UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant x Filed by a party other than the Registrant ¨

Check the appropriate box:

| | | | | |

| ¨ | Preliminary Proxy Statement |

| | | | | |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| | | | | |

| x | Definitive Proxy Statement |

| | | | | |

| ¨ | Definitive Additional Materials |

| | | | | |

| ¨ | Soliciting Material Pursuant to §240.14a-12 |

T Stamp Inc.

(Name of Registrant as Specified in its Charter)

Not applicable.

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check all boxes that apply):

| | | | | | | | |

| x | | No fee required. |

| | |

| ¨ | | Fee paid previously with preliminary materials. |

| | |

| ¨ | | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. |

3017 Bolling Way NE, Floor 2,

Atlanta, Georgia, 30305

NOTICE OF SPECIAL MEETING OF STOCKHOLDERS

To be held on March 20, 2024

February 1, 2024

Dear Stockholder:

We cordially invite you to attend the Special Meeting of Stockholders of T Stamp Inc. dba Trust Stamp (the “Special Meeting”). The Special Meeting will be held on Wednesday, March 20, 2024, at 9:00 a.m. Eastern Time and will be held entirely online live via audio webcast. You will be able to attend and participate in the Special Meeting virtually by visiting www.colonialstock.com/idai2024, where you will be able to listen to the Special Meeting live, submit questions, and vote.

You will find important information about the matters to be voted on at the Special Meeting in the accompanying Notice of Special Meeting of Stockholders and Proxy Statement. We are sending most of our stockholders a one-page Notice of Internet Availability of Proxy Materials (the “Notice”) instead of sending a full set of printed materials. The Notice tells you how to access and review on the internet the important information contained in the proxy materials. The Notice also tells you how to vote on the internet prior to the Special Meeting or by phone and how to request to receive a printed copy of our proxy materials.

Your vote is important. We hope you will attend the virtual Special Meeting. We encourage you to review the proxy materials and vote as soon as possible. You may vote on the internet or by phone as described in the attached proxy materials. You also may vote by mail if you timely request to receive printed copies of these proxy materials in the mail. You will also be able to vote your shares electronically during the Special Meeting. Details about how to attend the virtual Special Meeting, how to submit questions, and how to cast your votes are posted at www.colonialstock.com/idai2024 and can be found in this proxy statement in the section entitled “Questions and Answers about the Special Meeting and Voting—How can I attend and vote at the Special Meeting?”.

| | | | | |

| Very truly yours, |

| | |

| /s/ Gareth Genner |

| | Gareth Genner |

| | Chief Executive Officer |

3017 Bolling Way NE, Floor 2,

Atlanta, Georgia, 30305

NOTICE OF SPECIAL MEETING OF STOCKHOLDERS

| | | | | | | | |

Special Meeting Date | | Wednesday, March 20, 2024 |

| Time | | 9:00 a.m. Eastern Time |

| Place | | www.colonialstock.com/idai2024 |

| | |

| Items of Business | (1) | Approve the issuance of up to 3,600,000 shares of our Common Stock upon the exercise of certain warrants issued to an institutional investor pursuant to that certain Warrant Exercise Agreement dated December 21, 2023 as required by and in accordance with Nasdaq Listing Rule 5635(d)); and |

| | |

| (2) | To transact any other business that properly comes before the Special Meeting and any adjournment or postponement of the Special Meeting. |

| | |

| Record Date | | Holders of record of our capital stock on January 25, 2024, are entitled to receive notice of, and to vote at, the Special Meeting and any postponement or adjournment of the Special Meeting. |

| Voting | | Your vote is important. We encourage you to read the accompanying proxy materials and submit your vote as soon as possible. You can find information about how to cast your vote in the question-and-answer section of the accompanying proxy statement. |

Pursuant to rules adopted by the U.S. Securities and Exchange Commission (the “SEC”), we have elected to provide access to our proxy materials via the Internet. Accordingly, we are sending a Notice of Internet Availability of Proxy Materials (the “Notice”) to our stockholders entitled to notice of, and to vote at, the Special Meeting and at any postponement or adjournment thereof. Stockholders will have the ability to access the proxy materials at www.colonialstock.com/idai2024 or request to receive a printed set of the proxy materials by mail or an electronic set of materials by email. Instructions on how to access the proxy materials over the Internet or to request a printed copy may be found in the Notice. In addition, stockholders may request to receive proxy materials in printed form by mail or electronically by email on an ongoing basis. We believe these rules allow us to provide our stockholders with the information they need while lowering the cost of delivery and reducing the environmental impact of our Special Meeting.

