Berkshire Is Thwarted in Its Bid for Tech Data

November 29 2019 - 2:09PM

Dow Jones News

By Nicole Friedman

Berkshire Hathaway Inc. offered about $5 billion for technology

distributor Tech Data Corp. last week, but it was outbid by Apollo

Global Management, said Warren Buffett, Berkshire's chairman and

chief executive.

The rare insight into a Berkshire deal that fell through

illuminates the challenges facing the Omaha, Neb., conglomerate as

it looks to spend its growing cash pile. Berkshire had a record

$128 billion in cash as of Sept. 30, and Mr. Buffett is eager to

spend it on acquisitions and large investments. But he is unwilling

to pay prices that he sees as unreasonably high, and the

competition from private-equity firms and other large investors is

fierce.

Tech Data late Wednesday said it has agreed to be acquired by

Apollo for $145 a share in cash, or slightly more than $5 billion

not including debt, a $15-a-share increase from Apollo's offer

earlier in November.

After Apollo made its earlier offer for Tech Data, Bank of

America approached Berkshire portfolio manager Todd Combs last week

about buying the company, Mr. Buffett said in an interview. Mr.

Combs is one of two portfolio managers at Berkshire and a key

lieutenant for helping Mr. Buffett make investments and vet

potential deals.

Mr. Buffett said he read the company's financial statements and

investor presentations and was immediately interested.

"It was our kind of business. It's one you can understand," Mr.

Buffett said. "I may not understand all of the products that they

sell and I may not understand what the customers who buy the

products do with them, but I do understand the middleman's

role."

Greg Abel, Berkshire's vice chairman for noninsurance business

operations and another of Mr. Buffett's top lieutenants, visited

Tech Data's headquarters in Clearwater, Fla., last Friday.

Berkshire then made an offer to buy the company at $140 a

share.

Tech Data's board of directors approved the deal, Mr. Buffett

said, but Apollo raised its offer this week. Berkshire famously

doesn't participate in bidding wars, and it declined to raise its

price.

Berkshire's role in the bidding was reported earlier by

CNBC.

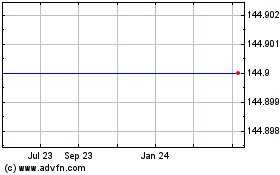

Tech Data shares recently traded 12% higher at $144.89.

Representatives for Tech Data and Apollo declined to

comment.

Write to Nicole Friedman at nicole.friedman@wsj.com

(END) Dow Jones Newswires

November 29, 2019 13:54 ET (18:54 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

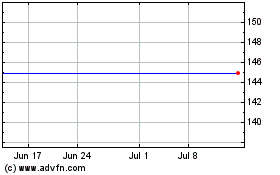

Tech Data (NASDAQ:TECD)

Historical Stock Chart

From Aug 2024 to Sep 2024

Tech Data (NASDAQ:TECD)

Historical Stock Chart

From Sep 2023 to Sep 2024