SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a)

of the Securities Exchange Act of 1934

Filed

by the Registrant ¨

Filed

by a Party other than the Registrant þ

Check the appropriate box:

|

¨

|

Preliminary Proxy Statement

|

|

¨

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

|

|

¨

|

Definitive Proxy Statement

|

|

þ

|

Definitive Additional Materials

|

|

¨

|

Soliciting Material Under Rule 14a-12

|

Stratus Properties Inc.

(Name of Registrant as Specified in Its Charter)

Oasis Management Company Ltd.

Seth Fischer

Ella Benson

Eugenio De La Garza Diaz

Laurier L. Dotter

(Name of Person(s) Filing Proxy Statement,

if other than the Registrant)

Payment of Filing Fee (check the appropriate

box):

|

þ

|

No fee required.

|

|

|

|

|

¨

|

Fee computed on table below per Exchange Act Rule 14a-6(i)(4) and 0-11.

|

|

|

1)

|

Title of each class of securities to which transaction applies:

|

|

|

|

|

|

|

2)

|

Aggregate number of securities to which transaction applies:

|

|

|

3)

|

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

|

|

4)

|

Proposed maximum aggregate value of transaction:

|

|

|

|

|

|

|

5)

|

Total fee paid:

|

|

|

|

|

|

¨

|

Fee paid previously with preliminary materials.

|

|

¨

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

|

|

|

1)

|

Amount Previously Paid:

|

|

|

|

|

|

|

2)

|

Form, Schedule or Registration Statement No.:

|

|

|

|

|

|

|

3)

|

Filing Party:

|

|

|

|

|

|

|

4)

|

Date Filed:

|

On April 15, 2021, Oasis Management Company

Ltd. (“Oasis”) issued a press release (the “Press Release”) announcing the public release of a

letter (the “Letter”) to the shareholders of Stratus Properties Inc. (the “Company”) highlighting

Stratus’ missteps, refuting false and misleading statements circulated by the Company and calling on shareholders to vote for change

by voting on the GOLD proxy card. A copy of the Press Release, which contains a link to the Letter, is filed herewith as

Exhibit 1 and a copy of the Letter is filed herewith as Exhibit 2.

Exhibit

1

Oasis

Files Definitive Proxy Statement and

Issues Letter to Stratus Shareholders

|

|

·

|

New Letter

Highlights Incumbent Board’s Failure to Hold Management Accountable for Totally Disregarding Five Year Plan

|

|

|

·

|

Recommends

a Full Portfolio Review and Increased Asset Churn to Narrow Stratus’ Discount to NAV

|

|

|

·

|

Oasis

Proposes New Exceptional Nominees to Hold Management Accountable

|

|

|

·

|

Urges

Shareholders to Vote on the GOLD Proxy Card for the Oasis Nominees

|

|

|

·

|

All materials

are available at www.abetterstratus.com

|

April 15, 2021 08:00 AM Eastern

Standard Time

Austin, Texas--(BUSINESS WIRE)--Oasis

Management Company Ltd. (“Oasis”) is the manager to a fund that is a significant, long-term shareholder of Stratus Properties

Inc. (NASDAQ: STRS) (the “Company” or “Stratus”) that beneficially owns over 13.5% of Stratus' ordinary shares.

Oasis today released a letter to Stratus

shareholders urging them to vote on the GOLD proxy card for the highly qualified and independent Oasis director nominees.

The letter highlights missteps and counters false and misleading statements circulated by the Company. The letter describes how Stratus’

share price underperformance is a direct result of broken promises and defensive actions which have destroyed shareholder value.

Oasis encourages its fellow shareholders

to read the letter, as well as its other letters and presentation which can be viewed on the homepage of www.abetterstratus.com.

All stakeholders are encouraged to contact

Oasis at info@abetterstratus.com.

Contacts

Shareholders:

Okapi Partners LLC

Mark Harnett: 646-556-9350

Patrick J. McHugh: 212-297-0721

Media

Taylor Hall

media@oasiscm.com

About Oasis Management Company Ltd.

Oasis

Management Company Ltd. manages private investment funds focused on opportunities in a wide array of asset classes across countries and

sectors. Oasis was founded in 2002 by Seth H. Fischer, who leads the firm as its Chief Investment Officer. More information about Oasis

is available at https://oasiscm.com.