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR SPECIAL MEETING OF STOCKHOLDERS TO BE HELD ON MARCH 20, 2024: This notice and our proxy statement are available at www.colonialstock.com/idai2024.

| | | | | |

| By Order of the Board of Directors of T Stamp Inc., |

| | |

| /s/ Gareth Genner |

| | Gareth Genner |

| | Chief Executive Officer |

| Atlanta, Georgia |

| February 1, 2024 |

TABLE OF CONTENTS

3017 Bolling Way NE, Floor 2

Atlanta, Georgia, 30305

(404) 806-9906

PROXY STATEMENT

QUESTIONS AND ANSWERS ABOUT THE SPECIAL MEETING AND VOTING

Why did I receive these proxy materials?

We are providing these proxy materials to you in connection with the solicitation by the Board of Directors (the “Board”) of T Stamp Inc., a Delaware corporation, of proxies to be voted at our Special Meeting of Stockholders (the “Special Meeting”).

The Special Meeting will be held on Wednesday, March 20, 2024, at 9:00 a.m. Eastern Time, online at www.colonialstock.com/idai2024. The Special Meeting will be a completely virtual meeting conducted via live audio webcast. You will be able to attend the Special Meeting online and submit your questions during the meeting by visiting www.colonialstock.com/idai2024 and clicking on the “Virtual Meeting Instructions” link under the proxy materials to register for the meeting. You must enter the control number included in your Notice, on your proxy card or on the instructions that accompanied your proxy materials. If you lose the control number, you may call Colonial Stock Transfer at (877) 285-8605 for assistance in recovering your control number. Only stockholders with a valid control number will be able to vote and ask questions at the Special Meeting, as well as access the list of stockholders as of the close of business on the Record Date (as defined below).

We expect to begin furnishing these proxy materials to stockholders on or about February 1, 2024.

A form of the proxy card is attached as Appendix A to this proxy statement.

When we use the term “Trust Stamp,” “Company,” “us,” “we,” or “our,” we mean T Stamp Inc. and its subsidiaries on a consolidated basis (unless context indicates otherwise).

What matters will be voted on at the Special Meeting?

We will ask stockholders to vote on the following matters at the Special Meeting:

| | | | | | | | |

| (1) | Approve the issuance of up to 3,600,000 shares of our Common Stock upon the exercise of certain warrants issued to an institutional investor pursuant to that certain Warrant Exercise Agreement dated December 21, 2023 as required by and in accordance with Nasdaq Listing Rule 5635(d) (Proposal 1); and |

| (2) | To transact any other business that properly comes before the Special Meeting and any adjournment or postponement of the Special Meeting. |

Who can vote?

Stockholders of record of our capital stock at the close of business on the record date of January 25, 2024 (the “Record Date”), are entitled to receive notice of, and to vote at, the Special Meeting. Our capital stock currently outstanding consists of our Common Stock, par value $0.01, all of which is designated as Class A Common Stock.

Each share of Class A Common Stock is entitled to one (1) vote per share as of the Record Date. For additional information, see our Third Amended and Restated Certificate of Incorporation filed as Exhibit 3.1 to the Company’s Registration Statement on Form S-1 filed with the SEC on August 23, 2023. Cumulative voting is not permitted.

As of the Record Date, 9,143,355 shares of our Class A Common Stock were issued and outstanding, representing all outstanding shares of capital stock of our Company.

A list of stockholders will also be available during the Special Meeting through the Special Meeting website for those stockholders who choose to attend.

To attend and participate in the Special Meeting, you must visit www.colonialstock.com/idai2024, click on the “Virtual Meeting Instructions” link, and follow the instructions to register for the meeting. The Special Meeting webcast will begin promptly at 9:00 a.m. Eastern Time. We encourage you to access the Special Meeting prior to the start time, and allow ample time for the registration and check-in procedures.

What is the difference between a stockholder of record and a beneficial holder?

Many of our stockholders hold their shares through a broker, bank, or other nominee rather than directly in their own name. There are some important distinctions between shares held of record and those owned beneficially.

Stockholder of Record

If your shares are registered directly in your name with our transfer agent, Colonial Stock Transfer Company, Inc. (“Colonial Stock Transfer”), you are the stockholder of record for those shares and are receiving proxy materials directly from us. As the stockholder of record, you have the right to grant your voting proxy directly to us or to vote online at the Special Meeting.

Beneficial Holder

If your shares are held in a stock brokerage account or by a bank or other nominee (commonly referred to as being held in “street name”), you are the beneficial holder of those shares. Your broker, bank, or other nominee is the stockholder of record and has forwarded proxy materials to you as the beneficial holder. As the beneficial holder, you have the right to direct your broker, bank, or other nominee how to vote your shares and are also invited to attend the Special Meeting. However, since you are not the stockholder of record, you may not vote your shares online at the Special Meeting unless you have the control number included in your Notice, on your proxy card or on the instructions that accompanied your proxy materials giving you the right to vote the shares.

How do I vote?

