false

0001872525

0001872525

2024-08-12

2024-08-12

0001872525

SWAG:CommonStock0.0001ParValuePerShareMember

2024-08-12

2024-08-12

0001872525

SWAG:WarrantsEachWarrantExercisableForOneShareOfCommonStockAtExercisePriceOf4.81375Member

2024-08-12

2024-08-12

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE

COMMISSION

Washington, D.C.

20549

FORM 8-K

CURRENT REPORT

Pursuant to Section

13 OR 15(d) of The Securities Exchange Act of 1934

Date of Report (Date

of earliest event reported): August 12, 2024

| STRAN & COMPANY, INC. |

| (Exact name of registrant as specified in its charter) |

| Nevada |

|

001-41038 |

|

04-3297200 |

(State or other jurisdiction

of incorporation) |

|

(Commission File Number) |

|

(IRS Employer

Identification No.) |

| 2 Heritage Drive, Suite 600, Quincy, MA |

|

02171 |

| (Address of principal executive offices) |

|

(Zip Code) |

| 800-833-3309 |

| (Registrant’s telephone number, including area code) |

| |

| (Former name or former address, if changed since last report) |

Check the appropriate

box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following

provisions:

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR

230.425) |

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange

Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange

Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section

12(b) of the Act:

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange

on which registered |

Common Stock,

$0.0001 par value per share

|

|

SWAG

|

|

The Nasdaq Stock

Market LLC

|

| |

|

|

|

|

| Warrants, each warrant exercisable for one share of Common Stock at

an exercise price of $4.81375 |

|

SWAGW |

|

The Nasdaq Stock Market LLC |

Indicate by check mark

whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 or Rule 12b-2 of the Securities

Exchange Act of 1934.

Emerging Growth Company

☒

If an emerging growth

company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or

revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

| Item 2.02. | Results

of Operations and Financial Condition. |

On August

12, 2024, Stran & Company, Inc. (the “Company”) issued a press release announcing selected preliminary financial results

for the six months ended June 30, 2024. A copy of the press release is furnished as Exhibit 99.1 to this report.

The

information furnished pursuant to this Item 2.02 (including Exhibit 99.1 hereto), shall not be deemed “filed” for purposes

of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities

of that section, nor shall it be deemed incorporated by reference into any filing under the Exchange Act or the Securities

Act of 1933, as amended (the “Securities Act”), except as expressly set forth by

specific reference in such a filing.

Forward-Looking Statements

The press release and the

statements contained therein include “forward-looking” statements within the meaning of Section 27A of the Securities

Act and Section 21E of the Exchange Act, which statements involve substantial risks and uncertainties. Forward-looking statements generally

relate to future events or the Company’s future financial or operating performance. In some cases, you can identify these statements

because they contain words such as “may,” “will,” “believes,” “expects,” “anticipates,”

“estimates,” “projects,” “intends,” “should,” “seeks,” “future,”

“continue,” “plan,” “target,” “predict,” “potential,” or the negative of

such terms, or other comparable terminology that concern the Company’s expectations, strategy, plans, or intentions. Forward-looking statements relating

to expectations about future results or events are based upon information available to the Company as of today’s date and are not

guarantees of the future performance of the Company, and actual results may vary materially from the results and expectations discussed.

The Company’s expectations and beliefs regarding these matters may not materialize, and actual results in future periods are subject

to risks and uncertainties that could cause actual results to differ materially from those projected, including risks and uncertainties

described in the Company’s Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q and Current Reports on Form 8-K, and other

filings with the Securities and Exchange Commission. All subsequent written and oral forward-looking statements concerning

the Company or other matters, and attributable to the Company or any person acting on its behalf, are expressly qualified in their entirety

by the cautionary statements above. The Company does not undertake any obligation to publicly update any of these forward-looking statements to

reflect events or circumstances that may arise after the date hereof, except as required by law.

| Item 9.01. | Financial

Statements and Exhibits. |

(d)

Exhibits

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

| Date: August 12, 2024 |

STRAN & COMPANY, INC. |

| |

|

| |

/s/ Andrew Shape |

| |

Name: Andrew Shape |

| |

Title: President and Chief Executive Officer |

Exhibit 99.1

Stran

& Company Reports Preliminary Selected Unaudited Results for the Six Months Ended June 30, 2024

Revenue

expected to grow approximately 10% compared to the first six months of 2023

Gross

margin expected to increase to 31.7% for the first six months of 2024 vs. 29.4% for the first six months of 2023

Cash,

cash equivalents and investments expected to increase to $21.5 million as of June 30, 2024, compared to $18.5 million at December 31,

2023

Quincy, MA / August

12, 2024 / Stran & Company, Inc. ("Stran" or the "Company") (NASDAQ: SWAG) (NASDAQ: SWAGW), a leading outsourced

marketing solutions provider that leverages its promotional products and loyalty incentive expertise, today reported preliminary selected

unaudited results for the six months ended June 30, 2024.