Important Information

Oasis Management Company Ltd., Seth

Fischer, Ella Benson, Laurie L. Dotter and Jaime Eugenio De la Garza Diaz (collectively, the "Participants") have filed with

the Securities and Exchange Commission (the "SEC") a definitive proxy statement and accompanying form of GOLD proxy

card to be used in connection with the solicitation of proxies from the shareholders of Stratus Properties Inc. (the "Company").

All shareholders of the Company are advised to read the definitive proxy statement and other documents related to the solicitation of

proxies by the Participants as they contain important information, including additional information related to the Participants. The definitive

proxy statement and an accompanying GOLD proxy card will be furnished to some or all of the Company's shareholders

and is, along with other relevant documents, available at no charge on Oasis' campaign website at https://www.abetterstratus.com/ and

the SEC website at http://www.sec.gov/. Information about the Participants and a description of their direct or indirect interests

by security holdings is contained in the definitive proxy statement filed by the Participants with the SEC on April 14, 2021. This document

will be available free of charge from the source indicated above

Disclaimer

This material does not constitute an offer to sell or a solicitation

of an offer to buy any of the securities described herein in any state to any person. In addition, the discussions and opinions in this

press release and the material contained herein are for general information only, and are not intended to provide investment advice. All

statements contained in this press release that are not clearly historical in nature or that necessarily depend on future events are “forward-looking

statements,” which are not guarantees of future performance or results, and the words “anticipate,” “believe,”

“expect,” “potential,” “could,” “opportunity,” “estimate,” and similar expressions

are generally intended to identify forward-looking statements. The projected results and statements contained in this press release and

the material contained herein that are not historical facts are based on current expectations, speak only as of the date of this press

release and involve risks that may cause the actual results to be materially different. Certain information included in this material

is based on data obtained from sources considered to be reliable. No representation is made with respect to the accuracy or completeness

of such data, and any analyses provided to assist the recipient of this material in evaluating the matters described herein may be based

on subjective assessments and assumptions and may use one among alternative methodologies that produce different results. Accordingly,

any analyses should also not be viewed as factual and also should not be relied upon as an accurate prediction of future results. All

figures are unaudited estimates and subject to revision without notice. Oasis disclaims any obligation to update the information herein

and reserves the right to change any of its opinions expressed herein at any time as it deems appropriate. Past performance is not indicative

of future results. Oasis has neither sought nor obtained the consent from any third party to use any statements or information contained

herein that have been obtained or derived from statements made or published by such third parties. Except as otherwise expressly stated

herein, any such statements or information should not be viewed as indicating the support of such third parties for the views expressed

herein.

Exhibit

2

April 15, 2021

Dear Fellow Stratus Shareholder,

Oasis Investments II Master Fund Ltd.

(“Oasis”) has been a Stratus shareholder since August 2016 and currently owns 13.67% of the stock, making the Fund one the

Company’s largest shareholders. Over the last four and half years, during which an Oasis representative sat on Stratus’ Board

of Directors (the “Board”), Oasis has conducted in-depth diligence on Stratus’ real estate holdings and gained firsthand

insight into Stratus’ many corporate governance deficiencies1. We believe that Stratus’ underlying real estate

has tremendous value that has been suppressed by management’s inability to execute on a value-creating strategy and an entrenched,

overly tenured Legacy Board2 that has proven incapable of overseeing management.

As a result, we have submitted for election at the Company’s 2021 Annual Meeting of Stockholders two independent, highly qualified directors

to join Stratus’ Board. We have also submitted a nonbinding advisory proposal to expand the Board and appoint a third highly

qualified, independent director. We believe that these three independent and highly qualified candidates will bring the deep

expertise and fresh perspective needed to unlock shareholder value at Stratus which could result in shareholders’ stock being valued

in excess of $50 per share, amounting to an upside of over 130%3.

Today, we are writing to ask

for your vote on the GOLD Proxy Card, which would be a vote in favor of accountability, appropriate oversight, and an

effective strategy that have all eluded Stratus for so long.

___________________

1 See our presentation filed on Schedule

14A with the Securities and Exchange Commission on March 1, 2021.

2 Consisting of Beau Armstrong, Jim Leslie, Mike

Madden, Chuck Porter and Jim Joseph.

3 All price appreciation calculated based on

the September 25, 2020 closing price, which was when Oasis’ representative’s resignation from the Board became

effective.