Stockholder of Record

If you are a stockholder of record, you can vote over the phone or on the internet prior to the Special Meeting by following the instructions you received from us in the mail or by email. If you requested to receive a full set of proxy materials in the mail, you also can vote by mail using the proxy card included with the materials. Finally, you can vote online at the Special Meeting by attending the Special Meeting online and following the instructions posted at www.colonialstock.com/idai2024.

Beneficial Holder

If you are a beneficial holder, you can vote over the phone or on the internet prior to the Special Meeting by following the instructions you received from your broker, bank, or other nominee in the mail or by email. If you requested to receive a full set of proxy materials in the mail, you also can vote by mail using the voting instruction card included with the materials. If you have not received this information from your broker, bank, or other

nominee, please contact them as soon as possible. You can vote online at the Special Meeting by attending the Special Meeting online and following the instructions posted at www.colonialstock.com/idai2024.

If you do not give your broker, bank, or other nominee instructions as to how to vote, under the rules of the Nasdaq, your broker, bank, or other nominee may vote your shares with respect to “routine” items, but not with respect to “non-routine” items. Proposal 1 (Approval of Issuance of Shares Upon Exercise of Warrants) is a “non-routine” proposal. If you do not instruct your broker, bank, or other nominee how to vote with respect to Proposal 1, your broker, bank, or other nominee will not vote on this proposal. Please be sure to return your voting instructions to your broker, bank, or other nominee so that your vote is counted. The voting deadlines and availability of telephone and internet voting for beneficial owners of shares held in “street name” will depend on the voting processes of the organization that holds your shares. Therefore, we urge you to carefully review and follow the voting instructions card and any other materials that you receive from that organization.

Multiple Holdings

If you hold shares both as a stockholder of record and as a beneficial holder, you must vote separately for each set of shares.

How can I attend and vote at the Special Meeting?

This year’s Special Meeting will be held entirely online live via audio webcast. Any stockholder can attend the virtual Special Meeting live at www.colonialstock.com/idai2024. If you were a stockholder as of the Record Date and you have your control number included in your Notice, on your proxy card, or on the instructions that accompanied your proxy materials, you can vote at the Special Meeting.

A summary of the information you need to attend the Special Meeting online is provided below.

| | | | | |

• | To participate in the Special Meeting, you will need the control number included in your Notice, on your proxy card, or on the instructions that accompanied your proxy materials. |

| |

• | The Special Meeting webcast will begin promptly at 9:00 a.m. Eastern Time on on Wednesday, March 20, 2024. We encourage you to access the Special Meeting prior to the start time. You should allow ample time for the check-in procedures. |

| |

• | The virtual Special Meeting platform is fully supported across browsers (Firefox, Chrome, and Safari) and devices (desktops, laptops, tablets, and cell phones) running the most updated version of applicable software and plugins. Participants should ensure that they have a strong Internet connection wherever they intend to participate in the Special Meeting. Participants should also give themselves plenty of time to log in and ensure that they can hear streaming audio prior to the start of the Special Meeting. |

| |

• | Instructions on how to attend and participate via the internet, including how to demonstrate proof of stock ownership, are posted at www.colonialstock.com/idai2024 by clicking on the "Virtual Meeting Instructions” link on the website. |

Questions pertinent to the Special Meeting matters will be answered during the virtual Special Meeting, subject to time constraints. Questions regarding personal matters, including those related to employment, product or service issues, or suggestions for product innovations, are not pertinent to Special Meeting matters, and therefore, will not be answered.

To participate in the Special Meeting, you will need the control number included in your Notice, on your proxy card or on the instructions that accompanied your proxy materials. If your shares are held in “street name,” you should contact your broker, bank, or other nominee to obtain your control number or otherwise vote through the broker, trustee, bank, or other holder of record. If you lose your control number, you may join the Special Meeting as a “Guest” but you will not be able to vote, ask questions, or access the list of stockholders as of the close of business

on the Record Date. Only stockholders with a valid control number will be able vote and ask questions at the Special Meeting, as well as access the list of stockholders as of the close of business on the Record Date.

What if during the check-in time or during the Special Meeting I have technical difficulties or trouble accessing the virtual Special Meeting website?

We will have technicians ready to assist you with any technical difficulties you may have accessing the virtual Special Meeting website. If you encounter any difficulties accessing the virtual Special Meeting website during the check-in or meeting time, please call the technical support number that will be posted on the Special Meeting login page.

Can I change or revoke my vote?

If you are a stockholder of record, you may change your vote at any time prior to the vote at the Special Meeting by taking any of the following actions:

| | | | | |

• | submitting a new proxy with a later date using any of the available methods described above; |

• | providing a written revocation to our Board Secretary; or |

• | voting online at the Special Meeting by following the instructions at www.colonialstock.com/idai2024. |

If you are a beneficial holder, you may change your vote by submitting new voting instructions to your broker, bank, or other nominee following the instructions they provided to you. You may also vote online at the Special Meeting, which will have the effect of revoking any previously submitted voting instructions, assuming you obtain your control number included in your Notice, on your proxy card, or on the instructions that accompanied your proxy materials.

