TORM plc First Quarter Report 2019

May 14 2019 - 2:53AM

TORM plc First Quarter Report 2019

”TORM’s results in the first quarter reflect the Company’s

strong operating performance in a product tanker market where a

significant recovery started in the fourth quarter of 2018. We made

a profit before tax of USD 23.5m in the first quarter of 2019, the

strongest quarterly result in three years, and the bookings so far

in the second quarter indicate a continued positive product tanker

market,“ says Executive Director Jacob Meldgaard and adds: “We have

extended our scrubber commitment with an additional 13 units, which

will bring the total number of scrubber-fitted vessels to 34, or

close to half of our fleet. With this balanced approach, TORM is

well-positioned to reap the benefits of the increased demand for

clean petroleum products expected from the implementation of the

IMO 2020 regulation.”

- EBITDA for the first quarter of 2019 was USD 61.5m (2018, same

period: USD 37.3m). The profit before tax amounted to USD 23.5m

(2018, same period: USD 1.1m). Cash flow from operating activities

was positive at USD 55.4m in the first quarter of 2019 (2018, same

period: USD 18.0m), and earnings per share (EPS) was 31 cents

(2018, same period: 1 cent). Return on Invested Capital (RoIC) was

8.8% (2018, same period: 2.4%).

- In the first quarter of 2019, TORM achieved TCE rates of

USD/day 17,949 (2018, same period: USD/day 14,225). The product

tanker freight rates started the first quarter of 2019 at strong

levels last seen in 2016 before softening throughout the quarter as

spring refinery maintenance gained pace.

- As of 31 March 2019, 11% of the remaining total earning days in

2019 were covered at an average rate of USD/day 16,311. As of 7 May

2019, 58% of the total earning days in the second quarter of 2019

were covered at USD/day 16,248. 22% of the total earning days in

the second to the fourth quarter of 2019 were covered at USD/day

16,026.

- During the first quarter of 2019, TORM entered into agreements

to sell two older vessels: the MR vessels TORM Amazon (built in

2002) and TORM Cecilie (built in 2001). The two vessels were sold

for a total consideration of USD 15m, and a total debt of USD 9m

was repaid in connection with the vessel sales. TORM Amazon was

delivered to its new owners during the first quarter of 2019, and

TORM Cecilie was delivered during the second quarter of 2019. As of

31 March 2019, excluding TORM Cecilie that is held for sale, TORM’s

fleet consists of 69 owned vessels, three chartered vessels and

nine vessels on order.

- In April 2019, TORM decided to install 13 additional scrubbers

through retrofit installations. These new scrubbers will be

produced by the joint venture ME Production China, in which TORM

holds an ownership stake of 27.5%. Including the 13 additional

scrubbers, TORM has committed to scrubber installations on 34

vessels, or close to half of our fleet. The remaining newbuilding

program with scrubbers and retrofit installations will be delivered

throughout 2019 and the first quarter of 2020. TORM will finance

the scrubber installations through a combination of additional debt

and cash-in-hand. 32 of the 34 scrubbers will be installed ahead of

the IMO 2020 deadline.

- As of 31 March 2019, TORM’s available liquidity was USD 438m

consisting of USD 155m in cash, USD 237m in undrawn credit

facilities and USD 46m in undrawn credit facilities subject to

documentation. As of 31 March 2019, net interest-bearing debt

amounted to USD 584m and TORM's net loan-to-value (LTV) ratio was

52%.

- Based on broker valuations as of 31 March 2019, TORM’s Net

Asset Value (NAV) excluding charter commitments was estimated at

USD 829m. This corresponds to a NAV/share of USD 11.2 or DKK 74.5.

TORM’s book equity amounted to USD 867m as of 31 March 2019. This

corresponds to a book equity/share of USD 11.7 or DKK 77.9.

- Based on broker valuations, TORM’s fleet including newbuildings

had a market value of USD 1,599m as of 31 March 2019. Compared to

broker valuations as of 31 December 2018, the market value of the

fleet decreased by USD 62m (~4%) when adjusted for sold vessels.

The book value of the fleet was USD 1,412m as of 31 March 2019

excluding outstanding installments on the newbuildings of USD 258m.