Oasis Management Company Ltd.

c/o Oasis Capital Advisors, LLC,

300 West 6th Street, Suite 1550, Austin, Texas 78701

+1 512 225 1025 info@oasiscm.com https://oasiscm.com twitter.com/Oasis_Capital

Please visit www.abetterstratus.com

for more information. Vote on the GOLD proxy card.

Promises Made, Promises Broken

The consequences from the total

lack of accountability, oversight and strategy at Stratus are manifold. Perhaps the most staggering example is Stratus’ total

failure to execute on the five-year plan it presented to shareholders on April 20, 2015, where it promised to “monetize a

large portion of its assets on an orderly basis and return cash to shareholders.”

Five years later, as demonstrated in

the summary chart that follows, the Company has failed to achieve every one of the objectives laid out to

shareholders in its five-year plan.

After the expiration of the

five-year plan and amidst pressure from Oasis, Stratus sold the Saint Mary in 2021, touting that “the sale of the Saint Mary

is another example of the substantial value that we create for our shareholders.” However, by our assessment, the shareholder

value, if any, that resulted from the sale of the Saint Mary has been trivial. Stratus’ stock price moved ~6% on the day

following the sale announcement, and by the end of the week, the stock was only up 2%. Also, contrary to the Company’s

promises in its five-year plan to return cash to shareholders, Stratus seemingly has no plans to do

so, as evidenced by its statement that proceeds from the Saint Mary will be reinvested into the Company’s

pipeline4.

In stark contrast to shareholders,

who have received nothing but broken promises and a stagnant stock price, Beau Armstrong has done remarkably well for himself.

While overseeing the Company’s failure to deliver on the five-year plan, Armstrong earned $8.7mm in total compensation for the

years 2015 through 2019. For the sale of the Saint Mary, Armstrong stands to personally receive 9% of the profit. Meanwhile, Armstrong

has not addressed the Company’s failure to deliver the results it promised to shareholders, and the Legacy Board has not

held management accountable for its failure to execute its five-year plan. A refreshed board would go a long way toward providing

the accountability and oversight that is missing from Stratus’ boardroom and, if achieved, we believe would result in vastly

improved returns for shareholders.

_____________________

4 https://www.stratusproperties.com/pressrelease/137/

Please visit www.abetterstratus.com

for more information. Vote on the GOLD proxy card.

REIT Conversion

After the expiration of the five-year

plan, Stratus refused to develop or disclose a new disposal plan that would return cash to shareholders. Instead, Stratus announced

its intent to explore a REIT conversion, which represented a stark departure from its previously communicated strategy, as it

effectively halts asset disposals and their potential associated shareholder returns through at least 2027. Furthermore, contrary

to the Company’s claims, it is not apparent that a REIT structure will create value for Stratus’ shareholders as Stratus’

portfolio, performance and strategy are precisely the opposite of those preferred by REIT investors, as detailed in the chart below:

While Stratus believes that

converting into a REIT will bring tax savings, the marginal tax benefits from a REIT structure are unlikely to outweigh the

reduction in discounted cash flow resulting from a seven-year delay in asset sales. It is notable that in three of the last five

years, Stratus did not even report an income tax expense on its income statement due to negative pre-tax income. This further

calls into question the magnitude of any tax savings benefit that Stratus would receive in a REIT conversion.

Please visit www.abetterstratus.com

for more information. Vote on the GOLD proxy card.

Rather than creating shareholder

value, we believe that Stratus’ idea of a REIT conversion is motivated by self-perpetuation. Becoming a REIT limits

Stratus’ abilities to sell assets and reduces the breadth of actions it can take to narrow its discount to NAV, effectively

providing management an excuse for doing nothing for the next five years. In our view, Stratus’ management and Legacy

Board’s main motives to explore a REIT conversion are to stall, entrench themselves, and secure their jobs through 2027 –

things that we believe can be prevented with experienced, independent and qualified directors in the boardroom.

Stratus has stated that Oasis is opposed

to a REIT conversion because of the negative tax consequences we would face as an offshore investor. However, this is simply not true.

According to the NAREIT website5, the highest effective tax rate on Qualified REIT Dividends

is typically 29.6% for U.S. investors and 30% for Non-U.S. Investors. Do you really think we would be waging a proxy fight over 40 basis

points of future tax savings on a dividend that may not even be paid out? As we have previously stated, Oasis has no ulterior motives.