Whether you are a stockholder of record or a beneficial owner of shares held in “street name”, your attendance at the Special Meeting online will not, by itself, automatically revoke your proxy.

What is the quorum requirement for the Special Meeting?

A quorum of stockholders is necessary for any action to be taken at the Special Meeting (other than adjournment or postponement of the Special Meeting). A quorum exists if stockholders holding one-third of the votes which could be cast by the holders of all outstanding shares of stock entitled to vote at the Special Meeting in person, or by means of remote communication, or by proxy. If you submit a properly completed proxy, even if you abstain from voting, your shares will be counted for purposes of determining the presence of a quorum. Broker non-votes (described below) also will be counted for purposes of determining the presence of a quorum if the broker, bank or other nominee uses its discretionary authority to vote on at least one routine matter under Nasdaq rules.

How will my shares be voted during the virtual Special Meeting?

Your shares will be voted in accordance with your properly submitted instructions.

Stockholders of Record

If you are a stockholder of record and you submit a proxy but do not include voting instructions on a matter, your shares will be voted in favor of the approval of Proposal 1 in accordance with the recommendations of our Board. If any other matters are properly presented for a vote at the Special Meeting or any adjournment or postponement thereof, your shares will be voted in the discretion of the named proxies.

Beneficial Holders and Broker Non-Votes

If you are a beneficial holder and you do not provide voting instructions to your broker, bank, or other nominee, that organization will determine if it has the discretionary authority to vote your shares on the particular matter. Under Nasdaq rules, these organizations have the discretion to vote your shares on routine matters - however, they do not have the discretion to vote your shares on non-routine matters such as Proposal 1. The unvoted shares are called “broker non-votes.” Shares that constitute broker non-votes are considered present for purposes of determining a quorum but are not considered entitled to vote or votes cast on the particular matter.

What are the voting requirements for each matter?

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Proposal | | | Vote

Required | | | Effect of

Abstentions | | | Broker Discretionary

Voting Allowed | | | Effect of

Broker

Non-Vote | |

(1) Approve the issuance of up to 3,600,000 shares of our Class A Common Stock upon the exercise of certain warrants issued to an institutional investor pursuant to that certain Warrant Exercise Agreement dated December 21, 2023 as required by and in accordance with Nasdaq Listing Rule 5635(d). | | | More votes FOR

than AGAINST | | | No effect | | | No | | | No effect | |

What are the recommendations of the Board?

Our Board recommends that you vote:

| | | | | |

• | “FOR” the issuance of up to 3,600,000 shares of our Class A Common Stock upon the exercise of certain warrants issued to an institutional investor pursuant to that certain Warrant Exercise Agreement dated December 21, 2023 as required by and in accordance with Nasdaq Listing Rule 5635(d) (Proposal 1) |

Any properly authorized proxy as to which no instructions are given will be voted in accordance with the foregoing recommendations.

Who will pay the costs of soliciting votes for the Special Meeting?

We will bear all expenses incurred in connection with the solicitation of proxies. We will reimburse brokers, fiduciaries, and custodians for their costs in forwarding proxy materials to beneficial owners of our common stock. Our directors, officers, and employees also may solicit proxies by mail, telephone, and personal contact. They will not receive any additional compensation for these activities. We will send proxy materials or additional soliciting materials to banks, brokers, other institutions, nominees, and fiduciaries, and these organizations will then forward the materials to the beneficial holders of our shares. On request, we will reimburse these organizations for their reasonable expenses in forwarding these materials.

How can I find the results of the voting after the Special Meeting?

We will announce preliminary voting results at the Special Meeting and will publish final results in a Current Report on Form 8-K to be filed with the SEC within four business days following the Special Meeting.