The outstanding installments include payments for scrubbers related

to these vessels. As of 31 March 2019, TORM’s order book stood at

nine newbuildings covering two LR1 and seven MR vessels. The LR1

and the MR vessels are expected to be delivered in 2019 and the

first quarter of 2020.

CONFERENCE CALLTORM will be hosting a

conference call for investors and financial analysts at 9:00 am

Eastern Time / 3:00 pm Central European Time. If you wish to listen

to the call, please dial +45 8071 8097 (+1 (866) 966 1396 for USA

connections) at least 10 minutes prior to the start of the call to

ensure connection and use 6877846 as conference ID. The

presentation can be downloaded from

https://investors.torm.com/.

|

CONTACT |

TORM

plc |

| Jacob Meldgaard,

Executive Director, tel.: +45 3917 9200 |

Birchin Court, 20

Birchin Lane |

| Christian

Søgaard-Christensen, CFO, tel.: +45 3917 9285 |

London, EC3V 9DU,

United Kingdom |

| Morten Agdrup, IR,

tel.: +45 3917 9249 |

Tel.: +44 203 713

4560 |

| |

www.torm.com |

ABOUT TORM TORM is one of the world’s leading

carriers of refined oil products. The Company operates a fleet of

approximately 80 modern vessels with a strong commitment to safety,

environmental responsibility and customer service. TORM was founded

in 1889. The Company conducts business worldwide. TORM’s shares are

listed on NASDAQ Copenhagen and NASDAQ New York (tickers: TRMD A

and TRMD). For further information, please visit www.torm.com.

SAFE HARBOR STATEMENTS AS TO THE FUTUREMatters

discussed in this release may constitute forward-looking

statements. Forward-looking statements reflect our current views

with respect to future events and financial performance and may

include statements concerning plans, objectives, goals, strategies,

future events or performance, and underlying assumptions and

statements other than statements of historical facts. The words

“believe,” “anticipate,” “intend,” “estimate,” “forecast,”

“project,” “plan,” “potential,” “may,” “should,” “expect,”

“pending” and similar expressions generally identify

forward-looking statements.

The forward-looking statements in this release are based upon

various assumptions, many of which are based, in turn, upon further

assumptions, including without limitation, management’s examination

of historical operating trends, data contained in our records and

other data available from third parties. Although the Company

believes that these assumptions were reasonable when made, because

these assumptions are inherently subject to significant

uncertainties and contingencies that are difficult or impossible to

predict and are beyond our control, the Company cannot guarantee

that it will achieve or accomplish these expectations, beliefs or

projections.

Important factors that, in our view, could cause actual results

to differ materially from those discussed in the forward-looking

statements include the strength of the world economy and

currencies, changes in charter hire rates and vessel values,

changes in demand for “ton miles” of oil carried by oil tankers,

the effect of changes in OPEC’s petroleum production levels and

worldwide oil consumption and storage, changes in demand that may

affect attitudes of time charterers to scheduled and unscheduled

dry-docking, changes in TORM’s operating expenses, including bunker

prices, dry-docking and insurance costs, changes in the regulation

of shipping operations, including requirements for double hull

tankers or actions taken by regulatory authorities, potential

liability from pending or future litigation, domestic and

international political conditions, potential disruption of

shipping routes due to accidents, political events or acts by

terrorists.

In light of these risks and uncertainties, you should not place

undue reliance on forward-looking statements contained in this

release because they are statements about events that are not

certain to occur as described or at all. These forward-looking

statements are not guarantees of our future performance, and actual

results and future developments may vary materially from those

projected in the forward-looking statements.

Except to the extent required by applicable law or regulation,

the Company undertakes no obligation to release publicly any

revisions to these forward-looking statements to reflect events or

circumstances after the date of this release or to reflect the

occurrence of unanticipated events.

- 10-2019 - TORM plc Q1 Report 2019 - UK

- Q1 Report 2019

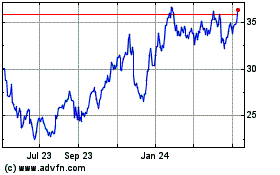

TORM (NASDAQ:TRMD)

Historical Stock Chart

From Mar 2024 to Apr 2024

TORM (NASDAQ:TRMD)

Historical Stock Chart

From Apr 2023 to Apr 2024