grant Date and prior to the date the vested Performance Units are settled, an amount equal to the per Share cash dividend(s) multiplied by the number of Shares earned and payable under the Performance Units granted to Employee under this Agreement, if any, shall be accrued on the Employee’s behalf and paid in cash to Employee at the same time and otherwise under the same terms and conditions as apply to such earned and payable Performance Units.

6.Tax Liability and Withholding. As a condition to the grant, vesting and settlement of the Performance Units, regardless of any action the Company or any Subsidiary or Affiliate takes with respect to any applicable taxes or tax withholdings, social contributions, required deductions, or other payments, if any (collectively, the “Tax-Related Items”), the Employee hereby acknowledges and agrees that the ultimate liability for all Tax-Related Items legally due by the Employee is and remains the Employee’s responsibility and may exceed any amount actually withheld by the Company or any Subsidiary or Affiliate. The Employee further acknowledges that the Company and its Subsidiaries and Affiliates (a) make no representations or undertakings regarding the treatment of any Tax-Related Items in connection with any aspect of the Performance Units, including the award of the Performance Units, the vesting of the Performance Units, the issuance of Shares in settlement of the Performance Units, the subsequent sale of Shares acquired at vesting and the receipt of and settlement of any dividend equivalents; and (b) do not commit to structure the terms of the Award or any aspect of the Performance Units to reduce or eliminate the Employee’s liability for Tax-Related Items or achieve any particular tax result. The Employee also agrees that he or she will not make any claim against the Company, or any of its Directors, Employees or Subsidiaries or Affiliates related to Tax-Related Items arising from the Performance Units. Prior to the relevant taxable event, the Employee hereby acknowledges and agrees that the Company and any Subsidiary or Affiliate shall satisfy all their obligations, if any, related to the Tax-Related Items by withholding all or a portion of any Shares that otherwise would be issued to the Employee upon settlement of the vested Performance Units. Such withheld Shares shall be valued based on the Fair Market Value as of the date the withholding obligations are satisfied. The Employee hereby acknowledges that the Employee will not receive a refund

in cash or Shares from the Company or any Subsidiary or Affiliate with respect to any withheld Shares, whose value exceeds their withholding obligations for Tax-Related Items, and such excess amount will be included in the taxes that the Company and any Subsidiary or Affiliate will pay to the applicable tax authorities on the Employee’s behalf. The Employee must pay to the Company or any Subsidiary or Affiliate any amount of Tax-Related Items that the Company or any Subsidiary or Affiliate may be required to withhold that cannot be satisfied by the means previously described. The Company or any Subsidiary or Affiliate may refuse to deliver the Shares to the Employee if the Employee fails to comply with the Employee’s obligations in connection with the Tax-Related Items. The Employee further acknowledges and agrees that the Employee is solely responsible for filing all relevant documentation that may be required in relation to the Performance Units or any Tax-Related Items other than filings or documentation that is the specific obligation of the Company or any Subsidiary or Affiliate pursuant to applicable law, such as but not limited to personal income tax returns or reporting statements in relation to the grant, vesting or settlement of the Performance Units, the holding of Shares or any bank or brokerage account, the subsequent sale of Shares, and the receipt of any dividends or dividend equivalents. The Employee also understands that applicable laws may require varying Share or Performance Unit valuation methods for purposes of calculating Tax-Related Items, and the Company and its Subsidiaries and Affiliates assume no responsibility or liability in relation to any such valuation or for any calculation or reporting of income or Tax-Related Items that may be required of the Employee under applicable laws. Further, if the Employee has become subject to Tax-Related Items in more than one jurisdiction, the Employee acknowledges that the Company or any Subsidiary or Affiliate may be required to withhold or account for Tax-Related Items in more than one jurisdiction.

7.Rights as Stockholder. Neither the Employee nor any person claiming under or through the Employee shall have any of the rights or privileges of a stockholder of the Company in respect of any Performance Units (whether vested or unvested) unless and until such Performance Units are settled in Shares and certificates representing such Shares shall have been issued, recorded on the records of the Company or its transfer agents or registrars, and delivered to the Employee. After such issuance, recordation and delivery, the Employee shall have all the rights of a stockholder of the Company with respect to voting such Shares and receipt of dividends and distributions on such Shares.