PROPOSAL 1 – APPROVAL OF ISSUANCE OF SHARES UPON EXERCISE OF WARRANTS

On December 21, 2023, the Company entered into a warrant exercise agreement (the “WEA”) with a certain existing institutional investor, pursuant to which the institutional investor agreed to exercise (the “Exercise”) (i) a portion (106,670) of the warrants issued to the institutional investor on June 5, 2023, which are exercisable for 1,279,700 shares of the Company’s Class A Common Stock, par value $0.01 per share (“Class A Common Stock”) with a current exercise price of $2.30 per share (the “June 2023 Warrants”), (ii) all of the warrants issued to the institutional investor on September 14, 2022, as amended on June 5, 2023, which are exercisable for 120,000 shares of Class A Common Stock, with a current exercise price of $2.30 per share (the “September 2022 Warrants”), and (iii) all of the warrants issued to the institutional investor on April 18, 2023, which are exercisable for 1,573,330 shares of Class A Common Stock, with a current exercise price of $3.30 per share (the “April 2023 Warrants” and collectively with all of the June 2023 Warrants and the September 2022 Warrants, the “Existing Warrants”). In consideration for the immediate exercise of 1,800,000 of the Existing Warrants for cash, the Company agreed to reduce the exercise price of all of the Existing Warrants, including any unexercised portion thereof, to $1.34 per share, which is equal to the most recent closing price of the Company’s Class A Common Stock on The Nasdaq Stock Market prior to the execution of the WEA. In addition, in consideration for such Exercise, the institutional investor received new unregistered warrants to purchase up to an aggregate of 3,600,000 shares of Class A Common Stock, equal to 200% of the shares of Class A Common Stock issued in connection with the Exercise, with an exercise price of $1.34 per share (the “New Warrants”) in a private placement pursuant to Section 4(a)(2) of the Securities Act of 1933 (the “Securities Act”).

The New Warrants will have substantially the same terms as the June 2023 Warrants, except that the New Warrants will not become exercisable until such time as the Company has received stockholder approval with respect to the issuance of shares of Class A Common Stock underlying the New Warrants and will remain exercisable for five (5) years from the stockholder approval. The Company agreed to hold a stockholder meeting for this purpose no later than the 90th calendar date following the entry into the WEA (or March 20, 2024). The Company agreed to file a resale registration statement on Form S-3 within 30 days of December 21, 2023 with respect to the New Warrants and the shares of Class A Common Stock issuable upon exercise of the New Warrants. The Existing Warrants and the New Warrants each include a beneficial ownership limitation that prevents the institutional investor from owning more than 9.99%, with respect to the Existing Warrants, and 4.99%, with respect to the New Warrants, of the Company’s outstanding Class A Common Stock at any time.

Additionally, pursuant to the WEA, from December 21, 2023 until the 100th day thereafter, the Company is prohibited from effecting or entering into an agreement to effect any issuance by the Company of any common stock of the Company or any common stock equivalents (or a combination of units thereof) involving a Variable Rate Transaction. The gross proceeds to the Company from the Exercise was approximately $2.4 million, prior to deducting warrant inducement agent fees and estimated offering expenses. The Company intends to use the remainder of the net proceeds for business growth, working capital and general corporate purposes.

The resale of the shares of Class A Common Stock underlying the Existing Warrants have been registered pursuant to a registration statement on Form S-1 (File No. 333-274160) with respect to the June 2023 Warrants, pursuant to a registration statement on Form S-1 (File No. 333-272343) with respect to the April 2023 Warrants, and pursuant to a registration statement on Form S-1 (333-267668), with respect to the September 2022 Warrants (collectively, the “Registration Statements”). The Registration Statements are currently effective for the resale of the shares of Class A Common Stock issuable upon the exercise of the Existing Warrants.

The foregoing descriptions of the WEA and the New Warrants are intended to be a summary, and are qualified in their entirety by reference to the Current Report on Form 8-K filed by the Company on December 21, 2023 which more fully describes the above transactions, agreements, and documents, and with which copies of the form of the WEA and the form of the New Warrant were filed as exhibits, which are incorporated by reference herein.

Reasons for the Financing

We believe that the funding from the transactions described above was necessary in light of the Company’s cash and funding requirements at the time. The proceeds that we received from the Exercise and may receive in connection with the exercise of the New Warrants will improve our capital position and provide financing for commercial growth, working capital and general corporate purposes. We also believe that the terms of the New Warrants are reasonable in light of market conditions and the size and type of the financing transaction.

Reasons for the Stockholder Approval

Our Class A Common Stock is listed on the Nasdaq Capital Market, and as such, we are subject to the Nasdaq Listing Rules. In order to comply with the Nasdaq Listing Rules and to satisfy conditions under the Exercise Agreement, we are seeking stockholder approval of this proposal.

Nasdaq Listing Rule 5635(d) requires stockholder approval prior to the issuance of securities in connection with a transaction other than a public offering involving the sale, issuance or potential issuance of common stock (or securities convertible into or exercisable for common stock) in an amount equal to 20% or more of the common stock or 20% or more of the voting power outstanding before the issuance at a price less than the “Minimum Price”. The Minimum Price is defined as the lower of (i) the closing price of the common stock immediately preceding the signing of the sale agreement or (ii) the average closing price of the common stock for the five (5) trading days immediately preceding the signing of the sale agreement.