We have the same interests as other stock investors: equity appreciation. That is the basis of our argument.

Poor Corporate Governance

We believe that many of Stratus’

issues stem from the Company’s poor corporate governance practices. The Company was originally established with inferior

and outdated governance practices, such as:

|

|

·

|

No director term limits;

|

|

|

·

|

A combined CEO/Chairman role;

|

|

|

·

|

No right by shareholders to call special meetings;

|

|

|

·

|

Board authority to issue blank

check preferred stock; and

|

|

|

·

|

The requirement

that any business combination not approved

by the majority of the board must be

approved by a supermajority vote of shareholders.

|

Since many of these guidelines require

a supermajority shareholder vote to amend, or can only be undone by the Board, these poor practices continue to this day.

The negative implications of these practices

have been further exacerbated by a Legacy Board comprised of Directors who lack independence and fail to provide an appropriate counterbalance

to the combined CEO / Chairman role held by Beau Armstrong. The Legacy Board’s average tenure exceeds 18 years, which we

believe in and of itself compromises independence. Additionally, many of the Directors are further conflicted through their connections

to each other and to Jim Bob Moffett, who was the co-founder and CEO of Freeport McMoRan from which Stratus was originally spun out and

for whom Beau Armstrong served as a “real-estate lieutenant.”6

Tenure and relationships aside,

we believe that a director’s independence is best judged by their decisions. The Legacy Board has presided over poor

decisions and has not provided an adequate check to the CEO’s power. Under their watch, Stratus hired the CEO’s

son, Buck Armstrong, as a consultant to the Company. Upon closer inspection, it appears that Buck is simultaneously employed by Stratus

while not being categorized as an employee and managed to receive an award under the Company’s Profit Plan in 2019. Whatever

the true nature of the relationship, the arrangement is problematic and, at the very least, is rife with conflict. We believe

that a board that takes its responsibility to shareholders seriously would not have allowed such an arrangement to proceed.

_____________________

5 https://www.reit.com/investing/investing-reits/taxes-reit-

investment#:~:text=The%20majority%20of%20REIT%20dividends,3.8%25%20surtax%20on%20investment%20income

6 See Oasis’ presentation filed on Schedule

14A with the Securities and Exchange Commission on March 1, 2021 for a chart detailing the conflicted relationships among the

Board's directors.

Please visit www.abetterstratus.com

for more information. Vote on the GOLD proxy card.

Another questionable decision authorized

by the Legacy Board includes a discretionary payout to a limited partner in Kingwood L.P. on October 31, 2019. Roughly 15 months

after initial investment, Stratus redeemed the partner’s interest at approximately a 12% return. During this same period,

Stratus’ stock returned negative 8.7%. This same Legacy Board authorized a poison pill without shareholder approval and excessively

compensated the CEO despite Stratus’ underperformance and failure to execute on its five-year plan.

Underperformance

Since 2005, Austin’s real

estate market has experienced a momentous rise, with an average appreciation of approximately 106% across multifamily, office,

and retail asset classes7. Taking into consideration Stratus’ leverage, we would have expected the Company’s

equity holders to realize a return that is multiples beyond that of the Austin market. However, since 2005, Stratus’ stock

price has remained flat – performance that is simply inexcusable in our opinion.

Also, since 2005, Austin’s

population has grown more than 40%, median home prices in the Austin- Round Rock MSA have grown by more than 200%, Austin office

rents have increased by more than 100%, and retail rents have increased by approximately 40% per square foot. Austin continues to

be a leading destination for many top tier corporations, such as Tesla, Amazon and Apple, who have been establishing and expanding

their presence in the Austin area. Stratus’ inability to capitalize on Austin’s booming market despite having some

of the best land entitlements and assets in the area speaks to the urgent change that is needed at the Company.

While Stratus claims

that its stock outperformed the MSCI US REIT Index on a one, five and ten year basis, we believe this analysis is misleading.

First, much of Stratus’ so-called outperformance has come after Oasis’ intervention and subsequent proxy filings,

a period in which Stratus’ stock price has appreciated 49.6%. Second, given the focus of Stratus’ asset portfolio

on the Austin retail and residential market, we find it surprising that Stratus’ Board thinks the most appropriate comparable

is the MSCI US REIT Index, which is heavily skewed towards operators with national logistics and telecommunications assets.