8.Acknowledgments. The Employee acknowledges and agrees to the following:

•The Plan is discretionary in nature and the Committee may amend, suspend, or terminate it at any time;

•The grant of the Performance Units is voluntary and occasional and does not create any contractual or other right to receive future grants of Performance Units, or benefits in lieu of the Performance Units even if the Performance Units have been granted repeatedly in the past;

•All determinations with respect to future awards of Performance Units, if any, including but not limited to, the times when the Performance Units shall be granted or when the Performance Units shall vest, will be at the sole discretion of the Committee;

•The Employee’s participation in the Plan is voluntary;

•The value of the Performance Units is an extraordinary item of compensation, which is outside the scope of the Employee’s employment contract (if any), except as may otherwise be explicitly provided in the Employee’s employment contract (if any);

•The Performance Units are not part of normal or expected compensation or salary for any purpose, including, but not limited to, calculating termination, severance, resignation, termination, redundancy, end of service, vacation, bonuses, long-term service awards, indemnification, pension or retirement benefits and in any event, should not be considered as compensation for, or relating in any way to, past service for the Company or any Subsidiary or Affiliate;

•The future value of the Shares is unknown and cannot be predicted with certainty;

•No claim or entitlement to compensation or damages arises from the termination of the Award or diminution in value of the Performance Units or Shares, and the Employee irrevocably releases the Company and its Subsidiaries or Affiliates from any such claim that may arise;

•Neither the Plan nor the Performance Units shall be construed to create an employment or service relationship;

•Nothing in this Agreement or the Plan shall confer upon the Employee any right to continue to be employed by, or continue in the service of, the Company or any Subsidiary or Affiliate or shall interfere with or restrict in any way the rights of the Company or the Subsidiary or Affiliate, which are hereby expressly reserved, to terminate the employment of the Employee, subject to applicable law;

•The transfer of employment of the Employee between the Company and any one of its Subsidiaries or Affiliates (or between Subsidiaries or Affiliates) shall not be deemed a Termination of Service;

•Nothing herein contained shall affect the Employee’s right to participate in and receive benefits under and in accordance with the then current provisions of any pension, insurance or other employee welfare plan or program of the Company or any Subsidiary or Affiliate; and

•The Company is not obligated, and will have no liability for, failure to issue or deliver any Shares upon vesting of the Performance Units unless such issuance or delivery would comply with the applicable laws, with such compliance determined by the Company in consultation with its legal counsel. Furthermore, the Employee understands that the applicable laws of the country in which the Employee is residing or working at the time of grant and/or vesting of the Performance Units (including any rules or regulations governing securities, foreign exchange, tax, labor or other matters) may restrict or prevent the settlement of the Performance Units and neither the Company nor any Subsidiary or Affiliate assumes liability in relation to the Performance Units in such case. The Performance Units may not be settled until such time as the Plan has been approved by the holders of capital stock of the Company, or if the issuance of such Shares would constitute a violation of any applicable laws, including any applicable U.S. federal or state securities laws or any other law or regulation. As a condition to the settlement of the Performance Units, the Company may require the Employee to make any representation and warranty to the Company as may be required by the applicable laws.

•The Employee understands and agrees that unless otherwise permitted by the Company, any cross-border cash remittance made to transfer proceeds received upon the sale of Shares my need to be made through a locally authorized financial institution or registered foreign exchange agency and may require the Employee to provide to such entity certain information regarding the transaction. Moreover, the Employee understands and agrees that the future value of the underlying Shares is unknown and cannot be predicted with certainty and may decrease in value, even below the fair market value on the Grant Date. The Employee understands that neither the Company nor any Subsidiary or Affiliate is responsible for any foreign exchange fluctuation between local currency and the United States Dollar or the selection by the Company or any Subsidiary or Affiliate in its sole discretion of an applicable foreign currency exchange rate that may affect the value of the Performance Units (or the calculation of income or Tax-Related Items thereunder).

9.Changes in Stock. In the event that as a result of a stock dividend, stock split, reclassification, recapitalization, combination of Shares or the adjustment in capital stock of the Company or otherwise, or as a result of a merger, consolidation, spin-off or other reorganization, the Company’s common stock shall be increased, reduced or otherwise changed, the Performance Units shall, subject to Section 409A of the Code, be properly adjusted.

10.Address for Notices. Any notice to be given to the Company under the terms of this Agreement shall be addressed to the Company, in care of its Secretary, at 1678 S. Pioneer Rd. Salt Lake City, UT 84104, USA or at such other address as the Company may hereafter designate in writing.