The private placement in which we issued the New Warrants to the investor did not constitute a public offering under the Nasdaq Listing Rules. The initial exercise price of the New Warrants was equal to or greater than the Minimum Price, but if the exercise price is adjusted pursuant to the exercise price adjustment provisions in the New Warrants, such reduced exercise price may be less than the Minimum Price. Immediately prior to entering into the WEA, and at the time the New Warrants were issued, we had 8,225,355 shares of Common Stock outstanding. Therefore, the potential issuance of 3,600,000 shares of our Common Stock upon exercise of the New Warrants would constitute in excess of 20% of the shares of our Common Stock outstanding prior to giving effect to the financing. Accordingly, we are seeking stockholder approval under Nasdaq Listing Rule 5635(d) for the sale, issuance or potential issuance by us of Common Stock (or securities convertible into or exercisable for our Common Stock) in excess of 20% of the shares of our Common Stock outstanding on the original date of entry into the WEA, at, if applicable, an exercise price less than the Minimum Price as a result of the exercise price adjustment features of the New Warrants, since such provisions may reduce the per share exercise price and result in the issuance of shares at less than the Minimum Price.

Under the Nasdaq Listing Rules, we are not permitted to undertake a transaction that could result in a change in control of us without seeking and obtaining separate stockholder approval. We are not required to obtain stockholder approval for the private placement offering in which we issued the New Warrants to the investor under Nasdaq Listing Rule 5635(b) because the investor has agreed that, for so long as they hold any shares of our Common Stock, neither they nor any of their affiliates will acquire shares of our Common Stock which will result in them and their affiliates, collectively, beneficially owning or controlling more than 9.99%, with respect to the Existing Warrants, and 4.99%, with respect to the New Warrants, of the Company’s outstanding Common Stock at any time.

Consequences of Not Approving this Proposal

The Board is not seeking the approval of our stockholders to authorize our entry into the WEA or the issuance of the New Warrants. The WEA and the New Warrants have already been executed and delivered, and the closing of the private placement has occurred. The failure of our stockholders to approve this proposal will mean that the exercise of the New Warrants will be limited to the extent that such exercise would result in the issuance, in the aggregate, of no more than 19.99% of the shares of our Common Stock outstanding at an exercise price less than the Minimum Price. We also agreed with the holder of the New Warrant that if we do not obtain stockholder approval of this proposal at this meeting, the Company will call a meeting every 90 days thereafter to seek stockholder approval until the earlier of the date on which stockholder approval is obtained or the New Warrants are no longer outstanding,

which would require us to incur the costs of holding one or more additional stockholder meetings until we receive such approval.

| | |

OUR BOARD RECOMMENDS A VOTE “FOR” APPROVING THE ISSUANCE OF UP 3,600,000 SHARES OF OUR CLASS A COMMON STOCK UPON THE EXERCISE OF CERTAIN WARRANTS ISSUED TO AN INSTITUTIONAL INVESTOR PURSUANT TO THAT CERTAIN WARRANT EXERCISE AGREEMENT DATED DECEMBER 21, 2023. |

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets out, as of December 31, 2023 the voting securities of the Company that are owned by executive officers and directors, and other persons holding more than 5% of any class of the Company’s voting securities or having the right to acquire those securities.

| | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | |

| | Amount | | Amount | | | |

| | and | | and | | | |

| | nature of | | nature of | | Percent | |

| | beneficial | | beneficial | | of | |

Name and Address of Beneficial Owner | | ownership | | acquirable | | class (1) | |

Named Officers and Directors | | | | | | | |

Gareth Genner, Chief Executive Officer, 3017 Bolling Way NE, Floor 2, Atlanta, Georgia, 30305 | | 168,962 | (7) | 3,340 | (2) | 1.00 | % |

Andrew Gowasack, President, 3017 Bolling Way NE, Floor 2, Atlanta, Georgia, 30305 | | 254,475 | | 6,680 | (2) | 1.52 | % |

Alexander Valdes, Chief Financial Officer, 3017 Bolling Way NE, Floor 2, Atlanta, Georgia, 30305 | | 75,136 | (8) | 4,968 | (2) | 0.47 | % |

Joshua Allen, EVP, Director, 3017 Bolling Way NE, Floor 2, Atlanta, Georgia, 30305 | | 7,952 | | 14,453 | (4) | 0.13 | % |

Tracy Ming, Financial Controller, 3017 Bolling Way NE, Floor 2, Atlanta, Georgia, 30305 | | 13,330 | | 5,239 | (2) | 0.11 | % |

William McClintock, Independent Non-Executive Director, Hub 8, Unit 2 The Brewery Quarter, High St, Cheltenham GL50 3FF, United Kingdom | | 13,716 | | 27,756 | (5) | 0.24 | % |

Charles Potts, Independent Non-Executive Director, 3017 Bolling Way NE, Floor 2, Atlanta, Georgia, 30305 | | — | | 4,215 | (10) | 0.02 | % |

Kristin Stafford, Independent Non-Executive Director, 3017 Bolling Way NE, Floor 2, Atlanta, Georgia, 30305 | | 234 | | — | | — | % |

