Form 8-K - Current report

October 27 2023 - 5:18PM

Edgar (US Regulatory)

0001447051

false

0001447051

2023-10-27

2023-10-27

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C.

20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION

13 OR 15(D) OF

THE SECURITIES EXCHANGE

ACT OF 1934

Date of Report (Date of earliest event reported):

October 27, 2023

TERRITORIAL BANCORP INC.

(Exact Name of Registrant as Specified in its Charter)

| Maryland |

1-34403 |

26-4674701 |

(State

or Other Jurisdiction

of Incorporation) |

(Commission File No.) |

(I.R.S. Employer Identification No.) |

| 1003 Bishop St., Suite 500, Honolulu, Hawaii |

|

96813 |

| (Address of Principal Executive Offices) |

|

(Zip Code) |

Registrant’s telephone

number, including area code: (808) 946-1400

Not Applicable

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the

Form 8-K is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

¨ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

¨ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

¨ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

¨ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2

of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ¨

If an emerging growth company, indicate

by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial

accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Securities registered pursuant to Section 12(b) of the Act

| Title

of each class |

|

Trading symbol |

|

Name

of each exchange on which registered |

| Common stock, par value $0.01 per share |

|

TBNK |

|

The NASDAQ Stock Market LLC |

On October 27, 2023, the Board of Directors

of Territorial Bancorp Inc. announced a quarterly cash dividend of $0.05 per share payable on November 24, 2023 to shareholders of

record as of November 9, 2023. A copy of the press release announcing the cash dividend is attached as Exhibit 99 to this report.

| Item 9.01 | Financial Statements and Exhibits |

| 104 | Cover Page Interactive Data File (embedded with the inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, hereunto duly authorized.

| | Territorial Bancorp Inc. |

| | |

| DATE: October 27,

2023 | By: |

/s/ Vernon Hirata |

| | Vernon Hirata |

| | Vice Chairman, Co-Chief Operating Officer and Secretary |

Exhibit 99.1

PRESS RELEASE

FOR IMMEDIATE RELEASE

Contact: Walter Ida

(808) 946-1400

Territorial Bancorp Inc. Declares Dividend

Honolulu, Hawaii, October 27, 2023 - Territorial Bancorp Inc.

(NASDAQ: TBNK) (the “Company”), headquartered in Honolulu, Hawaii, the holding company parent of Territorial Savings Bank,

announces that its Board of Directors approved a quarterly cash dividend of $0.05 per share. The dividend is expected to be paid on November 24,

2023 to stockholders of record as of November 9, 2023.

“Today’s interest rate environment

continues to be challenging to the banking industry. The steep increases in interest rates have resulted in higher mortgage rates, which

caused many potential homebuyers to hesitate before buying a home. These developments have led to lower loan volumes and higher interest

costs, which have impacted our net interest margins. We are being diligent in controlling our expenses as we work through this current

interest rate environment. Competition for deposits and pricing are impacting financial performance across the banking industry, and while

we expect our net interest margins to continue decreasing through the remainder of 2023,

our focus remains on maintaining our solid asset quality. We have strengthened our liquidity levels

and have been able to maintain our strong capital levels, which are above regulatory required levels” said Allan Kitagawa, Chairman

and CEO.

Forward-looking statements - This press release contains forward-looking

statements, which can be identified by the use of words such as “estimate,” “project,” “believe,”

“intend,” “anticipate,” “plan,” “seek,” “expect,” “will,” “may”

and words of similar meaning. These forward-looking statements include, but are not limited to:

| ● | statements of our goals, intentions and expectations; |

| ● | statements regarding our business plans, prospects, growth

and operating strategies; |

| ● | statements regarding the asset quality of our loan and investment

portfolios; and |

| ● | estimates of our risks and future costs and benefits. |

These forward-looking statements are based on our current beliefs and

expectations and are inherently subject to significant business, economic and competitive uncertainties and contingencies, many of which

are beyond our control. In addition, these forward-looking statements are subject to assumptions with respect to future business strategies

and decisions that are subject to change. We are under no duty to and do not take any obligation to update any forward-looking statements

after the date of this release.

The following factors, among others, could cause actual results to

differ materially from the anticipated results or other expectations expressed in the forward-looking statements:

| ● | general economic conditions, either internationally, nationally or in our

market areas, that are worse than expected; |

| ● | competition among depository and other financial institutions; |

| ● | inflation and changes in the interest rate environment that reduce our margins

or reduce the fair value of financial instruments; |

| ● | adverse changes in the securities markets; |

| ● | changes in laws or government regulations or policies affecting financial institutions, including changes in regulatory fees and capital

requirements; |

| ● | changes in monetary or fiscal policies of the U.S. Government, including

policies of the U.S. Treasury and the Federal Reserve Board; |

| ● | our ability to enter new markets successfully and capitalize on growth opportunities; |

| ● | our ability to successfully integrate acquired entities, if any; |

| ● | changes in consumer demand, spending, borrowing and savings habits; |

| ● | changes in accounting policies and practices, as may be adopted by the bank regulatory agencies, the Financial Accounting Standards Board,

the Securities and Exchange Commission and the Public Company Accounting

Oversight Board; |

| ● | changes in our organization, compensation and benefit plans; |

| ● | the timing and amount of revenues that we may recognize; |

| ● | the value and marketability of collateral underlying our loan portfolios; |

| ● | our ability to retain key employees; |

| ● | cyberattacks, computer viruses and other technological risks that may breach

the security of our websites or other systems to obtain unauthorized

access to confidential information, destroy data or disable our systems; |

| ● | technological change that may be more difficult or expensive than expected; |

| ● | the ability of third-party providers to perform their obligations to us; |

| ● | the ability of the U.S. Government to manage federal debt limits; |

| ● | the quality and composition of our investment portfolio; |

| ● | the effect of any pandemic disease, including COVID-19, natural disaster,

war, act of terrorism, accident or similar

action or event; |

| ● | changes in market and other conditions that would affect our ability to repurchase our common stock; and |

| ● | changes in our financial condition or results of operations that reduce capital available to pay dividends. |

Because of these and a wide variety of other uncertainties, our actual

future results may be materially different from the results indicated by these forward-looking statements.

v3.23.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

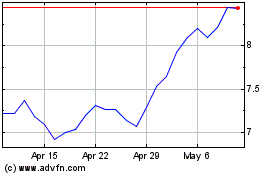

Territorial Bancorp (NASDAQ:TBNK)

Historical Stock Chart

From Apr 2024 to May 2024

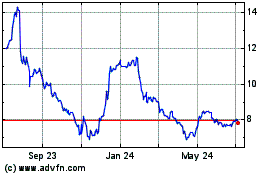

Territorial Bancorp (NASDAQ:TBNK)

Historical Stock Chart

From May 2023 to May 2024