TechTarget Announces Shareholder Approval for Combination with Informa Tech’s Digital Businesses

November 26 2024 - 5:00PM

Business Wire

TechTarget (Nasdaq: TTGT) today announced that at its Special

Meeting of Stockholders held on November 26, 2024, its shareholders

approved the previously announced transaction between TechTarget

and Informa PLC (LSE: INF.L), whereby Informa PLC will combine

Informa Tech’s digital businesses with TechTarget to create a

leading global B2B growth accelerator under a new holding company

(“New TechTarget”).

The parties anticipate closing the transaction on December 2,

2024. Upon completion of the transaction, New TechTarget’s shares

of common stock are expected trade on Nasdaq under the stock ticker

symbol “TTGT”.

A final report on the results of the Special Meeting of

Stockholders will be made available on a Form 8-K to be filed with

the Securities and Exchange Commission.

About TechTarget

TechTarget (Nasdaq: TTGT) is the global leader in purchase

intent-driven marketing and sales services that deliver business

impact for enterprise technology companies. By creating abundant,

high-quality editorial content across approximately 150 websites

and 1,000 webinars and virtual event channels, TechTarget attracts

and nurtures communities of technology buyers researching their

companies’ information technology needs. By understanding these

buyers’ content consumption behaviors, TechTarget creates the

purchase intent insights that fuel efficient and effective

marketing and sales activities for clients around the world.

TechTarget and its subsidiaries have offices in Boston, London,

Munich, New York, Paris, Singapore and Sydney. For more

information, visit techtarget.com and follow us on Twitter

@TechTarget.

About Informa Tech

Informa Tech is a leading provider of market insight and market

access to the global business technology community. Through

in-depth expertise and an engaged audience community, Informa Tech

helps business professionals make better technology decisions and

marketers reach the most powerful tech buyers and influencers in

the world. Across its portfolio of over 100+ trusted brands,

Informa Tech has over 1000 industry experts, including over 400

research analysts and consultants in global research group Omdia,

and a monthly audience reach of over 125 million. Informa Tech is a

division of FTSE 100 company Informa plc. For more information,

visit informatech.com

The digital businesses of Informa Tech being combined with

TechTarget include Industry Dive (Specialist B2B Content/Brands),

Omdia (Specialist Tech Research), NetLine (Demand Generation and

Buyer Intent), and other Specialist Tech Digital Media Brands (eg

Information Week, Light Reading, Heavy Reading, AI Business).

Additional Information and Where to Find It

In connection with the Transaction, CombineCo filed with the

Securities and Exchange Commission (the “SEC”) a registration statement on Form S-4 (File

No. 333-280529) (the “Registration

Statement”) containing a proxy statement of the Company that

also constitutes a prospectus of CombineCo (the “Proxy Statement/Prospectus”). The Registration

Statement was declared effective by the SEC on October 25, 2024,

and was first mailed to the Company’s stockholders on or about

October 25, 2024. The Company and CombineCo may also file other

documents with the SEC regarding the Transaction. This

communication is not a substitute for any proxy statement,

registration statement or prospectus, or any other document that

the Company or CombineCo (as applicable) may file with the SEC in

connection with the proposed transaction. BEFORE MAKING ANY VOTING

OR INVESTMENT DECISION, COMPANY INVESTORS AND SECURITY HOLDERS ARE

URGED TO READ CAREFULLY AND IN THEIR ENTIRETY THE DEFINITIVE PROXY

STATEMENT/PROSPECTUS AND ANY OTHER RELEVANT DOCUMENTS THAT ARE

FILED OR WILL BE FILED BY THE COMPANY OR COMBINECO WITH THE SEC, AS

WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO THESE DOCUMENTS, IN

CONNECTION WITH THE TRANSACTION WHEN THEY BECOME AVAILABLE, BECAUSE

THESE DOCUMENTS CONTAIN OR WILL CONTAIN IMPORTANT INFORMATION ABOUT

THE TRANSACTION AND RELATED MATTERS. Company investors and security

holders may obtain free copies of the definitive Proxy

Statement/Prospectus filed on October 25, 2024, as well as other

filings containing important information about the Company,

CombineCo, and other parties to the proposed transaction (including

Informa), without charge through the website maintained by the SEC

at www.sec.gov. Copies of the documents filed with the SEC by the

Company will be available free of charge under the tab “Financials”

on the “Investor Relations” page of the Company’s internet website

at investor.techtarget.com or by contacting the Company’s Investor

Relations Department at investor@techtarget.com.

Participants in the Solicitation

The Company, CombineCo and Informa, and their respective

directors and certain of their respective executive officers and

employees, may be deemed to be participants in the solicitation of

proxies from the Company’s stockholders in connection with the

proposed transaction. Information regarding the directors of

Informa is contained in Informa’s annual reports and accounts

available on Informa’s website at www.informa.com/investors and in

the National Storage Mechanism at

data.fca.org.uk/#/nsm/nationalstoragemechanism. Information

regarding the directors and executive officers of the Company is

contained in the Company’s proxy statement for its 2024 annual

meeting of stockholders, filed with the SEC on April 17, 2024, and

in other documents subsequently filed with the SEC. Additional

information regarding the participants in the proxy solicitations

and a description of their direct or indirect interests, by

security holdings or otherwise, is included in the definitive Proxy

Statement/Prospectus filed on October 25, 2024 and may be contained

in other relevant materials that are filed or will be filed with

the SEC (when they become available). These documents can be

obtained free of charge from the sources indicated above.

No Offer or Solicitation

This document is for informational purposes only and is not

intended to and does not constitute an offer to sell or the

solicitation of an offer to buy any securities, or a solicitation

of any vote or approval, nor shall there be any offer, solicitation

or sale of securities in any jurisdiction in which such offer,

solicitation or sale would be unlawful prior to registration or

qualification under the securities laws of any such jurisdiction.

No offer of securities shall be made except by means of a

prospectus meeting the requirements of Section 10 of the Securities

Act of 1933, as amended.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241126302539/en/

TechTarget, Media: Chris Kittredge or Ben Spicehandler

techtarget@fgsglobal.com

TechTarget, Investor Relations: Dan Noreck

dnoreck@techtarget.com

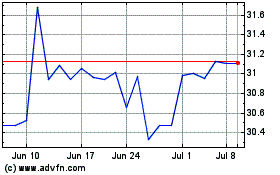

TechTarget (NASDAQ:TTGT)

Historical Stock Chart

From Dec 2024 to Jan 2025

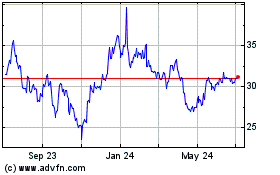

TechTarget (NASDAQ:TTGT)

Historical Stock Chart

From Jan 2024 to Jan 2025