Berta Pappenheim, Independent Non-Executive Director, 3017 Bolling Way NE, Floor 2, Atlanta, Georgia, 30305 | | — | | — | | — | % |

All executive officers and directors as a group (9 persons) | | 533,805 | | 66,651 | | 3.49 | % |

Other 5% Holders | | | | | | | |

Second Century Ventures, LLC, 430 North Michigan Ave, Ninth Floor, Chicago, IL 60611 | | 601,924 | (6) | 737,255 | (3) | 7.80 | % |

Armistice Capital Master Fund Ltd. c/o Armistice Capital, LLC, 510 Madison Avenue, 7th Floor, New York, NY 10022. | | — | | 5,655,030 | (9) | 32.95 | % |

| | | | | |

| (1) | Based on 9,143,355 shares of Class A Common Stock outstanding as of December 31, 2023, plus 8,021,584 shares of Class A Common Stock acquirable within 60 days of December 31, 2023. |

| | | | | |

| (2) | Represents shares of Class A Common Stock issuable pursuant to RSUs that vested on January 2, 2024 |

| | | | | |

(3) | Represents shares of Class A Common Stock issuable to Second Century Ventures, LLC (524,599), REach Ventures 2017 LP (186,442) upon the exercise of warrants any time at the option of the holder, shares of Class A Common Stock issuable to Second Century Ventures, LLC (18,504) at any time upon request pursuant to RSUs, and shares of Class A Common Stock issuable to Second Century Ventures, LLC (7,710) pursuant to RSUs that vested on January 2, 2024. |

| | | | | |

(4) | Represents shares of Class A Common Stock issuable at any time upon request pursuant to grants (9,648) and shares of Class A Common Stock issuable (4,805) pursuant to RSUs that vested on January 2, 2024. |

| | | | | |

(5) | Represents shares of Class A Common Stock issuable at any time upon request pursuant to RSUs (18,504) and shares of Class A Common Stock issuable (9,252) pursuant to RSUs that vested on January 2, 2024. |

| | | | | |

(6) | Represents shares of Class A Common Stock held by Second Century Ventures, LLC (521,795) and REach Ventures, LLC (80,129). |

| | | | | |

(7) | Represents shares of Class A Common Stock held by Gareth Genner’s spouse, Barbara Genner (159,405) and shares of Class A Common Stock held by Gareth Genner (9,557). |

| | | | | |

(8) | Represents shares of Class A Common Stock held by Alexander Valdes’ spouse, Victoria Valdes (250), New Direction Trust Company as Custodian FBO Alexander J. Valdes ROTH IRA (500) and shares of Class A Common Stock held by Alexander Valdes (74,386). Alexander J. Valdes ROTH IRA is wholly owned by Alexander Valdes. |

| | | | | |

(9) | Comprised of 3,600,000 shares of Class A Common Stock underlying the Warrants, 775,330 shares of Class A Common Stock underlying certain other Warrants, and 1,279,700 shares of Class A Common Stock underlying certain other Warrants held by Armistice Capital Master Fund Ltd. (the “Selling Stockholder”), a Cayman Islands exempted company. These warrants may be deemed to be indirectly beneficially owned by Armistice Capital, LLC (“Armistice”), as the investment manager of the Selling Stockholder; and (ii) Steven Boyd, as the Managing Member of Armistice Capital. Armistice and Steven Boyd disclaim beneficial ownership of the reported securities except to the extent of their respective pecuniary interest therein. The Warrants (and the other warrants held by the Selling Stockholder) are subject to a 4.99% beneficial ownership limitation, which limitations prohibit the Selling Stockholder from exercising any portion of the Warrants if, following such exercise, the Selling Stockholder’s ownership of our Class A Common Stock would exceed the applicable ownership limitation. This beneficial ownership limitation may be increased up to 9.99% at the option of the Selling Stockholder. The address of the Selling Stockholder is c/o Armistice Capital, LLC, 510 Madison Avenue, 7th Floor, New York, NY 10022. |

| | | | | |

(10) | Represents shares of Class A Common Stock issuable at any time upon request pursuant to grants. |

HOUSEHOLDING INFORMATION

We have adopted a practice called “householding.” This practice allows us to deliver only one copy of certain of our stockholder communications (such as the notice regarding the internet availability of proxy materials, our annual reports, or our proxy materials) to stockholders who have the same address and last name and who do not participate in email delivery of these materials, unless one or more of these stockholders notifies us that he or she would like to receive an individual copy of these notices or materials. If you share an address with another stockholder and receive only one set of proxy-related materials and would like to request a separate copy for this year’s Special Meeting or for any future meetings or stockholder communications, please send your written request to T Stamp Inc., 3017 Bolling Way NE, Floor 2, Atlanta, Georgia, 30305, Attention: Secretary, or call us at (404) 806-9906. Upon written or oral request, we will promptly deliver a separate copy to you. Similarly, you may also contact us through either of these methods if you receive multiple copies of proxy-related materials and other stockholder communications and would prefer to receive a single copy in the future.