A Better Stratus

To realize its potential, Stratus

needs (i) a mid-term strategic plan that will help reduce the Company’s discount to NAV and (ii) corporate governance reforms

that will increase management accountability.

Our proposed strategic plan for

Stratus is simple: close the NAV gap largely by executing on the plan that the Company laid out five years ago but failed to achieve.

To execute this successfully, we believe that Stratus begin by pausing the REIT exploration. Then, it must conduct a thorough review

of every asset in its portfolio. For assets in various stages of the development process, an NPV analysis should determine whether

the assets should be developed then sold, or sold immediately. For assets that the Company determines should be developed then sold,

a portion of management’s compensation should be tied to meeting the associated NPV forecasts (and development timeline)

to hold management accountable. Based on the results of the portfolio review, an internal timeline of asset sales and a range of

acceptable values should be compiled. This plan should also include an analysis of how the sale proceeds will be used. Although

we favor a return of cash to shareholders, if the Company’s balance sheet is overstretched, paying down debt may be more

pressing. A portion of management’s compensation should be tied to meeting these goals to hold management accountable. It

should also be clear that any piecemeal asset disposal plan that returns cash to shareholders needs to be judged against a sale

of the entire company. This Board has thus far shown neither the will nor the ability to take these basic steps.

___________________________

7 Based on REIS transaction data

Please visit www.abetterstratus.com

for more information. Vote on the GOLD proxy card.

Furthermore, a detailed analysis

of expenses (both expensed and capitalized) should be completed to identify cost saving initiatives. Again, a portion of management’s

compensation should be tied to meeting these goals to hold management accountable. Stratus’ decisions to hire family members for questionable

consulting roles and pay out excessive compensation exemplify the lack of cost discipline that results from poor oversight.

Nominees

Stratus’

underperformance8, the questionable decisions overseen by the Legacy Directors, and the total lack of

accountability demonstrate, in our view, that the current board is not capable of delivering the type of change that is

necessary for Stratus to succeed. We believe that the only way to ensure that Stratus realizes its potential is to elect new,

highly qualified, independent directors who will prioritize their duty to shareholders. Because Stratus has a staggered

board, we are nominating Ella Benson and Jaime De la Garza as Class II directors to replace Jim Leslie and Neville Rhone Jr.

We are also seeking a nonbinding advisory vote to expand the Board by one director and appoint Laurie Dotter to fill the

newly created vacancy. All three of the candidates are independent, possess extensive industry and public company experience,

and recognize the need for change at Stratus.

By contrast, Jim Leslie, one of

Stratus’ Class II nominees has been a Director of Stratus for 25 years. He has proven to be an ineffective advocate for

shareholders, presiding over questionable board decisions and excessive executive compensation as head of the Compensation

Committee. His track record on the only other public company board he has recently served, Dougherty’s Pharmacy (MYDP), hardly

inspires confidence considering that Dougherty’s filed for bankruptcy in 2020. We note that Jim Leslie

was a Director of Dougherty’s Pharmacy since 2001, Chairman since March 2002 and held interim executive roles at the company

before it filed for bankruptcy. We agree with the opinion expressed by Hutto city officials9 that Mr. Leslie's actions as

a developer demonstrate a lack of “financial and intellectual capacity to perform.” We further believe that Mr. Leslie's

track record of failure renders him unfit to serve as a director of Stratus, and Stratus’ willingness to go to war for him

should only increase shareholders’ skepticism.

Stratus’ second nominee, Neville Rhone Jr., was appointed to

Stratus’ Board at the suggestion of Beau Armstrong who knew Mr. Rhone from previously working together when Mr. Rhone

was at Canyon-Johnson Fund. This appointment illustrates that this Board maintains itself as a “club” built from within their own networks. In contrast to Stratus, Oasis’ nominees

are entirely independent and were selected in a process assisted by a third party. We believe that to be effective, directors need

to be put forth by the Company’s stockholders and not cherry-picked in advance by a classified board.

_____________________

8 See Oasis’ presentation filed on Schedule

14A with the Securities and Exchange Commission on March 1, 2021

9 ttps://www.statesman.com/news/20190830/hutto-developer-sue-each-other-over-baseball-field-project

Please visit www.abetterstratus.com

for more information. Vote on the GOLD proxy card.