“We experienced

solid growth for the first half of 2024 and currently estimate revenue increased by more than 10% compared to the first six months of

2024, as we increased market share despite a challenging market for many of our competitors,” commented Andy Shape, President and

CEO of Stran. “In addition, we project our gross profit margin increased to 31.7% for the six months ended June 30, 2024 compared

to 29.4% for the same period last year. We attribute these results to the ongoing execution of our growth strategy, including onboarding

new customers, increasing penetration within existing customers, implementing innovative technologies, and expanding our footprint nationwide.

We have consistently maintained a strong balance sheet, and are proud to report cash, cash equivalents and investments increased to an

estimated $21.5 million as of June 30, 2024, providing us a war chest to capitalize on synergistic and accretive M&A opportunities

to complement our organic growth. Additionally, we are working diligently to finalize our financial statements and look forward to formally

reporting the results upon completion of the process.”

The

selected unaudited results in this press release are preliminary and subject to the completion of accounting and interim review procedures

and are therefore subject to adjustment.

About Stran

For over 29 years,

Stran has grown to become a leader in the promotional products industry, specializing in complex marketing programs to help recognize

the value of promotional products, branded merchandise, and loyalty incentive programs as a tool to drive awareness, build brands and

impact sales. Stran is the chosen promotional programs manager of many Fortune 500 companies, across a variety of industries, to execute

their promotional marketing, loyalty and incentive, sponsorship activation, recruitment, retention, and wellness campaigns. Stran provides

world-class customer service and utilizes cutting-edge technology, including efficient ordering and logistics technology to provide order

processing, warehousing and fulfillment functions. The Company’s mission is to develop long-term relationships with its clients,

enabling them to connect with both their customers and employees in order to build lasting brand loyalty. Additional information about

the Company is available at: www.stran.com.

Forward

Looking Statements

This press release

contains “forward-looking statements” that are subject to substantial risks and uncertainties. All statements, other than

statements of historical fact, contained in this press release are forward-looking statements. Forward-looking statements contained in

this press release may be identified by the use of words such as “anticipate,” “believe,” “contemplate,”

“could,” “estimate,” “expect,” “intend,” “seek,” “may,” “might,”

“plan,” “potential,” “predict,” “project,” “target,” “aim,” “should,”

"will,” “would,” or the negative of these words or other similar expressions, although not all forward-looking

statements contain these words. Forward-looking statements are based on the Company’s current expectations and are subject to inherent

uncertainties, risks and assumptions that are difficult to predict. Further, certain forward-looking statements are based on assumptions

as to future events that may not prove to be accurate. These and other risks and uncertainties are described more fully in the section

titled “Risk Factors” in the Company’s periodic reports which are filed with the Securities and Exchange Commission.

Forward-looking statements contained in this announcement are made as of this date, and the Company undertakes no duty to update such

information except as required under applicable law.

Contacts:

Investor Relations Contact:

Crescendo Communications,

LLC

Tel: (212) 671-1021

SWAG@crescendo-ir.com

Press Contact:

Howie Turkenkopf

press@stran.com

v3.24.2.u1

Cover

|

Aug. 12, 2024 |

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Aug. 12, 2024

|

| Entity File Number |

001-41038

|

| Entity Registrant Name |

STRAN & COMPANY, INC.

|

| Entity Central Index Key |

0001872525

|

| Entity Tax Identification Number |

04-3297200

|

| Entity Incorporation, State or Country Code |

NV

|

| Entity Address, Address Line One |

2 Heritage Drive

|

| Entity Address, Address Line Two |

Suite 600

|

| Entity Address, City or Town |

Quincy

|

| Entity Address, State or Province |

MA

|

| Entity Address, Postal Zip Code |

02171

|

| City Area Code |

800

|

| Local Phone Number |

833-3309

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

true

|

| Elected Not To Use the Extended Transition Period |

false

|

| Common Stock, $0.0001 par value per share |

|

| Title of 12(b) Security |

Common Stock,

$0.0001 par value per share

|

| Trading Symbol |

SWAG

|

| Security Exchange Name |

NASDAQ

|

| Warrants, each warrant exercisable for one share of Common Stock at an exercise price of $4.81375 |

|

| Title of 12(b) Security |

Warrants, each warrant exercisable for one share of Common Stock at

an exercise price of $4.81375

|

| Trading Symbol |

SWAGW

|

| Security Exchange Name |

NASDAQ

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=SWAG_CommonStock0.0001ParValuePerShareMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=SWAG_WarrantsEachWarrantExercisableForOneShareOfCommonStockAtExercisePriceOf4.81375Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

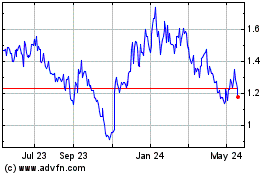

Stran (NASDAQ:SWAG)

Historical Stock Chart

From Jan 2025 to Feb 2025

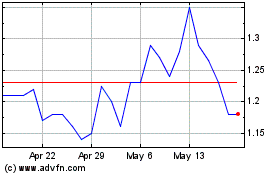

Stran (NASDAQ:SWAG)

Historical Stock Chart

From Feb 2024 to Feb 2025