STOCKHOLDER PROPOSALS

A stockholder who would like to have a proposal considered for inclusion in our 2024 proxy statement pursuant to SEC Rule 14a-8 must submit the proposal so that it is received by us no later than August 9, 2024, unless the date of our 2024 Annual Meeting is more than 30 days before or after December 29, 2024, in which case the proposal must be received a reasonable time before we begin to print and send our proxy materials. SEC rules set standards for eligibility and specify the types of stockholder proposals that may be excluded from a proxy statement. Stockholder proposals should be addressed to T Stamp Inc., 3017 Bolling Way NE, Floor 2, Atlanta, Georgia, 30305, Attention: Board Secretary.

In addition, a stockholder who intends to solicit proxies in support of director nominees other than the Company’s nominees for the 2024 Annual Meeting of Stockholders in accordance with Exchange Act Rule 14a-19 must provide notice to our principal executive offices at the address above no later than October 29, 2024. Any such notice of intent to solicit proxies must comply with all the requirements of SEC Rule 14a-19.

WHERE YOU CAN FIND MORE INFORMATION

Trust Stamp files reports, proxy statements and other information with the SEC as required by the Exchange Act. You can read Trust Stamp’s SEC filings, including this proxy statement, over the Internet at the SEC’s website at www.sec.gov. We also maintain a website at www.truststamp.ai, at which you may access these materials free of charge as soon as reasonably practicable after they are electronically filed with, or furnished to, the SEC.

You can obtain any of the documents listed above from the SEC, through the website of the SEC at the address described above or from us by requesting them in writing or by telephone at the following address:

T Stamp Inc.

Attention: Board Secretary

3017 Bolling Way NE, Floor 2,

Atlanta, Georgia, 30305, USA

(404) 806-9906

This document is a proxy statement of Trust Stamp for the Special Meeting of Trust Stamp stockholders. The information contained in this document speaks only as of the date of this document unless the information specifically indicates that another date applies.

INCORPORATION OF CERTAIN INFORMATION BY REFERENCE

The SEC allows us to incorporate by reference into this proxy statement information contained in documents that we file with it. This means that we can disclose important information to you by referring you to those documents. We incorporate by reference each document we file under Sections 13(a), 13(c), 14 or 15(d) of the Exchange Act after the date of the initial filing of this proxy statement and before the Special Meeting (other than current reports on Form 8-K furnished pursuant to Item 2.02 or Item 7.01 of Form 8-K, including any exhibits included with such information, unless otherwise indicated therein). We also incorporate by reference in this proxy statement the following documents filed by us with the SEC under the Exchange Act:

| | | | | |

| ● | our Annual Report on Form 10-K for the fiscal year ended December 31, 2022, filed with the SEC on March 30, 2023; and |

| | | | | |

| ● | our Quarterly Reports on Form 10-Q for the quarter ended March 31, 2023, filed with the SEC on May 15, 2023, for the quarter ended June 30, 2023, as amended, filed with the SEC on August 22, 2023. and for the quarter ended September 30, 2023, filed with the SEC on November 7, 2023. |

| | | | | |

| ● | our Registration Statement on Form S-1 filed with the SEC on August 23, 2023. |

We undertake to provide without charge to each person to whom a copy of this proxy statement has been delivered, upon request, by first class mail or other equally prompt means, a copy of any or all of the documents incorporated by reference in this proxy statement, other than the exhibits to these documents, unless the exhibits are specifically incorporated by reference into the information that this proxy statement incorporates. You may obtain documents incorporated by reference by requesting them in writing or by telephone at the address and telephone number set forth above under “Where You Can Find More Information.”

Other Matters

The Board does not know of any other matters to be brought before the Special Meeting. If any other matters not mentioned in this proxy statement are properly brought before the Special Meeting, the individuals named in the enclosed proxy intend to use their discretionary voting authority under the proxy to vote the proxy in accordance with their best judgment on those matters.

| | | | | |

| By Order of the Board of Directors of T Stamp Inc., |

| | |

| /s/ Gareth Genner |

| Gareth Genner |

| Chief Executive Officer |

| February 1, 2024 |

Appendix A

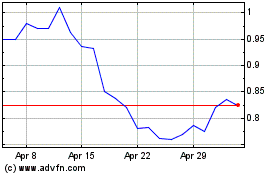

T Stamp (NASDAQ:IDAI)

Historical Stock Chart

From Apr 2024 to May 2024

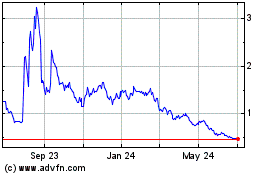

T Stamp (NASDAQ:IDAI)

Historical Stock Chart

From May 2023 to May 2024