In short, Stratus would like you

to vote for more of the same – more years of stagnant performance, an entrenched board and total lack of accountability –

without any explanation for why shareholders should expect this time to be any different. Oasis, on the other hand, believes that

Stratus has the potential to unlock the considerable value of its properties with proper oversight by a refreshed and independent

Board. To that end, we ask you to support our two shareholder nominees–Ella Benson and Jaime De la Garza—and

also vote in favor of expanding the board to include Laurie Dotter.

Sincerely,

Ella Benson

All

stakeholders are encouraged to contact Oasis at info@abetterstratus.com.

About Oasis Management

Company Ltd.

Oasis Management

Company Ltd. manages private investment funds focused on opportunities in a wide array of asset classes across countries and sectors.

Oasis was founded in 2002 by Seth H. Fischer, who leads the firm as its Chief Investment Officer. More information about Oasis

is available at https://oasiscm.com.

Important Information

Oasis Management

Company Ltd., Seth Fischer, Ella Benson, Laurie L. Dotter and Jaime Eugenio De la Garza Diaz (collectively, the “Participants”)

have filed with the Securities and Exchange Commission (the “SEC”) a definitive proxy statement and accompanying form of GOLD proxy

card to be used in connection with the solicitation of proxies from the shareholders of Stratus Properties Inc. (the “Company”).

All shareholders of the Company are advised to read the definitive proxy statement and other documents related to the solicitation of

proxies by the Participants as they contain important information, including additional information related to the Participants. The

definitive proxy statement and an accompanying GOLD proxy card will be furnished to some or all of the Company's shareholders

and is, along with other relevant documents, available at no charge on Oasis' campaign website at https://www.abetterstratus.com/ and

the SEC website at http://www.sec.gov/. Information about

the Participants and a description of their direct or indirect interests by security holdings is contained in the definitive proxy statement

filed by the Participants with the SEC on April 14, 2021. This document will be available free of charge from the source indicated above.

Disclaimer

This material does

not constitute an offer to sell or a solicitation of an offer to buy any of the securities described herein in any state to

any person. In addition, the discussions and opinions in this press release and the material contained herein are for general

information only, and are not intended to provide investment advice. All statements contained in this press release that are

not clearly historical in nature or that necessarily depend on future events are “forward-looking statements,”

which are not guarantees of future performance or results, and the words “anticipate,” “believe,”

“expect,” “potential,” “could,” “opportunity,” “estimate,” and

similar expressions are generally intended to identify forward-looking statements. The projected results and statements

contained in this press release and the material contained herein that are not historical facts are based on current

expectations, speak only as of the date of this press release and involve risks that may cause the actual results to be

materially different. Certain information included in this material is based on data obtained from sources considered to

be reliable.

Please visit www.abetterstratus.com

for more information. Vote on the GOLD proxy card.

No representation is made with respect to the accuracy or completeness of such data, and any analyses provided to

assist the recipient of this material in evaluating the matters described herein may be based on subjective assessments and assumptions

and may use one among alternative methodologies that produce different results. Accordingly, any analyses should also not be viewed

as factual and also should not be relied upon as an accurate prediction of future results. All figures are unaudited estimates

and subject to revision without notice. Oasis disclaims any obligation to update the information herein and reserves the right

to change any of its opinions expressed herein at any time as it deems appropriate. Past performance is not indicative of future

results. Oasis has neither sought nor obtained the consent from any third party to use any statements or information contained

herein that have been obtained or derived from statements made or published by such third parties. Except as otherwise expressly

stated herein, any such statements or information should not be viewed as indicating the support of such third parties for the

views expressed herein.

Contacts

Please visit www.abetterstratus.com

for more information. Vote on the GOLD proxy card.

8

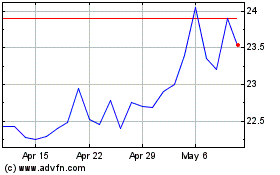

Stratus Properties (NASDAQ:STRS)

Historical Stock Chart

From May 2024 to Jun 2024

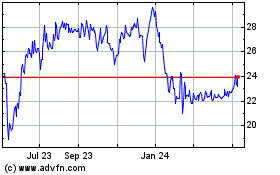

Stratus Properties (NASDAQ:STRS)

Historical Stock Chart

From Jun 2023 to Jun 2024