11.Restrictions on Transfer. Except as provided in this Appendix A and Appendix B, this award and the rights and privileges conferred hereby shall not be transferred, assigned, pledged or hypothecated in any way (whether by operation of law or otherwise) and shall not be subject to sale under execution, attachment or similar process. Upon any attempt to transfer, assign, pledge, hypothecate or otherwise dispose of this award, or of any right or privilege conferred hereby, or upon any attempted sale under any execution, attachment or similar process, this award and the rights and privileges conferred hereby immediately shall become null and void. Regardless of whether the transfer or issuance of the Shares to be issued pursuant to this Agreement has been registered under the Securities Act of 1933, as amended (the "1933 Act") or has been registered or qualified under the securities laws of any state or other jurisdiction, the Company may impose additional restrictions upon the sale, pledge, or other transfer of the Shares (including the placement of appropriate legends on stock certificates and the issuance of stop-transfer instructions to the Company’s transfer agent) if, in the judgment of the Company and the Company’s counsel, such restrictions are necessary in order to achieve compliance with the provisions of the 1933 Act, the securities laws of any state, or any other law. Stock certificates evidencing the Shares issued pursuant to this Agreement, if any, may bear such restrictive legends as the Company and the Company’s counsel deem necessary under applicable laws or pursuant to this Agreement.

12.Binding Agreement. Subject to the limitation on the transferability of this award contained herein, this Agreement shall be binding upon and inure to the benefit of the heirs, legatees, legal representatives, successors and assigns of the parties hereto.

13.Conditions for Issuance of Certificates for Stock. The Shares deliverable to the Employee upon settlement of vested Performance Units may be either previously authorized but unissued Shares or issued Shares which have been reacquired by the Company. Subject to Section 409A of the Code, the Company shall not be required to issue any certificate or certificates for Shares hereunder prior to fulfillment of all the following conditions: (a) the admission of such Shares to listing on all stock exchanges on which such class of stock is then listed; (b) the completion of any registration or other qualification of such Shares under any state or federal law or under the rulings or regulations of

the Securities and Exchange Commission or any other governmental regulatory body, which the Committee shall, in its absolute discretion, deem necessary or advisable; (c) the approval or other clearance from any state or federal governmental regulatory body, which the Committee shall, in its absolute discretion, determine to be necessary or advisable; and (d) the lapse of such reasonable period of time following the Settlement Date as the Committee may establish from time to time for reasons of administrative convenience.

14.Plan Governs. This Agreement is subject to all terms and provisions of the Plan. In the event of a conflict between one or more provisions of this Agreement and one or more provisions of the Plan, the provisions of the Plan shall govern.

15.Governing Law. This Agreement shall be governed by and construed in accordance with the laws of the State of Delaware, without reference to its principles of conflicts of law. For purposes of litigating any dispute that may arise directly or indirectly from this Agreement, the parties hereby submit and consent to the exclusive jurisdiction of the State of Utah and agree that any such litigation shall be conducted only in the courts of Utah or the federal courts of the United States located in Utah and no other courts.

16.Committee Authority. The Committee shall have the power to interpret the Plan and this Agreement, and to adopt such rules for the administration, interpretation and application of the Plan as are consistent therewith and to interpret or revoke any such rules. All actions taken and all interpretations and determinations made by the Committee in good faith shall be final and binding upon the Employee, the Company and all other interested persons. No member of the Committee shall be personally liable for any action, determination or interpretation made in good faith with respect to the Plan or this Agreement. In its absolute discretion, the Board may at any time and from time to time exercise any and all rights and duties of the Committee under the Plan and this Agreement.

17.Imposition of Other Requirements. The Company reserves the right to impose other requirements on the Employee’s participation in the Plan, on the Performance Units and the Shares subject to the Performance Units and on any other award or Shares acquired under the Plan, or take any other action, to the extent the Company determines it is necessary or advisable in order to comply with applicable laws or facilitate the administration of the Plan. The Employee agrees to sign any additional agreements or undertakings that may be necessary to accomplish the foregoing. Furthermore, the Employee acknowledges that the applicable laws of the country in which the Employee is residing or working at the time of grant, vesting and settlement of the Performance Units or the sale of Shares received pursuant to the Performance Units (including any rules or regulations governing securities, foreign exchange, tax, labor, or other matters) may subject the Employee to additional procedural or regulatory requirements that the Employee is and will be solely responsible for and must fulfill. Such requirements may be outlined in but are not limited to the Country-Specific Addendum (the “Addendum”) attached hereto, which forms part of this Agreement. Notwithstanding any provision herein, the Employee’s participation in the Plan shall be subject to any applicable special terms and conditions or disclosures as set forth in the Addendum. The Employee also understands and agrees that if he works, resides, moves to, or otherwise is or becomes subject to applicable laws or Company policies of another jurisdiction at any time, certain country-specific notices, disclaimers and/or terms and conditions may apply to him as from the Grant Date, unless otherwise determined by the Company in its sole discretion.

18.Captions. Captions provided herein are for convenience only and are not to serve as a basis for interpretation or construction of this Agreement.

19.Severability. In the event that any provision in this Agreement shall be held invalid or unenforceable, such provision shall be severable from, and such invalidity or unenforceability shall not be construed to have any effect on, the remaining provisions of this Agreement.

20.Modifications to the Agreement. This Agreement constitutes the entire understanding of the parties on the subjects covered. The Employee expressly warrants that he or she is not executing this Agreement in reliance on any promises, representations, or inducements other than those contained herein. Modifications to this Agreement or the Plan can be made only in an express written contract executed by a duly authorized officer of the Company.

21.Amendment, Suspension or Termination of the Plan. By accepting this award, the Employee expressly warrants that he or she has received a right to an equity based award under the Plan, and has received, read, and understood a description of the Plan. The Employee understands that the Plan is discretionary in nature and may be modified, suspended, or terminated by the Company at any time.

22.Compliance with Laws and Regulations. The Employee understands that the vesting of the Performance Units under the Plan and the issuance, transfer, assignment, sale, or other dealings of the Shares shall be subject to compliance by the Company (or any Subsidiary or Affiliate) and the Employee with all applicable requirements under the laws, rules, and regulations of the country of which the Employee is a resident. Furthermore, the Employee agrees that he or she will not acquire Shares pursuant to the Plan except in compliance with all under the laws, rules, and regulations of the country of which the Employee is a resident.

23.Data Privacy. The Employee hereby explicitly and unambiguously consents to the collection, use and transfer, in electronic or other form, of his or her personal data by and among, as applicable, the Company and its Subsidiaries, Affiliates or third-parties, as may be selected by the Company, for the exclusive purpose of implementing, administering and managing the Employee’s participation in the Plan. The Employee understands that refusal or withdrawal of consent will affect the Employee’s participation in the Plan; without providing consent, the Employee will not be able to vest or realize benefits (if any) from the Performance Units.

The Employee understands that the Company and any Subsidiary or Affiliate or designated third parties may hold certain personal information about the Employee including, but not limited to, the Employee’s name, home address and telephone number, date of birth, social security number (or any other social or national identification number), salary, nationality, job title, termination date, and reason, electronic mail address, number of Shares held and the details of all Performance Units or any other entitlement to Shares awarded, canceled, vested, unvested or outstanding for the purpose of implementing, administering and managing the Employee’s participation in the Plan (“Personal Data”). The Employee further understands that Personal Data may be transferred to the Company or any Subsidiary or Affiliate, or to any third parties assisting in the implementation, administration and management of the Plan (“Data Recipients”); that these Data Recipients may be located in the United States, the Employee’s country (if not the United States) or elsewhere, and that a Data Recipient’s country may have different data privacy laws and protections than the Employee’s country. In particular, the Company may transfer Personal Data to the broker or stock plan administrator assisting with the Plan, to its legal counsel and tax/accounting advisor, and to the Subsidiary or Affiliate that is the Employee’s employer and its payroll provider.

The Employee should also refer to the Company’s applicable policies (which are available to the Employee separately and may be updated from time to time) for more information regarding the collection, use, storage, and transfer of the Employee’s Personal Data.

24. Electronic Delivery: The Company may, in its sole discretion, decide to deliver any documents related to the Performance Units granted under this Agreement and participation in the Plan or future awards that may be granted under the Plan or any other Company-related documents by electronic means or to request the Employee’s consent to participate in the Plan by electronic means. By accepting this award of Performance Units, whether electronically or otherwise, the Employee hereby consents to receive such documents by electronic delivery and, if requested, to agree to participate in the Plan through an online or electronic system established and maintained by the Company or another third party designated by the Company, including but not limited to the use of electronic signatures or click-through electronic acceptance of terms and conditions.

25. Documents in English. To the extent the Employee has been provided with a copy of this Agreement, the Plan, or any other documents relating to the Performance Units in a language other than English, the English language documents will prevail in case of any ambiguities or divergences as a result of translation.

v3.23.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

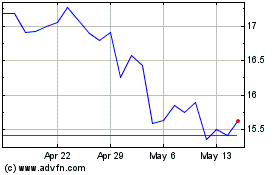

Varex Imaging (NASDAQ:VREX)

Historical Stock Chart

From Apr 2024 to May 2024

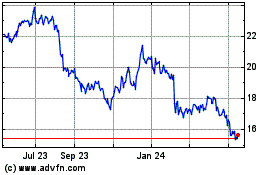

Varex Imaging (NASDAQ:VREX)

Historical Stock Chart

From May 2023 to May 2024